EURUSD BUY SETUP 📊 EURUSD UPDATE — Buy Setup in Focus

EURUSD is holding above a key support zone, and price action suggests bullish continuation if structure remains intact. Buyers are stepping in with controlled risk and clear upside potential.

📌 Trade Levels

🔓 Entry: 1.17233

❌ Stop Loss: 1.16945

🎯 Target: 1.17373

Trade with confirmation, not emotions. Let the market do the work.

⚠️ For educational purposes only. Not financial advice.

Techincalanalysis

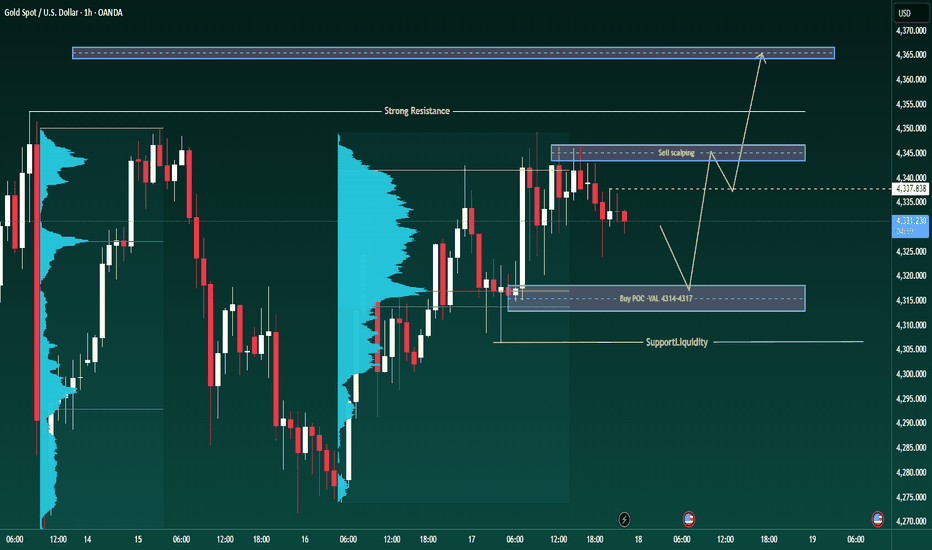

GOLD SHORT FROM RESISTANCE

GOLD SIGNAL

Trade Direction: short

Entry Level: 4,331.73

Target Level: 4,308.37

Stop Loss: 4,347.18

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

XAUUSD (H1) – Awaiting confirmation to exit trendlineXAUUSD (H1) – Awaiting confirmation to exit trendline

Buy 4304, Sell 4346 | Gold compresses range before US data

Strategy Summary

Gold is compressing within a sideways range and gradually narrowing (typical "range compression before breakout"). The larger frame still leans towards long-term Buy, but in the short term, I prioritize trading according to trendline + support/resistance zones, with a profit target of about 10 points. The key point today is to wait for confirmation to exit the trendline to avoid entering orders amidst noise.

Important technical levels on the chart

Support / Buy test trendline: 4304 (trendline test area)

Short-term resistance: 4328

"Strong Liquidity" zone above: around 4346 (likely to react)

Distant target if breakout: 4374

Scenario 1 – BUY according to trendline (priority)

✅ Entry Buy: around 4304

SL: 4295

TP (reference): 4314 → 4324 → 4328 (can partially close after 10 points)

Logic: 4304 is the "Buy test trendline" area – if the price tests and holds, the probability of bouncing back to test the resistance area 4328 is high.

Scenario 2 – SELL at strong liquidity zone (scalp)

✅ Sell: around 4346 (Strong Liquidity zone)

For SELL orders, the most reasonable TP is ~4338 (exact target ~10 points).

SL should be placed above the area to avoid being swept when the price stretches (you can consider placing it one step above 4346).

Logic: 4346 is close to a large liquidity/resistance zone – price hitting this area often reacts, suitable for scalping by rhythm.

"Confirmation" conditions to avoid noise

Strong increase confirmation: price breaks and holds above the resistance area (preferably clear H1 candle close) → then the target expands to 4374.

