TheGrove | GBPCAD buy | Idea Trading AnalysisGBPCAD broke through multiple resistance line and is now holding above the trendline and key level zone. The current pullback toward the marked support cluster suggests a potential continuation of the bullish move, provided price holds this structure.

GBP/CAD is trading within a rising channel, with price holding above the ascending support line after a clear bullish and is moving on Resistance level.

Hello Traders, here is the full analysis.

GOOD LUCK! Great BUY opportunity GBPCAD

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad ⚜️

Community ideas

GOLD and USD fundamental analysis and causality currentlyMacro-Financial Analysis of XAUUSD, XAGUSD, and the US Dollar Index: A Comprehensive Q1 2026 Fundamental Assessment

The global financial landscape in January 2026 is defined by a profound transition in the macro-economic regime, characterized by a shift from the post-pandemic recovery era into a period of acute geopolitical fragmentation, aggressive fiscal realignment, and a technological revolution centered on artificial intelligence. This environment has precipitated a historic divergence in the performance of hard assets versus traditional fiat instruments. While the US Dollar Index (DXY) grapples with a systemic crisis of confidence, gold (XAUUSD) and silver (XAGUSD) have ascended to unprecedented record highs, driven by a combination of sovereign de-dollarization, industrial scarcity, and a fundamental reassessment of global risk.

As of late January 2026, the primary catalysts for market momentum are rooted in the implementation of the One Big Beautiful Bill (OBBB) Act in the United States, a contentious pause in the Federal Reserve’s monetary easing cycle, and a worsening geopolitical climate involving territorial disputes over Greenland and the subsequent fracturing of Western trade alliances.1 These factors have created a "multi-dimensional polarization" in global markets, where fiscal stimulus and technological optimism coexist with deep concerns regarding debt sustainability and currency weaponization.5

The US Dollar Index (DXY): Fiscal Expansion and the Crisis of Confidence

The US Dollar Index, which serves as a benchmark for the greenback’s strength against a basket of six major currencies, is currently undergoing a period of intense structural pressure. In January 2026, the DXY slumped to 47-month lows, breaking below the pivotal 96.00 handle before attempting a tentative stabilization near 96.41.7 This depreciation marks a significant reversal from the elevated levels seen in early 2025, when the index frequently traded between 106.00 and 109.00.9

The fundamental drivers behind this dollar weakness are layered. At the surface level, weak consumer confidence data and dovish rhetoric from the executive branch regarding the benefits of a weaker currency for manufacturing competitiveness have triggered sentiment-driven sell-offs.7 Beneath these immediate triggers lies a complex fiscal story defined by the One Big Beautiful Bill Act and its impact on the long-term creditworthiness of the United States.

The Fiscal Impulse: One Big Beautiful Bill (OBBB) Act and Debt Sustainability

The OBBB Act, signed into law on July 4, 2025, represents the most significant overhaul of the US tax and spending code in the 21st century.3 By permanently extending the provisions of the 2017 Tax Cuts and Jobs Act (TCJA) and introducing new tax exemptions for tips, overtime, and senior citizens, the bill has created a massive fiscal impulse.10 While proponents of the bill, including the Council of Economic Advisers, suggest that the GDP could grow by over 5% in the short run due to these measures, more cautious analyses from the Congressional Budget Office (CBO) and Yale’s Budget Lab highlight severe long-term risks.12

The CBO projects that the OBBB will increase the federal deficit by $3.4 trillion over the next decade, a figure that rises to more than $4 trillion when accounting for additional interest on the national debt.10 This expansion of debt is occurring at a time when the US debt-to-GDP ratio is already on a path to reach 194% by 2054.14 The "crowding out" effect of this government borrowing is pushing real interest rates higher, as the market demands a larger term premium for holding long-dated US debt.14 Consequently, while the dollar may benefit from higher yields in a traditional "Dollar Smile" scenario, it is currently suffering from a "Dollar Smirk," where the fiscal deficit and policy uncertainty act as a drag on the currency’s attractiveness despite high nominal rates.15

OBBB Provision

10-Year Deficit Impact

Economic Objective

Long-term Consequence

Individual Rate Cuts

+$2.2 Trillion

Sustaining Consumer Spending

Erosion of Revenue Base

Standard Deduction Double

+$1.4 Trillion

Working Class Relief

Increased Debt Load

Business Expensing

+$646 Billion

Re-shoring Manufacturing

Short-term Capex Boost

Clean Vehicle Rollbacks

-$543 Billion

Fiscal Offset

Delayed Green Transition

Medicaid Reforms

-$917 Billion

Spending Reduction

Social Safety Net Pressure

Data compiled from.10

Federal Reserve Policy: The January 2026 Pause and Internal Dissension

The Federal Reserve’s January 28, 2026, policy decision to maintain the federal funds rate at a target range of 3.50% to 3.75% was widely expected but far from unanimous.2 This move represents the first pause after three consecutive 25-basis-point cuts in late 2025.19 The FOMC’s statement adopted a "hawkish tilt," upgrading its assessment of the labor market and economic growth to "solid" while acknowledging that inflation remains "somewhat elevated" at a core PCE rate of approximately 2.7% to 3.0%.2

However, the internal split within the committee—manifested by dissents from Governors Christopher Waller and Stephen Miran in favor of a rate cut—suggests that the Fed is struggling to balance its dual mandate.2 The "data-dependent" approach is complicated by the fallout from the late-2025 government shutdown, which skewed top-tier data and delayed the publication of key employment and inflation readings.2 Chair Jerome Powell has indicated that the Fed is "well-positioned" after previous cuts but faces a new inflationary challenge from tariffs, which he characterized as a "one-time price event" rather than a demand-driven trend.2

This monetary policy stance has significant implications for the DXY. If the Fed maintains a "higher-for-longer" posture while the Bank of Japan (BoJ) and Reserve Bank of Australia (RBA) continue their tightening cycles, the dollar may find localized support against those specific pairs.24 However, the broader trend remains bearish as investors price in the possibility that the Fed will eventually have to prioritize labor market stability over inflation as unemployment stabilizes near 4.5% to 4.6%.13

Commitment of Traders (COT) Analysis: US Dollar Index

Positioning data from the Commodity Futures Trading Commission (CFTC) as of late January 2026 confirms a deeply entrenched bearish sentiment toward the US dollar. Non-commercial traders, including large speculators and hedge funds, have maintained a net-short position in the DXY for the better part of seven months.28

Market Participant

Net Positioning (Jan 2026)

Trend from Previous Month

Sentiment Classification

Large Speculators

-38,000 contracts

Short exposure reduced by 75%

Cautiously Bearish

Asset Managers

Net Short

Flipped from long in early Jan

Institutionally Bearish

Non-Commercial

-6,418 contracts

Strengthening short conviction

Momentum Bearish

DXY Spot Level

96.41

Approaching 3-year lows

Technically Oversold

Data sourced from.8

The COT report highlights a critical vulnerability: while large speculators have reduced their absolute short exposure, asset managers have recently flipped to a net-short stance for the first time since October 2025.28 This alignment suggests that institutional capital is increasingly hedging against a further decline in the dollar, potentially driven by the "crowded" nature of long Euro and long Yen trades.26 Analysts note that if US economic data continues to surprise to the upside, particularly in terms of GDP growth or persistent service-sector inflation, these short positions could be vulnerable to a tactical squeeze.26

