SNDK Q2 Earnings – Bearish Alert After Parabolic RallySNDK Earnings Trade – 2026-01-29

Signal: 🔴 Bearish

Target Price: ~$469 (Down ~13.5%)

Reason: Extreme overbought + poor earnings+ parabolic run → “sell the news” setup

Options Strategy: Bear Put Spread (limits risk, captures downside)

Buy: $545 Put

Sell: $535 Put

Expiry: 2026-01-29 (0DTE)

Cost: ~$5 per spread

Extra Notes:

Implied volatility is low (14.6%), so options are cheap

Historical moves suggest the stock can move more than the market expects

STRATEGY: BEAR PUT SPREAD (Debit Strategy - Exploiting Underpriced Downside)

Community ideas

Microsoft - The worst day in 5 years!🚀Microsoft ( NASDAQ:MSFT ) remains bullish despite the crash:

🔎Analysis summary:

Today Microsoft created its worst day in five years. But at the same time, Microsoft is also approaching a significant confluence of support. And if we soon see bullish confirmation, Microsoft will just create another bullish all time high break and retest.

📝Levels to watch:

$430

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

XAUUSD – 30M – Bullish Continuation StructureOANDA:XAUUSD

After sweeping liquidity and forming a higher low, XAUUSD delivered a strong bullish leg. The current pause below resistance suggests absorption rather than weakness. As long as price holds above the 5,230 support, bullish continuation remains valid.

Key Scenarios

✅ Bullish Case 🚀 → Clean break and acceptance above 5,330

🎯 Target: 5,380 → 5,420

❌ Bearish Case 📉 → Failure to break resistance

A rejection from 5,300–5,330 could trigger a corrective pullback toward 5,230, while structure remains bullish above demand.

Current Levels to Watch

Resistance 🔴: 5,300 – 5,330

Support 🟢: 5,230 / 5,000

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice. Please do your own research before trading.

Hellena | Oil (4H): SHORT to support area 62.295.Colleagues, earlier I described the upward movement as a full-fledged ABC correction, and the price justified expectations and completed the planned upward movement, but at the moment I think it is worth considering that wave A has been extended.

This fits well with both the old and new scenarios.

I expect wave “B” to begin its movement soon.

I will not set distant goals and will wait for the price to reach the first support area — the maximum of wave “3” of the middle order at 62.295.

I admit the possibility of updating the maximum of wave “A” approximately in the resistance area of 65.199.

In general, if correction “B” continues too far down, I will return to the old scenario.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

GBPUSD Price Update – Clean & Clear ExplanationGBP/USD is currently trading within a broader bullish structure, but recent price action shows signs of short-term bearish pressure after rejection from a key resistance zone.

A Price previously respected an ascending channel, making higher highs and higher lows. However, the latest impulsive bearish candle indicates a breakdown from the rising structure, suggesting weakening bullish momentum.

A strong resistance zone is marked around 1.3810 – 1.3835, where price was rejected aggressively. After the rejection, price dropped sharply and is now attempting a minor pullback toward the previous structure and resistance area.

If price fails to hold above this resistance, a continuation to the downside is likely. The projected bearish move targets two major support zones: first support near 1.3720 and support around 1.3680,

“If you come across this post, please like, comment, and share. Thanks!”

Gold Rush 2.0 $8K by June !?!? Gold Rush 2.0 – History Doesn’t Repeat, But It Rhymes

The first Gold rush (2000–2011) took ~10 years to play out.

Price moved roughly +654%, then did what markets always do after euphoria:

45% retracement over the next 5–6 years.

Fast forward.

Technically, Gold Rush 2.0 started around 2016.

We’re now roughly 10 years into the cycle.

If history rhymes (not repeats), the math points to something interesting:

• A similar expansion would put gold somewhere around $7.5k–$8k around June

• Followed by a deep corrective phase back toward the $4k zone 😱

Does that mean it has to happen?

Of course not.

But ignoring long-term structure and human behaviour has never worked either.