If the trendline is lost & breaks 4295: stop BUY, avoid stubbornness during news phases.

Today's fundamental context (direct impact on XAUUSD)

DXY rises as the market is cautious ahead of the University of Michigan Consumer Sentiment Index → may exert short-term pressure on gold.

However, November CPI decline increases expectations that the Fed may cut interest rates soon → medium-term is a supportive factor for gold.

CME FedWatch: probability of holding rates steady in January ~73.3%, probability of a 25bps cut ~26.6% → the market remains very sensitive to data, easy to "sweep both ends".

Which scenario are you leaning towards: pullback to 4304 to buy, or up to 4346 to sell reaction?

Gold Is Being Tested at the TopGOLD (XAUUSD) – Daily Structure & Macro Context

Technical Structure (Daily)

On the 1D timeframe, Gold remains in a primary bullish trend, but price action is now clearly hesitating near the previous ATH zone (~4,380–4,400). This area has historically attracted strong supply, and the current behavior confirms that sellers are actively defending it.

Price is still trading inside an ascending channel, respecting the rising trendline from the November lows. However, momentum has slowed notably as candles compress beneath the old ATH, forming overlapping highs and shallow pullbacks rather than clean continuation. This is a classic distribution vs. re-accumulation zone, not an impulsive breakout phase.

Key technical observations:

- Higher highs and higher lows remain intact → macro trend still bullish

- Repeated rejection near old ATH → supply absorption in progress

- EMA structure (34 & 89) remains supportive below → downside currently corrective

A clean daily close above the old ATH would confirm continuation toward new highs. Conversely, failure to hold the rising trendline opens room for a deeper pullback toward the EMA cluster, without invalidating the broader uptrend.

Macro Drivers (What’s influencing Gold now)

1. US Dollar Stabilization

The recent pause in Gold’s advance aligns with a short-term stabilization in the US Dollar. As USD demand temporarily recovers, Gold loses momentum but does not break structure a sign of balance, not weakness.

2. Fed Policy Expectations

Markets continue to price in eventual rate cuts, but the timing remains uncertain. The absence of immediate dovish confirmation from the Fed keeps Gold capped near highs, as traders reduce leverage and wait for clearer signals.

3. Real Yield Sensitivity

While real yields have stopped rising aggressively, they remain elevated enough to slow Gold’s upside acceleration. This creates consolidation rather than reversal.

4. Geopolitical & Risk Hedging Still Present

Despite short-term hesitation, Gold continues to benefit from structural demand as a hedge, which explains why pullbacks remain shallow and well-supported.

Forward Scenarios

Bullish continuation: Acceptance above old ATH → trend expansion resumes

Corrective scenario: Rejection at ATH → pullback toward trendline / EMAs

Invalidation: Only a sustained break below the rising structure would shift the macro bias

Key Takeaway

Gold is not topping out it is being priced under uncertainty.

The market is balancing strong long-term bullish drivers against short-term macro hesitation. This zone is where decisions are made, not where trends end.

GBP/CAD BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

We are targeting the 1.835 level area with our short trade on GBP/CAD which is based on the fact that the pair is overbought on the BB band scale and is also approaching a resistance line above thus going us a good entry option.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

XAUUSD M45: SELL at OB 4.331–4.339, BUY at 4.306–4.3121) Market Context (M45) – SMC & Price Structure

The spike up followed by a strong sell-off is a liquidity event (liquidity sweep), creating a clear bearish displacement.

After the sell-off, the price is retracing in a pullback/retest manner → prioritize the strategy “SELL retracement at supply zone,” or “BUY reaction at demand zone” if there is a sweep down.

2) Key Levels

Liquidity Sell (liquidity peak): 4.367.982

OB Bearish (Sell Zone): 4.331.123 – 4.338.610

Liquidity Support (Demand): 4.312.463 – 4.306.358

Current reference price: ~4.326 (currently in the middle of the range, not an optimal entry point)

3) Trading Plan

Scenario A – SELL at OB Bearish (priority)

If the price retraces to the 4.331 – 4.339 zone and shows rejection signals:

pinbar / shadow

downward engulfing

or bearish ChoCH on M15–M45

Then prioritize SELL following the retracement in the short-term bearish structure.

