ETH/USDT 4H chart🧭 Trend Context

• Main Trend: Up – clear HH/HL breakout.

• Price respects the uptrend line (orange).

• The last upward impulse was very strong (dynamic breakout to ~3400).

⸻

📊 Key Horizontal Lines

🔴Supports

• 3188–3200 – local support + prior S/R flip

• 3130 – strong structural support

• 3052 – last line of trend defense (critical)

🟢 Resistances

• 3232 – current resistance (price reaction now)

• 3317 – important resistance/consolidation

• 3404 – high impulse (local ATH)

⸻

📐 Price Structure

• The drop from ~3360 to ~3188 looks like an impulse correction, not a trend reversal.

• Currently, the price:

• has rebounded from support

• is above the trend line

• is fighting against 3232

👉Into the decision zone.

⸻

📉 Stochastic RSI

• Was oversold (0–20)

• Now retracing upward

• Potential for an uptrend, but no confirmed breakout

⸻

🔮 Scenarios

✅ Baseline scenario (bullish – more likely)

Conditions:

• Hold >3188

• Breakout and 4-hour close above 3232

Targets:

• 3317

• 3400–3420

⸻

⚠️ Corrective scenario

If:

• Rejection from 3232

• Reversion to the downtrend

Targets:

• 3188

• 3130

• Extreme: 3050 (still uptrend)

Resistence

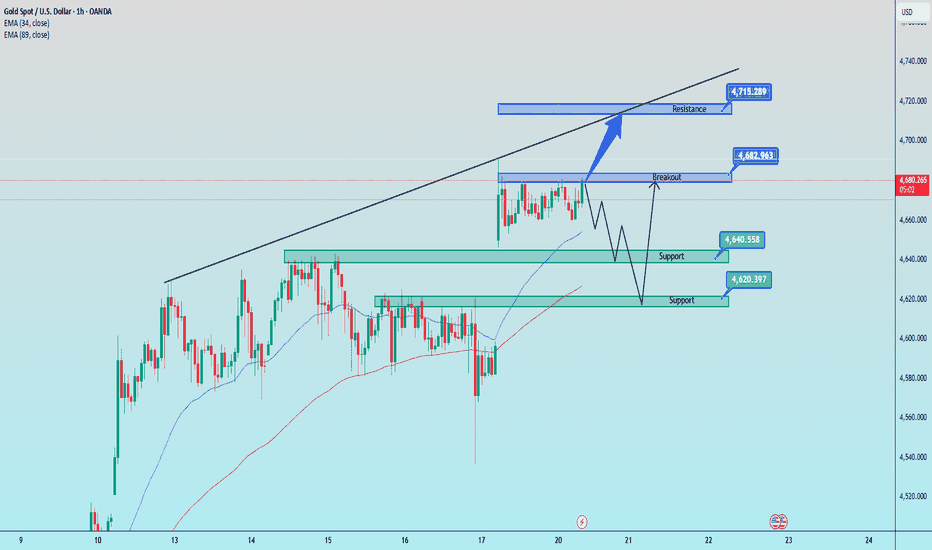

Gold continues to be a safe haven 20/01/261️⃣ Trendline

Main trend: BULLISH

Price is moving above the long-term ascending trendline → Higher High – Higher Low structure remains intact.

The current pullback is only a technical correction within an uptrend, with no signs of structure breakdown yet.

2️⃣ Resistance

4,680 – 4,682: Short-term resistance, previous consolidation zone → requires a clear break and close to confirm bullish continuation.

4,715 – 4,717: Strong resistance, confluence of previous high + upper trendline → high probability of profit-taking reaction.

3️⃣ Support

4,640 – 4,642: Near-term support, technical pullback zone.

4,620 – 4,622: Strong support, demand zone + EMA confluence + GAP → ideal trend-following buy zone if price shows holding signals.

4️⃣ Preferred Scenarios

Priority: Buy with the trend at support zones.

Break and hold above 4,690 → confirms bullish continuation, target 4,715.