Why this cycle feels different (or maybe not):

• Central banks quietly stacking gold at record pace

• Fiat currency debasement becoming “normal policy”

• Debt levels that mathematically can’t be paid back

• De-dollarisation whispers getting louder every year

• Wars, instability, and trust erosion in institutions

Gold doesn’t move because of headlines.

It moves because confidence erodes slowly… then all at once.

Not saying buy.

Not saying sell.

Just zooming out, connecting dots, and respecting one thing markets never lost: Cycles driven by human psychology.

History doesn’t repeat… but it has an uncanny habit of whispering clues to those willing to listen.

Food for thought.

Nothing more.

Just don't HOLD!!

God bless you all!!

Lingrid | GBPJPY Continuation Anticipated Following CorrectionFX:GBPJPY perfectly played out my previous trading idea. Price has absorbed the recent pullback without damaging the broader bullish structure, forming a clear higher low above the rising support line. The selloff appears corrective with demand stepping in precisely where trend continuation would be expected. Market behavior suggests sellers are losing follow-through rather than gaining control.

As long as price remains supported above the 210.5 demand zone, upside pressure may gradually rebuild. A push back through short-term resistance could trigger a renewed expansion toward the upper resistance area, aligning with the prevailing bullish channel.

➡️ Primary scenario: support holds → continuation toward 213.5.

⚠️ Risk scenario: a decisive breakdown below 210.5 could delay continuation and open room for deeper consolidation.

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

EURUSD - The correction may be over. Bullish trend FX:EURUSD is forming a correction within an uptrend and testing the support of the local uptrend channel and the 1.1900 zone.

The weak dollar is providing tremendous support for the euro. The currency pair is testing important support within the uptrend. There is a possibility of the correction ending and growth...

The currency pair is in a correction phase, with an emphasis on local downward resistance (triangle boundary). A breakout of the boundary could trigger growth due to the end of the correction.

Panic zone - support at 1.1898. (A breakout of this support could break the bullish structure)

Resistance levels: 1.1970, 1.2025, 1.2082

Support levels: 1.900, 1.1898

Ahead lies the resistance of the triangle; a breakout of this boundary will confirm the end of the correction, and if the bulls keep the price above 1.197, the market will be able to move into an active growth phase. Before that, a retest of 1.1907 - 1.1920 is possible.

Best regards, R. Linda!

Gold was bought at 5240, awaiting the interest rate decision.

Gold, after surging to 5311, has pulled back and is currently trading at 5256; before today's Federal Reserve interest rate decision, it is expected to consolidate, maintaining a bullish bias with some fluctuations; short-term support is at 5240, strong support at 5230-5220; short-term resistance is at 5260-5270, strong resistance at 5284, a break above this level would target 5296-5311;

In terms of trading strategy, it is recommended to buy above 5240, any changes will be notified during the trading session;

The price of gold once again hit a new historical record today, reaching 5311. However, before the Federal Reserve's interest rate decision on Thursday, market sentiment has turned cautious. Although it is widely expected that interest rates will remain unchanged, the "hawkish hold" stance may still put short-term pressure on the current overheated bullish sentiment, and the pullback in gold prices from the high is related to this.

From a technical perspective, there is a divergence in short-term bullish and bearish forces:

The consecutive bearish candles on the 1-hour chart reflect a slowdown in upward momentum, and the shooting star pattern on the 4-hour chart further signals a potential stall in the rally. However, in the overall bull market, such technical patterns should be considered as a correction phase in the upward trend, rather than a signal of trend reversal. The trading strategy should continue to follow the trend, treating the price pullback to important support areas as an opportunity to build long positions.

SPX500 | Hits 7,000 as Big Tech Earnings Fuel Risk AppetiteSPX500 | Tags 7,000 as Big Tech Earnings Reignite Risk Appetite

The S&P 500 touched the 7,000 level for the first time, as investors embraced risk amid a heavy flow of big tech earnings. Strong results from Microsoft and Meta, despite elevated AI spending, reinforced confidence in growth, while Tesla gained even after reporting its first annual revenue decline.

