Stock Market Trap: Why Your Stop Loss is Just a Pie CrustIn the global theater of financial markets, many retail traders feel like protagonists in a psychological thriller. You identify a pristine support level, set your stop loss with surgical precision, and wait.

Suddenly, a violent candle "hunts" your level, triggers your exit, and—as if by magic—the market reverses and rallies in your original direction.

You feel watched. You feel targeted by "Operators."

This is not a conspiracy; it is the Sovereign Reality of Liquidity.

1. The Institutional Paradox: The "Big Fish" Problem

To understand why you are being hunted, you must understand the Inertia of Size.

Imagine a massive Institution (FII) attempting to deploy huge capital. They are like a Blue Whale in a shallow pond.

The Constraint: If they execute a market order, they will exhaust all available sellers and drive the price up against themselves (Slippage).

The Requirement: To enter a massive LONG position without slippage, they require an equally massive pool of Sell Orders at a specific price.

The Trap:

Your Stop Loss (on a Long position) is technically a Sell Market Order.

When thousands of retail traders place their stops at a predictable level, they create a Liquidity Cluster.

The Big Players don’t "see" your account; they see a concentrated pool of liquidity. They utilize algorithmic precision to drive price into that pool, "harvesting" your sell orders to fill their massive buy orders at a wholesale price.

2. The Analogy: The Fragile Crust

Think of Market Structure like a Pie or Samosa.

The "Support Level" is the golden, crispy crust. It appears solid.

But for the Smart Money, the crust is merely an obstacle to the filling (The Liquidity) inside.

They must break the crust (trigger the stops) to access the liquidity that fuels their move. Once the crust is shattered and the liquidity is absorbed, the shell is discarded, and the market rallies.

3. Engineering Your Edge

To evolve from "Retail Prey" to "Institutional Aligned," you must stop trading the lines and start trading the volume.

A. The Ceiling (High Volume Node) When price approaches a massive volume shelf from below, do not buy the breakout immediately. The trapped buyers from the past will sell to exit at breakeven. This is often a Shorting Zone.

B. The Floor (Liquidity Trap) When price drops into a historical volume cluster, do not panic sell.

The Professional Reaction: Wait for the "Crust" break (a dip below the level to hunt stops).

The Trigger: Watch for a strong 1-hour candle close back ABOVE the level. This is the Swing Failure Pattern (SFP).

🏛 Case Study: Nifty 50 Index

(Please refer to the chart image above)

We can see this mechanic playing out live on the Nifty 50:

The Operator's Fortress: Note the massive Volume Shelf (HVN) at the top. This acts as a supply zone.

The Psychological Level (25,000): This is a round number where most retail stops are hiding.

The Plan: We do not blind buy 25,000. We wait for the "Stop Hunt" into the 24,900 zone, followed by a sharp reclamation. That is the Institutional Entry.

💻 BONUS: The "Wick Detector" Script (Free)

I have written a custom Pine Script tool for the TradeX Guru community. This tool automatically highlights candles that "break the crust" (long lower wicks) and reject price.

@version=6

indicator("Wick Detector", overlay=true)

// Calculate the size of the lower wick relative to the body

wickRatio = (math.min(open, close) - low) / (high - low)

// Identify if the lower wick is > 50% of the candle (The Liquidity Grab)

isLiquidityGrab = wickRatio > 0.50

plotshape(isLiquidityGrab, title="Grab", location=location.belowbar, color=color.teal, style=shape.diamond)

// —————————————————————————————————————————————————————————————————————————————

// BRAND MARK

// —————————————————————————————————————————————————————————————————————————————

var table wMark = table.new(position.top_center, 1, 1)

if barstate.islast

table.cell(wMark, 0, 0, "TradeX Guru", text_color=color.new(#f5a733, 20), text_size=size.huge)

The Math: It measures the lower wick (the tail) of every candle.

The Trigger: If the lower wick is larger than 50% of the total candle size, it prints a Teal Diamond (💎) below that candle.

How to Learn Trade With It (The Strategy)

Do not buy every diamond you see. Use this 3-step filter:

Step 1: Check the Location (Context) Only look at the Diamond if it appears at a Key Level:

Is price at a strong Support zone?

