Elise | XAUUSD – 30M | Bullish ContinuationOANDA:XAUUSD

After the impulsive upside move, XAUUSD entered a healthy consolidation phase. The pullback into demand was met with support, suggesting this move is corrective rather than distributive. As long as price holds above the demand zone, the bullish continuation scenario remains valid.

Key Scenarios

✅ Bullish Case 🚀 → Hold above 4,995

🎯 Target 1: 5,135

🎯 Target 2: 5,220

❌ Bearish Invalidation 📉 → Sustained breakdown below 4,995 would weaken bullish structure.

Current Levels to Watch

Resistance 🔴: 5,135 – 5,160

Support 🟢: 4,995 – 5,015

⚠️ Disclaimer: This analysis is for educational and informational purposes only. It is not financial advice. Please conduct your own research before trading.

Community ideas

XAUUSD – Brian | M45 Technical Outlook — Buyers Still in Control Above 5,200

Gold continues to trade firmly above the 5,000 milestone, with price action confirming strong bullish acceptance at higher levels. On the M45 timeframe, the market remains in an expansion phase, supported by aggressive buying volume and well-defended value areas.

Current conditions suggest that buyers are still in control, with pullbacks being absorbed rather than sold into. This behavior typically characterises a strong trending environment rather than a distribution phase.

Macro Context (Brief Overview)

From a fundamental perspective, institutional positioning remains stable, with no signs of defensive de-risking despite gold trading at record highs. At the same time, the market remains sensitive to upcoming macro events, which may introduce short-term volatility but have not altered the broader bullish bias so far.

As long as uncertainty persists and risk appetite fluctuates, gold continues to benefit from its role as a strategic hedge.

Market Structure & Volume Context (M45)

The current structure on M45 remains constructive:

Price is holding above the rising trendline.

Buying volume remains elevated, indicating strong demand and reduced willingness to sell.

Pullbacks continue to develop in a corrective manner rather than impulsive declines.

In strong trends, high volume combined with shallow retracements often signals continuation rather than exhaustion.

Key Technical Zones to Watch

Based on the chart structure and volume profile, several zones stand out:

Upside Reaction Zone

5,385: A major resistance and extension area where price may pause, consolidate, or react before deciding the next directional leg.

Primary Value Support

POC + VAH: 5,243 – 5,347

This is the most critical zone for continuation. Acceptance and holding within this range would reinforce the bullish structure.

Secondary Support

VAL: 5,163 – 5,168

A deeper pullback into this zone would still be considered corrective as long as price stabilises and reclaims value.

Deeper Structural Support

POC: 5,086 – 5,091

This level represents broader value and would likely come into play only during heightened volatility.

Forward Expectations & Bias

Primary bias: Bullish continuation while price holds above value zones

Pullbacks are currently viewed as opportunities for re-accumulation rather than trend reversal.

Short-term volatility is expected, but structure remains the key reference point rather than individual candles.

Strong trends rarely move in straight lines. The ability of gold to hold value during pauses continues to support the case for further upside.

Refer to the accompanying chart for a detailed view of value areas, trend structure, and projected paths.

Follow the TradingView channel to get early structure updates and join the discussion on key market levels.

ETHUSDT ASAP will hit the first target 3700$As observed on the chart, Ethereum has demonstrated resilience at the key $2,700 daily support level. This constructive price action suggests a potential bullish reversal, with the initial technical target projected toward the $3,700 resistance zone .

A decisive breakout above $3,700—particularly if accompanied by rising volume —would likely accelerate upward momentum and could set the stage for a retest of previous highs or an extension toward new multi-week peaks , depending on broader market structure.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

Gold at ATH before FOMC shakeout first or straight breakout?🧭 Macro Snapshot

Donald Trump maintains a hardline stance, increasing military presence in the Middle East → geopolitical risk remains elevated.

Tonight’s key focus: Federal Reserve

Political pressure and questions around Fed independence.

DXY continues to weaken, retesting major historical support (2020–2022) → supportive for gold.

👉 Conclusion: Geopolitics + a weaker USD set the bullish bias, while the Fed determines short-term volatility.