Markets largely looked past recent Greenland-related geopolitical jitters, returning focus to earnings momentum. While round numbers often attract headline-driven flows and profit-taking, breaking above them typically signals underlying confidence, even if follow-through takes time.

Technical Outlook

The bullish structure remains intact as long as price trades above the 6988 pivot.

Holding above 6988 supports a continuation toward 7020, with further upside potential toward 7050, marking a new all-time high zone.

A move below 6988 would trigger a short-term pullback toward 6972.

Further downside below 6972 would open the way for a deeper correction toward 6941.

Key Levels

• Pivot: 6988

• Support: 6972 – 6941

• Resistance: 7020 – 7050

V when does BTC rip? patience butterfly. soon. not yet. but soonThe most important chart right now for BTC is this:

XCUUSD/XAUUSD

when u look at copper you need to put it in gold pair

tanking

business cycle heading for a hard landing.

bitcoin is a tech stock even though (you and i) know it's not.

the world sees it this way. k? that's what's important rn.

that's called "being early" but really - i dislike that meme - but it's actually true. how many ppl can articulate bitcoin? nevermind eth. nevermind everything else. for norms the price is product. yas, a bit qween, but not exactly. not in the long term.

so hear me out butterfly.

the storm is upon us. this is really, honestly, quite common. you can't have hair spray on fire bull markets unless you have some draw down. this is normal! btc went from 15k to like 125k. we will probs do 60-70k lows... then 350k. if that happens are you going to size manage to benefit?

this is what you need to be thinking:

how do i manage this drawdown

1/ no position is basically "i don't understand this at all"

2/ size managing and paying attention is "i care but i won't lose myself and i'm preparing"

3/ full size is "dumb"

4/ leverage here is "FAFO"

so we'll watch this chart.

i'm 55% cash. i like sbet but that's a deeper conversation. a way way deeper one. i think eth outperforms btc in the 5-10y context. but honestly, people (the mkt) sees eth as a bitcoin beta in the short term (1-3y) which means... btc lower... eth even lower... and sbet is eth beta... so *even* lower lol. so again, size management. prepare. watch.

owl mode.

we'll come back. we'll be the ones that survived. that's what keeps you here. that's what stacks the PnL. you can't full port always. well u can. but well... lol. you'll need some luck and that's not really my style. time is the alpha. especially in HQ assets. and best in assets nobody understands. btc/eth are "dinosaurs" to a lot of us. but let's get real, go ask someone on the street to explain this to you.

just keep that head screwed on. i'll be here to write when i'm moving.

for now. i'm owl mode. perched. hungry. but fasting. i'm going for kill. but i can wait. wait is my alpha. study.

V

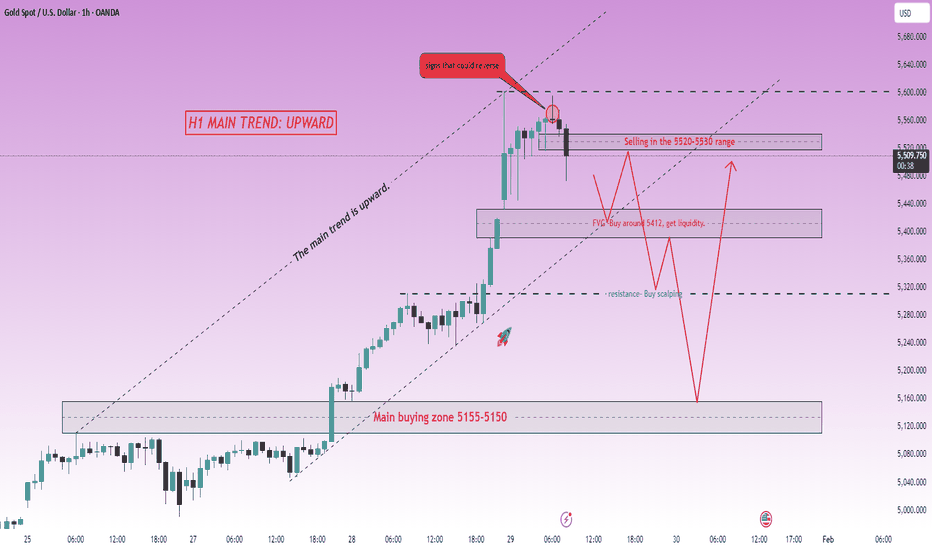

XAUUSD (H1) – Liam Plan

Uptrend intact, but signs of short-term exhaustion | Trade reactions, not impulse

