Search in ideas for "divergence"

DivergenceDivergence is when the price of an asset is moving in the opposite direction of a technical indicator, such as an oscillator, or is moving contrary to other data. Divergence warns that the current price trend may be weakening, and in some cases may lead to the price changing direction.

Basically there are four majour divergence,such as Regular Bullish,Regular Bearish,Hidden Bullish and Hidden Bearish.

Divergence USDJPY divergence If anyone is good with elliot wave and rsi divergence please comment. I believe this is known as reverse bullish. would appreciate some input

Also found an elliot wave inside my other Elliot wave so since the first correction was pretty close to the mark i guess this one should be pretty close too.

I dont pretend to know how long the dollar will drop all i know is the drop is slower than the climb which tells me a lot. I also want to see if friday will continue a down trend. I think the trade will probably go thru the weekend

im just gonna set a price order to catch a piece of the spike

This is not investment advice

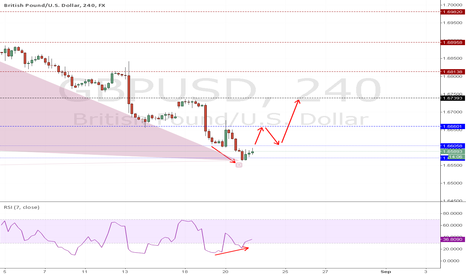

divergence on multiple timeframesDivergences on multiple timeframes often give a good signal for a bounce. A bit too late to get the best price possible.

I've been seeing a lot of bounces favouring the triple divergence. If it lowers to the .786 fib whilst making a triple divergence it can make for a very good trade.

Divergence 2hr on AvaxDivergence occurs when price makes higher highs, while indicators paint lower lows or vice versa. Simply put, divergence is when price direction contradicts indicator direction, creating a noticeable conflicting pattern.

A bullish divergence occurs when the RSI displays an oversold reading followed by a higher low that appears with lower lows in the price. This may indicate rising bullish momentum, and a break above oversold territory could be used to trigger a new long position.The bearish is opposite to it