Loss of 4,620 → short-term trend weakens, wait for a retest of the lower ascending trendline.

Trading Plans

BUY GOLD (Scalp): 4,640 – 4,642

Stop Loss: 4,635

Take Profit: 50 – 100 – 150 pips

BUY GOLD: 4,620 – 4,622

Stop Loss: 4,610

Take Profit: 100 – 300 – 500 pips

SELL GOLD: 4,715 – 4,717

Stop Loss: 4,727

Take Profit: 100 – 300 – 500 pips

ADA/USDT 12h🔍 Market structure

Medium-term trend: corrective / sideways after an upward impulse

Price is moving in a narrowing channel (descending wedge/triangle)

Lower highs + held support → pressure before breakout

📐 Key levels

🟢 Resistances

0.407–0.410 – local resistance + upper structure line

0.426 – very important level (previous high + price reactions)

0.451–0.452 – strong HTF resistance (if an impulse occurs)

🔴 Support

0.384–0.385 – key support (if it falls → weak)

0.371

0.352

📊 Price Action

The last upward impulse was rejected exactly at the resistance of 0.426

Currently, the price is consolidating just above 0.384

Every move lower is bought, but there is no strong volume for growth

👉 The market is in compression - the breakout is getting closer.

📉 Stochastic RSI

Oscillator close to the oversold zone

No clear bullish crossover yet

This favors a rebound, but is not a confirmation of the long

🧠 Scenarios

✅ Bullish scenario (more technically correct)

Conditions:

Defense 0.384

Breakout above 0.407–0.410 (preferably close 12h candle)

Goals:

0.426

0.451

➡️ This would be a breakout from the wedge + continuation of the impulse

❌ Bear scenario

Conditions:

Candle close below 0.384

Goals:

0.371

0.352

➡️ This means negating the structure and returning to the range

Beautifully made HH and then HL.QUICE Analysis

Closed at 38.93 (16-01-2026)

Beautifully made HH and then HL.

Crossing & Sustaining 46 may lead it towards 59 - 60.

Immediate Support seems to be around 35.

However, it should not break 31 now else we

may witness more selling pressure towards 28 initially.

Gold price movements at the end of the week, January 16, 2026.1️⃣ Trendline

Main trend: BULLISH.

Price remains above the long-term ascending trendline → the Higher High – Higher Low structure is still intact.

Current phase: sideways consolidation below resistance within an ascending channel → the market is building pressure.

2️⃣ Resistance

4,640 – 4,642: Major resistance.

Confluence: previous high + upper trendline.

Scenarios:

Rejection → high probability of a corrective pullback.

4,668 – 4,670:

New ATH zone + break of previous high + trendline extension.

3️⃣ Support

4,578 – 4,580:

Near-term support, equilibrium zone within the range.

4,515 – 4,517:

Strong support / breakout retest + previous GAP.

Loss of this zone → short-term bullish structure weakens, downside risk increases.

4️⃣ Preferred Trading Scenarios

Sell on reaction at 4,640 – 4,645 if clear rejection signals appear.

Buy with the trend at 4,515 – 4,520 once strong holding signals are confirmed.

Primary Trade Setups

SELL GOLD: 4,668 – 4,670

Stop Loss: 4,678

Take Profit: 100 – 300 – 500 pips

BUY GOLD (Scalp): 4,578 – 4,580

Stop Loss: 4,574

Take Profit: 50 – 100 – 200 pips

BUY GOLD: 4,515 – 4,517

Stop Loss: 4,505

Take Profit: 100 – 300 – 500 pips

LTC is in a clear downward trend📉 MARKET STRUCTURE

Main Trend: Down

Sequence: Lower High → Lower Low

Price is moving in a clear downward channel.

Any upward breakout = correction, not a trend change.