📊 Intraday Range to Watch

Upper range: 5,280 – 5,305

Lower range: 5,190 – 5,160

→ High probability of range trading and liquidity absorption ahead of the Fed decision.

🟢 Support

5,220–5,225 | 5,150–5,165 | 5,080–5,085 | 5,050–5,060

🔴 Resistance

5,280–5,294 | 5,300 | 5,315 | 5,380–5,385

⚠️ Strategy Notes

Expect possible fake moves / stop hunts within the range.

Avoid chasing highs or catching tops without confirmation.

Focus on price reaction at key levels and stay disciplined.

Summary: Gold is fundamentally supported, but today the key is how price reacts within 5,160–5,305.

Be patient — wait for confirmation — trade the reaction.

BITCOIN - Consolidation below 90K. Weak marketBINANCE:BTCUSDT failed to break through the 90K area, and the market is forming a cascade of resistance, indicating the dominant position of sellers in the current circumstances.

The market still looks quite weak, and any attempts at growth are a hunt for liquidity. Global and local trends are bearish, with sales dominating (outflow of funds).

There is no fundamental support, the transfer of assets to crypto exchanges and the outflow of funds from ETF funds continues, which in general indicates weak market sentiment during the crypto winter. The current cycle is downward, and there is a possibility of a retest of the 80,000-75,000 zone.

Technically, Bitcoin is facing strong resistance at 89K and, unable to continue its growth, is rebounding and heading downwards. A short squeeze may form before the fall.

Resistance levels: 88,950, 89,590, 90,350

Support levels: 86970, 86100

If the bears keep the price below 89000, the market may fall to an intermediate bottom of 86000, however, closing below 86K could signal a further decline to 80K.

Best regards, R. Linda!

XRP Dips UNDER $2 - Are we Heading BACK TO $1 ??Have you been watching XRP lately?

I was quite surprised that it held above the $2 as long as it did, to be honest.

But now, as the entire market dips, XRP drops... and it is notoriously know to dump and lose all bullish season gains.

Apart from all the controversy, if and I say IF you managed to held the $1 bag up until now - you would be in profit. Buying over $2 would have been high risk, and now we are likely approaching another few key buy zones, depending on where the price finds a bounce. The questions is.... worth it to accumulate or not?

Seeing price action in the 4h under the moving averages is always bearish for the SHORT term, which we do:

The massive wick in July 2025 already indicated the beginning of the bear market, and the lower moving averages is likely where we will find major support - 1.40 ish.

XAUUSD (Gold) – 30M Trendline Support & Breakout ContinuationPrice is holding above the rising trendline and support zone, forming a bullish continuation structure. A successful hold or breakout above the range opens the path toward higher targets.

Immediate Support: 4960 – 4975

Range High / Resistance: 4985 – 4990

First Target: 5025 – 5045

Extended Target: 5070 – 5100

Bullish bias remains valid above trendline support. Look for retest confirmation or clean breakout before entries and manage risk accordingly.

Bitcoin at Key Support – Correction Complete or Another Drop!?Bitcoin( BINANCE:BTCUSDT ) has continued its correction in recent days due to the following key reasons:

1. U.S. Government Shutdown Risk: Political deadlock over the federal budget deadline (January 30) has triggered a "risk-off" sentiment in global markets, pushing investors away from volatile assets like Bitcoin.

2. Trade Tensions and Tariff Threats: Trump's threats of 100% tariffs on Canadian imports have strengthened the U.S. dollar ( TVC:DXY DXY), acting as a headwind for Bitcoin and contributing to broader market declines.

3. ETF Outflows and Market Fundamentals: Net outflows of about $6.1B from Bitcoin spot ETFs over the past three months, combined with on-chain realized losses for holders and leveraged position liquidations, have intensified selling pressure.

4. Geopolitical Tensions in the Middle East: Escalating conflicts, including risks around Iran and oil( FX_IDC:USDBRO ) supply disruptions, have amplified global uncertainty and risk aversion, leading to further sell-offs in cryptocurrencies as investors seek safer assets.

