NFLX Above HVL (85) — Positive Gamma Fuels Upside ContinuationNFLX Trading Plan — Liquidity + Gamma Aligned

Market Structure Context

NFLX is holding above key price support (≈86) and above Gamma Flip / HVL at 85

Structure has transitioned from sell pressure → absorption → balance

Price is now consolidating above high-liquidity demand, favoring upside continuation if support holds

Gamma & Liquidity Read

Gamma Condition: ✅ Positive (Call-Dominated Environment)

Net GEX: Increasing intraday (+7.49M since 14:30)

DEX: Expanding intraday (+62%), confirming dealer positioning is becoming more supportive

Put/Call Ratio: 0.31 → strong call bias

Top Volume Strikes: 86–90 (heavy call concentration)

👉 This creates a pin + magnet effect above 85, with dealers incentivized to defend dips and hedge upside.

Key Levels to Trade

🔹 Support Zones

Primary Support: 86.0–85.5 (price + structure support)

Gamma Flip / HVL: 85.0 ⚠️ (line in the sand)

Last Defense: 83.0–82.3 (put support / liquidity pocket)

🔺 Upside Targets

Near-Term Magnet: 88.0 (0DTE call resistance)

Extension Target: 90.0 (largest call OI + GEX expansion)

Stretch Target: 95–100 zone (upper liquidity + call resistance)

Trade Thesis

🟢 Bull Case (Primary)

As long as price holds above 85, NFLX remains in positive gamma

Dealers hedge calls → volatility compresses → price grinds higher

Best longs come from:

Pullbacks into 86–85.5

Acceptance above 88 for momentum continuation

🔴 Bear Case (Invalidation)

A clean break and acceptance below 85

Gamma flips negative → volatility expansion risk

Opens downside to 83 → 80 (put support zone)

Execution Notes

Favor pullback longs, not chase breakouts

Expect slower, controlled upside (positive gamma environment)

Size up only on confirmed support holds or acceptance above 88

NFLX

Netflix - Small UpsideSince July 2025, Netflix shares have been in a corrective phase, forming wave A .

At the moment, a small move in the opposite direction is expected - a short-term upward move.

Key targets:

91 - local correction

94

96

Estimated upside potential from current levels:

Approximately 10-12%

---

Please subscribe and leave a comment!

You’ll get new information faster than anyone else.

---

Netflix | NFLX | Long at $83.99Technical Analysis

The stock price for Netflix NASDAQ:NFLX briefly touched the top of my selected historical simple moving average. This is often a strong area of support / resistance / algorithmic share accumulation. While economic / NASDAQ:WBD acquisition news may push the share price lower in the near-term, potentially closing the open price gap in the low $70's, NASDAQ:NFLX and YouTube dominate the streaming services. That's not going to change any time soon. The point is, it's a stock I am comfortable hanging on to.

Health

Debt-to-equity: 0.6x (healthy)

Quick ratio / short-term debt: 1.2 (not bad, but slightly lower than ideal)

Altman's Z-score / long-term debt / bankruptcy risk: 10+ (extremely low risk)

Insiders

Caution: nothing but selling

Growth

62.8% earnings-per-share growth projected between 2026 ($3.17) and 2029 ($5.16)

34.2% revenue growth projected between 2026 ($51.2 billion) and 2029 ($68.7 billion)

Action

While there may be near-term weakness down near $70, I've entered a starter position at $83.99. The "perfect dip" would be down near $74 and then rising (another entry), but the price may test shaky hands - especially with the NASDAQ:WBD deal / news.

Targets into 2029

$107.00 (+27.4%)

$122.00 (+45.3%)

Netflix, Inc. (NFLX) Buying Opportunity Ad revenue is booming

Netflix’s advertising revenue more than doubled to ~$1.5B in 2025 and analysts expect it to double again in 2026 to ~$3B — driven by rapid growth in the lower-priced ad tier and new AI-powered ad formats.

User base continues to expand

The company just reported ~325 million paid subscribers, adding ~25M new members and showing continued global traction.

Content library and growth potential expanding

Netflix is diversifying into video podcasts, live events, and popular IP franchises, and it recently revised its offer for Warner Bros. Discovery’s studio & HBO Max assets — a strategic move that could significantly enlarge its content ecosystem if it closes.

