Silver

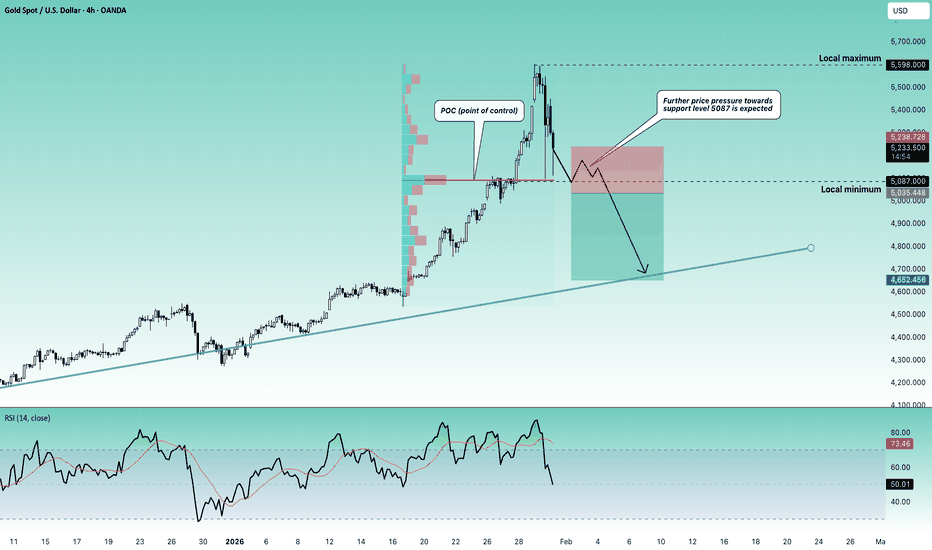

Stop!Loss|Market View: GOLD🙌 Stop!Loss team welcomes you❗️

In this post, we're going to talk about the near-term outlook for GOLD ☝️

Potential trade setup:

🔔Entry level: 5035.448

💰TP: 4652.456

⛔️SL: 5238.728

"Market View" - a brief analysis of trading instruments, covering the most important aspects of the FOREX market.

👇 In the comments 👇 you can type the trading instrument you'd like to analyze, and we'll talk about it in our next posts.

💬 Description: A downward correction is observed in the metals market amid likely profit-taking. This trend could continue, especially today before the weekend. Technically, a sharp price squeeze toward 5087 is expected, which would form a good base for a downward breakout toward 4600-4700, where the trendline support is also located.

Thanks for your support 🚀

Profits for all ✅

$ilver - Price Levels to watch / 2 Month Pivot Points There is potential that $ilver might touch close to $ 130 within the next two months if we hold up that momentum.

There is one conservative R:R 1.6 (put stop under the pivot) and one more agressive R:R 3 entry idea here. Also you can wait for the breakout to happen and wait for a retest if you want to play it safe (but who knows if there might even be a retest given the fundamentals)

PLAN B: If we fail to hold ~ $ 75 price might revisit the 2M pivot - that would be a quick shorting opportunity then.

If you are just holding silver coins/bars long term, I wouldnt panic if the price cycles back down to $60 or even $45. This would be within the expected volatility and could be a geat opportunity to stack more physical.

1 Year / 12M Silver Chart AnalysisDid take a look at 1-Year candle chart of $ilver and try to put the peak of 1979/80 in rough relation to this year 2025. 79/80 the overshoot went up +70% in relation to the prior years close. So if this repeats the same way the overshoot for 2026 would be ~60% with top at 126$

2025 is the largest freaking candle on this chart. Huge candles often come with follow up....

The measured overshoot for the peak of 2010/2011 amazingly (!) is 61% as well... So from what I see here - a huge 1 Year candle is often followed by a +60% overshoot in the following year. 2010 closed at 30$ - 2011 peaked at 50$.

#XAGUSD SILVER - Wait For A Dip Toward The TrendlineThe chart shows a strong uptrend in XAGUSD with higher highs and higher lows, supported by two rising trendlines and prior resistance turned support near 100.

Price is currently pulling back from recent highs around 117–120, and the plan on the chart is to wait for a dip toward the trendline/100 zone and then look for long (buy) setups in line with the bullish trend.

SILVER FREE SIGNAL|SHORT|

✅SILVER taps a higher-timeframe premium supply and shows bearish displacement, confirming rejection from an ICT POI. Expect continuation lower toward resting sell-side liquidity.

—————————

Entry: 116.45$

Stop Loss: 121.69$

Take Profit: 109.00$

Time Frame: 1H

—————————

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Gold - What now?Hold gold for 1 year. It may give additional return of around 30-40% in one year. If it goes downside then there may be a long consolidation. Gold may be a risky investment considering the returns it has given in the past 2-2.5 years but considering past performance a small part of the rally is still left which may be completed in the next 12-14 months. Physical gold can be considered a better option to buy as it may enter a new range and will not see the current levels.