Let’s dive into the technical analysis of Bitcoin on the 1-hour timeframe to see how it’s performing. Stay tuned!

As I expected in the previous idea , Bitcoin followed the anticipated bullish and bearish movements, reaching its targets (Targets Done).

Currently, Bitcoin is moving near a support zone($86,420-$83,820) and has also created a new CME Gap($89,205-$88,385) with the start of this trading week.

From an Elliott Wave perspective, it appears that Bitcoin has completed its main wave 5 near the support zone($86,420-$83,820) and support line, so we can now expect a corrective wave.

Additionally, we can observe a negative Regular Divergence (RD-) between two consecutive valleys.

I expect that after a correction, Bitcoin will resume its upward movement and potentially reach the first target of $88,667. With strong bullish momentum, we could see Bitcoin move even higher in the short term.

Note: Bitcoin, like other dollar-denominated assets, is influenced by various factors, including political statements and news. Therefore, it’s crucial to manage risk carefully and stay prepared for any scenario. Make sure to keep an eye on updates.

I’d love to hear your thoughts on Bitcoin. Do you think the downward trend will persist, and how far do you expect it to drop?

First Target: $88,667

Second Target: $89,401

Third Target: $90,231

Stop Loss(SL): $85,527(Worst)

Cumulative Long Liquidation Leverage: $86,450-$85,600

Cumulative Short Liquidation Leverage: $88,890-$88,400

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Bitcoin Analysis (BTCUSDT), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

Trading Weekends Is a Dead-Man ZoneWeekend trading in crypto looks active on the surface, but the structure underneath is fragile. Liquidity thins, participation drops, and price becomes easier to move with relatively small orders. What appears to be opportunity is often noise amplified by absence of depth. This is why weekends quietly drain accounts rather than build them.

Institutional participation is minimal during weekends.

Many large players reduce exposure or remain inactive, which removes the stabilizing force that normally absorbs volatility and validates structure. Without that participation, levels lose reliability. Breakouts occur without follow-through. Reversals happen without warning. The market is not directional; it is reactive.

Spreads widen and order books thin. This increases slippage and distorts risk. Stops that would survive during active sessions are easily tagged. Entries that look precise on the chart fill poorly in reality. Execution quality degrades, even if the setup appears valid in hindsight.

Another issue is narrative vacuum. During the week, price responds to macro flows, funding dynamics, and session-based participation. On weekends, these drivers are largely absent. Price often rotates aimlessly or runs obvious liquidity pools without establishing commitment. Traders mistake movement for intent and become the liquidity that others exit against.

Psychology also shifts. Weekends invite boredom trading.

Without a structured routine, traders lower standards, widen assumptions, and take setups they would normally ignore. Losses feel smaller individually, but they accumulate through frequency and poor sequencing.

There are exceptions. High-impact events or structural carryover from a strong weekly close can create opportunity. These situations are rare and require reduced size and stricter confirmation. For most traders, restraint is the edge.

The market will still be there on Monday with clearer structure, deeper liquidity, and better execution conditions. Survival in trading is not about participation at all times. It is about choosing when conditions justify risk. Weekends rarely do.

BTC Faces Major Resistance Before FOMC – Breakdown or Breakout?As I expected in the previous idea , Bitcoin( BINANCE:BTCUSDT ) has followed the anticipated bullish and bearish trends and has reached all of its targets (full target).

Now, the question is whether Bitcoin can sustain above the $90,000 level. Stay tuned!

At the moment, Bitcoin is moving near the resistance zone($90,600-$89,300) and around the 50_SMA(Daily), and the resistance line.

From an Elliott Wave perspective, it seems that Bitcoin is completing a Double Three Correction(WXY) within the ascending channel.

I expect that Bitcoin might not break through this resistance zone($90,600-$89,300) on the first attempt and could start to decline, potentially dropping to around $88,133. If the bearish momentum continues, we might see even lower targets.

