XAUUSD - Gold has reached its ceiling?!Gold is trading above the EMA200 and EMA50 on the 4-hour timeframe and is trading in its ascending channel. A reduction in the upward momentum and a correction towards the demand range will provide us with a better risk-reward buying position.

On December 10, the Federal Reserve surprised financial markets when it announced that **just two days after halting its balance sheet runoff**, it would resume **expanding its balance sheet starting December 12**. At first glance, this swift reversal appeared to signal a return to accommodative monetary policies, but a closer examination reveals that **its nature and scale differ meaningfully from past experiences**.

Although the move came earlier and with greater force than markets had anticipated, it should not be interpreted as the **start of a new round of quantitative easing (QE)**. During the 2008 global financial crisis and again amid the COVID-19 shock in March 2020, the Federal Reserve injected massive liquidity into the financial system through **large-scale purchases of long-term government bonds**. Those programs were designed to **push down bond yields, ease financial stress, and directly support economic activity**.

What is unfolding today is fundamentally different. This time, **liquidity injections are primarily being conducted via short-term securities**, and, crucially, there is no expectation that **the size of the Fed’s balance sheet will increase relative to GDP**—a key distinction from traditional QE episodes.

In reality, recent decisions more closely resemble the events that followed the **repo market turmoil of September 2019**. At that time, the Federal Reserve misjudged the impact of new liquidity regulations on banks’ demand for central bank reserves and allowed **balance sheet reduction (QT)** to continue for too long. As a result, **excess reserves fell to levels insufficient to meet liquidity needs during critical moments**, triggering a sharp spike in short-term interest rates and ultimately forcing an **emergency intervention by the central bank**.

While markets typically enter a quieter phase ahead of year-end holidays, certain **geopolitical risks** have the potential to disrupt this seasonal calm. One of the most prominent risks is the **escalation of tensions between the United States and Venezuela**. In recent days, Donald Trump has repeatedly warned about **expanding military actions against drug trafficking networks**, even floating the possibility of shifting operations from maritime routes onto Venezuelan territory—a scenario that could rapidly intensify tensions.

Along these lines, the United States has effectively imposed a **de facto blockade on sanctioned oil tankers** over the past week, restricting their movement to and from Venezuela. Should Trump decide to further escalate pressure on the government of **Nicolás Maduro**, the likelihood of a meaningful market reaction would rise considerably. Such a scenario could initially **support oil prices** and, to a lesser extent, **drive safe-haven flows toward gold**.

Qt

QE is Back, Why?When he said, 'cease the balance sheet runoff,' it means the Fed plans to keep its balance sheet stable — basically, to stop their balance sheet from shrinking any further under quantitative tightening. But that doesn’t mean they’re starting quantitative easing again.

10 Year Yield Futures

Ticker: 10Y

Minimum fluctuation:

0.001 Index points (1/10th basis point per annum) = $1.00

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

FOMC conference transcript on 29 Oct 25 pertaining to Fed's balance sheet:

"We also decided to conclude the reduction of our aggregate securities holdings as of December 1.

At today’s meeting, the Committee also decided to conclude the reduction of our aggregate securities holdings as of December 1. Our long-stated plan has been to stop balance sheet runoff when reserves are somewhat above the level we judge consistent with ample reserve conditions. Signs have clearly emerged that we have reached that standard. In money markets, repo rates have moved up relative to our administered rates, and we have seen more notable pressures on selected dates along with more use of our standing repo facility. In addition, the effective federal funds rate has begun to move up relative to the rate of interest on reserve balances. These developments are what we expected to see as the size of our balance sheet declined and warrant today’s decision to cease runoff.

Over the 3-1/2 years that we have been shrinking our balance sheet, our securities holdings have declined by $2.2 trillion. As a share of nominal GDP, our balance sheet has fallen from 35 percent to about 21 percent. In December, we will enter the next phase of our normalization plans by holding the size of our balance sheet steady for a time while reserve balances continue to move gradually lower as other non-reserve liabilities such as currency keep growing. We will continue to allow agency securities to run off our balance sheet and will reinvest the proceeds from those securities in Treasury bills, furthering progress toward a portfolio consisting primarily of Treasury securities. This reinvestment strategy will also help move the weighted average maturity of our portfolio closer to that of the outstanding stock of Treasury securities, thus furthering the normalization of the composition of our balance sheet.