Is price near a round number (like 25,000 on Nifty)?

If a diamond appears in the middle of nowhere, ignore it.

Step 2: The Signal

Wait for the candle with the Teal Diamond to close.

This confirms the "Stop Hunt" is finished. The "Whale" has absorbed the sellers.

Step 3: The Entry & Stop Loss

Entry: Buy on the next candle if it stays above the diamond candle's low.

Stop Loss: Place your SL just below the Low of the diamond candle. (If price breaks this low, the setup failed).

The Meaning: A long lower wick means sellers tried to push the price down (breaking the crust), but buyers aggressively pushed it back up. This is a classic Liquidity Grab.

The Axiom: The market is not a charitable organization. It is an efficiency engine designed to transfer capital from the Impatient to the Disciplined.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trading involves significant risk.

Supportandresistances

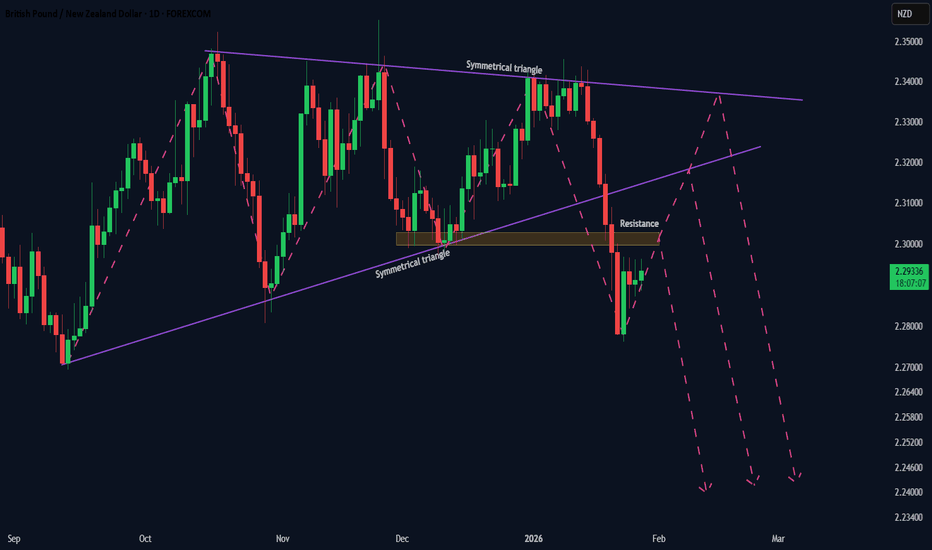

Market Pressure (Part 1) | Symmetrical Triangle BreakdownPrice previously developed inside a clear symmetrical triangle on the Daily chart, representing a prolonged phase of balance between buyers and sellers.

That balance was resolved to the downside with a decisive breakdown, signaling that selling pressure has taken control .

Price is now in a pullback phase , which is a natural behavior after a strong directional expansion.

This is not a prediction — it is an observation of how market pressure interacts with structure after imbalance .

📉 Scenario Observations – Pullback Within Bearish Pressure

Possible pullback paths while bearish pressure remains dominant:

• pullback into prior resistance , then continuation lower

• pullback toward the ascending trendline , followed by rejection

• deeper pullback toward the descending triangle trendline , then continuation lower

All three scenarios reflect corrective movement within a bearish pressure environment .

⚠️ Pressure Reassessment

If price breaks and sustains above the descending trendline , bearish pressure becomes less evident and the structure requires reassessment.

🧠 Key Insight

Markets move from balance → imbalance → correction.

Pressure, not patterns, determines continuation.

⚠️ Educational & Analytical Use Only

This analysis is shared strictly for educational and analytical purposes.

No financial advice, trade signals, or guarantees are provided.

All decisions remain the sole responsibility of the reader and should align with their own ethical, legal, and religious principles.

Crypto Total Market Cap HTF UpdatePrice is still ranging after a strong sell-off and trading below HTF supply.