Gold (XAUUSD): The Sovereign Safe-Haven and Geopolitical Barometer

Gold has entered a historic bull market phase, surpassing the psychologically and technically significant $5,000 per ounce threshold in late January 2026.30 The metal’s ascent to a record high of $5,600 marks one of the strongest rallies in modern market history, with gains of approximately 30% year-to-date following a 65% surge in 2025.4 This "orderly rally" reflects a fundamental transformation in how the market values gold—shifting from a mere inflation hedge to a cornerstone asset used for protection against geopolitical fragmentation and currency weaponization.31

Geopolitical Fragmentation: The Greenland Dispute and NATO Tensions

The primary catalyst for the early 2026 surge in gold prices is the eruption of fresh geopolitical tensions centered on Greenland.1 The Trump administration's renewed focus on the strategic importance of the Arctic territory, coupled with threats of tariffs on countries that block US interests in the region, has unsettled international risk sentiment.1 This situation has effectively opened a new front in the global trade war, primarily aimed at Europe and raising serious questions about the future of NATO.1

Gold has absorbed this geopolitical stress directly, acting as a "barometer of global anxiety".31 Unlike crude oil, which has reacted cautiously to these headlines due to a well-supplied market, gold has pushed forcefully to record highs.33 This divergence suggests that investors are no longer solely concerned with supply-chain disruptions but are seeking a refuge from systemic political risk and the potential collapse of established diplomatic orders.31

De-Dollarization and the Central Bank Structural Bid

A more profound and long-term force driving gold is the accelerating trend of de-dollarization among emerging market (EM) central banks.31 These institutions have been aggressively diversifying their reserves away from the US dollar to hedge against the risk of financial sanctions and to protect their economic sovereignty.16

Net central bank purchases reached nearly 300 tons in the first eleven months of 2025, with China reporting a 14-month streak of continuous buying through December.31 This "structural bid" provides a permanent floor for gold prices, as sovereign demand is largely insensitive to the metal's high nominal price.31 Furthermore, wealth management platforms and institutional investors have begun re-integrating gold into multi-asset portfolios as a "diversified store of value" that outperforms US Treasuries in a period of fiscal instability.15

Driver Category

Momentum Influence

Underlying Mechanism

Future Outlook

Geopolitics

High (Upward)

Greenland Conflict/NATO Friction

Continued High Volatility

Monetary Policy

Moderate (Upward)

Fed Pause/Expectation of Cuts

Potential Tailwinds in H2 2026

Central Bank

Persistent (Upward)

De-dollarization in EM

Structural Long-term Support

ETF Inflows

Rising (Upward)

Retail & Institutional FOMO

Risk of Speculative Bubble

Fiscal Health

High (Upward)

OBBB Debt Load Concerns

Hedge against US Solvency

Data synthesized from.1

Commitment of Traders (COT) Analysis: Gold (GC) Futures

Positioning in the COMEX gold futures market reflects a high level of speculative commitment, though analysts caution that the market has not yet reached a state of "euphoric extreme".1

Managed Funds: This category of traders increased their net-long exposure by 11.5k contracts (9.4%) in mid-January, pushing their net exposure to range highs on a 3-month rank basis.1 The move was primarily driven by a rise in gross-long exposure (+12.4k contracts).1

Large Speculators: Speculative bulls added 27.7k contracts to their net-long positions, indicating a strong desire to chase the trend even at record price levels.1

Commercial Traders: In contrast, commercials (producers and end-users) are heavily on the short side, with approximately 24.7k short contracts versus 5k long.35 This is typical hedging behavior as producers lock in prices at historic highs to protect against a future correction.35

The divergence between commercials and speculators suggests that while the trend is firmly bullish, the physical market is beginning to build up a significant hedge wall, which could lead to sharp intraday reversals if geopolitical tensions show signs of de-escalating.31

Silver (XAGUSD): Industrial Nexus and the Market Squeeze

Silver has emerged as the standout performer of 2026, characterized by a parabolic rally that saw prices surge from approximately $31.60 to a record high of $120 per ounce in a single month.4 This 65% jump in January 2026, following a 150% gain in 2025, has outpaced gold significantly, compressing the gold-silver ratio to near 15-year lows of approximately 43:1, with Citigroup forecasting a further narrowing to 32:1.4

The fundamental drivers for silver are fundamentally different from gold. While silver retains its status as a monetary hedge and safe-haven, its primary momentum is now dictated by its role as an indispensable industrial metal for the twin revolutions of Green Energy and Artificial Intelligence.4

The AI Supercycle and Green Energy Revolution

Silver's unmatched electrical and thermal conductivity makes it critical for the high-performance hardware that underpins the AI boom.4

AI Infrastructure: Massive investments in data centers and high-frequency signal transmission require silver for specialized cooling systems and power delivery modules.6

Solar Photovoltaics (PV): The solar industry is currently in a state of crisis due to its reliance on silver paste.39 China's solar manufacturing sector, which accounts for the vast majority of global production, has seen input costs triple over the past year.39 Each standard solar cell requires specific silver paste formulations, and at $120 per ounce, the risk of "demand destruction" or a forced shift toward copper substitution is rising.32

Electric Vehicles (EVs): The average silver requirement per vehicle has multiplied as manufacturers shift to higher-voltage systems and advanced battery management.37

China’s Export Restrictions and the Supply Squeeze

A pivotal fundamental shift occurred in January 2026 when China implemented new export licensing requirements for refined silver.4 This policy, designed to protect domestic manufacturers and build strategic reserves, has created "artificial scarcity" in the global physical market.37 International buyers are now forced to compete for a dwindling pool of available supply in an increasingly illiquid market, where incremental demand changes have an outsized impact on price.37

On the supply side, silver production remains highly inelastic. Approximately 70% of silver is produced as a by-product of lead, zinc, and copper mining.37 Therefore, mining operations cannot easily ramp up silver production in response to higher prices without a corresponding increase in demand for the primary metals.37 This structural constraint, combined with China's export curbs, has set the stage for a classic "market squeeze".37

Silver Market Factor

Status in Q1 2026

Impact on Momentum

Price Target

$150 (Citi Forecast)

Bullish Bias

China Export Policy

Licensing Restrictions

Supply Scarcity

Industrial Usage

60% of Total Demand

Structural Tightness

By-Product Mining

Delayed Supply Response

Price Inelasticity

Solar PV Sector

Significant Cost Inflation

Potential Demand Destruction

Data sourced from.4

Commitment of Traders (COT) Analysis: Silver (SI) Futures

Despite the explosive move in price, the COT data for silver reveals a surprising level of caution among institutional futures traders, suggesting that the rally is being driven by the physical market and retail momentum rather than speculative futures length.

