NZD/CAD BULLS ARE STRONG HERE|LONG

Hello, Friends!

NZD/CAD pair is trading in a local downtrend which we know by looking at the previous 1W candle which is red. On the 4H timeframe the pair is going down too. The pair is oversold because the price is close to the lower band of the BB indicator. So we are looking to buy the pair with the lower BB line acting as support. The next target is 0.797 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Techincalanalysis

USD/JPY BEARS WILL DOMINATE THE MARKET|SHORT

USD/JPY SIGNAL

Trade Direction: short

Entry Level: 157.430

Target Level: 156.866

Stop Loss: 157.807

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

USD/CAD SHORT FROM RESISTANCE

Hello, Friends!

The BB upper band is nearby so USD-CAD is in the overbought territory. Thus, despite the uptrend on the 1W timeframe I think that we will see a bearish reaction from the resistance line above and a move down towards the target at around 1.373.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR/AUD BUYERS WILL DOMINATE THE MARKET|LONG

Hello, Friends!

We are going long on the EUR/AUD with the target of 1.769 level, because the pair is oversold and will soon hit the support line below. We deduced the oversold condition from the price being near to the lower BB band. However, we should use low risk here because the 1W TF is red and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

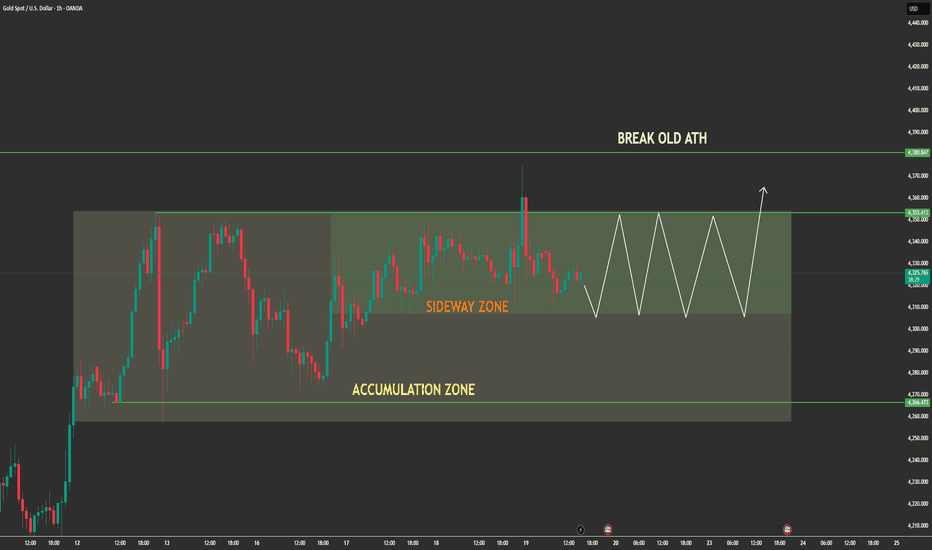

XAUUSD (H4) – Tuesday Outlook Broke the old ATH, trend continuation | Buy the pullback at 4442, sell premium at 4559

Strategy summary

Gold has broken the previous all-time high (ATH) and the bullish structure remains intact. Today my priority is still buying with the trend, but only on a clean pullback — no chasing. The secondary plan is a reaction sell at a premium Fibonacci zone if price extends too aggressively.

1) Technical view (based on your chart)

The breakout above the old ATH is a strong bullish signal: we have a clear higher high and price is building a new base.

The chart highlights a Buy VL / value area just below current price — a logical pullback zone to reload longs.

Above, there’s a 1.618 Fibonacci premium sell zone, where profit-taking often shows up.

Key point: The trend is bullish, but the higher we go, the more likely we see sharp wicks and quick pullbacks. Stay disciplined and trade the levels.

2) Trade plan for today (clear entry, SL, target)

Scenario A (priority): BUY the Asia pullback

✅ Buy: 4442

SL: 4435

Target: 4747 (your projected target)

Logic: This is a clean pullback into the session value area. If price holds here, continuation becomes the higher-probability path.

