NZD/JPY BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

We are targeting the 89.269 level area with our short trade on NZD/JPY which is based on the fact that the pair is overbought on the BB band scale and is also approaching a resistance line above thus going us a good entry option.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Techincalanalysis

The gold came down as we expected previouslyWe are going to look for a buy in gold as it came down to a cheap level and we are waiting for the price to retest to our febonachi level and 1h OB so that we put a long position in gold. I hope you guys are learning and enjoying from the experienced trader thanks.

GOLD SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

GOLD is making a bullish rebound on the 4H TF and is nearing the resistance line above while we are generally bearish biased on the pair due to our previous 1W candle analysis, thus making a trend-following short a good option for us with the target being the 4,553.45 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

AUD/JPY BULLS ARE GAINING STRENGTH|LONG

AUD/JPY SIGNAL

Trade Direction: long

Entry Level: 105.605

Target Level: 106.012

Stop Loss: 105.332

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR/NZD BULLISH BIAS RIGHT NOW| LONG

EUR/NZD SIGNAL

Trade Direction: long

Entry Level: 2.015

Target Level: 2.020

Stop Loss: 2.012

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Gold Before CPI: Top or Trap?1. STRATEGIC CONTEXT

Primary trend: GOLD remains in an uptrend; the higher-timeframe structure is still intact.

Macro backdrop:

CPI tonight may cause short-term volatility.

However, geopolitics is currently a stronger driver than CPI.

Key geopolitical risks:

Greenland tensions → escalating global strategic rivalry.

Protests in Iran, power and internet cuts → rising Middle East risks.

👉 Strategic implication:

Gold continues to be supported as a safe-haven asset → pullbacks are for buying, not for chasing shorts.

📊 2. CURRENT MARKET STRUCTURE

Price is:

Holding the ascending trendline

Consolidating in a box, compressing ahead of CPI

Market condition:

High probability of false breakouts

Top-catching traps are very likely before the news

📍 3. KEY PRICE LEVELS

🔴 RESISTANCE

4,680 – 4,700

→ Previous high / ATH zone

→ Reactive sells only if clear rejection appears

4,655 – 4,660

→ Intermediate resistance, easily swept pre-CPI

🟣 CONSOLIDATION BOX

4,595 – 4,630

→ Sideways range ahead of CPI

→ No FOMO inside the box

🟢 SUPPORT

4,545 – 4,550 → Major confluence support

4,480 → Medium-term support, trendline retest

4,420 → Deep support, last bullish structure zone

📝 4. IMPORTANT NOTES

Higher CPI:

May trigger a technical pullback

❌ Does NOT automatically mean a top

Lower / in-line CPI:

Gold may consolidate above highs and break ATH

Selling before CPI:

→ Reactive scalps only, no holding

Buying:

→ Only when price reaches key zones with clear reaction

🎯 5. STRATEGIC MINDSET

❌ Don’t force top-catching while geopolitics supports gold

✅ Focus on risk management – wait for zones – wait for confirmation

🧠 Before CPI: survival > profit

Scalp the Flow. Respect the Trend.CAPITALCOM:US100 Price is showing a short-term bullish rebound, but it’s happening inside a higher-timeframe bearish environment. For me this is a classic setup: scalp longs in discount, then fade rallies into premium supply.

📌 Higher Timeframe Context VANTAGE:NAS100 (Daily)

• Price is still capped below the daily premium / supply zone

• Daily structure remains heavy unless we reclaim key resistance

• Buyers are reacting, but HTF control is still bearish below major supply

➡️ Daily Bias: Bearish below 26,000

📈 Intraday Structure (1H)

• Sharp selloff delivered, then price started rebounding

• Short term flow: bullish correction

• Key levels visible:

• Support: ~25,540 – 25,600

• Nearest resistance / sell area: ~25,720 – 25,780

• Higher resistance: 25,900+, then 26,000 zone

🔴 Short Scenario (Primary | With HTF Trend)

• Sell zone 1: 25,720 – 25,780 (first premium reaction area)

• Sell zone 2: 25,900 – 26,000 (major supply / higher premium)

• What I want to see:

• Weak push up + rejection

• Failure to hold above the zone (no clean acceptance)

• Targets:

• 25,600

• 25,540

• Extended: 25,480 → 25,400

This is the main play if price gives us a clean premium reaction.

