Gold Under Pressure | Fed Chair Warsh Fuels Sell Zone at 4,800Hey Traders,

In today’s trading session, we are closely monitoring XAUUSD (Gold) for a potential selling opportunity around the 4,800 zone. Gold was previously trading in a strong uptrend and is now undergoing a corrective phase, approaching a key retracement level and the 4,800 support-turned-resistance area, which may act as a strong reaction zone.

From a fundamental perspective, the recent nomination of Kevin Warsh as the new Federal Reserve Chair has reinforced expectations of a more hawkish and fiscally disciplined policy stance. This development is providing short-term strength to the US Dollar, which tends to be bearish for Gold, especially during corrective phases.

With both technical resistance and near-term USD strength aligning, Gold may face additional downside pressure before any broader trend continuation.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

Technical Analysis

Gold Breaks Its Trend – Sellers Take ControlAfter a sharp rally to record highs, XAUUSD has officially entered a structural weakening phase , no longer just a normal corrective pullback. Pressure from a stronger USD, expectations that the Fed will maintain a hawkish stance, and aggressive profit-taking in the derivatives marke t have all combined to drain gold of its short-term bullish momentum.

On the chart, the downtrend is becoming increasingly clear . Price has been rejected repeatedly at higher resistance zones, forming a sequence of lower highs, while the descending trendline continues to act as a key ceiling. The fact that price is trading below the Ichimoku cloud signals that sellers are firmly in control of the short- to medium-term trend.

The current rebound toward 4,850 is purely technical in nature. If price fails to break above this area and gets rejected again, selling pressure is likely to resume . In that case, the 4,350 zone becomes the next logical target, where the market may pause and react.

Overall, both the news backdrop and price structure are aligned to the downside . In this environment, the more appropriate strategy is to prioritize trend-following trades, patiently waiting for pullbacks to look for sell opportunities, rather than trying to catch a falling knife while sellers remain dominant.

EURUSD Outlook | Downtrend Pullback Meets USD StrengthHey Traders,

In today’s trading session, we are closely monitoring EURUSD for a potential selling opportunity around the 1.19000 zone. EURUSD remains in a well-defined downtrend and is currently undergoing a corrective pullback, approaching a key trendline confluence and the 1.19000 support-turned-resistance area, which may act as a strong rejection zone for bearish continuation.

From a fundamental perspective, the recent nomination of a new Federal Reserve Chair is expected to support the US Dollar in the short term, as markets anticipate a more conventional and fiscally disciplined policy stance. This near-term USD strength could add further downside pressure on EURUSD and is also short-term bearish for Gold, reinforcing the broader risk-off bias.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

EURUSD at Key Resistance | Fed Warsh Boosts DollarHey Traders,

In today’s trading session, we are monitoring EURUSD for a selling opportunity around the 1.18500 zone.

EURUSD remains in a clear downtrend and is currently undergoing a corrective pullback, with price approaching the descending trendline and the 1.18500 key support–resistance zone. This area could act as a strong technical rejection zone in line with the broader bearish structure.

Fundamentally, the recent nomination of Kevin Warsh as the new Fed Chair is supporting a stronger US dollar bias in the short term. Warsh is widely viewed as a more hawkish and fiscally disciplined choice, which may reinforce expectations of tighter monetary conditions — adding further pressure on EURUSD to the downside.

As always, wait for price action confirmation at the zone before execution and manage risk accordingly.

Trade safe,

Joe

GOLD 03/02: H4 ROUTE MAP – SMC STRUCTURE UPDATEGold prices have swept the peak liquidity and broken the upward structure on H4. But this is not the start of a new trend, rather a rebalancing phase after the sell-off. The next direction will depend on how prices react at key SMC zones.

CONTEXT

Expectations around the Fed and interest rate path remain unclear → USD and yields are highly volatile.

Geopolitical instability continues to provide a supportive backdrop for gold, but not enough to create a new trend on its own.

As a result: gold reacts strongly during the day, but there is no long-term commitment yet.

➡️ This explains why prices bounce quickly but have not broken the structure.

H4 TECHNICAL STRUCTURE

The previous H4 uptrend has been broken:

Sweep peak

CHoCH decline

Current prices are in a technical pullback after a strong decline.

