EURAUD Will Go Up From Support! Long!

Please, check our technical outlook for EURAUD.

Time Frame: 4h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 1.732.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 1.737 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Like and subscribe and comment my ideas if you enjoy them!

Swing

SILVER Is Going Down! Sell!

Here is our detailed technical review for SILVER.

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 9,339.2.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 8,461.1 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

EURJPY Will Fall! Short!

Take a look at our analysis for EURJPY.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 183.710.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 182.882 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Like and subscribe and comment my ideas if you enjoy them!

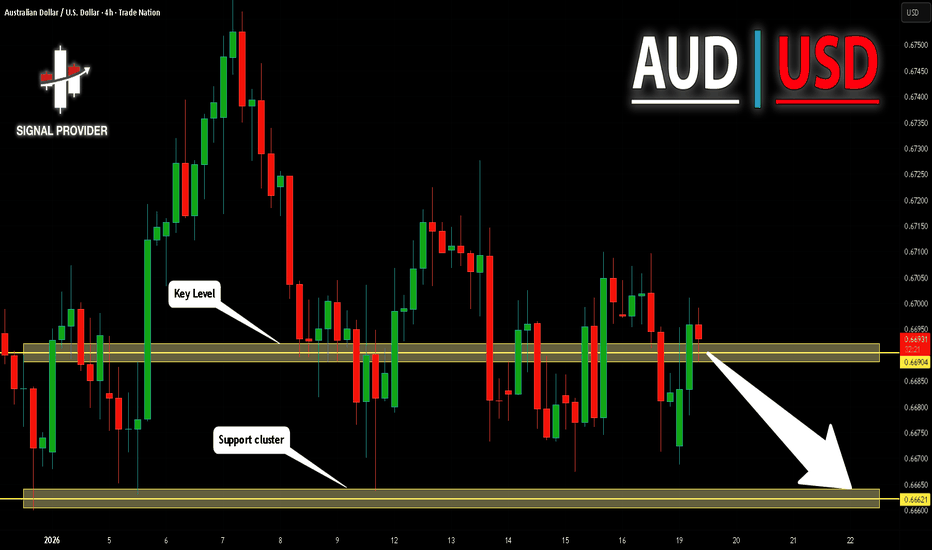

AUDUSD Will Go Lower From Resistance! Sell!

Please, check our technical outlook for AUDUSD.

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 0.669.

The above observations make me that the market will inevitably achieve 0.666 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Like and subscribe and comment my ideas if you enjoy them!

USDJPY Will Go Lower! Short!

Here is our detailed technical review for USDJPY.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 158.007.

Taking into consideration the structure & trend analysis, I believe that the market will reach 157.485 level soon.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Like and subscribe and comment my ideas if you enjoy them!

Potential 5X on GBPUSDAs Positioned on the Chart

I'm looking to take advantage of a short Intraday Pullback on the GBPUSD Buy Impulse, an added position to the earlier entry, to see Price down to Discount @ 1.3219 and Potentially for a long swing to 1.2786 if the market Unfolds to being Bearish.

Apply proper Risk

Patience is the ! Ieios

USOIL Will Go Down! Sell!

Take a look at our analysis for USOIL.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 59.397.

Considering the today's price action, probabilities will be high to see a movement to 57.080.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

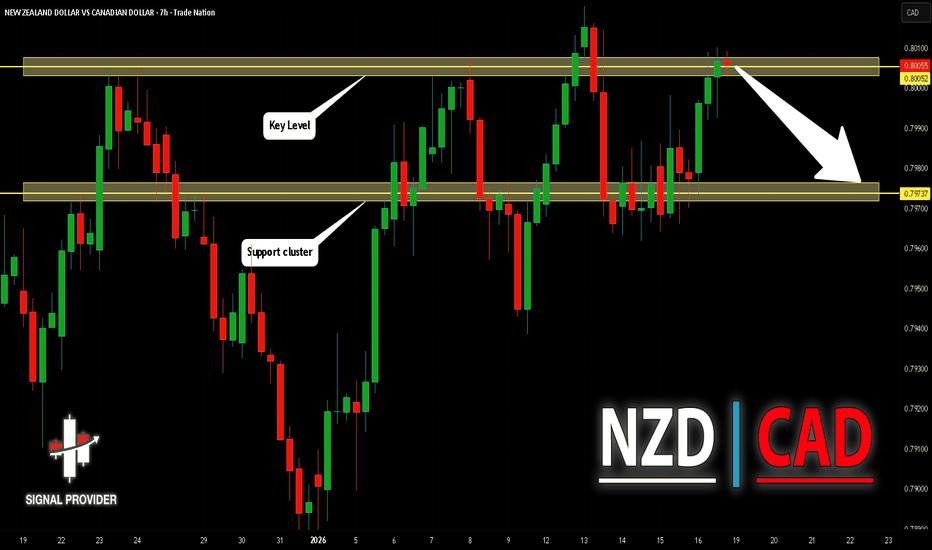

NZDCAD Is Very Bearish! Short!

