SILVER SHORT FROM RESISTANCE

Hello, Friends!

SILVER is making a bullish rebound on the 4H TF and is nearing the resistance line above while we are generally bearish biased on the pair due to our previous 1W candle analysis, thus making a trend-following short a good option for us with the target being the 6,927.1 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Techincalanalysis

Ethereum Is Pressing the Ceiling — Breakout or Final Rejection Hello everyone,

On the H1 timeframe, the key focus right now is not chasing upside, but evaluating how Ethereum is behaving at a critical resistance cluster after a well-structured recovery. Price has already done the hard work on the downside; the market is now at a decision point.

After the sharp sell-off into the 2,900–2,920 support zone, ETH formed a clean base and transitioned into a step-by-step recovery, printing higher lows and reclaiming multiple intraday levels. The advance has been orderly and controlled, not impulsive — a sign that buyers are rebuilding positions rather than FOMO buying.

Structurally, price has now pushed into the 3,020–3,035 resistance zone, which has historically capped upside. The current candles are reacting directly at this level, confirming it as active supply, not a level the market can ignore. This is exactly where we expect hesitation, consolidation, or a rejection attempt.

From a price action perspective, two valid scenarios are visible directly on the chart:

- Primary scenario: a shallow pullback toward the 3,000–3,010 area to retest demand, followed by another push higher. Acceptance above 3,035–3,050 would confirm a breakout and open the door toward 3,070–3,100.

- Alternative scenario: failure to hold above reclaimed levels, leading to a deeper pullback toward 2,970–2,990, where buyers would need to step in again to keep the bullish structure intact.

Importantly, there is no distribution pattern yet. Pullbacks remain corrective, candles overlap constructively, and price continues to hold above prior breakout levels. That keeps the bias constructive, but not confirmed.

In short, Ethereum is not late, and it is not guaranteed. It is compressing at resistance, and the next few H1 closes will determine whether this move resolves into acceptance and expansion, or a final rejection and reset.

Wishing you all effective and disciplined trading.

Ethereum at a Critical Inflection Zone, Breakout Acceptance or..Hello Traders,

Ethereum on the H1 timeframe is currently trading within a clearly defined short-term bullish structure, supported by a rising curved trendline that reflects sustained higher lows and controlled upside momentum. Price has been respecting this dynamic support while gradually pushing higher, indicating that buyers remain in control in the short term.

At the same time, price is now approaching a major horizontal resistance zone, which has previously acted as a supply area and is marked clearly on the chart. This zone represents a key decision point, where upside continuation requires strong acceptance rather than a simple liquidity sweep.

If price manages to break above this resistance and hold above it with clean structure, continuation toward higher levels becomes a valid scenario. In this case, the preferred execution is not chasing the breakout, but waiting for a pullback that successfully retests the broken level and holds above it. This confirms acceptance and offers a more favorable risk-to-reward profile.

On the other hand, failure to hold above the resistance would likely trigger a corrective rotation. A rejection from this zone could lead price back toward the rising trendline and the nearby support levels. As long as these supports hold, such a move would still be classified as a healthy pullback within a broader bullish structure rather than a trend reversal.

The bullish outlook becomes invalid if price decisively breaks below the rising structure and accepts beneath the marked support zone. That would signal a structural shift and open the door for deeper downside rotations.

At this stage, Ethereum is not at an entry point but at a decision area. Patience and confirmation are critical here. Let the market reveal whether it chooses continuation or correction before committing capital.

Share your view in the comments.

