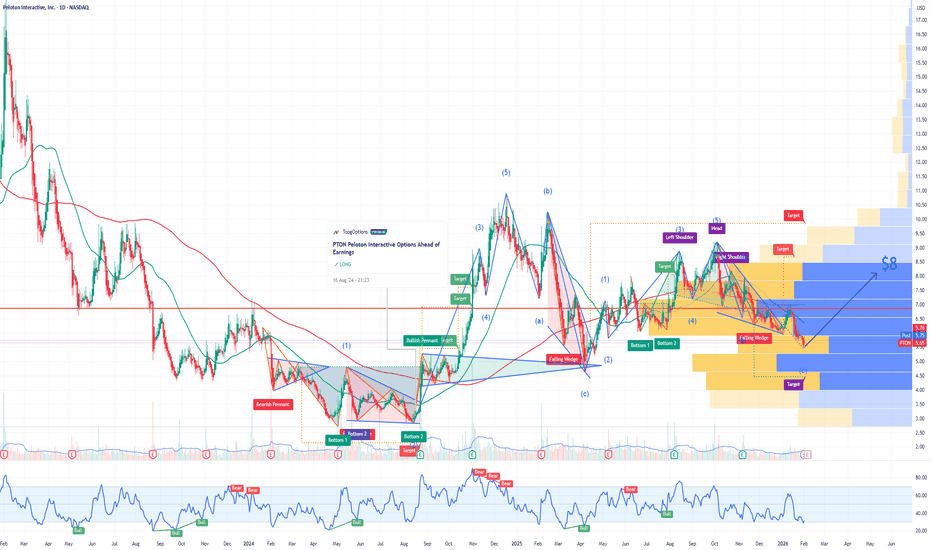

PTON Peloton Interactive Options Ahead of EarningsIf you haven`t bought the dip on PTON:

Now analyzing the options chain and the chart patterns of PTON Peloton Interactive prior to the earnings report this week,

I would consider purchasing the 8.00usd strike price Calls with

an expiration date of 2026-7-17,

for a premium of approximately $0.53.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Strategy

The Backtesting Mindset: Why Strategies Really FailWhy Backtesting, Defaults, and Market Conditions Decide Strategy Survival

Most trading strategies don’t fail because the logic is wrong.

They fail because traders trust them outside the conditions they were ever tested for.

This post ties together three core ideas every trader eventually learns the hard way.

Why Backtesting Matters (Before You Trust Any Strategy)

Backtesting is not about proving a strategy works.

It’s about finding where it breaks.

One profitable backtest only shows survival under one set of assumptions. Markets rotate. Volatility changes. Behavior shifts.

Backtesting across parameters, symbols, and timeframes reveals whether performance is structural or accidental.

If you don’t know worst drawdown, recovery behavior, and normal variance, you don’t know the strategy.

→ Read the full lesson

Why Default Strategy Settings Fail Across Markets

Default indicator settings feel safe because they’re familiar.

That doesn’t make them universal.

Defaults were never designed to work across all symbols, timeframes, or market conditions. A strategy that works on one chart says very little about robustness.

Small parameter changes often expose whether performance is stable or fragile.

Testing replaces assumptions with behavior.

→ Read the full lesson:

Why Market Conditions Expose Strategy Weakness

Strategies rarely stop working overnight.

They degrade as market regimes rotate.

Trends, ranges, volatility, and liquidity change. A strategy can struggle simply because it’s operating in the wrong environment.

Backtesting over long periods shows performance clustering. Profits and drawdowns align with specific conditions.

This doesn’t eliminate losses.

It explains them.

→ Read the full lesson:

Final Thought

Backtesting doesn’t predict the future.

It defines boundaries.

It replaces:

This should work

With:

This is how it behaves

That shift is the difference between trading and guessing.

Are you trading price zones or just guessing lines?Ever watched price slam into some line on your chart, bounce like a rubber ball, and thought: “What kind of witchcraft is this?”

Relax, that “witchcraft” has a boring name - support and resistance.

In human words:

Support - zone below price where buyers usually wake up and say “cheap, I’m in”. Price often stops falling or bounces from there.

