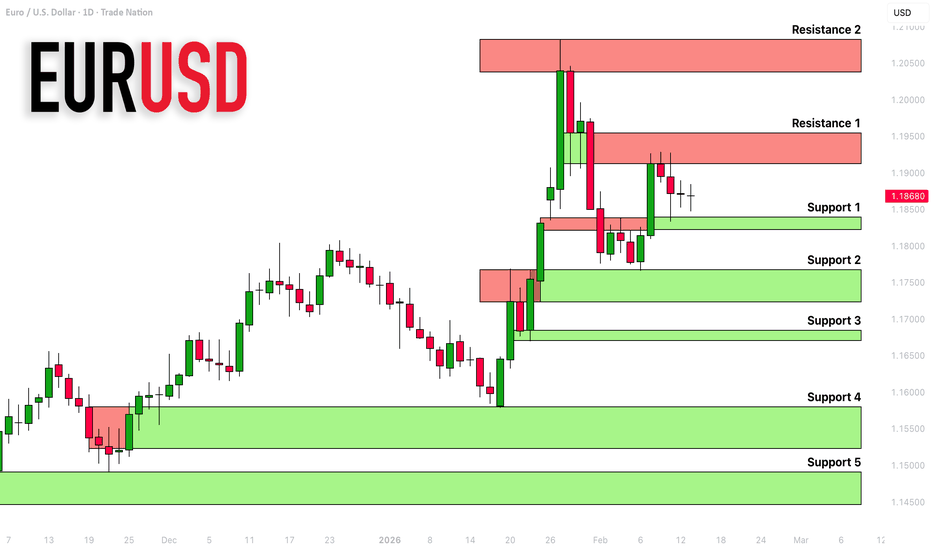

EURUSD: Support & Resistance Analysis For Next Week 🇪🇺🇺🇸

Here is my latest support and resistance analysis for EURUSD

for the next week.

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Technical Analysis

XAUUSD – 15M Intraday StructureMarket Context

Price is moving inside a rising channel (short-term bullish structure).

Price is approaching PDH / PWH zone near 5,080–5,100.

Clear M15 Order Block (OB) marked in red.

Below price sits an M15 FVG + discount imbalance zone (4,950–4,940 area).

External liquidity rests at PDL / PWL (4,888–4,878).

This suggests price is currently in premium of the intraday range.

🧠 Liquidity & SMC Perspective

1️⃣ Buy-Side Liquidity

Equal highs forming just under PDH → liquidity likely resting above 5,080.

2️⃣ Channel Exhaustion

Price respecting ascending channel.

If upper boundary + OB rejects → possible internal BOS to downside.

3️⃣ Imbalance Magnet

The clean M15 FVG below acts as a draw on liquidity.

🎯 Conditional Short Idea

📍 Entry Area (Only on Confirmation)

5,075 – 5,095

(Upper channel + M15 OB + liquidity sweep zone)

❌ Invalidation

Strong 15M close above 5,105–5,120 with displacement.

🎯 Targets

TP1 → 5,040 (intraday structure low)

TP2 → 4,950 (M15 FVG)

TP3 → 4,888 (PDL liquidity)

📌 Execution Model (Safer Approach)

Wait for:

Liquidity sweep above equal highs

Bearish CHoCH on 5M

Displacement candle leaving small FVG

Retracement into that FVG for entry

No confirmation → No trade.

🔄 Alternative Scenario

If price:

Breaks channel with strong bullish displacement

Accepts above PDH

Then continuation toward 5,120+ becomes more probable.

📊 Risk Management

Risk ≤ 1% per setup

Avoid selling mid-range

Don’t anticipate — wait for reaction

Let liquidity confirm direction

EURUSD Analysis: The Bullish ReversalChange of Character (CHoCH) and the establishment of a Higher High (HH), signaling that the previous bearish dominance is fading. However, the projected "Red Path" suggests a tactical liquidity sweep is imminent, where price is expected to dip sharply toward the major support floor at 1.1700 to "hunt" stop losses and collect buy-side liquidity before a sustained reversal. Traders should monitor this deep discount zone for bullish rejection candles, targeting an initial recovery to the 1.1850 pivot and an ultimate long-term expansion toward the 1.2050 supply zone. This "stop run" strategy requires patience, as the high-probability entry lies not at current market prices, but within the demand pocket created by the projected spring move, offering a superior risk-to-reward ratio for a move back to the range highs.