Managed Funds: Net-long exposure in silver futures fell to its least bullish level since February 2024 during the January rally.1 Funds are "clearly in no mood to chase this parabolic rally," perhaps fearing a bubble burst or being deterred by the volatility.1

Large Speculators: This group has also seen net-long exposure trend lower since its peak in mid-2025, suggesting a rotation out of futures and potentially into physical bullion or mining equities.1

Commercial Hedging: The silver rally has triggered massive "short covering" from industrial producers.32 As prices surged, those who had hedged future production at $30 or $40 per ounce faced severe margin calls, forcing them to buy back their short positions and adding further fuel to the upside momentum.32

This "inherently unstable" dynamic, where producers are being squeezed out of their hedges, suggests that the silver rally is driven by technical and physical factors that could reverse sharply if the supply-demand balance is restored.32

Treasury Yields and the 2026 Economic Outlook

The US Treasury market is providing critical context for the performance of the DXY and precious metals. As of late January 2026, the 10-year Treasury yield is at 4.24%, while the 2-year yield has softened slightly to 3.53%.41 This has resulted in a "bull steepening" of the yield curve, where shorter-term rates fall faster than long-term rates as the market anticipates eventually lower Fed policy while worrying about long-term fiscal deficits.14

The Yield Curve as a Recessionary Indicator

Historically, a negative spread between the 10-year and 2-year Treasury notes (the 10-2 spread) is a reliable leading indicator of a recession, with an average lead time of 48 weeks from the first inversion.41 The curve was continuously inverted from July 2022 through August 2024.41 In early 2026, the curve has un-inverted and is steepening—a phase that historically precedes the actual onset of a recession by an average of 18.5 weeks.41

This "un-inversion" is currently a major fundamental driver. If the market believes a recession is imminent despite the OBBB's short-term stimulus, the dollar will likely remain under pressure while gold benefits from flight-to-quality flows.16 However, if the stimulus successfully engineers a "soft landing" with 2.5% GDP growth, yields may stabilize at higher levels, potentially curbing the gold rally in the second half of 2026.17

Inflation Expectations: Core PCE and the Tariff Impact

Inflation expectations remain a point of contention between the Fed and the market. The University of Michigan survey indicates that consumers expect 3.4% inflation over the 5-to-10-year horizon, likely influenced by the perceived long-term impact of tariff policies and fiscal spending.43 Goldman Sachs, however, forecasts that core PCE inflation will fall to 2.1% by December 2026 as the "one-time" boost from tariffs fades and AI-driven productivity gains begin to exert downward pressure on prices.13

The divergence between high consumer inflation expectations and the Fed's target is a primary reason why bond yields have remained elevated.43 For gold and silver, this "sticky inflation" environment is highly favorable, as it keeps real interest rates from rising too aggressively even as nominal yields move higher.5

Global Monetary Divergence: DXY vs. Major Counterparts

The performance of the DXY in early 2026 is heavily influenced by the relative strength of its major components, particularly the Euro, the Yen, and the British Pound. A significant trend of monetary policy divergence is emerging, which is acting as a primary driver of currency momentum.

The Japanese Yen (USDJPY) and Intervention Risks

The Japanese Yen has become a source of intense volatility for the dollar. Suspected intervention by the Bank of Japan and the Ministry of Finance to buy the Yen and sell the Dollar has pushed the USDJPY from highs near 159 down toward 152.79.44 The BoJ is moving away from its decade-long accommodative stance, with historical highs in JGB yields (30-year at 3.35%) encouraging capital repatriation.25 This reversal of carry trades—where investors borrow in Yen to buy higher-yielding US assets—is a major headwind for the dollar and a tailwind for the Yen.17

The Euro (EURUSD) and the ECB Hold

The Euro has stabilized near 1.19 against the dollar as the European Central Bank (ECB) is expected to maintain its policy rate on hold despite falling inflation.8 This creates a yield differential advantage for the Euro as the Fed continues its pausing/easing cycle.24 However, the Euro faces its own risks from the Greenland-related trade war and the potential for structural drag from high energy costs.1

The British Pound (GBPUSD) and Economic Fragility

Sterling has reached four-year highs above 1.3850 against the dollar.7 This strength is somewhat paradoxical given the "sluggish" nature of UK GDP growth and rising unemployment.25 The Pound’s rally is largely a function of a "crisis of confidence" in the dollar rather than a surge in UK economic optimism.7 The Bank of England (BoE) is expected to continue a very gradual easing cycle, with a 25-basis-point cut anticipated in Q1 2026, though the market expects the BoE to remain more restrictive than the Fed in the long run.25

Currency Pair

Rate (Jan 29, 2026)

Central Bank Stance

Key 2026 Driver

DXY

96.41

Pause after Easing

Fiscal Deficit/OBBB

EURUSD

1.1932

On Hold

US-Europe Trade Friction

USDJPY

152.79

Gradual Tightening

JGB Yield Spikes/Intervention

GBPUSD

1.3772

Gradual Easing

Inflation Persistence

AUDUSD

0.6994

Potential Tightening

Metals Demand (Gold/Silver)

Data synthesized from.8

Industrial and Mining Fundamentals: The Foundation of Precious Metals Supply

The historic rally in gold and silver has fundamentally changed the economics of the mining industry, which in turn influences future supply expectations.

Mining Profitability and the Incentive for Expansion

With gold at $5,000+ and silver at $120, mining companies are experiencing record margins. For example, Hochschild Mining’s 2026 production forecast of 300,000 to 328,000 gold equivalent ounces is being achieved at all-in sustaining costs (AISC) of approximately $2,157 to $2,320 per ounce.39 This creates substantial operating margins that support aggressive capital allocation for project expansion.39

Furthermore, project valuations have been transformed. BMO analysis indicates that at current prices, the net present value (NPV) of marginal deposits can rise from $1.1 billion to $2.8 billion, making previously unviable projects economically attractive.39 However, the time lag for bringing new mining capacity online remains significant, typically ranging from 5 to 10 years, meaning that the current supply crunch in silver is unlikely to be resolved through new production in the near term.37

The Role of Secondary Supply and Recycling

As prices hit record highs, "recycling economics" become a critical component of fundamental analysis.37 High prices incentivize the scrap of electronics and jewelry, providing a secondary source of supply that can help dampen price volatility.37 In the silver market, the high cost of the metal is already forcing solar manufacturers to improve the efficiency of their "thrifting" processes—reducing the amount of silver required per cell—though the technical limits of this are being reached.32

Narrative Synthesis: The Road to 2027

The convergence of these fundamental drivers points toward a period of sustained volatility and structural change. The DXY is currently the victim of a "Sell America" sentiment that, while it has not yet materialized into a full-scale rout, has left the currency technically and fundamentally vulnerable.7 The dollar’s primary hope for a recovery lies in the potential for the OBBB Act to trigger a genuine economic boom that forces the Fed back into a tightening cycle, thereby widening yield differentials in the dollar’s favor.17

For gold, the path remains firmly upward as long as the Greenland geopolitical conflict persists and central banks continue to treat the metal as a "cornerstone asset" for the new financial order.1 The rally to $5,000 and beyond is not merely speculative; it is a repricing of risk in a world where the dollar-centric system is no longer the undisputed anchor.31

Silver, however, is the most volatile piece of the puzzle. Its surge to $120 is a "pure momentum trade" meeting "structural tightness".4 While the industrial demand from AI and solar PV provides a robust long-term floor, the extreme short-covering by producers and the potential for demand destruction at $150+ suggest that silver will be the site of the most intense market battles in 2026.32

Strategic Assessment and Market Forecasts

As we evaluate the fundamental landscape for XAUUSD, XAGUSD, and the DXY, several high-conviction themes emerge for the remainder of Q1 and Q2 2026.

