Basic Technical Analysis 101SELF DEVELOPMENT/METHODOLOGY/PSYCHOLOGY

Basic Technical Analysis

Interpreting the candlestick

This type of chart is an extension of the bar chart and is actively utilised by the investors in China for more than 500 years of time period. It helps in providing the information regarding open, close, low and high in the dimensional format. It can be seen that the vertical axis of the chart helps in providing information on the prices of the FOREX whereas the horizontal axis represents the time period. The green candles are the representation of the advances of the currency and the red candles, on the other hand, represents the decline in the value of the FOREX. Moreover, the body denotes the thick portion of the candle, and the vertical line represents the wick. This chart helps the investor to forecast the future price movement of the FOREX.

Charting systems

In the mind of a few people, charts are the exemplary image of the trader’s speciality. The experienced eye can make ups and down. Charting is a questionable piece of the fund. Future research is probably going to reveal things about outlining that would amaze people today. All things considered, even individuals who eagerly restrict the training are ought to be acquainted with the essential techniques of charting.

Technical

How I use the RSI (2) & Stochastic to trade stocksThis is a quick description as how I use STOCH and the RSI2 to help me find key pullbacks in a trending market.

Throughout trending markets we expect to see healthy pull backs. This happens as people rotate out of certain stocks/sectors, price drops and this gives us a great opportunity to enter the stock at a discounted price.

If we take $MSFT as an example we can see price hit a high of $97 on 2nd March - RSI was above 97 and Stoch was reaching 90. I wouldn't always take this as a signal to sell. In a strong bull market these readings will be common.

Several days later we see price fall to $87, just over a 10% discount. It's a fire sale and we need to get in on this bargain! The RSI was below 2 and Stoch below 10. Now we wouldn't jump straight in. We would check the news and financials to establish any reason for the drop. If there is nothing obvious we need to look to get in and buy this discounted giant.

If you had bought in at $87 your stocks would be worth over $108 now! Not bad is it?

Hindsight is a wonderful thing but give it a go, back test the strategy and see if it works for you.

I'll be adding more over the coming weeks so make sure you give me a follow :D

Trading Major Markets using Stops and Margin: Risk/Reward RatiosTrading Major Markets 1 of 2

You've probably already learned a lot through trading Bitcoin.

Those skill-sets are super scalable.

Often am in too much of a hurry to cover other markets to have time to lay out stops and risk reward ratios - hoping that you're experienced enough to work them out for yourself when I miss doing them- which will be quite often in fast markets.

There just isn't time except at weekends to cover things from a newbie's perspective.

This analysis is meant to be for more experienced traders really.

But for newer traders this is one way of trading technical signals. It isn't fool-proof. No system is.

But it works well across multiple markets if used with discipline, and without emotion.

But please don't believe mere words.

If it interests you please test it first.

20 times.

Calibrate your rifle sights/stops as per the pinned message at top of crypto pages and test tolerance levels of stops given.

It will never be perfect though.

We don't have to be either.

Just close enough...

Wave Trading and Wave Counting

Don't really see where Elliott 'waves' figure in the great scheme of things or at the micro level either.

Would like to. But have little evidence usually.

But If Elliott floats your boat and you can trade off it that's great. Please share if so ; )

In the meantime smaller time scale signals are there to be traded. And if we trade them with stops and a system that works more often than not we can make good returns on half and more of the positive trades and yet limit losses on the ones that don't work out as planned.

And by trading smaller moves we become part of and merge into the longer term. It's more fun to ride the smaller waves - they too become part of the bigger wave anyway.

And if we can see a good Elliott wave amongst the noise all the better. If so, share it dude!

Until then, if you can SEE that the stop is very close or ideally that price is right on it (limit down as with FB last week for example) then it's a SPECULATIVE buy with a stop close underneath the level given.

It's 'speculative' because we don't know that this will be the bottom.

In this respect 'breakouts', though still speculative, are less so than buying lows. We all want to do the latter: the buy low sell high mantra didn't make it to market mantra-hood by coincidence.

But lows can be more difficult to spot than breakouts, which no one misses really.

For example with the Dow recently it was around 20 to 50 points of stop if you were buying the dips, (see global markets link at top of main page)

Some will just leave orders in the market with a decent stop - say if looking to buy the Dow within 10 or 15 points of a given level (cannot expect to be bang on every day, you know that already) - they leave the order to strike or not and then use a stop at least 20 lower on Dow and maybe 50 at most. And some stick in a limit order too at the same time as the stop.

Sometimes it works well.

Sometimes it never gets struck.

And sometimes it's a big fail and we get stopped out for 20-50 points on the Dow.

It takles a lot of the emotion out of the equation. Not all of it. But a lot of it.

