NZD/CHF BEARS ARE STRONG HERE|SHORT

Hello, Friends!

NZD/CHF is making a bullish rebound on the 1H TF and is nearing the resistance line above while we are generally bearish biased on the pair due to our previous 1W candle analysis, thus making a trend-following short a good option for us with the target being the 0.459 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Techincalanalysis

AUD/USD SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

AUD/USD pair is trading in a local uptrend which we know by looking at the previous 1W candle which is green. On the 8H timeframe the pair is going up too. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 0.664 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

XAUUSD (H1) – Monday Trading Plan Lana prioritizes sell setups until a new high is broken

Quick summary

Technical context: Price has pulled back strongly from the All-Time High, showing short-term weakness

Daily bias: Sell on rallies, until price breaks and holds above a new high

Key events: Speech from U.S. President Trump and updates related to U.S.–China trade may increase volatility

News impact – what to watch

Trump’s speech: Often drives short-term USD sentiment through comments on growth, tariffs, and inflation. Gold may react sharply to headline risk.

U.S.–China trade activity (CCPIT): Any improvement in trade sentiment can support USD in the short term, adding pressure to gold. Rising tensions would favor gold as a safe haven.

Because of this, Lana will focus on price reaction at key zones rather than predicting the news outcome.

Technical analysis (H1)

Gold printed a new All-Time High and then sold off aggressively, signaling profit-taking near the top.

Price is now consolidating within a corrective structure, where selling rallies remains the higher-probability play.

Key zones identified on the chart:

Sell zone: 4529 – 4531

Buy reaction zone: 4498 – 4500 (support)

Trading plan for Monday

Primary scenario – Sell rallies

Sell: 4529 – 4531

This zone is expected to act as resistance during the current correction.

Bias change condition:

Only shift to a bullish continuation if price breaks above the previous high and holds.

Secondary scenario – Short-term buy reaction

Buy: 4498 – 4500

This is considered a scalp-only setup, as the overall intraday bias remains bearish.

Session notes

Asian session may remain slow, while volatility is likely to increase around the scheduled events.

Best trades are expected when price returns to planned zones rather than trading in the middle of the range.

This analysis reflects Lana’s personal market view and is not financial advice.

Ethereum Trapped Between Supply and DemandETH/USD (4H) — Market Analysis

Market Structure

Ethereum is stuck in a broad sideways range after a strong rejection from the upper resistance zone (~3,000–3,050).

The sharp sell-off from the top confirms strong supply pressure at premium prices.

Current price action shows range rotation, not trend continuation.

Key Zones

Strong Resistance: 3,000–3,050

→ Previous rejection zone, heavy sell orders remain.

Mid Resistance: ~2,960–2,980

→ Short-term cap where price repeatedly fails.

Support Zone: 2,880–2,910

→ Buyers defended this area multiple times.

Major Support: 2,760–2,800

→ Last demand before structure turns bearish.

Probable Scenarios

Base Case (Higher Probability):

Price continues sideways consolidation, bouncing between support and resistance to absorb liquidity.

Bullish Scenario:

A clean 4H close above 2,980–3,000 opens upside continuation toward the upper resistance zone again.

Bearish Scenario:

Loss of 2,880 support exposes ETH to a deeper drop toward 2,760–2,800.

Momentum & Trend Context

EMAs are flattening, confirming range conditions.

No impulsive follow-through yet → market is waiting for a catalyst.

Macro Context

Risk assets remain sensitive to USD strength and bond yields.

With no strong bullish macro trigger, ETH is more likely to range than trend aggressively in the near term.

Bottom Line

Ethereum is in balance mode.

Until price clearly accepts above resistance or breaks support, expect choppy, two-sided price action rather than a sustained trend.

Chumtrades XAUUSD Any pullback is an opportunity to buy higher.This morning’s move was a corrective sell-off, best understood as profit-taking from BUY-side, not a trend reversal.

The overall structure remains within a rising trend channel, with no sign of a structural break → BUY bias stays intact, looking to buy pullbacks in line with the trend.

🟢 Key Support Zones

447x: near-term support (4476 – 4472 – 4470)

4450 – 4455

4430 – 4435

🔴 Key Resistance Zones

4548 – 4550

4560 – 4565

4599 – 4600 (upper resistance)

📌 Additional Note

453x is a mid-zone to watch closely for price reaction.

📊 Intraday Expectation

Price is expected to range sideways on the H2 timeframe

Range high: 4549

Range low: 4473

→ Possible BUY near the lower boundary and SELL near the upper boundary if the range holds.