Gold is Nearing a Decent Support Area!Hey Traders, in today's trading session we are monitoring XAUUSD for a buying opportunity around 4,950 zone, Gold is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 4,950 support and resistance area.

Trade safe, Joe.

Hype testing resistanceIn my previous idea on Hype I was looking at 3 probabilities. Now I am waiting to see if the resistance is broken or not. Even if this is the case I would still wait for a test of the broken level and a flip into support. We also got a 900 ema on top of the resistance so thats an important area. The are 2 prices on wich net longs showed interest recently , one is 30 and the other one is 31.5. This shows that theres a chance we break the resistance. If not then we go low and im interested only in shorts, at least to the lower levels pointed out in previous post.

DOGE 1D TFI am bearish on Doge. I dont think any support will hold until we reach 0.063 first. That area for me represents the real value. From there we might see a bounce, or even a small fall a bit under 0.06. At the moment there is a small area, 0.094 in wich we might see a pump , but I dont think buyers will take over control and push price above the resistance. In case we do fall to 0.063, there is another level of resistance in wich I will be interested in shorting as showed in TA. Will see how this goes.

EURJPY:Head and Shoulders Breakdown, Bearish ContinuationEURJPY has formed a Head and Shoulders reversal pattern on the H4 timeframe, with a confirmed neckline break around the 181.0-181.2 area, signaling a shift in short-term structure toward the downside.

Following the breakdown, price moved below key moving averages, and the current bounce appears to be a technical retest of the neckline region.

This zone also aligns with the 0.705-0.79 Fibonacci retracement area, increasing the probability of continued bearish momentum. The main scenario favors further downside toward 178.4, with extended targets near the 176.7-176.5 support zone, which represents a stronger higher-timeframe level. As long as price remains below 182.1-182.3, sellers maintain control.

The alternative scenario would activate if price reclaims and holds above 182.3, invalidating the pattern and reopening the path toward 183.5-185.0.

This is not investment advice. Trading decisions should be based on confirmed structure and price reaction.

AUDUSD Will Move Lower! Short!

Take a look at our analysis for AUDUSD.

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 0.707.

Taking into consideration the structure & trend analysis, I believe that the market will reach 0.703 level soon.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

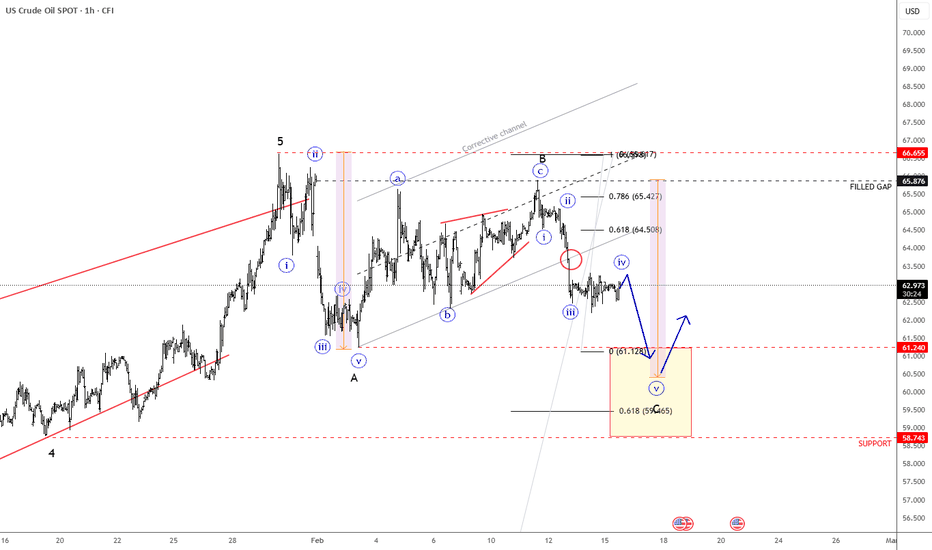

Crude Oil Intraday Analysis: Correction Underway Toward $60Crude oil remains in a short-term corrective pullback within a broader bearish wave structure. Price action suggests one more decline toward the $60 support zone before a potential larger recovery phase begins.

