What is the outlook for gold after the December 26th holiday?1️⃣ Trend / Trendline

Price is moving within a short–to–medium term ascending channel.

Upper trendline (dynamic resistance): price has been tested multiple times → clear profit-taking pressure.

Lower trendline (dynamic support): continues to support price during pullbacks.

2️⃣ Resistance

4,560 – 4,555: strong resistance, confluence of previous highs + upper trendline → area prone to volatility and short-term reversal.

3️⃣ Key Decision Zone (Pivot / Breakout)

4,488 – 4,490: former breakout zone.

Holding above this area → uptrend remains intact.

Losing this area → risk of deeper correction increases.

4️⃣ Support

4,430 – 4,432: key support, aligned with channel bottom + strong demand zone.

Positive reaction → technical rebound opportunity.

Breakdown below → ascending channel failure, trend weakens.

📌 Trading Plan

BUY GOLD: 4,430 – 4,432

Stop Loss: 4,420

Take Profit: 100 – 300 – 500 pips

SELL GOLD: 4,558 – 4,560

Stop Loss: 4,570

Take Profit: 100 – 300 – 500 pips

Resistence

BNB/USDT 1W chart1️⃣ Main trend

• Long-term trend: upwards

The black trend line is respected - the market moves in a higher highs / higher lows structure.

• The recent upward move was expansive and parabolic → it was not a healthy growth, just FOMO.

➡️ Correction was inevitable.

⸻

2️⃣ Current price situation

• Current price ~ USDT 840

• The market rejected the 1020-1160 zone very aggressively

(long wick = smart money distribution)

This does NOT look like:

• continuation of impulse ❌

• only for local peak and market cooling ✅

⸻

3️⃣ Key levels (most important)

🟢 Resistances

• 911–920 → first hard resistance

• 1020–1030 → distribution zone

• 1160 → ATH / extreme (unrealistic without long consolidation)

🔴 Support

• 780–800 → KEY

This is:

• previous resistance

• psychological level

• place of price reaction

• 600–620 → strong HTF support

• ~520–550 → the last line of defense of the trend

⸻

4️⃣ RSI Stochastic (bottom)

• RSI in the oversold zone

• BUT:

• on W1 RSI may stay in oversold for a long time

• this is NOT yet a buy signal in itself

We are waiting for:

• RSI turn up

• preferably bullish cross + price reaction

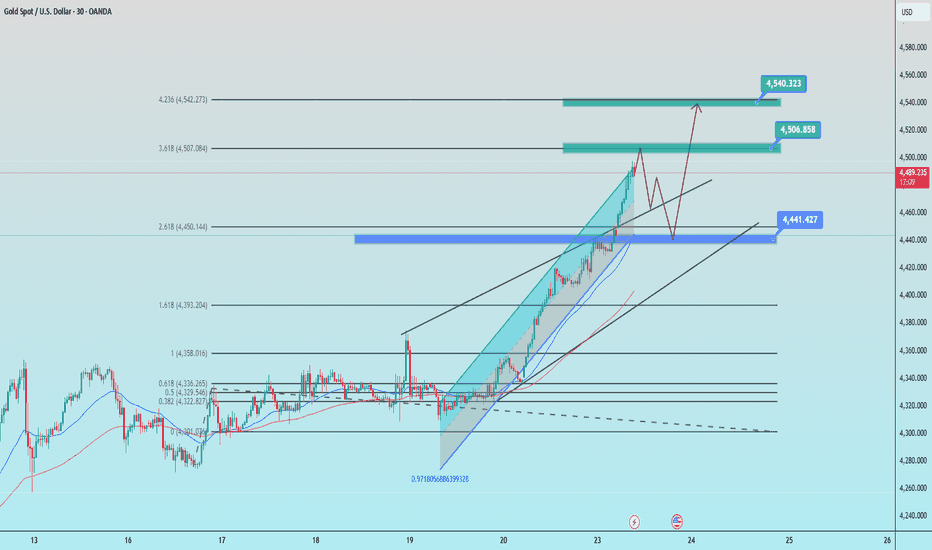

How will gold prices fluctuate after the GDP report?1️⃣ Trendline

The short–to–medium term ascending channel remains intact; price is moving within the channel → the primary trend is bullish.

Upper trendline (dynamic resistance): price is approaching this area → high probability of consolidation / profit-taking.

Lower trendline (dynamic support): acts as the main demand zone for pullbacks.

2️⃣ Support

4,470 – 4,468: Near-term support, overlapping with the consolidation zone & short-term MA.

4,447 – 4,445: Stronger support, structural low within the ascending channel.

4,360: Deep support; a break below this level would signal risk of channel breakdown.

3️⃣ Resistance

4,500: Psychological resistance & short-term high.