Quick summary

Gold remains in a strong H1 uptrend, continuing to print higher highs and higher lows within a well-defined bullish structure. However, after the recent sharp advance, price is starting to slow near the highs, increasing the likelihood of short-term pullbacks and two-sided price action.

➡️ The broader trend stays bullish, but execution should now be level-driven and reaction-based, not momentum chasing.

Technical view

Price is currently trading at elevated levels relative to recent structure, where prior buying activity has already been absorbed.

Key price areas to watch:

Short-term sell area: 5520 – 5530

Upper resistance area: around 5600

Pullback buy area: 5405 – 5420

Primary buy zone: 5150 – 5155

The current structure favors a pullback and rebalancing phase before any sustained continuation higher.

Trading scenarios

SELL – short-term reaction trades

Look for sell reactions around 5520 – 5530 if price shows weakness.

Downside targets sit near 5420, with further extension possible if the pullback develops.

These sells are tactical and short-term, not calls for a trend reversal.

BUY – aligned with the main trend

Primary scenario

Buy pullbacks into 5405 – 5420 if the area holds.

Targets back toward 5520 and higher.

Deeper scenario

If volatility increases, wait for price to retrace toward 5150 – 5155.

This area offers the best risk-to-reward for trend continuation.

Key notes

Strong trends still correct; patience matters.

Avoid entries in the middle of the range where risk outweighs reward.

Short positions are tactical only while the broader structure remains bullish.

What’s your plan:

selling reactions near 5520 – 5530, or patiently waiting for a pullback into 5405 – 5420 to rejoin the uptrend?

— Liam

GBP/JPY Best Places To Buy And Sell Cleared , 400 Pips Waiting !Here is m y opinion on GBOP/JPY On 4H T.F , We have a Huge movement To Upside & Then to downside since Last 2 weeks , and we have a good range for buy and sell started between 211.900 to 210.000 so we can buy and sell GBP/JPY This Week from 2 areas , 210.000 will be the best place for Buy and 211.900 will be the best place for Sell , now the price very near buy area so we can Enter a buy trade now and targeting 211.900 and when the price touch it and give us a good bearish P.A , we can enter a sell trade and targeting 210.000, It`s All Depend On Price action , if we have a daily closure below our support then this idea will not be valid anymore .

Entry Reasons :

1- Lowest Level The Price Touch It

2- Broken Res .

3- New Support Touched .

4- Clear Price Action .

5- Clear Support & Res .

6- Price Range Cleared .

Nifty 50: Bullish "Inner Trend" Breakout Setup (RR 1:4)Market Analysis

While the Nifty 50 remains compressed within a large-scale Symmetrical Triangle, a critical shift is occurring on the 15-minute timeframe. Inside this "squeeze," we observe a clear short-term uptrend characterized by consistent Higher Lows (the blue arrow path).

The "Trend Within a Trend" Logic

Long-Term Structure: Price is squeezed between Descending Resistance (falling upper trendline) and a horizontal demand zone.

Internal Support (25,350): This serves as the Ascending Support line for the immediate short-term trend. It acts as a rising floor where buyers are aggressively stepping in.

The Logic: This internal strength acts as a leading indicator. If the "inner trend" holds above 25,350, it will likely drive the price to break out of the "outer" descending resistance toward the next major supply zone.

Trade Execution (Buy on Retest)

Long Entry: 25,300 (Retest of demand zone / Premium Discount 50% of Fib).

Take Profit (Target): 25,600 (Major supply zone target post-triangle breakout).

Stop Loss: 25,235 (Structural invalidation below the internal support).