📐 KEY LEVELS

🟩 RESISTANCES (sell zones)

84.50 – current S/R flip (was support → now resistance)

94.50 – strong HTF level, where the market has been rejected multiple times

107.50 – key trend reversal level (BOS)

🟥 SUPPORT

72.00–72.50 – key support, currently being tested

63.10 – next strong HTF support

Below → empty space to ~55–58

🔎 PRICE ACTION – WHAT YOU CAN SEE

Recent Bounce:

Weak HH

No volume

Strong rejection from:

Upper channel line

Level ~84.5

Current candle:

Aggressive supply

No demand response

👉 Sellers in full control

📊 STOCH RSI

Turnover from the upper zones

Bearish momentum

No bullish divergence

👉 Oscillator confirms continuation of the downtrend

🧠 SCENARIOS

🔴 BASELINE SCENARIO (60–65%)

Descent lower

Condition:

Close D1 below 72

Target:

63.1

Possible breakout to 60–61

🟡 CORRECTIVE SCENARIO (25–30%)

Bounce Technical

Condition:

Holding 72

Demand candle + follow-up

Target:

84.5

Maximum 94.5

DOES NOT change the trend

🟢 TREND REVERSE SCENARIO (<10%)

Condition:

Close D1 > 94.5

Then reclaim 107.5

👉 Only then can we talk about a bull market

🎯 HOW TO PLAY IT (technically)

Short:

Retest 84–85 or 94–95

SL: above the structure

TP: 72 → 63

Long:

Only a reaction to 63

Short-term scalp / swing

No forcing the low

XAUUSD (Gold) – 1H Chart | Price Action Analysis**XAUUSD (Gold) – 1H Chart | Price Action Analysis**

**Current price:** ~4,610

### 📊 Market Structure

* Gold is moving **sideways within a defined range** after a strong prior bullish move.

* Price recently bounced from the lower range and is now **testing the upper boundary (resistance)**.

### 📉 Moving Averages

* **EMA 9 & EMA 21:** Closely aligned and flat → short-term consolidation.

* **EMA 50 (≈4,607):** Holding as **key dynamic support**.

* Price above EMA 50 keeps the **overall bias neutral to bullish**.

### 🟥 Support Zones

* **Immediate support: 4,590 – 4,585**

* Strong demand zone where buyers stepped in previously.

* **Lower support:** 4,560 – 4,540

* Breakdown below this area may weaken bullish structure.

### 🟩 Resistance Zones

* **Immediate resistance: 4,620 – 4,625**

* Price is currently reacting here.

* **Upper resistance / breakout zone:** 4,650 – 4,670

* A sustained break could open further upside.

### 🔁 Scenarios

* **Bullish scenario:**

A **clean hourly close above 4,625** may trigger upside continuation toward **4,650+**.

* **Bearish scenario:**

Rejection from resistance and a **break below 4,585** could lead to a deeper pullback.

### 🧠 Summary (Mind-Safe)

* Gold is **range-bound between support and resistance**

* **Breakout above resistance = bullish continuation**

* **Rejection + support break = corrective move**

* Wait for **clear confirmation on H1**

*Educational purpose only – not financial advice.*

Following yesterday's PPI report, what will the gold price be li1️⃣ Trendline

Main trend: BULLISH

Price is moving inside an Ascending Channel → the Higher High – Higher Low structure is still intact.

Currently, price is trading in the upper half of the channel, meaning buyers remain in control, but the market has started to consolidate / correct after a strong bullish impulse.

2️⃣ Resistance

📍 4,683 – 4,685

Major supply zone + top of the ascending channel

📍 4,640 – 4,642

Price has been rejected multiple times here → Smart Money distribution + trendline resistance

➡ Only look for short (SELL) trades if rejection signals appear

(e.g., pin bar, bearish engulfing, strong rejection wick)

3️⃣ Support

📍 4,548 – 4,550

Strong confluence zone:

Bottom of the ascending channel

Previous breakout zone

EMA + major trendline

This is a BUY zone in line with the trend

➡ If price pulls back to this area and holds, the probability is high for a continuation toward 4,685

📈 Trading Plan

BUY GOLD

Entry: 4550 – 4548

Stop Loss: 4538

Take Profit: 100 – 300 – 500 pips

SELL GOLD

Entry: 4683 – 4685

Stop Loss: 4693

Take Profit: 100 – 300 – 500 pips

Gold surged and continued to rise on January 12, 2026.1️⃣ Trendline

Short-term structure: Bullish after the breakout.

