Stock Market Forecast | BTC TSLA NVDA AAPL AMZN META MSFTWelcome to your essential weekly guide for navigating the dynamic stock market! In this in-depth analysis, we provide a comprehensive stock market forecast covering key movers like the S&P 500 CME_MINI:ES1! (SPY) and Nasdaq 100 CME_MINI:NQ1! NASDAQ:NDX (QQQ), alongside a detailed Bitcoin ( CRYPTOCAP:BTC ) analysis. We dive deep into major large-cap stocks, including Tesla (TSLA), Nvidia (NVDA), Apple (AAPL), Amazon (AMZN), Meta (META), and Microsoft (MSFT), offering crucial insights for your day trading and investing strategies.

This video breaks down complex market movements using advanced technical analysis, identifying critical support and resistance levels. We also analyze sector rotation, market sentiment, dark pool activity, and upcoming earnings reports, integrating key macroeconomic data to pinpoint high-probability market scenarios for the week ahead. Whether you're focused on individual stocks or broader market trends, our financial analysis aims to equip you with actionable knowledge. Discover the future of the stock market and gain valuable trading tips to stay ahead!

Timestamps are provided below so you can easily jump to specific tickers and chart analysis that matter most to your portfolio.

0:00 Intro

0:14 Sector Data & Rotation

1:49 Sentiment Data

2:07 Dark Pools (QQQ / PSQ)

4:03 Rate Cut Odds

4:29 Earnings Calendar

4:53 Economic Data Next Week

5:21 SPY Technicals

7:36 MAG7 Dark Pool Context

9:23 QQQ Technicals

11:58 Bitcoin Technicals

18:01 Tesla (TSLA)

20:02 Meta (META)

23:50 Amazon (AMZN)

26:30 Microsoft (MSFT)

30:18 Google (GOOGL)

32:15 Apple (AAPL)

34:12 Nvidia (NVDA)

35:39 Wrap Up

Spy!

SPY: Short Signal with Entry/SL/TP

SPY

- Classic bearish formation

- Our team expects fall

SUGGESTED TRADE:

Swing Trade

Sell SPY

Entry Level - 690.62

Sl - 692.78

Tp - 684.19

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

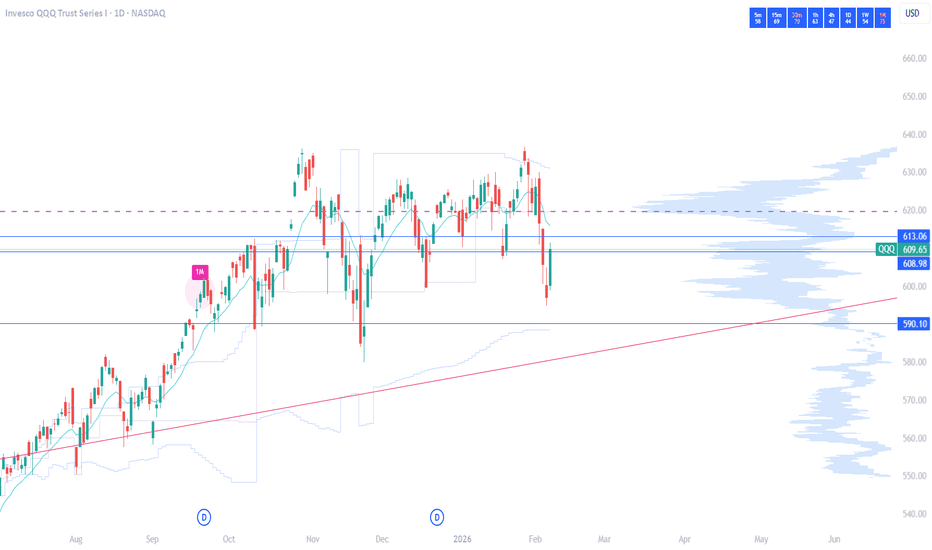

QQQ Weekly Outlook – Week 5 of 2026 (Feb 02–06)QQQ Weekly Outlook – Week 5 of 2026 (Feb 02–06)

Weekly Recap

Last week, the market followed our bullish framework perfectly. QQQ fully respected the bullish scenario, delivering a clean and profitable week. The market opened with a gap up and reached all bullish targets, allowing positions to be closed in profit.