Resistance - zone above price where sellers say “enough, too expensive”. Price often stops rising or pulls back from there.

Key word here - zone. Not an exact pixel line you worship like a religion.

Let me give you 5 simple principles of trading from levels that I wish someone had yelled at me when I started.

1) Levels are crowds, not lines

A level is just a place where many traders are watching the same price. Limit orders, stop losses, take profits - all parked there. That’s why price reacts.

So don’t draw 10 lines like a spider web. Mark the area where reactions happened before and think in zones.

2) The stronger the history, the stronger the level

Good level has a backstory:

- price reversed there several times

- there were strong candles away from that zone

- it’s visible on higher timeframes (H4, D1)

One tiny bounce on M5 doesn’t make it “iron support”. That’s like calling someone your soulmate after one date.

3) Trade reaction, not prediction

Classic beginner mistake:

“Price is near support - I buy.”

My logic:

“Price is near support - I watch.”

I don’t care that price is approaching the level, I care how it behaves there:

- sharp wick and fast rejection

- volume spike

- several failed attempts to break

No reaction - no trade. Level is not a button, it’s just a potential battle zone.

4) Trend + level = your best friend

Buying support in an uptrend - you’re with the smart money.

Buying support in a downtrend - you’re that hero trying to catch a falling knife with bare hands.

Same level, totally different probabilities. I use levels with the trend for main entries, and against the trend only for small, tactical trades with tight stops.

5) Levels break - don’t marry them

Biggest trap: “It bounced 3 times, it MUST bounce again.”

No, it doesn’t. Sometimes level breaks, eats all stops, and keeps going.

I always have a simple plan:

- if level holds - I trade bounce

- if level breaks and fixes behind it - I trade in new direction

Price doesn’t “betray” you. It just doesn’t owe you anything.

Maybe I’m wrong, but most traders don’t lose on levels because “levels don’t work” - they lose because they fall in love with one line and ignore the actual price behavior.

Support and resistance are just places where crowd psychology leaves footprints. Learn to read those footprints - and suddenly the chart stops looking random and starts looking like a story. And that’s when trading levels becomes fun.

XAUUSD: Smart Money Is Offloading While Retail Keeps BuyingOn XAUUSD, we still observe a bullish market structure, but price is clearly in an extended condition after the vertical impulse that pushed quotations toward the 5,150 area. The rejection candle formed after the high signals selling pressure and a potential start of a corrective phase toward the first dynamic demand zone around 4,900–4,800, aligning with the short-term ascending channel that has now been broken to the downside. The daily RSI is also exiting overbought territory, indicating weakening momentum and a likely sideways-to-bearish rotation in the near term.

From the COT Report, we can see a gradual reduction in long exposure from Non-Commercial traders, while Commercial players continue increasing their short hedges. This is a typical late-trend dynamic where smart money starts reducing risk. Rising open interest suggests the market is preparing for a directional move, but the current positioning favors a pullback scenario rather than immediate bullish continuation.

Gold seasonality shows that after January’s strength, February has historically been associated with consolidation or corrective phases before a potential new bullish leg into spring. This supports the idea of a technical retracement toward inefficiency zones left open during the recent rally.

From an FX Sentiment perspective, retail traders remain predominantly long (above 60%), which is generally considered a contrarian signal, statistically favoring further downside or liquidity sweeps before any continuation of the primary trend.

Trading Scenario:

As long as price remains below the 5,200–5,250 resistance area, the short-term bias remains corrective, with potential downside targets at 4,950 and then 4,800, where we will assess new bullish continuation structures. Only a strong reclaim above recent highs would reactivate the bullish leg toward new all-time highs.

AUD/USD: 90% of Traders Are Short… and Price Keeps RallyingAUD/USD has completed a clean and impulsive breakout above a major daily supply zone, which is now acting as structural support. This move marks a clear regime shift from the previous consolidation phase into a trend continuation environment.