FVG + Fibonacci zones are playing the role of the next decisive points.

ROUTE MAP – PRICE ZONES TO WATCH

🔴 UPPER ZONE – SELL REACTION ZONE

👉 5230 – 5300

H4 FVG

Fib 0.618 – 0.705

Typical pullback zone in a declining structure

➡️ If prices rebound here but are not accepted, the upward move is just a pullback to continue the decline.

👉 5350 – 5450

High FVG + Fib 0.786

Only if prices hold above this zone, the declining structure will truly be invalidated.

🟢 LOWER ZONE – BUY REACTION / SUPPORT

👉 4950 – 5000

Fib 0.5

Balance zone – likely to see two-way reactions

👉 4850 – 4900

Fib 0.382

H4 Demand – important support zone

👉 4600 – 4550

Liquidity low

Only activated if bearish continues strongly

HOW WE MONITOR THE MARKET NOW

In the current context:

News creates short-term momentum

But the H4 structure still guides the trend

We focus on:

Observing price reactions at FVG & fib

Clearly distinguishing:

daily reflex moves (scalp)

and structure acceptance for swing

Strong pullbacks often attract emotions, but the market only truly speaks the truth when it holds key price zones.

Future updates will focus on actual price reactions, not predictions. Follow to not miss important reaction points this week.

— LucasGrayTrading

BTCUSD: Is Every Pullback a Trap?BTCUSD is currently trading within a clearly defined bearish trend , as both news flow and technical structure favor the sellers . Short-term capital has become more cautious, buying momentum has weakened after the prior strong rally, and there is no sufficiently strong catalyst to trigger a genuine trend reversal.

From a news perspective, the macro backdrop remains risk-off . The USD stays relatively stable, while expectations for policy easing remain uncertain, leaving Bitcoin without the momentum needed for a sustainable upside move. As a result, current rebounds are mostly technical in nature, rather than signals of a new bullish trend.

On the chart, the bearish structure remains intact, with a consistent sequence of Lower Highs and Lower Lows. Price continues to respect the descending trendline and has been repeatedly rejected on rallies, confirming that sellers are still in control. The Ichimoku cloud above price acts as dynamic resistance, further limiting recovery attempts.

The 84,900 zone stands out as the nearest and most critical resistance. This area represents a confluence of the descending trendline and a technical pullback zone , making the probability of renewed selling pressure relatively high. On the downside, 80,600 remains a strong support level, where price may react or form a short-term technical bounce.

Overall, BTCUSD is in a controlled bearish phase . As long as price fails to break and hold above the descending trendline , rebounds should be viewed as sell-the-rally opportunities, rather than reasons to rush into expecting a long-term bottom.

ENSOUSDT: short setup from daily support at 1.2632BINANCE:ENSOUSDT.P is correcting as expected following the pump.

The initial decline halted at the 1.2632 level. The following day, we witnessed a False Breakout relative to this price, which confirms the level's validity (as a False Breakout can only occur relative to a significant level). Essentially, a False Breakout represents the asset's inability to sustain a price below or above a certain point.

What do we see next? weakness. The asset failed to take out yesterday's High. Since we cannot go up, we are now seeing a gradual approach — a slow bleed — back toward our established support at 1.2632.

This gradual approach is clearly visible on the 4H timeframe and signals a strong bearish intent. This is not a panic dump; it is a methodical move where every limit buy order standing in the way is being slowly and confidently absorbed. Such clarity and precision in price action suggest that strong capital is driving this move.

Therefore, the breakdown of this level is simply a matter of time. Disclaimer: This is the crypto market. Anything can happen at any moment, and even the most professional analysis can be invalidated instantly. Always remember this.

GBPJPY: Important Breakout 🇬🇧🇯🇵

I see a confirmed breakout of a major daily horizontal resistance on GBPJPY.

The market will continue rising and reach 213.7 level soon.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

#NIFTY Intraday Support and Resistance Levels - 03/02/2026Nifty is expected to open with a strong bullish gap-up of around 500–800+ points, which clearly reflects positive sentiment and aggressive buying interest in the market. Such a gap-up generally indicates overnight strength driven by global cues or strong domestic triggers, and it often puts immediate pressure on short positions. However, traders should stay alert during the opening minutes, as large gap-ups can initially show volatility or brief profit booking before the real directional move unfolds.