🟢 Long Scenario (Secondary | Scalp Only)

• Valid while price holds above 25,600

• Best entries are pullbacks into support, not chasing highs

• Upside targets (scalp):

• 25,720 – 25,780 (first take profit zone)

• If acceptance happens: 25,850, then 25,900

⚠️ Longs are counter trend scalps until daily supply is reclaimed.

❌ Cancellation / Invalidation Levels

• Long scalp invalidated if: 1H closes below 25,520

• Short bias invalidated if: 1H accepts above 25,800

• HTF bearish invalidated if: 1H + daily acceptance above 26,000 (strongest flip)

🎯 Final Expectation

Short-term, price can keep pushing up from discount, but I expect rallies to get tested hard at 25,720–25,780 first. If that zone rejects, sell-side continuation remains the higher probability path.

Not financial advice. Risk management is mandatory.

EUR/USD BEARS ARE GAINING STRENGTH|SHORT

EUR/USD SIGNAL

Trade Direction: short

Entry Level: 1.168

Target Level: 1.164

Stop Loss: 1.170

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

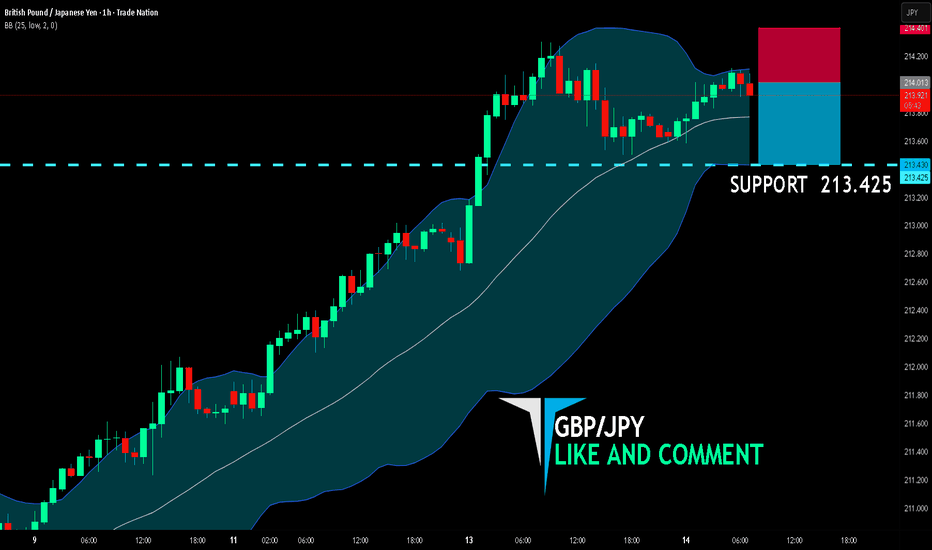

GBP/JPY BEARISH BIAS RIGHT NOW| SHORT

GBP/JPY SIGNAL

Trade Direction: short

Entry Level: 214.013

Target Level: 213.425

Stop Loss: 214.401

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR/GBP BEST PLACE TO SELL FROM|SHORT

Hello, Friends!

Bearish trend on EUR/GBP, defined by the red colour of the last week candle combined with the fact the pair is overbought based on the BB upper band proximity, makes me expect a bearish rebound from the resistance line above and a retest of the local target below at 0.864.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NZD/CHF SHORT FROM RESISTANCE

Hello, Friends!