From a price action perspective, the daily chart shows a well-defined bullish structure, with higher highs and higher lows developing inside an ascending channel. The breakout occurred with strong range expansion and decisive daily closes, signaling institutional participation rather than a retail-driven spike. Any pullback into the former supply area should be interpreted as a technical retest, not as a bearish signal, as long as daily structure holds.

Looking at the COT data, positioning remains supportive of further upside. Commercials continue to build short exposure on AUD (hedging activity), while Non-Commercials are still not aggressively long. This tells us the market is not crowded on the long side, leaving room for additional upside. At the same time, the US Dollar Index COT structure remains weak, reinforcing the bearish pressure on USD and indirectly supporting AUD/USD strength.

The seasonality component adds another layer of confluence. Historically, late January through February tends to be a positive seasonal window for AUD/USD, especially following prolonged accumulation phases. This timing aligns well with the current technical breakout.

On the FX sentiment side, positioning is extremely one-sided: over 90% of retail traders are short AUD/USD. This represents a classic contrarian setup, often observed during the early or mid-stages of sustained bullish trends. As long as retail remains heavily short, the probability of further upside pressure and short squeezes remains elevated.

Operational conclusion: the broader context supports a bullish continuation bias. Pullbacks toward the former supply (now demand) zone are technically constructive and offer potential trend-following opportunities. Only a daily close back below the reclaimed structure would invalidate the bullish scenario. Until then, downside moves should be viewed as opportunities, not weakness.

CADJPY Daily: Premium Zone RejectionCADJPY remains in a solid bullish Daily structure (higher highs/higher lows) and is still respecting the ascending channel, but price is now trading inside a major Daily supply/premium zone where the probability of a deeper correction is rising. The latest candles are showing rejection from the highs and RSI is rolling over, signaling weakening momentum right at a key technical area. Below current price, the first major demand/support sits at 112.70–113.00, and if that level fails the next downside target becomes 110.00. Retail sentiment is ~60% short (contrarian supportive, potential squeeze risk), but sentiment alone is not enough to justify longs into supply. COT still points to structural JPY weakness (speculators net-short), keeping the macro bias supportive for CADJPY, but the technical context favors a pullback before continuation. Seasonality in January is mixed/soft for both JPY and CAD, reinforcing the idea of a corrective phase rather than a clean trend acceleration. Plan: avoid chasing longs into supply, wait for confirmation—either a rejection and breakdown targeting 112.70–113.00 then 110.00, or a breakout/acceptance above supply followed by a retest before considering continuation entries.

EURAUD: Retail Is 83% LONG… Next Leg Could Still Be DownLooking at EURAUD on the daily timeframe, my bias remains bearish. The structure is clear: lower highs, lower lows, strong downside impulses, and weak pullbacks. Price is currently around 1.70, a key decision area where the market could either build a technical retracement or continue directly toward lower demand zones.

Retail sentiment shows around 83% of traders are long on EURAUD. I read this from a contrarian perspective, especially in a trending market. When positioning is heavily skewed against the main direction, it often acts as fuel for continuation rather than reversal.

From the COT perspective, speculators remain strongly net long on the euro, while AUD positioning is lighter. To me, this suggests possible crowding on the euro side, where profit-taking could add further downside pressure on the pair. Even if the euro positioning is technically positive, price action does not currently support a bullish EURAUD scenario.

Seasonality also aligns with this view, as January has historically not been particularly supportive for the euro, while AUD performance tends to be more mixed. It’s not a standalone signal, but it doesn’t contradict the bearish structure.

Technically, I’m watching the 1.724–1.732 resistance zone as the first potential reaction area on a pullback. Higher up, the 1.75–1.79 supply cluster would be a premium area to look for weakness. On the downside, my key references remain 1.69, then 1.67–1.68 demand, and in extension 1.64–1.65.

As long as price respects the bearish daily structure, I view retracements as opportunities, not reversals. This bias would only shift if the market reclaims and holds above 1.73, and especially above 1.75, where the structure would begin to change.

SOL - The $100 Level That MattersSOL is now retesting the $100 round number, a level that has acted as strong support for months. Every time SOL reached this zone in the past, buyers stepped in and defended it aggressively.

That makes this area critical.