Scenario B: SELL the premium Fibonacci reaction

✅ Sell: 4559

SL: 4568

TP: scale out on the reaction (short-term profit-taking), or manage based on momentum after rejection

Logic: 4559 is a premium Fibonacci zone. If price spikes into it, a rejection move is very common — but only sell with reaction, not by chasing.

3) Macro context (why gold stays supported)

XAU/USD is building on yesterday’s strong rally (+2%) and is printing fresh record highs for a second day.

Price is pushing toward the 4,500 psychological level during Asia, supported by multiple safe-haven drivers.

Comments from US Treasury Secretary Scott Bessent add uncertainty around the long-term reliability of Fed policy — and uncertainty typically supports gold.

4) Risk management (Liam rule)

Don’t chase after breakout. Only buy at 4442 as planned.

Risk per trade: max 1–2%.

If stopped out, wait for the next structure — no revenge trading.

What’s your bias today: buying the 4442 pullback, or waiting for a 4559 reaction sell?

Wave 3 Is Complete — Gold Is Resetting for the Final ExpansionXAUUSD (H1) — MARKET ANALYSIS

1. Market Structure

- Gold has respected the major demand / support zone around 4,350 – 4,360, where strong buying pressure entered and pushed price aggressively higher. From this base, the market completed a clean impulsive Wave (1) → (3) sequence.

- The sharp rally into the 4,410 – 4,420 area confirms that buyers are fully in control of the trend.

2. Elliott Wave Context

Wave (1): Breakout from the support zone with increasing momentum.

Wave (2): Shallow pullback, holding above the demand area → bullish sign.

Wave (3): Strong expansion leg, accelerating vertically (the strongest wave).

Current Phase: Price is now expected to enter Wave (4) — a healthy technical correction.

Next Move: After Wave (4) completes, Wave (5) is projected to extend toward new highs.

This wave behavior confirms a trend continuation structure, not a reversal.

3. Key Levels to Watch

- Support Zone: 4,350 – 4,360

Must hold to keep the bullish structure intact.

- Wave (4) Correction Zone: Around 4,380 – 4,395

Ideal area for price to stabilize and build energy.

- Wave (5) Target: 4,450+

Final expansion of the current impulsive cycle.

4. Price Action & Momentum

No distribution behavior at the top pullback is controlled.

Momentum remains strong despite short-term profit-taking.

Structure shows higher highs and higher lows, confirming trend strength.

5. Scenario Outlook

🔼 Primary Scenario (High Probability):

Price corrects modestly into Wave (4)

Holds above the 4,350 support zone

Expands into Wave (5) toward higher targets

🔽 Invalidation:

Strong breakdown below 4,350

→ would signal a deeper correction and delay the bullish continuation.

Conclusion

Gold is not topping it is resetting. The current pullback is a technical pause within a strong impulsive uptrend. As long as the support zone holds, the market is structurally aligned for one more upside expansion toward new highs.

This is a classic buy the dip in an impulsive trend, not a sell-the-rally environment.

AUD/NZD — H4 | Dec 22, 2025 — Wave 4 (Yellow) correction, prepar🔎 AUD/NZD — H4 | Dec 22, 2025 — Wave 4 (Yellow) correction, preparing for Wave 5

• On the H4 timeframe, AUD/NZD has completed a higher-degree wave (2) in red, unfolding as an Expanding Flat, with wave C red ending in an Ending Diagonal near 1.14213 — a classic signal of bearish exhaustion.

• From this low, price has developed an impulsive wave (1) in white, internally structured as waves 1–2–3–4–5 in yellow.

• Wave 3 yellow topped around 1.15091, and the market is currently correcting in wave 4 yellow, forming a healthy a–b–c structure in blue.

• Once wave 4 yellow completes while structure remains valid, wave 5 yellow is expected to unfold, completing wave (1) white before a larger corrective phase.

