Pivotstrategy

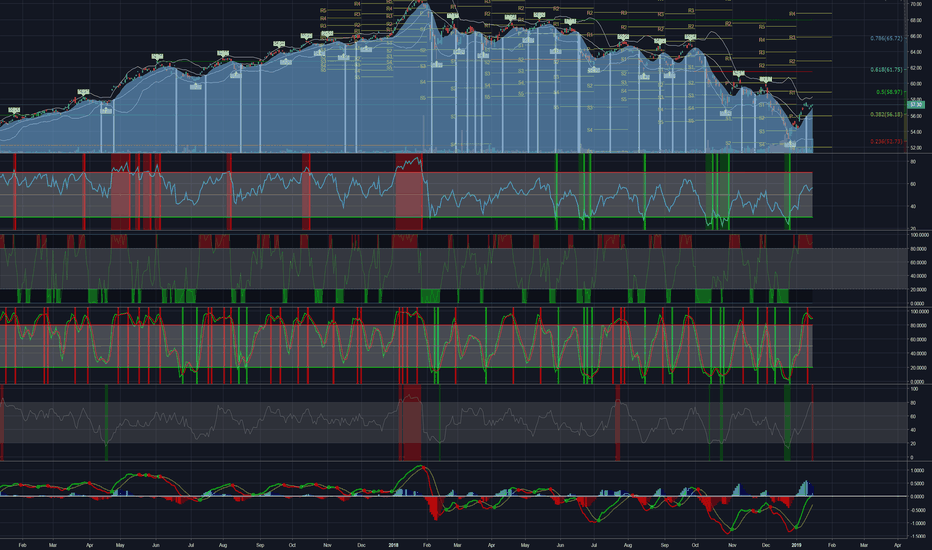

Retroceso evidente hacia el punto pivotRetroceso evidente hacia el punto pivot en relacion a los dos dias anteriores que aperturaron sobre el punto pivot, ademas de esto dos confirmaciones mas sobre la tendencia:

1) debe tener un momento de retroceso ya que fueron impulsos muy fuertes al alza luego de dias de bajada del precio en zig-zag.

2) coincidencia casi perfecta del proximo punto pivot con un soporte altamente probable.

Luego de todo el desplazamiento al alza habra que calcular los retrocesos con fibonacci para entrar en pocisiones en corto con un estilo de scalping.

VWAP, Volume profile and pivots combined for day tradingAs annotated on the chart, weekly pivots combined with volume profile and VWAP bands can give high % entries.

me

On responsive days, VWAP bands give accurate points of entry for a move back to the current VWAP or POC.

Be wise to the the of day that is developing, and use the appropriate strategy. For example on trend days do not play for responsive moves as you'll get run over. Neutral/balancing/normal days buy or sell out of value for a return to value using VWAP and pivots as a guide. Stops should be placed above or below pivots or the next VWAP band (2.5 or 3 SD).

For further accuracy use the bigger picture- market and volume profile of the last few days.

VWAP and volume profile combined with pivots for day tradingAs annotated on the chart, weekly pivots combined with volume profile and VWAP bands can give high % entries.

On responsive days, VWAP bands give accurate points of entry for a move back to the current VWAP or POC.

Be wise to the the of day that is developing, and use the appropriate strategy. For example on trend days do not play for responsive moves as you'll get run over. Neutral/balancing/normal days buy or sell out of value for a return to value using VWAP and pivots as a guide. Stops should be placed above or below pivots or the next VWAP band (2.5 or 3 SD).

For further accuracy use the bigger picture- market and volume profile of the last few days.

EURJPY Day Trade *LEARN TO DAY TRADE FX CURRENCIES*Here is another example of how to day trade FX currencies using a simple combination of Daily Pivot Points , 2x EMA's and the trendline tool on TradingView.

The first entry is based on the bullish trendline being broken and a retested. A lower low was made with the break of the TL and therefore this retest was a new lower high signalling a trend reversal. Price also rejected the daily pivot level and the 15 minute 50EMA. Because this is a fresh trend reversal, the 200 and 50 EMA's were not aligned but that is quite often the case with this style of entry.

Stop Loss is always placed 10 pips above the current high.

Target 1 is always the daily S1 level. If price manages to break through here with some momentum then it is highly likely that it will reach the daily S2 or even S3 levels. If you hold the trade to these levels then your R:R ratio will be increased dramatically.

The second trade opportunity came a day later. This entry is again based off of price rejecting the daily pivot level but it had done this 3 times in the same day so it is safe to assume that the Pivot level is acting as a strong resistance. The 50 and 200 EMA's were aligned and confirming a bearish trend (50 below 200) and the 15 minute timeframe chart had made a flag continuation pattern.

Stop Loss is always placed 10 pips above the current high.

Target 1 is always the daily S1 level. If price manages to break through here with some momentum then it is highly likely that it will reach the daily S2 or even S3 levels. If you hold the trade to these levels then your R:R ratio will be increased dramatically.

ODE / Bitcoin (ODE/BTC): Supports, Pivots & ResistencesFind Winning Trades In Seconds >> efcindicator.com (Special Discount)

ODE / Bitcoin (ODE/BTC): Supports, Pivots & Resistences – Short-Term

Paxos Standard / Bitcoin (PAX/BTC): Support, Pivot & ResistenceFind Winning Trades In Seconds >> efcindicator.com (Special Discount)

Paxos Standard / Bitcoin (PAX/BTC): Support, Pivot & Resistence – Short-Term

CHESAPEAKE ENERGY CORPORATION (CHK): Pivot, Support, ResistencesFind Winning Trades In Seconds >> efcindicator.com (Special Discount)

CHESAPEAKE ENERGY CORPORATION (CHK): All The Pivots, Supports & Resistences

KITOV PHARMA LTD. (KTOV): All The Pivots, Supports & ResistencesFind Winning Trades In Seconds >> efcindicator.com (Special Discount)

KITOV PHARMA LTD. (KTOV): All The Pivots, Supports & Resistences