4,548 – 4,550: Major resistance, confluence of upper trendline + supply zone → primary profit-taking target.

4️⃣ Scenarios

Holding above 4,470 → favor buy-on-dips following the trend, targets 4,500 → 4,550.

Rejection at 4,500–4,550 → potential pullback toward 4,450 before the next directional decision.

Clear break and hold above 4,560 → bullish continuation / trend expansion.

📈 Trade Setup

BUY GOLD: 4,447 – 4,445

Stop Loss: 4,437

Take Profit: 100 – 300 – 500 pips

SELL GOLD: 4,548 – 4,550

Stop Loss: 4,560

Take Profit: 100 – 300 – 500 pips

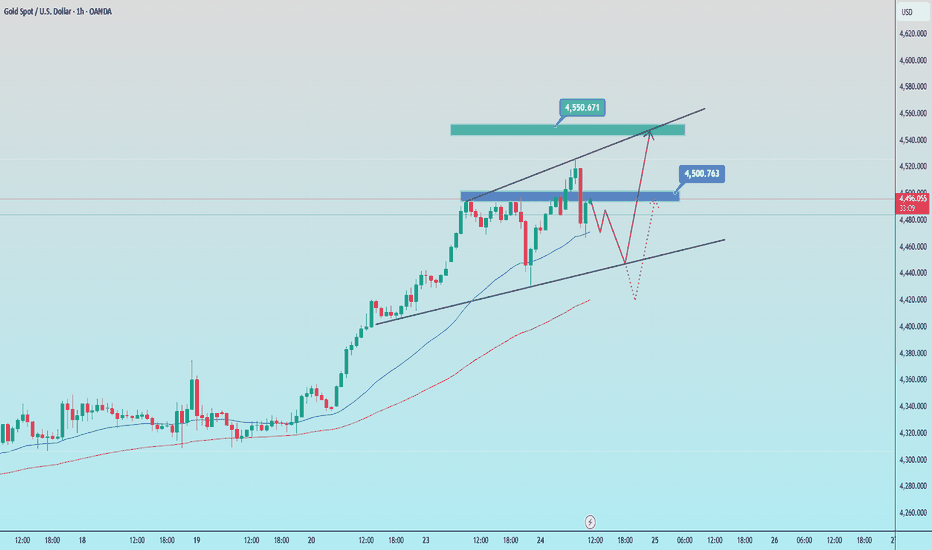

Gold prices continue to reach record highs, and the upward trend1️⃣ Trendline

The medium-term ascending channel remains intact; price is trading near the upper boundary → the primary trend remains bullish.

The short-term rising trendline (below) acts as dynamic support; pullbacks continue to be well absorbed.

Price is approaching the upper trendline → an area prone to short-term volatility and profit-taking.

2️⃣ Support

4,441 – 4,443: key support zone (demand area + trendline confluence).

Holding above this zone → prioritize buy setups in line with the trend.

A break below → increased risk of a deeper correction toward 4,395 – 4,400 (Fibonacci 1.618).

3️⃣ Resistance

4,506 – 4,508: near-term resistance (Fibonacci 3.618) → a technical pullback may occur.

4,538 – 4,540: major resistance ahead (Fibonacci 4.236) → primary target on a confirmed breakout.

4️⃣ Preferred Scenarios

Primary trend: BULLISH.

Look for buy opportunities on pullbacks to the 4,44x zone, with confirmation from trendline + EMA support.

Break and hold above 4,510 → bullish momentum extends toward 4,54x.

Failure near 4,50x → technical correction, while the bullish structure remains intact.

📈 Trade Setup

BUY GOLD: 4,441 – 4,443

Stop Loss: 4,431

Take Profit: 100 – 300 – 500 pips

SELL GOLD: 4,538 – 4,540

Stop Loss: 4,550

Take Profit: 100 – 300 – 500 pips

$Btc Faces Rejection Near 91K — Key Price Action Levels to WaBitcoin is currently showing clear rejection near its previous resistance zone between $90,000 and $91,000, with repeated rejections forming around the $90,500–$90,600 area. This zone is acting as a strong supply region, and price action is struggling to sustain above it.

From a structure perspective, the market needs confirmation before considering long positions. Ideally, Bitcoin should either form a clear higher low after a controlled pullback or print a double bottom pattern while holding above the critical $80,500 support zone. If this support remains intact and buyers step in with strong volume, upside continuation can be expected.

However, if $80,500 fails, the structure weakens significantly. In that scenario, downside pressure may accelerate, opening the door for a deeper move toward the $75,000 region, which aligns with previous demand zones.

At the moment, the market structure does not favor aggressive long entries. Long positions should only be considered after confirmed price action signals such as support validation or bullish structure shift. On the other hand, short positions remain valid near resistance, especially when taken close to rejection zones with proper risk management.

