IMPP Imperial Petroleum Options Ahead of EarningsIf you haven`t bought IMPP before the rally:

Now analyzing the options chain and the chart patterns of IMPP Imperial Petroleum prior to the earnings report this week,

I would consider purchasing the 7usd strike price Calls with

an expiration date of 2026-4-17,

for a premium of approximately $0.85.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Options-strategy

Gold at a Turning Point: Will It Rise or Fall?As we zoom in and take a closer look at how GOLD is moving, one thing becomes immediately clear:

The market has just shown a powerful upward surge, but now something intriguing is happening. The price is compressing, forming a tight, small triangle, a sign that the market is building up energy. In moments like this, there are usually two potential paths, but given the bullish context, I can almost feel that a breakout to the upside is the more likely scenario.

What do you think? Do you agree with me?

Let me know your thoughts in the comments! And trust me, joining the TradingView community is one of the best ways to improve your skills as a trader every single day.

Just a reminder: this isn't financial advice, but rather my personal take on the chart.

TSLA V3 Weekly Alert — Deep ITM CALL SignalTSLA QuantSignals V3 Weekly 2025-11-14

AI & Technical Forecast

Katy AI Target: $421.69 (+3.2% upside)

Expected Dip: $390.59 Monday before mid-week recovery

Momentum: Strong weekly uptrend, MACD bullish, EMA alignment confirms uptrend

Support: $402.40

Resistance / AI Target: $421.69

Insights:

Friday expiration entry offers volatility discount; deep ITM call captures most delta with minimal extrinsic loss

PCR 3.30 → institutional put-heavy positioning, creating potential contrarian opportunity

Event Risk: Elon Musk fireside chat (Friday 1:05 PM ET) may spike volatility

🎯 Trade Setup

Parameter Value

Direction CALL

Strike $370.00

Entry $40.30–$40.55 (mid: $40.42)

Target 1 $46.00 (+13.8%)

Target 2 $52.00 (+28.6%)

Stop Loss $35.05 (–13.3%)

Position Size 2–3% of portfolio

⚡ Key Advantages

Deep ITM structure → high delta exposure (stock-like behavior)

Limited extrinsic value → reduces theta and IV crush risk

Timing aligned with post-event momentum and mid-week recovery

Risk/Reward ~2.15:1 (Target 1 vs stop)

🚨 Risk Notes

PCR 3.30 → extreme hedging/fear; stop may trigger quickly

Theta decay accelerates Mon-Wed; manage positions carefully

Deep ITM calls → wider spreads; use limit orders

Consider scaling out at Target 1 to reduce gamma exposure

Summary:

TSLA deep ITM weekly call provides contrarian, medium-conviction bullish exposure, leveraging AI trajectory and technical alignment. Suitable for 7-day horizon with disciplined risk management.

SLS SELLAS Life Sciences Group Options Ahead of EarningsAnalyzing the options chain and the chart patterns of SLS SELLAS Life Sciences Group prior to the earnings report this week,

I would consider purchasing the 3.50usd strike price Calls with

an expiration date of 2027-1-15,

for a premium of approximately $0.52.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

ACHR to take flight (again)ACHR is my favourite vertical flight buys. I think JOBY is over-priced, and EVTL just doesn't seem to have enough market visibility.

I've been in and out of ACHR for the better part of 2 years, and it's coming back into a spot where a swing makes a bit of sense.

It's still in the rising wedge (which of course, it could fall out of), but there's lots of support to indicate that it should hold.

1. Today at pre-market it's trading at $10. That's almost exactly the POC for the past year.

2. The 200 day moving average is at about $9.50

3. The lower trendline is at about $9.00

With earnings on Thursday, there is some risk to this trade, but I think with options premiums, it's a good risk/reward balance.

On open, I'll look to sell puts somewhere around my ideal entry point which is $9.

Ideally I'd like a 10% value on the puts which means that I'd like about $0.09 per share.

If the earnings crash, and I own the stock below $9, I'm OK with that. If the stock price drops, but stays above $9, I may just outright buy it. If the stock price jumps, I'll keep the premium, and wait for a new entry point at a later date.

I'll update this at market open.