USD/CAD BEARS ARE GAINING STRENGTH|SHORT

USD/CAD SIGNAL

Trade Direction: short

Entry Level: 1.376

Target Level: 1.373

Stop Loss: 1.379

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

ETH/USD SELLERS WILL DOMINATE THE MARKET|SHORT

ETHUSD SIGNAL

Trade Direction: short

Entry Level: 3,117.28

Target Level: 3,026.44

Stop Loss: 3,177.72

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

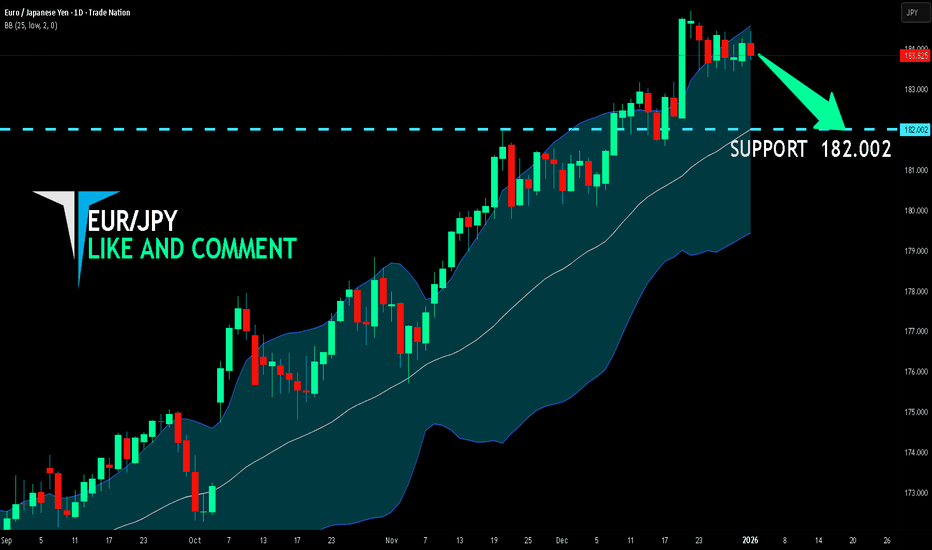

EUR/JPY BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

Previous week’s green candle means that for us the EUR/JPY pair is in the uptrend. And the current movement leg was also up but the resistance line will be hit soon and upper BB band proximity will signal an overbought condition so we will go for a counter-trend short trade with the target being at 182.002.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

XAUUSD (H4) – Monday SetupGeopolitical shock risk, gold may spike | Trade liquidity and reaction zones only

Quick summary

News around Trump’s claim that Maduro has been detained, plus Venezuela’s response (they don’t know his and his wife’s whereabouts and are demanding proof of life), raises geopolitical uncertainty sharply. For gold, that’s a classic catalyst for a gap/spike at Monday open.

So my rule for Monday: no FOMO, only trade liquidity zones and confirmed reactions on the chart.

1) Macro context: Why gold can surge on Monday

Rising geopolitical tension often drives flows into safe-haven assets like gold.

When facts are unclear and tensions escalate, the market can open with:

✅ sharp spikes, ✅ liquidity sweeps, ✅ wider spreads.

➡️ Best approach: wait for price to hit levels, then trade the reaction — not the headline.

2) Technical view (H4 – based on your chart)

Gold is currently moving inside a larger structure after a heavy move, and your chart highlights the key zones clearly:

Key zones

Sell test support 4450 (pullback area where price may get sold)

Liquidity 4330 (major liquidity magnet)

OB 4309 (order block / short-term reaction zone)

Support 4277 (intermediate support)

Buy zone 4203–4206 (deep support / swing buy area)

3) Monday trading scenarios (Liam style: trade the level)

Scenario A (priority): Spike up → SELL around 4450

✅ If gold pumps on the headline at the open:

Sell around 4450 (sell-test zone)

SL: above the most recent swing high (refine on lower TF)

TP1: 4330

TP2: 4309

TP3: 4277

Logic: Headline-driven opens often spike to sweep buy-side liquidity first, then rotate back into value/liquidity.

Scenario B: Sweep down → BUY at liquidity zones

✅ If price gets pulled down first:

Buy around 4330 (Liquidity)

Buy confirmation at 4309 (OB)

SL (guide): below 4300

TP: 4380 → 4450 (scale out)

Logic: 4330 is a major liquidity magnet and often produces a sharp reaction bounce.

Scenario C (worst-case dump): BUY the deep support 4203–4206

✅ If volatility is extreme and price flushes:

Buy: 4203 – 4206

SL: 4195

TP: 4277 → 4330

Logic: This is a deep swing-buy area if the market does a hard liquidity reset.

4) Key notes for a headline-driven Monday open

Avoid trading the first 5–10 minutes if spreads widen.

Only enter once price hits the level and shows a clear reaction (rejection / engulf / MSS on M15).

Reduce size — geopolitical opens can whip hard.

Do you think Monday’s move sweeps up into 4450 first, or drops straight into 4330 liquidity?

XAUUSD D1 – Liquidity Rotation in a Bullish ChannelLiquidity Rotation Inside a Strong Bullish Channel

Gold remains in a clear long-term uptrend on the daily timeframe, trading inside a well-defined ascending channel. Recent volatility, however, suggests the market is entering a liquidity-driven correction phase rather than a trend reversal.

TECHNICAL STRUCTURE

On D1, price is still respecting the rising channel, with higher highs and higher lows intact.