Reference targets:

TP1: 4.312

TP2: 4.306

Invalidation:

M45 candle closes firmly above 4.339 and holds → stop the SELL idea.

Scenario B – BUY at Liquidity Support (reversal scenario)

If the price is pulled down to the 4.312 – 4.306 zone and shows signs of sweep + reclaim (piercing down then closing back up the zone).

Upon confirmation, watch for BUY retracement.

Reference targets:

TP1: 4.331

TP2: 4.339

Note: if the price touches the OB Bearish again without breaking it, prioritize closing and observing the reaction.

Scenario C – Sweep up to Liquidity Sell 4.368 then reverse

If the price breaks above OB Bearish and continues to run liquidity up to 4.368.

The 4.368 zone is suitable for finding a sell reaction (only SELL with confirmation signals).

4) News on 18/12 affecting gold

On 18/12, there is US CPI (November): the most impactful news on gold as it directly affects interest rate expectations, yields, and USD.

On the same day, there are usually Initial Jobless Claims and activity indicators (e.g., Philly Fed), which can easily create short-term spikes for XAUUSD.

After the CPI day, the market often exhibits liquidity sweeps on both ends before choosing a direction → avoid FOMO, prioritize trading at the right zone.

5) Quick Conclusion

Short-term bias: prioritize SELL retracement at OB 4.331–4.339 until the price strongly reclaims above.

Defensive scenario: BUY reaction at 4.312–4.306 if there is a sweep + confirmation.

Avoid entering trades in the middle of the range; wait for “right zone – right signal.”

XAUUSD H1 Main Trend for the Weekend

Gold failed to confirm a sustainable upward momentum after yesterday's price reaction, prioritizing a short-term adjustment scenario before reassessing the trend

PRIORITY SCENARIO

Strategy to sell based on reactions at large volume areas, suitable for the current short-term structure

Focus sell area: 4332 – 4342

Technical basis: these are areas concentrated with volume according to the Volume Profile, where price is likely to show distribution reactions after a weak recovery

Expected movement: price recovers to the large volume area for distribution, then continues the adjustment phase

Daily target:

Heading towards the 4275 area, coinciding with the Fibonacci retracement area and underlying support

Position management:

Sell should only be held short-term. If the price surpasses and stabilizes above 4342, risk should be reduced and avoid holding sell orders.

ALTERNATIVE SCENARIO

Monitor price reactions at deeper support areas to reassess trading opportunities

Strong support area: around 4275

Technical context: this is the convergence area between structural support and Fibonacci retracement, likely to show defensive buying force

Expected movement: if the price reacts well at this area, the market may enter a re-accumulation state

MAIN REASON

On H1, the previous upward phase failed to maintain a clear upward structure, indicating weakening buying force

Volume Profile helps identify the 4332 – 4342 areas as advantageous entry points for the sell reaction scenario

The 4275 area serves as a reasonable adjustment target in the context of a typically momentum-lacking weekend market

MACRO CONTEXT AND MEDIUM-TERM OUTLOOK

While short-term fluctuations lean towards adjustment, major institutions still maintain a positive outlook for gold in the medium and long term. Goldman Sachs forecasts gold prices could reach $4,900/oz by the end of 2026, supported by strong buying demand from central banks and positive impacts from the Fed's interest rate cut cycle.

This suggests that short-term declines may be more of a technical adjustment rather than a reversal of the long-term trend.

USOIL BUYERS WILL DOMINATE THE MARKET|LONG

USOIL SIGNAL

Trade Direction: long

Entry Level: 55.27

Target Level: 56.16

Stop Loss: 54.67

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBP/USD BULLS WILL DOMINATE THE MARKET|LONG

Hello, Friends!