Key Levels to Watch:

Resistance: $90,500 – $91,000

Immediate Support: $80,500

Breakdown Target: $75,000

Patience is key here. Let the market show its intent before committing to directional bias.

ETH/USDT 4H Chart Review🔎 Market Structure

Medium-term trend: downward

The price is moving within a descending channel (orange lines).

Each upward breakout has been corrected lower so far.

Current: consolidation after a strong rebound from the low.

📉 Key Levels

🔴 Support

2925 USDT – very important local support (currently being tested).

2756 USDT – strong support from the previous reaction.

2600 USDT – last line of defense (structural low).

🟢 Resistance

3057 USDT – key resistance + near the moving average (SMA).

3225 USDT – strong supply reaction level.

3346 USDT – upper range of the structure, very strong resistance.

📐 Moving Average (green)

Price below the SMA → market still under supply control.

Until the 4-hour period closes clearly above ~3057, any upward move is a correction, not a trend change.

📊 Stochastic RSI

There was an overheating (80+), now a downward turn.

This is a cooling signal, possible:

a sideways correction,

or another decline to support.

🧠 Scenarios

🐻 Baseline scenario (more likely)

Rejection from the downward channel.

Retest of 2925 → if it breaks:

2756

and in an extreme case, 2600.

🐂 Alternative scenario (bullish)

Breakout of 3057 + close of the 4-hour candle above.

Targets:

3225

3346

Condition: Breakout from a descending channel (not just a wick).

Trading plan for the last week of 20251️⃣ Trendline

Main ascending trendline (price channel):

The medium-term trend remains bullish. Price is moving within the channel and is currently in the upper half, → favor buying with the trend.

Upper trendline:

Dynamic resistance, aligning with Fibonacci extensions → high probability of volatility and profit-taking around this area.

2️⃣ Resistance

4,380 – 4,400:

Strong resistance zone, confluence of the upper trendline + Fibonacci 2.618 → a clear breakout and hold is required to open further upside momentum.

4,510:

Next upside target if price breaks and holds above 4,380 (higher Fibonacci extension zone).

3️⃣ Support

4,260 – 4,270:

Short-term support, demand zone + moving averages → losing this zone may trigger a deeper correction.

4,140 – 4,150:

Major support below, near the lower trendline of the ascending channel → strategic buy zone in line with the overall trend.

4️⃣ Fibonacci

Fibonacci retracement highlights:

0.382 – 0.5: Intermediate support during pullbacks.

2.618 – 3.618: Key resistance/target zones above, where price is likely to react strongly.

📈 TRADE SETUPS

BUY GOLD: 4,260 – 4,258

Stop Loss: 4,248

Take Profit: 100 – 300 – 500 pips

SELL GOLD: 4,400 – 4,402

Stop Loss: 4,412

Take Profit: 100 – 300 – 500 pips

BTC/USDT 1H Chart Review📌 MARKET CONTEXT

Higher timeframe trend (H4/D1): correction in an uptrend

Current (1H): consolidation below resistance after a strong rebound

Price is squeezed between:

descending trendline (blue)

local support ~87.5–88k

This is a classic decision zone.

🟦 PRICE STRUCTURE

What we see:

Strong rebound from ~85.4k

Higher lows (orange line) → local uptrend

Price fails to break:

~88.7–89.0k (green zone)

➡️ Rising low + ceiling = triangle / compression

🟥 KEY LEVELS

🔴 Support:

88,130 – local micro-support (now being tested)

87,477 – very important (H1 structure)

86,880 – critical (loss = bias change)

85,447 – impulse low (bulls' last line of defense)

🟢 Resistance:

88,770 – first hard resistance

89,934 – key (range high)

90 770 – only after the structure is broken

📉 TRENDLINES

Blue (downtrend): still respected ❗

Orange (uptrend): acts as dynamic support

➡️ Breaking these two lines = strong move (up or down)

📊 STOCH RSI

Was overbought

Now reversing down

No bullish divergence

➡️ Short-term: cooling / possible pullback

🧠 SCENARIOS (specific)

🟢 SCENARIO 1 – BULLISH (less likely, but strong)

Conditions:

H1 candle close above 88,800

Breakout and hold above the blue trendline

Targets:

89,900

90,770

Retest 88.7k = perfect long

🔴 SCENARIO 2 – BEARISHES (more likely now)

Conditions:

Rejection of 88.7k

H1 close below 87,470

Targets:

86,880

85,450

This would be a healthy pullback to the structure, not the end of the bull market.

What will the price of gold look like after the CPI report?1️⃣ Trend Structure

Price is moving within a short-term ascending channel → the bullish trend remains dominant.