NOK Nokia Options Ahead of EarningsAnalyzing the options chain and the chart patterns of NOK Nokia prior to the earnings report this week,

I would consider purchasing the 5.50usd strike price Calls with

an expiration date of 2025-11-21,

for a premium of approximately $0.34.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Dealers Were in Short Gamma. No Surprise We DroppedA massive flip zone just showed up on the GEX map and dealers were positioned deep in short gamma.

That means every downward move in spot forced them to sell even more to hedge, amplifying the pressure.

So it’s not a random sell-off , it’s a mechanical reaction from the dealer flow itself.

When the market enters negative gamma territory, volatility feeds on itself.

Why IonQ (IONQ) Could Be the NVDA of Quantum ComputingIf you haven`t bought IONQ before the rally:

Now you need to know that IonQ isn’t just another speculative quantum stock — The company is building a robust ecosystem around its best‑in‑class trapped‑ion architecture and targeting fault‑tolerant, networked quantum systems. With record bookings, major acquisitions, and a strong balance sheet, IonQ could emerge as the NVIDIA equivalent for quantum infrastructure.

Key Bullish Arguments

1) Superior Quantum Tech – Trapped‑Ion Advantage

IonQ’s trapped-ion processors boast 99.9% two-qubit fidelity, demonstrating higher accuracy and scalability than superconducting alternatives

These systems also operate at room temperature, meaning simpler deployment and lower costs

2) Ecosystem Strategy & Acquisitions

The $1.08B acquisition of Oxford Ionics (expected close in 2025) expands IonQ’s qubit control tech, pushing toward planned 80,000 logical‑qubit systems by decade’s end

Combined with ID Quantique and Lightsynq, IonQ is building a full-stack quantum and networking offering

3) Strong Revenue Growth & Cash Runway

Revenue soared from $22M in 2023 to $43.1M in 2024, with bookings of $95.6M

. Q1 2025 saw $7.6M revenue and EPS –$0.14, beating expectations; cash reserves near $697M provide years of runway

4) Real Commercial Deployments

IonQ sold its Forte Enterprise quantum system to EPB ($22M deal) for hybrid compute and networking, marking real-world commercial applications

5) AI & Quantum Synergy

Involvement in NVIDIA’s Quantum Day and hybrid quantum‑classical AI demos (e.g., blood pump simulation with Ansys, ~12 % faster) indicates strategic synergy and positions IonQ as a critical piece in the future AI stack

Recent Catalysts:

Texas Quantum Initiative passes – positions IonQ at forefront of U.S. state-backed innovation

Oxford Ionics acquisition pending – major expansion in qubit scale & tech

Barron’s analyst buys – industry analysts see long-term potential; IonQ among top quantum picks

Broader quantum optimism – McKinsey & Morgan Stanley forecasts highlight synergy between quantum and AI, benefiting IonQ

KMX CarMax Options Ahead of EarningsIf you haven`t sold KMX before the previous earnings:

Now analyzing the options chain and the chart patterns of KMX CarMax prior to the earnings report this week,

I would consider purchasing the 90usd strike price in the money Calls with

an expiration date of 2027-1-15,

for a premium of approximately $4.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CRM Salesforce Options Ahead of EarningsIf you ahven`t bought CRM before the rally:

Now analyzing the options chain and the chart patterns of CRM Salesforce prior to the earnings report this week,

I would consider purchasing the 300usd strike price Calls with

an expiration date of 2025-12-19,

for a premium of approximately $7.52.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

HPQ HP Options Ahead of EarningsIf you haven`t sold HPQ before the previous earnings:

Now analyzing the options chain and the chart patterns of HPQ HP prior to the earnings report this week,

I would consider purchasing the 26usd strike price Puts with

an expiration date of 2025-8-29,

for a premium of approximately $0.42.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

JD Options Ahead of EarningsIf you haven`t bought JD before the recent rally:

Now analyzing the options chain and the chart patterns of JD prior to the earnings report this week,

I would consider purchasing the 32.50usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $3.10.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

PTON Peloton Interactive Options Ahead of EarningsIf you haven`t bought the dip on PTON:

