PAYPAL P/E (TTM): 11.1x

Forward P/E: 12.5x – 15.5x

Free Cash Flow (TTM): $5.56 млрд.

ROE (Return on Equity): 24.3%

Debt/Equity: 0.56 (56%)

Revenue Growth (YoY): 7.0% – 8.5%

PEG Ratio: 0.85

Dividend Yield: 0%

Cash on Hand: $10.76 billion

Free Cash Flow (FCF) Margin: 19.5% (Adj. FCF Margin: 27.1%)

Quick Ratio: 1.34

Institutional Ownership: 75.95%

Current Ratio: 1.34

Analyst Targets:

DCF (Base Case - Alpha Spread): $101.05

DCF (Simply Wall St): $122.00

Wall Street Average Target: $76.97

Gross Margin: 42.1%

Sales Growth (TTM): 8.2%

Altman Z-Score: 2.82 (Safe Zone / Borderline)

AI Catalyst: New integration with OpenAI seen as key to 2026 performance.

Buybacks: The company continues to aggressively buy back shares (over $5 billion planned), which artificially boosts EPS.

Next important date: Q4 2025 financial report and 2026 guidance to be announced on February 3, 2026.

Community ideas

GOLD - Control Cycle Structure | Path to $5,000+Heads up….

The pullback from $4,549 isn’t weakness. It’s structure resetting before continuation. Gold completed a clean five-wave impulse from the Liberation Day tariff break at $3,000 to the Boxing Day high at $4,549. Wave (I) is complete. Price around $4,440 is Wave (ii) - corrective and controlled. Shallow matters.

Add Zone: $4,000–$4,200

This is where buyers position.

Below $4,000 sits the line that defines the structure.

Invalidation: $3,900.

Break it and the structure fails. Above it, momentum holds. Corrections compress in strong trends. Floors rise in control regimes. Sellers don’t get paid.

This is a control cycle, not a growth cycle. Central banks continue accumulating. USD reserve diversification is structural. FED cuts are expected Q2 as Powell exits May 2026. Policy paths are narrow. Gold functions as a trust anchor, not a trade. Supply chains are being managed. Strategic materials are politicised.

Gold prices this in advance.

Levels

Current: $4,430

Add zone: $4,000–$4,200

Major support: $4,000

Invalidation: $3,900

Targets:

$4,700 → $5,000 (Wave iii, Q2–Q3)

Extension toward $5,400 (Q4)

Skew remains asymmetric while $3,900 holds.

Corrections don’t end trends in control regimes. They prepare the next leg. Gold isn’t reacting. It’s leading.

Stay long. Outguess the break.

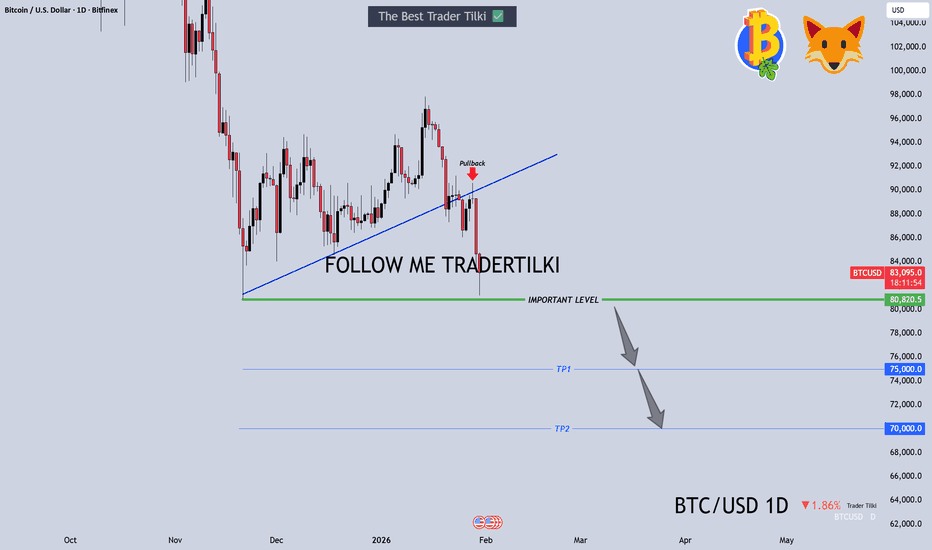

Bitcoin’s Critical Fortress: 1-Day Swing Analysis | TraderTilki Greetings my friends,

I analyzed Bitcoin for you on the 1-day timeframe.

Yesterday, many of my followers asked me to do a Bitcoin analysis because a lot of people got liquidated. I was truly sorry for their losses. You know, each of my followers is important to me. You are my valuable followers, I cannot ignore you.

Friends, right now Bitcoin’s key support fortress is at the $80,000 level. If Bitcoin falls below $80,000, it will first drop to $75,000 and then quickly to $70,000.

However, if it holds at $80,000, it can reach $90,000–$95,000 levels.

The most critical point here is the $80,000 level.