CLAIRE JONES. Can I just ask you a quick follow-up on QT? How much of the fund impressions we've seen in money markets are related to the U.S. Treasury issuing more shortterm debt?

CHAIR POWELL. That could be one of the factors, but the reality is that we've seen --the things that we've seen, higher repo rates in the federal funds rate moving up, these are the very things that we -- that we look for. We actually have a framework for looking at the place we're trying to reach. What we said for a long time now is that when we feel like we're a little bit, or a bit above what we consider a level that's ample, that we would freeze the size of the balance sheet. Of course reserves will continue to decline from that point forward, as non-reserve liabilities grow. So this happened, some of it -- some things have been happening for some time now, showing a gradual tightening in money market conditions, really in the last, call it three weeks or so, you've seen more significant tightening, and I think a clear assessment that we're at that place. The other thing is, we're -- the balance sheet is shrinking at a very, very slow pace now. We've reduced it by half twice, and so there's not a lot of benefit to be, to be holding on for it to get the last few dollars, because again, when the balance sheet -- reserves are going to continue to shrink as non-reserves grow. So there was support on the Committee, as we thought about it, to go ahead with this and announce effective December 1 that we will be freezing the size of the balance sheet. And the December 1 date gives the markets a little bit of time to adapt.

STEVE LIESMAN. Just a follow-up on the balance sheet, if you stop it, the runoff now, does that mean you have to go back to actually adding assets sometime next year so that the balance sheet doesn't shrink as a percent of GDP and become a tightening factor?

CHAIR POWELL. So, you're right, the place we'll be on December 1 is that the size of the balance sheet is frozen, and as mortgage-backed securities mature, we'll reinvest those in treasury bills, which will foster both a more treasury balance sheet, and also a shorter duration.

So that's -- in the meantime, if you freeze the size of the balance sheet, the non-reserve liabilities, currency for example, they're going to continue to grow organically and because the size of the balance sheet is frozen, you have further shrinkage in reserves. And reserves is the thing that we're -- that we're managing that has to be ample. So, that'll happen for a time, but not a tremendously long time. We don't know exactly how long, but at a certain point, you'll want to start -- you'll want to start reserves to start gradually growing to keep up with the size of the banking system and the size of the economy. So we'll be adding reserves at a certain point, and that's the last point. Even then we'll be -- we didn't make decisions about this today, but we did talk today about the composition of the balance sheet. And there's a desire that the balance sheet be -- right now it's got a lot more duration than the outstanding universe of treasury securities and we want to move to a place where we're closer to that duration. That'll take some time. We haven't made a decision about the ultimate endpoint, but we all agree that we want to move more in the direction of a balance sheet that more closely reflects the outstanding treasuries. And that means a shorter duration balance sheet. Now, this is something that's going to be -- take a long time and move very, very gradually and I don't think you'll notice it in market conditions. But that's the direction of things.

Bitcoin-Gold Ratio Versus Monetary Policy

Chart shows:

—Bitcoin/Gold

—20-Week SMA

—SMA Slope Z-Scores*

—Fed Funds

—QE & QT

Bitcoin/Gold broke support of its 20W SMA for the 6th time in Bitcoin's history while the SMA slope normalizer* value reached zero (the long SMA rolled over), the Fed enters a rate-cutting cycle, and QT is ending.

These could represent increased bearish probabilities for the Btc/Gold ratio on medium and long timeframes.

*Slope Normalizer: The differentiated (positive and negative values are separated before subsequent calculations are made with the data) normalized z-scores (z-scores below 1 are muted while z-scores above 1 are not muted, in order to emphasize unusual values.)

When used with the SMA as an input, this essentially shows the normalized values of the rates of change of the SMA (on this chart, it is showing the normalized slope of the long-term simple moving average.)