And if you can work out the RISK in points you can then work out potential rewards too.

Then it becomes possible to divide your total bank into 20 - so 20k total bank for ease of explanation = 20 trades or bets of $1000 each at a maximum - for this is effectively what we are doing... Betting that our call is better than the market's call at that moment in time compared to some future moment in time.

We don't have to be right much more than 50% of the time though we all want to be.

If we can be stoical/philosophical about losses and wins and tread the line without thinking either we're too clever or too stupid we stand a better chance of handling the inevitable losses when they come.

To think you're Billy-whizz of the markets and then discover you're not is way more disheartening than

never thinking that crap in the first place...

Part 2next

Introducing 'Remora' and the 'Spaghetti Pretzel Logic Engine'Summary:

What follows is a 10min video of me giving you a peek at our latest iteration of 'Remora', a volume (only) based financial indicator....

Algorithm: Remora (because it allows even the smallest fish, to swim with the biggest sharks, without getting eaten by them. Ever.)

Version: v6 'Black Magic' Series (because we now have a new moving average (the black line) involved with trade decisions.)

Particular Iteration in Video: 'Longfin' (because it holds trades insanely long, through difficult trading conditions, designed to pop a typical stop losses.)

Available to the public: Not yet. (If you are interested, send me a message, and I'll add you to a list of people to contact, later.)

Seeking Angel Money: We need about $50k to ICO. The tokens would then be used to pay fees associated with trading, using our turnkey bot and and algorithms, and establish a market value for this particular technology, based on supply and demand.

...Remora is currently being developed for use with a bot, but I am demonstrating it in the video the way a 'human' would understand it. It appears to trade based on a signal green line, but in actuality, there are multiple types of 'logic' at play, behind the scenes (that you can throttle, based on your symbol and appetite for risk, etc.) which comprise the 'Spaghetti Pretzel Logic Engine', which is really the 'brains' behind everything) that crunches the trade volume data, and then spits out a single, actionable, trade decision, that you can count on being correct the vast majority of the time. (And when it's wrong, you will know by the next candle, and so while a false positives still happen, this particular iteration of Remora, reduced this number by more than 2 thirds, and represents a major breakthrough in logic and the evolution of this particular algorithm.)

correlation myths and mysteries, crypto doom of asicsSo back to basics, without any background in economy, financial trading, except experience, logic and an analytical mindset.

by overlaying S&P 500 with btc, you see that both move in similar ways, with S&P slightly leading BTC.

does this mean we can predict btc's direction with S&P 500 as guideline? guess not as they are totally not coupled.

S&P relates to bussiness and the trade in big players in the economy of the world.

BTC has no direct relation to the real world, it is in some sense tied to certain Fiat currencies, as btc is the main value being used in the crypto currencies trading platforms. High activity on the overall crypto market, causes btc to move its needle.

But there are obviously other factors at play too. big holders can move the needle as well. with the majority of BTC hashrate in china, and the fact that the main BTC pools are also in chinese hands, means that they have a leverage that is disproportionate, and they are capable of moving the BTC needle in whatever direction they want.

just an imaginary scenario, say all the big BTC pools dump their holdings in a fell swoop when price rides high.. you evaporate billions of value. which will impact the economy.

would a spread portfolio over multiple crypto currencies help? No it will not, look at the historic graphs overlay btc with any other coin, you will see that they rise and fall with BTC, some magnified, some reduced, but if btc drops to 1$ some day... the rest of the coins will be a fraction of that.

doom scenario .

that is why it is important to support asic resistant coins. XMR did a good attempt, but I am afraid the changes are not big enough to deter the asic builders. asic design used to be very expensive, nowadays its not the case anymore ROI is reasonable if you can have a few months of runtime out of your asics. which typically use low power, combined with high hashrate. ( 10-20x compared to best ( and expensive) GPU's at a fraction of the power)

try to run 10TH/s btc with GPU cards, calculate the power draw including cooling and aquisition cost... system board 100$ GTX1080ti 1000$ * n ( 4GH/s per card : n=2500) =2.5M$ gpu's with around 450 KW of power which also needs cooling. with cheap electricity -> .01 $ / KW -> $4,50 per hour :), this leads to a loss of $4,25 per hour, aka as a yearly loss of $37K with ROI to infinity.

then compare to a antminer of similar performance, look at the power draw including cooling ( running cost) and aquisition cost

example Antminer T9+ 10TH/s -> 1406W... hourly profits : 0,24$ yearly $2075, break even in 201.9 days.

so the question is, has S&P been influenced by BTC manipulations or does the S&P influence btc ( macro economic behaviour)

to be continued

Understanding Market Expectation Is ImportantUnderstanding and having a basic expectation of how the market tends to move is important not only for traders, but for investors too.