Preferred scenario (Bullish):

• Wait for confirmation of wave 4 yellow completion to buy in alignment with wave 5 yellow, trading with structure and momentum.

Invalidation:

• A breakdown below the wave 4 yellow low invalidates the scenario and requires a full recount.

Trade tip:

“When diagonals end, impulse begins — structure always leads price.”

EUR/JPY BEST PLACE TO SELL FROM|SHORT

Hello, Friends!

We are now examining the EUR/JPY pair and we can see that the pair is going up locally while also being in a uptrend on the 1W TF. But there is also a powerful signal from the BB upper band being nearby, indicating that the pair is overbought so we can go short from the resistance line above and a target at 182.822 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GOLD BEARS ARE STRONG HERE|SHORT

GOLD SIGNAL

Trade Direction: short

Entry Level: 4,422.84

Target Level: 4,368.45

Stop Loss: 4,459.03

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

XAUUSDXAUUSD Key Levels On Watch:

Gold is currently in a short-term pullback after a strong bullish impulse. Price is correcting toward a key demand/support zone marked on the chart (green area). This zone previously acted as a base and may attract buyers again.

• Overall structure remains bullish.

• Current move looks like a healthy retracement

• Support zone around 4315–4320

• If price reacts strongly from this area, a bullish continuation toward the previous highs is possible

• A minor dip into support followed by strong rejection would confirm buyer strength

📈 Bias: Buy on confirmation from support.

⚠️ Always wait for confirmation and manage risk properly

Gold Isn’t Stalling — It’s Loading Liquidity for BreakoutGOLD (XAUUSD) — DETAILED TECHNICAL & MACRO ANALYSIS

1. Market Structure

- Gold remains in a clear bullish market structure on the H1–H4 timeframes.

The impulsive leg that pushed price toward $4,380 confirms strong buyer dominance.

- Instead of rejecting sharply from the high, price has transitioned into a sideways-to-slightly-up consolidation, which is a classic continuation pattern, not distribution.

- Higher lows continue to form inside the range, showing controlled pullbacks rather than panic selling.

This behavior indicates acceptance near highs, which is a key characteristic of strong trends.

2. Key Price Zones & Liquidity Behavior

Resistance Zone: $4,350 – $4,380

This zone is being tested multiple times without aggressive rejection.

Each pullback from resistance is becoming shallower, signaling supply absorption.

Sellers are active, but they are not in control.

Support Zone: $4,250 – $4,270

Buyers consistently defend this zone.

No clean breakdown or high-volume sell-through has occurred.

This confirms that downside moves are corrective, not trend-reversing.

Liquidity Insight

Liquidity is building above the range highs.

Compression inside the box suggests the market is preparing for expansion, not exhaustion.

3. Price Action Interpretation

- Gold is forming a bullish consolidation below previous highs, often seen before breakouts.

- Volatility contraction inside the range implies energy buildup.

- Chasing price inside the range is low probability.

- Edge only appears on confirmation : a clean acceptance above resistance or a sweep-and-hold from support.

4. Macro Environment (Why Gold Is Supported)

Federal Reserve Policy

The Fed remains restrictive, but markets increasingly price rate cuts in 2025, not further hikes.

Real rates are no longer accelerating higher.

The “higher-for-longer” narrative is fully priced, reducing downside pressure on gold.

U.S. Dollar & Yields

The U.S. Dollar is struggling to extend its upside momentum.

Real yields have stabilized, removing a major headwind for gold.

This macro balance allows gold to hold elevated levels instead of correcting deeply.

Risk & Capital Flows

Risk assets (equities, crypto) remain volatile and rotational.

Capital is flowing toward defensive and hedging assets.

Central bank gold demand remains structurally strong.

Seasonality

Year-end and early Q1 historically favor gold due to:

Portfolio rebalancing

Lower liquidity amplifying moves

Institutional positioning for the new year

5. Scenario Outlook

Primary Scenario (High Probability)

Continued consolidation above support

Gradual pressure against resistance

Clean breakout → new ATH above $4,380

Alternative Scenario

Another rejection from resistance

Range extension without breakdown

Structure remains bullish as long as $4,250 holds

Only a strong, high-volume breakdown below support would invalidate the bullish thesis — currently not supported by either price action or macro data.

