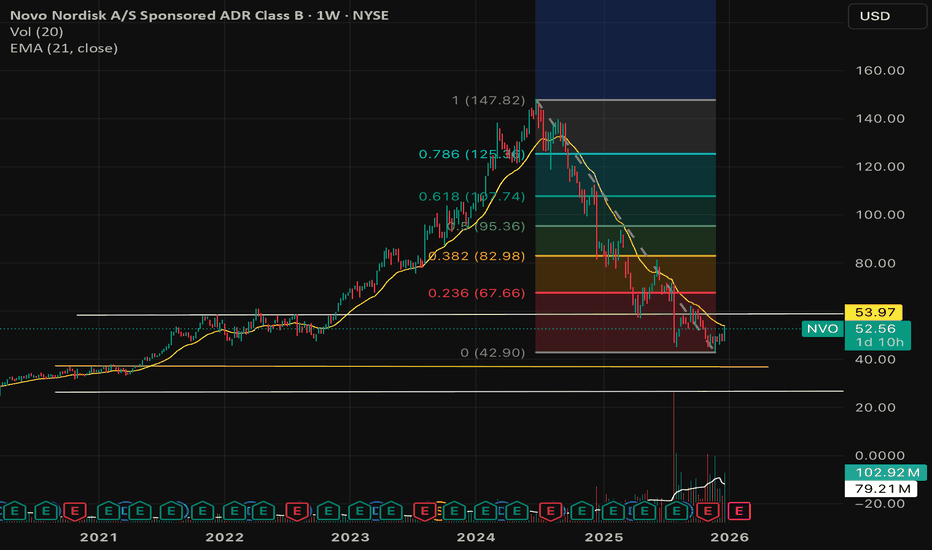

NVO Bullish reversalNVO has started its journey of bullish reversal FINALLY

2026 is the year of NVO strong come back

64 is a very strong resistance , if it closes the daily candle above 64 then we are easily looking at next stop

Enter once its confirmed daily close above 64 with stop loss 58 and ride the wave of bullish reversal :)

NVO

QuantSignals Edge: NVO Bearish Continuation DetectedNVO Weekly Signal | 2026-01-20

📊 TRADE DETAILS 📊

🎯 Instrument: NVO

🔀 Direction: PUT (SHORT)

🎯 Strike: 60.00

💵 Entry Price: 1.65

🎯 Profit Target: 2.50

🛑 Stop Loss: 1.10

📅 Expiry: 2026-01-23

📏 Size: 2.0

📈 Confidence: 60%

⏰ Entry Timing: N/A

Resolution: LLM recommends BUY CALLS but Katy predicts BUY PUTS (-1.38% move). Proceed with caution.

🧠 ANALYSIS SUMMARY

Katy AI Signal: Bearish. The AI predicts a clear downward trajectory over the next ~2 days, with a final target of $59.63 (a -1.10% move from $60.30). The full 78-point time series shows a consistent decline from $60.27 to $59.47, establishing a NEUTRAL trend with bearish momentum. The entry signal is "HOLD," but the price path is decisively lower

Market Context:

• Sharp gap down (-5.11%) with heavy volume (1.9× avg)

• Trading below VWAP & session open

• Katy AI projects continued downside (~-1.38%)

• Options flow slightly bearish (PCR 1.12, $60P active)

Trade Logic:

Short-term bearish continuation play following a breakdown. Katy AI + real-time price action overrides the higher-level bullish weekly bias. Strike chosen for balanced delta and fast payoff if downside continues.