NZD/CHF is trending down which is clear from the red colour of the previous weekly candle. However, the price has locally surged into the overbought territory. Which can be told from its proximity to the BB upper band. Which presents a classical trend following opportunity for a short trade from the resistance line above towards the demand level of 0.457.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR/USD BULLS WILL DOMINATE THE MARKET|LONG

EUR/USD SIGNAL

Trade Direction: short

Entry Level: 1.163

Target Level: 1.165

Stop Loss: 1.161

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

IS BTC Finally Booming Again? Not So Fast! The Daily BOS UpHey, Traders. BTC has had some significant pushes these last few days and it has been surprising to many. But, if you've been following our posts on ETH and our structural analyses, you can see how this has been playing beautifully like a flute! Please see our previous posts for more details.

Where are we now?

BTC has been playing out a H4 Structure the last few days. This started with an H4 Break of Structure Up back on Dec 2 when it closed above 92,500. This BOS was a good push up, but as we have shown here numerous times, it usually leads to a significant pull back to the Source. In this case, the source was around 84,600. We saw BTC fall exactly back to this area. To many this seemed like another crash and there were many posts, speculations, etc. about Fed rates, Gold Pumps, etc. But to keen technical traders, this was all expected, and offered a great opportunity to buy at around $85K.

This return to the H4 Source set the way for BTC to push back up to the Daily Supply Zone (94,500 - 96,800) where we are today. There was little to nothing to stop it from returning here after the H4 Confirmation.

So, What's Next?:

At today's close, BTC gave a Daily BOS Up, with a close above this Daily Supply Zone ~96,700. This has been long awaited, and is the first Strong Bullish sign since we fell from ATH in October. So, this is the first Real signal that the BTC fall is over (the lows have been put in around 80K). Now, what we should expect from here is two-fold:

1. In my analyses, A BOS up almost always leads to a pullback return to the Source. In this case, the Daily Source is (80,500 - 87,500). That is a large area, so I would look for the H4 source within that zone (80,500 - 84,500) for the most likely pullback area. This is the strongest and most likely scenario.

2 . The only way we don't fall back to this Daily Source area is with a strong Retest and Rejection of this latest Daily Supply Zone. This is not as likely, but could happen. The Retest needs to be strong, though. We need to see a Daily bearish candle push significantly back into this Daily supply zone, but get rejected hard and end up closing back above the top of the zone - above 96,700. If that happens, then we need another strong bullish daily candle away from the zone. These MUST happen to keep BTC going up. If we get this pattern, then it's off to the races and there will only be a few insignificant resistance areas (110K - 112K) and (114K - 115K) that will slow it down on its way back to near ATH. I'd expect a push back to 123K, and then a strong re-assessment from there.

So, that's what I see playing out on BTC. Please leave me your comments, suggestions, etc. as I would love to hear from you. Also, if you don't have strong technical analysis skills and would like to learn how we "READ" the markets, drop me a line and I'd be glad to discuss our training programs with you. Happy Trading!!!

GOLD SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

GOLD pair is in the downtrend because previous week’s candle is red, while the price is clearly rising on the 4H timeframe. And after the retest of the resistance line above I believe we will see a move down towards the target below at 4,543.21 because the pair is overbought due to its proximity to the upper BB band and a bearish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NZD/CAD BEARS ARE GAINING STRENGTH|SHORT

NZD/CAD SIGNAL

Trade Direction: short

Entry Level: 0.798

Target Level: 0.796

Stop Loss: 0.799

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

XAUUSD H1– Bullish Bias, Waiting for Channel BreakoutXAUUSD H1 – Bullish Bias, Waiting for Channel Breakout

Gold continues to trade inside an ascending channel on H1, and the overall structure still favours upside continuation. At this stage, the priority is not chasing price, but waiting for either a clean channel breakout or a controlled retest of demand before the next impulsive move.

TECHNICAL STRUCTURE

Price is consolidating inside a rising channel after a strong impulsive rally.

Higher lows are still being respected, showing that buyers remain in control.

The current range looks like re-accumulation, preparing for the next expansion leg.