Higher lows are forming → buying pressure is still present; however, the price range is tightening, increasing the probability of either a breakout or a breakdown.

2️⃣ Resistance

4,350: Near-term resistance, aligned with the upper boundary of the price channel → a clear breakout is required to extend the bullish momentum.

4,400: Major resistance / upside target → a potential profit-taking zone if the breakout succeeds.

3️⃣ Support

Lower trendline of the ascending channel: A key dynamic support that determines whether the trend holds or breaks.

4,256: Strong horizontal support / demand zone → a breakdown below this level would invalidate the bullish structure and increase the risk of a deeper correction.

4️⃣ Scenarios

Break above 4,350 → confirms trend continuation, targeting 4,400.

Rejection at resistance combined with a break of the trendline → favors a corrective move toward 4,256.

BUY GOLD : 4258 - 4256

Stoploss : 4248

Take Profit : 100-300-500pips

SELL GOLD : 4400 - 4402

Stoploss : 4412

Take Profit : 100-300-500pips

BTC/USDT 4H chart📉 Trend and Structure

H4 Trend: Downtrend / Downtrend Consolidation

Sequence of lower highs + lower lows from around 95k

Currently, the price is below key resistance levels; the market has not regained its upward structure.

🟩 Key Chart Levels

Resistance

94,596 – Very strong resistance (upper range zone)

91,600 – Local resistance / consolidation center

90,748 – Flip level (former support → resistance)

Support

88,385 – Short-term support (already tested)

85,226 – Current price reaction zone

83,596 – Key structural support

80,646 – Last line of defense (if 83.6k falls)

📊 RSI (14)

RSI ~40–45 → Lack of strength Buyers

No bullish divergence

RSI has not returned above 50 → trend remains bearish

📉 Stochastic RSI

Recently in the overbought zone → downward trend

This confirms a correction/further weakness

No confirmation of an upward impulse

🧠 What does price action say?

Last candle: strong upward rejection

No follow-through after bounces

Any upward breakout is sold

📌 Scenarios

🔴 Baseline scenario (more likely)

Consolidation / further decline to:

83,600

and with market weakness even 80,600

Shorts have an advantage below 88,400

🟢 Alternative scenario (bullish)

Conditions:

H4 close above 88,400

Then breakout and hold at 90,700

Only then:

Targets: 91,600 → 94,600

Without this = only corrections in a downtrend

Looking forward to the important news releases on December 181️⃣ Trend & Trendline

Main trend: Medium-term uptrend remains intact.

Rising trendline (solid): Price is holding above it → a key dynamic support.

Rising trendline (dashed): Secondary support below, used to confirm a breakdown if the main trendline is lost.

Price structure: Higher Lows are still being maintained → no trend reversal signal yet.

2️⃣ Key Support Levels

4,305: Dynamic support + EMA → losing this level would weaken bullish momentum.

4,260: Strong confluence zone (Fibo + demand zone) → critical support.

3️⃣ Key Resistance Levels

4,350: Short-term resistance – price is reacting strongly here.

4,373 (Fibo 3.618): Intermediate technical barrier.

4,400: Major resistance / extension target – strong profit-taking zone.

🎯 Scenarios

Holding above the trendline + 4,300:

→ Favor BUY following the trend, targets at 4,350 → 4,400.

Trendline break & loss of 4,260:

→ Trend weakens → look for SELL on pullbacks, targets 4,220 – 4,200.

📌 Trade Setup

BUY GOLD: 4260 – 4258

Stop Loss: 4248

Take Profit: 100 – 300 – 500 pips

SELL GOLD: 4400 – 4402

Stop Loss: 4412

Take Profit: 100 – 300 – 500 pips

Gold price movements following the NF report on December 17th.1️⃣ Trend Structure & Trendline

🔹 Main Trend

The market is currently in a medium-term uptrend:

Higher Lows are being formed

Highs are approaching or exceeding previous highs (potential Higher High)

The ascending trendline (below) is still intact → acting as the backbone of the current trend

👉 Only a decisive break below this rising trendline would invalidate the medium-term uptrend.

🔹 Short-term Descending Trendline (Upper)

The descending trendline above is pressuring price in the short term

It acts as a dynamic resistance, where selling pressure appears on rallies

Price is currently compressing between the descending trendline (above) and support (below) → a consolidation phase before a strong move

📌 A clear breakout above the descending trendline = confirmation of trend continuation to the upside.

2️⃣ Key Resistance

🔴 Major Resistance Zone: 4,380

This zone represents:

A previous high

A clear supply zone

If price breaks into this area:

Strong profit-taking and volatility are likely

Confirmation is required (strong close, good volume) for continuation

👉 A sustainable bullish move is only confirmed when price breaks and holds above 4,379.