Short-term volatility weighing on the stock

Q4 results beat revenue and EPS expectations, but shares pulled back due to weaker guidance for early 2026 and concerns about acquisition funding and slowing subscriber acceleration.

Bottom line: strong underlying business momentum + near-term headline noise = potential swing entry on technical support.

Technical Set-Up

Price has reached a well-defined demand zone that has acted as support in the past

RSI is deeply oversold, signaling sellers are exhausted

The chart is showing an initial bounce from demand

This is the kind of entry zone with asymmetric reward vs risk we look for.

Buy zone: 86-87

Stop loss: Below 80.80 (daily close invalidates, tight stop loss equal to only 6% drop)

Targets:

TP1: 91.56 ( +6.3% )

TP2: 104.41 ( +21.23% )

TP3: 123.70 ( +43.50% )

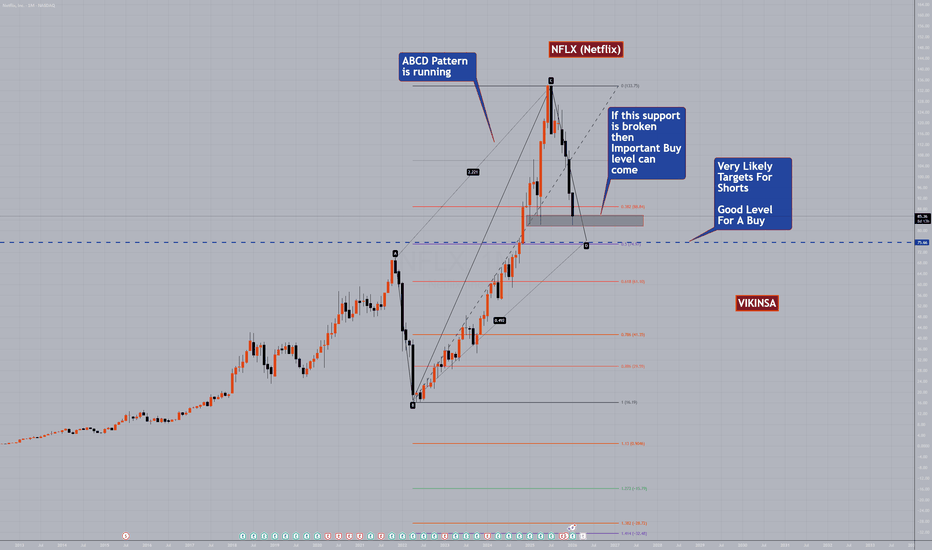

NFLX (Netflix) Possible Buy OpportunityNetflix along with several other NASDAQ stocks have been taking good levels of corrections. I posted about Microsoft yesterday too.

Netflix is running inside an ABCD pattern which can bring it down to the 50% retracement level around 75.66. However, this can only happen if the current support is broken and a bull trap is set. There are a few more levels which can be good levels to BUY or for Dollar Cost Averaging but they are not in the scope of this simple analysis as of now.

Lets wait and watch and always this is not and advice but just an observation. Risk management is extremely important as always.

Follow for more. Please support this analysis by liking, commenting, and sharing with friends, colleagues, traders, and trading communities. Thanks👍🙂

NFLX: The "Electric Fence" Rejection (Educational Case Study)

In today's educational breakdown, we are looking at a textbook example of Bearish Market Structure on Netflix.

Many traders get trapped buying "dips" that are actually "lower highs." By using the Institutional Mean (Anchored VWAP), we can visualize exactly where the Smart Money stepped in to defend their short positions.

Here is the technical breakdown of the move using the Cantillon Institutional Volume Suite .

1. The "Electric Fence" (The Rejection)

(Look at the Yellow Circle on the chart)

The most critical moment on this chart happened when price rallied back up to the $116 level.

The Trap: To the naked eye, this looked like a strong recovery.

The Structure: Price ran exactly into the Purple AVWAP Line (The Institutional Mean).

The Result: In a Bearish Regime (Price below Mean), the AVWAP often acts as an "Electric Fence." The moment price touched it, selling pressure resumed, and the trend rolled over.

Lesson: Never chase a rally into a declining Institutional Mean. It is often a point of maximum resistance.

2. Losing Value (Volume Profile)

(Look at the Blue Histogram on the left)

Point of Control (Red Line): The majority of volume was traded near $120. This was "Fair Value."