After hitting those targets, price moved back into a range and started to show some retracement following the Mid Week update. I’m also sharing last week’s QQQ Weekly Outlook on the side for reference.

At this stage, I see increasing indecision in the market. Below, I’m outlining my strategy to navigate this uncertainty.

Scenarios – Prediction

Scenario: The Range

At the moment, I do not see a clear directional bias. Price is trading between well defined key levels, and I expect range behavior unless those levels are decisively broken.

My base case is a range bound market, where price reacts from the Range High and Range Low zones and rotates back into the range.

Deviations into these areas followed by a close back inside the range would keep price compressed within its internal structure. A strong break and acceptance beyond the range boundaries would signal the market’s true directional bias.

Key Levels to Watch / Trade

Range High: 636.5

Range Low: 607 – 599.5

Mid Range / Internal Liquidity: 630 – 618

Game Plan

If price sweeps liquidity at one of these key levels and then closes back inside the range, I will look to trade in the opposite direction of the liquidity grab.

The core idea is to fade moves where traders get trapped thinking the level has broken, only for price to reverse back into the range.

Example:

If the 618 level gets tapped and price closes back above it with either two 1H candles or one 4H candle, I will treat that as a deviation and look for call side setups.

If, instead, price breaks a key level with strong acceptance and closes firmly above or below it, that would suggest continuation in that direction.

Example:

A strong close below 618 would shift my focus toward the Range Low at 607, where I would look to trade the downside using puts.

Position Management Notes

Positions should only be taken after confirmation, either through a clean break or a clear deviation at key levels. If price closes back against the direction of the expected move, the setup is invalidated and the position should be stopped.

For example, if 618 breaks strongly and I enter short, but price then reclaims 618 with two consecutive 1H closes above it, that would invalidate the short setup and signal the need to exit.

I share deeper US Market breakdowns and weekly scenario updates on Substack. Link is in my profile.

This analysis is for educational purposes only and reflects my personal opinion. It is not financial advice.

SPY Weekly Outlook – Week 5 of 2026 (Feb 02–06)SPY Weekly Outlook – Week 5 of 2026 (Feb 02–06)

Weekly Recap

Last week, SPY respected our bullish framework perfectly, resulting in a clean and profitable execution. The market opened with a gap up and reached Bullish Target 1, where we took partial profits and reduced exposure.

We then carried the remaining position toward the 700 level with a break even stop. However, price failed to expand further, closed back inside the range, and started to retrace after the mid week. As a result, the remaining position was stopped out around breakeven.

(For reference, I’m sharing last week’s SPY Weekly Outlook on the side.)

At this stage, I see growing indecision in the market, and below I outline my strategy to navigate this environment.

Scenarios – Prediction

Scenario: Range Play

At the moment, I do not see a clear directional bias. Price is trading between well defined key levels and I expect reactions from these zones.

My base case is a range bound market, where price gets rejected from the Range High and Range Low areas and rotates back inside the range.

Deviations into these levels followed by acceptance back inside the range would keep price compressed within its internal structure. A strong break and acceptance beyond the range boundaries would signal the market’s true directional bias.

Key Levels to Watch / Trade

Range High: 697.75

Range Low: 676.5 – 669.5

Mid Range / Internal Liquidity: 687.25 – 684.25

Game Plan

If price sweeps liquidity at one of these key levels and then closes back inside the range, I will look to trade in the opposite direction of the liquidity grab.

The core idea is to fade moves where traders get trapped thinking the level has broken, only for price to reverse back into the range.