The rejection from the upper channel highlights profit-taking and sell-side liquidity absorption near premium levels.

Current price action suggests a rotation between upper liquidity (distribution) and lower value zones (accumulation).

KEY LIQUIDITY ZONES TO WATCH

Sell-side liquidity (premium zone):

4480 – 4485

This area represents a strong liquidity cluster near the upper channel and prior expansion highs, where price has shown clear rejection.

Buy-side liquidity (value zones):

4180 – 4185

A psychological level and mid-channel support where buyers may re-enter if price rotates lower.

4000 – 4005

Major long-term liquidity and Fibonacci confluence near the lower channel boundary, acting as a key structural support.

EXPECTED PRICE BEHAVIOUR

Short term: price may continue to fluctuate and rebalance between liquidity pools, with choppy conditions likely.

Medium term: as long as price holds above the lower channel, pullbacks are considered corrective within the broader bullish trend.

A clean rejection from sell liquidity followed by a move into buy liquidity would be a healthy reset for continuation later.

FUNDAMENTAL & GEOPOLITICAL BACKDROP

Geopolitical risk has sharply increased after former President Trump announced a large-scale US operation against Venezuela, including the arrest of President Maduro.

This event adds a new layer of uncertainty to global markets and reinforces safe-haven demand.

Historically, rising geopolitical tensions, combined with a softer US dollar environment, tend to support gold prices, especially on higher timeframes.

BIG PICTURE VIEW

Gold’s long-term bullish narrative remains intact

Current moves are driven by liquidity rotation, not weakness

Geopolitical risk could accelerate upside once the corrective phase completes

Patience remains key. Let price move between liquidity zones before committing to the next directional leg.

BITCOIN BEST PLACE TO SELL FROM|SHORT

BITCOIN SIGNAL

Trade Direction: short

Entry Level: 89,775.17

Target Level: 88,820.23

Stop Loss: 90,412.01

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

USD/CHF BEARS ARE STRONG HERE|SHORT

Hello, Friends!

USD/CHF is trending down which is clear from the red colour of the previous weekly candle. However, the price has locally surged into the overbought territory. Which can be told from its proximity to the BB upper band. Which presents a classical trend following opportunity for a short trade from the resistance line above towards the demand level of 0.784.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

USD/JPY SHORT FROM RESISTANCE

Hello, Friends!

USD/JPY pair is in the uptrend because previous week’s candle is green, while the price is clearly rising on the 4H timeframe. And after the retest of the resistance line above I believe we will see a move down towards the target below at 155.701 because the pair overbought due to its proximity to the upper BB band and a bearish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

ETH/USD BEARS ARE GAINING STRENGTH|SHORT

ETHUSD SIGNAL

Trade Direction: short

Entry Level: 3,030.23

Target Level: 2,957.15

Stop Loss: 3,078.86

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

BITCOIN BULLS WILL DOMINATE THE MARKET|LONG

BITCOIN SIGNAL

Trade Direction: long

Entry Level: 87,599.76

Target Level: 90,106.43

Stop Loss: 85,916.50

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

XAUUSD (D1) – Elliott ABC in play Lana sells the pullback, waits to buy at major liquidity 💛

Quick summary

Timeframe: Daily (D1)

Elliott view: Price is likely developing an ABC corrective structure after a strong rally

Strategy: Sell the B-wave pullback into supply, buy only when price returns to strong liquidity

Context: Precious metals started 2026 strong, but short-term volatility and re-accumulation swings are still expected

Fundamental backdrop (supports the bigger trend)

Gold and silver opened 2026 with strong momentum, extending the best run since the late 1970s. Goldman Sachs remains bullish on precious metals and continues to highlight an aggressive long-term target (around $4,900 for gold).

Lana’s key point: the long-term bull cycle can remain intact, but the market still needs healthy corrections to reset liquidity and build new structure.

Technical view (D1) – Elliott ABC structure

On the Daily chart, after the powerful top, gold dropped sharply, forming a clean Wave A. The current structure suggests:

Wave B: a corrective rebound into resistance/supply

Wave C: a potential move back down into liquidity zones before the next major direction is confirmed

This ABC lens helps avoid getting trapped when the news looks bullish, but price is still in a corrective phase.

Key levels from the chart

1) Sell zone (B-wave supply)

Sell: 4435 – 4440

This zone aligns with marked resistance and a Fibonacci pullback cluster (0.236 / 0.382). If price retraces here and shows rejection, it’s a strong area to look for B-wave selling pressure.