The US Dollar Index: A Fragile Stabilization

The DXY is expected to remain in a range between 94.00 and 98.00 in the first half of the year.17 A break below 94.00 would likely signal a more systemic flight from US assets, potentially triggered by a worsening of the fiscal deficit or a failed Fed nomination process.7 Conversely, if the PCE inflation data for early 2026 comes in "well above 2.5%," as some analysts anticipate based on PPI trends, the Fed may be forced to adopt a more hawkish tone, providing a floor for the dollar.26

Gold: Consolidation at New Extremes

Gold’s rally to $5,600 has moved into a "territory of strategic hedge".4 While technical pullbacks toward $5,000 or $5,100 are possible if geopolitical headlines soften, the structural demand from central banks and the re-absorption of gold into mainstream institutional portfolios suggest that any correction will be short-lived.31 Goldman Sachs and JPMorgan both see gold as a "perfect tail risk hedge," with targets potentially reaching even higher if the AI bubble bursts or if the Greenland conflict escalates into a NATO-wide crisis.16

Silver: The Volatility Engine

Silver remains "gold on steroids".4 With physical scarcity driven by China's export licensing and the "by-product dependency" of mining, silver could feasibly reach the Citi target of $150 per ounce within the next quarter.4 However, traders must remain vigilant regarding the risk of "bubble behavior," particularly as managed funds exit their long positions and leaving the rally to be driven by producer short-covering and retail participation.1

Asset

Q1 2026 Target

Primary Bullish Catalyst

Primary Bearish Risk

DXY

94.50 - 97.00

Upside Inflation Surprises

Fiscal Deficit/Debt Concerns

XAUUSD

$5,400 - $5,800

Geopolitical (Greenland)

Peace Negotiations/NATO Calm

XAGUSD

$135 - $150

AI Infrastructure Demand

Solar Demand Destruction

10Y Yield

4.10% - 4.50%

Fiscal Supply Pressure

Recession Confirmation

Data synthesized from.1

In conclusion, the fundamental analysis of these three core assets reveals a global economy in flux. The US Dollar's historic dominance is being challenged by its own domestic fiscal policies and the emergence of strategic rivalries that have re-elevated hard assets to their traditional role as ultimate stores of value. For market participants, navigating 2026 requires a nuanced understanding of how technological change (AI) and geopolitical friction (Greenland/Trade Wars) intersect with the mechanics of the futures markets (COT Reports) and the realities of physical supply. The era of low-volatility, dollar-centric stability has given way to a multi-polar, commodity-driven landscape where resilience and security are the new primary variables in the global wealth equation.

Gold, Inflation, and the money velocity correlation.Good day traders and investors,

The “you’ll own nothing and be happy” Prophecy, no. Prediction, no. Planning, yes. It means, you’ll be priced out and there is nothing you can do about it.

Central planning at it’s finest, or worst, depending on your point of view. Make no mistake, these moves by Gold are direct result of central planning. Nothing is accidental.

Golds unprecedented rise should scare you, even if you own some. Golds rise to me is screaming the next wave of inflation is coming and will likely be twice as powerful from the previous wave. The money velocity could be a conferential confirmation. Money velocity is the rate of money moving and changing hands in the economy. It’s generally a very good thing, and healthy robust economy should have a very high velocity. However, there can be instances where it can be fueled by inflation, so it can be deceptive and that’s not so good. It could be rising because of higher prices. The last couple years the velocity was stagnate and going sideway. Just recently it started to up tick, exactly like in 2020 with golds rise. The lower version of the velocity chart which is the rate of change annually that came out of 2020 was the highest ever in recorded history. This could prove to be good or bad thing. If it catches support and keeps going higher along with inflation, it will not be a goof thing. However if inflation does get back into control then it would not be bad, as it would show accelerated growth in the economy (likely not, at least for now).

It wasn’t until after Gold found a top and went sideways while consolidated that inflation really came in. The market needed time to absorbed what happened. It realized products were to cheap, to how much money was out there and inflation took it’s course. History could repeat over the next couple years IMO. Bitcoin could get some of this pouring into it along with alts, just like back in 2021. It took time, a few months for it to come in and propel Bitcoin to it’s new highs. During golds run bitcoin was essentially just going sideways, then corrected to key market structure at 9.8k to 10k. Once it found support, it took off from there and didn’t stop until 70k. This could happen very similarly this time. A retest of 69k could be the bottom of the correction before it build up of pressure for the final run up either late this year or 2027.

This is my prediction from my analysis at this time. Let me know what you think down below.

I’ll leave you with a quote you may or may not know.

“Allow me to issue the currency of a nation and I care not who rules it”

Regards,

WeAreSat0shi

XAUUSD (1H) — Liquidity Sweep → Demand Reaction Setup**XAUUSD (1H) — Liquidity Sweep → Demand Reaction Setup**

Gold just printed a **sharp sell-off into a higher-timeframe demand zone**, sweeping sell-side liquidity below prior structure. Price is now reacting at a **key demand + EMA confluence**, suggesting this move is likely **distribution → stop hunt**, not trend failure.

🔹 **Bias:** Bullish continuation

🔹 **Entry Idea:** Buy from demand reaction / confirmation

🔹 **Invalidation:** Clean H1 close below the lower demand zone

🔹 **Targets:**

• First scale: prior range high

• Final TP: **5,590–5,600 (TP zone / equal highs liquidity)**

As long as price holds demand, this looks like a **classic liquidity grab before continuation**. Expect volatility, then expansion to the upside.

⚠️ Wait for confirmation — don’t chase the candle.

📌 Not financial advice. Trade your plan.

$GUTS , HUGE RISKENTRY : CMP

TP : Wherever you fill confortable

SL : IF you wish

P.s. REAL POSSIBILITY THAT GOES TO ZERO!!!!!

My SL is never a SELL, just an alarm to stop adding money and wait for better dca

Follow, Boost, Thank You !!

⚠️ Financial Disclaimer:

This post is not financial advice. I am not your financial advisor, your life coach, or your legally responsible adult.

Always do your own research and never trade based solely on internet comedy.

MSTR MicroStrategy ¡Really BULLISH Next 3 Months!Hello everyone, please give this idea a boost and follow me here on TW for my regular critical updates on Bitcoin, Ethereum, Solana, MicroStrategy, Gold & Silver, based off Martin Armstrong's Socrates.

Real GREAT news for MSTR 😮🚨 Since October MSTR was going through a WATERFALL EVENT on ALL time levels and little by little starting with the lower time frames the WATERFALL EVENT signal started to go away. Finally, Socrates is now calling for a TEMP LOW on the Monthly, Quarterly and Yearly is even calling for TEMP LOW TURNING UP .

The Weekly is still showing downward pressure though...

I can now start looking at the Weekly and Monthly Bullish Reversal and the price gap from today to those reversals is HUGE. Also, volatility in February through April is showing all maxed out so, I believe it could enter a BREAKOUT MODE rather fast once it starts to close above the DAILY REVERSALS.