Price has broken above the descending trendline → sellers have lost control.

The current move is a bullish impulse, and the market is waiting for a pullback to form a higher low.

2️⃣ Key Support Zones

4,550 – 4,548

Nearest support (breakout retest zone)

If this zone holds → the bullish trend remains intact.

4,515 – 4,513

Strong support zone

Confluence of:

Old resistance → new support

Rising trendline

EMA & price structure

👉 This is the best buy zone

If this area is broken → the short-term bullish structure is invalidated.

3️⃣ Resistance

4,640 – 4,642

Major resistance

Fibonacci 2.618 extension

Supply zone

👉 This is the main target of the current bullish wave

4️⃣ Price Scenarios

Bullish scenario (priority)

Price pulls back to 4,550 → 4,515

Holds support

Forms a higher low

→ Then continues higher toward 4,640

Bearish scenario (structure failure)

Price closes clearly below 4,515

→ Short-term uptrend is broken

→ Price may drop toward 4,480 – 4,440

📈 Trading Plan

BUY GOLD: 4,513 – 4,515

Stop Loss: 4,503

Take Profit: 100 – 300 – 500 pips

SELL GOLD: 4,640 – 4,642

Stop Loss: 4,650

Take Profit: 100 – 300 – 500 pips

BTC/USD 4H Chart Review🔎 Market Structure

Medium-term trend: up

The price is moving within an ascending channel (the lower and upper limits are nicely respected).

Last move = upward impulse from a consolidation breakout.

📈 Current Situation

The price has broken out above key resistance at ~94,600 USD (red line)

We are currently in the 97,500–98,200 USD zone (local resistance).

This is the first test of this zone from below → a natural place for reaction.

🟩 Key Levels

Resistance

98,200–98,300 USD – local resistance (green line)

103,800 USD – main channel target / ATH region

Supports

94,600 USD – most important support (flip from resistance)

89,400 USD – middle of the structure + previous accumulation

Lower channel boundary ~87–88k USD – last defense

📊 MACD

Strong bullish crossover

The histogram is rising → upward momentum is accelerating

No downward divergence (on (for now)

➡️ This supports continued growth, not a reversal.

🧠 Scenarios

🟢 Baseline scenario (most likely)

Short consolidation/pullback

Retest of USD 94,600–95,000

Continuation up → 98k → 100k → 103–104k

🟡 Alternative scenario

Rejection of USD 98k

Drop to USD 89,400

Still uptrend as long as the channel holds

🔴 Bullish negation

4-hour close below 89,400

Then the structure breaks down → drop to 86–84k

USDJPY M15 RSI Divergence and Short-Term Pullback Setup📝 Description

FX:USDJPY has extended into a local premium zone after a strong impulsive rally. Price is holding near recent highs, but momentum is slowing as RSI shows clear bearish divergence, suggesting exhaustion rather than continuation.

________________________________________

📈 Signal / Analysis

Primary Bias: Bearish while price holds below the recent high and RSI divergence remains valid

Preferred Setup:

• Entry: 158.90

• Stop Loss: Above 159.11

• TP1: 158.67

• TP2: 158.50

• TP3: 158.30 (H1 FVG / liquidity draw)

________________________________________

🎯 ICT & SMC Notes

• RSI bearish divergence indicates weakening bullish momentum

• Price trading in premium after impulsive expansion

• Pullback expected toward nearby FVGs

________________________________________

🧩 Summary

Despite the strong upside move, momentum divergence suggests limited continuation. As long as price fails to push higher with strength, a corrective pullback toward lower PD arrays is favored.