Key observations:

Price is reacting inside a bearish order block

Range high sits around 3.18–3.22T

A push into 3.22T would likely be a buy-side liquidity grab

Many shorts are positioned below this level

No HTF acceptance above supply yet

My bias remains bearish

As long as price stays below 3.22–3.25T, downside remains likely

Any move into 3.22T without acceptance is fake breakout risk

Mid-range remains a no trade zone

If you have any questions or feedback, feel free to drop them in the comments.

Disclaimer: This is not financial advice. Just sharing my personal market view.

MrC

GBPUSD Brewing a Latte: Cup & Handle Special EditionWelcome to Market Prophecy..

The recent weekly decline in GBPUSD occurred because the price failed to break above the 1.37476 resistance level (marked in yellow) and dropped to 1.30375. If the price does not break below the 1.30375 daily support level, there is a strong likelihood that it will rebound and attempt to test the nearest resistance at 1.35639. Based on the projection I’ve drawn, there is a high probability that the price will form a cup-and-handle pattern on the weekly chart. Don’t miss the opportunity for a potential swing buy.

Good luck, everyone! And hey, don’t forget to smash that like button and drop your wildest market predictions in the comments! ❤️

Disclaimer: My trading strategy isn’t a signal—it’s more like a workout for my brain. I’m just here flexing my market structure knowledge and sharpening my trading skills while building my trade journal. Think of it as financial gym time—no personal trainers, just candlesticks!

HOW-TO: Analyze Support, Resistance & Short-Term DirectionHOW-TO: Analyze Support, Resistance & Short-Term Direction Using Volume Scope Pro (1H Example)

Introduction

This HOW-TO explains how to use the Volume Scope Pro — Order Flow Volume Analysis indicator to identify support and resistance, interpret order-flow signals such as absorption and distribution, evaluate buyer/seller strength, and determine a short-term market bias on the 1-hour timeframe.

1 — Chart Settings & Data Inputs

• Main timeframe: 1H

• LTF (Low-Timeframe data): 15-second volume blocks

• LTF coverage: ~115 bars

• Instrument: MES1! (CME Micro E-mini S&P 500)

This setup provides a high-resolution view of order flow behind each hourly candle by aggregating ultra-low timeframe volume behavior.

2 — Buy & Sell Volume Behavior

BUY Side:

• Buy Current Amount ≈ 18.539K

• 20-period Buy Average ≈ 54.044K

→ Buyers are significantly below their normal activity level.

→ Interpretation: Buyers are NOT supporting current price levels.

SELL Side:

• Sell Current Amount ≈ 17.073K

• 20-period Sell Average ≈ 50.857K

→ Sellers are also below average, but buyer weakness is far more pronounced.

Summary:

In higher timeframes like 1H, lack of buyer activity is often more important than strong selling. Here, buyers are too weak to create a sustained bottom.

3 — Trend Angle Convergence & Divergence (Trend θ)

BUY:

• Price vs Buy Volume (3 and 20 periods) = Divergent

→ Price attempts to hold or bounce are NOT backed by buyer aggression.

SELL:

• Price vs Sell Volume (3-period) = Convergent

→ Short-term movement is driven by sellers, strengthening the bearish bias.

4 — Delta Analysis

• Current Delta ≈ +1.46K

• Global Delta (100 candles):

– Positive Δ Sum ≈ 273.812K

– Negative Δ Sum ≈ 225.671K

Interpretation:

Although short-term delta is positive and long-term delta slightly favors buyers, the price structure does NOT reflect bullish dominance.

This type of delta behavior often indicates absorption rather than a trend shift — meaning buyers are active but ineffective at moving price.

5 — Support & Resistance Zones (SR Engine)

Volume Scope Pro identifies two main zones:

• Resistance Zone: 6880.75 ~ 6885.25

• Support Zone: 6707.75 ~ 6766.75

Current Position:

Price is holding inside the upper boundary of the Support Zone.

There was a minor bounce, but the reaction lacked strength and failed to break structural highs.

6 — Order-Flow Overlay Signals (OB / Distribution / Absorption)

• Multiple OB and Distribution labels appear near upper structure → clear signs of supply, selling pressure, and exhaustion at highs.