Example:

If the 676.5 level gets tapped and price closes back above it with either two 1H candles or one 4H candle, I will treat that as a deviation and look for call side setups.

If price instead breaks a key level with strong acceptance and holds above or below it, that would signal continuation beyond the range.

Example:

A strong close below 684.25 would shift my focus toward the Range Low at 676.5, where I would look to trade the downside using puts.

Position Management Notes

Positions should only be taken after confirmation, either through a clean break or a clear deviation at key levels. If price closes back against the direction of the expected move, the setup is invalidated and the position should be stopped.

For example, if 684.25 breaks strongly and I enter short, but price then reclaims 684.25 with two consecutive 1H closes above it, that would invalidate the short setup and signal the need to exit.

I share deeper US Market breakdowns and weekly scenario updates on Substack. Link is in my profile.

This analysis is for educational purposes only and reflects my personal opinion. It is not financial advice.

SPY Structure Update (Daily)SPY experienced a structural reset during the February–April drawdown, followed by a clear trend shift. Since that transition, price has maintained a steady upward trajectory, with all key EMAs remaining in healthy alignment well above the 200 EMA.

Short-term and intermediate EMAs continue to support price, confirming that the broader trend structure remains intact rather than corrective.

Momentum & Participation

RSI: Holding near the neutral 50 level, reflecting balanced conditions with a slight upward bias rather than exhaustion.

On-Balance Volume (OBV): Showing early improvement, suggesting participation remains constructive and supportive of trend continuation.

Summary:

Trend structure remains healthy on the daily timeframe. Momentum is stable, participation is supportive, and no structural degradation is present at this time. This remains a structural read of current conditions, not a prediction.

PUT/Call Buy signal was given at the close 2/5We had an A x 1.618 to = wave C at the low in the cash sp 500 this now can be counted 2 ways this wave simple wave 4 low it also held .786 This is at 80% odds this would give 7021/7031 target by 2/9 to 2/11 Cycle turn . Or the bearish or should i say very bearish count wave abc down for wave A of the crash this is now 60 % I took profit on open I went long in after market when I saw the math for a 15 % long I am in 100 % now . and will relax today and watch structure . Best of trades WAVETIMER

ES (SPX, SPY) Analysis, Key-Zones, Setup for Fri (Feb 6)Yesterday was rough for tech with Nasdaq dropping over 1.3% after GOOGL's capex guidance spooked the market. MSFT down nearly 5% didn't help either. But overnight we got some relief - Amazon announcing $200B in AI infrastructure spending gave futures a decent lift. VIX pulled back from the 21+ levels which is helping stabilize things a bit.

ES bounced off the 6820 area and pushed back up toward the prior range. We're currently sitting around the 6850-6860 zone which is right at VWAP and the prior day's equilibrium. The bounce looks corrective so far rather than impulsive.

Forecast:

- Overnight: Choppy consolidation with slight upward drift

- Morning Session: Expecting a push into 6865-6875 resistance zone

- Afternoon: Likely fade if rejection at resistance holds

- Daily Close: Targeting below 6850 if short setup triggers

- Expected Range: 6825 to 6890

- Most Likely Path: Grind up into 6865-6875, find sellers, mean revert back toward 6840-6825

Friday Events:

- Pre-market: Watching for continuation of tech bounce

- Morning: Jobs data aftermath still influencing sentiment

- VIX: Currently around 20 - elevated but cooling

- After the bell: Light earnings calendar

Resistance:

- 6960-7005 – Major resistance, 7005 is the RTH High from earlier this week

- 6900-6920 – Upper resistance zone, would need strong momentum to reach

- 6880-6890 – Secondary resistance, this is where the short thesis gets invalidated

- 6865-6875 – Primary zone of interest, entry zone for mean reversion short

Support:

- 6845-6840 – First support and T1 target for shorts

- 6825-6835 – T2 target zone, prior support area

- 6800-6820 – Major support and T3, this is the key level bulls need to hold

- 6760-6780 – Deep support, only in play if 6800 breaks

Critical Level:

- 6850 – VWAP and equilibrium pivot, the line in the sand for intraday bias

Strategic Bias - Mean Reversion Short:

The setup here is a mean reversion short looking for a fade off the 6865-6875 resistance zone. Here's the thinking:

- Structure: The 1H chart shows a lower high pattern forming. Yesterday's selloff created a clear supply zone in the 6865-6890 area. The overnight bounce looks like a retracement into that supply rather than a trend reversal.