BTC vs Gold/Silver Outlook

Good luck! and stay safe 🙏🏻

USDCAD— FRGNT DAILY CHART FORECAST. Q1 | W4 | D29 | Y26📅 Q1 | W4 | D29 | Y26

📊 USDCAD— FRGNT DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:USDCAD

XAUUSD/ 15mints chart AnaylsisXAUUSD is currently reacting around a key demand zone after a recent shift in structure. I’m watching for a potential liquidity sweep into support followed by bullish confirmation for a move back toward the weekly highs. Patience and risk management are key — wait for validation before entry. Not financial advice.

Another 11 Million Tests, Still No Edge: The RSIPart II of the RSI Analysis: Testing the Momentum Hypothesis

Preface: a reader's challenge

This study exists because of a question from our community. Following the publication of our first RSI analysis, several readers asked whether we had tested the indicator incorrectly. The mean-reversion interpretation, they argued, represents retail misconception. Sophisticated traders use RSI as a momentum confirmation tool, buying strength rather than fading it. Would we test this alternative hypothesis?

We welcome such challenges. Our research agenda is shaped by questions that meet one criterion: the hypothesis must be quantitatively testable. This requirement excludes many popular trading concepts. Elliott Wave theory, for instance, involves subjective wave counting that different analysts interpret differently. Fibonacci retracements require discretionary placement of anchor points. Support and resistance levels depend on the trader's eye. These approaches may or may not have merit, but they cannot be rigorously tested because two analysts examining the same chart will identify different signals.

RSI momentum signals, by contrast, are precisely defined. When RSI crosses above 60, that crossing is objective and verifiable. This objectivity enables the comprehensive testing we conduct here. We encourage readers to continue suggesting testable hypotheses, as community engagement improves the relevance of our research.

A necessary caveat before proceeding: our findings demonstrate that RSI signals lack statistical edge in aggregate across millions of parameter combinations. This does not prove that no individual trader has developed a profitable RSI-based approach. Markets are complex, and edge can emerge from sources our methodology does not capture: discretionary pattern recognition, combination with fundamental analysis, superior execution, or genuine skill in identifying context-dependent applications.

However, traders claiming RSI profitability should exercise extreme caution regarding overfitting and data mining bias. When testing thousands of parameter combinations on historical data, some will appear profitable by chance alone. The human mind excels at constructing post-hoc narratives explaining why those specific parameters work, creating false confidence in strategies that will fail going forward. Our use of Bonferroni correction specifically guards against this trap by demanding evidence so strong that chance alone cannot explain it.

Furthermore, while standalone RSI signals show no edge, the indicator may contribute value within broader systematic frameworks. RSI can serve as a volatility filter, identifying regimes of elevated or suppressed momentum where other strategies perform differently. It can function as a confirmation layer, requiring RSI alignment before executing signals from primary strategies based on moving averages, breakouts, or fundamental factors. Some quantitative funds incorporate RSI among dozens of inputs in machine learning models, where weak individual signals combine into stronger ensemble predictions. In mean-variance optimization, RSI readings might inform position sizing rather than entry timing. These applications differ fundamentally from the standalone signal testing we conduct here. They use RSI as one component among many rather than as a primary decision driver.

Our study tests the specific claim that RSI signals alone identify profitable trading opportunities. That claim fails comprehensive examination. Whether RSI contributes marginal value within sophisticated multi-factor frameworks remains an open question we do not address. Readers should interpret our findings accordingly: RSI as a standalone trading tool is statistically worthless, but this does not preclude all possible uses of the indicator.

Abstract

Following our previous study that examined 15 million parameter combinations of RSI overbought/oversold signals, this continuation addresses the natural counterargument: perhaps RSI should be used as a momentum indicator rather than a mean-reversion tool. We conducted an additional 11 million statistical tests using RSI as a trend-following signal, buying when strength emerges and selling when weakness appears. The combined evidence from 26 million tests across both studies is unambiguous: RSI provides no statistically significant edge under any interpretation. Not a single test survived Bonferroni correction. The indicator that millions of retail traders rely upon is informationally worthless regardless of how it is applied.

1. Introduction: the counterargument

In our previous study titled "15 Million Tests, Zero Edge: The RSI " we demonstrated that the popular mean-reversion interpretation of RSI produces no statistically significant trading edge. We tested over 15 million parameter combinations across 16 assets and five asset classes. The results were devastating: exactly zero tests survived Bonferroni correction for multiple comparisons.

However, we anticipated a specific criticism. In Section 5.1 of that study, we noted that institutional traders who incorporate RSI typically use it as a momentum filter rather than a mean-reversion signal. The approach is precisely opposite to retail wisdom: they buy when RSI is above 50 indicating upward momentum and sell when RSI is below 50. We referenced Antonacci's (2014) research on dual momentum showing that trend-following approaches consistently outperform mean-reversion strategies.

This raised an obvious question: if mean-reversion RSI fails, does momentum RSI succeed? Perhaps retail traders simply have the signal backwards. Perhaps RSI works, but only when used to confirm trends rather than fade them.

This follow-up study directly addresses that hypothesis. We apply the same rigorous methodology to test RSI as a momentum indicator, generating buy signals when the oscillator demonstrates strength and sell signals when it shows weakness. The theoretical case for this approach is stronger than for mean-reversion, given the well-documented momentum anomaly in financial markets documented by Jegadeesh and Titman (1993).

If RSI has any legitimate use in trading, momentum confirmation would be it. Our findings, however, extend the conclusions of our first study: RSI fails under both interpretations. The indicator contains no exploitable information regardless of how traders choose to apply it.

2. Theoretical framework: why momentum RSI might work

Before presenting our methodology and results, we must establish why the momentum interpretation of RSI has theoretical merit that the mean-reversion interpretation lacks.

The momentum effect in financial markets has been documented extensively since Jegadeesh and Titman's seminal 1993 paper in the Journal of Finance. Their study demonstrated that buying past winners and selling past losers generated significant profits over three to twelve month horizons. This finding proved remarkably robust across markets, time periods, and asset classes. Carhart (1997) elevated momentum to the status of a fundamental risk factor, adding it to the Fama-French three-factor model.

The behavioral explanation for momentum centers on investor underreaction. Daniel, Hirshleifer, and Subrahmanyam (1998) proposed that investors initially underreact to new information due to anchoring bias, leading prices to adjust gradually rather than immediately. Hong and Stein (1999) developed a model where information diffuses slowly across investor groups, creating predictable price trends.

If these behavioral mechanisms generate momentum in asset prices, technical indicators that identify trend initiation should theoretically capture some of this effect. The RSI, by measuring the magnitude of recent gains relative to recent losses, appears suited to this task. When RSI crosses above a threshold, it signals that buying pressure has overcome selling pressure, potentially indicating the beginning of an upward trend.

Antonacci (2014), whom we cited in our previous study, argued that combining absolute momentum with relative momentum produces superior risk-adjusted returns. His framework suggests that RSI above 50 could serve as an absolute momentum filter, confirming that an asset is in an uptrend before committing capital. This represents the most theoretically grounded case for RSI momentum trading.