KEY LEVELS TO WATCH

Buy-on-retest zone:

4612 – 4615

This is the most important level in the short term. A successful retest and hold here keeps the bullish structure intact and opens the door for continuation.

Upper resistance / reaction zone:

4688 – 4690

This area may cause short-term reactions or consolidation, but a strong break and acceptance above it would confirm bullish momentum.

Upside target:

4745

This is the next major objective once price breaks out of the channel and absorbs sell-side liquidity above.

Sell-side liquidity below:

The lower boundary of the channel acts as liquidity support. As long as price holds above it, pullbacks are considered corrective.

PRIORITY SCENARIO – BULLISH CONTINUATION

Price retests 4612–4615, holds above the zone, and forms bullish confirmation.

A breakout above 4688–4690 confirms strength.

Momentum accelerates toward 4745 as buy-side liquidity is triggered.

ALTERNATIVE SCENARIO – RANGE EXTENSION

If price fails to break immediately, further consolidation inside the channel is possible.

In this case, patience is key until a clear breakout or a clean retest of demand appears.

SUMMARY VIEW

Bias remains bullish

Focus on buying pullbacks, not chasing highs

A confirmed break of the channel is the signal for the next expansion

4612–4615 defines whether buyers stay in control

The market will show direction once liquidity is taken — wait for confirmation.

Are tech stocks about to surge? Nasdaq New Highs? The market is very close to making a big move.

We believe the market is still bullish and will likely trend higher.

Today crypto was strong when the market was weak. This could be signaling tech is about to capture some bullish liquidity.

Banks got decimated today, which allows lots of capital to rotate back into tech.

The Nasdaq is lagging and the only indices to not make new all time highs.

GBP/USD — H8 | Jan 13, 2026 | Elliott Wave Outlook 🔎 GBP/USD — H8 | Jan 13, 2026 | Elliott Wave Outlook — Wave 1 completed, market entering consolidation before Wave 3

• On the H8 timeframe, GBPUSD has completed a 5-wave impulse in yellow, topping at 1.35678, which also marks Wave 1/A in green of a higher-degree cycle.

• Wave (4) yellow unfolded as a white Triangle, followed by a strong breakout in Wave (5) yellow into the high.

• After completing 1/A green, GBPUSD has entered Wave 2/B green, developing as a yellow A–B–C corrective structure.

• Wave A yellow has already completed, and the market is currently moving within Wave B yellow.

• Once Wave B yellow finishes, GBPUSD is expected to form Wave C yellow to complete the entire corrective phase, before triggering Wave 3/C green — the strongest and most impulsive phase of the cycle.

📌 Primary scenario (Bullish – medium term):

• Wait for Wave C yellow to complete, then look for buy opportunities aligned with Wave 3 green.

⛔️ Invalidation level:

• A break below 1.30102 invalidates the bullish structure → wave count must be reassessed.

🧭 Trade philosophy:

Markets do not reverse after a strong trend — they consolidate to travel further.

SILVER BEST PLACE TO SELL FROM|SHORT

Hello, Friends!

We are going short on the SILVER with the target of 7,986.4 level, because the pair is overbought and will soon hit the resistance line above. We deduced the overbought condition from the price being near to the upper BB band. However, we should use low risk here because the 1W TF is green and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBP/CHF BEARS ARE STRONG HERE|SHORT

GBP/CHF SIGNAL

Trade Direction: short

Entry Level: 1.074

Target Level: 1.073

Stop Loss: 1.075

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR/NZD BEARS ARE STRONG HERE|SHORT

Hello, Friends!

EUR/NZD pair is trading in a local downtrend which know by looking at the previous 1W candle which is red. On the 4H timeframe the pair is going up. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 2.023 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR/CHF BEST PLACE TO SELL FROM|SHORT

Hello, Friends!