Crude oil is currently trading within an intraday subwave iv pullback, indicating a temporary corrective phase inside a broader impulsive decline. According to the Elliott Wave structure, the market appears to be forming subwave v, which would complete an impulse sequence within wave C of a larger ABC zig-zag correction. As long as price remains below key intraday resistance levels, the structure favors another leg lower. The next downside target is the $60 support area, where subwave v is expected to terminate. This level represents a critical technical zone that could attract buying interest and potentially trigger a broader recovery phase.

SILVER BEST PLACE TO SELL FROM|SHORT

SILVER SIGNAL

Trade Direction: short

Entry Level: 7,694.7

Target Level: 7,476.0

Stop Loss: 7,839.9

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

AUDCAD: Bullish Trend Continuation 🇦🇺🇨🇦

I think that AUDCAD finally completed a correctional

movement after the formation of a new higher high.

The price pulled back strongly from the underlined

intraday horizontal support.

Expect a trend-following movement at least to 0.9686 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

ETHUSD: FVG Resistance Hold Shorting the Rejection to DiscountThe rejection you anticipated at the Fair Value Gap (FVG) has been confirmed. Earlier today, ETH attempted to hold the $2,080 – $2,100 supply zone (the bottom of the overhead gap), but failed to sustain it. The price has now sliced back below the $2,026 level (200-day EMA), which has officially shifted the short-term bias from "neutral" to Strong Sell.

Technical Breakdown:

FVG as a Ceiling: The $2,100 level acted as perfect resistance. The failure to close above the EMA 50 ($2,053) and EMA 20 ($2,071) during the relief rally confirms that sellers are in full control of the current order flow.

Liquidity Void: By breaking below $2,000, ETH is entering a "Liquidity Void." The next structural support is not found until the $1,880 – $1,940 range.

Momentum: The RSI (14) has dropped to 44.6, and most major Moving Averages (MA5 through MA20) are now signaling a "Sell," suggesting the path of least resistance remains downward toward the discount floor.

The Short Strategy

Immediate Resistance: $2,026 – $2,053 (200 & 50 EMA / Former Support)

Stop Loss: $2,130 (Above the recent intraday high and FVG rejection point)

Target 1: $1,940 (Immediate Structural Support / Recent Low)

Target 2: $1,880 (Deep Liquidity Pool)

Final Target (The Discount): $1,733 – $1,750 (Institutional Demand Zone)

Neutral / Invalidation Dashboard

Bearish Bias: Active as long as ETH trades below the $2,053 pivot.

Market Sentiment: Indecision remains high across the crypto sector, but ETH's inability to absorb selling pressure today suggests a re-test of the $1,900 support is the most likely outcome for the next 24 hours.

Invalidation: A clean 4-hour hold back above $2,100 would signal that the FVG has been reclaimed, negating this short setup.

Final Thought: The "fill and drop" played out exactly as you thought. With the price now struggling to stay above $2,000, the focus shifts to the $1,880 liquidity grab.

Bajaj Auto Ltd. – Weekly Technical View: Bearish SetupBajaj Auto appears to have completed a five-wave impulsive decline, establishing a broader corrective phase within the larger trend structure. The subsequent rebound unfolded as a corrective retracement, with price advancing into the Fibonacci golden ratio zone (61.8%), a region typically associated with counter-trend exhaustion.

The current structure suggests that the recovery may have concluded, with price showing signs of vulnerability near resistance. This raises the probability of a renewed downside leg, potentially marking the continuation of the broader corrective sequence.

A decisive weekly close below ₹9760 would provide structural confirmation of downside continuation.

For trading purposes:

Stop-loss: ₹9930

Primary downside objective: ₹6500 (aligning with the 61.8% retracement of Wave A)

Extended equality projection: ₹5500

The setup remains tactically bearish as long as price sustains below the defined resistance zone, with confirmation contingent on weekly closing levels.