📈If $100 holds, this level could once again act as a base for stabilization and a potential upside reaction.

📉But if $100 breaks, the picture changes entirely, and SOL risks entering a much deeper bearish phase into 2026.

Will history repeat itself… or will this support finally give way?

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

DCA Target Drag: Why You Don't Need a Full Recovery

One of the biggest misconceptions in trading is that if you buy an asset at $100 and it drops to $80, you need it to go back to $100 to break even. In a DCA (Dollar Cost Averaging) system, every Safety Order (SO) 'drags' your Take Profit (TP) target closer to the current price.

Using the OrangePulse LITE visual framework, we can see exactly how this works. By adding volume at lower levels, your average price drops significantly. The bot automatically recalculates the new TP line based on the updated average. This means a minor 5% relief bounce can exit a trade that is currently 15% in drawdown.

Conclusion: Success in DCA isn't about picking the bottom; it's about the speed of the target adjustment. Math > Predictions.

Why Traders Freeze Even With a Profitable StrategyOne of the most misunderstood challenges in trading is freezing under uncertainty. Many traders assume the problem comes from missing skills, weak discipline, or an incomplete strategy. In practice, freezing rarely originates from technical shortcomings. It emerges from how the human nervous system reacts when outcomes are uncertain.

Most traders who freeze are prepared. They have a defined system, tested rules, and a clear execution plan. The difficulty arises at the moment where a decision must be made without knowing the result. Preparedness and uncertainty tolerance are separate skills. One can exist without the other. Many traders know exactly what to do, yet struggle to act because the outcome cannot be guaranteed.

Freezing follows a predictable pattern. A trader builds a system, tests it, and recognizes valid setups in real time. When execution becomes necessary, hesitation appears. The hand pauses, the mind begins negotiating, and small delays feel justified. Waiting for more confirmation appears rational, but often reflects discomfort with uncertainty rather than patience. The trade moves without execution, followed by frustration rooted in inaction rather than loss.

Over time, freezing erodes execution consistency. Valid setups are skipped, entries become late, and price is chased instead of anticipated. Statistical performance becomes unreliable because execution no longer matches the system. Confidence weakens, not because the method fails, but because the trader fails to apply it consistently. This often leads to misplaced blame on market conditions, strategy selection, or external factors, while the underlying issue remains unresolved.

Under uncertainty, logic loses influence. Even when traders understand probabilities, risk distribution, and long-term expectancy, the nervous system responds as if uncertainty represents personal threat. Stress responses override analytical thinking. Decision-making shifts from structured execution to self-protection. This biological response persists unless explicitly trained for.

Habitual freezing changes behavior. Missed trades generate frustration, which leads to forced entries and impulsive decisions. The trader oscillates between inactivity and overreaction. Rules remain written but lose authority during live execution. Discipline appears intact externally, while internal decision-making is driven by fear and relief rather than process.

Progress begins when confidence is no longer treated as a prerequisite for action. Confidence develops after consistent execution, not before it. Trading becomes more manageable when framed as participation rather than control. Outcomes remain uncertain, but execution remains consistent. Each decision becomes a simple question of alignment with rules, independent of emotional state.

Practical improvement comes from shifting focus toward probabilities, cultivating curiosity instead of judgment, and building tolerance through repetition. Emotional stability develops through exposure, not motivation. Each executed trade reinforces functional behavior under uncertainty.

Markets continuously test a trader’s relationship with uncertainty. Progress depends on the ability to execute despite incomplete information. Some traders wait for certainty that never arrives. Others act according to plan and accept uncertainty as part of the process. Trading rewards consistency under uncertainty. Functioning within it is the skill that separates stalled progress from long-term development.

GBPAUD: 89% Retail Long + Daily Supply GBPAUD remains clearly bearish on the daily timeframe: we still have a clean LH/LL structure and steady selling pressure inside a well-defined descending channel. The latest bearish leg pushed price back into a key demand zone around 1.98–1.96. This area has produced technical bounces in the past, but it has never turned into a real trend reversal. That’s why the cleanest read right now is simple: bearish trend + sellable pullback, not a reversal. Price already reacted with a sharp spike, but as long as we stay below the 2.00–2.02 supply/imbalance, any upside move is simply a potential spot for trend sellers to step back in. My main scenario is a rebound into supply followed by short continuation, targeting liquidity below the lows: 1.9650 first, then 1.9500 if momentum expands. Invalidation is clear: only a sustained recovery above 2.02/2.03 with strong daily closes and follow-through would shift the bias.