⚠️ Risk Management

No major news at the moment; price is mainly driven by technical flows.

Holiday period → thin liquidity, higher risk of stop hunts.

Keep stops reasonable and avoid overtrading.

Wishing everyone a productive trading day.

BITCOIN SELLERS WILL DOMINATE THE MARKET|SHORT

BITCOIN SIGNAL

Trade Direction: short

Entry Level: 87,523.10

Target Level: 84,571.68

Stop Loss: 89,485.39

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBP/USD BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

We are going short on the GBP/USD with the target of 1.340 level, because the pair is overbought and will soon hit the resistance line above. We deduced the overbought condition from the price being near to the upper BB band. However, we should use low risk here because the 1W TF is green and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

XAUUSD H4 – Trading the Uptrend Channel with LiquidityTrading the Uptrend Channel with Liquidity and Volume Profile

Gold remains bullish on the H4 timeframe and continues to respect a well-defined rising channel. With price approaching extended areas, the higher-probability approach is to buy pullbacks at value zones and treat the upper boundary as a short-term profit-taking area rather than chasing momentum.

TECHNICAL CONTEXT

The uptrend structure is still intact, with price forming higher lows inside the channel.

After a strong impulsive leg, the market is now consolidating and rebalancing, which favours execution around Volume Profile and FVG zones.

The upper channel boundary often acts as a short-term exhaustion area, while value zones below offer better risk-to-reward long entries.

PRIORITY SCENARIO – MAIN PLAN

Buy the pullback at key value and liquidity zones

Buy POC: around 4485

Buy zone FVG support: around 4368

Rationale:

The 4485 POC is a high-volume area where price frequently reacts during pullbacks.

The 4368 FVG aligns with channel support and represents an imbalance area that price often revisits before continuation.

Expected behaviour:

A pullback into POC or the FVG zone, followed by a bullish reaction, can set up the next leg higher within the channel.

ALTERNATIVE SCENARIO – SECONDARY PLAN

Short-term sell scalp near the upper boundary

Sell scalping zone: around 4600

Note:

This is strictly a short-term scalp if price reaches the upper channel boundary and shows clear rejection. It is not a trend reversal thesis.

KEY TAKEAWAYS

The H4 trend remains bullish, but the channel range is wide, making chasing price riskier.

Volume Profile and FVG zones define higher-probability execution areas.

The best edge comes from buying pullbacks at value, while treating 4600 as a potential short-term reaction zone.

XAUUSD (H4) – Weekly Plan Bull trend still in control | Buy the pullback at 4430, sell reaction at 4573, target 4685

Weekly strategy snapshot

On H4, gold is still holding a strong bullish structure inside the rising channel. Price has already expanded higher, so next week I’m not chasing — I’m prioritising a trend buy on pullback into liquidity. Above, the 1.618 Fibonacci zone is a clean area for a reaction sell / profit-taking.

1) Technical view (based on your chart)

H4 structure remains bullish: higher highs + higher lows.

Price is extended after the breakout, so mid-range entries are risky.

The chart clearly marks Sellside Liquidity – Buy 4430 as the key “reload” area.

Upside zones: Sell 4573 (Fibo 1.618) and the extension target 4685.

2) Key Levels for next week

✅ Buy zone (Sellside Liquidity): 4430

✅ Sell reaction (Fibo 1.618): 4573

✅ Extension target: 4685

3) Weekly trading scenarios (Liam style: trade the level)

Scenario A (priority): BUY the pullback with the trend

✅ Buy: around 4430 (wait for a liquidity sweep + reaction)

SL (guide): below the 4430 zone (refine on lower TF / spread)

TP1: 4530 – 4540

TP2: 4573

TP3: 4685 (if momentum continues)

Logic: After a breakout, price often returns to “collect liquidity” before the next leg higher. 4430 is the cleanest dip-buy location on this structure.

Scenario B: SELL reaction at premium Fibonacci (short-term)

✅ Sell: around 4573

SL (guide): above the zone

TP: back toward value / potentially toward 4430 if a clear correction develops

Logic: 4573 is a premium area where profit-taking often shows up. This is a reaction sell — not a long-term bearish bias.

4) Macro context (from your news) & gold impact

Trump’s comments on tariffs, a sharper reduction in the trade deficit, and strong GDP messaging can keep markets sensitive to USD / yields expectations. That can create sharp intraday swings.