The Fed Cuts Balance Sheet Runoff by 80% - BULLISH!RISK-ON 🚨

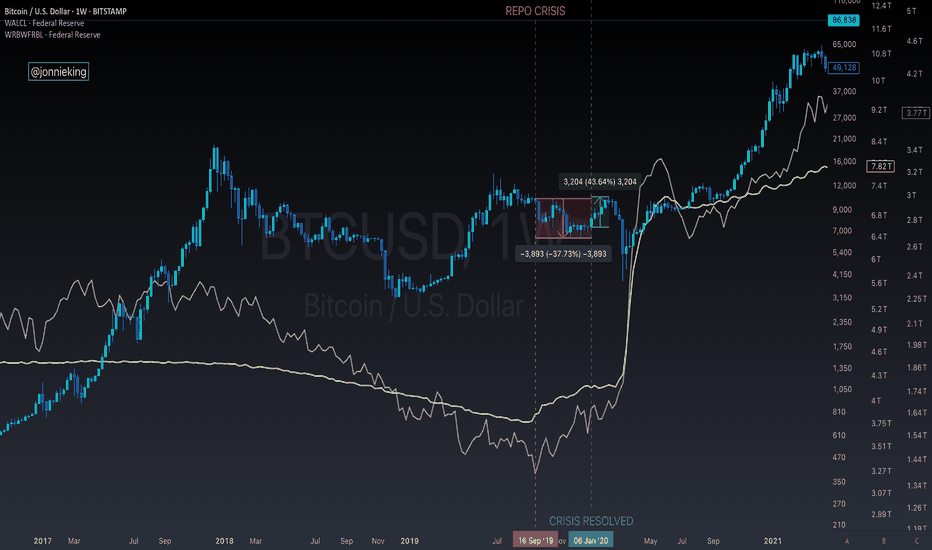

I’m seeing so many people incorrectly analyzing the September 2019 emergency repo OMOs, which were short-term liquidity injections from the Fed, and then comparing it to the price of BTC going down, before QE officially started in March 2020 because of the pandemic.

Here’s what really happened.

September 15, 2019 was a tax deadline, pulling ~$100B out of markets as large corporations paid the IRS and funds flew into the TGA.

Meanwhile, the Treasury issued new T-Bills to rebuild cash reserves following the post-debt ceiling resolution in August, draining another $50-100B as big banks and institutions absorbed the securities.

During this time, the Fed continued reducing its balance sheet (QT) down to $3.76T, but the balance sheet did not leave enough slack for unexpected cash drains to the system, such as corporate taxes and Treasury issuance.

Unfortunately, the Fed was flying blind and did not have a hard number estimate for “ample reserves” in the banking system.

These reserves were largely hoarded by a few of the larger banking institutions due to Liquidity Coverage Ratio (LCR) rules and a higher IOER at 2.1% vs the ON RRP rate of 1.7% - a 40 bp spread.

This caused a liquidity crisis in the US repo market because bank reserves held at the Fed ($1.36T) were too low and repo lending dried up. Banks weren’t able to access each other’s reserves to fund daily operations.

SOUND FAMILIAR !?

The US just resolved its CR to avoid a government shutdown, and they will be refilling the TGA by issuing new T-Bills. The reverse repo facility is also nearly drained.

Today, we heard the Fed will be reducing its securities runoff from $25B - SEED_TVCODER77_ETHBTCDATA:5B on April 1st, an 80% adjustment.

One of the main drivers is they wanted to get ahead of another 2019-style repo crisis (although they won’t say this), rather than being reactive and having to perform emergency OMOs once again.

Now to go back to my original point with people saying the Fed reducing its balance sheet runoff is a big nothingburger based on BTC price action in 2019.

BTC dumped because of the repo crisis, NOT because markets needed QE.

By early 2020, the liquidity crisis was resolved, and BTC pumped ~45% before the pandemic hit in March and nuked the chart.

Proof is in the pudding - just look at the 2017 bull market.

QT started in October 2017, and the market ripped until early 2018.

The Fed reducing its balance sheet runoff by 80% is definitely a signal of risk-on for educated market participants, as it leaves more reserves in the financial system, which gives banks more liquidity to loan the market.

i.e. M2 go up.

But keep listening to your favorite large accounts who are all of a sudden macro gurus, what do I know 🤓

When Alt-Season? Here's the Key FactorAlt-Season = BTC.D going down, but liquidity is king.