The Breakdown: Once price accepted below this High Volume Node, the "floor" became a "ceiling."

Current State: We are now falling through a low-volume pocket. When price loses structure, it often seeks the origin of the move (the Anchor Point) to find new buyers. We are approaching that structural base near $80-$82.

Summary

Netflix remains in a confirmed Bearish Regime. The rejection at the Purple Line ($116) confirmed that sellers are still in control. Until price can reclaim that Institutional Mean, the path of least resistance remains lower.

Trade the structure, not the noise.

Netflix (NFLX) Shares Fall Despite Strong Earnings ReportNetflix (NFLX) Shares Fall Despite Strong Earnings Report

Yesterday, Netflix (NFLX) released its quarterly results, which, albeit only slightly, exceeded Wall Street analysts’ expectations — both in terms of earnings per share (EPS) and gross revenue. Despite this, NFLX shares fell in after-hours trading to around the $82.50 level.

Why Did NFLX Shares Fall?

Bearish sentiment is being driven by the following factors (according to media reports):

→ Cautious guidance from management. Netflix expects revenue growth to slow to 11–13%, compared with 15–16% in 2025.

→ Subscriber growth dynamics. While total subscriber numbers increased to a record level of around 325 million, the pace of growth is slowing. By comparison, the company added roughly 23 million new users in 2025, versus 41 million in 2024.

→ M&A considerations. As we noted on 8 December, Netflix’s share price could be significantly affected by a potential acquisition of Warner Bros. Discovery. Such a large-scale deal carries risks related to increased debt and adds to uncertainty.

Technical Analysis of the NFLX Chart

In our earlier analysis of Netflix (NFLX) share price action, we identified both ascending and descending channels, noting that:

→ In October, the ascending channel was broken to the downside, with the breakout level around $117 acting as resistance, reinforcing the relevance of the descending trajectory.

→ In December, NFLX shares moved into the lower half of the descending channel, accompanied by rising volumes and accelerating downside momentum — a bearish signal — and settled below the psychological $100 level, which may now act as resistance.

If NFLX trading opens today around $82.50, then:

→ the price will be below the lower boundary of the channel;

→ it will be close to key 2025 lows, which may provide support;

→ oscillators will indicate oversold conditions.

Under these circumstances, a short-term rebound in NFLX shares is possible. However, it appears that more substantial catalysts are required to reverse the current sustained downtrend.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Netflix Stock Dives as Crowds Reach for the Remote: Binge Over?Netflix NASDAQ:NFLX investors who hit play heading into the earnings were expecting a feel-good episode. Instead, they got a cliffhanger — and not the good kind.

Shares of the streaming giant are lower by about 5% pre-market Wednesday, even after the company posted better-than-expected fourth-quarter earnings.

So what happened? In short: margins. Or rather, the lack of excitement around them.

Netflix reported a Q4 profit of 56 cents per share, edging past expectations , with revenue jumping nearly 18% year over year to $12.05 billion. Then Netflix dropped its 2026 margin guidance, and the mood changed fast.

💰 The Numbers

On paper, the quarter looked solid. Net income climbed to $2.42 billion, up from $1.87 billion a year earlier. Revenue beat forecasts. Subscriber momentum held with 325 million paid users around the globe.

Looking ahead, Netflix guided full-year 2026 revenue between $50.7 billion and $51.7 billion, comfortably around — and slightly above — Wall Street’s expectations. So far, so binge-worthy.

But then came the fine print. Netflix expects an operating margin of 31.5%, below the 32.6% analysts had penciled in. In an environment where every basis point is treated like a plot twist, that was enough to send shares tumbling.

🎬 The Warner Deal

Margins didn’t just slip on their own. Netflix said its outlook includes about $275 million in expenses tied to its planned acquisition of Warner Bros. Discovery’s NASDAQ:WBD streaming and studios assets — a move that’s ambitious, expensive, and not without controversy.

The deal carries a price tag of roughly $83 billion, valuing the Warner assets at about 25 times expected 2026 EBITDA. For comparison, Disney trades at around 11 times its expected EBITDA. Investors noticed the gap, apparently. Also, Paramount NASDAQ:PSKY is still trying to figure out how to grab the entire Warner Bros. studios.

Netflix has also paused its share buybacks, choosing instead to conserve cash to fund the acquisition. That may make strategic sense, but buybacks are a favorite comfort blanket for shareholders — and taking it away rarely goes well.