At the same time, policy and geopolitical uncertainty still supports safe-haven demand — which is why the best approach remains: follow the trend, enter at liquidity.

5) Risk notes

Don’t chase at highs.

Only act at the levels: 4430 or 4573.

Max risk per trade: 1–2%.

What’s your bias for next week: buying the 4430 pullback, or waiting for 4573 to sell the reaction?

XAUUSD (H4) – Trading with the Rising Channel Lana focuses on pullback buys for the week ahead 💛

Weekly overview

Primary trend (H4): Strong bullish structure, price is respecting a clean ascending channel

Current state: Price is trading near ATH and Fibonacci extensions → short-term reactions are possible

Weekly strategy: No FOMO. Lana prefers buying pullbacks at value zones, not chasing highs

Market context

Recent comments from the U.S. highlight strong economic growth and confidence in trade policies. While such statements can influence USD sentiment, gold at year-end is often driven more by liquidity conditions and technical structure than headlines.

With holiday liquidity thinning out, price movements can become sharper and less predictable. That’s why this week Lana stays disciplined and trades strictly based on structure and key levels.

Technical view based on the chart (H4)

On the H4 timeframe, gold is moving smoothly within a rising channel, consistently forming higher lows.

The strong impulse leg has already completed its psychological breakout phase, and price is now hovering near the upper area of the channel.

Key points:

Fibonacci extension zones near the top act as psychological resistance, where temporary pullbacks are normal.

The best opportunities remain inside the channel, around value and liquidity zones.

Key levels Lana is watching this week

Primary buy zone – Value Area (VL)

Buy: 4482 – 4485

This is a value zone within the rising channel. If price pulls back here and holds structure, continuation to the upside becomes more likely.

Safer buy zone – POC (Volume Profile)

Buy: 4419 – 4422

This POC zone shows heavy prior accumulation. If volatility increases or price corrects deeper, this area offers a more conservative buy opportunity.

Psychological resistance to respect

4603 – 4607: Fibonacci extension & psychological barrier

At this zone, a short-term rejection or liquidity grab is possible before the next directional move.

Weekly trading plan (Lana’s approach)

Buy only on pullbacks into planned zones, with confirmation on lower timeframes.

Avoid chasing price near ATH or psychological resistance.

Reduce position size and manage risk carefully during low-liquidity holiday sessions.

Lana’s note 🌿

The trend is strong, but discipline at the entry is everything. If price doesn’t return to my zones, I’m happy to stay patient and wait.

This is Lana’s personal market view, not financial advice. Always manage your own risk. 💛

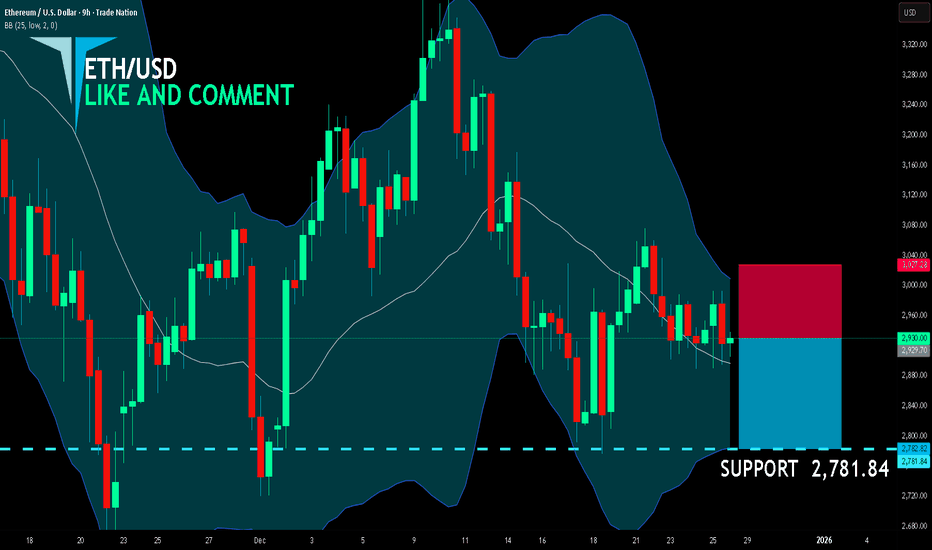

ETH/USD BEST PLACE TO SELL FROM|SHORT

ETHUSD SIGNAL

Trade Direction: short

Entry Level: 2,929.70

Target Level: 2,781.84

Stop Loss: 3,027.28

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

AUD/NZD SHORT FROM RESISTANCE

Hello, Friends!