Right now, I don’t believe we’ll see a true alt-season until the Fed starts QE.

At the last FOMC meeting, Powell confirmed that QT will continue, meaning there is no reason to expect QE soon.

For QE to return, something needs to break—whether in the stock market or the broader economy.

Right now:

- Stock indices are at all-time highs

- The economy remains resilient

But cracks could form later this year

Possible triggers for QE:

- A stock market correction

- A credit event (bank failures, debt crisis)

- A sudden economic downturn

Why QE Matters for Crypto

- QE (Quantitative Easing) = Fed buys assets → Lowers interest rates → Pumps risk assets.

- QT (Quantitative Tightening) = Fed sells assets → Raises interest rates → Drains liquidity.

Crypto thrives in QE environments—that’s why we had the last alt-season in 2021, during extreme money printing.

In the chart, BTC.D is overlaid with Total Fed Assets.

- When the Fed’s balance sheet expands (QE) → BTC.D drops → Alts pump.

- When the Fed’s balance sheet contracts (QT) → BTC.D rises → BTC dominance increases.

Bottom Line:

For altcoins to outperform, we likely need another QE cycle. Without it, liquidity remains tight, and BTC.D stays high.

What’s your take? Will QE return in 2024, or will the Fed hold the line?

Something bad will happen. Quarterly TheoryWhat I have done here is split up the first quarter of the year into 4 quarters. Think of a bullish daily candle, it opens, makes a low, expands to make a high, and then reverses after making a high. This happens in 4 different steps. Everything I look at in these times consists of breaking things up in 4 quarters.

Inside this 3rd quarter of the fist quarter of the year, I split it into 4 more cycles. The blue zone is the best time to trade, that's when price should expand to make a high/low. I am identifying the previous green cycle traded to make a high so now I will be framing shorts from here until most of march.

Quantitative Tightening Effects on the Markets This video tutorial discussion:

• What is QE and QT?

• Each impact to the stock market

• The latest QT, how will the stock market into 2024?

Dow Jones Futures & Its Minimum Fluctuation

E-mini Dow Jones Futures

1.0 index point = $5.00

Code: YM

Micro E-mini Dow Jones Futures

1.0 index point = $0.50

Code: MYM

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

🔥 Is The Bitcoin Halving Causing Bull Markets? New Theory!The classical Bitcoin theory about halvings is that they "cause" bull-markets because the supply mined gets halved, leading to a negative supply shock and therefore increasing the value per Bitcoin.

This is not a surprising theory since it makes a lot of sense and has worked in the past. But, is the halving really that important for the Bitcoin price?

I've plotted the balance sheets of the largest central banks in white. If this line goes up, it indicates an expansion of the balance sheet (Quantitative Easing / QE), which can roughly be interpreted as printing money. It appears that Bitcoin bull- and bear-markets are highly correlated with central banks expanding their balance sheets. White line goes up, BTC goes up, white line goes down (or sideways) BTC goes down.

I've marked two previous occurrences where the central banks started QE in purple. Bitcoin arguably started the bull-market from those points, and not once the halving (yellow) took place.

From this chart we can conclude that the Central Banks are a decisive factor in the start and end of Bitcoin bull markets. Sure, the halving is a highly anticipated event among retail investors and manages to revive the interest into crypto, but I'd argue that QE (= a better investing climate) is the main reason why Bitcoin goes up and down in cycles.

In other words, we can have a BTC bull-market during a period of QE without the halving taking place. We can't have a bull-market after the halving without QE.

If you enjoyed this analysis, please give it a like. Share your thoughts below 🙏

SPY ResistanceThe S&P500 has had a major bounce and rally off the lows.

The bull market trend is on the near precipous of being recaptured, however it still has work to do.

Much of the chop recently has left many market participants confused.

If you're confused about the market it means that the market makers are doing their job well.

Most ecnomic data is turning negative, with aspects of inflation starting to reappear.

BOE, CPI and the FedWe're probably going to bounce from here (maybe muck around for the rest of the week and bounce next week higher); I think the BOE's QE decision is going to have people hoping that perhaps the Fed will do the same. The fact that a central bank can flinch and go the other way is a huge psychological change. This is somewhat of an exogenous event to the positive, to an already oversold market. Rally is going to continue (this is also area of the 200 weekly MA support).