On the COT side, I don’t see positioning supporting a sustainable GBP upside, and AUD strength isn’t showing the type of structural shift needed to justify a GBPAUD reversal. This reinforces the idea that most bounces are more likely exit liquidity than real bullish restarts. Seasonality in this phase tends to move in “bursts”: quick rebounds that fade once the market reprices relative strength and flows—perfectly aligned with a bounce → continuation setup. The final piece is retail sentiment: roughly 89% long on the cross. It’s not an entry trigger by itself, but in a bearish trend it often becomes the perfect fuel for the next leg down—because when retail is this crowded on the long side, it doesn’t take much to trigger stops, pressure, and acceleration.

Operational summary: below 2.02/2.03, GBPAUD remains a sell-on-rallies market. I want to see a clean pullback, rejection into supply, then a breakdown back toward the lows.

XAUUSD: Key Pullback Zones Before the Next Leg UpXAUUSD remains in a strong daily uptrend, trading inside a well-defined ascending channel. Price is holding around 4,700, near recent highs, and moving in a “stair-step” structure: impulse → controlled pullback, with no major structural breakdowns. This is typical of a healthy trend where liquidity gets absorbed and repositioned progressively.

In the short term, the most important level is the GAP/imbalance around 4.63k, acting as a natural magnet zone for a pullback. In a bullish environment, it’s common to see price retrace into that inefficiency to “fill” part of the move before continuation. The key concept is simple: the best long timing is not chasing highs, but waiting for a controlled retracement as long as price remains above demand.

Main Daily Demand Zones

4.42k–4.50k: primary pullback area, if it holds, it confirms a classic buy-the-dip continuation scenario.

4.00k–4.18k: deeper major demand, a test here would imply a broader reset and deeper mean reversion risk.

Momentum-wise, RSI remains trend-consistent: no clear structural reversal signal, but it highlights that buying “high” without a pullback increases the risk of poor timing.

From a macro positioning perspective, COT is clearly bullish:

Non-Commercials heavily net long (296k vs 45k short)

Commercials heavily net short (typical hedging behavior)

With Open Interest rising (527,455), the move looks supported by fresh participation, not just short covering.

Seasonality also supports the bullish bias: January is historically positive for gold, especially mid-to-late month. This works best as a probability filter, not an entry trigger.

Retail sentiment shows 59% short vs 41% long, which is a clean contrarian bullish signal: the crowd keeps trying to fade the trend, often fueling further upside spikes and extensions.

Primary bias: bullish continuation.

Scenario A (preferred): pullback into 4.63k–4.65k and/or 4.50k–4.42k → bullish reaction (rejection / engulfing / strong close) → continuation to new highs.

Scenario B: direct breakout continuation → more fragile structure, higher risk of fakeouts and a sharp drop back into the GAP.

Invalidation: daily breakdown below 4.42k with strong closes below support → potential mean reversion toward the lower demand zone.

EUR/USD | Bounce to 1.18 or Breakdown to 1.15?EURUSD is at a key inflection point: on the Daily chart the structure is still bearish (lower highs/lower lows inside a descending channel), but price has now reached a major demand/support zone with an ascending trendline coming in. This creates a high-probability “reaction area” where a corrective bounce can start. This is not a full reversal call: a long only makes sense with confirmation (base holding + higher lows + reclaim of the first key levels). Upside targets are 1.1695–1.1705 as the first magnet, then 1.1750, and finally 1.1800–1.1820 if price can reclaim and hold above resistance. If EURUSD fails to hold demand and closes below the base on the Daily, the long scenario is invalidated and bearish continuation opens toward 1.1570 and 1.1535.