• OS and ABS signals at support did not result in meaningful continuation → weak follow-through from buyers.

Combined with weak buy volume, the market shows bearish intent.

7 — Short-Term Projection

Given:

✓ Weak buy volume compared to averages

✓ Sellers showing short-term dominance

✓ Converging sell-side angles

✓ Price reacting weakly to support

✓ Strong supply clusters above

✓ Delta showing ineffective buying

→ Short-term bearish continuation is the more probable scenario.

As shown on the chart, the Short Position tool highlights:

• Entry around the upper support boundary

• Stop above the minor pullback high

• Target near the lower support boundary

This forms a clear, structured bearish setup with defined R:R.

Disclaimer

This publication is for educational purposes only. Volume Scope Pro does not guarantee profit or certainty of market direction. Traders must perform independent risk management and verification at all times.

GOLD (XAU/USD) – 30M: Sideways Consolidation Ahead? Key Levels &Hello traders,

Looking at the 30-minute chart of Gold, I’m seeing strong signs that price is entering a sideways consolidation phase — potentially setting up for a breakout later, but for now, expect range-bound action.

🔹 Pattern Breakdown:

We’re inside a descending triangle / wedge structure formed by points X → A → B → C → D.

The lower trendline (blue) is holding as support, while the upper trendline (red) is acting as resistance.

Recent price action from C to D shows diminishing momentum — classic sign of exhaustion before consolidation.

🔹 Key Clues Supporting Sideways Movement:

✅ Volume Drying Up: Notice how volume has decreased after the spike at point C — this often precedes consolidation.

✅ Price Rejection at Resistance: Multiple tests near $3,780–$3,790 (marked “Weak High”) failed to break higher — suggesting sellers are active.

✅ LuxAlgo Indicator Neutral: The Smart Money Concepts indicator shows mixed signals — no clear bullish/bearish bias yet.

✅ Horizontal Zones Strong: Price is respecting key horizontal levels — $3,720 (strong support), $3,780 (resistance). This reinforces range behavior.

🎯 What to Expect:

Short-term (next 24–48 hrs): Range-bound between $3,720 – $3,780.

Breakout Trigger: Watch for a close above $3,790 (bullish) or below $3,715 (bearish).

Target if Breakout Occurs:

Bullish: $3,850+ (next major resistance)

Bearish: $3,680 (previous swing low)

⚠️ Risk Management:

If trading the range: Buy near $3,720, sell near $3,780.

Stop loss: Below $3,710 (for longs) or above $3,790 (for shorts).

Avoid chasing breakouts until confirmed with volume + candlestick confirmation (e.g., engulfing bar).

📌 Pro Tip: Use this consolidation to re-evaluate your position. Is your stop-loss tight? Are you over-leveraged? Sideways markets are perfect for adjusting strategy without emotional decisions.

Let me know — are you expecting a breakout soon, or do you think Gold will chop sideways for days?

#Gold #XAUUSD #SidewaysMarket #RangeBound #TechnicalAnalysis #TradingView #ChartPatterns #GoldTrading #Consolidation #SupportAndResistance #LuxAlgo #Forex #Commodities #30MinuteChart #MarketAnalysis

✅ Bonus Tips for Posting:

Add your username: @raheel007khan at top or bottom.

Use emojis sparingly (like 📉 ✅ ⚠️) to highlight key sections.

Ask a question at the end to boost engagement (“What’s your take?”).

This version gives clarity, context, and actionable insight — exactly what TradingView users look for. Let me know if you want to tailor it for swing traders, scalpers, or longer-term investors!

💬 “The market doesn’t always move — sometimes it breathes. And that’s when smart traders prepare.”

Bitcoin (BTC/USD) Rising Wedge BreakdownMarket Structure & Analysis:

Rising Wedge Formation: Price has been moving within a rising wedge pattern, which is typically a bearish reversal pattern.

Bearish Breakdown Expected: BTC is testing the lower boundary of the wedge, indicating a potential breakdown.

Resistance Zone:

$89,649 – Key resistance level preventing further upside.

$88,336 – Local resistance that price failed to sustain above.