The contrast with mean-reversion theory is stark. Mean-reversion assumes that extreme RSI readings indicate exhaustion and impending reversal. But no compelling theoretical mechanism explains why oversold assets should rebound or overbought assets should decline. Markets can remain irrational longer than traders can remain solvent, as the saying attributed to Keynes reminds us.

Momentum theory, by contrast, has both empirical support and behavioral explanations. If RSI is to work anywhere, it should work as a momentum indicator. This study tests whether it does.

3. Data and methodology

3.1 Asset universe and data sources

We constructed a diversified asset universe spanning four major categories. United States equities were represented by SPY, QQQ, IWM, and DIA. International equities were represented by EFA and EEM. Commodities were represented by GLD, SLV, and USO. Fixed income was represented by TLT and IEF.

Foreign exchange pairs were excluded from this analysis due to data availability constraints with the TwelveData API. This omission is unlikely to affect conclusions given that forex markets showed near-zero edge in our previous mean-reversion study, consistent with the efficient market hypothesis for currency markets.

Daily price data covered approximately 5,000 trading days per asset, spanning from inception through January 2025. All prices for equity ETFs are adjusted for dividends and splits.

3.2 Parameter grid specification

We designed the parameter grid to comprehensively test the RSI momentum hypothesis:

RSI calculation periods ranged from 2 to 60 days in single-day increments, producing 59 distinct period lengths. This range encompasses the standard 14-day default as well as shorter periods favored by active traders and longer periods that might capture intermediate-term trends.

Long entry thresholds ranged from 45 to 85, representing the level above which RSI must cross to generate a buy signal. Traditional momentum interpretation suggests buying when RSI exceeds 50, indicating positive momentum. We tested a wide range to ensure robustness.

Short entry thresholds ranged from 15 to 55, representing the level below which RSI must cross to generate a sell signal. This captures the inverse momentum logic of selling when RSI demonstrates weakness.

Holding periods included 1, 2, 3, 5, 7, 10, 15, 20, 30, 45, 60, and 90 days, identical to our previous study for comparability.

This specification produced 1,190,148 unique parameter combinations per asset. Across 11 assets, the total parameter space encompassed 13,091,628 potential tests. After filtering for combinations generating at least 15 signals, 11,035,184 complete statistical tests were analyzed.

3.3 Signal definition: the opposite of mean-reversion

The momentum signal definition differs fundamentally from the mean-reversion approach tested in our previous study. In that study, we defined buy signals when RSI crossed below oversold thresholds, expecting a rebound. Here, we define the opposite: a long signal occurs when RSI crosses above the upper threshold from below, indicating that buying pressure has strengthened sufficiently to push the oscillator into bullish territory.

Similarly, a short signal occurs when RSI crosses below the lower threshold from above, indicating intensifying selling pressure. This is the opposite of the mean-reversion approach where crossing below thresholds generated buy signals.

For each signal, we calculate the forward return over the specified holding period. The edge is computed as the difference between mean returns following signals and the baseline mean return. A positive edge indicates that momentum RSI signals identify periods of above-average returns.

3.4 Statistical framework

We employ identical statistical methodology to our previous study to ensure direct comparability. Welch's t-test compares signal returns against baseline returns. The Bonferroni-corrected significance threshold for 11 million tests at alpha equals 0.05 is approximately 4.5 times ten to the negative ninth power.

4. Results

4.1 Aggregate findings

Figure 1 presents the summary dashboard mirroring the format from our previous study.

Panel A shows the distribution of edge values for both long and short momentum signals. The histogram is centered precisely at zero, indistinguishable from our mean-reversion results. Neither momentum buying nor momentum selling produces consistent outperformance.

Panel B displays the percentage of tests achieving nominal significance by asset category. The rates range from 3.6 percent for bonds to 9.2 percent for US equities. While US equities exceed the five percent expected under the null hypothesis, this excess represents significance in the wrong direction, as we detail below.

Panel C reveals how edge varies by holding period. No consistent pattern emerges across the twelve holding periods tested. Some show marginally positive average edge, others marginally negative, with magnitudes economically insignificant.

Panel D presents the p-value distribution. The uniform spread between zero and one matches theoretical expectation under the null hypothesis of no effect.

The aggregate statistics tell the same story as our previous study. Mean long signal edge equals positive 0.0091 percentage points with a median of exactly zero. Mean short signal edge equals positive 0.0011 percentage points with a median of exactly zero. These edges are economically meaningless: transaction costs alone would overwhelm any such edge by an order of magnitude.

Most critically, after applying Bonferroni correction, exactly zero tests achieved statistical significance. Combined with our previous study, we have now conducted 26 million tests of RSI signals. Not a single one survives proper statistical scrutiny.

4.2 Results by asset category

Figure 2 displays box plots of edge distribution for each asset category, allowing direct comparison with Figure 2 from our previous study.

Commodities showed the most favorable results, with mean long edge of positive 0.35 percentage points and mean short edge of positive 0.50 percentage points. These figures might appear promising until one considers that no commodity tests survived Bonferroni correction. The variation is consistent with noise, not signal.

Bonds displayed mean long edge of positive 0.07 percentage points and mean short edge of negative 0.02 percentage points. The negative short edge is particularly notable: selling bonds when RSI shows weakness actually underperforms random timing.

International equities showed negative edges for both signal types, with long edge of negative 0.09 percentage points and short edge also negative 0.09 percentage points. RSI momentum signals actively harm performance in these markets.

United States equities produced the most damaging results for momentum proponents. The long signal edge averaged negative 0.23 percentage points and the short signal edge averaged negative 0.33 percentage points. These are the largest magnitude edges in our study, and they are negative. RSI momentum signals in the world's most liquid equity market reliably identify periods of below-average returns.

This finding requires careful interpretation to avoid a logical trap. The negative edge for momentum signals might suggest that RSI identifies trend exhaustion, which would seem to validate mean-reversion trading. If buying strength leads to below-average returns, should we not sell strength instead? This reasoning appears compelling but is fundamentally flawed, and understanding why illuminates the true nature of RSI failure.

First, consider what the data actually shows. The momentum long signal in US equities produces returns of negative 0.23 percentage points relative to baseline. This does not mean buying strength produces losses; it means buying strength produces returns slightly below the average holding period return. The baseline return for US equities is positive due to the long-term upward drift of equity markets. A negative edge of 0.23 percentage points means momentum entries underperform random entries by less than a quarter of a percentage point, not that they produce absolute losses.

Second, and more critically, our previous study already tested the mean-reversion hypothesis directly. If RSI truly identified trend exhaustion, then buying oversold conditions should produce positive edge, as exhausted downtrends reverse into uptrends. But we found mean oversold edge of negative 0.01 percentage points, statistically indistinguishable from zero. Selling overbought conditions, which would capitalize on exhausted uptrends, produced edge of exactly zero. The mean-reversion study provided no evidence that RSI identifies exploitable reversals.

The apparent contradiction dissolves when we recognize what RSI actually measures: noise. The negative momentum edge in US equities and the zero mean-reversion edge are both consistent with a single explanation. RSI oscillations around price movements contain no predictive information whatsoever. The small negative momentum edge likely reflects regression to the mean in a noisy system rather than genuine trend exhaustion. Assets that have risen enough to push RSI above momentum thresholds are slightly more likely to experience smaller subsequent gains simply because extreme short-term movements are followed by more typical movements. This is not the same as mean reversion in the trading sense of predictable reversals.