GBP/USD is trending up which is obvious from the green colour of the previous weekly candle. However, the price has locally plunged into the oversold territory. Which can be told from its proximity to the BB lower band. Which presents a beautiful trend following opportunity for a long trade from the support line below towards the supply level of 1.341.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR/GBP BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

It makes sense for us to go short on EUR/GBP right now from the resistance line above with the target of 0.874 because of the confluence of the two strong factors which are the general downtrend on the previous 1W candle and the overbought situation on the lower TF determined by it’s proximity to the upper BB band.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

XAUUSD (H1) – Friday Weekend

Lana prioritizes the adjustment phase towards the POC area, looking to Sell in the liquidity zone 💛

Quick Summary

Context: Friday, the market often tends to take profits and sweep liquidity before the week closes

Monitoring Frame: H1

Main Viewpoint: Prioritize a decrease during the day (adjustment phase)

Key Point to Note: 4308 has reacted multiple times, a sensitive point in the structure

Market Context

The weekend is usually a time when the cash flow is “lighter” and price behavior tends to lean towards profit-taking. Therefore, an adjustment phase to gain more liquidity is the scenario Lana prioritizes today.

From a medium-term perspective, some large institutions still maintain a positive view on gold. However, in intraday trading, Lana still prioritizes following the current price behavior and trading according to the liquidity zone.

Technical View H1

On H1, the price is fluctuating around the accumulation zone, and the POC/VAL area indicates this is a market zone that has been “back and forth” for quite a while. When the price returns to these areas, there is usually a clear reaction.

The 4308 area is noteworthy because the price has reacted multiple times, so this is a point that could determine whether the adjustment phase continues.

Today's Trading Scenario

Main Scenario – Sell at POC/VAL area (large liquidity)

Sell: 4335 – 4340

Lana prioritizes waiting for the price to rebound to this area to sell according to the adjustment phase. This is a large liquidity zone, suitable for finding a downward reaction during the day.

Alternative Scenario – Buy scalping at near support

Buy: 4284 – 4289

This Buy order is only for scalping when the price hits the support area and a bounce reaction appears. If the market continues to be weak, Lana will not hold the Buy for too long.

Session Notes

If the price continues to be rejected around resistance areas and cannot surpass the supply zone, the adjustment scenario will have an advantage.

For Friday, Lana prioritizes light trading, quick closing, avoiding holding positions too long over the weekend.

Lana's Notes 🌿

Each scenario is just a probability. Lana always sets a stop loss first, chooses the appropriate volume, and is ready to skip if the price does not reach the waiting area.XAUUSD (H1) – Friday Weekend

Lana prioritizes the adjustment phase towards the POC area, looking to Sell in the liquidity zone 💛

Quick Summary

Context: Friday, the market often tends to take profits and sweep liquidity before the week closes

Monitoring Frame: H1

Main Viewpoint: Prioritize a decrease during the day (adjustment phase)

Key Point to Note: 4308 has reacted multiple times, a sensitive point in the structure

Market Context

The weekend is usually a time when the cash flow is “lighter” and price behavior tends to lean towards profit-taking. Therefore, an adjustment phase to gain more liquidity is the scenario Lana prioritizes today.

From a medium-term perspective, some large institutions still maintain a positive view on gold. However, in intraday trading, Lana still prioritizes following the current price behavior and trading according to the liquidity zone.

Technical View H1

On H1, the price is fluctuating around the accumulation zone, and the POC/VAL area indicates this is a market zone that has been “back and forth” for quite a while. When the price returns to these areas, there is usually a clear reaction.

The 4308 area is noteworthy because the price has reacted multiple times, so this is a point that could determine whether the adjustment phase continues.

Today's Trading Scenario

Main Scenario – Sell at POC/VAL area (large liquidity)

Sell: 4335 – 4340

Lana prioritizes waiting for the price to rebound to this area to sell according to the adjustment phase. This is a large liquidity zone, suitable for finding a downward reaction during the day.

Alternative Scenario – Buy scalping at near support

Buy: 4284 – 4289

This Buy order is only for scalping when the price hits the support area and a bounce reaction appears. If the market continues to be weak, Lana will not hold the Buy for too long.

Session Notes

If the price continues to be rejected around resistance areas and cannot surpass the supply zone, the adjustment scenario will have an advantage.

For Friday, Lana prioritizes light trading, quick closing, avoiding holding positions too long over the weekend.