3️⃣ Key Support

🟢 Near-term Support: 4,277

This zone includes:

Confluence with moving averages

A price level with multiple reactions

Role: Healthy pullback support

👉 Holding above this level keeps the short-term uptrend intact.

🟢 Deeper Support: 4,258

A structural support level

If price breaks below 4,277:

A retest of 4,258 is highly likely

This is a trend-decision zone

📌 A breakdown below 4,258 significantly increases the probability of price returning to the major ascending trendline below.

4️⃣ Trading Plan

🟢 BUY GOLD: 4258 – 4256

Stop Loss: 4246

Take Profit: 100 – 300 – 500 pips

🔴 SELL GOLD: 4379 – 4381

Stop Loss: 4391

Take Profit: 100 – 300 – 500 pips

ATOM/USDT short-term🔍 Market Structure

Clear downtrend – price is moving within a descending channel (lower highs and lows).

Each bounce is sold at the upper band of the channel.

No signal of a change in structure yet (no HH + HL).

📉 Current Price Status

Price is at the lower end of the channel.

Consolidation after a downward impulse → typical bearish continuation or short technical rebound.

Current Zone:

~2.02–2.05 USDT – local support + demand reactions.

🟢 Key Levels

Support

2.049 – local support (current reaction)

1.999 – strong psychological support

1.951

1.878 – lower demand zone (important!)

Resistance

2.099

2.125

2.201 – key resistance / S→R flip.

Upper channel line (~2.20–2.23)

📊 Stochastic RSI

Oscillator often in oversold territory.

Currently recovering from the low → possible short rebound.

BUT: in a downtrend. The Stoch RSI is not a long-term signal.

➡️ More likely a pullback, not a trend change.

🧠 Scenarios

🔴 Baseline scenario (most likely)

Bounce to:

2.09 → 2.12

Rejection + further decline:

1.99

then 1.95 / 1.88

➡️ Short at resistance levels in line with the trend.

🟢 Alternative scenario (less likely)

Breakout of 2.20 + close of the 1H candle above the channel

Retest from above

Then targets:

2.28

2.35–2.40

➡️ Only then can we talk about a change in structure.

How will gold prices fluctuate before major news is released? 1️⃣ Trend & Trendline

Price is moving within a medium-term ascending channel (two black trendlines).

After a strong breakout, price is pulling back toward the upper trendline of the channel → this is a key decision zone for the short-term trend.

The overall structure remains Higher High – Higher Low, indicating that the main trend is still intact.

2️⃣ Key Support

4,257: Confluence support zone (trendline + previous price structure).

→ Holding above this level: favor a recovery in line with the bullish trend.

→ Losing this level: price may slide toward the lower boundary of the ascending channel.

3️⃣ Resistance / Targets

4,352: Near-term resistance – previous high; a clear breakout is needed to confirm continuation.

4,379: Higher resistance at the previous ATH – next target if 4,352 is broken successfully.

4️⃣ Main Scenarios

Bullish scenario: Hold above 4,257 → rebound toward 4,352 → extend to 4,379.

Short-term bearish scenario: Break below 4,257 → deeper correction toward the lower trendline of the ascending channel before new buying interest appears.

Trading Plan

BUY GOLD: 4,257 – 4,255

Stop Loss: 4,245

Take Profit: 100 – 300 – 500 pips

SELL GOLD: 4,379 – 4,381

Stop Loss: 4,391

Take Profit: 100 – 300 – 500 pips

BTC/USD 4H Chart🔎 Market Structure (4H)

Medium-term trend: still up, but clearly weakening

Price has broken out of the local uptrend channel (black line broken)

Currently, we have a downward impulse + attempted demand reaction

This looks like a distribution → SL breakout → seeking demand lower

🧱 Key Levels (from your chart)

🟢 Resistance (now selling)

89,255 – first local resistance (now S/R flip)

91,857 – strong resistance, previous consolidation

93,713 – supply zone / last LH

94,700–95,000 – very strong resistance (high range)

👉 Until we return and close the 4H period above 91.8k, longs are counter-trend

🔴 Support (most important)

87,621 – currently being tested / very important

84,216 – key HTF support (must-hold for bulls)

81,308

77,820 – deep range low

📉 Momentum & price action

Last candle: strong decline + long lower wick

= demand reaction, but no confirmation

No 4H HH/HL structure yet

This looks like a dead cat bounce or a retest of the breakout

📊 Stoch RSI

Was heavily oversold

Now a sharp upward move

⚠️ But:

In downtrends, the Stoch RSI often gives false long signals

Price confirmation is needed, not just an oscillator

🧠 Scenarios (specific)

🟡 Scenario 1 – Base case (most likely)

Pullback → further decline

Bounce to 89.2k – 90k

Rejection

Down to 84.2k

Market decision there

👉 This is a textbook retest of a broken structure

🟢 Scenario 2 – Bullish (less likely, but possible)

Conditions:

4-Hour Close > 91,857

Then a retest of the high-low

Then targets:

93.7k

94.7–95k

Only above 95k does the full uptrend resume

🔴 Scenario 3 – Bearish (if demand breaks)

If:

4-Hour Close < 87.6k

Then:

A quick move to 84.2k

Breakout = 81.3k

Extreme: 77.8k

ETH/USDT 1D CHart Long-Term.