📚 The Content

Management made the strategic case clear. Warner’s library, development pipeline, and IP — plus HBO Max — would supercharge Netflix’s content offering and allow for more personalized and flexible subscription options.

Co-CEO Ted Sarandos called the deal a “strategic accelerant,” insisting Netflix can pursue it while still delivering “healthy growth.”

Still, investors aren’t just weighing the upside. There are real risks:

A hostile bid from Paramount Skydance complicating the landscape

Regulatory scrutiny that could delay or derail the transaction

Integration challenges that could pressure margins further

📉 The Stock

Markets don’t trade earnings only; they also trade expectations. And Netflix entered this report priced for near-perfection.

Shares are now set to open around $82, a one-year bottom, and are lower by more than 35% from the $134 peak hit last June. That’s a brutal correction for a company that still dominates global streaming.

But this is what happens when growth stocks promise expansion and efficiency at the same time. If one wobbles — even slightly — the reaction can be swift.

🛋️ A Buying Opportunity?

Not everyone is reaching for the remote, though. Some analysts argue the pullback creates a chance to snap up shares at a relatively attractive valuation, especially for a company that continues to grow profits and cash flow — whether or not the Warner deal closes.

Netflix still has scale, pricing power, and a global audience most media companies would happily trade their studios for. The question isn’t whether Netflix is broken. It’s whether investors are comfortable sitting through a more complicated chapter.

The earnings season continues with Intel NASDAQ:INTC reporting tomorrow. A bunch of Magnificent Seven folks are slated for updates next week, including Apple NASDAQ:AAPL , Microsoft NASDAQ:MSFT , Amazon NASDAQ:AMZN , Meta NASDAQ:META , and Tesla NASDAQ:TSLA .

Off to you : Are you looking to snap it up? Or waiting for the dip of the dip? Share your views in the comments!

NFLX & NVDA = Hagia Sophia WARNING!🚨 WARNING! NVDA is the next NFLX

I first started warning about NFLX in the summer. You can see the formation setups step by step here. From H&S to the Hagia Sophia (rounding top) with a tower (head test)

The only time you will see such a pattern is at tops!

The H&S never failed. instead it head tested, which ended up being extreme. (Not uncommon in a raging, euphoric, bubbalicious market.)

What is most important about the Hagia Sophia pattern is that it signals that we are in the endgame stages of the move.

It's time to GTFO & STFO!

When exactly you GTFO is not as relevant as actually GTFO! You always need an exit strategy. Otherwise, you will ride it all the way back down, right into losses.

Shorting it on the other hand is differnet animal. This is the time to start picking your battles. Dipping your toe in the water, ready to take losses until it fails.

In this case, there were 3 key areas (CRACKS) to short. Two out of the 3 would have gotten you huge gains IF you understood the pattern.

NVDA looks the same today as NFLX looked back in the summer.

If you are long - GTFO RUN with Profits & STFO!

If you want to short wait for the next key area to CRACK!

Lastly, I bet you are wondering if NFLX is done going down? Answer is NO!

NFLX is now at 4️⃣ Deep Decline (-30%) — Moral Pressure Phase

“Buy when there’s blood in the streets”

“This is how generational wealth is made”

“The smart money is buying”

“Be greedy when others are fearful”

“This is once-in-a-decade”

📌 Translation: We need new buyers to absorb forced selling.

#FAFO

If you enjoy the work:

👉 Drop a solid comment

Let’s push it to 6,000 and keep building a community grounded in raw truth, not hype.

Could NFLX break to new ATH?Alright, kind of a crazy idea... but hear me out.

I've been thinking NFLX has started a longer term corrective cycle and we'd see a small bounce from here, but after looking at some options flows, it made me question that idea. After relooking at the chart, it makes me think the stock could be much more bullish than I originally thought.

We're extremely oversold on pretty much every timeframe, from the daily all the way to the 3W. On higher timeframes (2W-3W) , the chart actually still looks extremely bullish with the RSIs still at/above the parabolic levels.

If we were to get a positive reaction to earnings, I can actually see one more leg higher to complete the final 5th wave of the move.

The target would be around the $156-157 levels however I've marked off other possible resistance levels. If price can break $125, it would strengthen the idea.

A close below $82 would invalidate it.