Please stay safe, improve your risk management and psychological control. Technical analysis accounts for only 10% of success. It is not the most important factor — the key is trading experience, risk management, and psychological discipline.

My friends, I share these analyses thanks to every single like I receive from you. I sincerely thank all my friends who support me with their likes.

Respect and love

SELL Signal: XAU/USD (Gold Spot)

Entry: ~5,062 (bearish OB + FVG area)

SL: >5,096–5,104 (above OB/FVG invalidation or recent structure high)

TP1: 5,033–5,025 (prior low / BOS target)

TP2: 4,975–4,950 (deeper support / extension) Reason: Price in clear downtrend after BOS, now rejecting at bearish Order Block + 5M FVG (~5,056–5,101 shaded). Bearish structure + rejection wick → high-probability continuation lower. #Gold #XAUUSD #Trading #Bearish #OrderBlock #FVG #Downtrend #PreciousMetals Not financial advice. Trading involves high risk of loss. Always DYOR, use proper risk management, and never risk more than you can afford to lose.

This Is A 3-step Intraday Strategy 📊 VWAP + Earnings + Stochastic: A Simple Day Trading Edge

This is a 3-step intraday strategy I use to stay aligned with smart money and avoid random trades.

🟢 Step 1: VWAP – Market Bias

Price above VWAP = bullish environment

I only look for long trades

Bonus confirmation if the first 15 minutes hold above VWAP

👉 VWAP tells me who’s in control.

🟡 Step 2: Earnings – The Catalyst

I wait for an earnings report

Earnings bring real volume and volatility

No catalyst = no interest from institutions

👉 Earnings explain why the stock is moving.

🔵 Step 3: Stochastic – Entry Timing

Stochastic is below 20 (oversold)

I wait patiently for a bullish cross

Entry only after confirmation — no chasing

👉 Stochastic tells me when to enter.

✅ Trade Logic

✔ Price above VWAP

✔ Earnings present

✔ Stochastic below 20 and turning up

When all three align → high-probability long setup 📈

⚠️ Rule That Keeps Me Safe

❌ I never buy if price is below VWAP, even if stochastic looks good.

📌 Bias first. Catalyst second. Timing last.

That’s the edge.

Rocket boost this content to learn more

Disclaimer: Trading is risky please use a stimulation

trading account first before

you trade with real money

Gold Volatility Rises, Risk of Short-Term Correction📊 Market Overview:

Gold experienced a very sharp sell-off to the 5093 zone in the previous session due to heavy profit-taking after hitting a record high, combined with strong volatility during the U.S. session. After the sudden drop, gold staged a technical rebound and is currently trading sideways around the 51xx–52xx zone, indicating cautious market sentiment and the absence of a clearly confirmed new trend.

________________________________________

📉 Technical Analysis:

• Key Resistance Levels:

• 5225 – 5250 (technical rebound zone, repeatedly rejected)

• 5350 – 5400 (previous highs, strong distribution zone)

• Nearest Support Levels:

• 5090 – 5110 (sharp sell-off low, key support)

• 5000 – 5030 (psychological support, a break may trigger deeper losses)

• EMA:

• Price is currently hovering around EMA 09, indicating an unclear short-term trend, with the market in a sideways consolidation / technical rebound phase after the sharp decline.

• Candlestick / Volume / Momentum:

• A strong long lower-wick candle formed near the 5090 zone, confirming dip-buying demand.

• However, rebound volume remains modest, suggesting this is not yet a sustainable bullish move but rather a technical pullback.

• Bearish momentum has slowed, but no clear bullish reversal signal has appeared.

________________________________________

📌 Outlook:

Gold may continue to range or correct slightly in the short term if it fails to decisively break above 5225–5250. A break below 5090 would reinforce the short-term bearish outlook. Conversely, holding above 5090 and breaking above 5250 could open the door to a clearer recovery phase.

________________________________________

💡 Proposed Trading Strategy:

🔻 SELL XAU/USD at: 5247 – 5250

🎯 TP: 40 / 80 / 200 pips

❌ SL: ~5253.5

🔺 BUY XAU/USD at: 5093 – 5090

🎯 TP: 40 / 80 / 200 pips

❌ SL: ~5086.5

$DYDXUSDT QUICK ANALYSIS (1H)BINANCE:DYDXUSDT is currently trading around $0.154–$0.155 on the 1h timeframe. Price remains in a well-defined bearish structure, confirmed by a series of lower highs and lower lows, indicating that sellers are still in control.

After a corrective bounce, the asset will now retrace into a supply zone, where the price will show rejection and lack of bullish follow-through. This reaction suggests the move higher is corrective rather than impulsive, supporting a bearish continuation scenario from this region witch also conformed by Volume Profile Tool.

Key Levels

Supply / Entry Zone: $0.1565 – $0.1575

Target 1: $0.1525

Target 2: $0.1485

Stop Loss: $0.1585

As long as the price holds below the supply zone, the bearish structure remains intact. A clean break and close above $0.1585 would invalidate this setup and signal absorption of supply.