EUR/CHF pair is in the downtrend because previous week’s candle is red, while the price is obviously rising on the 4H timeframe. And after the retest of the resistance line above I believe we will see a move down towards the target below at 0.930 because the pair is overbought due to its proximity to the upper BB band and a bearish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

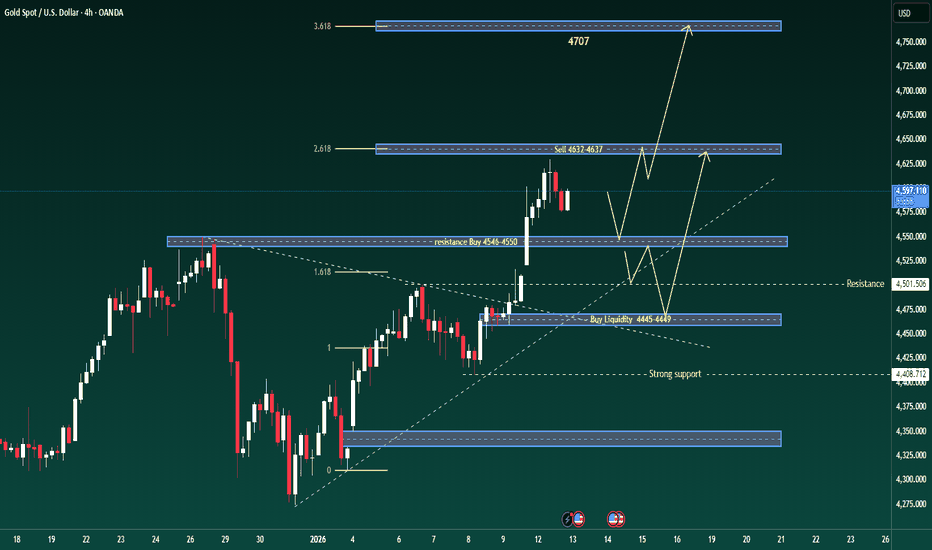

XAUUSD H4 – Correction First, Then ExpansionXAUUSD H4 – Pullback Then Continuation Using Fibonacci and Key Levels

Gold remains in a strong bullish trend on H4, but the current structure suggests the market needs a pullback into liquidity before the next expansion leg.

Market View

The recent rally has pushed price into premium territory, which often triggers short-term profit-taking.

Fibonacci extensions are acting as liquidity magnets: 2.618 is a key reaction zone, while 3.618 is the next expansion target.

Main approach: wait for the pullback into support/buy zones, then follow the trend.

Key Levels to Watch

Near resistance: 4546–4550 (reaction zone / key resistance)

Sell reaction zone: 4632–4637 (Fibonacci 2.618, likely to cause volatility)

Expansion target: 4707 (Fibonacci 3.618)

Buy liquidity zone: 4445–4449 (best buy area in this structure)

Strong support: 4408 (critical defensive support)

Scenario 1 – Shallow Pullback, Then Push Higher

Idea: price pulls back lightly, holds structure, and resumes the uptrend quickly.

Preferred pullback zone: 4546–4550

Expectation: move back up toward 4632–4637, and if absorbed, extend toward 4707

Confirmation to watch: H4 candles hold above 4546–4550 with clear buying response (rejection wicks, strong closes, momentum return)

Scenario 2 – Deeper Pullback to Sweep Liquidity, Then Strong Rally

Idea: price sweeps deeper into the best demand zone before the next major leg.

Deep pullback zone: 4445–4449

Expectation: bounce back to 4546–4550 → then push to 4632–4637 → and potentially extend to 4707

Confirmation to watch: strong reaction at 4445–4449 (buyers absorb, structure holds, no clean breakdown)

Important Notes

4632–4637 is a sensitive zone where profit-taking and sharp swings can appear before continuation.

If price breaks and holds below 4445–4449, shift focus to 4408 to judge whether the bullish structure is still being defended.

Conclusion

The main trend is still bullish, but the best edge comes from waiting for a pullback and buying at key levels.

Focus zones: 4546–4550 (shallow pullback) and 4445–4449 (deep pullback with better R:R).

If Fibonacci expansion continues, the next upside target is 4707.

If you share the same view, follow me to get the next updates earlier.