Lana's Notes 🌿

Each scenario is just a probability. Lana always sets a stop loss first, chooses the appropriate volume, and is ready to skip if the price does not reach the waiting area.

XAUUSD H1 Trading with Volume Profile Ahead of CPI RiskXAUUSD H1 Trading with Volume Profile Ahead of CPI Risk

Gold is slowing down as the market awaits news and liquidity is fragmented, so prioritize trading according to Volume Profile zones to choose advantageous entry points instead of chasing prices.

PRIORITY SCENARIO

Strategy to buy at POC and VAL zones according to Volume Profile, suitable for a medium-term perspective.

Buy zone: 4314 – 4317

SL: 4307

TP: 4328 – 4345 – 4363 – 4370

Technical context:

On H1, the price is accumulating and reacting around the value area. The 4314–4317 area is the POC and VAL zone, often a liquidity attraction point and likely to see buying pressure if the structure maintains support.

Expected movement:

Price holds the 4314–4317 zone, absorbs short-term selling pressure, then rebounds to the above TP levels. When approaching 4345, monitor reactions as this is an area prone to selling pressure.

Position management:

If the price quickly rises but fails to hold above 4328, consider reducing risk. If the price clearly breaks below 4307, prioritize stopping the buy scenario and wait for a deeper zone.

ALTERNATIVE SCENARIO

Sell scalping strategy at short-term resistance zone, higher risk as the larger trend still favors buying.

Sell scalping zone: 4343 – 4346

SL: 4353

TP: 4325 – 4310 – 4290

Technical context:

The 4343–4346 area is a sell scalping zone on the chart, suitable for short-term trading when the price rebounds to resistance and clear rejection signals appear.

Note:

Sell should only be a scalping order. Do not prioritize holding long sell positions if the market is still in an accumulation phase awaiting news.

MAIN REASON

Volume Profile shows that POC and VAL zones are advantageous entry points during a sideways market lacking a clear trend.

The 4314–4317 zone acts as a value support area for finding buy points, while 4343–4346 is suitable for sell scalping when the price rebounds to resistance.

When the market awaits news, the likelihood of liquidity sweeps increases, so trading by zones will be more effective than chasing candles.

MACRO CONTEXT AND CPI DATA

The upcoming US CPI release during the North American session will be the main variable guiding Fed policy expectations, directly impacting USD and gold. Ahead of data risk, dovish expectations from the Fed are causing USD to lack strong upward momentum, but volatility may spike suddenly at the time of the news release, creating spikes and sweeping SL on both ends.

RISK MANAGEMENT AND MONITORING

Do not open orders when the price is between zones and has not reached the exact levels of 4314–4317 or 4343–4346.

Prioritize reducing volume before CPI or only maintain positions that are already profitable and manage tightly.

Focus on observing price reactions at POC VAL and sell scalping zones, as these are decisive points for short-term direction.

EUR/CHF BULLS ARE GAINING STRENGTH|LONG

Hello, Friends!

EUR/CHF is making a bearish pullback on the 4H TF and is nearing the support line below while we are generally bullish biased on the pair due to our previous 1W candle analysis, thus making a trend-following long a good option for us with the target being the 0.933 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

BITCOIN SELLERS WILL DOMINATE THE MARKET|SHORT

BITCOIN SIGNAL

Trade Direction: short

Entry Level: 87,356.26

Target Level: 85,301.83

Stop Loss: 88,725.88

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBP/CHF BEST PLACE TO SELL FROM|SHORT

GBP/CHF SIGNAL

Trade Direction: short

Entry Level: 1.063

Target Level: 1.061

Stop Loss: 1.064

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

XAUUSD M30: Watch for BUY at 4.317–4.303, target 4.337–4.3461) Market Context (M30) – SMC & Price Structure

• The chart is on the M30 timeframe (not H1).

• After the impulsive move up, price has entered a consolidation / corrective phase , with BOS and ChoCH signals indicating a rotation of order flow around the equilibrium zone.

• Price is currently trading in the middle of the range, so the optimal approach is to wait for price to return to Demand/OB or wait for a sweep into Supply before making decisions.