- Context: Despite the bounce, the broader picture still shows weakness. Tech got hit hard and one Amazon headline doesn't fix the GOOGL/MSFT damage. Buyers need to prove themselves above 6880 for me to flip bullish.

- The Play: Looking for price to push into 6865-6875 and show rejection (wicks, failed breakout, momentum divergence). If we get that, the trade is short targeting VWAP at 6850 first, then 6840, with a runner toward 6825.

- Risk: Stop above 6881. If price closes above that level with momentum, the lower high thesis is dead and shorts need to step aside.

- Invalidation: A strong push through 6890 with follow-through would shift bias to neutral/bullish and open up a run toward 6920+.

How I'm seeing it:

- Bearish bias below 6880, looking for mean reversion short at 6865-6875

- First target is VWAP at 6850, then 6840, extended target 6825

- If 6881 breaks with conviction, step aside - bulls taking control

- Below 6800 would confirm broader weakness and open 6760-6780

The overnight bounce gave us a setup. Now it's about waiting for price to reach the zone and show its hand. No need to chase - let the trade come to us.

Good Luck !!!

$SPY & $SPX — Market-Moving Headlines Friday Feb 6, 2026🔮 AMEX:SPY & SP:SPX — Market-Moving Headlines Friday Feb 6, 2026

🌍 Market-Moving Themes

☁️ Cloud Confidence Restored

AMZN earnings reverse the AI capex panic as AWS profit growth proves spending is paying off

🚗 Legacy Auto Breakdown

Ford EV losses confirm widening gap between legacy automakers and Tesla as price wars intensify

📱 Ad Tech Surprise

SNAP earnings signal renewed advertiser demand and Gen Z engagement after years of stagnation

📊 Jobs Day Volatility

Non-Farm Payrolls set the tone for rates expectations, risk appetite, and end-of-week positioning

🛡️ Gold as Shock Absorber

Gold remains bid as hedge against both recession fear and inflation surprise from jobs data

📊 Key U.S. Economic Data Friday Feb 6 ET

8:30 AM

U.S. employment report Jan: 55,000

U.S. unemployment rate Jan: 4.4%

U.S. hourly wages Jan: 0.3%

Hourly wages YoY: 3.6%

10:00 AM

Consumer sentiment prelim Feb: 55.0

12:00 PM

Fed Vice Chair Philip Jefferson speaks

3:00 PM

Consumer credit Dec: $8.0B

⚠️ For informational purposes only. Not financial advice.

📌 #SPY #SPX #JobsReport #NFP #AMZN #AI #Cloud #Macro #Markets #Stocks #Options

BITCOIN targets updated The chart is that of my work in Bitcoin I still see this as the ending of the first ABC decline .we are now into the second cluster of support . I still see a 5th wave ENDING Now beginning . I am watch IGV I have a low in 79 Handle they are all connected . I started buying CALLS in spy as of this post and will in IGV best of trades WAVETIMER

$SPY & $SPX — Market-Moving Headlines Thursday Feb 5, 2026🔮 AMEX:SPY & SP:SPX — Market-Moving Headlines Thursday Feb 5, 2026

🌍 Market-Moving Themes

🧠 AI Cost Reckoning

Big Tech spending fears intensify after GOOGL capex shock and AMD collapse, forcing markets to question AI profitability timelines

🏭 Hardware vs Software Divide

Capex-heavy AI buildouts favor chip and infrastructure suppliers while pressure mounts on software margins