2) Buy zone (major liquidity – potential C-wave completion)

Buy Liquidity: 4196 – 4200

This is the strongest liquidity area on the chart. If Wave C plays out, Lana will look for buying opportunities here with clearer risk control.

3) Deeper accumulation liquidity

Accumulate liquidity: the lower accumulation area highlighted on the chart

If the market sweeps deeper than expected, this is the region where longer-term buyers may step in.

Trading plan (Lana’s approach)

Primary idea: Sell rallies into 4435–4440 if price shows weakness (B-wave rejection).

Primary buy plan: Wait for price to revisit 4196–4200 and confirm support (liquidity absorption).

If price breaks and holds above the sell zone, Lana stops selling and waits for a new structure to form.

Note on early-year behavior

The first weeks of the year often bring “messy” moves as liquidity returns and positioning resets. Lana will only trade at planned zones and avoid entries in the middle of the range.

This is Lana’s personal market view and not financial advice

XRP | FVG Retrace Then Consolidation Before Breakout

Executive Summary

XRP is trading at $2.02 within an ascending triangle on the 4H timeframe. After reclaiming the psychological $2 level, price faces resistance at $2.02-$2.12. Expecting a short-term bearish move into the FVG (Fair Value Gap) at $1.75-$1.80, followed by consolidation, then a breakout either up or down.

BIAS: NEUTRAL - Bearish Short-Term, Then Consolidation, Then Breakout

Current Market Data

Current: $2.0231 (+0.85%)

Day's Range: $2.0059 - $2.0385

52-Week: $1.6106 - $3.6662

Market Cap: $122.74B

ETF Holdings: $1.16B+ (24 consecutive days of inflows)

Performance:

1W: +9.82% | 1M: -7.96% | 3M: -31.88%

6M: -10.94% | YTD: +9.99% | 1Y: -15.73%

Key News

XRP spot ETFs hold $1.16B+ with $1.4B total inflows

Ripple unlocked 1B XRP on Jan 1 (monthly escrow) - supply pressure

JPMorgan GTreasury integration on XRP Ledger

CLARITY Act markup scheduled for January 2026

$2 zone has rejected XRP since 2017 - major resistance

Technical Structure - 4H

Ascending Triangle:

Rising support trendline - higher lows

Horizontal resistance at $2.00-$2.02

Upper resistance at $2.12

FVG filled on left, was resistance, then broken

FVG Zone:

$1.75-$1.80 - Unfilled gap / liquidity sweep zone

Expect retrace here before consolidation

Ideal long entry if bounce confirms

Key Levels:

Resistance:

$2.00 - $2.02 - Horizontal resistance

$2.12 - Upper resistance (breakout level)

$2.20 - $2.50 - Bullish targets

Support:

$1.88 - $1.91 - Immediate support

$1.75 - $1.80 - FVG zone / liquidity sweep

$1.72 - Major support zone (bottom red line)

SCENARIO ANALYSIS

SHORT-TERM: Bearish Into FVG

Price retraces to $1.75-$1.80 FVG zone

Sweeps liquidity below $1.80

Consolidation phase begins

THEN: Breakout Either Direction

BULLISH: Break above $2.12 → Targets $2.20, $2.50

BEARISH: If no FVG bounce → Break below $1.72 → Targets $1.61, $1.45

My Assessment

Ascending triangle at $2 resistance. Short-term bearish into FVG at $1.75-$1.80, then consolidation. Wait for breakout confirmation before committing to direction. The $2 zone has rejected XRP since 2017 - this is a make-or-break level.

Strategy:

Expect short-term drop to $1.75-$1.80 FVG

Watch for consolidation and breakout direction

Long above $2.12 → Target $2.20-$2.50

Short below $1.72 → Target $1.61-$1.45

Comment your thoughts on the XRP 2026 Bull or Bear RALLY!

NVO – Weekly Structure UpdateThesis

NVO is attempting a structural reversal after a deep corrective phase, supported by both long-term trend support and improving fundamental visibility.