Novo Nordisk (NVO): Bullish Divergence Plays Out Back in December 2024, I posted a Head & Shoulders Reversal pattern alert

on NVO right in the making

The falling knife of this stock cut through all visible targets not only this alert

Fast forward present time, the price had bottomed last November at $43 losing 63% from last post, unbelievable sell-off

Quite often we see Bearish Divergence in my posts

This is the rare case we observe Bullish Divergence on the weekly RSI

It printed higher valleys for the whole 2025 while the price has been doing the opposite - lower bottom one after another

Last November it finally reversed the price to the upside

The action was fast as the price has already reached the former top of $62

This the next bullish trigger after the price released from the orange downtrend

You can see that the RSI has already crossed over 50 igniting the Bullish mode

The target area for the bullish run is set at 38.2-61.8% Fibonacci retracement area between

$84 and $108

$NVO graveyards of gaps waiting to be filled!- NYSE:NVO trend reversal has already happened and is in a uptrend

- NYSE:NVO fundamentals are getting stronger and operates in a field which is exploding every year.

- NYSE:NVO entered 2026 with a stellar announcement of weight loss pills which makes it accessible to lot of people

- NYSE:NVO CEO is fired up with all cylinders when it comes to execution. NASDAQ:AMZN partnership for distribution channel was masterclass move.

Novo Nordisk (Revised) | NVO | Long at $47.78**This is a revised analysis from February 5, 2025: I am still in that position, but added significantly more below $50**

Novo Nordisk NYSE:NVO is now trading at valuations before its release of Wegovy and Ozempic... From a technical analysis perspective, it's within my "major crash" simple moving average zone (gray lines). When a company's stock price enters this region (especially large and healthy companies) I always grab shares - either for a temporary future bounce or a long-term hold. While currently trading near $47 a share, I think worst case scenario here in 2025 is near $38-$39. Tariffs may cause a recession in the second half of 2025, so no company would be immune.

As mentioned above, I am still a holder at $86.74. However, I went in much heavier within my "major crash" simple moving average band and have a final entry planned near $38-$38 (if it drops there). My current cost average is near $55.00.

Why do I still have faith in NYSE:NVO ? Because no one else does right now, yet it generated $42 billion in revenue, $14 billion in profits, and has significant cash flow YoY. The company has a massive pipeline, despite Wegovy and Ozempic competition, and I think the market is undervaluing its position in the pharmaceutical industry.

Revised Targets in 2028:

$60.00 (+25.6%)

$70.00 (+46.5%)

$80.00 (+67.4%)

NVO – Long-Term Cycle View (5–7 Years)Thesis

NYSE:NVO is transitioning from a completed Cycle Wave 2 into a new multi-year expansion phase. The long-term bull structure remains intact, with fundamentals now acting as a catalyst for the next cycle leg.

Context

- Weekly timeframe

- Primary bull trend originates from the 2009 GFC low (< $1)

- Cycle Wave 1 completed in July 2024

- Deep corrective Cycle Wave 2 now appears complete

What I see

-Structural reversal underway from long-term trend support

- Price stabilizing in a major accumulation / buy zone

- New Wegovy pill acts as a fundamental trigger aligning with the technical reversal

- Momentum and structure support the start of Cycle Wave 3

What matters now

- Holding the current base keeps the Cycle Wave 3 thesis intact

- This phase is about accumulation, not timing short-term moves

Buy / Accumulation zone

- Current zone remains suitable for long-term positioning

- This is where multi-year risk/reward is defined

Targets

- Cycle Wave 3 (1.618 Fib): ~$273. Expected around early 2029. Approx. +450% from the buy area

- Cycle Wave 5: ~$415. Expected around 2033. Approx. +730% from the buy area

Income

- Dividend yield ~2.1% adds meaningful carry while holding

Conclusion

Strong technical cycle alignment + improving fundamentals make NYSE:NVO a compelling long-term hold. This is a position built to be held through volatility, not traded.

$NVO – Weekly Structure | Reversal From Long-Term SupportThesis

NYSE:NVO is attempting a structural reversal after a deep corrective phase, supported by long-term trend support and improving fundamental visibility.