XAGUSD Bullish Breakout: Trend Continuation Toward 124.00This is a 30-minute XAGUSD (Silver vs USD) chart showing a bullish breakout within a well-defined uptrend.

Overall trend: Price is moving inside a rising channel, respecting an ascending trendline that has acted as dynamic support.

Ichimoku Cloud:

Price is above the cloud, confirming bullish market structure.

The cloud is rising and expanding, signaling strong underlying momentum and trend stability.

Key resistance & breakout:

A horizontal resistance zone capped price multiple times.

Silver has now broken and held above this level, confirming a bullish breakout.

Price action: Post-breakout consolidation shows higher lows, indicating acceptance above resistance rather than a false break.

Support confluence: The breakout level aligns closely with the rising trendline and the top of the Ichimoku cloud, strengthening the bullish bias.

Target projection: An upside target is marked near 124.00, consistent with trend continuation and prior structure extension.

Overall, the chart favors trend continuation to the upside, as long as price remains above the breakout zone and ascending trendline.

SILVER | Pullback as Precious Metals Rally PausesPRECIOUS METALS MINERS | Pullback as SILVER Rally Pauses

European precious metals miners opened lower as investors took profits after the recent strong rally in TVC:GOLD and TVC:SILVER . The pause in bullion momentum weighed on mining equities, which tend to amplify moves in underlying metal prices.

In early London trade, Fresnillo and Hochschild fell around 3.2% and 2.5%, respectively, while losses extended beyond precious-metals-focused miners, reflecting a broader risk-off tone at the open.

Technical Outlook

The price maintains a bearish structure while trading below the 112.91 pivot.

As long as price remains below 112.91, downside pressure is expected toward 110.40.

A confirmed 1H close below 110.40 would strengthen bearish continuation toward 107.46, followed by 103.35.

On the upside, bullish momentum would only be activated with a 1H close above 112.91, opening the way toward 117.19 and 119.83.

Key Levels

• Pivot: 112.91

• Support: 109.41 – 107.47 – 103.40

• Resistance: 115.00 – 117.20 – 119.84

XAUUSD: dip-buy setup🛠 Technical Analysis: On the M15 timeframe, Gold is consolidating after a strong impulse move and is currently trading inside a short-term rising channel. Price has repeatedly reacted from the highlighted resistance zone around the 5,580–5,600 area, showing that supply is defending the top of the structure. The current pullback looks like a controlled correction, with the key demand area marked near 5,450 acting as the main support for a continuation move. The chart also suggests a potential liquidity sweep below 5,450 before the bullish leg resumes, so patience for confirmation is important. As long as price holds above the support zone and quickly reclaims the channel, the upside continuation toward the next expansion target remains valid. A clean breakdown and sustained hold below 5,450 would weaken the bullish structure and open room toward the lower support zones (5,300 and 5,100). Overall bias stays bullish, but execution is focused on buying the dip from the marked support and targeting a rebound into the upper resistance area.

———————————————

❗️ Trade Parameters (BUY)

———————————————

➡️ Entry Point: Buy on a pullback into the 5,450 support zone (allowing a brief sweep below 5,450)

🎯 Take Profit: 5,638.40

🔴 Stop Loss: 5,406.47

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

#EURJPY , Gonna be sweet with us ?📊 Morning Market Brief | London Session Prep

🔎 Instrument Focus: #EURJPY

⚠️ Risk Environment: High

📈 Technical Overview:

Not a Quality Setup , if it Moves Perfectly will take it , if not .... just let it go

🚀 Trading Plan:

• Need Valid momentum Structure over the POI

• LTF ENTRY NEEDED

• Just and Only for QuickScalp

🧠 Stay updated with real time news and macro events, visit 👉 @News_Ash_TheTrader_Bot

#Ash_TheTrader #Forex #EURUSD #MarketInsight #PriceAction #TradingPlan #RiskManagement #LondonSession #Scalping #Futures #NQ #Gold

Stop!Loss|Market View: USDJPY🙌 Stop!Loss team welcomes you❗️

In this post, we're going to talk about the near-term outlook for the USDJPY currency pair☝️

Potential trade setup:

🔔Entry level: 153.102

💰TP: 151.009

⛔️SL: 154.358

"Market View" - a brief analysis of trading instruments, covering the most important aspects of the FOREX market.

👇 In the comments 👇 you can type the trading instrument you'd like to analyze, and we'll talk about it in our next posts.

💬 Description: The USD remains susceptible to selling due primarily to geopolitical risks, and yesterday's Federal Reserve results were perceived by the market as unfavorable for the American currency. This trend will likely persist until the end of the week, but special attention should be paid to today's and especially tomorrow's US session. Profit-taking is likely before the weekend.

