EUR/GBP SENDS CLEAR BULLISH SIGNALS|LONG

Hello, Friends!

The BB lower band is nearby so EUR-GBP is in the oversold territory. Thus, despite the downtrend on the 1W timeframe I think that we will see a bullish reaction from the support line below and a move up towards the target at around 0.872.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Swing

BITCOIN Will Fall! Short!

Take a look at our analysis for BITCOIN.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 89,762.58.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 88,815.72 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Like and subscribe and comment my ideas if you enjoy them!

EURCAD Will Go Up From Support! Long!

Please, check our technical outlook for EURCAD.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The price is testing a key support 1.609.

Current market trend & oversold RSI makes me think that buyers will push the price. I will anticipate a bullish movement at least to 1.624 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Like and subscribe and comment my ideas if you enjoy them!

GOOGLE WHERE THE MONEY IS### 🚨 GOOG Technical Analysis: Is Google Ready to Blast Off in 2026? 🚀

Hey traders! As of **January 4, 2026**, Alphabet (GOOG) sits at **$315.32** (up ~0.48% recently), fresh off a monster **65% rally in 2025** – its best year since 2009. Your TradingView chart nailed the long-term uptrend perfectly: from 2022 lows around $80-100, through a sharp 2025 dip, to new highs near $328. That green ascending trendline is pure gold, projecting toward **$400+** by 2027 if bulls stay in control.

THAT MEANS, IF YOU POSITION WELL, ARE PATIENT, FOLLOW TRENDS AND INDICATORS, and time it correctly (Which is difficult, meaning watch the numbers and indicators to time the move), you can ride the down wave, into the up wave long. AND MANY TRADES ALONG THE WAY!! This means there is a LOT of money for well placed trades.

But is this the calm before another moonshot... or a sneaky top? Let's break it down **clearly and step-by-step** – no fluff, just actionable insights to hook you in and keep you reading.

#### 1. **Current Price Snapshot** (As of Jan 4, 2026)

- **Price**: $315.32

- **Recent Range**: High ~$328 (Nov 2025), Low ~$310

- **52-Week Range**: ~$143 to $329

- **Market Mood**: Neutral sentiment, but AI hype is strong after 2025's blowout performance.

#### 2. **The Big Trend: Bullish Ascent Intact**

- **Primary Trend**: Strong uptrend since 2022 bear market bottom.

- **Key Driver**: That green ascending support line (from ~$83 in 2022) has held every major dip, including the 2025 pullback to ~$156-210.

- **Current Status**: Price hugging resistance at ~$315-322. Break above = acceleration; hold = consolidation.

- **Projection Match**: Your chart's line points to ~$380-400 by mid-2027 – aligns with optimistic analyst views if AI (Gemini, Cloud) delivers.

#### 3. **Critical Support & Resistance Levels** (Watch These Like a Hawk)

- **Immediate Resistance**: $322 (recent high) → $328-329 (all-time high)

- **Key Resistance**: $340-350 (next upside targets on breakout)

- **Immediate Support**: $310 → Green trendline (~$300 near-term)

- **Major Supports**: $262 (38.2% Fib), $220-240 (prior consolidation), $181 (deeper retrace)

- **Breakdown Risk**: Below $290-300 trendline = potential drop to $262 or lower (bear warning!).

#### 4. **Chart Patterns & Signals**

- **Overall Structure**: Series of higher highs/lows with bullish flags and V-bottom reversals (e.g., 2025 dip).

- **Recent Action**: Zigzag consolidation near highs – possible ascending triangle forming.

- **Earnings Markers**: Mostly green "E" beats in 2025 fueled rallies; watch Feb 3, 2026 report for the next catalyst.

- **Volume Note**: Low volume on recent moves – needs spike for conviction breakout.

#### 5. **Bull Case: Why GOOG Could YOLO to $400+**

- AI dominance (Gemini, Cloud growth >30%)

- Strong fundamentals: Search engagement up, massive Cloud backlog

- Analyst Consensus: Median target ~$330-340 (up 5-8% from here), some as high as $385-400

- Momentum: Best Mag7 performer in 2025 – carryover potential huge

#### 6. **Bear Case: Risks That Could Trigger a Crash Scenario**

- Heavy 2026 capex (~$114B on AI/data centers) pressuring margins

- Antitrust heat & competition (e.g., OpenAI, Bing threats)

- Valuation: ~30x forward P/E – rich if growth slows

- Technical Risk: Failure at $329 high = double-top, potential pullback to $280-300

#### 7. **Quick Trade Ideas**

- **Bullish Play**: Buy dip to green trendline (~$300-310), target $340-350. Stop below $290.

- **Bearish Play**: Short on failed breakout above $329, target $262.

- **Safe Play**: Wait for volume breakout – add alerts on TradingView!

This chart screams **uptrend with upside bias**, but respect the resistance – 2026 could be epic if AI pays off, or choppy if capex bites. What's your take: Moon or correction? Drop your thoughts or another chart – let's discuss! 📈🔥

Ghost feed may not be accurate, please only use as a projected guideline.

*(Not financial advice – DYOR, markets can moon or crater anytime.)*

ETHUSD Will Go Lower! Sell!

Here is our detailed technical review for ETHUSD.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 3,117.66.

The above observations make me that the market will inevitably achieve 3,028.82 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

EURGBP Will Go Up! Buy!