If you get in too early, you suffer unnecessary drawdowns.

If you get in too late, you will either suffer losses, or miss the train.

In trading and investing, there is more than just entry and exit.

Core rules to trade with Sinewave & MomentumHope this educational content will help you make a better use of the indicators.

Remember that these rules are just ground rules. Positions sizes and stops positionning will depend on your own risk profile.

This is up to you to find your comfort zone on these parameters.

Indicators used in this video are : PRO Sinewave & PRO Momentum

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

You can check my indicators via my TradingView's Profile : @PRO_Indicators

Kindly,

Phil

Bullish Consolidation 1-2-3-Breakout PatternThis is a great example of the 1-2-3-Breakout pattern on Bitcoin using the Daily chart.

This pattern can be applied to any equity. Chart patterns represent human behavior and that is a constant among all asset classes.

Point 1 - The First Test - The New High

Price reaches a new high and pulls back when investors take profits.

Price falls.

Point 2 - Second Test

New buyers come in and price tries to attack the highs for a second time. Often this attack fails, because there just aren't as many buyers as before, and people who didn't get a chance to sell at (1) now have a chance, so they sell and run to the bank.

Price falls.

A trend line has now formed between point 1 and 2. This downward trend line basically shows us that price is making lower highs. What we want is to see a higher high, which is an uptrend. Pretty easy right?

Well we can't see a higher high until we break out of the downtrend, meaning, we have to break out of this trend line.

Point 3 - Third Test

People start to watch the trend line as well, so it becomes a self-fulfilling prophecy and the price starts to get stuck under the trend line.

In general, we know that we have less buyers here than before. So here we ask the question, will we ever breakout of this downtrend? Or will we crash down because the buyers are disappearing

Point 4 - The breakout

Now we have the answer. This is VERY OFTEN the fail or succeed point of a pattern like this. After 1,2 and 3 tests of the downtrend, either buyers will give up and go home, meaning sellers take over and price breaksdown OR new buyers come in from somewhere, or maybe they were just waiting for lower prices to buy. Whatever the reason, they step in and start buying. We breakout of the downtrend line, and that inspires more buyers to come in because they were the ones waiting for the trend line break. And then price starts moving fast because everyone wants to buy. THen the media says "this is a great buy" and boom more people come in.

Until finally....we reach a new high price (1) once again. Investors take profits and the whole cycle repeats itself.

If we IDENTIFY the patterns, and RECOGNIZE the breakout points, then we can be prepared to jump in at a favorable point.

Practical Exercise - Understanding Fractal NatureMarket develops in FRACTALS.

Understanding how each timeframe is developing is important in timing our trade entries. When we decide to take any trade, we now have a better understanding and expectation of our trades.

Practical Exercise

1) Find an example where the two timeframes' bias are aligned.

2) Find another example where the two timeframes' bias are NOT aligned.

3) Keep trade of how these two examples develop.

Practical Exercise - Identify 3rd Market ScenarioUnderstanding that market moves in an impulse or corrective nature, we can now further categorise market moves into 3 scenarios.

Here we will illustrate the 3rd scenario - an impulse move, followed by a crawling move.

Practical Exercise

1) Find an example of such scenario in the market. It can be any currency pair, any timeframe.

2) Record down what's the next move after this scenario.

3) Repeat this practice to gather a total of 10 examples.

*Refer to the first comment below for a sample of this practical exercise.

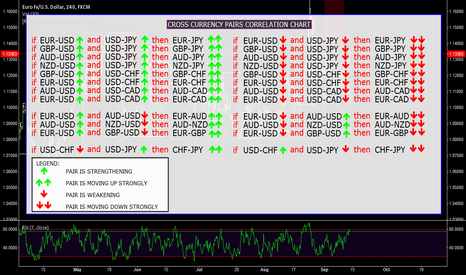

CROSS CURRENCY PAIRS CORRELATION - ADVANCED ANALYSIS Hi all, I wanted to share this chart with you - I am hoping it works when I publish it and the arrows stay inline with the text - something very interesting we all know about currencies moving in tandem with each other to some degree different economic events causing them to stop moving together but eventually they will again.

As a forex trader, if you check several different currency pairs to find the trade setups, you should be aware of the currency pairs correlation, because of two main reasons:

1- You avoid taking the same position with several correlated currency pairs at the same time and so you do not increase your risk. Additionally, you avoid taking opposite positions with the currency pairs that move against each other, at the same time.

2- If you know the currency pairs correlations, it may help you predict the direction and movement of a currency pair, through the signals that you see on the other correlated currency pairs.

If you would like more information describing the affects - reply with a short note and I will paste a URL