From a technical view, the zone around 25550 will be the first crucial level to watch. If Nifty sustains above this level after the opening, it will confirm bullish continuation. In that scenario, the index can gradually move towards 25750, 25800, and 25950+. Further strength above 26050 will signal a higher breakout, opening the path for extended targets around 26150, 26200, and 26250+, keeping the broader trend decisively positive.

On the downside, despite the gap-up bias, traders must remain cautious of false breakouts. The level near 25450 will act as an important support. If Nifty slips below this zone and fails to reclaim it, it may indicate early profit booking after the gap-up. In such a case, a corrective move towards 25350, 25300, and 25200 cannot be ruled out, especially if selling pressure increases near resistance zones.

Overall, the structure remains bullish as long as Nifty holds above key support levels, and buying on dips is likely to be the preferred strategy. Traders are advised to avoid chasing prices at the open, wait for confirmation near important levels, and manage risk strictly, as gap-up sessions often bring sharp intraday swings along with strong trending opportunities.

AUDUSD: Aussie Resumes Higher After RBA Lifts RatesThe Australian dollar is rebounding strongly as the RBA’s rate hike reinforces the bullish Elliott Wave structure and supports further upside momentum.

AUDUSD is posting strong gains after bouncing today in response to the RBA’s decision to lift the key interest rate. From a technical perspective, price has been trending higher since breaking out of the base channel in mid-January, and this type of breakout confirms that the market remains in an extended impulsive phase. This suggests that wave three, or wave C, is still unfolding.

Importantly, the larger black wave three cycle is not complete yet and should continue to subdivide into five waves. Therefore, after the current retracement phase, further upside is expected into wave 5 of 3/C. Ideally, price should hold above the 0.69–0.70 support zone, which also represents a key psychological level and an important technical floor.

GPSUSDT.P: long setup from daily resistance at 0.008500SETUP SUMMARY

BINANCE:GPSUSDT.P is holding well below the level, considering yesterday’s strong rally. Usually, a correction is expected, but we see the asset sticking nearly to the level and consolidating clearly and calmly, without sharp moves — this is a sign of a confident buyer.

About 2 hours ago, there was a false breakout, and this is now the key factor to watch: whether a correction follows it. If not, it is a strong long signal. If a correction occurs, it means sellers are blocking the upside, and we will need to wait for a new approach and re-evaluate the overall picture. Therefore, the shallower the correction and the faster the re-test of the level, the better.

PRO-THESIS FACTORS:

volatility contraction on approach

impulse absorption at the level

close retest

price compression (Squeeze) (4h)

lack of rejection after false break

at-level close ADVERSE FACTORS:

overhead congestion

lack of accumulation Leave your thoughts on the setup in the comments. Follow this profile to monitor all upcoming ideas

XAGUSD -WHO IS GOOD IN "TRIANGLES"? ?? COMMENT PLEASE 02-02-2026XAGUSD - G-Money's short version analysis based purely on technical analysis only, no nonsense or "BS". I do totally ignore any fundamental analysis, technical analysis only

I was always not so good with triangle, any ideas ??? Just wonder... 5m/15m/30m charts...

XAGUSD - still not in my technical analysis range...

Chart is itself explaining. Kept a "KISS" approach all the way ( "Keep It Simple, Stupid") & beginners friendly... ;)

I do hope that nobody ignoring SL ( Stop Loss) ! Without it, It is a fastest way to loose hard earned money...

;)

Trade safe & don't do "gambling". In the end it never pays, not worth it to risk loose all your $...

PS: above technical analysis is done for the community & educational purpose only! It is not a financial advice. Just share my very own insight to it.