💊 Healthcare Rotation Accelerates

LLY strength highlights capital rotation out of volatile Tech into durable growth healthcare

⚖️ Macro Crosscurrents

Weak ADP payrolls clash with strong services data, keeping recession and no-landing narratives in conflict

🛡️ Defensive Repositioning

Gold stabilizes as investors hedge against Tech volatility and labor market uncertainty

📊 Key U.S. Economic Data Thursday Feb 5 ET

8:30 AM

Initial jobless claims Jan 31: 212,000

delayed release due to shutdown

10:50 AM

Atlanta Fed President Raphael Bostic speaks

⚠️ For informational purposes only. Not financial advice.

📌 #SPY #SPX #AI #GOOGL #AMD #Macro #Jobs #Gold #Healthcare #Markets #Stocks #Options

WAVE 5 target 7031 plus or minus 2The sp 500 has declined today in what seems to be an ABC decline and has held support at 6833 the low is 6839 I have labeled this as wave B in wave 5 of my diagonal wave C of 5 is a target of 7031 By if we are to have anything short of this target it would be 7006 in which wave C of 5 would be .786 of the Wave A I maintain The top is on 2/9 peak the window is no more that 2/11 open So The damage in my work in IGV in my super cycle peak is clear what lies ahead in 2026 They are running with both hands into the oldest the DJI i still need a print of 50100 to 50540 into feb 9 to call The TOP . stand ready best of trades WAVETIMER

$SPY & $SPX — Market-Moving Headlines Wednesday Feb 4, 2026🔮 AMEX:SPY & SP:SPX — Market-Moving Headlines Wednesday Feb 4, 2026

🌍 Market-Moving Themes

🧠 AI Reversal Setup

AMD earnings confirm AI chip demand is accelerating, resetting sentiment for NVDA AVGO MU and the broader semi complex

📉 Tech Shakeout Exhaustion

Tuesday’s Nasdaq selloff looks like a leverage flush ahead of real earnings confirmation rather than a trend break

💰 Inflation Hedge Resilience

Gold and Silver rebound sharply, signaling investors are not abandoning inflation protection despite recent liquidation

👷 Labor Market Stability

Steady job openings and ADP data reinforce the no-landing narrative heading into Friday’s payrolls

🏦 Fed Noise Returns

Lisa Cook remarks late in the day could reintroduce rate volatility after markets ignored recent Fed warnings

📊 Key U.S. Economic Data Wednesday Feb 4 ET

8:15 AM

ADP employment Jan: 45,000

9:45 AM

S&P final U.S. services PMI Jan: 52.5

10:00 AM

ISM services Jan: 53.5%

6:30 PM

Fed Governor Lisa Cook speaks

⚠️ For informational purposes only. Not financial advice.

📌 #SPY #SPX #AMD #NVDA #AI #ISM #ADP #Macro #Earnings #Stocks #Options

Opening (IRA): SPY February 27th 590/600/725/735 Iron Condor... for a 1.29 credit.

Comments: More of an engagement/boredom trade than anything else. Selling the 10 delta short options and buying the wings out from there to generate a 75% POP (Probability of Profit) setup that pays in the neighborhood of 10% of the width of the wings.

Metrics:

Max Profit: 1.29 ($129)

Buying Power Effect: 8.71 ($871)

ROC at Max: 14.81%

50% Max: .65 ($65)

ROC at 50% Max: 7.41%

Will look to adjust on side test or on side approaching worthless.