Support Levels:

$86,852 - $85,335 – Intermediate support range.

$80,402 – Main target for a bearish move.

$76,725 – Secondary support in case of further decline.

Trading Plan:

Sell Setup:

Wait for confirmation of a breakdown below the wedge.

Enter short if price closes below $86,852 with volume confirmation.

Stop Loss: Above $88,336 to avoid false breakouts.

Take Profit Targets:

TP1: $84,474 (first support level).

TP2: $80,402 (main target).

TP3: $76,725 (extended bearish target).

Risk Factors:

If BTC finds strong support at $86,852, a bounce could invalidate the bearish setup.

Macro events (ETF approvals, institutional buy-ins, Fed rate decisions) may impact price action.

Gold (XAU/USD) Bullish Retest SetupMarket Structure & Analysis:

Uptrend Confirmation: Price has been in a strong bullish trend, forming higher highs and higher lows.

Resistance & Retest: The price recently hit a resistance zone around $3,054 and pulled back for a retest.

Support Zone: A key support level is marked at $3,010, which has held multiple times.

Bullish Retest Setup: If the price successfully retests this support level and confirms bullish momentum, we can anticipate a potential move toward the next resistance level.

Target Levels:

First Target: $3,054 (recent high)

Final Target: $3,089 (next major resistance)

Trading Plan:

Buy Setup: Enter after confirmation of bullish price action at the support level ($3,010).

Stop Loss: Below $3,010 to avoid false breakouts.

Take Profit:

TP1: $3,054

TP2: $3,089

Risk Factors:

If the support at $3,010 breaks, price may drop toward the next major support at $2,911, invalidating the bullish setup.

Economic events (such as FOMC meetings, CPI data, or geopolitical risks) may cause unexpected volatility in gold prices.

(XAU/USD) Forming a Bearish Reversal–Key Short Setup Unfolding!Chart Pattern: Head and Shoulders Formation

The chart shows a potential Head and Shoulders pattern, which is a bearish reversal setup. The head is the highest peak, while the two shoulders form lower highs on both sides. The price has already broken below the neckline, indicating a sell opportunity.

Key Levels:

Resistance Levels:

$3,055.29 – Major resistance

$3,046.10 – Key level near recent highs

$3,030.58 – Short-term resistance where price is currently retesting

Support Levels (Potential Targets):

$2,981.18 – First support level

$2,939.81 - $2,931.99 – Strong demand zone

$2,881.49 – Major support level

Trade Setup:

Entry:

The price has broken below the neckline and is currently retesting the breakdown zone (~$3,030.58).

If the retest holds, it confirms a sell entry opportunity.

Target:

First target near $2,981.18

Second target around $2,939.81 - $2,931.99

Final target at $2,881.49 for a deeper correction

Stop-Loss:

A stop-loss above $3,046.10 to minimize risk

Market Sentiment:

The break below the neckline and a possible rejection at the retest area suggest further downside potential.

If buyers push the price above $3,046.10, the bearish outlook would be invalidated.

This setup presents a high-probability short trade if confirmation follows through after the retest. Traders should monitor price action around the retest zone before entering a position. 🚨📉

Gold (XAU/USD) Bearish Reversal – Potential Sell SetupAnalysis Overview

The 4-hour chart of Gold (XAU/USD) shows a possible head formation, indicating a potential trend reversal. The price has faced resistance near the 3,053 level, leading to a rejection. The current price action suggests a bearish movement, with a possible downside target at the support zones marked in the chart.

Key Levels:

📍 Resistance: 3,053

📍 Current Price: 3,030

📍 Target Levels: 2,978 / 2,962 / 2,931

📍 Major Support: 2,881

Trading Plan

🔴 Sell Entry: Below 3,030

🎯 Target: 2,978 / 2,962 (Short-Term), 2,931 / 2,881 (Extended)

🛑 Stop Loss: Above 3,053

Technical Outlook

The market structure suggests a potential breakdown.

Confirmation will be needed through further bearish momentum.

Traders should watch for rejection candles or breakdown from key levels.