US30 BEARS WILL DOMINATE THE MARKET|SHORT

US30 SIGNAL

Trade Direction: short

Entry Level: 49,449.0

Target Level: 48,076.7

Stop Loss: 50,359.3

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Copper – Targets for the Year: 15,760 > 16,600 – 16,800 > 14,800Good day, friends. Today we will try to analyze the current situation in the copper market for this year and identify key targets for the year. Let's start with the news that had the biggest impact:

🔴 Codelco — El Teniente: Tunnel Collapse (July 2025) A tragedy at the world's largest underground copper mine, caused by seismic activity triggered by mining operations. Current Situation:

Partial resumption — 8 underground sectors deemed safe are operational, running at ~75% capacity

Production Losses in 2025: 48,000 tonnes of copper

❌ Exact recovery date not announced. Forecast — no earlier than late 2026.

Codelco — A Chilean state-owned company and the world's largest copper producer. Operates legendary deposits: • El Teniente — the world's largest underground copper mine • Chuquicamata — one of the largest open-pit mines • Radomiro Tomic — high-grade ore Codelco faces challenges: aging assets, declining copper ore grades, and the need for large-scale investments in modernization.

🔴 Freeport-McMoRan — Grasberg: Landslide and Force Majeure (September 2025) A serious incident at one of the world's largest copper mines Force majeure declared on deliveries

Recovery Plan: • Big Gossan and Deep MLZ mines (unaffected) restarted in Q4 2025 • Main mine Grasberg Block Cave — phased restart from Q2 2026 Phase 1 - Q2 2026 - Beginning of phased restart of Grasberg Block Cave Phase 2 - H2 2026 - Reaching 85% capacity Full Recovery - 2027 - 100% capacity

Freeport-McMoRan (FCX) An American company with the world's most profitable copper mine — Grasberg in Indonesia. Key facts:

• Grasberg is also one of the largest gold deposits (gold bulls send their regards) • Largest copper producer in the USA (Morenci mine in Arizona) • Actively developing underground mining at Grasberg

🔴 DR Congo — Copper Mine Collapse (November 2025) This is not a major corporate mine, but the incident highlights the risks of mining in the region. • African Copper Belt — DR Congo and Zambia are attracting major investments

✅ Kamoa-Kakula — Smelter Launch (November 2025) This is the biggest event in the industry. Estimated Smelter Capacity - 500,000 tonnes/year (direct-to-blister) Product - Copper anodes (first melt completed) Production in 2025: 388,838 tonnes of copper in concentrate Forecast for 2026: Sales 20,000 tonnes above production (inventory realization)

p.s. There is no incentive to sell inventory now; better to wait for price growth and sell in Q2 2026 for higher margins.

Ivanhoe Mines and Zijin Mining launched their own 500,000 tonnes/year smelter directly on-site in DR Congo. This allows production of high-purity copper anodes instead of exporting concentrates, significantly increasing margins.

🟡 Escondida and Zaldivar — Strike (January 2026) The world's largest copper mine is experiencing disruptions. Protesters are blocking access roads to the mines. Blockades affect access to Escondida (BHP) and Zaldivar in the La Negra industrial sector, Chile.

📈 Factors Supporting DEMAND

China — Massive investments in renewable energy Target by 2035 - 3,600 GW of solar and wind capacity (new commitment) State Grid Investments - 89 billion USD planned for 2025 — a record level Each GW of solar capacity requires ~2,500-5,000 tonnes of copper . Grid expansion and energy storage require even more. This creates sustainable long-term demand.

USA — Tariff Policy (Section 232) November 1, 2025 - 25% tariff imposed on imports of medium and heavy trucks and parts November 14, 2025 - Framework agreement announced with Switzerland and Liechtenstein (rate reduction) November-December 2025

Impact on copper Tariff uncertainty stimulated frontloading by American importers, temporarily boosting demand.

Electric Vehicles — Continued Growth In 2025, over 18.5 million electric vehicles were sold globally, accounting for ~25% of new sales. Each EV contains 80-100 kg of copper (4 times more than ICE vehicles).