BTC Update📊 CRYPTOCAP:BTC Update

BTC is clearly in a downtrend 📉.

What’s next? 👇

Using Fibonacci extension, we have important levels where price could

stabilize, bounce, or be considered for long-term accumulation.

🔹 First key area:

Around $76,000

→ aligns with Fibo 0.618 🧲

🔹 Second key area:

Between $69,000 – $67,000

→ previous POC (red zone)

→ also the previous ATH of the last bull run

These are the most important BTC levels right now.

⚠️ Important note:

BTC is not showing any bullish signals at the moment.

The overall market also shows no clear reversal signs.

For now,

we remain in a bear market 🐻

until proven otherwise.

Stay patient,

risk management first.

NSDQ100 oversold bounce back support at 25610Key Support and Resistance Levels

Resistance Level 1: 26230

Resistance Level 2: 26500

Resistance Level 3: 26690

Support Level 1: 25610

Support Level 2: 25366

Support Level 3: 25200

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Why the 1H Timeframe is the 'Sweet Spot' for DCA Bots

In the world of algorithmic trading, more data isn't always better—it’s often just more noise. Many traders make the mistake of running DCA bots on 1m or 5m timeframes, only to see their safety orders get "chewed up" by minor market fluctuations.

At OrangePulse, we recommend the 1-Hour (1H) Timeframe as the primary engine for our v3.0 strategy. Here’s why:

Filtering the Noise: 1H candles represent significant capital movement. By waiting for a 1H confirmation, the bot avoids "fakeouts" that happen on lower timeframes, ensuring your Base Order (BO) starts on a more reliable signal.

Safety Order Integrity: On lower timeframes, a quick 1% wick can trigger multiple Safety Orders (SO) in seconds, over-leveraging your position before a real recovery starts. On the 1H, your grid has "room to breathe," allowing the math to work in your favor during structural moves.

Execution vs. Over-trading: High-frequency DCA leads to high fees and high stress. The 1H timeframe strikes the perfect balance between keeping the bot active and maintaining extreme precision.

Conclusion: Trading isn't about how many trades you take, but how many you survive and close in profit.

OrangePulse Tip: Our v3.0 LITE is optimized to handle these 1H swings with a sophisticated "Target Drag" effect—bringing your profit line to the price faster than the market can react.

XAUT / USDT ()XAUT Expectation:

XAUT has the uptrend and price reached the expected target 5300 point and make new ATH on 5610 point, now one more retest on the 4951 point can be dangerouse and price can decrease till 4500 point.

Geopolitics situation is an advantage for the GOLD price; the USA regional conflict and the Iran regional conflict are pushing the price up. Also, dollar wickless makes the Gold up trend.

BTCUSD Will it bounce or drop below Nov 21 low 80619.96INDEX:BTCUSD Last Dec I started marking Fib retrace from Nov 11, 2025 107461.75 peak down to Nov 21, 2025 low, I noticed it sells off at around 0.5 fib 12/4 and 12/9. After the 2nd rejection, I marked four price targets. TP1 🎯 20251118 LoD 89258.35, TP2 🎯 0.236 fib 86954.43, TP3 🎯 20251120 LoD 86038.18 and TP4 🎯 20251122 LoD 83496.68.

Didn't expect it to be here sooner than expected in my danger zone just above 80619.96 Nov 21,2025 low. Since we're here, I added a fifth price target at the lower trend line TP5 🎯 Feb 2026 lower trendline around 75652.35 area. There's also my lower target 20210414 high at 64898.56.

NASDAQ (US100) – Trading Plan for Today | Jan 30🔥 NASDAQ (US100) – Trading Plan for Today | Jan 30

Today’s session opened below the key level at 25,853,

with the lower key level positioned below the Point of Control.

This structure defines a short-biased intraday context.

Price failed to reclaim and accept above the key level,

confirming seller control.

Intraday plan (short)

Primary target:

– lower daily reversal zone boundary

In this area, I expect:

– partial profit-taking,

– potential short-term reaction.

As long as price remains below 25,853, the short bias stays valid.

Acceptance back above this level would invalidate the short setup.

This is not financial advice. Risk management is required.

GBPJPY M30 | Bullish Breakout Momentum: Bullish

Price is currently above the ichimoku cloud.

Buy entry: 212.230

- Pullback support

Stop Loss: 211.567

- Overlap support

Take Profit: 212.694

- Pullback resistance

- 127.2% Fib extension

- 61.8% Fib retracement

High Risk Investment Warning

Stratos Markets Limited (fxcm.com/uk), Stratos Europe Ltd (fxcm.com/eu):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (fxcm.com/en): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited (fxcm.com/au):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com/au

Vedanta - My Stock Pick for 2026Starting the year at ATH. Coming out of 15 year period of consolidation.

Look for dips till 530 to enter.

Target: 765 / 1200

Support: 530 / 495 / 360

Below 495 exit temporarily and buyback on reversal above 530.

Disclaimer: I have entered the trade around 606. Looking for dips to build on position.