📊 What’s Your Take on Gold? Will it hit the lower support levels? Let me know in the comments! 👇

Gold/EUR (XAU/EUR) – Bearish Reversal Zone IdentifiedThis Gold to Euro (XAU/EUR) 4-hour chart shows a breakout from a descending channel, followed by a strong bullish rally. The price has now reached a key resistance zone, where sellers might step in to push prices lower.

Key Observations:

Downtrend Channel Breakout: The price was previously moving in a downward sloping channel but has now broken out, signaling bullish momentum.

Resistance Zone: The price is currently testing a significant resistance level, indicated by the marked "Sell" area.

Potential Reversal: If selling pressure increases at this resistance, we could see a price decline toward the identified target support zones.

Key Support Levels:

First Target Zone: Around 2,750 EUR

Second Target Zone: Near 2,675 EUR

Trading Plan:

Sell Setup: Look for bearish confirmation (such as rejection wicks or a lower high formation) before entering a short position.

Stop Loss: Above the resistance zone to avoid false breakouts.

Take Profit: Based on the highlighted support areas.

If bulls continue pushing beyond resistance, it could invalidate the sell setup, leading to further upside movement. Traders should monitor price action closely for confirmation.

Gold (XAU/USD) on a 4-hour timeframe, showing a potential short Chart Analysis:

Current Price: $3,039.93

Resistance Level: $3,055.47 (marked as a key level where a sell opportunity is identified).

Target Level: $3,000.73 (suggested as the take-profit area).

Support Zone: Highlighted around $2,900.

Trading Idea:

The price is in an uptrend, but a potential reversal is expected at the $3,055.47 resistance level.

If the price fails to break above this resistance, a short position could be considered.

Entry Strategy: Sell near $3,055.47 upon confirmation of rejection.

Target: A drop towards $3,000.73.

Stop Loss: Above the resistance zone to manage risk.

Conclusion:

This is a counter-trend short setup, aiming for a pullback within the broader bullish trend. Traders should monitor price action near resistance before entering a trade.

Last Time XRPUSD Will Be Under $1! Raise the "Flags"!BITSTAMP:XRPUSD - Bull Flag Prediction

Based on lack of Volume and price falling into a Descending Channel.

The suspected Flagpole from the Low @ .4860 before the Rally to the current High @ 1.26541, suggest a potential 160% increase in price once a Bullish Break confirms the Bull Flag!

First, Price will make a Retracement to the 38.2% Fibonacci Level, testing the July 2023 Highs and the Support of the Descending Channel around .94 - .92 cents.

Added confluence is the Retracement would also be testing the 200 EMA since the appearance of Golden Cross across all Timeframes!

This could be the Last Time BITSTAMP:XRPUSD sees below $1!!

Rallies come in waves, if you missed the first, don't miss this one!!

“The Nasdaq Index Extends Losses”In the U.S., the JOLTS job openings decreased by 237,000 in July compared to the previous month, dropping to 7.673 million. This marks the lowest level since January 2021. Following this data, expectations have increased that the Federal Reserve (Fed) could reduce the policy rate by a total of 125 basis points across its three remaining meetings this year. Additionally, the likelihood of a 50 basis point rate cut at the Fed’s September meeting has risen to 45%.

The release of U.S. macroeconomic data, which has triggered recession concerns, has led to increased selling pressure on the indices.

Technically, the Nasdaq index, which has retreated to the 18,780 level, could experience further selling pressure, potentially reaching the support levels of 18,450 and 17,900. In the event of a potential buying movement, if we see a close above the 18,900 level, the upward trend could extend to the resistance levels of 19,520 and 19,970.

Sideways Movement with Trade OpportunitiesEURUSD is exhibiting a sideways movement on the weekly chart.

Here are two potential trade opportunities:

1. Buying Opportunity:

- Wait for a retest of support at 1.0847 for a potential buying opportunity.

2. Shorting Opportunity:

- Look for a shorting opportunity on the Bearish Shark Pattern at 1.0893.

What's your preferred trade plan for EURUSD?

Bearish Bat Confirmed, Shorting Opportunites AheadUSDJPY's Weekly chart confirms the presence of a Bearish Fib-3 Bat Pattern, signaling a potential trading opportunity.