6. Final Conclusion

Gold is not topping — it is digesting gains.

Technically: bullish structure + acceptance near highs

Macro-wise: supportive environment, not restrictive

Behavior: accumulation and compression, not distribution

This is a macro-aligned continuation setup, where patience is rewarded and impulsive entries are punished.

GBP/USD Is Range-Bound — Macro Pressure Favors RotationMarket Structure (H1)

GBP/USD is currently trading inside a well-defined moving range, capped by a firm resistance zone near 1.3450 and supported by demand around 1.3315. Price action within this box is overlapping and corrective, confirming a non-trending environment. The sharp rejection from resistance followed by weak follow-through on rebounds shows that buyers lack conviction, while sellers have not yet forced a decisive breakdown.

The latest impulsive move into the range was quickly absorbed, and price is now rotating back toward the mid-to-lower portion of the structure. As long as the pair remains below resistance, upside attempts are mean-reverting, not trend-defining.

Liquidity & Price Behavior

This range is acting as a liquidity container. Repeated tests of both extremes suggest ongoing stop-hunting rather than accumulation for a breakout. The projected path toward the lower boundary aligns with how price typically behaves in balanced conditions — rotating until liquidity is fully cleared.

Macro & Policy Context

From a macro perspective, conditions currently weigh on GBP:

The U.S. dollar remains supported by relatively higher yields and a still-restrictive Federal Reserve stance.

Markets continue to price rate cuts cautiously, keeping USD demand elevated during periods of uncertainty.

In contrast, the UK outlook remains softer, with slower growth expectations limiting GBP upside.

This macro divergence explains why GBP/USD struggles to accept above resistance and why rallies are being sold into rather than extended.

Conclusion

GBP/USD is not setting up for a breakout it is rotating within a macro-constrained range.

Failure at resistance favors continuation toward the support zone.

Only a clean acceptance above 1.3450 would shift the structure bullish.

Until then, patience remains key. The edge lies in reacting to range extremes, not anticipating trend continuation.

This Is Not a Breakout Yet — Gold Is Quietly Loading the MoveOANDA:XAUUSD 1H Technical Analysis

Market Structure

Gold is no longer trending impulsively. Price has transitioned into a clear accumulation → sideways expansion phase right below the old ATH.

What matters here is behavior, not direction.

- Strong impulsive leg already completed

- Price failed to immediately break higher

- Market shifted into range compression instead of reversal

This confirms buyers are still in control, but they are absorbing supply rather than chasing price.

Key Zones on the Chart

Upper Range / Pre-ATH Supply: ~4,350 – 4,380

- Sideway Zone (Value Area): Mid-range where price is rotating

- Accumulation Base: ~4,260 – 4,280 (range low / demand pocket)

Price continues to respect the range boundaries:

- Highs are capped → liquidity building above

- Lows are defended → no breakdown structure

This is balanced price action, not weakness.

Price Action Logic

Inside the box:

- Overlapping candles

- Repeated up/down rotations

- No follow-through selling

This is time-based correction, not price-based correction.

Markets often do this before expanding through major highs.

Scenarios Ahead

Primary (Higher Probability):

- Continued oscillation inside the range

- Liquidity builds on both sides

- Expansion → break above old ATH

Alternate:

- Sweep lower range once more

- Immediate reclaim

- Same upside continuation

A clean break below the accumulation base would be the only structure failure — and that has not happened.

Bottom Line

Gold is not stalling.

It is compressing energy inside value.

When this range resolves, it will not be subtle.

Bitcoin Is Not Trending — It’s Testing Conviction.BTC/USD – 1H Technical Analysis

Market Structure

- Bitcoin is clearly trading inside a well-defined horizontal range, bounded by a firm support zone below and a heavy resistance zone above. There is no trend dominance at the moment price is rotating, not expanding.