Every post I see on NFLX is bearish, so I like this idea bc I don't think many people even see this as a possible outcome. Let's see.

NFLX – Q4 Earnings Preview | Big Moves Incoming?🏢 Company Overview – Netflix, Inc. (NASDAQ: NFLX)

Netflix NASDAQ:NFLX is a global leader in streaming entertainment, offering on-demand content in over 190 countries. With an expanding portfolio of original series, films, and now ad-supported tiers and gaming, it remains a dominant force in digital media. A 10-for-1 stock split in November 2025 has broadened investor access.

💰 Q4 FY25 Earnings Snapshot

Revenue Forecast: $11.96–$12.0B (+16–17% YoY)

EPS Estimate: ~$5.45 | Split-adjusted: ~$0.55

Operating Margin: Expected 23.9%–24.1%

Ad Revenue: FY25 could close at $5.9B, nearly double earlier projections

🔍 Focus will shift to 2026 guidance, especially around ad-tier growth & margin expansion

📰 Trump’s Bond Buys Fuel Speculation

Donald Trump bought 2 tranches of Netflix bonds ($250K–$500K each) in Dec 2025, maturing in 2029

Purchases came days after Netflix’s $72–$83B all-cash bid for Warner Bros. Discovery

Part of over $100M in bond holdings, drawing attention ahead of earnings

📉 Price Action – Technical Snapshot

Current Price: ~$88–$89

52-Week High: $134

Drop: -29% in the past 6 months, driven by Warner deal uncertainty

📉 Recent 10-for-1 split (Nov 2025) reset investor sentiment

💡 Trade Setup

🎯 Entry: $80.85 - 83.00

✅ Targets: $92.00 ➤ $104.00

❌ Stop Loss: $73.00

📈 Bull Case: Analysts eye $130+ if FY26 margins expand to 32–35%

🧠 Final Thoughts

With major catalysts in play—earnings, margin guidance, ad growth, and M&A—volatility is expected. Keep an eye on volume and after-hours moves.

Daytrade and Swing idea for NFLX! OptionsMastery:

🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Netflix, Inc. (NASDAQ: $NFLX) Set To Report Earnings TodayShares of Netflix, Inc. (NASDAQ: NASDAQ:NFLX ) are gearing for a breaking amidst earnings report today. The share price is set to break from a bullish rectangle pattern eyeing the $150 resistant zone.

Albeit down 0.06% in last recorded session, the stock is already up 0.66% as it gears for earnings results Tuesday, January 20, 2026, after market close.

Financial Performance

In 2024, Netflix's revenue was $39.00 billion, an increase of 15.65% compared to the previous year's $33.72 billion. Earnings were $8.71 billion, an increase of 61.09%. Return on equity (ROE) is 42.86% and return on invested capital (ROIC) is 32.46%.

Analyst Summary

According to 35 analysts, the average rating for NFLX stock is "Buy." The 12-month stock price target is $127.24, which is an increase of 44.59% from the latest price.

About NFLX

Netflix, Inc. provides entertainment services. The company offers television (TV) series, documentaries, feature films, and games across various genres and languages. It also provides members the ability to receive streaming content through a host of internet-connected devices, including TVs, digital video players, TV set-top boxes, and mobile devices.

Will NFLX earnings halt its slide?A snippet from ForexTraderPaul's YT Channel Monday Market Update #211: Greenland is cold whilst Defence Stocks are hot.

NFLX has been on my mind. I've been considering cancelling my own subscription. I realise that I use it less and less. Is that a reflection of the quality of NFLX output or just a reflection on my own choices on how to spend my time and energy? Discuss.

In the meantime NFLX share price has been on a considerable slide for a few months now. We looked at NFLX a few months ago wen I felt that $100 would act as a magnet to drag price down towards it. Well, it went much further lower and we now trade sub $90. Looking at the weekly candles whilst they remain bearish they're getting smaller and appear to be struggling to move lower with energy. Will Q4 earnings halt the slide?

Points to note:

- Ad-tier growth and password-sharing enforcement have stabilised subscriber trends.

- Cash flow generation is now the primary valuation driver.

- Competitive pressure persists but pricing power has improved.

What traders should be aware of: the stock reacts to changes in growth rate, not headline subscriber numbers.