First Target: $88,133

Second Target: Cumulative Long Liquidation Leverage: $87,000-$85,630

Stop Loss(SL): $91,823(Worst)

Cumulative Short Liquidation Leverage: $92,000-$91,000

CME Gap: $93,060-$92,940

In the coming hours, markets face the Fed Funds Rate decision and Powell’s press conference, which typically bring elevated volatility. If the Fed holds rates at 3.75% as expected, the initial reaction may be muted, but real movement will depend on forward guidance. Historically, when outcomes align with expectations, gold tends to stay supported amid uncertainty, especially with U.S. government shutdown risks in the background, while Bitcoin remains sensitive to liquidity signals and risk sentiment. Any shift in Powell’s tone — whether more cautious or more hawkish — can quickly drive sharp moves.

⚠️ Traders should expect volatility both at the release and during the press conference, avoid impulsive entries, and prioritize risk management.

Note: Rising tensions in the Middle East could quickly intensify Bitcoin's downward trend

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Bitcoin Analysis (BTCUSDT), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

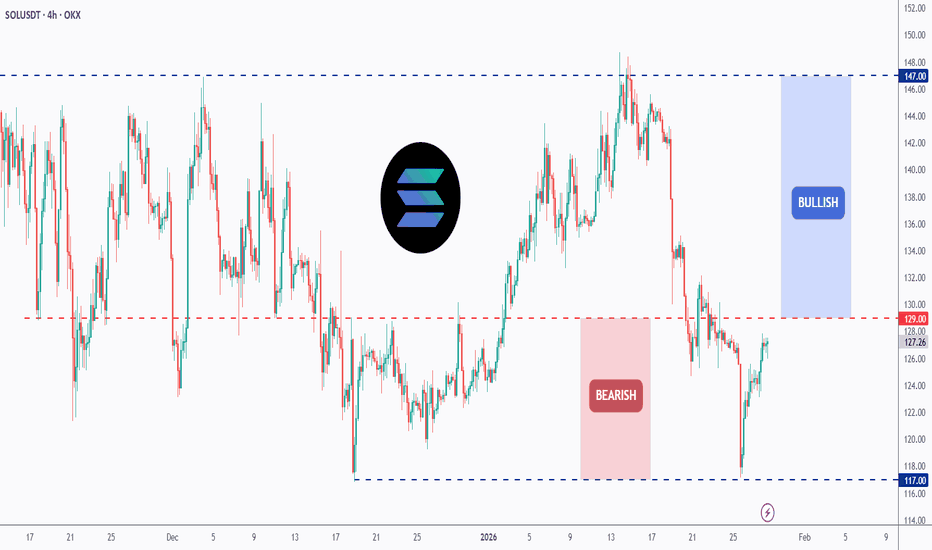

SOL - The Building Block!I call this area the Building Block, and it’s doing exactly what it’s supposed to do.

Right now, CRYPTOCAP:SOL is trading below the $129 structure, and as long as price stays under this level, the bias remains bearish. No guessing, no forcing it. Structure is structure.

That said, this level is important.

👉 A clean break and hold above $129 would change the picture completely and mark the start of a bullish phase, opening the door for higher prices.

Until that happens, patience is key. Let CRYPTOCAP:SOL prove itself before switching bias.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

SILVER | Pullback as Precious Metals Rally PausesPRECIOUS METALS MINERS | Pullback as SILVER Rally Pauses

European precious metals miners opened lower as investors took profits after the recent strong rally in TVC:GOLD and TVC:SILVER . The pause in bullion momentum weighed on mining equities, which tend to amplify moves in underlying metal prices.

In early London trade, Fresnillo and Hochschild fell around 3.2% and 2.5%, respectively, while losses extended beyond precious-metals-focused miners, reflecting a broader risk-off tone at the open.

Technical Outlook

The price maintains a bearish structure while trading below the 112.91 pivot.

As long as price remains below 112.91, downside pressure is expected toward 110.40.

A confirmed 1H close below 110.40 would strengthen bearish continuation toward 107.46, followed by 103.35.

On the upside, bullish momentum would only be activated with a 1H close above 112.91, opening the way toward 117.19 and 119.83.