Context

- Weekly timeframe

- 70% correction from cycle highs

- Price has respected the long-term trendline originating in 2016

- Recent product developments in weight-loss therapies improve long-term business outlook

What I see

- Price held the long-term rising support after the correction

- Recent advance reclaimed the 50-day moving average

- Price is consolidating above short-term support, suggesting stabilization

- Structure is transitioning from decline to base formation

What matters now

- Holding above the 50-day MA keeps the early reversal structure intact

- Next key test sits at the confluence of the 0.618 Fibonacci retracement and the 200-day moving average near the $60 area

Buy / Accumulation zone

- Pullbacks toward the current base and rising support zone remain the area of interest

Targets

- Initial resistance at the 0.618 Fib / 200-day MA confluence

- A confirmed higher low after that test would define Wave 1–2 structure

- Longer-term reference remains the 200-week moving average overhead

Risk / Invalidation

- Loss of the long-term trendline would invalidate the reversal thesis

XAUUSD (H2) – Liam Plan (Jan 02) Price is compressing in a structure, wait for the trendline break to choose direction 🎯

Quick summary

After the strong bearish BOS, gold is rebounding and compressing inside a diagonal structure (triangle/flag-like). Today the clean approach is confirmation trading:

SELL only after a confirmed break of the trendline (4348–4350) as marked on your chart.

SELL reactions at the upper supply / VAL zones (4460–4463 and 4513–4518).

BUY is secondary — only if price holds the 4400–4405 key support and shows a clear reaction on lower timeframes.

Macro backdrop (CME FedWatch)

Probability Fed holds rates in January: 85.1%

Probability of a 25 bps cut in January: 14.9%

By March: probability of 25 bps cumulative cut: 51.2%, hold 42.8%, 50 bps cut 5.9%

👉 This keeps markets sensitive to USD / yields expectations. Gold can bounce technically, but volatility spikes are likely — so we stick to levels + confirmation.

Key Levels (from your chart)

✅ Sell zone 1: 4513 – 4518

✅ Sell VAL: 4460 – 4463

✅ Reaction / flip zone: 4400 – 4405

✅ Breakdown trigger: 4348 – 4350 (sell upon confirmed trendline breakout)

Trading scenarios (Liam style: trade the level)

1) SELL scenarios (priority)

A. SELL on trendline breakdown confirmation

Trigger: clean break + close below 4348–4350

Entry: sell the retest back into the broken trendline

TP1: 4320–4305

TP2: 4260–4240

TP3: deeper extension (towards the 41xx area) if momentum expands

Logic: This is the clearest “trend confirmation” on your chart. No chasing — let price confirm first.

B. SELL reaction at supply

Sell: 4460–4463 (VAL)

Stronger sell: 4513–4518 (premium supply)

Only sell with visible weakness / rejection on M15–H1.

2) BUY scenario (secondary – reaction only)

Buy zone: 4400–4405

Condition: hold the zone + print higher lows on lower TF

TP: 4460 → 4513 (scale out)

Logic: This is a key support/flip area. If it holds, price can rotate up to test supply above before the next decision.

Key notes

Compression often creates false breaks — don’t trade mid-range.

Two clean plays only: break 4348–4350 to sell with confirmation, or retrace to 4460/4513 to sell the reaction.

What’s your bias today: selling the 4348 breakdown, or waiting for 4460–4463 for a cleaner pullback sell?

XAUUSD (H1) – Early 2026 OutlookShort-term recovery inside a larger bullish cycle 💛

Quick market recap

2025 performance: Gold surged ~64%, the strongest annual gain since 1979

Recent move: Sharp year-end correction driven by profit-taking and margin adjustments, not trend reversal

Big picture: The multi-year bull market in precious metals remains intact

Fundamental context (why the trend still matters)

Despite the late-2025 pullback, the broader precious metals complex remains structurally strong. Gold, silver, platinum, and palladium all benefited from:

Fed rate-cut cycle expectations

Persistent geopolitical tensions

Strong central bank buying

Industrial demand and supply constraints (especially for silver and platinum)

Most analysts agree the recent correction was technical in nature. The long-term outlook still points toward gold potentially testing 5,000 USD/oz and silver approaching 100 USD/oz in 2026, although short-term volatility is expected to remain high.

Technical view (H1) – Based on the chart

After failing to hold above the ATH, gold experienced a sharp bearish displacement, followed by a stabilization phase near a strong support zone. Price is now attempting a recovery, but the structure suggests this is still a corrective move within a broader range.

Key observations:

Strong sell-off broke short-term bullish structure

Price is rebounding from major support, forming a potential higher low

Overhead liquidity and Fibonacci zones remain key reaction areas

Key levels Lana is watching

Buy zone – Strong liquidity support

Buy: 4345 – 4350

This is a strong liquidity zone where price already reacted. If price revisits this area and holds structure, it offers a favorable risk-to-reward buy aligned with the larger bullish cycle.