Context

- Weekly timeframe

- Multi-year uptrend followed by a sharp corrective decline

- Price has retraced into the long-term rising support zone

- Recent developments in weight-loss treatments improve medium- to long-term outlook

What I see

- Price has held the long-term rising trendline

- Corrective ABC structure appears complete

- Price is stabilizing inside a well-defined accumulation range

- Momentum is shifting from expansion down to basing behavior

What matters now

- The key confluence level sits at the 200-day moving average and the 0.618 Fibonacci retracement near the $59 area

- A break and hold above this level would confirm the reversal structure

- Failure at this level would likely extend consolidation

Buy / Accumulation zone

- The current base along long-term support remains the primary area of interest

- Structure favors accumulation while price holds above the rising trendline

Targets

- First confirmation level at the 200-day MA / 0.618 Fib confluence

- Longer-term reference remains the 200-week moving average in the $80 area

- That level represents a full structural reset following the correction

Risk / Invalidation

- Loss of the long-term rising trendline would invalidate the reversal thesis

NVO – Weekly Structure UpdateThesis

NVO is attempting a structural reversal after a deep corrective phase, supported by both long-term trend support and improving fundamental visibility.

Context

- Weekly timeframe

- 70% correction from cycle highs

- Price has respected the long-term trendline originating in 2016

- Recent product developments in weight-loss therapies improve long-term business outlook

What I see

- Price held the long-term rising support after the correction

- Recent advance reclaimed the 50-day moving average

- Price is consolidating above short-term support, suggesting stabilization

- Structure is transitioning from decline to base formation

What matters now

- Holding above the 50-day MA keeps the early reversal structure intact

- Next key test sits at the confluence of the 0.618 Fibonacci retracement and the 200-day moving average near the $60 area

Buy / Accumulation zone

- Pullbacks toward the current base and rising support zone remain the area of interest

Targets

- Initial resistance at the 0.618 Fib / 200-day MA confluence

- A confirmed higher low after that test would define Wave 1–2 structure

- Longer-term reference remains the 200-week moving average overhead

Risk / Invalidation

- Loss of the long-term trendline would invalidate the reversal thesis

$NVO is 2026 top trade idea. Offers risk adjusted 50-100%- NYSE:NVO has most likely bottom and offer 50-100% upside from ~$50ish level.

- Weight loss technical addressable market is exploding. People are getting weight & fat conscious.

- Weight loss pill will make it accessible for lot of people. It's quite easy to consume than injectables.

Novo Nordisk (NVO) 1WI’m looking at the weekly NVO chart as of late December 2025, and this is no longer about fear or headlines. It’s about structure and valuation. After a powerful multi year rally from 2022 to 2024, the stock went through a deep and healthy correction. In 2025, price built a strong weekly demand base around the 50–55 USD area, where volume profile, historical support and long term buyers align. Selling pressure is fading, volatility is compressing, and price action is stabilizing.

Technically, NVO is transitioning into a post correction accumulation phase. On the weekly timeframe, RSI has recovered from oversold territory and is holding a neutral bullish range. MACD is forming a constructive reversal structure, while declining volume on down moves suggests exhaustion rather than distribution. As long as price holds the weekly base and does not break lower, the recovery scenario remains valid, with upside reference zones near 72–75 USD and later 90–92 USD if momentum confirms.

From a fundamental perspective, as of the end of 2025, Novo Nordisk remains one of the highest quality businesses in global healthcare. Revenue exceeds 39 billion USD, with the Diabetes and Obesity Care segment generating more than 85% of total sales, continuing to show resilient growth. The United States and Europe remain the core revenue drivers, while international markets continue to expand steadily.

Cash flow quality remains strong. Operating cash flow is above 18 billion USD on a TTM basis, free cash flow stays positive despite heavy investments into capacity expansion and R&D. Dividend policy remains disciplined and shareholder friendly, with TTM dividend yield around 2.3% and a payout ratio near 35–36%, leaving room for both reinvestment and future dividend growth.

What matters is that the 2025 correction did not come with any structural deterioration of the business. This was not a business breakdown, but a valuation reset after an extreme growth phase. Expectations have been normalized, multiples compressed, while fundamentals stayed intact. That’s where asymmetry begins to emerge.