🔍 Market Structure (Price Action)

1️⃣ Trend

Long-term: The uptrend has been broken (a downward breakout from the black trend line).

Medium-term: A sequence of lower highs and lower lows → a downtrend.

The current rebound is a correction in the downtrend, not a confirmed reversal.

📐 Key Levels (very well marked)

🔴 Support

2768 USDT – key support (current local bottom).

2157 USDT – final support from the previous structure (if 2768 breaks → a very real pullback).

🟢 Resistance

3506 USDT – current nearest resistance (retest after a downward breakout).

4101 USDT – strong supply zone + former support.

4477 USDT – main structural resistance (region of previous highs).

👉 Price is now exactly in the decision zone between 2768 and 3506.

📉 Trendline

Breaked and rejected (retest ended with a decline).

This is a classic signal of a downtrend continuation.

Until the price returns above 3506 and sustains, there is no uptrend.

📊 Stochastic RSI

The oscillator frequently reaches the 80–100 zone.

Currently: Moving out of overbought → signal of weakening upward momentum.

No bullish divergence → no confirmation of a trend change.

🧠 Scenarios

🐻 Baseline scenario (more likely)

Rejection of 3506

Return to around 3000 → 2768

Breakthrough of 2768 = open path to ~2150

🐂 Alternative (conditional) scenario

Daily close above 3506

Retest of 3506 as support

Only then is a move towards 4100 possible

🎯 Final conclusions

This is not a market for longs without confirmation.

The current rebound looks like a pullback in a downtrend.

Safeest:

Short at resistance (3506 / 4101)

Long only after a breakout and holding of 3506

TECHNICAL ANALYSIS BNB/USDT1️⃣ Market Structure and Trend

The chart shows a long-term uptrend, confirmed by a very clean ascending trendline (orange), which has been acting as dynamic support for over a year.

After a strong breakout to ~1380, the price began a correction but still hasn't broken the higher low structure → the uptrend is intact.

2️⃣ Key Levels (exactly from your chart)

🟢 Resistance Levels (green):

~1018 USDT

~1150 USDT

~1249 USDT

These are potential targets for a renewed uptrend.

🔴 Support Levels (red):

~879 USDT – the closest important support

~838 USDT – a key defensive level

~683 USDT – deep support / last HTF trendline

The price is currently trading directly above the first support level.

3️⃣ Trendline (orange)

Your trendline is:

strong, multi-point

drawn on the D1 timeframe

currently around 850–880 USDT

➡️ If the price falls, the trendline perfectly aligns with the 838–879 zone, strengthening this zone as a "must defend."

4️⃣ Oscillators – Stoch RSI (bottom)

Currently:

The oscillator is in a high zone (above 80) → indicating local overbought

However, there is no clear downward crossover yet.

Meaning:

👉 Upward momentum is still active, but we are closer to a local high than a low.

5️⃣ Scenarios

🟢 Upside scenario (more likely as long as the trendline holds)

Condition: Maintaining the 879/838 levels and the trendline.

Targets:

1018 USDT – first resistance

1150 USDT – important medium-term resistance

1249 USDT – main HTF target

The longer the price consolidates above the orange trendline, the greater the chance of a renewed attack on 1150–1249.

🔴 Downside scenario (less likely, but crucial)

Condition: Downside breakout of 838 USDT and closing of the D1 candle below the trendline.

Then:

the market could enter a deeper correction phase

the target would be the 683 USDT level – this is also the main support level, where reactions were previously strong

This is a "capitulation" scenario, but it doesn't seem to be dominant given the current price action.

6️⃣ What can we see on the chart "here and now"?

✔️ The price has rebounded from the local low

✔️ It is still between support at 879 and resistance at 1018

✔️ The uptrend is intact

✔️ A potential HTF higher low has formed

✔️ The Stoch RSI shows momentum, but caution is warranted

➡️ The market is consolidating within the uptrend, with a high chance of a breakout upwards – provided support is maintained.

TECHNICAL ANALYSIS – BTCUSD (4H)1. Market Structure: Ascending Channel (Orange)

The chart clearly shows an ascending trend channel – the upper and lower orange lines.

Lower Channel Support: ~$87,000

Upper Channel Resistance: ~$96,000

Medium-term trend = uptrend as long as the price remains within this channel.