Risk/Reward Ratio: 1:4.6.

Conclusion

The internal structure is increasingly bullish despite the overall sideways compression. As long as the 25,350 Ascending Support holds, the pressure remains on sellers to defend the overhead resistance. A breakout with high volume above 25,400 will confirm the move toward 25,600+.

USDJPY M30 | Bullish Bounce Off Pullback SupportMomentum: Bullish

Price is currently above the ichimoku cloud.

Buy entry: 153.046

- Pullback support

- 78.6% Fib retracement

- 100% Fib projection

Stop Loss: 152.764

- Swing low support

Take Profit: 153.495

- Swing high resistance

High Risk Investment Warning

Stratos Markets Limited (fxcm.com/uk), Stratos Europe Ltd (fxcm.com/eu):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (fxcm.com/en): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited (fxcm.com/au):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com/au

XAGUSD Bullish Breakout: Trend Continuation Toward 124.00This is a 30-minute XAGUSD (Silver vs USD) chart showing a bullish breakout within a well-defined uptrend.

Overall trend: Price is moving inside a rising channel, respecting an ascending trendline that has acted as dynamic support.

Ichimoku Cloud:

Price is above the cloud, confirming bullish market structure.

The cloud is rising and expanding, signaling strong underlying momentum and trend stability.

Key resistance & breakout:

A horizontal resistance zone capped price multiple times.

Silver has now broken and held above this level, confirming a bullish breakout.

Price action: Post-breakout consolidation shows higher lows, indicating acceptance above resistance rather than a false break.

Support confluence: The breakout level aligns closely with the rising trendline and the top of the Ichimoku cloud, strengthening the bullish bias.

Target projection: An upside target is marked near 124.00, consistent with trend continuation and prior structure extension.

Overall, the chart favors trend continuation to the upside, as long as price remains above the breakout zone and ascending trendline.

Huge fluctuations. Be wary of another sharp pullback.The gold market is never smooth sailing; volatility is the norm, and both rises and falls present challenges. Don't be impatient due to sudden surges, nor underestimate yourself because of brief pullbacks. Every market correction filters out the steadfast, and every adjustment prepares the ground for a new market trend. Anchor your direction with rationality, cultivate confidence with patience, and don't let short-term fluctuations disrupt your rhythm!

On Thursday, gold bulls tested the 5600 level, but the US session suddenly collapsed, with a rapid drop of 400 points in one hour and 212 points in five minutes – a truly breathtaking moment. Friday saw a similar pattern, reaching a high of around 5450 before quickly falling back to around 5111 in the early Asian session. Short-term fluctuations were tens of dollars per minute, making short-term trading extremely difficult. Currently, the technical picture shows a large range-bound movement, offering no favorable trading environment.

Under such violent volatility, any trade can be wiped out instantly. What we need to do now is patiently wait for market sentiment to cool down, for volatility to return to rationality, and for the trend to emerge clearly.

Friday will see the announcement of the new Federal Reserve Chair, with Kevin Warsh currently the frontrunner. If elected, his election would significantly boost the dollar and US Treasury yields, which would put downward pressure on gold prices. Therefore, everyone should be wary of another sharp price correction on Friday.I will post more strategies in the channel.

Gold Outlook 2026: Buy or Sell After $5,600 Spike? PPI Data🟡 Gold Outlook 2026 Buy or Sell

📅 30 January 2026

📊 MARKET OVERVIEW

Gold experienced an exceptionally volatile session on January 29, 2026, rallying to a fresh all time high near $5,600 before a sharp wave of profit taking triggered a rapid sell off, briefly pushing prices down toward the $5,110 area. The session was marked by extreme intraday swings of more than 6%, reflecting overstretched positioning after a powerful multi month rally and short term exhaustion at record levels. Despite the correction, gold still closed the day only modestly lower and remained up more than 20% for January, keeping the broader bullish trend intact amid persistent safe haven demand and macroeconomic uncertainty.