COT: Non-Commercials are still net long EUR, but longs are decreasing and shorts are increasing (not a strong bullish signal), while USD Index positioning remains net short without aggressive expansion, so price confirmation is essential.

Seasonality for January is often mixed, typically favoring corrective moves over clean trends, meaning a bounce is possible but must be managed with discipline. FX sentiment is retail-short heavy (~57%), so a clean reclaim could trigger a short squeeze and accelerate into higher liquidity pools.

Trade idea: look for longs only with confirmation from demand, targeting 1.1700 → 1.1750 → 1.1800/1.1820; a break below the base invalidates the setup and shifts bias back bearish toward 1.1570/1.1535.

MUltibagger in making

After a downfall of 58% from it's high, Jindal Saw formed a base at around 153. After a sequential gains in Q3 results stock surges and gives a breakout at 176.

Jindal Saw is a manufacturing company focused on pipes mainly used for water, oil and gas, sewarage with a market cap of 11365 cr.

Financials are all good for the company,

PE : 10

ROE : 15%

Positive cashflow

Stock declines to a level of 177 after a breakout and now is the best time to buy this stock for a huge upside.

AUDCHF - Pullback Into Structure, Watching the ReactionAUDCHF remains overall bullish, trading cleanly inside the rising blue channel. After the recent push higher, price is now pulling back into a very interesting area.

We’re approaching the intersection of the demand zone and the lower blue trendline. This is exactly the kind of confluence I like to see in a trending market.

As long as this intersection holds and price respects the lower boundary of the channel, I’ll be looking for trend-following long setups, with confirmation coming from lower timeframes.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

1/20 - Pre-Market read and Game plan for the day. 1) Primary plan: Sell the retest (bearish continuation)

Bias stays short while below POI 1 (25,128) and especially below POI 2/PDL area.

A+ entry idea for today:

• Let price pop into POI 2 (25,096.5) or POI 1 (25,128)

• Wait for rejection (lower high, strong red candle, failure to hold above, wick + close back under)

• Targets (scale):

1. POI 3 (25,044.75)

2. POI 4 (25,021.25)

3. POI 5 FVG MID (25,002.5)

4. POI 6 (24,979.25)

• Invalidation: A clean reclaim + hold above POI 1, and especially if it starts accepting above 25,128 (don’t fight that).

Why this is clean: you’re using your POIs like “stairs” — sell at the top stair, take profit at the next stair down.

⸻

2) Secondary plan: Bounce scalp ONLY if a POI holds

If price sweeps into POI 5 / POI 6 and you get a hard rejection + reclaim (fast snap back), that’s your mean reversion scalp.

• Long scalp trigger: reclaim back above the POI you swept (ex: wick under 25,002.5 then closes back above it)

• Targets: back to POI 4 → POI 3 → POI 2

• Rule: if it accepts below the POI you’re trying to long, don’t average down — next stop becomes POI 6 / POI 8 zones.

⸻

3) Flip plan: Only get bullish above POI 1

If price reclaims POI 1 (25,128) and holds (not just wicks), then you can tell members:

• “Okay, bears failed — now we look for pullback longs into POI 1/POI 2 as support.”

• Upside “checkpoints”: 25,311 (NY PM High) then 25,430 (NY AM High / PDH)

⸻

Why you are NOT changing POIs from yesterday

1. POIs are HTF anchors, not feelings.

They’re built off prior session highs/lows, PDH/PDL, and liquidity/FVG zones. Those levels don’t change just because price is noisy.

2. POIs only change after “acceptance” or “mitigation.”

You adjust levels when price fully breaks + accepts (multiple closes through) or when the zone is clearly mitigated (used up and no longer reacting).

3. Consistency = tradable data for the community.

If you move POIs every morning, your members can’t build pattern recognition. Keeping them fixed lets everyone see the same reactions.

4. Your screenshots literally show POIs working.

Price is reacting around POI 1/2 and then stair-stepping lower — that’s exactly what POIs are for.

EUR/USD: Resistance Broken, Phase One CompletePhase one is complete: the local resistance at 1.1721–1.1736 has been broken. In addition to the 'Call Ladder' opened on January 14, several vertical Call Spreads hit the market this past Friday, just ahead of the rally. While a correction was technically overdue from a charting perspective, the timing of these entries suggests these players might be 'in the know.'