Thanks for your support 🚀

Profits for all ✅

Silver Futures | Daily ChartSilver has moved into a vertical rally phase, showing strong momentum but now entering a possible EXHAUSTION GAP ZONE

Sharp impulsive move after accumulation

Price far extended from base → mean reversion risk

Volume expansion supports trend, but follow-through needs monitoring

Sustaining above this zone keeps the bullish bias intact

Failure to hold may lead to short-term consolidation or retracement

📌 Trend is bullish, but risk increases at higher levels.

Educational view only. Not a buy/sell recommendation.

CRITICAL JUNCTIONThe larger trend is down.

Shorter term trend is up.

There are 3 cases to be made here.

I currently don't see any reason for the green case, but perhaps the yellow. Gold and silver are signaling for the red case.

Strong Dollar Camp

- Scott Bessent's comments were helpful "strong dollar policy".

- Long Term Yields are rising. If they are relatively higher than their peers and confidence in the U.S. returns, it could be massively bullish.

Neutral Camp

Jerome Powell essentially walked away today, and said the rest is up to the next guy.... Did nothing to defend the dollar, or weaken it further. Stable Mable.

Weak Dollar Camp

- Trump weakens the dollar "who needs allies".

- Congress just wants to keep printing more to spend, they're only arguing about what to spend it on...

XAUUSD - Still In Strong Uptrend, Anticipating Potential Bounce!Price of XAGUSD is in a strong uptrend, moving inside an ascending channel, so bias is bullish.

The green channel shows higher highs and higher lows, signalling continuation to the upside while it holds.

The blue circle marks the lower channel area where the idea is to wait for a pullback and then look for long (buy) entries, not shorts.

As long as price respects that rising support, upside targets are the upper channel and higher levels, while a clean break below would weaken this bullish view.

$QQQ Momentum Fracture Near Highs Similar Conditions To 2022 TopWe are currently trading inside a tight range near highs after a strong trend. What stands out to me is not price itself but momentum behavior.

When I compare this structure to the 2022 topping period I notice three things lining up.

Price consolidated near highs rather than expanding higher

RSI chopped sideways in the mid range instead of making higher momentum highs

MACD compressed and flattened showing loss of directional strength

That same behavior is showing up again now. RSI is not expanding with price and MACD is compressing instead of pushing higher. This is typically what distribution looks like before direction is resolved.

This does not mean price must collapse immediately. It does mean upside is no longer being confirmed by momentum and risk is increasing at these levels.

For me this is an area to be cautious chasing longs and instead focus on reactions. Acceptance above the range with expanding RSI and MACD would invalidate this. Failure and rejection would confirm a topping process.

This is a conditions based thesis not a prediction.

Looking at a swing perhaps, if we can consolidate and head lower. Patience for the next few days.

Silver spot price versus the miners...The lag being experienced by the silver miners seems to be caused by market skepticism as to whether the meteoric rise in the price of silver is sustainable.

The miners will be reporting their 4Q25 earnings soon, which should be impressive given the rise in the spot price of silver for that quarter.

High‑Beta Silver Exposure – USAS Swing StructureAmericas Gold and Silver (USAS) operates silver‑focused assets like the Galena Complex in Idaho and the Cosalá operation in Mexico, with additional growth from the Crescent silver mine restart planned around mid‑2026. I’m treating this as a higher‑risk, higher‑reward silver stock, marking out major development milestones, expansion news, and deep weekly demand zones to capture explosive moves during strong silver cycles.

SILVER Bullish Bias! Buy!

Hello,Traders!

SILVER strong bullish structure remains intact as price respects rising trendline support. Current pullback looks corrective, with smart money likely targeting higher liquidity above recent highs. Time Frame 1H.

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SILVER XAGUSD - 1h Technical Analysis On 1hr tf, SILVER is making descending triangle with price range is continuously squeezing. It is most likely to break out upwards.

Pole has been used to arrive to the TP.

EMA 9 has crossed EMA 21 and AO also suggesting bullish trend. RSI is mid range suggesting gradual rise in buying trend

Trade Values

Buy-1: 115.169

Buy-2: 110.650 (Risky but more profitable)

SL: 104.731

TP-1: 130

TP-2: 140

Could silver go to $120?A couple of days ago, I thought silver finally peaked when it formed a massive doji candle on the daily chart. I initially highlighted this 4H doji (circled), and we later saw a big follow-up drop that wiped out the day's entire gains which by the way was the biggest ever nominal gains. BUT... Now it looks like the bulls have held onto key levels and lots of intraday levels have turned into support, having previously acted as resistance. Any remaining bears may well have their stops resting above that doji high. Those stops could be targeted next. If so, silver may well head to $120 from here. This is obviously just an observation, not a trade idea. Silver's volatility makes it very difficult to trade this market with too much conviction. Goes without saying, that regardless of direction, risk management (stops) should never be forgotten and position sizes also need to manageable.

By Fawad Razaqzada, market analyst with FOREX.com