Tactically, I see NVO as a long term quality compounder, where 2025 served as a reset year. As long as the weekly structure holds, the path for gradual upside remains open. This is not a short term trade, but a trend rebuilding phase driven by cash flow, market leadership and scale.

Sometimes the best opportunities appear not at peak optimism, but when the market has already done its emotional damage and the numbers are still standing.

NVO mid-term TANVO keeps getting stronger, there's a positive accumulation on daily and it's currently under the resistance of SMA50 and it should breakout, let's wait and see. Long-term accumulation is getting stronger as well but the indicators are also under the resistance yet, though it shouldn't be hard for NVO to push the price towards $60ish and see where we go from there.

Breaking: Novo Nordisk A/S (NVO) Set For 80% BreakoutShares in Novo Nordisk surged over 7% Tuesday premarket after the Wegovy maker secured approval of its GLP-1 pill — a world first.

The U.S. Food and Drug Administration’s approval of Novo Nordisk’s GLP-1 pill gives the Danish pharmaceutical giant a head start over U.S. rival Eli Lilly

The pill’s starting dose of 1.5 milligrams will be available in pharmacies and via select telehealth providers with savings offers for $149 per month in early January, the firm said.

Cash-paying patients can access it for the same price via President Donald Trump’s direct-to-consumer website, TrumpRx, according to the deal Novo Nordisk struck with his administration last month. Drug pricing has been top of mind this year as the U.S. looks to reduce the costs paid by consumers.

The approval caps a turbulent year for Novo, which has been marked by board drama, supply chain shortages, a bidding war against Pfizer, and criticisms over the execution of its U.S. strategy.

Technically, NYSE:NVO stock is gearing for a 80% breakout as the asset is set to break above the symmetrical triangle pattern amidst the FDA approval news bid.

About NVO

Novo Nordisk A/S, together with its subsidiaries, engages in the research and development, manufacture, and distribution of pharmaceutical products in Europe, the Middle East, Africa, Mainland China, Hong Kong, Taiwan, North America, and internationally. It operates in two segments, Diabetes and Obesity Care, and Rare Disease. The Diabetes and Obesity care segment provides products for diabetes, obesity, cardiovascular, and other emerging therapy areas.

NVO long-term TAThere's a good chance that Novo Nordisk will shine again! Technically speaking the volumes and the indicators have not turned bullish yet, but despite of the long downtrend the indicators have been improving for quite some time, weekly accumulation is rising steadily, which signals positive divergence, the current area of $40-45 is good for the support and potential new uptrend in the process. Can it dive even lower? Sure it can but that will push the divergence even higher. In short, keep an eye on NVO.

NVO USThe decline in Novo Nordisk shares is not the result of a single factor, but rather the result of a complex set of fundamental issues: weakening financial performance, loss of competitive advantage in key products, and increased strategic risks.

While negative data on Eli Lilly's weight loss pill in August 2025 triggered a temporary optimistic rebound in NVO shares, it failed to reverse the overall downward trend caused by the company's deeper structural problems.

Now, in order:

Operating and Financial Results

Sales and operating profit growth forecasts for 2025 have been lowered twice; Q3 2025 results below expectations

Operating margin fell to 41.7% from 44.7% (YoY), gross margin decreased to 81.0% from 84.6%

Free cash flow declined 11% due to a sharp increase in capital expenditures

Competitive pressure:

Superiority of Eli Lilly products.

Zepbound (Eli Lilly) demonstrates greater effectiveness in weight loss (20.2% vs. 13.7% for Wegovy); Mounjaro overtook Ozempic in diabetes sales.

NVO's CagriSema failed to meet expectations in clinical trials.

Companies such as Viking Therapeutics, Altimmune, Roche, and Amgen are developing promising anti-obesity drugs, threatening the Novo Nordisk-Eli Lilly duopoly.

The company recently agreed to set a "maximum fair price" for Medicare under the Inflation Reduction Act.