2) Key Levels

• Supply / $$$ (upper targets): 4,346.655

• Intermediate Supply: 4,337.166

• OB Buy (Demand 1): 4,317–4,315 (tag 4,317.623)

• BUY Swing (Demand 2 – deeper): 4,303–4,305 (tag 4,303.099)

• Risk reference: SL reference at 4,289

3) Trading Scenarios (SMC – conditional setups)

Scenario A – BUY pullback at OB 4,317–4,315 (intraday priority)

• If price pulls back into 4,317–4,315 and shows clear bullish reaction (long lower wicks, bullish engulfing, or a bullish ChoCH on M15/M30).

• Then prioritize BUY continuation trades.

• Reference targets:

• TP1: 4,337

• TP2: 4,346

• If price reaches 4,337 / 4,346 and shows strong rejection, prioritize partial profit-taking rather than expecting a straight continuation.

Scenario B – Deep sweep into BUY Swing 4,303–4,305 (higher-quality setup)

• If price breaks below the 4,317 OB and continues to sweep liquidity into 4,303–4,305 .

• Only BUY after a clear reversal signal appears (post-sweep + fast reclaim).

• Reference targets: 4,317 → 4,337 → 4,346.

Scenario C – SELL reaction at Supply (counter-trend, scalp only)

• If price rallies into 4,337 or 4,346 and prints distribution signals (strong rejection / bearish ChoCH).

• A short SELL toward 4,317 can be considered.

• Note: SELLs are purely technical reactions; the primary bias remains “buy the dip” at the marked Demand zones.

4) News on 18/12 Impacting Gold (Macro Drivers)

• US CPI (November) released today — typically a major volatility driver for XAUUSD due to its direct impact on rate expectations and the USD.

Bureau of Labor Statistics

• On the same day: Initial Jobless Claims and the Philadelphia Fed Manufacturing Index — often cause short-term spikes around release times.

S&P Global

• Beyond the US, markets are also monitoring a series of central bank decisions (ECB/BoE/Norges Bank/Riksbank…), which may amplify USD and risk sentiment volatility, indirectly affecting gold.

S&P Global

CPI Trading Guidance

• Avoid entering trades right before CPI; preferably wait 5–15 minutes after the release for structure to become clearer, then execute based on reactions at 4,317 / 4,303 or Supply reactions at 4,337 / 4,346 .

5) Conclusion (Bias & Risk)

• Intraday bias: prioritize BUYs at Demand (4,317–4,315 and deeper 4,303–4,305).

• Focus on “right level – right signal”; avoid FOMO in the middle of the range.

• Maintain strict risk management, as CPI day often brings elevated volatility.

— Trade the levels, not the noise.

Bitcoin Is Sitting on a Decision ZoneMARKET BRIEFING – BTC/USD (1H)

Market State:

– Bitcoin has completed a sharp sell-off into a strong support zone and is now stabilizing, showing early signs of absorption rather than continuation lower. Momentum has paused, not flipped.

Key Levels:

– Strong Support Zone: 85,100 – 85,600

– Range Top / Reclaim Level: ~88,000

– Major Resistance: 91,500 – 92,000

Price Action:

– Selling pressure weakened immediately upon reaching support, followed by compression — typical range-building behavior after an impulsive drop.

– Structure suggests sideways consolidation before the market chooses direction.

Next Move:

– Expect continued rotation inside the 85,100 – 88,000 range.

– A clean reclaim above 88,000 opens the path toward 91,500 – 92,000.

– Failure to hold 85,100 would invalidate the base and reopen downside risk.

Bitcoin is not breaking down it’s being absorbed.

Until price exits the range with acceptance, time is the key variable, not direction.

Accumulation Isn’t Safety — It’s a SetupETH/USD – H4 MARKET ANALYSIS

1. Market Structure

Ethereum remains in a broader bearish structure on H4.

Price has been forming a series of distribution → breakdown → re-accumulation cycles, each one occurring at lower price levels, confirming that sellers are still controlling the higher timeframe trend.

Each accumulation zone visible on the chart represents temporary absorption, not trend reversal. After each range, price fails to expand higher and instead continues to break down toward lower demand.