🧮 KEY FUNDAMENTALS

🕰️ US Producer Price Index PPI 8:30 AM ET

PPI is the main inflation catalyst today, offering insight into upstream price pressures. A hotter than expected reading could strengthen the USD and delay rate cut expectations, pressuring gold, while softer data may revive bullish momentum after yesterday’s correction.

🔥 Core PPI Ex Food and Energy

Closely watched for underlying inflation trends, Core PPI will heavily influence rate expectations. Sticky core inflation would be gold negative in the short term, whereas easing pressures would support gold’s non yielding appeal.

🏭 Chicago PMI 9:45 AM ET

This regional manufacturing gauge can shift risk sentiment. A weak print may fuel recession concerns and boost safe haven demand for gold, while stronger data could favor risk assets and cap upside.

🛢️ Baker Hughes Rig Count Later Today

Primarily oil focused and a secondary driver for gold, but large changes can influence broader commodity sentiment and inflation expectations indirectly.

🌍 GEO POLITICS

🚨 US Government Shutdown Risk Surges

Markets are now pricing a 73% probability of a US government shutdown ahead of the January 31 funding deadline, reflecting rising uncertainty in Washington.

🏛️ Funding Talks at a Critical Stage

The risk centers on stalled negotiations in Congress, particularly around Department of Homeland Security funding, with no clear agreement in sight.

🗣️ Trump Signals Markets Remain Skeptical

Former President Donald Trump stated, “We don’t want a shutdown,” but despite the rhetoric, investors remain cautious as political gridlock keeps shutdown odds elevated.

🏦 Trump Says He Will Announce Federal Reserve Chair Pick

US President Donald Trump confirmed that he will reveal his choice for the next Federal Reserve Chair today. The announcement carries major implications for monetary policy direction, Federal Reserve independence, and future interest rate expectations, with potential ripple effects across the US dollar, Treasury yields, equities, and gold as investors assess whether the nominee signals a more hawkish or dovish stance.

📉 WHAT DO ANALYSTS EXPECT

🏦 El Salvador purchased $50 million worth of gold, signaling continued central bank demand amid rising global economic and geopolitical uncertainty.

📢 Reports indicate Trump is preparing to announce a new Federal Reserve Chair, increasing market sensitivity around future monetary policy direction and interest rate expectations.

📉 Trump criticized current Fed leadership and pushed for lower interest rates, a stance generally viewed as supportive for gold as a hedge against easier monetary policy.

🧠 Markets are increasingly pricing in Kevin Warsh as the likely Fed Chair nominee, raising speculation about a potentially more hawkish policy path.

⚠️ Expectations of a Warsh nomination triggered short term pressure on gold, alongside gains in the US dollar and volatility across risk assets.

🟡 Gold briefly pulled back as the dollar strengthened, but broader sentiment remains supportive due to policy uncertainty, fiscal dominance concerns, and demand for real assets.

🔥 Geopolitical tensions, including US threats toward Iran, lifted oil prices and reinforced gold’s role as a safe haven asset.

✅ CONCLUSION

Gold remains structurally bullish despite extreme volatility, with profit taking near record highs viewed as a healthy correction within a powerful uptrend. Near term direction hinges on US inflation data and the Fed Chair announcement, which could drive sharp moves via USD and rate expectations. However, persistent geopolitical risks, rising shutdown odds, and central bank demand continue to underpin gold as a core safe haven asset.

GOLD (XAU/USD) LONG SIGNAL

Entry: Around current levels ~5,264 - 5,287 (retracement zone after sharp pullback, near the FVG area to be filled + holding above key lower supports)

Bullish confirmation: Deep retracement filling the Fair Value Gap (FVG) from the prior impulsive move + strong rejection from lower levels, now showing signs of reversal with price pushing back toward the broken resistance (former BOS/IDM area turning into support). Momentum shifting bullish again in this massive uptrend.