Updated wave structure for the Cash sp 500 Major turn is at hand Under the current wave structure and Fib relationships within the waves We have forming a Major Top The breakdown in IGV is the canary in the coal mine and The 10 and 20 year bonds markets show a breakdown forming The rotation is nearing the end of what I call the game of MUSICAL CHAIRS is just about over The RUG PUT is Close I was hoping to see One last gasp up above 7021 to 7081 midpoint 7044 zone for about nine months I have stated The top should be seen in the 6981 to 7031 I Am Happy to have seen the market Hold up But the charts show rotation ending . The market based on CYCLES is starting the weak seasonal first down leg I have a cluster of Spiral pointing at 2/9/2026 for The TOP BUT rallies are weaker and weaker So has of tonight I took a 75 % long PUTS deep in the money in the SPY for 2028 and 2027 . The blowoff it gold and silver and then the freefall shows me there is little support and change in ASSETS to roll over is started We are at a muti year trendline IGV and it should take out the april 7 panic low Easy ! best of trades WAVETIMER

S&P Wheel Spinning Around Fibo 161. End Of TrendLast time I’ve published about the S&P was in mid November, 2025 mentioning higher time frames like the weekly and the monthly charts. And I was expecting a downtrend to start in January (I know, we are in February), I’ve even mentioned to a couple of friends. Though I remind you that the Stoch RSI on the monthly chart has crossed downwards as expected.

I’ve also mentioned before that every financial report is expecting a recession mid 2026 and if everybody is expecting and declaring the same thing, either it doesn’t happen or it happens earlier by another reason. I might be wrong but I’m publishing what I’m observing and seeing on the charts.

As you know, these time frames take a bit time to form. And as we see on the daily chart, the bars on are struggling around Fibonacci 161 level. An indicator that we have reached the end of the trend. And the RSI is having a huge negative divergence which is kind of scary.

In addition, Nvdia cannot move upwards and having a similar appearance - which is like a Wycoff distribution. And Bitcoin is another thing to pay attention to. It’s being beaten up bad. I was expecting Btc to go as low as 74,000 level but seems like it will bounce and go lower than this for another round. (Possible to go as low as 45-50,000 level.) Bitcoin moves first (either way), the stock market follows. All of these might turn out to be wrong but time will tell.

$SPY & $SPX — Market-Moving Headlines Tuesday Feb 3, 2026🔮 AMEX:SPY & SP:SPX — Market-Moving Headlines Tuesday Feb 3, 2026

🌍 Market-Moving Themes

🧠 AI Earnings Reset

PLTR blowout restores confidence in enterprise AI demand with read-through to AI SOUN and broader software

🏭 Manufacturing Re-Acceleration

Strong ISM manufacturing confirms expansion and shifts narrative away from recession fears toward real-economy growth

💾 Memory Supply Crunch

Rotation continues from compute into storage as SNDK MU and WDC benefit from AI data bottlenecks

💰 Anti-Fiat Stabilization

Gold and crypto attempt to base after forced liquidation as markets digest Kevin Warsh Fed Chair nomination

📉 Dip-Buying Psychology

Equities absorb weekend panic as capital rotates out of crowded hedges and back into stocks

📊 Key U.S. Economic Data Tuesday Feb 3 ET

9:45 AM

- S&P final U.S. services PMI Jan: 52.5

10:00 AM

- Job openings JOLTS Dec: 7.1 million

- ISM services Jan: 53.5%

⚠️ Disclaimer: For informational purposes only. Not financial advice.

📌 #SPY #SPX #PLTR #AI #ISM #JOLTS #Macro #Earnings #Stocks #Options

$SPY & $SPX — Market-Moving Headlines Week of Feb 2–6, 2026🔮 AMEX:SPY & SP:SPX — Market-Moving Headlines Week of Feb 2–6, 2026

🌍 Market-Moving Themes

💥 Anti-Fiat Unwind

Gold, Silver, and Crypto suffer forced liquidation as capital rotates out of crowded hedges

🧠 AI Earnings Take Center Stage

GOOGL, AMZN, PLTR headline a second straight AI earnings stress test week

🏭 Manufacturing vs Services Split

Weak manufacturing data contrasts with resilient services, complicating the growth narrative