2. Key Levels You Have Marked

Resistance

$94,133 – local resistance from which the price recently rejected.

$95,866 – upper boundary of the resistance zone + near-upper channel line.

$99,067 – high target upon channel breakout.

Support

$92,190 – price is currently within this zone, struggling to maintain it.

$90,757 – important intraday support; a breakout opens the way lower.

USD 88,203 – strong support, converging with the lower part of the channel.

3. Price action

Currently, I see:

Rejection from the 94.1k level, which is resistance.

Attempt to return to the center of the structure, but the candlestick is rejected from above.

The market is making a short-term lower high → slight weakening of momentum.

4. Stoch RSI

Stoch RSI (4h):

The lines are in a downward trend from the upper levels, meaning a short-term correction is just beginning.

There is no signal for an upward reversal yet → momentum favors a move to lower support levels.

⭐ 5. Scenarios for the next hours/1–2 days

BULLISH (if BTC maintains 92k–90.7k)

Condition: No break below $90,757

Potential moves:

Consolidation at 92k–91k

Stoch RSI begins to curve upward

Attack:

$94,133

$95,866 (upper channel resistance)

Target:

→ $96,000

→ possible test of $99,000 with a strong breakout

BEARISH (if BTC breaks $90,757 down)

This is a key level. If it breaks:

A quick decline to $88,203

High probability of a retest of the lower channel line (~87k)

This still won't destroy the uptrend, but it will open the door to buying lower.

ETH ANALYSIS – 1h📊 ETH ANALYSIS – 1h

🔥 1. Key Fact on the Chart

We have a very strong upward impulse that:

Breaked the upper band of the descending channel (blue)

Touched the upper line of the ascending channel (orange)

Was immediately rejected (long wick)

The MACD shows extreme overbought + potential divergence in the making

Such a move usually indicates a short squeeze + profit-taking → i.e., a temporary weakening and a retest of the breakout.

🎯 2. Price areas I see on your chart

Green (resistance/TP for longs):

3479–3490 – structural highs, strong resistance

3420 – local resistance

3375 – first real resistance after the breakout

Red (support/defense levels of the structure):

3338–3348 – first test zone after the breakout

3293 – key level — sustain = trend continuation

3180–3200 – consolidation zone broken (likely retest)

📉 3. What does the current wick mean?

This giant wick signals:

short liquidations

lack of demand for a continuation after the first resistance breakout

high probability of a return to the range

possibility of a retest of the breakout (around 3185–3210)

This doesn't look like a classic breakout with a continuation, but rather a fakeout and the need for a correction.

📈 4. Scenarios

➡️ Bullish (more likely if 3293 holds)

Price falls to the 3338–3293 zone

Builds a local HH/HL

Starts a move to 3375, then 3420

If 3420 breaks → target 3480–3500

➡️ Bearish (if price loses 3293)

Retest from the bottom of 3293

Return to the blue channel

Target: 3185–3200

If this level breaks → 3050–3080 (lower band of the channel)

📟 5. MACD

MACD is:

extremely stretched

signal line begins to collapse

histogram decreases after Explosion

→ This almost always means a local intraday high + a drop to support.

Gold is still compressed and waiting for a breakout1️⃣ Trendline

Main ascending trendline (lower): Still holding firmly → the medium-term bullish structure remains intact. Every pullback continues to react positively at this trendline.

Short-term ascending trendline (upper – mild slope): Price is moving very close to this line → showing signs of consolidation / price compression before the next directional move.

2️⃣ Resistance

4,240 – 4,245 (blue zone): Strong resistance. Price has tested this area multiple times without a clear breakout → selling pressure is still present.

4,380: Distant resistance / extended target if price successfully breaks above the resistance zone.

3️⃣ Support

4,210 – 4,215 (Fibo 0.618): Key short-term support, aligned with the short-term uptrend → a decisive zone for near-term direction.

4,135 – 4,130 (Fibo 0.5 + main ascending trendline): Strong structural support. A breakdown below this area would significantly weaken the bullish trend.

4️⃣ Primary scenarios

Holding above 4,210 – 4,215: Continued consolidation → wait for a breakout above 4,270 to confirm bullish continuation.

Break below 4,165: Price may pull back toward 4,135 – 4,140 to test demand.

👉 Overall trend: Bullish, but currently at a sensitive zone. A resistance breakout is needed to confirm continuation.

📈 Trading Plan

BUY GOLD: 4,130 – 4,132

Stop Loss: 4,122

Take Profit: 100 – 300 – 500 pips

SELL GOLD: 4,213 – 4,215

Stop Loss: 4,223

Take Profit: 100 – 300 – 500 pips

ETHUSD 1D chart1️⃣ Trend and key levels

Trend

• The overall neutral-growth trend, but with clear consolidation.