This is a range-controlled market, not a breakout or breakdown phase.

Key Zones

- Resistance Zone: ~89,800 – 90,300

- Mid-Range Value: ~87,700 – 88,200

- Support Zone: ~85,100 – 85,500

Price has repeatedly:

- Rejected from resistance with strong wicks

- Found aggressive buying interest at support

- Returned back to value without follow-through

That behavior confirms liquidity cycling, not directional intent.

Price Action Read

The latest move is a support bounce, not a trend reversal.

- The impulsive drop into support was immediately absorbed

- Buyers stepped in, pushing price back into the range

- However, upside momentum weakens as price approaches mid-range

This suggests the market is resetting positioning, not committing yet.

Scenarios Ahead

Primary Scenario (Range Continuation):

- Short-term pullback into mid-range

- Another rotation toward resistance

- Final liquidity sweep before a real breakout attempt

Breakout Scenario (Confirmation Required):

- Clean acceptance above resistance

- Holding above the range high

- Only then does upside expansion become valid

Until that acceptance happens, all upside moves are still range trades.

Bottom Line

Bitcoin is not bullish or bearish right now.

It is forcing traders to choose patience or punishment.

The real move begins after the range breaks not inside it.

Ethereum Is Loading — Breakout or Fake Move?ETHUSD (H1) — Quick Market Analysis

Market Structure

ETH is holding a short-term bullish structure after a strong rebound from the lower demand zone.

Price is printing higher lows, showing buyers are gradually regaining control.

Key Levels

Support Zone: ~2,915 – 2,920

Current Pivot: ~2,970 – 2,980

Target 1: ~3,050

Target 2: ~3,160

Price Behavior

Price is consolidating above support, forming a bullish continuation pattern.

No strong rejection yet → selling pressure remains weak.

The dotted path suggests a pullback → higher low → expansion structure.

Scenarios

Primary Scenario (Bullish):

Hold above support → push toward Target 1, then extension to Target 2.

Alternative Scenario:

A brief dip toward support to absorb liquidity before continuation higher.

Summary

ETH is not topping it’s pausing and building energy.

As long as support holds, upside targets remain valid.

US100 SENDS CLEAR BEARISH SIGNALS|SHORT

US100 SIGNAL

Trade Direction: short

Entry Level: 25,351.0

Target Level: 24,524.8

Stop Loss: 25,900.5

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

AUD/CHF BEARS ARE GAINING STRENGTH|SHORT

Hello, Friends!

Previous week’s green candle means that for us the AUD/CHF pair is in the uptrend. And the current movement leg was also up but the resistance line will be hit soon and upper BB band proximity will signal an overbought condition so we will go for a counter-trend short trade with the target being at 0.524.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

XAUUSD (H4) – Weekly Outlook (Dec 22–26)Buy the dip inside the channel, watch for a short-term correction after Wave 5

Strategy summary for next week

On the H4 chart, gold is still trading inside a mid-term rising channel. However, the wave structure suggests Wave 5 is likely завершed, so next week I’m focusing on two main ideas:

Mid-term BUY bias, but only if price pulls back to a better liquidity area.

Short-term SELL correction, triggered only with confirmation (break below 4309) on the lower timeframe.

1) Technical view: Uptrend channel holds, but a correction is likely

Price is currently in the upper half of the channel → not an ideal spot to chase longs.

The chart highlights two key liquidity areas:

Liquidity Sell Zone near 4433 (upside target, only valid if price builds a clean path higher).

Strong Liquidity around 4254 (the area where I want to reload mid-term longs).

Meaning: The channel is still the main framework, but if Wave 5 has finished, a pullback/correction is normal before the next directional leg.

2) Mid-term plan (priority): BUY at channel liquidity

✅ Buy zone: 4250 – 4255

SL: 4240

Expectation: A rebound back toward the channel’s midline, and if momentum returns, continuation toward 4433.