Take a look at our analysis for EURGBP.

Time Frame: 9h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is testing a major horizontal structure 0.870.

Taking into consideration the structure & trend analysis, I believe that the market will reach 0.874 level soon.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Like and subscribe and comment my ideas if you enjoy them!

USDCAD Will Move Lower! Short!

Please, check our technical outlook for USDCAD.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 1.373.

Considering the today's price action, probabilities will be high to see a movement to 1.371.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Like and subscribe and comment my ideas if you enjoy them!

BITCOIN Is Going Down! Short!

Please, check our technical outlook for BITCOIN.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 89,485.66.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 88,189.90 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Like and subscribe and comment my ideas if you enjoy them!

NZDUSD Will Go Down From Resistance! Short!

Take a look at our analysis for NZDUSD.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 0.582.

Taking into consideration the structure & trend analysis, I believe that the market will reach 0.578 level soon.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Like and subscribe and comment my ideas if you enjoy them!

ETHUSD Is Bearish! Sell!

Here is our detailed technical review for ETHUSD.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 2,959.86.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 2,876.23 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Like and subscribe and comment my ideas if you enjoy them!

ETHUSD Will Fall! Sell!

Here is our detailed technical review for ETHUSD.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 2,930.60.

The above observations make me that the market will inevitably achieve 2,781.99 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Like and subscribe and comment my ideas if you enjoy them!

BITCOIN Is Bearish! Short!

Please, check our technical outlook for BITCOIN.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 88,936.67.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 87,778.70 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Like and subscribe and comment my ideas if you enjoy them!

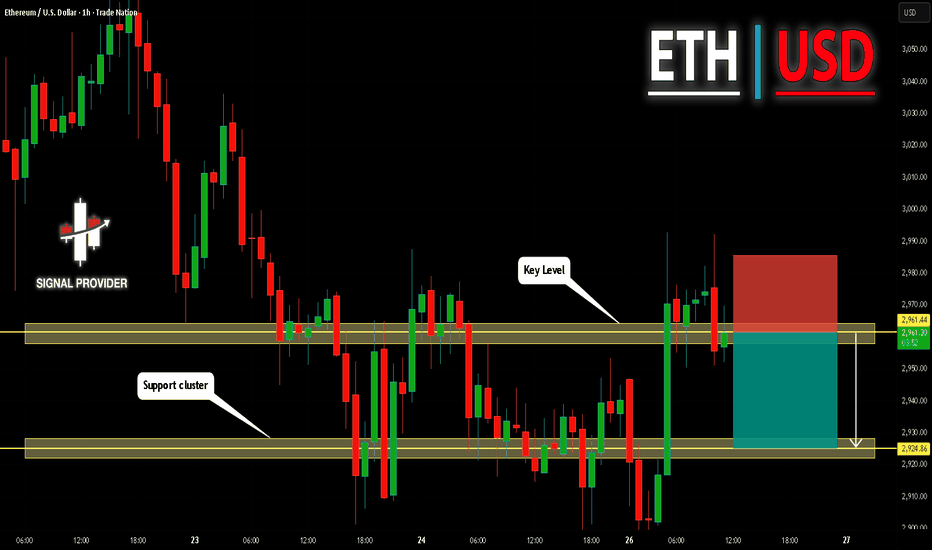

ETHUSD Is Going Down! Short!

Take a look at our analysis for ETHUSD.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 2,961.44.

Taking into consideration the structure & trend analysis, I believe that the market will reach 2,924.86 level soon.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Like and subscribe and comment my ideas if you enjoy them!

BITCOIN Will Go Lower! Sell!

Please, check our technical outlook for BITCOIN.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 87,507.46.

Considering the today's price action, probabilities will be high to see a movement to 84,599.59.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

AUDCHF Will Move Lower! Sell!

Take a look at our analysis for AUDCHF.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 0.529.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 0.528 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Like and subscribe and comment my ideas if you enjoy them!

AUDNZD Is Very Bearish! Sell!

Here is our detailed technical review for AUDNZD.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 1.150.

The above observations make me that the market will inevitably achieve 1.139 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

ETHUSD Will Fall! Sell!

Please, check our technical outlook for ETHUSD.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 2,939.57.

Considering the today's price action, probabilities will be high to see a movement to 2,893.67.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Like and subscribe and comment my ideas if you enjoy them!

BITCOIN Will Go Lower! Sell!

Take a look at our analysis for BITCOIN.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 87,438.65.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 86,446.42 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

BITCOIN Will Go Down! Short!

Please, check our technical outlook for BITCOIN.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 86,886.48.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 84,673.23 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Like and subscribe and comment my ideas if you enjoy them!

CHFJPY Will Move Lower! Sell!

Here is our detailed technical review for CHFJPY.

Time Frame: 8h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 198.026.

The above observations make me that the market will inevitably achieve 196.023 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Like and subscribe and comment my ideas if you enjoy them!

ETHUSD Is Bullish! Buy!

Take a look at our analysis for ETHUSD.

Time Frame: 1h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is testing a major horizontal structure 2,924.68.

Taking into consideration the structure & trend analysis, I believe that the market will reach 2,971.06 level soon.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Like and subscribe and comment my ideas if you enjoy them!

GOLD Is Very Bearish! Short!

Please, check our technical outlook for GOLD.

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 4,459.75.

Considering the today's price action, probabilities will be high to see a movement to 4,363.61.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!