Key Levels

• Pivot: 112.91

• Support: 109.41 – 107.47 – 103.40

• Resistance: 115.00 – 117.20 – 119.84

EURUSD Short: Fake Breakout at Supply, Pullback to 1.1850Hello traders! Here’s a clear technical breakdown of EURUSD (4H) based on the current chart structure. EURUSD initially traded within a well-defined ascending channel, confirming a strong bullish environment with consistent higher highs and higher lows. This phase reflected clear buyer control and healthy trend continuation. After reaching the upper boundary of the ascending channel, price lost momentum and transitioned into a descending corrective channel, signaling a temporary pullback rather than a full trend reversal. The corrective move remained orderly, with price respecting the descending structure and gradually compressing toward the lower boundary. At the lower edge of the descending channel, EURUSD formed a clear pivot point, where seller pressure weakened and buyers stepped back in aggressively. This led to a bullish breakout from the descending channel, confirming the end of the corrective phase. Following the breakout, price accelerated sharply higher, impulsively breaking above the key Demand Zone around 1.1850, which previously acted as resistance. This clean structure flip confirmed strong buyer commitment and renewed bullish momentum.

Currently, price then surged directly into the higher-timeframe Supply Zone around 1.2000–1.2050, where a fake breakout occurred. The rejection from this area suggests that sellers are active at the highs and that the market may be temporarily overextended after the strong impulse. Such behavior often leads to a corrective retracement rather than immediate continuation.

My primary scenario is a corrective pullback from the supply zone toward the 1.1850 Demand Zone (TP1). This level represents former resistance turned support and is a key area where buyers previously entered aggressively. As long as EURUSD holds above this demand zone, the broader bullish structure remains intact, and any pullback should be viewed as corrective within an overall uptrend. A strong bullish reaction and stabilization from the demand area could open the door for another attempt higher toward the supply zone and potentially new highs. However, a decisive breakdown and acceptance below the 1.1850 demand zone would weaken the bullish bias and increase the probability of a deeper correction. For now, the market favors buyers, with the current move best interpreted as a pullback after a strong impulsive rally. Manage your risk!

Elise | XAUUSD | 30M – Bullish Continuation After Structure HoldOANDA:XAUUSD

After a sharp impulsive move, XAUUSD pulled back into prior structure and demand, where buyers stepped in decisively. The current consolidation near highs suggests absorption of selling pressure. As long as price holds above the recent support, the probability favors an upside continuation toward higher liquidity.

Key Scenarios

✅ Bullish Case 🚀 (Primary) → Break and acceptance above resistance opens continuation.

🎯 Target: 5,150 – 5,220

❌ Bearish Case 📉 (Invalidation) → A sustained move below the recent structure low would weaken the bullish outlook and signal deeper correction.

Current Levels to Watch

Resistance 🔴: 5,130 – 5,150

Support 🟢: 5,060 – 5,020

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice. Please conduct your own research before trading.

EURUSD Monthly Rejection ZoneQuick Summary

After the strong rally on EURUSD price appears to have targeted the monthly FVG

This aligns with equal highs located within that zone and This area may support a bearish reaction and continuation of the broader downtrend

The expected move would aim to fill the liquidity void left over the past 10 days

Full Analysis

Following the significant upside move on EURUSD price action suggests that the market was targeting the monthly fair value gap

This scenario is logical as the FVG aligns with equal highs which often acts as a strong liquidity zone

The presence of equal highs within this higher timeframe imbalance increases the probability of a bearish reaction

Such areas commonly attract price before initiating a move in the opposite direction

If price begins to react from this zone the resulting move would form a clear orderflow structure

This orderflow could serve as a strong base for continuation of the broader bearish trend

The main downside objective in this scenario is the liquidity void that EURUSD has left behind over the past 10 consecutive days

That imbalance represents a significant magnet for price and supports the idea of a deeper corrective or trend continuation move

As long as price remains below the monthly reaction zone the bearish outlook remains valid

The focus now is on monitoring price behavior for confirmation that the higher timeframe rejection is holding

CADJPY: Swing Sell at the liquidity void area! Target 105! Dear traders,

I hope you’re doing well. We have a fantastic selling opportunity with the CADJPY pair. The price is approaching the liquidity gap and is likely to fill it. Once filled, we could see a reversal from that point. Our target is set at 105, but feel free to adjust your take profit based on your analysis and strict risk management.