As a result of the deal, the price of Wegovy for certain patient categories is also expected to drop to $149 per month, compared to the current starting price of $1,349. Such a sharp price reduction will directly impact revenue and profits.

Novo Nordisk's share of the US GLP-1 market fell to 43%, while Eli Lilly's grew to 57%.

To protect profitability, Maziar's new CEO, Mike Dusdar, initiated stringent cost-cutting measures, including a hiring freeze, layoffs, and a 23.8% reduction in R&D spending. While this may support cash flow in the short term, this strategy raises concerns about long-term innovation. Eight R&D projects were terminated, potentially slowing the market launch of promising next-generation drugs such as CagriSema and oral semaglutide.

NVO shares attempted a reversal around $60, but then this figure became a mirror level, and investors sold en masse from this price, which is certainly concerning. The chart shows volumes around $60. Be that as it may, the price is now below $50, and we can see the market trying to catch a low, trying to cling to any level. We're expecting a lower price.

$NVO Short Setup | EMA Wall Stops Bulls, Downside Active🎯 NVO Bearish Breakdown: 200 EMA Rejection Setup 🐻

📊 Asset Overview

Novo Nordisk (NVO) - NYSE

Type: Swing/Day Trade Opportunity

Bias: Bearish Reversal Confirmed ⚠️

🔍 Technical Analysis

The bulls just got rejected harder than a bad pickup line at the 200 EMA! 📉 We're seeing strong bearish momentum building up with heavy downside pressure taking control. The market structure screams reversal, and bears are flexing their dominance.

Key Technical Factors:

🚫 200 Exponential Moving Average acting as dynamic resistance

📉 Bearish momentum accelerating with high selling pressure

🔄 Clear market structure reversal pattern forming

🐻 Bears in full control of price action

💰 Trade Setup - "The Thief Strategy"

🎯 Entry Strategy

Layering Method - Multiple limit orders for optimal positioning:

Layer 1: $53.00

Layer 2: $52.00

Layer 3: $51.00

Feel free to add more layers based on your risk appetite and account size!

🛑 Stop Loss

Thief SL: $56.00

⚠️ Risk Disclaimer: This is MY stop loss level. You're the captain of your own ship - adjust based on your risk tolerance and trading plan. Trade at your own risk!

🎯 Target Zone

Primary Target: $44.00

📍 Why $44? Strong support confluence + oversold conditions + potential bull trap zone. Smart money takes profits where the crowd panics!

⚠️ Profit Taking Note: This is MY target. You make your money, you take your money. Don't be greedy - secure those gains when YOUR plan says so!

🔗 Related Pairs to Watch

Keep your eyes on these correlated assets for confirmation:

📈 Pharma/Healthcare Sector:

NYSE:LLY (Eli Lilly) - Direct competitor in diabetes/obesity space

NASDAQ:SNY (Sanofi) - European pharma correlation

AMEX:XLV (Healthcare ETF) - Sector-wide momentum gauge

💵 Currency Impact:

TVC:DXY (US Dollar Index) - Strong dollar = pressure on international stocks

$EUR/USD - Danish Krone correlation (Denmark-based company)

💊 Related Healthcare Plays:

NYSE:JNJ (Johnson & Johnson) - Large-cap healthcare sentiment

NYSE:PFE (Pfizer) - Big pharma correlation

Watch for divergences or confirmations across these pairs to validate the bearish thesis!

📝 Key Points Summary

✅ 200 EMA rejection = institutional selling zone

✅ Bearish market structure confirmed

✅ Multiple entry layers = better average price

✅ Strong support target at $44 = ideal exit zone

✅ Risk management is KING 👑

⚡ The Thief's Edge

This "layering strategy" lets you build positions gradually while managing risk like a pro. Instead of going all-in at one price, you spread your entries to capture the best average. It's not about timing the perfect entry - it's about stacking the odds in your favor! 🎲

🎭 The Thief Strategy: A playful nickname for layered limit order entries. Trade responsibly and within your means.