________________________________________

🌍 Fundamental Notes / Sentiment

With key US CPI data today, volatility risk is elevated. Any positioning should be approached with strict risk management, as CPI outcomes can trigger sharp, two-sided moves before direction is confirmed.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

How did gold prices fluctuate on January 13, 2026?1️⃣ Trendline

Short-term trend: CLEARLY BULLISH

Price is respecting the rising trendline and staying above the EMA, which means buyers are in control.

Market structure: Higher High – Higher Low ⇒ no reversal signal yet.

2️⃣ Support

4548 – 4550 Nearest support, not tested yet → good zone for scalp buys

4520 – 4515 Strongest support (Demand zone + Fibonacci 1.618 + Rising trendline)

➡ If price pulls back to 4,520 and holds, it’s a high-probability trend-buy setup.

3️⃣ Resistance

4630 – 4632 Short-term resistance → scalp sell / profit taking

4643 – 4645 Major resistance (Fibonacci 2.618 + previous supply zone)

➡ 4,645 is a high-probability reversal / heavy profit-taking zone.

4️⃣ Price Scenarios

Main scenario (preferred):

Price pulls back to 4,520 → bounces → moves to test 4,645.

Bearish scenario:

If H1 closes below 4,520, the trendline breaks → price may drop to 4,495 – 4,480.

🎯 Trade Plan

BUY GOLD

Entry: 4520 – 4522

Stop Loss: 4510

Take Profit: +100-300-500 pips

SELL GOLD

Entry: 4643 – 4645

Stop Loss: 4653

Take Profit: +100-300-500 pips

BTC/USDT Chart Review📉 Key Levels (from the chart)

🟥 Support Levels

1. 90,402 – current, very important

• Local pivot

• Price is reacting, defending

2. 89,112 – strong structural support

• Convergence: horizontal + trend line

• Loss = change in short-term bias

🟩 Resistance Levels

1. 92,659 – closest resistance

• Rejection zone after a correction

2. 94,525 – high impulse

• Breakout = trend continuation / ATH attack

⸻

📊 RSI Stochastic

• RSI Stochastic has exited the oversold zone (0–20) very dynamically

• Currently close to / in the overbought zone (80–100)

👉 Conclusion:

• Short-term: risk of a pullback

• Trend: this is a sign of strength, not weakness, as long as the price holds Support

⸻

🧠 Scenarios

🟢 Scenario 1 – BULLISH (baseline)

• Price maintains 90,400

• Consolidation → breakout 92,659

• Targets:

• 94,500

• Next: 96,000+

📌 This is a healthy correction in an uptrend.

⸻

🟡 Scenario 2 – Technical Pullback

• Rejection from 92k

• Downtrend to:

• 90,400

• Max 89,100

• Until there is an 8-hour candle close below 89,100 → trend remains OK.

⸻

🔴 Scenario 3 – Bearish (less likely)

• Strong 8-hour close below 89,100

• Trendline breakout

• Then:

• 87 500 – 86,800 as the next demand zone

SOL/USDT 4H chart📌Market Structure

• Medium-term trend: up

• Clear Higher Low (around 117 → 126 → 133)

• Price respects the ascending trend wave (black)

• Currently consolidating after an upward impulse

⸻

🔴Key Horizontal Lines

Resistances

• 140.4 USDT – local resistance, multiple rejections

• 147.2 USDT – main resistance/supply zone

Supports

• 133.2 USDT – most important short-term support (POC of the structure)

• 126.9 USDT – strong HTF support + trendline

• ~117–120 USDT – extreme (end-of-line scenario)

⸻

📊Oscillator (Stoch RSI)

• Currently in an oversold zone

• No advanced bullish trend yet Crossover

• To the owner:

• Pullback/recovery, not an immediate drop

• Potential available below 140+ if support holds

⸻

🧠 Scenario

🟢 Baseline scenario (more likely)

• Weapons price 133 USDT

• Consolidation 133–140

• Breakout 140.4 → 147.2

• Target: 147–150 USDT

🟡 Corrective scenario

• Breakout of 133 USDT

• Downside to 126.9 USDT (ideal retest of the trendline)

• Market decision there:

• Defense → continuation up

• No defense → deeper correction

🔴 External scenario (less likely)

• Loss of 126.9

• Structure change → entry to area 120 / 117

BNB H1 HTF FVG Rejection and Pullback Continuation Setup📝 Description

On the H1 timeframe, CRYPTOCAP:BNB has pushed into a higher-timeframe H4/H1 Order Block and overlapping H1–30m FVGs, where price is now showing hesitation. The recent upside move appears corrective within a broader range, with price trading in premium and reacting to unmitigated sell-side areas.