Take a look at our analysis for NZDCAD.

Time Frame: 7h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 0.800.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 0.797 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Like and subscribe and comment my ideas if you enjoy them!

AUDCAD Is Going Down! Sell!

Please, check our technical outlook for AUDCAD.

Time Frame: 7h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 0.930.

The above observations make me that the market will inevitably achieve 0.925 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

USOIL Is Going Down! Short!

Please, check our technical outlook for USOIL.

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 61.732.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 59.230 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Like and subscribe and comment my ideas if you enjoy them!

GOLD Will Move Lower! Sell!

Please, check our technical outlook for GOLD.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 4,607.34.

The above observations make me that the market will inevitably achieve 4,577.45 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Like and subscribe and comment my ideas if you enjoy them!

BITCOIN Will Go Higher From Support! Buy!

Take a look at our analysis for BITCOIN.

Time Frame: 1h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 94,951.39.

Considering the today's price action, probabilities will be high to see a movement to 96,189.10.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Like and subscribe and comment my ideas if you enjoy them!

HPQ | Wrong Memories, Right Support & P/E IS DANG LOWNYSE:HPQ

Remember the good ol' days?

Cornucopias on your tightie whities label...

Beren stein Bears...

A shiny new HP desktop delivered in a cow-patterned box...

WRONGGGGGGGGGGGGGGG

There never was a cornucopia on your fruit of the loom undies.

It is and always was the Beren STAIN Bears.

It was Gateway that delivered their product in cow-patterned boxes .

Stop living in the past. I have no idea what HP even does anymore. Stock looks like it's coming into some potential support. P/E is at 7.94.

Front-running with a small starter position. Add range? It's orbiting $18.60ish...

I'm not a financial advisor. I JUST LIEK THE STOCK.

THANK YOU FOR YOUR ATTENTION TO THIS MATTER

GBPCHF Will Go Lower! Short!

Here is our detailed technical review for GBPCHF.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 1.074.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 1.073 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

EURJPY Will Go Up! Buy!

Take a look at our analysis for EURJPY.

Time Frame: 1h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The price is testing a key support 184.271.

Current market trend & oversold RSI makes me think that buyers will push the price. I will anticipate a bullish movement at least to 185.460 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Like and subscribe and comment my ideas if you enjoy them!

USDCHF Is Bearish! Short!

Here is our detailed technical review for USDCHF.

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 0.801.

Taking into consideration the structure & trend analysis, I believe that the market will reach 0.798 level soon.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Like and subscribe and comment my ideas if you enjoy them!

USDJPY Is Very Bearish! Sell!

Take a look at our analysis for USDJPY.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 158.498.

Considering the today's price action, probabilities will be high to see a movement to 157.948.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

CADCHF Will Grow! Long!

Here is our detailed technical review for CADCHF.

Time Frame: 1h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 0.576.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 0.577 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Like and subscribe and comment my ideas if you enjoy them!

AUDJPY Will Go Lower From Resistance! Sell!

Take a look at our analysis for AUDJPY.

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 106.402.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 105.687 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Like and subscribe and comment my ideas if you enjoy them!

CADJPY Will Go Lower! Short!

Please, check our technical outlook for CADJPY.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 114.550.

The above observations make me that the market will inevitably achieve 114.248 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

NASDAQ (NAS100) – 15-Minute Timeframe Tradertilki AnalysisMy friends, greetings,

I have prepared a NASDAQ-NAS100 analysis for you.

My friends, if NAS100 reaches the levels of 25754.54-25731.54 on the 15-minute timeframe, I will open a buy position.

My target will be the 25905.40 level.

My friends, I share these analyses thanks to each like I receive from you. Your likes increase my motivation and encourage me to support you in this way.🙏✨

Thank you to all my friends who support me with their likes.❤️

GOLD Will Go Down! Sell!

Here is our detailed technical review for GOLD.

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 4,609.41.

Taking into consideration the structure & trend analysis, I believe that the market will reach 4,502.66 level soon.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Like and subscribe and comment my ideas if you enjoy them!

GBPAUD Will Move Lower! Short!

Take a look at our analysis for GBPAUD.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 2.011.

Considering the today's price action, probabilities will be high to see a movement to 2.006.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Like and subscribe and comment my ideas if you enjoy them!