The most recent accumulation zone is forming below previous structure, which is a bearish characteristic.

2. Accumulation Behavior Insight

These repeated accumulation zones show:

- Sideways compression after impulsive moves

- Liquidity building before continuation

- Lack of strong bullish expansion after ranges

This confirms that:

Accumulation here is bearish continuation, not bullish accumulation.

The market is loading liquidity before the next downside expansion.

3. Key Technical Zones

- Current Accumulation Zone: ~2,900 – 3,000

- Major Support / Liquidity Target: ~2,720

- Invalidation Zone: Strong acceptance above the previous accumulation highs

As long as price remains capped below prior range highs, downside risk remains dominant.

4. Scenario Outlook

🔽 Primary Scenario – Bearish Continuation (High Probability)

Expected flow:

- Price continues to range inside the current accumulation zone

- Sellers absorb buy-side liquidity

- Breakdown below range lows

- Expansion toward the major demand zone near 2,720

This follows the exact same behavior seen in previous cycles on the chart.

⚠️ Alternative Scenario – Structure Shift

Only valid if:

- Price breaks above the accumulation range

- Holds and accepts above previous highs

- Builds a higher high & higher low structure

- Until that happens, any upside move is corrective only.

5. Trading Perspective

Bias: Sell rallies / wait for breakdown confirmation

Avoid longing inside accumulation without confirmation

Best opportunities come after range failure

Patience is key market is compressing before expansion

Summary

Ethereum on H4 is not accumulating for reversal it is compressing for continuation.

Repeated accumulation zones at lower levels confirm that the market is preparing for another downside leg.

As long as price stays below prior structure highs, the roadmap remains clear:

Range → Liquidity Build → Breakdown → Expansion Lower

👉 What do you think — will ETH hold this accumulation, or is another flush coming?

USDCAD Massive Short! SELL!

My dear friends,

My technical analysis for USDCAD is below:

The market is trading on 1.3788 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.3775

Recommended Stop Loss - 1.3793

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

ETH | UPDATE📊 ETH Update — Momentum Zone in Focus

Ethereum is trading near an important structure area where buyers have previously stepped in. Holding above this support keeps the bullish bias intact, and a strong reaction from this zone could open the door for a move toward the next resistance level.

🔓 Entry: 2,948

❌ Stop Loss: 2,865

🎯 Target: 3,027

Volume and price behavior around these levels will be key.

Do you see continuation from here or a pullback first? Share your view below 👇

A like/support helps this idea reach more traders 🚀

⚠️ Disclaimer: This reflects personal market analysis and is not financial advice.

BABA: when China allows growth againAlibaba remains one of the most undervalued mega-cap tech companies globally. After years of regulatory pressure and weak macro conditions in China, the company is entering a stabilization phase. Regulatory risks have eased, and Chinese authorities are signaling support for the technology sector and domestic consumption. Alibaba continues to generate strong cash flow, operates a massive ecosystem across e-commerce, cloud, and logistics, and actively executes share buybacks, reducing float. At current levels, the market is pricing in excessive pessimism, creating asymmetric upside if macro conditions improve.

From a technical perspective, price is trading inside a rising channel. After a strong impulse, the market moved into a corrective phase, forming a swing zone. Price remains above key EMA levels, confirming a valid medium-term uptrend. The current area represents a buyer interest zone aligned with structural support and Fibonacci levels. Declining volume during the pullback supports the idea of a healthy correction rather than trend reversal.

Trading plan: as long as price holds above the current support zone and confirmation appears, long positions become attractive. The first target is a return to previous highs, followed by Fibonacci extensions. Medium-term targets align with the upper boundary of the channel. A breakdown below the swing zone would invalidate the bullish scenario and signal deeper correction.

The best opportunities often appear when fear fades but confidence hasn’t returned yet.

USD/JPY BEARS ARE STRONG HERE|SHORT

Hello, Friends!

Previous week’s green candle means that for us the USD/JPY pair is in the uptrend. And the current movement leg was also up but the resistance line will be hit soon and upper BB band proximity will signal an overbought condition so we will go for a counter-trend short trade with the target being at 154.236.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