It makes sense for us to go short on AUD/NZD right now from the resistance line above with the target of 1.148 because of the confluence of the two strong factors which are the general downtrend on the previous 1W candle and the overbought situation on the lower TF determined by it’s proximity to the upper BB band.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR/USD — H1 | Elliott Wave Outlook🔎 EUR/USD — H1 | Elliott Wave Outlook — Correction Completed, Bullish Continuation Expected

• On the H1 timeframe, EURUSD continues to maintain a bullish Elliott Wave structure, formed after completing a W–X–Y corrective phase (teal).

• Wave Y (teal) of the prior corrective structure appears to have завершed around the 1.17026 area.

• After completing wave 3 (red) near 1.18021, EURUSD entered a contracting A–B–C–D–E correction (yellow), with wave E terminating around 1.17665.

• Price is now forming the initial impulsive advances from this base, indicating fading selling pressure and increasing probability of a bullish continuation.

• As long as EURUSD holds above the 1.17665 level, the bullish structure remains intact.

📌 Preferred Scenario (Bullish):

• Wait for confirmation signals and look for long opportunities in alignment with the prevailing uptrend, prioritizing structure and momentum-based trades.

⛔️ Invalidation Level:

• A break below 1.17665 would invalidate the bullish scenario and require a reassessment of the wave count.

🧭 Trade Philosophy:

Do not predict where the market will go — follow where capital is flowing.

BITCOIN BEARS WILL DOMINATE THE MARKET|SHORT

BITCOIN SIGNAL

Trade Direction: short

Entry Level: 88,992.60

Target Level: 87,778.70

Stop Loss: 89,798.89

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

XAUUSD- Trading Liquidity During the Year-End SessionXAUUSD H1 – Trading Liquidity During the Year-End Session

Gold remains in a bullish structure, but this is a holiday market with weaker liquidity as many banks are closed. The best approach here is to trade around liquidity and value areas, rather than chasing price during extended moves.

TECHNICAL OVERVIEW

On H1, price continues to respect an ascending channel, moving through expansion and pullback phases.

After the latest strong push, the market is now consolidating and rotating, which typically favours level-based execution.

Momentum remains positive overall, but it is not accelerating aggressively, suggesting selective buying and a higher probability of liquidity sweeps during thin conditions.

PRIORITY SCENARIO – MAIN PLAN

Buy the pullback at key liquidity zones inside the bullish channel

Buy liquidity zone: 4475 – 4478

Buy POC zone: 4409 – 4412

Technical rationale:

The 4475–4478 area is a near-term liquidity pocket within the channel where buyers often step in during technical pullbacks.

The 4409–4412 region aligns with the Volume Profile POC, a value area where price frequently stabilises and rebalances supply and demand.

Expected price behaviour:

A corrective move into these liquidity zones, followed by a bullish reaction, can set up the next leg higher within the channel structure.

ALTERNATIVE SCENARIO – SECONDARY PLAN

Short-term sell only at the upper boundary as a scalp

Sell zone: 4565 – 4469

Context:

This zone sits near the upper channel boundary where profit-taking is common, especially when liquidity is thin. Any sell idea should be treated as a short-term scalp rather than a trend reversal.

WHY LIQUIDITY-BASED TRADING MATTERS HERE

Holiday sessions can produce irregular flows, sharp spikes, and stop runs

Volume Profile helps define higher-probability execution areas instead of emotional entries

Trading around value and liquidity improves consistency when price action becomes less reliable

FUNDAMENTAL BACKDROP AND MARKET SENTIMENT

OANDA traders highlight multiple drivers behind the strength in precious metals, with longer-term projections pointing to further upside for gold and silver next year. The narrative remains supported by safe-haven demand, expectations of easier monetary conditions, and a softer USD tone.

Still, in the short term, the holiday environment can distort price action, making liquidity zones even more important for execution.