Sell zone – Short-term resistance (scalping)

Sell scalping: 4332 – 4336

This zone aligns with short-term resistance and Fibonacci reaction levels. If price fails here, a brief pullback toward support is possible.

Important overhead liquidity

Key liquidity: 4404 area

A clean break and hold above this level would signal stronger bullish continuation toward higher targets.

Scenarios to consider

Scenario 1 – Range correction continues

Price reacts at short-term resistance, rotates back into liquidity, and builds a base before the next directional move.

Scenario 2 – Bullish continuation resumes

A break above overhead liquidity opens the path toward higher levels, potentially retesting prior highs as the new year unfolds.

Lana’s approach 🌿

Trade zones, not headlines

Focus on price reaction at liquidity levels

Accept short-term volatility while respecting the long-term bullish structure

This analysis reflects Lana’s personal market view and is not financial advice. Please manage risk carefully and trade responsibly 💛

GOLD BUY TODAY | Demand Zone Holding, Upside Targets Open🔓 Entry: 4380 – 4390

❌ Stop Loss: 4365

🎯 Target: 4430 Next Target: 4450

GOLD BUY (XAUUSD) Price is holding above a key demand zone with bullish price action and trend support intact. Looking for upside continuation as buyers remain in control. A sustained move higher can push price toward the next resistance levels. Trade is planned with clear risk management and favorable risk-reward, suitable for intraday to short-term continuation.

XAUUSD H4 Buy Limit | Trend Continuation Setup📊 XAUUSD Technical Analysis (H4)

Price is moving within an ascending structure and continues to respect the bullish trendline.

After a healthy pullback into the demand zone, a continuation to the upside is expected.

🔹 Entry Zone: Buy Limit at 4258 – 4216

❌ Stop Loss: Two H4 candle closes below 4196

✅ Target: 4353

📌 Once the buy limit is activated, partial risk management will be applied.

After price reaches 4290, the position will be secured by moving to break-even (risk-free).

⚠️ Always manage your risk properly.

Wishing you success and victory,🧿❤️✌️

FXG Team Management” 🏅

XAU/USD SHORT POSITION CHART PREDICTION Market Structure

Price is moving inside a rising channel (higher highs & higher lows).

Currently testing the upper channel + supply/resistance zone.

This area often acts as a profit-taking / reversal zone. Key Observations

Strong push into resistance → bullish momentum weakening

Upper zone aligns with previous rejection highs

Expectation: pullback toward channel support

Trade Bias: Short-term Sell

Sell Zone (Entry):

4380 – 4385 (current resistance / supply)

Stop Loss:

Above 4400 (clear break & close above supply invalidates sell)

Targets:

TP1: 4365 (minor intraday support)

TP2: 4354 (marked support zone)

TP3 (extended): 4340 (lower channel support, if momentum increases)

Wait for rejection candle / bearish confirmation at entry

Bitcoin Is Coiling — The Next Move Won’t Be QuietBITCOIN (BTC/USD) – 4H MARKET ANALYSIS

Market Structure Overview

- Bitcoin is currently trapped in a well-defined range on the H4 timeframe.

- Price is oscillating between a major resistance zone around 90,000–90,500 and a strong support zone around 86,500–87,000.

- Repeated rejections at resistance and consistent reactions from support confirm a classic consolidation / distribution range.

Key Technical Observations

- Each push into the resistance zone is met with strong selling pressure, indicating supply dominance at higher levels.

- Sellers, however, are failing to break decisively below support, suggesting buyers are still absorbing liquidity.

- The repeated zig-zag structure inside the range shows liquidity being built, not trend continuation yet.

- Volume remains relatively muted compared to impulsive legs → typical behavior before a -volatility expansion.

Scenarios to Watch

Bullish Breakout Scenario

A clean breakout and acceptance above 90,500 could trigger a strong upside expansion, opening the path toward 92,000–94,000.

This would confirm accumulation and invalidate the current range.

Bearish Breakdown Scenario

A decisive break below 86,500 would shift the structure into a deeper corrective phase.

In that case, downside momentum could accelerate quickly as range support fails.

Trading Bias & Strategy

Neutral bias while inside the range.

Best strategy: trade reactions at the edges of the range, not the middle.

For swing positioning, patience is key — wait for a confirmed breakout with volume before committing size.

Conclusion

Bitcoin is not trending it is preparing.

The longer the range holds, the stronger the eventual breakout.

Stay disciplined, protect capital, and let the market reveal direction before acting.