👷 Labor Market Reality Check

ADP, Jobless Claims, and Friday’s Jobs Report will drive Fed cut expectations

🌏 Emerging Market Pressure

India budget selloff highlights fragility across EM, raising spillover risk to EEM

📅 Post-FOMC Re-Pricing

Markets digest last week’s Fed tone through hard data instead of rhetoric

📊 Key U.S. Economic Data — Feb 2 to Feb 6 (ET)

MONDAY, FEB. 2

- TBA Auto sales Jan | Previous: 16.1M

- 9:45 AM S&P flash U.S. manufacturing PMI Jan | Previous: 51.9

- 10:00 AM ISM manufacturing Jan | Actual: 48.4 | Forecast: 47.9

TUESDAY, FEB. 3

- 9:45 AM S&P final U.S. services PMI Jan | Previous: 52.5

- 10:00 AM Job openings Dec | Actual: 7.1M | Previous: 7.1M

- 10:00 AM ISM services Jan | Actual: 53.5 | Previous: 54.4

WEDNESDAY, FEB. 4

- 8:15 AM ADP employment Jan | Actual: 45K | Forecast: 41K

THURSDAY, FEB. 5

- 8:30 AM Initial jobless claims Jan 31 | Actual: 212K | Previous: 209K

- 10:50 AM Atlanta Fed President Raphael Bostic speaks

FRIDAY, FEB. 6

- 8:30 AM U.S. employment report Jan | Actual: 55K | Forecast: 50K

- 8:30 AM U.S. unemployment rate Jan | Actual: 4.4% | Previous: 4.4%

- 8:30 AM U.S. hourly wages Jan | Actual: 0.3% | Previous: 0.3%

- 8:30 AM Hourly wages YoY | Actual: 3.6% | Previous: 3.8%

- 10:00 AM Consumer sentiment prelim Feb | Actual: 54.0 | Previous: 56.4

- 3:00 PM Consumer credit | Actual: $8.0B | Previous: $4.2B

⚠️ Disclaimer: For informational purposes only. Not financial advice.

📌 #SPY #SPX #Macro #JobsReport #NFP #Earnings #AI #Crypto #Gold #Markets #Options

SPY Weekly Outlook – Week 4 of 2026 (Jan 26–30)SPY Weekly Outlook – Week 4 of 2026 (Jan 26–30)

Technical Look

SPY moved exactly as expected on the bearish side, reaching its downside targets with the Tuesday open last week and finding a bounce from those levels.

In the Mid Week Update shared afterward, I highlighted that price had transitioned into a bullish structure and that higher targets were now in focus. I’m also linking last week’s outlook on the side for reference.

Scenarios – Prediction

At this point, I am tracking two possible scenarios for SPY.

Scenario 1: Bullish Scenario (Likely)

With the bullish structure formed during the week, I expect price to continue higher and potentially target all time highs. Bullish sentiment remains strong enough to support this move.

That said, risks remain. Escalation around Iran or a potential 100% tariff on Canada could shift market structure back to bearish, so staying cautious is important.

This bullish scenario can play out in two ways:

1-A direct gap up open followed by continuation toward bullish targets

2-A pullback toward the 687 area, a brief deviation, then a bounce with a strong close above that level, leading to higher targets

Bullish scenario targets:

691 – 696 – 700

Scenario 2: Bearish Scenario

Geopolitical tension around Iran or a potential tariff shock could still trigger a bearish shift, keeping this scenario in play.

A strong break and close below 687 would activate the bearish scenario for me. On any retest, price should fail to reclaim and close back above 687. If that happens, I would look to actively trade this scenario using puts.

Potential bearish targets:

676.5 and 669.5

Position Management Notes

I manage risk by scaling out of positions at key reaction levels and adjusting exposure as structure confirms. Partial profit taking at major levels is a core part of my approach.

I share deeper SPY-QQQ breakdowns and weekly scenario updates on Substack. Link is in my profile.

This analysis is for educational purposes only and reflects my personal opinion. It is not financial advice.