Good luck and trade safely. If you like our idea, please like, comment and follow for more.

Team Setupsfx_

GOLD 4H CHART ROUTE MAP UPDATE & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our 4h chart route map and trading plan for the week ahead.

We are now seeing price play between two weighted levels with a gap above at 4999 and a gap below at 4923. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

4999

EMA5 CROSS AND LOCK ABOVE 4999 WILL OPEN THE FOLLOWING BULLISH TARGET

5082

EMA5 CROSS AND LOCK ABOVE 5082 WILL OPEN THE FOLLOWING BULLISH TARGET

5156

EMA5 CROSS AND LOCK ABOVE 5156 WILL OPEN THE FOLLOWING BULLISH TARGET

5228

BEARISH TARGET

4923

EMA5 CROSS AND LOCK BELOW 4923 WILL OPEN THE FOLLOWING BEARISH TARGET

4842

EMA5 CROSS AND LOCK BELOW 4842 WILL OPEN THE SWING RANGE

4740

4665

EMA5 CROSS AND LOCK BELOW 4665 WILL OPEN THE SECONDARY SWING RANGE

4596

4519

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

What’s Driving the S&P 500 Right Now?Observing the S&P 500 at this stage, I believe the key point is not any single headline, but the fragile balance between expectations and reality. The market is no longer reacting strongly to good news, yet it tends to wobble quickly when faced with less favorable signals—classic behavior after a prolonged rally.

The Fed: It’s No Longer About Rates, but Expectations

The Federal Reserve is not more hawkish than before, but it also hasn’t delivered a dovish signal strong enough to ignite a fresh wave of buying. Most expectations for easing have already been priced in, creating an asymmetric reaction to news: positive developments merely help the market hold its ground, while cautious or ambiguous messages are enough to trigger volatility.

This explains why the S&P 500 can maintain elevated levels but struggles each time it approaches the 7,000 zone. There is no panic selling, yet there is also no catalyst compelling investors to pay meaningfully higher prices.

Inflation and Economic Data: A “No Panic, No Euphoria” Zone

Recent data suggest that inflation is not reaccelerating, but it is also not cooling as quickly as initially hoped. This is an environment where the Fed can afford to wait, and where large investors are in no rush to make aggressive bets.

For the S&P 500, such conditions typically result in sideways movement, technical pullbacks, and trend-based consolidation rather than steep rallies. The market needs clearer data to break out of its current state of hesitation.

Earnings: Capital Is Becoming More Selective

One notable development this earnings season is the increasing divergence beneath the surface. Some heavyweight stocks continue to deliver solid growth and support the index, while many others are offering more cautious forward guidance.

As a result, the S&P 500 is no longer rising in a broad-based manner. The index holds up, but internal momentum weakens, making each advance slower and more fragile. This does not look like a classic distribution top; rather, it reflects a shift from “buy everything” to a more selective allocation of capital.

Global Capital Flows: No Sign of an Exit

Most importantly, there is still no clear evidence that capital is leaving U.S. markets. The U.S. dollar, bonds, and gold are not all rising sharply at the same time—a combination that typically signals a genuine risk-off phase.

As long as large capital remains in place, it is difficult for the broader S&P 500 trend to reverse abruptly.

The Bigger Picture & My View

Combining both technical and fundamental factors, the picture is fairly straightforward: the market is not weak enough to collapse, but not strong enough to break out immediately. This phase tests investors’ patience more than their conviction.

In the near term, the S&P 500 may continue to probe the 6,880–6,900 area. If upcoming data do not deliver negative surprises, holding above the EMA 89 and extending the consolidation could pave the way for another attempt at the 7,000 level in the weeks ahead.

What about you—do you see the S&P 500 as a market on the verge of a breakout, or one that simply needs more time to digest current price levels?

DXY Update and What It Means for CryptoThis is a fresh update on the DXY (US Dollar Index), and the chart is finally doing something interesting for crypto bulls.