Target: 5,297 – 5,311 (FVG fill complete + next minor resistance), then extension toward 5,340 – 5,400+ and ultimately back to retest 5,500–5,560 highs if bulls regain full control

Stop Loss: Below 5,250–5,260 (below recent swing low / invalidates the reversal and FVG hold) Watching for continuation higher as gold absorbs the correction and resumes its structural bull run—classic buy-the-dip setup! #Gold #XAUUSD #GoldPrice #Bullish #FVG #Trading #PreciousMetals #BuyTheDip #Commodities Not financial advice — This is just my personal view based on the chart. Gold remains extremely volatile after its historic 2025–2026 run, and sharp reversals or deeper corrections are always possible. Do your own analysis, use strict risk management, and only trade with capital you can afford to lose!

TESLA New brutal Bear Cycle targets $270. 10 months ago (March 21 2025, see chart below) we made what many considered a bold buy call on Tesla (TSLA) amidst the Tariff war, which right on the market bottom. In September, our $450 long-term Target was hit:

The model was based on Tesla's previous Accumulation Phase of 2015 - 2019, which resembled the stock's price action since the November 2021 High.

As this December we reached the 1-year Resistance (similar to the 2017-2019 one), we expect the stock to start a new long-term correction phase (Bear Cycle). In 2018, that marginally breached below the 1W MA200 (orange trend-line) twice before (towards the end of Time Fib extension 5.0) it rebounded again.

That 1W MA200 bottom coincided with a 0.382 horizontal Fibonacci retracement test (orange). That is currently at $270, and this is our long-term Target for Tesla on this upcoming correction.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BTC Structural Breakdown: Rejection at $89k Leading to New 2026 This analysis covers the recent price action on the 4-hour (4H) timeframe, utilizing SMC to identify key institutional levels. After failing to hold levels above the $88,000 – $89,000 range, Bitcoin has entered an aggressive bearish expansion phase.

Key Technical Insights:

• Structural Shift (CHoCH & BOS): The chart displays a clear Change of Character (CHoCH) followed by multiple Breaks of Structure (BOS) to the downside. This confirms that sellers are now in control of the medium-term trend.

• Strong High vs. Weak Low: Price was rejected from a identified "Strong High" near $88,394. It is now targeting the "Weak Low" located in the yellow demand zone around $83,400 – $84,000, which aligns with fresh 2026 lows recently established below $85,000.

• Liquidity & Gaps: The aggressive drop has left behind unmitigated supply zones (red boxes). The large red arrow suggests a high-probability continuation toward lower liquidity pools as institutional sell-side pressure remains high, evidenced by over $160M in ETF outflows this week.

• Market Context: This downturn coincides with a broader Wall Street selloff and investors shifting toward gold as a preferred safe-haven.

Summary: The technical outlook is bearish. A recovery would require reclaiming the $88,000 resistance; otherwise, further downside toward the $81,250 support level is likely.

Mean Reversion in Action | Intraday Structure & Market MechanicsShort-term market moves often appear chaotic, but beneath the surface, price frequently follows statistical and structural tendencies — one of the most important being mean reversion.

This chart provides a clean real-time example of how price behavior stabilizes following volatility expansion.

What Is Mean Reversion?

Mean reversion describes the tendency for price to return toward its short- and medium-term averages after extended deviation.

Rather than forecasting direction, this framework focuses on understanding market mechanics — specifically:

• Volatility expansion

• Distance from trend EMAs

• Momentum exhaustion

• Structural re-balancing

What We Observe Here

Following aggressive downside momentum:

• Price extended significantly below key short-term EMAs

• Volatility expanded rapidly

• Momentum reached short-term exhaustion levels

• Mean distance became statistically stretched

As a result, price began reverting back toward its structural equilibrium zone.

This process reflects mechanical market behavior, not predictive bias.

Why This Matters

Mean reversion is one of the most important principles for understanding:

• Intraday stabilization

• Volatility compression

• Structural resets

• Trend sustainability

Rather than attempting to predict bottoms or tops, observing how price behaves around its structural means offers clearer insight into market condition and participation.

Final Structural Note

When markets experience rapid deviation, reversion toward trend averages is a natural response — especially when volatility becomes extended.

This does not imply directional certainty.

It simply demonstrates how markets normalize after imbalance.