Then ahead is the CPI, and i think this may come in lighter than expected and the markets may rally even higher; hoping that the Fed will back off the 75bp hike and ease up going in to the end of the year. Of course it can be a terrible double digit number, in which case the markets will tank; basically translates to 'what the Fed is doing is not working, and they're driving the economy to the ground anyway'.

But despite the data, and any easing of raising, since the Fed has pretty much said that they want to reach a certain target (despite what they say about being data dependent and whatnot), they're gonna plow ahead with the 75bp raise, then 50, as expected. I think this will be a big downer for the markets, and they will, despite fairly solid communication by the Fed, lose faith in the FED and find them to be stubborn and unwavering, leading the economy in to a recession in 2023.

Having said that, there's always exogenous events that can change the course of this, mostly to the downside, whether that be Ukraine, Taiwan, or a worsending housing/real estate market condition in China, etc.

Bitcoin Long VS Dollar pullbackEasy idea... Long against the DXY pullback... should we not get it then i'm out before stops but thinking 28-30k and or 200 day MA easy targets if it can get above trend lines.

DXY could easily make another pop to around 114.40 IMO but that would be the top for me... that is my line in the sand to remain in long positions: $BTC $MARA $ARBK $BTCM $ZIM

Hot Take: QT crashes market to pre covid pricesHot take: we see a crash all the way back to mid-covid lows / pre-covid prices. Get ready for 300$ TSLA, 8000$ BTC, 400$ ETH.

(That’s about the price level where this bearish divergence started from the QE fed infinite money printing machine….. wildly dubious speculation to be sure definitely not advice DYOR)

What do you guys think?

The 10 Year QE Bubble - "To Infinity, and Beyond!"A simple look at more recent boom and bust periods of the S&P500

Thinking Out Loud

Is the QE Bubble bursting before our eyes?

Will we see an all time high before a huge collapse and more Stimulus/QE?

Opinion

Outlook seems bearish for the long-term.

These market levels are not sustainable, and inorganic, we are in the last phase of the QE bubble before it goes pop.

COVID19 Wave 2 seems guaranteed at this point... Economic recovery is not going to be a V...

Positioning

I'm continuing to add on more shorts at these levels and above, long-term, mostly through inverse ETFs.

I will continue trading the market pops and drops, while adding on to my long-term shorts.

*Fundamentals seem forgotten, but at the end of the day, they ALWAYS rule the markets... this Market is in Mania.

Long term charts of USD pairs support DXY bulls?I've recently been looking over long term charts of USD pairs. Technically they show setups for a possible strong move up in DXY. I'm going to post a series of these charts because I believe they may be supportive of a much stronger USD....

This is contrary to my opinion that the USD should weaken given a number of reasons...

Freeze in interest rate hikes / possible cuts

Halting QT program

Record high US deficits

I'm going to let the charts speak for themselves as technical setups often defy rational reasoning. Also, technical patterns that date back 50 years are being traded by people with much more money than you or I..... And the lines seem clean. Everything in this modern economy is manipulated.... SPY, Gold, Silver, Currencies....

USD bulls might not be ready to give up without a fight...

SPX Short QT 2019 BreakDown Are you Ready?One year into the runoff and already the rumors is the FEDS may pause more? So,like january, is that a buy the rumor sell the news?

Stopping already,must be a huge problem like a global slowdown on the horizon,what a minute, duh..

Is to much being red into the Quantitative Tightening?

If they do not end QT then the volatility will be like no other ever witnessed, by a long shot.

But if the do end it how will the remaining trillion from the last crisis ever get off the books? You tell me.. Funny Money..Do you have any more of those dollar bills..Ha. WTH

Nomura is the primary dealer for all the bonds purchased for the U.S. Of course the Japanese company was only approved after they purchased Lehman's Asian & European Assets. Hmm Even though they applied in 1985. It's all in who you know.. Mama Said

So what is you thought great people of the world?

Do you continue or do they stop?

Trade safe

SP:SPX