________________________________________

📈 Signal / Analysis

Primary Bias: Bearish below HTF Order Block

Preferred Setup:

• Entry: 907.5 (H1 FVG)

• Stop Loss: Above 912

• TP1: 901.9

• TP2: 890.8

• TP3: 880.2

________________________________________

🎯 ICT & SMC Notes

• Price reacting inside HTF Order Block (H4/H1)

• Clear H1–30m FVG rejection zone overhead

• Below-price liquidity and unfilled FVGs remain intact

________________________________________

🧩 Summary

CRYPTOCAP:BNB is currently trading in premium HTF territory, where sellers are expected to defend. Failure to reclaim and hold above the H1 FVG increases the probability of a pullback toward the 890 and 880 liquidity zones. This setup favors patience on shorts rather than chasing upside.

________________________________________

🌍 Fundamental Notes / Sentiment

Overall crypto sentiment remains mixed, with majors showing corrective behavior rather than strong impulsive continuation. In the absence of a clear risk-on catalyst, rallies into HTF supply are more likely to attract distribution.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

Gold price movements before the release of the NONFARM data.1️⃣ Trend / Trendline

Short-term trend: Sideways–bearish within a contracting triangle pattern.

Price is being compressed between the descending trendline above (selling pressure) and the ascending trendline below (weakening support).

Current structure: A technical rebound, but price has not broken the descending trendline yet ⇒ no confirmed bullish reversal.

2️⃣ Resistance

4,520 – 4,525: Strong resistance

Confluence of: previous highs + Fibonacci 1.618 + descending trendline.

Prefer sell-on-rejection if bearish price action appears.

3️⃣ Support

4,395 – 4,400: Key support zone

Confluence of: range low + demand zone.

A clear break below this area ⇒ breakdown risk, price may slide further.

4️⃣ Scenarios

Priority: Trade the breakout.

Bullish scenario: Break and close above the descending trendline & above 4,525 ⇒ opens the path for further upside.

Bearish scenario: Break and close below 4,395 ⇒ confirms bearish continuation, favor sell-with-trend setups.

👉 The market is at a decision zone – avoid FOMO and wait for clear confirmation at the boundaries.

Trade Plans

BUY GOLD: 4,398 – 4,400

Stop Loss: 4,388

Take Profit: 100 – 300 – 500 pips

SELL GOLD: 4,523 – 4,525

Stop Loss: 4,533

Take Profit: 100 – 300 – 500 pips

BTC/USDT 4H Chart📈 Trend

Main trend: up

Local trend: downward correction

The uptrend line (black) has still not been broken → this is crucial.

🟩 Support Zones

The most important levels you have well-marked:

91,120 – 91,400

Current price reaction

Local support + mid-range

Decisive in the short term

90,120

Very important zone

Overlaps with:

previous consolidation

potential retest of the trendline

Loss = deepening correction

88,843

Strong structural support

If price reaches here → high probability of bounce

87,235

Bulls' last line of defense

Break = structure changes to bearish

🔴 Resistance

91,400 – 91,500

Nearest resistance

Here we'll see if the uptrend has fuel

92,718

Very important level

Return above = bulls regain control

94 834

High / supply zone

Unlikely to be broken on the first try without an impulse.

📊 Stochastic RSI

Was heavily oversold.

Now bouncing from the lows → a short-term bounce signal.

Note: in an uptrend, the Stochastic RSI often gives false short signals.

➡️ Supports a corrective bounce scenario, not a dump.