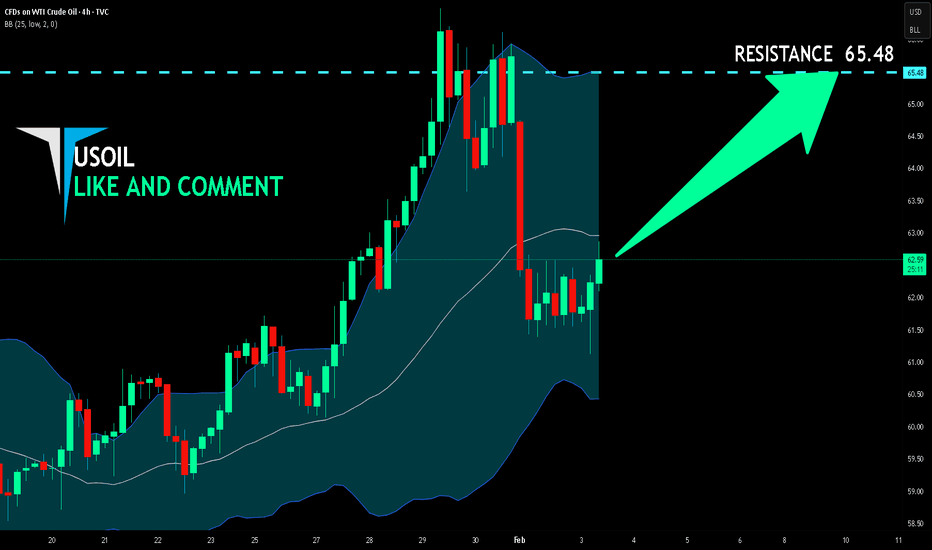

USOIL BULLS ARE GAINING STRENGTH|LONG

Hello, Friends!

Bullish trend on USOIL, defined by the green colour of the last week candle combined with the fact the pair is oversold based on the BB lower band proximity, makes me expect a bullish rebound from the support line below and a retest of the local target above at 65.48.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBPCHF: Supply Zone Breakout 🇬🇧🇨🇭

GBPCHF broke and closed above a key daily supply cluster.

A breakout occurred with a high momentum bullish candle.

We see a retest of a broken structure now.

With a high probability, the pair will resume growing

and reach 1.0682 level then.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Solana Price Action | Fair Value Gap PerspectiveThis chart highlights price action behavior using liquidity and Fair Value Gap (FVG) concepts for educational purposes. Price previously reacted from a higher price imbalance zone, where selling pressure increased, leading to a strong downward displacement. Such moves often leave inefficiencies (FVGs) in the market, which can later act as reaction areas.

Following the decline, price consolidated and moved back upward into a short-term range, forming equal highs. These areas are commonly observed as liquidity zones, where price may seek resting orders before choosing direction. The current structure shows price moving within a broader range, with both upside and downside liquidity pools still present.

The projected path on the chart illustrates a possible scenario, not a prediction. Markets may seek liquidity above recent highs before reacting toward lower demand areas, but price can always invalidate any technical idea. This analysis is focused on understanding market behavior, not forecasting outcomes.

Traders are encouraged to combine this view with their own risk management, timeframe alignment, and confirmation.

🧠 Concepts Used (Educational)

Liquidity zones

Fair Value Gaps (FVG)

Range behavior

Price imbalance

Market reaction areas

AXSUSDT.P: short setup from 4h support at 2.043BINANCE:AXSUSDT.P has entered a consolidation phase following a strong rally. This range is wide enough to allow for trading inside the structure.

I have identified a local level, relying primarily on the 4H timeframe. The asset has been trading just above this support for an extended period. Recently, there was a tap on the level, and now we are seeing a close retest developing — this is a strong bearish (Short) signal.

Since this is an intra-range trade and not a breakout from the major consolidation channel, we might not see a massive move. However, securing a solid 5R (5 to 1) risk-to-reward ratio is highly feasible.

#BANKNIFTY PE & CE Levels(03/02/2026)Bank Nifty is expected to witness a very strong gap-up opening, potentially in the range of 1000+ points, indicating a sharp bullish sentiment at the start of the session. This kind of opening usually reflects aggressive short covering combined with fresh long build-up, especially after the heavy selling pressure seen in the previous sessions. However, such large gap-ups are often followed by high volatility, so traders should avoid impulsive entries in the first few minutes and instead observe price behavior near key levels.

From a technical perspective, the immediate focus will be on how Bank Nifty behaves above the 59550–59600 zone. If the index sustains above this region after the opening volatility, it will confirm bullish strength. In that case, a continuation move towards 59750, 59850, and 59950+ can be expected. A clean breakout and hold above 60050 would further strengthen the bullish structure, opening the gates for higher upside targets around 60250, 60350, and even 60450+ in the coming sessions.