So, to answer the big question: is the Euro headed higher? Rather than guessing, I’ll be analyzing the exchange reports (which are currently glitching) and will provide an update shortly. If last week’s portfolios are being closed out, the sentiment will shift back toward a weaker Euro.

However, I suspect these positions are still being held. We’ll see what the data says.

Relying solely on charts to draw conclusions is definitely not my style — and I hope it isn’t yours either.

$MSTR counter trend bounce?NASDAQ:MSTR has finally broken out of it's bottoming structure and looks set for a counter trend rally.

If we can break above $200, then there's little resistance above.

I think the highest probability is that we see $263-272 before the bounce is over so that we fill the gaps left from the move down.

There's one gap at $205 and another at $258.

I think if btc can rally into $103k-112k, that MSTR will sharply follow to the upper resistance levels.

I do not think we'll break the upper blue trend line. Then I think we'll see continuation to the downside to one of the two lower $100 range targets.

Let's see how it plays out.

BULL – In My Top 10 Picks for 2026: Is Webull the Next HOOD?I’ve been following BULL (Webull) closely, and it’s firmly in my top 10 picks for 2026. Structurally, the story is very compelling.

Retail participation in financial markets continues to grow, and platforms that serve these investors—brokerages like Webull—are direct beneficiaries of this trend.

When I think about the trajectory, BULL reminds me a lot of our early calls on HOOD.

Robinhood currently trades at a market capitalization of roughly $97 billion. BULL, on the other hand, is valued at only around $4 billion.

That gap highlights the potential upside if Webull can continue to grow its user base and improve monetization.

The numbers alone are not the full story, of course. Financial results and execution matter, and Webull will need to prove that it can convert its growing user base into consistent revenue streams.

But structurally, the ingredients are there. As user monetization improves, I expect financial performance to start reflecting this, which could be a major catalyst for the stock.

The stock's 52-week range of $7.57 to $79.56 further fuels my bullish stance.

After dipping to its lows amid broader market volatility, BULL has shown resilience, trading around $8.16 as of mid-January 2026.

This setup strongly reminds me of our early HOOD call positions when the stock was trading around $9, back in its post-IPO correction phase. Robinhood eventually surged as retail trading boomed, and I anticipate a similar catalyst for Webull—perhaps through strategic partnerships, international expansion, or even acquisition interest in a consolidating industry.

In my view, BULL represents a rare combination of structural tailwinds, compelling valuation, and optionality. For those looking for a top pick for the year, it checks all the boxes.

The Trade That Changed Me ForeverThere was a trade years ago that worked perfectly.

Not because it was lucky.

Not because the market was easy.

But because I didn’t think.

Everything was already decided.

Structure was clear. Risk was defined.

I just executed.

And that moment stayed with me.

Think about driving.

The road changes.

Traffic changes.

Conditions are never the same.

Yet you don’t overthink every move.

You don’t debate the steering or the brakes.

You just drive.

Because repetition turned chaos into instinct.

That’s exactly what happened with my trading.

Flawless Execution Is the Turning Point

That trade taught me something simple:

Trading becomes profitable when execution becomes automatic.

When price reaches your level, there’s no conversation.

No hesitation... No emotion... No noise...

YOU. JUST. ACT.

I didn’t feel excitement.

I didn’t feel fear.

I felt calm.

When execution becomes second nature, trading stops being heavy, and starts flowing... Just like driving.

Question for you:

When did trading start to feel natural for you? or are you still forcing every decision?

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~ Richard Nasr

AUD/USD: Bull Trap Incoming?AUD/USD is showing clear signs of a slowdown in the bullish trend after December’s impulse, with price now consolidating below a key supply area and within a structure that is starting to lose momentum. On the daily chart, the market delivered a clean directional move, but the current phase is typical of a context where institutional players begin to distribute gradually, while retail traders tend to enter late, chasing the trend. This makes the current zone a major decision area: either price breaks higher and accelerates, or it triggers a bearish rotation into the demand blocks below.