NFLX Netflix Options Ahead of EarningsIf you ahven`t sold the top on NFLX:

nor bought the stock before the rally:

With Netflix (NFLX) reporting Q4 2025 earnings today, January 20, 2026, the stock looks primed for a rebound—trading at $88.00, down 91% from its 2021 highs but showing signs of being oversold on the 14-day RSI at around 27 (below 30 threshold, signaling potential buying exhaustion).

Consensus expects 17% revenue growth to $11.97B and 28% EPS jump to $0.55, with FY2025 sales up 15% and positive momentum from ads tier and subscriber gains.

Adding fuel: Netflix's pending $82.7B acquisition of Warner Bros. (from Warner Bros. Discovery spin-off in Q3 2026) could supercharge content library and synergies, boosting long-term growth.

Analyzing the options chain and chart patterns prior to earnings, I would consider a debit call spread:

Buy the $110 strike call and sell the $130 strike call, with expiration August 21, 2026, for a net premium of approximately $2.61.

If the position moves favorably post-earnings (e.g., RSI bounce and positive guidance), I'd scale out half for risk management.

This is a bullish, defined-risk play on NFLX's recovery—DYODD, high volatility expected!

NFLX | Descending Channel into Earnings OverhangNetflix heads into Q4’25 earnings (Jan 20) with the business broadly intact, but the stock weighed down by a one-off margin shock, deal uncertainty, and valuation nerves rather than a fundamental break.

What Happened This Quarter (Q3’25 Context)

• Core operations were solid, but reported margins were dragged lower by a ~$619m Brazil tax charge booked in cost of revenues.

• Management stated clearly that ex-Brazil, operating income and margin would have beaten guidance, and does not expect this item to be recurring.

• Ads momentum continues to build (upfront commitments more than doubled), but no dollar figures were provided — leaving the Street conservative.

• Buybacks continued, supportive for EPS but not enough to offset near-term uncertainty.

Why the Stock Has Been Sliding Since Late June

This has been about overhangs, not business deterioration:

1. Valuation & growth anxiety after a strong run into mid-2025.

2. Brazil tax shock making a good quarter screen as a margin miss.

3. Warner deal uncertainty (regulatory, pricing, structure) keeping multiples compressed.

Scenarios

• If the upper channel holds:

Price may continue to fade back toward channel support as earnings risk keeps buyers selective.

• If the channel breaks:

A decisive reclaim of the upper boundary would suggest earnings resolved one or more overhangs, opening scope for a broader mean reversion.

Catalysts (Jan 20, 2026 – Q4’25 Earnings)

What would matter beyond a decent quarter:

• FY’26 guidance that forces estimates higher (revenue and/or margin).

• Ad revenue quantified in dollars (Q4, run-rate, or 2026 commitments).

• Clear margin snapback narrative, reinforcing Brazil as truly one-off.

• Reduced Warner deal uncertainty (structure or regulatory clarity).

What Could Keep Pressure On

• Cautious FY’26 outlook despite solid Q4.

• Ads momentum framed qualitatively, not financially.

• Any indication Brazil-type costs could repeat.

• Escalation or complication in the Warner process.

Takeaway

This remains a decision zone inside a descending channel.

Without FY’26 guidance upgrades or ad $ disclosure, even a “good” quarter may not be enough to break the trend.

NFLX | IM HUNGRY FOR FUTURE TENDIESWill NASDAQ:NFLX keep taking the beat down? Who knows.

Should we desperately buy up all the shares possible now? If we do, our futures selves in 2036 will probably be popping champagne and spraying it all over the place on a yacht.

If the beat down continues, where can we look to pick up MOAR?! Is there a sweeter "please sir may I have another" buy zone?

Looking at the chart, a reasonable Fire Sale range could be between $70ish and $90ish. That's flirting with 50%+ off the ATH highs (we've seen 75%+ gut punches before, remember 2022? Good times).

SMALL Starter position initiated. Add in target range. Cry if we head lower than that but HODL. Look, I'm just tryna get some TENDIES 🍗🍗🍗. Hopefully my future self will send me a bucket of KFC from 2036.