🧠 Scenarios

🟢 Baseline scenario (more likely)

Defense 90-91k

Bounce → test 91.5k → 92.7k

Consolidation and decision

🔴 Negative scenario

Break 90 120

Down to 88.8k

Reaction there (or fake breakdown)

Gold prices adjust pending NF news.1️⃣ Trendline

Main short-term trend: Bearish.

Price remains below the upper descending trendline → selling pressure still dominates.

Current structure: A technical pullback within a downtrend; no solid reversal signal yet.

The lower short-term ascending trendline is under threat → increased downside risk if key support is broken.

2️⃣ Resistance

4,520 – 4,522:

Very strong resistance, confluence of:

Fibonacci extension

Descending trendline

Previous supply zone

👉 Priority: Look for sell setups when price approaches this zone.

👉 Buy only if price breaks above and closes with confirmation.

3️⃣ Support

4,400 – 4,402:

Key support area, confluence of:

Trendline support

Demand zone

EMA / price structure

👉 A break below this zone would confirm a break of the short-term bullish structure, opening the door for a deeper decline.

📈 Trading Plan

BUY GOLD: 4,400 – 4,402

Stop Loss: 4,390

Take Profit: 100 – 300 – 500 pips (4450)

SELL GOLD: 4,520 – 4,522

Stop Loss: 4,530

Take Profit: 100 – 300 – 500 pips (4,470 )

Buyers are continuing to capitalize on their favorable positions1️⃣ Trendline

Short-term trend: corrective rise within a larger downtrend.

Price is being capped by the descending trendline → a key decision zone for the next move.

Current structure: short-term higher lows, but price has not broken the descending trendline yet ⇒ no confirmation of a medium-term trend reversal.

2️⃣ Resistance

4,520 – 4,522: strong resistance

Confluence: descending trendline + previous supply zone + Fibonacci extension

Expectation: strong selling pressure / high probability of rejection

3️⃣ Support

4,435 – 4,440: near-term support

Role: maintaining the short-term bullish corrective structure

4,400 – 4,405: major support

Confluence: demand zone + structural low + EMA

→ Key zone determining whether the corrective bullish move can hold

4️⃣ Primary Scenarios

Sell bias: prioritize sells at 4,520 – 4,522 upon clear price rejection signals.

Buy reactions: only consider buys if price holds above 4,400 – 4,435 and confirms a short-term reversal.

👉 The market is currently in a “decision zone” — wait for confirmation, avoid FOMO.

Trade Plans

BUY GOLD: 4,437 – 4,435

Stop Loss: 4,425

Take Profit: 100 – 300 – 500 pips

SELL GOLD: 4,520 – 4,522

Stop Loss: 4,532

Take Profit: 100 – 300 – 500 pips

LTC/USDT 1D Chart 🔎 Market Structure

The market is in a downtrend (a series of lower highs and lower lows).

The price is moving within a descending channel (black lines).

The recent move is a rebound from the lower demand zones, but the trend has not yet been broken.

📉 Trend & Price Action

The main downtrend line has not been broken – the price has reached it and is reacting.

The current move looks like a pullback/upward correction, not a trend reversal.

No clear higher high → the structure remains bearish.

🟢 Key Levels

Resistance (sell zones)

86.84 USDT – local resistance (currently being tested)

95.83 USDT – strong structural resistance

103.54 USDT – previous downside base

110.66 USDT – very strong resistance (key to trend reversal)

Support (buy zones)

78.67 USDT – local support

72.25 USDT – strong demand zone

63.14 USDT – critical support (channel bottom)

📊 Indicators

Stochastic RSI

Currently in the overbought zone (>80)

Historically, on this chart, → often ends in a correction

Signal: watch out for shorts / profit-taking

CHOP Index

High → market was in consolidation

Recent CHOP breakout down → possible impulse but not yet confirmed by volume

🧠 Scenarios

🔴 Baseline scenario (more likely)

Rejection at 86–88 USDT

Return to around 78.67 → 72.25

Continuation of the downtrend

🟢 Alternative scenario (bullish, conditional)

Daily close above 95.83

Then a breakout of 103.54

Only 110.66 = a real trend change to up

🎯 Final conclusion

This is a correction in a downtrend, not a trend reversal.