Now analyzing the options chain and the chart patterns of PTON Peloton Interactive prior to the earnings report this week,

I would consider purchasing the 7.50usd strike price Calls with

an expiration date of 2025-8-8,

for a premium of approximately $0.46.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

MSFT Microsoft Corporation Options Ahead of EarningsIf you haven`t bought MSFT when they announced the 49% stake in OpenAI:

Now analyzing the options chain and the chart patterns of MSFT Microsoft Corporation prior to the earnings report this week,

I would consider purchasing the 550usd strike price Calls with

an expiration date of 2025-12-19,

for a premium of approximately $14.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

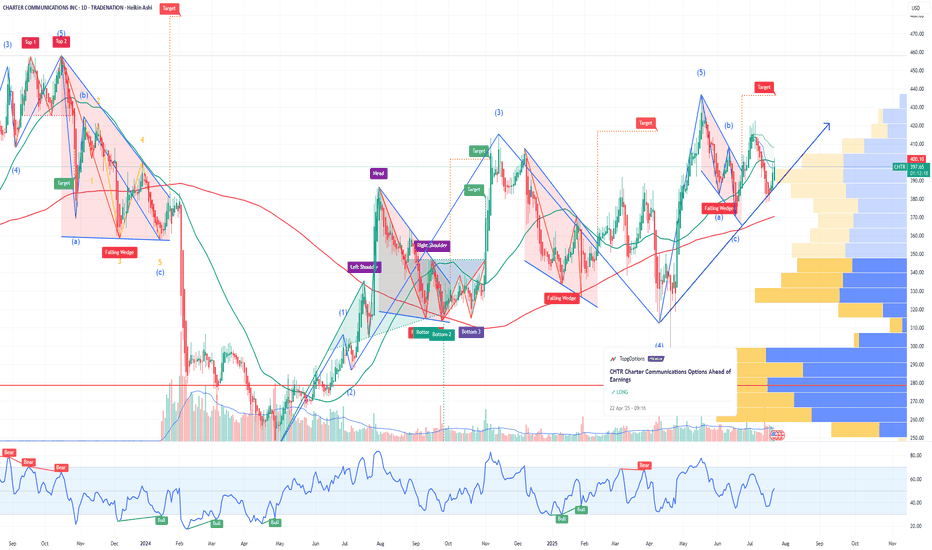

CHTR Charter Communications Options Ahead of EarningsIf you haven`t bought CHTR before the previous earnings:

Now analyzing the options chain and the chart patterns of CHTR Charter Communications prior to the earnings report this week,

I would consider purchasing the 387.5usd strike price Calls with

an expiration date of 2025-7-25,

for a premium of approximately $22.55.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DG Trading Setup: Capitalizing on RangeDollar General has experienced a stabilization phase following its Q1 2025 results, with same-store sales increasing 2.4% and revenue growing 5.3% to $10.4 billion. The company has regained traction in the discount retail space, mitigating previous challenges related to shrink and operational inefficiencies.

Institutional Flow & Market Positioning

Recent institutional flow highlights large orders in DG’s 115 call and 110 put, signaling either:

- A range-bound setup, where smart money expects the stock to stay between $110-$115 in the near term.

- Potential volatility, with institutions hedging both directions ahead of an unexpected move.

Considering the ATR (18) and standard deviation (7.353), this aligns with a low-breakout probability, making range-based strategies the optimal play. The absence of earnings between now and July further supports sideways movement expectations.

Options Trade Setup: Iron Condor

To capitalize on premium decay and IV contraction, I’m structuring an iron condor:

- Sell 115 Call / Buy 120 Call

- Sell 110 Put / Buy 105 Put

This strategy ensures limited risk while collecting premium in a high-probability range trade.