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#NVO #NovoNordisk #BearishSetup #SwingTrading #DayTrading #TechnicalAnalysis #StockMarket #NYSE #ThiefStrategy #LayeringStrategy #PharmaStocks #200EMA #BearishReversal #TradingIdeas #PriceAction #RiskManagement #Healthcare #BiopharmaTrade

NVO entering "Catch that knife!" zone - Novo NordiskNVO entering "Catch that knife!" zone

Eli Lilly & Co. and Novo Nordisk A/S struck a deal with the Trump administration to offer their blockbuster obesity drugs at lower prices: " ... we're offering it at drastic discounts."

Wake me up when it hits $26

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations

Time to go Long NVO?NVO has had a tough year. It's down 53% ytd.

I accumulated 100 shares at $50 in August and stupidly held the bag despite the price hitting my target of 60.

The price is back down around $50, and looking like a good time to buy.

If you look down at the RSI the last 2 times it sunk to oversold, it triggered runs of 10-20pts.

Personally, I think the stories of increased competition are overblown. This is the largest company in Europe and still a leader. The share price needs help from some US gov't policy, but it's definitely in its accumulation zone again. Moreover, it looks like it could finally break the downward trendline started back in December.

Share prices dopped to $50 once again today on the news that it's bidding on Metsera. And on the news, I bought another 100 shares.

This trade is active.

$NVO end of bearish trend. - NYSE:NVO has exited the bearish trend and very soon it will be doing a trend reversal and enter a new trend.

- if it consolidates, trade sideways or up is yet to be seen.

- However, if a stock exits such a prominent downtrend then move to the upside after breakout is explosive.

- Fundamentals are backing $NVO.

- R&D is crown jewel of this company

- Operation efficiency is improving under the new leadership

- Entering new markets like India would unlock huge market for NYSE:NVO

- Pills are the next growth lever for the company.

- On top of that, Valuation is too cheap for an exploding TAM of weight loss and it's health benefit.

$NVO supertrend 3-5x in next 5 years- Don't trade NYSE:NVO but invest.

- NYSE:NVO is in 28 years of uptrend and the innovation DNA of this company will prove the investors yet again.

- Reasons to be bullish on NYSE:NVO

- NYSE:NVO is making pills for weightloss but that not only helps in weight management but also reduces risk of heart attack, stroke, control diabetes.

- Injections are costly to manufacture and has less shelf life on top of that in order to take injections one often require assistance whereas pills is very easy to consume just like vitamins.

- NYSE:NVO move towards oral pills unlock massive TAM ( technical addressable market ) as millions of people are suffering with obesity, diabetes, chronic heart and brain disease that having access to this pill would be like getting a vitamin pill.

- NYSE:NVO is like index fund for denmark just like NASDAQ:QQQ where majority of weight is taken by big tech stocks. Danish funds and people will continue to buy the dip regardless of whether NYSE:NVO is in bearish cycle or bullish.

- NYSE:NVO valuation is super cheap and is even lower than NYSE:NVO started the injectibles for weight loss.

- NYSE:NVO leadership is reflective and has conducted reduction in workforce which is rare for healthcare company as healthcare company usually run like welfare/government bloated. CEO is ready to keep startup like culture and promote innovation DNA alive.

- I believe NYSE:NVO offers asymmetric opportunity and is going to be a long term compounder for years to come.

Why Did Novo Stock Fall So Sharply YesterdayNovo Nordisk shares plunged nearly 20–23% on July 29, 2025, marking its worst trading day since Black Monday in 1987.

Significant Downgrade of 2025 Financial Outlook

The company revised its sales growth forecast for 2025 down to 8–14%, from its prior guidance of 13–21%, and reduced expected operating profit growth from 16–24% to 10–16%. This adjustment was attributed to weaker-than-expected demand for Wegovy and Ozempic, and rising competitive pressures

#TheWallStreetJournal

I will start my accumulation using DCA, but will be happier to start buying this stock heavily from $47 zone.

trade with care.

I look forward to connecting with you