To illustrate concretely: suppose a stock rises five percent in a week, pushing RSI above 70. Our momentum study shows that buying at this point produces slightly below-average forward returns. But our mean-reversion study shows that selling at this point does not produce above-average returns either. The stock's future path is simply unpredictable from its RSI reading. It might continue higher, consolidate sideways, or decline, and RSI provides no information about which outcome will occur. The slight underperformance following momentum signals reflects the mathematics of bounded oscillators rather than actionable trading information.

Furthermore, the academic literature on momentum and mean-reversion operates on different time horizons than RSI signals. Jegadeesh and Titman's momentum effect occurs over three to twelve month formation and holding periods. Mean-reversion in equity markets, to the extent it exists, manifests over multi-year horizons as documented by DeBondt and Thaler (1985) in their study of long-term reversals. RSI operates on a fourteen-day default period with our study testing holding periods up to ninety days. These horizons fall into what might be called the no-man's-land of predictability: too short for momentum effects, too long for microstructure-based patterns, and too short for long-term mean reversion.

The bottom line is unambiguous: neither momentum nor mean-reversion RSI trading produces statistically significant edge. The slight negative momentum edge in US equities does not imply that mean-reversion works; we tested that directly and it does not. RSI readings are noise, and no interpretation of that noise yields profitable trading signals.

4.3 Parameter sensitivity

Figure 3 presents heatmaps showing how edge varies across the parameter space, directly comparable to Figure 3 in our previous study.

The upper panels display long signal edge against RSI period and threshold on the left, and against threshold and holding period on the right. The lower panels show corresponding short signal results.

If RSI momentum signals possessed genuine predictive power, we would expect consistent regions of positive edge across the parameter space. Instead, the patterns appear random. Small positive regions sit adjacent to equally sized negative regions with no systematic structure.

Comparing these heatmaps to those from our mean-reversion study reveals striking similarity: both show noise without signal. Neither mean-reversion nor momentum interpretation identifies parameter combinations with reliable predictive power.

4.4 Multiple testing correction

Figure 4 shows the distribution of p-values for long and short momentum signals separately, formatted identically to Figure 4 from our previous study.

The percentage of tests achieving nominal significance at p less than 0.05 equals 6.48 percent for long signals and 5.63 percent for short signals. These rates are only slightly elevated above the five percent expected under the null hypothesis, and entirely consistent with correlation among tests rather than genuine predictive power.

After Bonferroni correction, zero tests remain significant. This matches exactly the result from our mean-reversion study. Whether testing 15 million mean-reversion combinations or 11 million momentum combinations, the conclusion is identical: no evidence of edge.

5. Combined analysis: 26 million tests, zero edge

The primary contribution of this study is completing the comprehensive examination of RSI utility. Table 1 presents the combined results across both studies.

Table 1 displays the combined results from approximately 26 million RSI tests conducted across both studies. The mean-reversion study from Part I tested roughly 15 million parameter combinations, finding a mean oversold edge of negative 0.01 percentage points and a mean overbought edge of zero. The momentum study in Part II tested approximately 11 million combinations, finding a mean long edge of positive 0.01 percentage points and a mean short edge of zero. Nominal significance rates hovered between 5.6 and 8.8 percent across all signal types, only marginally exceeding the five percent expected under the null hypothesis. Most importantly, not a single test from either study survived Bonferroni correction.

The symmetry is remarkable. Mean-reversion produces a tiny negative edge for buy signals; momentum produces a tiny positive edge. The magnitudes are indistinguishable from zero in both cases. The nominal significance rates hover around five percent as expected under the null hypothesis. No tests survive correction in either study.

These are not marginal findings subject to interpretation. The evidence is overwhelming: RSI signals contain no exploitable information. The indicator fails whether used for mean-reversion or momentum, across all asset classes tested, across all parameter combinations examined, and across all holding periods from one day to three months.

6. Why RSI fails despite valid momentum theory

The failure of RSI momentum signals despite the well-documented existence of momentum in asset returns requires explanation. Several factors contribute to this disconnect.

6.1 Information transformation destroys the signal

The RSI transforms raw price data through Wilder's specific mathematical operation. This transformation may destroy the momentum signal present in returns. Academic momentum research by Jegadeesh and Titman (1993) and subsequent studies use simple past returns over formation periods of three to twelve months. The RSI uses a smoothed ratio of gains to losses over much shorter periods, typically 14 days.

Moskowitz, Ooi, and Pedersen (2012) documented time-series momentum in the Journal of Financial Economics using raw returns, not oscillator transformations. Novy-Marx (2012) demonstrated that intermediate-term momentum in raw returns outperforms more complex momentum measures. Adding mathematical transformations to price data does not create new information; it can only preserve or destroy existing information. RSI appears to destroy it.

6.2 Signal timing occurs at trend exhaustion

Academic momentum strategies buy assets after strong performance over three to twelve months and hold for similar horizons. RSI generates signals based on short-term oscillator movements that may not align with these horizons.

When RSI crosses above 70, it indicates that recent buying pressure has been intense. However, this intensification may occur late in a momentum cycle after the bulk of gains have been realized. Our finding that US equity long signals precede below-average returns supports this interpretation. RSI momentum signals may identify trend exhaustion rather than trend initiation.

6.3 Forty-five years of arbitrage

The RSI has been publicly available since 1978. Any simple trading rule based on its signals has been known for nearly five decades. Lo (2004) argued in his adaptive markets hypothesis that profitable trading strategies become arbitraged away as they become widely known.

If RSI signals ever contained useful information, that information has likely been incorporated into prices by the countless traders who have tested the same ideas before us. The remaining edge after forty-five years of scrutiny is indistinguishable from zero.

7. Implications for traders

The combined findings of our two studies have direct practical implications that we summarize here.

7.1 Abandon all RSI-based strategies

In our previous study, we recommended that traders stop using RSI overbought/oversold levels as signals. We now extend this recommendation: traders should stop using RSI entirely as a mechanical trading signal. Neither mean-reversion nor momentum interpretation produces edge. The indicator is informationally empty.

7.2 Use raw returns for momentum

For traders seeking momentum exposure, academic research supports using simple past returns rather than oscillator transformations. Jegadeesh and Titman's original methodology of ranking assets by three to twelve month trailing returns remains robust. No indicator improvement is necessary or beneficial.

7.3 Accept fundamental unpredictability

Our 26 million tests represent an exhaustive search for RSI edge that does not exist. Rather than searching for the next indicator or parameter combination, traders would benefit from accepting that short-term price movements are fundamentally unpredictable. This acceptance redirects attention toward controllable factors: position sizing, diversification, cost minimization, and behavioral discipline.

8. Limitations

This study has limitations consistent with those noted in our previous work. We examined only daily data. Transaction costs were not explicitly modeled. Combination strategies incorporating multiple indicators were not tested.

Future research might examine whether RSI contains conditional information given specific market regimes. However, such conditional approaches face severe data mining risks, and the complete absence of unconditional effect provides little reason for optimism.