Shorts are logical under resistance

Longs are only short-term/scalp

Swing longs only after a breakout of 103–110

Gold is currently experiencing strong growth.1️⃣ Trendline

Short-term trend: bullish pullback within a larger bearish trend.

Price has broken the descending trendline → confirming a short-term structural shift.

However, price is still below a major supply zone → no medium–long-term reversal yet.

2️⃣ Support

4,400 – 4,402

Key support zone

Confluence of: demand zone + Fibonacci 0.5–0.618 + EMA

→ Area for technical buy reactions / holding buy positions.

Below 4,400: short-term bullish structure is invalidated.

3️⃣ Resistance

4,515 – 4,517

Strong resistance zone

Confluence of: Fibonacci 1.618 + previous supply zone

→ Prioritize sell reactions, avoid FOMO buying.

4️⃣ Fibonacci

Current rebound has reached:

1.0 → trendline break

Next target: 1.618 (4,515)

Only a clean breakout above 1.618 would open the door for a higher bullish scenario.

📌 Trade Setup

BUY GOLD: 4402 – 4400

Stop Loss: 4390

Take Profit: 100 – 300 – 500 pips

SELL GOLD: 4515 – 4517

Stop Loss: 4527

Take Profit: 100 – 300 – 500 pips

LINK/USDT 1W Chart Long-Term📌 PRICE STRUCTURE

Long-term trend: still up, confirmed by the ascending trendline (orange).

The price respects the trendline – each dip below was bought.

We are now in the midst of a strong upward impulse correction (peak ~$26–27).

🟢 KEY LEVELS

Support

$13.7–14.7 → current demand zone/consolidation

$11.63 → strong HTF support (low of previous reactions)

$7.84 → worst-case scenario (only in the event of a market breakdown)

Resistance

$18.85 → key HTF resistance (mid-range)

$22–24 → supply zone after the last impulse

$26–30 → ATH range/supply zone

📈 PRICE ACTION

Price is consolidating above the trendline → this is bullish behavior

No downward impulse – more likely accumulation

Candles with long downward wicks = supply absorption

➡️ This doesn't look like distribution, but rather a base for a move.

📊 INDICATORS

Stochastic RSI

Was in the oversold zone

Starting to curve upwards → potential buy signal (HTF)

CHOP

Falls to around 40

This indicates the end of consolidation and preparation for a trend

Perfect for an upside breakout in the coming weeks

🔮 SCENARIOS

🟢 BASELINE SCENARIO (most likely)

Sustaining $13.7–14.7

Breakout $18.85

Targets:

$22–24

Next $26–28

📌 Typical range → weekly breakout.

🔴 NEGATIVE SCENARIO

Weekly close below $11.63

Trendline negated

Decline to:

$9–$8

Strong long-term accumulation zone there

What's new in gold prices this week? 01/05/20261️⃣ Trendline

Short-term: Bearish. Price remains below the descending trendline → selling pressure is still dominant.

Structure: Weak technical pullback, forming a lower high → no clear reversal signal yet.

2️⃣ Resistance

4,445 – 4,447: Strong resistance, confluence of Fibonacci 0.618 + trendline touch → ideal sell zone if confirmation appears.

3️⃣ Support

4,396 – 4,394: Near-term support + previous breakout zone + lower trendline touch.

4,333 – 4,331: Major support + GAP area + lower trendline touch.

4️⃣ Scenarios

Priority: Look for SELL setups at resistance, trading with the trend.

BUY: Only reactive buys at strong support levels, no FOMO.

Trade Plan

BUY GOLD: 4333 – 4331

Stop Loss: 4321

Take Profit: 100 – 300 – 500 pips

SELL GOLD: 4445 – 4447

Stop Loss: 4457

Take Profit: 100 – 300 – 500 pips