THANK YOU FOR YOUR ATTENTION TO THIS MATTER

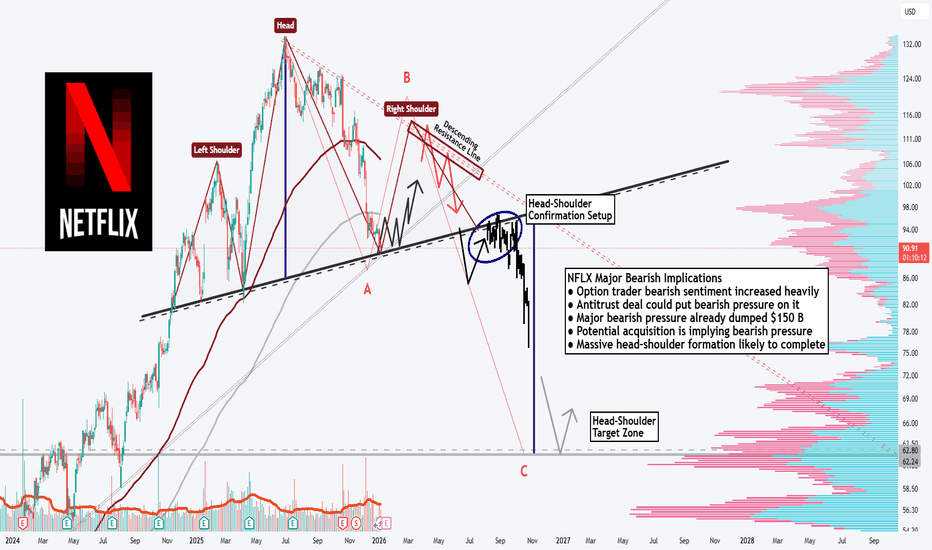

NFLX: Massive Head-Shoulder-Formation!Hello There,

welcome to my new analysis about the Netflix stock (NFLX). Recently, I spotted major underlying factors that will be highly determining for the whole upcoming price action. The stock already dumped heavily bearishly towards the downside, almost declining over $150 B in market cap. Such a major pullback is in most cases not followed by an immediate market recovery. Most of the time, such a determining price action is likely to move on forward in the direction it came from.

When looking at the chart, we can see that Netflix is about to complete this massive head-and-shoulders formation. The left shoulder as well as the head of the formation have already been completed. Netflix has this main descending trendline within the whole structure, which serves as a major resistance. Especially, when Netflix moves into this area again, it will highly likely be the origin of massive bearishness and a pullback towards the downside.

This implies that the right shoulder of the whole formation will complete once Netflix pulls back from the descending resistance line towards the downside. Once this happens and Netflix breaks down below the neckline of the head-and-shoulders formation, this will be the origin of the whole bearish continuation setup as it is marked within my chart. This setup will be the perfect entry zone for a potential entry on the short side.

Once the whole formation has been completed, the target area of 60 will be activated. Especially when there is a breakdown with high bearish volatility, this will be the origin of a massive bearish continuation. It will be interesting to watch how Netflix completes this whole formation and continues to reach the target zones. Once the targets are reached, there could be a continuation towards the downside if bearish volatility is high enough.

There are also many fundamental factors that make Netflix a bearish stock. One of them is that Netflix as a company faces major critique because of its $72B Warner Bros. deal. Members of Congress call it an "antitrust nightmare". They also define it as a bad business move. Such actions are likely to attract more and more bearish volume moving into the market. As massive bearish deal structures are likely to increase such dynamics.

With this being said, it is great to consider the important trades upcoming.

We will watch out for the main market evolutions.

Thank you very much for watching!

NFLX and Chill this winter94 is a great entry point, with the "most"downside potential limited at around 76. The Longer you hold the longer the chances are that this break 135. I'm Going in because tis the season/new year to make some gains!!!

Ohhh also the death cross is upon us in the chart, but no matter momma didn't raise no B****

Also scared money don't make money!

Netflix - This stock will drop another -30%!📽️Netflix ( NASDAQ:NFLX ) is still totally bearish:

🔎Analysis summary:

A couple of months ago, Netflix retested a major resistance trendline. This was a clear sign for us to take profits and Netflix has already been dropping about -30%. Looking at structure, the next support is the previous all time high, meaning Netflix will drop another -30%.

📝Levels to watch:

$70

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Short Signal for $NFLX - $85 TargetNetflix is a company that has not just have had tons of controversy recently but are also in the middle of streaming wars in which people are unconfident if they can still maintain market share. After the expected Warner acquisition, the company would still be much lower on cash. Short signals are increasing and today the trendline has broken. As always, none of this is investment or financial advice. Please do your own due diligence and research.