On the flip side, traders must remain cautious despite the positive opening. The zone around 59450–59400 will act as a crucial intraday support. If the index fails to hold above this level and starts slipping back, it may indicate profit booking after the gap-up. In such a scenario, a pullback towards 59250, 59150, and 59050 is possible. A sustained move below 59050 would weaken the bullish momentum and may shift the market back into a consolidation or corrective phase.

Overall, the broader sentiment for the day remains bullish, supported by the expected massive gap-up opening. Still, the key lies in sustainability above major resistance-turned-support zones. Traders are advised to trade with discipline, wait for confirmation near important levels, and manage risk strictly, as gap-up days often bring sharp intraday swings in both directions.

AUD/NZD BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

AUD/NZD is trending down which is evident from the red colour of the previous weekly candle. However, the price has locally surged into the overbought territory. Which can be told from its proximity to the BB upper band. Which presents a beautiful trend following opportunity for a short trade from the resistance line above towards the demand level of 1.157.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

BTCUSDT - "GAME " ON 2m CHART, A QUICK SELL SET UP - 02-02-2026BTCUSDT - G-Money's short version analysis based purely on technical analysis only, no nonsense or "BS". I do totally ignore any fundamental analysis, technical analysis only

BTCUSDT - still kinda on the "move" and continue DOWN... (2m TRADE, RISKY...)

Who did enter this trade earlier congratulations! Who missed it... See you next time! ;)

Chart is itself explaining. Kept a "KISS" approach all the way ( "Keep It Simple, Stupid") & beginners friendly... ;)

I do hope that nobody ignoring SL ( Stop Loss) ! Without it, It is a fastest way to loose hard earned money...

;)

Trade safe & don't do "gambling". In the end it never pays, not worth it to risk loose all your $...

PS: above technical analysis is done for the community & educational purpose only! It is not a financial advice. Just share my very own insight to it.

Trading Gold Without a Stop Loss: A Slow Suicide1️⃣ No Stop Loss Is Not Courage

Many traders believe that trading gold without a Stop Loss shows confidence, toughness, or the ability to withstand volatility.

In reality, it often means the opposite.

Not using a Stop Loss usually comes from one simple reason: an unwillingness to admit being wrong. When price moves against the position, instead of accepting a controlled loss, traders choose to hold and convince themselves that gold will eventually come back.

The problem is that the market does not operate on personal belief.

Not having a Stop Loss does not make you stronger.

It only makes your mistakes harder to fix.

2️⃣ In Gold Trading, No Stop Loss Means No Brakes

XAUUSD is a high-volatility market that reacts aggressively to news and capital flows.

Price can move far and fast — sometimes within minutes.

Trading gold without a Stop Loss is like driving downhill without brakes.

At first, it may feel manageable.

But once momentum accelerates, you no longer have a choice.

Gold does not care where you entered.

And it will not stop just because your account is in pain.

3️⃣ A Trade Without a Stop Loss Rarely Kills You Instantly

The real danger is that it kills you slowly.

It starts with a small drawdown.

Then a deeper one.

Until you no longer have the emotional clarity to exit.

What began as a trade becomes:

- A holding position

- A hope trade

- A prayer trade

At that point, it is not just your account at risk — your discipline and mental control are already gone.

And once emotions take over decision-making, the outcome is usually inevitable.

4️⃣ Long-Term Traders Are Not the Ones Who Win the Most

They are the ones who lose with limits.

A Stop Loss is not there to be hit.

It exists so you always know:

- Where you are wrong

- How much you are willing to lose

- And whether you can come back tomorrow

In gold trading, a Stop Loss is not a personal preference.

It is the price of staying in the game.

Without it, sooner or later, the market will teach you this lesson — with real money.

CAD/CHF BEST PLACE TO BUY FROM|LONG

CAD/CHF SIGNAL

Trade Direction: long

Entry Level: 0.568

Target Level: 0.570

Stop Loss: 0.567

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR/CAD BUYERS WILL DOMINATE THE MARKET|LONG

EUR/CAD SIGNAL

Trade Direction: long

Entry Level: 1.611

Target Level: 1.614

Stop Loss: 1.609

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