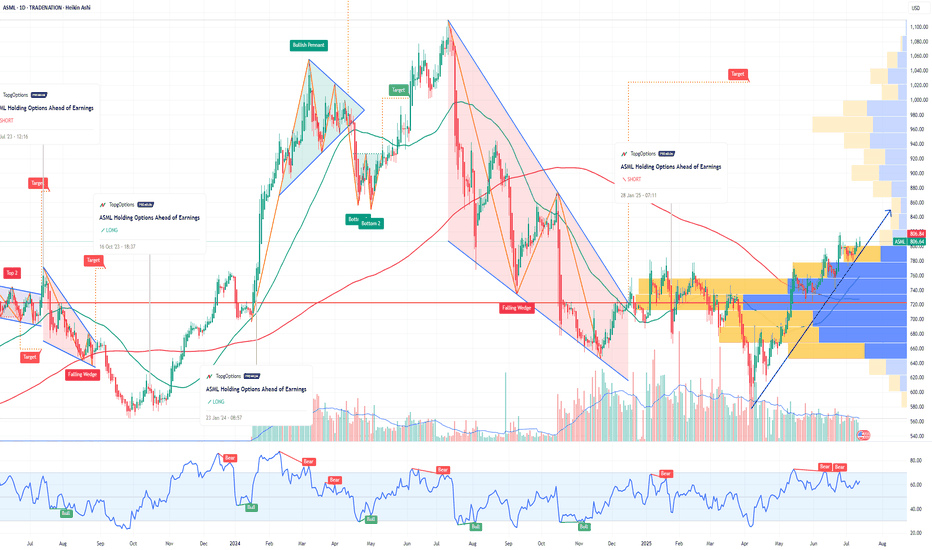

ASML Holding Options Ahead of EarningsIf you haven`t bought the dip on ASML:

Now analyzing the options chain and the chart patterns of ASML Holding prior to the earnings report this week,

I would consider purchasing the 800usd strike price Calls with

an expiration date of 2025-7-25,

for a premium of approximately $32.00.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

MP Materials Options Ahead of EarningsIf you haven`t bought MP before the previuos earnings:

Now analyzing the options chain and the chart patterns of MP Materials prior to the earnings report this week,

I would consider purchasing the 25usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $2.97.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Carvana Leading Auto Retail – Outpacing LAD & AN-Financial Performance & Momentum:

Carvana reported a record-breaking adjusted EBITDA of $488M in Q1 2025, up $253M YoY, with an EBITDA margin of 11.5% (+3.8pp YoY). The company's strong operational efficiency positions it as a leader in the auto retail industry, nearly doubling the margins of competitors like Lithia Motors (LAD) and AutoNation (AN).

- Competitive Positioning & Growth Outlook:

Carvana’s EBITDA quality is superior due to lower non-cash expenses, enhancing long-term sustainability. The company expects sequential EBITDA growth in Q2 and targets 13.5% EBITDA margins within 5-10 years.

-Peer Comparison:

- Lithia Motors (LAD): EBITDA margin at 4.4% (up from 4% YoY), facing tariff-related headwinds that could impact pricing and demand.

- AutoNation (AN): SG&A as a percentage of gross profit rose to 67.5% in Q1, expected to stay between 66-67% in FY 2025, pressuring margins further.

-Options Flow & Institutional Activity - Key Levels: $350/$370

Recent institutional flow activity indicates strong positioning around $350/$370 strikes, potentially signaling a vertical spread in play rather than outright selling:

1️⃣ Momentum Confirmation:

- CVNA has strong upside momentum following its Q1 results, reinforcing a bullish outlook for near-term price action.

- Institutional traders may be accumulating bullish vertical spreads rather than unwinding positions.

Vertical Spread Setup ($350/$370 Strikes)

- Long Call ($350 Strike) → Signals expectations for further upside.

- Short Call ($370 Strike) → Caps max profit while reducing cost.

- Breakeven Price: $359 → CVNA must close above $359 for profitability.

Profit & Risk Zones

- Above $370: Maximum profit achieved.

- Between $359-$370: Partial profit zone (spread remains in play).

- Below $359: Spread loses value, making recovery dependent on extended upside momentum.

MKC McCormick & Company Options Ahead of EarningsAnalyzing the options chain and the chart patterns of MKC McCormick & Company prior to the earnings report this week,

I would consider purchasing the 85usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $1.40.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

RBRK Rubrik Options Ahead of EarningsAnalyzing the options chain and the chart patterns of RBRK Rubrik prior to the earnings report this week,

I would consider purchasing the 90usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $5.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.