CAD/CHF SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

Bearish trend on CAD/CHF, defined by the red colour of the last week candle combined with the fact the pair is overbought based on the BB upper band proximity, makes me expect a bearish rebound from the resistance line above and a retest of the local target below at 0.569.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

ETH/USD BEARS ARE GAINING STRENGTH|SHORT

ETHUSD SIGNAL

Trade Direction: short

Entry Level: 2,956.06

Target Level: 2,924.29

Stop Loss: 2,977.25

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR/CAD BEARISH BIAS RIGHT NOW| SHORT

EUR/CAD SIGNAL

Trade Direction: short

Entry Level: 1.617

Target Level: 1.615

Stop Loss: 1.618

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

BITCOIN BULLS WILL DOMINATE THE MARKET|LONG

BITCOIN SIGNAL

Trade Direction: long

Entry Level: 86,725.16

Target Level: 87,794.83

Stop Loss: 86,012.05

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

XAUUSD – Rising Channel Technical View Lana stays bullish, waiting for pullbacks to buy 💛

Quick summary

Trend: Clearly bullish, price is moving inside a well-defined rising channel

Timeframe: H1

Current state: Price is near the upper part of the channel, so a psychological reaction near Fibonacci extension is possible

Strategy: No chasing. Lana prefers buying pullbacks into value/liquidity zones

Market context

Gold remains strong into year-end, even as liquidity becomes thinner. The current push higher looks very momentum-driven, and Fibonacci extension areas often act as short-term “reaction zones” before the next directional decision.

On the longer-term side, bold forecasts like Jim Rickards’ view (gold potentially reaching very high levels in 2026) show that bullish sentiment in precious metals is still alive. Still, for Lana, short-term trading must follow structure and zones, not headlines.

Technical view: price inside a rising channel

On the chart, gold is respecting a clean ascending channel, consistently printing higher lows.

Key observations:

The upper Fibonacci extension area around 4603–4607 is a psychological barrier, where a short-term pullback can happen.

The best entries are usually found when price returns to value areas inside the channel, not at the top.

Key levels Lana is watching

Primary buy zone – Value Area (VL)

Buy: 4482 – 4485

This is a value area inside the rising channel. If price pulls back here and structure holds, continuation to the upside becomes more likely.

Deeper buy zone – Liquidity POC

Buy: 4419 – 4422 (POC)

This level shows heavy prior accumulation on the Volume Profile. If year-end liquidity causes a deeper shakeout, this zone becomes a safer area to look for buys.

Trading notes

4603–4607 is a psychological resistance zone — not a place to chase longs.

Only buy when price reaches the planned zone and shows confirmation on the lower timeframe.

With thin liquidity: reduce position size and keep risk tight.

Lana’s note 🌿

The trend is strong, but patience at the right entry matters more than catching every move. Lana follows structure, not emotions.

BTC Is Not Weak Liquidity Is Being CollectedBTCUSD – 1H |

Market Structure: Clear range-bound market inside a high-liquidity box. No trend breakdown yet.

Current Price Action: Sharp pullback from range high → price now reacting at range support (~86.8K).

Key Zones:

Support: 86.8K – 87.0K (buyers defending).

Resistance: 90.5K (range high / liquidity target).

Scenario:

Hold above support → rebound back into range → retest 90K–90.5K.

Lose 86.5K → range failure → deeper correction toward 85.2K.

Macro Context:

USD strength is not accelerating, risk assets remain bid → supports range continuation rather than breakdown.

➡️ Bias: Range trade. Favor longs near support, patience until liquidity is taken at the top.

Bitcoin Is Not Weak — It’s Reloading LiquidityBTC/USD – QUICK ANALYSIS (1H)

Structure

Price is rotating inside a high-liquidity range

Recent sell-off did not break structure → liquidity grab

Buyers defended the range low / intraday support

Key Zones

Support: ~87,000 – 86,800

Range Mid: ~88,300

Resistance: ~90,500 – 90,800

Price Behavior

Sharp drop = stop-hunt, not trend reversal

Current bounce shows absorption + acceptance back into range

Outlook

Base case: Range continuation → push back to range high

Bullish trigger: Acceptance above 88.5k

Invalidation: Clean breakdown below 86.8k

Bias

Neutral → Bullish within range

Strategy: Trade the range, not the breakout

Santa’s Pause: Markets Waiting for the Next BreakoutETH/USD – 1H |

Structure

Price is holding above the key support ~2,900–2,920.

Current move is a sideways-to-up consolidation, not a breakdown.

Momentum

Price is compressing around 2,940–2,960 (EMA cluster).

This is typical pre-expansion behavior after a sell-off.

Scenario

Base case: Hold support → grind higher → retest 2,980–3,000.

Break & hold above 3,000 → continuation toward 3,080–3,120.

Invalidation: Clean breakdown below 2,900.

Macro Context

No fresh bearish macro trigger.

Risk sentiment stable → downside moves likely corrective.

Bias

Bullish above support.

Trade the range, wait for breakout confirmation.