DXY just broke down out of a descending triangle, a classic bearish pattern where lower highs crush into flat support until the floor finally gives way. On this chart, that breakdown is now in play, and for crypto, that’s a big deal.

The move isn’t small either. DXY is having one of its biggest drops ever: is down about

‑15.6% from its 2022 peak, trading around 96.8 today, the largest slide since 2017. That last major dollar dump came right before global liquidity surged and crypto went into a historic bull market.

There’s also a level that keeps showing up in history: 95 on DXY.

- The last time DXY broke and lived below 95, BTC went parabolic.

- In both 2017 and 2021, decisive breaks under 95 lined up with major Bitcoin bull phases.

We obviously can’t copy‑paste the past, but the message is pretty clear.

Liquidity looks for risk and crypto is one of the purest risk assets on the board.

$AMZN - Inverted Head and Shoulders Pattern Perfect Setup!Hello My Exit Liquidities!

The Head and Shoulders pattern is one of the most used and noticed patter in trading

In this case we have a inverted head and shoulders which is just a regular head and shoulders, but upside down

When seeing a regular head and shoulders people usually look to go short to flow with the momentum

However, with an inverted head and shoulders people usually look to go long

This setup on NASDAQ:AMZN 1H chart is a perfect example of this pattern

I'll be watching this one!

THE KOG REPORT - FOMCTHE KOG REPORT – FOMC

This is our view for FOMC, please do your own research and analysis to make an informed decision on the markets. It is not recommended you try to trade the event if you have less than 6 months trading experience and have a trusted risk strategy in place. The markets are extremely volatile, and these events can cause aggressive swings in price.

A quick FOMC Report today due to the increased volatility in the markets and the move we wanted already having been achieved.

We have the lower support level here at 5306 level which needs to break to go lower, while the resistance above is sitting at 5335-40 which in our opinion needs to break to go higher. We’ve added the hot spots and we’ll publish the red box targets and algo targets, however, we will say this, these are risky markets and although price is moving without pull backs, they’re going to want you in high before they make that correction.

Sentiment doesn’t seem to be there yet with the confidence in the move lacking, so one way to do that is to drop the price, and get those buyers in at every support level.

Caution is needed, let them move the price, once it settles, the structure will form for the trade to present itself.

RED BOXES:

Break above 5410 for 5415, 5420 and 5434 in extension of the move

Break below 5379 for 5370, 5358, 5350 and 5427 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

SUIUSDT 1,760% profits potential with 5X leverage —LONG tradeYou know the very famous saying, "buy when the market is red." It is good to buy when the market is red but we have to take into consideration the context of this buying, the broader market.

Is the market bullish as a whole? Does the chart in question have bullish potential?

SUIUSDT is now moving within the "opportunity buy-zone." This is what I call a really good entry zone or great prices. This is the best ever when it comes to a possible entry for a leveraged trade. Not only the price is right but the timing, timing is truly great.

This chart setup has a very strong bullish bias and we expect very strong growth, and fast; within days.

Here you have the full trade-numbers:

_____

LONG SUIUSDT

Leverage: 5X

Potential: 1760%

Allocation: 4%

Entry zone: $1.26 - $1.45

Targets:

1) $1.77

2) $2.05

3) $2.50

4) $2.87

5) $3.24

6) $3.77

7) $4.44

8) $5.55

9) $6.38

Stop: Close weekly below $1.25

_____

Thanks a lot for your continued support.

I will continue to share more as this type of opportunity doesn't repeat very often. The time is now to take action.

If you are reading this now, you have really good timing. You are well aligned. Keep up the good work.

I am wishing the best for you.

Namaste.

GOLD Price Update – Clean & Clear ExplanationGold is currently respecting an ascending trendline, showing overall bullish structure. Price has reacted strongly from the demand zone near 5045, creating a higher low and pushing back toward resistance.

Technical Overview

Depend on the price closes above 5105, buying momentum may accelerate toward the upper resistance zone around 5125–5150. This area is marked as the primary target for longs Failure to hold above the trendline and rejection from resistance may lead to a pullback toward:

“If you come across this post, please like, comment, and share. Thanks!”