Logic: This is the “better price” area aligned with the channel structure + key liquidity. Risk-reward is far cleaner than buying at the highs.

3) Short-term plan: SELL the correction only after confirmation

Because Wave 5 looks completed, a corrective sell is valid — but I only want to sell after the market confirms on the lower timeframe:

✅ Bearish confirmation: break below 4309

After the break, prefer a sell on retest (no chasing).

A realistic correction target is a move back toward the 425x liquidity zone.

Note: This is a short-term correction trade and doesn’t conflict with the mid-term buy bias.

4) Fundamentals next week: Holiday liquidity = more sweeps

Dec 22–26 includes multiple European holidays, which often means thin liquidity: price may not trend hard, but it can still wick and sweep stops.

Geopolitical risk remains elevated: Israeli officials plan to brief Trump on potential new strikes on Iran — this can trigger sudden safe-haven flows into gold.

Action: Trade smaller, trade cleaner, and avoid getting trapped in abnormal volatility.

5) Execution checklist

Mid-term BUY: wait for 4250–4255, SL 4240.

Short-term SELL: only activate if 4309 breaks, then sell the retest on lower TF.

No FOMO in a low-volume holiday week.

Which scenario are you leaning into next week: buying 425x, or waiting for a 4309 breakdown to sell the correction?

XAUUSD H4 – Medium-Term Outlook for the Coming Week

Gold remains within a broad rising channel, but recent price action shows clear rejection at the upper trendline. For the week ahead, the focus is on a potential technical pullback, while keeping an alternative bullish scenario if the market fully accepts higher prices.

PRIORITY SCENARIO – MAIN SCENARIO

Wait for structural confirmation to sell the medium-term corrective move

Key confirmation level: a break of the trendline around 4317

Trade idea: look for confirmation below 4317 to sell the corrective leg within the rising channel

Technical context: price is trading near the upper boundary of the channel and showing rejection, a common setup before a rotation back toward lower value areas

Position management:

Sell positions should be treated strictly as corrective trades within a broader uptrend.

If price fails to stay below 4317 and regains bullish structure, risk should be reduced and short positions avoided.

ALTERNATIVE SCENARIO – SECONDARY SCENARIO

Trend continuation if price breaks to new highs and finds acceptance

Trigger condition: a clean breakout to new highs with sustained bullish momentum

Trade idea: prioritise buy setups once the market clearly accepts higher prices

Technical context: successful breakouts often lead to range expansion, making short positions unfavourable

KEY MEDIUM-TERM BUY ZONE

Liquidity-based opportunity in the event of a deeper pullback

Reference buy zone: around 4220

Rationale: this area represents a major liquidity cluster and a logical zone to monitor for bullish reactions during a deeper year-end pullback

KEY TECHNICAL REASONS

The dominant H4 trend remains bullish, but rejection at the upper channel increases the probability of a technical correction

The 4317 level acts as a key decision point to distinguish between a genuine pullback and temporary consolidation

The 4220 area serves as a value zone aligned with liquidity for potential trend-following buys

MACRO AND NEWS CONTEXT

Recent comments have reinforced expectations of future rate cuts to address labour market risks, which remains supportive for gold in the broader context.

Geopolitical developments, including discussions around the next steps in the Gaza peace process, continue to underpin safe-haven demand.

However, year-end holiday conditions often result in thinner liquidity, wider spreads, and less reliable price moves, making discipline and risk control essential.

RISK MANAGEMENT AND WEEKLY PLAN

Avoid chasing long positions near the upper trendline of the rising channel.

Only consider short positions after clear confirmation below 4317, avoiding emotional top-picking in a bullish market.

If price breaks and holds above recent highs, shift focus back to trend-following buy setups.

Reduce position size during the holiday week and prioritise trades around well-defined key levels rather than extended moves.