From a technical standpoint, price action highlights a recent top in the 0.6740–0.6760 area, followed by an immediate rejection and pullback. At the moment, AUD/USD is trading within a balance zone between 0.6660–0.6685, which acts as a “holding” range where the market could attempt one last recovery before a potential breakdown. The key point is that the structure is becoming increasingly fragile: bounces are less explosive and price is no longer printing progressive highs with the same efficiency.

The most attractive probabilistic scenario is tied to a bearish rotation: a clean breakdown below the 0.6660 level would significantly increase the odds of a move into the first intermediate demand zone around 0.6600–0.6620, with a potential extension toward the deeper demand block between 0.6450–0.6520 (the area where the market previously accumulated before the bullish impulse). This lower zone represents the natural “magnet” if distribution completes, as it aligns with liquidity and a prior rebalancing area within the trend.

Daily RSI is also losing strength and normalizing, consistent with a market shifting from an impulsive phase into a corrective one. In this type of environment, the most dangerous moves are “W-shaped” patterns or sharp spikes above recent highs, as they often serve to grab liquidity before reversing aggressively. For this reason, the 0.6740–0.6760 range remains the ideal zone to monitor for a potential fake breakout, followed by a drop back below 0.6700 as a weakness trigger.

Looking at the COT report, Australian Dollar positioning shows Non-Commercial traders still net short (short exposure higher than long exposure). Meanwhile, the Dollar Index also shows a speculative component leaning short, but with dynamics that require caution: if USD finds macro support, even for a technical rebound, AUD/USD would automatically become vulnerable. The key takeaway is that we do not have a “clean bullish” positioning backdrop for AUD, making an extended rally less sustainable without a fresh accumulation phase.

From an FX sentiment perspective, the signal is extremely clear: the majority of traders are short AUD/USD (87%), with only 13% long. This matters because, from a contrarian angle, it could still fuel one final upside push via a short squeeze. However, when price is trading below supply and fails to progress, such an extreme sentiment imbalance can also act as a trap signal: if the market breaks lower, many shorts already in position may take profits too early, while late longs get liquidated, accelerating the downside move.

Finally, seasonality on AUD/USD suggests that January is often not a linear month: the market frequently experiences rotation and rebalancing phases after year-end trends. This fits perfectly with the idea of a mean reversion / pullback phase before any potential new directional cycle.

Operational conclusion: as long as AUD/USD remains below 0.6740–0.6760, the bias stays for a controlled correction, with downside acceleration risk below 0.6660. My focus is on a distribution pattern followed by a rotation toward 0.6600 and then 0.6450–0.6520, while keeping the alternative scenario open for one last bullish liquidity grab before the real move unfolds.

CADJPY – Bullish Structure IntactOn the CADJPY daily chart, price is trading within a well-defined bullish structure, characterized by higher highs and higher lows and supported by an ascending dynamic trendline. Following the impulsive move into the 114.50–115.00 area, the market is currently undergoing a consolidation phase below a daily supply zone, with compressed highs and a short-term loss of momentum. This price behavior is consistent with a technical pause rather than a structural reversal, especially considering that the lower demand areas between 112.50–111.00 remain clean, well-defended, and aligned with previous breakout levels.

From a COT perspective, the outlook remains constructive for CADJPY. On the CAD side, Commercials are showing a renewed increase in net long exposure, while JPY positioning continues to reflect structural weakness, leaving the market exposed to further carry-driven flows. January seasonality reinforces this setup: historically, the Japanese yen tends to underperform during this month, while the Canadian dollar shows relative stability, creating a favorable backdrop for a bullish continuation after potential pullbacks.

On the FX sentiment side, retail positioning is heavily skewed to the short side (above 70%), providing a clear contrarian signal. The majority of market participants remain positioned against the prevailing trend, increasing the probability of continuation once weak hands are flushed out.

In summary, CADJPY remains medium-term bullish, with a preference for long exposure on pullbacks into daily demand. Only a decisive and confirmed break below 111.00 would invalidate the constructive scenario and require a reassessment of the directional bias.