One approach to engage this trade involves patience, waiting for a break and close below 146.66 on the 1-hourly chart.

Upon confirmation, I plan to enter the trade, anticipating a significant pullback or a setup aligning with the bearish pattern.

What are your thoughts or trade plans for USDJPY?

Share your insights or strategies below!

Bullish Momentum in Focus!Trading on the Euro Yen has been on a bullish trend, with some market consolidation due to the over-extended movement. To take advantage of this trend, we recommend buying at support and selling at resistance, which can potentially produce a profit potential of 170pips on the 4-hourly chart.

On the daily chart, we have just broken the very aggressive and trending bullish trend line, but there are other trend lines that can offer a buying opportunity. However, we suggest waiting for a selling opportunity at 158.49 and a buying opportunity at 156.79 on the 4-hour chart, where there is a precise entry point for a bullish run.

With an initial stop-loss at 156.33 and the first target at 157.35, this trade can be engaged on the 1-hourly chart at 156.82. It is important to note that this is not trading advice, and investors should do their own analysis and not follow blindly.

Bulls and Bears in the SpotEver wondered about the intricate tango between bulls and bears in the trading world? 🕺💃 Let's take a peek at the Euro-dollar's current moves on the weekly chart.

While the bullish trend has held its ground, recent weeks have seen the bears making their mark. But, there's a key level – 1.0637 – that holds the secret to shifting the scene. A break below this level could paint a different picture, turning a stronger bull into a weaker one.

Zooming into the daily chart, it's clear that the market is in a delicate balance. A breach below 1.0637 could mark the transition from bullish to bearish.

But it's not just black and white – both the four-hour and one-hour charts show their own stories of bearish movement. 📉📊

In this thrilling scenario, we have two trader groups with differing opinions. This is where the magic happens.

Both buyers and sellers can potentially rake in profits, timing their entries and exits just right.

Aggressive traders might pounce on a shorting opportunity with higher timeframe confirmation, while the conservative ones seek more clues before engaging.

Ready to dive into this intriguing trading universe?

Now, let's return to our weekly chart adventure. The trend line might have been crossed, but the true test lies in 1.0637.

For those braving the bearish waters, a retest at the trend line could be your golden ticket. 🎫🐻

But hey, you can always set your trend line alerts, adapting to your strategy.

If buying is your game, keep an eye on 1.0737 for a possible retest opportunity. On the four-hour chart, our aggressive traders spot a chance in the retest of the trend line.

Stay within those lines, and the shorting opportunity might be just around the corner. And for the one-hour chart enthusiasts, the red and blue lines reveal a potential 40 pips journey.

Got more to discuss? Want to crack the code of profitable trading in just 15 minutes a day? 🕰️

GBPUSD at the crossroads.On the weekly timeframe, OANDA:GBPUSD has come back down to previous resistance turned support AND the line of an uptrend. What do we think? Personally, I am short. Last week's indecision candle was met with higher than normal volume followed by a continued selloff. A break below could mean big red soon.

BTC 1H Review Short-Term!Hello everyone, I invite you to check the current situation on BTC in pair to USDT, taking into account the interval of one hour. First of all, we will use the blue lines to mark the uptrend channel, from which the price exited at the bottom and entered the downtrend channel formations. What's more, very often the exit from the channel is close to the size of the channel, in this situation we can see the price drop to around $28236.

In order to determine the support places for the BTC price, we will use the Trend Based Fib Extension tool, and here we see that the first support is at the price of $ 28973, then we can define the support zone of $ 28,528 to $ 28,171, but when the price breaks out of this zone, further we have very strong support at $27815 followed by $27305.

Looking the other way, we can determine the places of resistance in a similar way. First, we will mark the resistance zone from $29734 to $30009, when we break it we have resistance at $30277, then resistance at $30690, then very strong resistance at $31175.

The CHOP index indicates that the collected energy is used for a local price increase, the RSI indicates a significant increase with room for the price to go higher, but on the STOCH indicator we can see that we have exceeded the upper limit, which may affect the slowdown of the price increase and even return to correction.