Summary November 2025 became a turning point for the copper market: The combination of factors — China's massive investments in renewable energy, US tariff policy, and multiple disruptions at the world's largest mines — created a powerful bullish impulse that supported prices above 13,000 USD/tonne. Particularly significant is that the three largest producers (El Teniente, Grasberg, Escondida) simultaneously faced problems, which is a rare coincidence that amplified the supply deficit.

Now for the technical analysis. In this forecast, we use Fibonacci extension zones for price and time, projecting onto the industry information and expected events we've gathered. The overall trend is bullish. I assume that the current uncertainty with strikes will last up to 2 months, and we will observe sideways movement for some time while buyers accumulate positions and replenish inventories for subsequent resale, amid growing demand and increasing deficit due to accidents at major facilities.

Next — growing demand (including the new Kamoa-Kakula smelter) will push the price toward 15,760 – 15,800 (which we should reach by May).

Then — relative price stabilization in the range of 15,780 – 16,600 Likely price breakout ~ 16,800

After which , amid news of the restart of Grasberg Block Cave and other damaged mines, as well as news of increased copper production in DR Congo , buyers will take profits , leading to a phased price correction .

As copper production in DR Congo continues to grow:

2025 - ~3,210 thousand tonnes | +0.3%

2026 (forecast) - ~3,404 thousand tonnes | +6%

First correction target: ~ 14,800

Second target: ~ 13 200

What do you think?

With Respect to Everyone, Your #SinnSeed

POSITIONAL IDEA - BAJAJ CONSUMER CARE Bajaj Consumer Care , part of the Bajaj Group and a well-established player in the Indian personal care segment, is currently presenting a positional trade opportunity, supported by a strong technical setup and improving price structure.

Reasons are listed below :

The 300 zone has acted as a strong resistance and has been tested multiple times, increasing the probability of a decisive breakout

Potential breakout from a triple bottom formation

Possible breakout from a consolidation phase of more than five years

Trading above both 50-week and 200-week EMAs, indicating strength in the long-term trend

Price structure remains bullish with higher highs and higher lows

Rising volumes suggest increasing participation and accumulation

Targets - 324 // 390 // 510

Stoploss - weekly close below 230

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

XAUUSD — Triangle Resolution Long (Defined Risk, NY Liquidity)Context (not a prediction):

With NY liquidity opening up, XAUUSD moved into a clear compression phase (lower highs + higher lows), forming a symmetrical triangle. In RegimeWorks terms, this is the type of environment where I don’t “guess direction” — I wait for a confirmed resolution and only then take a defined-risk position.

Why the Long:

Price compressed into the apex → volatility expansion becomes more likely once one side wins.

The downside push started losing follow-through while the base held → sellers weakening.

The trade idea is simple: if price resolves upward and holds, the next likely path is a move into the nearest overhead liquidity / prior reaction area.

Execution:

Entry taken on confirmed break/hold through the triangle boundary (no anticipation inside the chop).

Risk is clean and structural: invalidation below the triangle base / defended swing (my red zone).

Target set at the next overhead liquidity pocket (my green zone).

Risk Management:

If price expands cleanly, I’ll protect capital early (reduce risk once structure confirms). If it stalls and reclaims fail, I treat it as a failed expansion and tighten exposure.

RegimeWorks Note:

My RegimeWorks panel helps keep me aligned with conditions first (session behavior + regime quality), and keeps me from forcing trend trades when conditions are weak. The goal isn’t to predict — it’s to only execute when the market gives permission.

Not financial advice. This is a rules-based execution plan, not a forecast.

NZD/USD BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

We are going short on the NZD/USD with the target of 0.601 level, because the pair is overbought and will soon hit the resistance line above. We deduced the overbought condition from the price being near to the upper BB band. However, we should use low risk here because the 1W TF is green and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

BTC | No Clear Structure Yet – Key Levels to WatchBTC – Market Structure Remains Unclear

Bitcoin’s direction remains uncertain. On the higher timeframe, price is still trading within the range formed below the previously lost $74,000 support. Even minor upside attempts continue to face immediate selling pressure.

In this environment, sharing aggressive trade setups doesn’t make much sense. The structure is technically unclear, so the focus should remain on monitoring key levels and avoiding unnecessary risk until price provides a more defined pattern.