• The price rebounded dynamically from the bottom (approx. USD 2,850), which creates the first higher low structure → the potential beginning of an upward impulse.

Support

• $2,973-$3,000 – SMA #1 + local support.

• USD 2,851 – strong support from which the candle made a very large wick upwards.

Resistances

• USD 3,169 – the first strong resistance, several candles bounced from this level.

• $3,236 – key daily resistance. Breakout = signal of strong momentum and opening the way to USD 3,300-3,430.

⸻

2️⃣ Candle formation and behavior

• A bullish candle with a long lower wick appeared → this is a signal of buyers.

• The price is making a series of higher lows, but no higher high yet → the market is waiting for a breakout of USD 3,236 to confirm the uptrend.

⸻

3️⃣ SMA (moving averages)

🔴 SMA #1 (short-term)

• Price is just above it → acts as support.

• If the daily candle closes below $3,000, the downside momentum returns.

🟢 SMA #2 (long term, ~$3,430)

• Is high above the price → long-term bearish pressure until the price returns to the price area.

⸻

4️⃣ RSI (momentum)

RSI around 45–50

• Neutral territory.

• Zero overbought/oversold.

• Slight upward trend in RSI → buyer momentum is growing, but without an overheating signal.

Conclusion: The market has room to move higher before the RSI becomes high.

⸻

5️⃣ MACD

• MACD is above the signal line → slight, early bullish signal.

• The histogram increases, but there is no significant acceleration.

Interpretation: increases are possible, but without strong momentum yet.

Gold is trending sideways ahead of major news.1️⃣ Trendline

Short-term rising trendline (black dotted):

Price is still moving above the trendline → the uptrend remains valid. Every pullback continues to find support.

Long-term rising trendline (below):

This is the major structural support, crucial for determining the medium-term trend if it gets broken.

2️⃣ Resistance

4,260 – 4,265:

A strong resistance zone where price has been rejected multiple times → strong selling pressure.

➜ Break and close above this zone: opens a new upside expansion.

➜ Failure to break out: likely leads to a corrective move.

3️⃣ Support

4,165 – 4,170:

Short-term support, a confluence of the rising trendline and a previous demand zone.

Below 4,165:

Price may slide quickly toward a lower rising trendline → higher risk of a deeper correction.

4️⃣ Main scenarios

Primary scenario: Sideways consolidation below resistance → pullback toward 4,165, then watch for price reaction.

Strong bullish scenario: Only valid if price decisively breaks above 4,265 with volume confirmation.

👉 Strategy: Avoid FOMO at resistance. Focus on price reaction at support or clear, confirmed breakouts.

Trading Plan

BUY GOLD: 4,169 – 4,067

Stop Loss: 4,159

Take Profit: 100 – 300 – 500 pips

SELL GOLD: 4,263 – 4,265

Stop Loss: 4,275

Take Profit: 100 – 300 – 500 pips

BTC/USDT 4H Chart 🔍 MARKET STRUCTURE

The chart shows a broad ascending channel in which BTC has been moving for several days:

Lower trend support: ~$87,500 – $88,000

Upper trend line: ~$94,500 – $95,000

The price has clearly rebounded from around $89,200, an important demand level.

📈 KEY LEVELS

Support

USD 89,284 – local support from which a rebound occurred

USD 87,804 – the next, much stronger support level consistent with the trendline

Resistance

USD 91,466 – currently being tested

USD 94,141 – key resistance and the upper band of the channel

📊 CHART SITUATION (4 hours)

1. Price action

The price has made a strong upward impulse from support at USD 89,280.

It is currently reaching local resistance at USD 91,450 – USD 91,700.

If this level is broken, the target is USD 94,000 – USD 94,500.

If it fails, a pullback to USD 90,200/USD 89,300 can be expected.

📉 MACD

Your MACD shows:

Bullish crossover – buy signal.

The histogram changes from red to green → momentum is increasing.

The curves are diverging, confirming the strength of the move.

This indicates that the short-term trend is turning bullish.

📌 TWO TRADING SCENARIOS

🟢 BULLISH Scenario (more likely)

Condition: H4 candle breakout and close above USD 91,700.

Targets:

TP1 → USD 92,800 – USD 93,200

TP2 → USD 94,000 – USD 94,500 (upper channel)

Stop-loss (if you were going long):

below USD 90,500

Safer below USD 89,280

MACD confirms this scenario.

🔴 BEARISH Scenario

Condition: rejection of USD 91,700 and a close below USD 90,500.

Targets:

TP1 → USD 89,300

TP2 → USD 87,800 (key trendline)

A drop to USD 87,800 would be an ideal place for large players to buy again.