References

Antonacci, G. (2014). Dual Momentum Investing: An Innovative Strategy for Higher Returns with Lower Risk. New York: McGraw-Hill Education.

Carhart, M.M. (1997). On persistence in mutual fund performance. Journal of Finance, 52(1), 57-82.

Daniel, K., Hirshleifer, D. and Subrahmanyam, A. (1998). Investor psychology and security market under and overreactions. Journal of Finance, 53(6), 1839-1885.

Hong, H. and Stein, J.C. (1999). A unified theory of underreaction, momentum trading, and overreaction in asset markets. Journal of Finance, 54(6), 2143-2184.

Jegadeesh, N. and Titman, S. (1993). Returns to buying winners and selling losers: Implications for stock market efficiency. Journal of Finance, 48(1), 65-91.

Lo, A.W. (2004). The adaptive markets hypothesis. Journal of Portfolio Management, 30(5), 15-29.

Moskowitz, T.J., Ooi, Y.H. and Pedersen, L.H. (2012). Time series momentum. Journal of Financial Economics, 104(2), 228-250.

Novy-Marx, R. (2012). Is momentum really momentum? Journal of Financial Economics, 103(3), 429-453.

Wilder, J.W. (1978). New Concepts in Technical Trading Systems. Greensboro, NC: Trend Research.

DAX.GER - LETS GOTeam Update – DAX Trade Plan

Eight hours ago, we went long on DAX and successfully hit our target.

Momentum has continued to hold, so we are taking the next setup.

New Long Position

Entry Zone: 24440–24455

Stop Loss: 23283

Targets Target 1: 24486–24515 - Take 30% partial. Move stop loss to breakeven

Target 2: 24555–24630

Expectation: Either during European market open, or Before the US market open

The structure is clean, liquidity is aligned, and continuation is highly probable.

LETS GO

XAUUSD 4H — Bearish Pullback from Supply ZoneGold has reacted strongly from a key resistance/supply area and is now showing bearish continuation on the 4-hour timeframe. Price broke the rising structure and is moving lower toward the demand zone around 5290–5185. As long as price stays below the supply zone, sellers remain in control. Watch for bearish confirmation or rejection at lower levels before entering trades. Risk management is important.

USDJPY set to drop?In recent rate hike by BOJ from 0.5 to 0.75, USDJPY has had significant break of structure shows a major change in the direction of the trend.

As price continue it's trend, there is a hgiher chance for the market to drop to 147.87 level to where prvious gap open has not been tested.

With earlier, Unemployment data price has maintained it's trend and started move back below the recent level of support.

With retest of the support, A sell entry is high probable.

MAJOR TURN 2/9/2026 plus or minus 1 TD This is the chart I promised to Post But waited till Now . This is my forecast Updated as I have said the market will see 5600/6100 easy my and on 10/10 to 10/20 2026 in the form a large ABC decline ! I see the market still seeing a 7031 in Cash SP 500 into 2/9/26 Best of trades WAVETIMER !

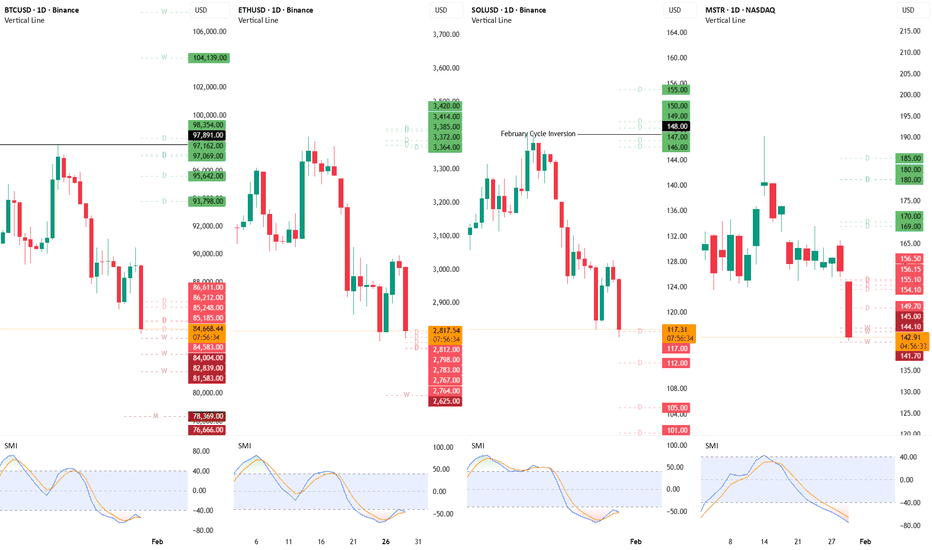

BTC ETH SOL MSTR Quick UpdateHello everyone, please give this idea a boost and follow me here on TW for my regular critical updates on Bitcoin, Ethereum, Solana, MicroStrategy, Gold & Silver, based off Martin Armstrong's Socrates.

The main difference in today's crash between crypto and metals is that today crypto had a target for a LOW and metals for a HIGH and you can see that crypto is crossing red reversals, implying that they should get a strong bounce tomorrow HOWEVER, tomorrow could be a HIGH so, if you got caught holding LONGs, you should close them tomorrow because metals are not done just yet so, the crypto pump seems to have failed yesterday as I posted and it could go lower into next week possibly.

BTC vs Gold vs Silver Please Give Me Your Thoughts On This

Good luck! and stay safe 🙏🏻

#USDCAD , First one after many month !📊 Morning Market Brief | London Session Prep

🔎 Instrument Focus: #USDCAD

⚠️ Risk Environment: High

📈 Technical Overview:

Not a Quality Setup as EJ ... just will observe it .... no need to rush on it

🚀 Trading Plan:

• Need Valid momentum Structure Close

• LTF ENTRY NEEDED ‼️

• Just and Only for QuickScalp

🧠 Stay updated with real time news and macro events, visit 👉 @News_Ash_TheTrader_Bot

#Ash_TheTrader #Forex #EURUSD #MarketInsight #PriceAction #TradingPlan #RiskManagement #LondonSession #Scalping #Futures #NQ #Gold

USDJPY H1 – Price Reaction at Key Levels (29/01/2026)USDJPY is analyzed on the 1-hour timeframe (H1).

The market is currently trading within a broader bearish environment, as price remains below the higher-timeframe moving average and has previously produced a strong impulsive move to the downside. After that impulse, price entered a corrective phase.

On the H1 timeframe, USDJPY formed a short-term bullish correction from the recent swing low, creating higher highs and higher lows. However, this move stalled after reacting into a supply zone aligned with the previous bearish leg. The rejection from that area indicates selling pressure is still active.

Price is now pulling back from the supply zone and moving toward the lower demand area marked on the chart. This zone previously acted as a reaction point and may be used as a reference for trade management or further confirmation.

As long as price remains below the recent swing high and below the higher-timeframe resistance, the bearish scenario remains valid. A clear reaction or structure shift around the demand zone will be important for the next directional move.

This idea is based on market structure, supply and demand, and price reaction on the H1 timeframe, without relying on indicators or predictions.

This is a technical analysis idea for educational purposes, not financial advice.