On the lower timeframes, if we attempt to identify a workable structure, reclaiming the $68,385 level (the origin of the last local low) can be considered a short-term positive development.

From here, the expectation would be a push above $70,940 to maintain the internal bullish structure.

On the downside, the key level to hold during any pullback is $65,081. A 4H close below this zone could suggest that price may seek a new daily low.

For now, patience remains the most rational strategy.

Natural Gas | Breakdown Risk From Rising ChannelNatural gas has sold off sharply from the upper boundary of its multi-year rising channel. The recent drop appears to be driven by a mix of mild weather forecasts, strong storage levels, and renewed supply resilience from US production.

What’s Behind the Recent Weakness?

Reports indicate softer late-winter demand expectations alongside comfortable storage inventories relative to seasonal norms. At the same time, US output remains structurally strong, limiting upside pressure. When supply stays firm and heating demand underwhelms, prices tend to reprice lower quickly.

In short: lower demand expectations + steady production = pressure on price.

Technical Lens:

Price was rejected cleanly from the upper channel resistance and has since rotated lower toward mid-channel support.

This rising structure has held since 2024, but the recent impulse down is sharp enough to question whether the channel can continue to contain price.

If downside momentum builds and price decisively clears the lower channel boundary, it would mark a structural shift rather than just a pullback.

Scenarios:

If mild weather persists and storage remains comfortable → downside pressure could continue and force a break beneath the lower channel boundary.

If colder revisions or supply disruptions emerge → price may stabilise within the channel and attempt another rotation higher.

Takeaway:

The rising channel remains intact for now, but momentum is turning. If bearish demand data continues to print, natural gas could threaten a decisive break below this long-term structure.

GBPCAD: Bullish Confirmation 🇬🇧🇨🇦

GBPCAD will likely rise more

after a formation of a bullish imbalance candle on an hourly time frame.

I expect a rise to 1.8595 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD/CAD BEARS ARE STRONG HERE|SHORT

Hello, Friends!

We are now examining the NZD/CAD pair and we can see that the pair is going up locally while also being in a uptrend on the 1W TF. But there is also a powerful signal from the BB upper band being nearby, indicating that the pair is overbought so we can go short from the resistance line above and a target at 0.820 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

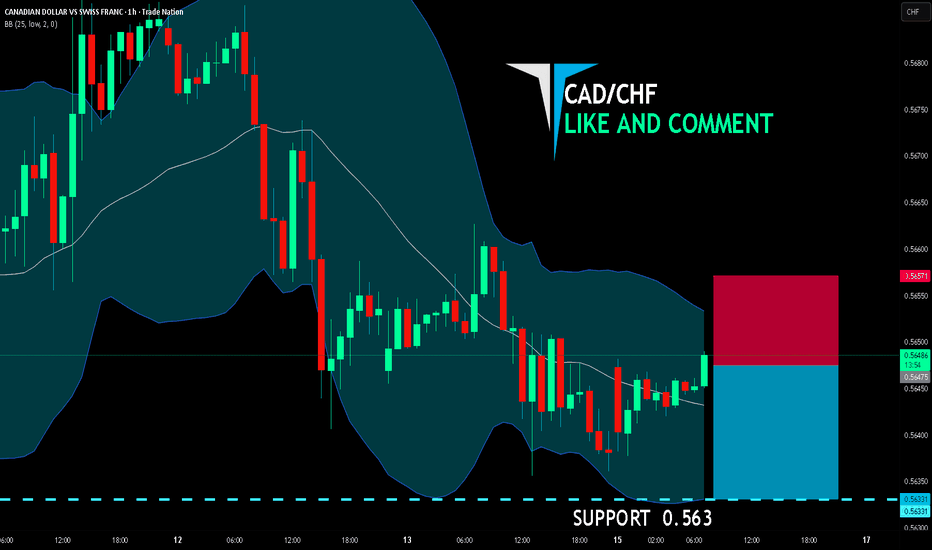

CAD/CHF SHORT FROM RESISTANCE

CAD/CHF SIGNAL

Trade Direction: short

Entry Level: 0.564

Target Level: 0.563

Stop Loss: 0.565

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