XAUUSD (D1) – Weekly OutlookXAUUSD (D1) – Weekly Outlook: Lana focuses on buying discounted zones, preparing for a possible ABC correction 💛

Quick summary

Higher timeframe (Daily): The main uptrend remains intact and structurally strong

Elliott Wave: Gold likely completed Wave 5, with a potential ABC corrective phase ahead to complete the cycle

Liquidity: Christmas week and year-end positioning may cause thin liquidity and irregular price movements

Plan: No chasing. Lana waits for price to reach key buy zones at 4250 and 4205

Market context for next week

Next week’s trading activity may slow down due to the Christmas holiday and preparations for the year-end. Thinner liquidity often leads to sharp, irregular moves and liquidity sweeps.

At the same time, ongoing geopolitical tensions continue to support gold, while USD weakness adds further tailwinds.

Because of this, Lana prefers a zone-based approach rather than trying to predict exact tops or bottoms.

Technical view on D1

On the Daily chart, gold still shows a solid bullish foundation. However, from an Elliott Wave perspective, price appears to be finishing the final impulsive wave (Wave 5).

After a Wave 5 completion, a corrective ABC structure is common, allowing the market to rebalance before the next major move.

For Lana, a correction is not bearish—it’s an opportunity to look for higher-probability buys at discounted levels instead of chasing price at elevated zones.

Key levels Lana is watching

1) Primary buy zone: 4250

This level previously acted as a strong resistance and was decisively broken. Liquidity remains concentrated in this area, making it a favorable zone to look for buying opportunities if price pulls back.

2) Long-term buy zone: 4205 (POC from Volume Profile)

This is a major Point of Control where price previously accumulated heavily. If the ABC correction extends deeper, this zone becomes a key area for longer-term positioning.

Trading plan for next week (overview)

Early in the week, Lana will observe lower timeframes to confirm entries.

Priority is given to pullbacks toward 4250; deeper corrections may offer opportunities near 4205.

With thin holiday liquidity, Lana plans to:

reduce position size

keep stop losses clearly defined

scale out profits once price reacts from the zones

Lana’s note 🌿

Holiday weeks often bring fewer clean setups but more unexpected liquidity grabs. Lana will stay patient, trade selectively, and focus only on price levels that truly make sense.

This is Lana’s personal market view, not financial advice

USOIL SELLERS WILL DOMINATE THE MARKET|SHORT

USOIL SIGNAL

Trade Direction: short

Entry Level: 56.54

Target Level: 55.07

Stop Loss: 57.51

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 4h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NZD/CHF BULLISH BIAS RIGHT NOW| LONG

Hello, Friends!

NZD/CHF is trending up which is evident from the green colour of the previous weekly candle. However, the price has locally plunged into the oversold territory. Which can be told from its proximity to the BB lower band. Which presents a beautiful trend following opportunity for a long trade from the support line below towards the supply level of 0.466.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

BTCUSD: Potential Pullback from Local ResistanceBitcoin is currently testing a significant resistance zone, and we are seeing signs of exhaustion at these levels. This setup focuses on a high-probability short opportunity targeting the immediate support levels below.

The Technical Thesis

Resistance Rejection: Price has reached a supply zone (highlighted in orange) where previous selling pressure originated. The current price action shows a struggle to maintain momentum above $89,000.

Market Structure: After a strong push, we are looking for a "lower high" or a failure to break the previous peak, signaling a shift in short-term trend.

Targeting Liquidity: The primary targets are the established support levels where buyers previously stepped in.

Trade Setup Details

Entry Zone: $88,100 - $89,000

Stop Loss (SL): Above the recent swing high at $90,336 (Critical to protect against a breakout).

Take Profit 1 (TP1): $87,000 (First Support).

Take Profit 2 (TP2): $85,000 (Strong Support / Major Liquidity Pool).

Risk Management

As always, BTC can be highly volatile. Ensure you are using proper position sizing. If the price closes decisively above the orange resistance zone on a 4H timeframe, the bearish thesis is invalidated.

What do you think? Will we see a bounce at $87k, or is a deeper correction to $85k incoming? Let me know your thoughts in the comments!