GBPUSD: BoS Trading 🇬🇧🇺🇸

I see a confirmed bullish break of structure on GBPUSD on a daily.

After a breakout, the market retest a broken structure and we see

a strong buying imbalance on an hourly time frame.

Expect more growth today.

Goal - 1.3575

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Technical Analysis

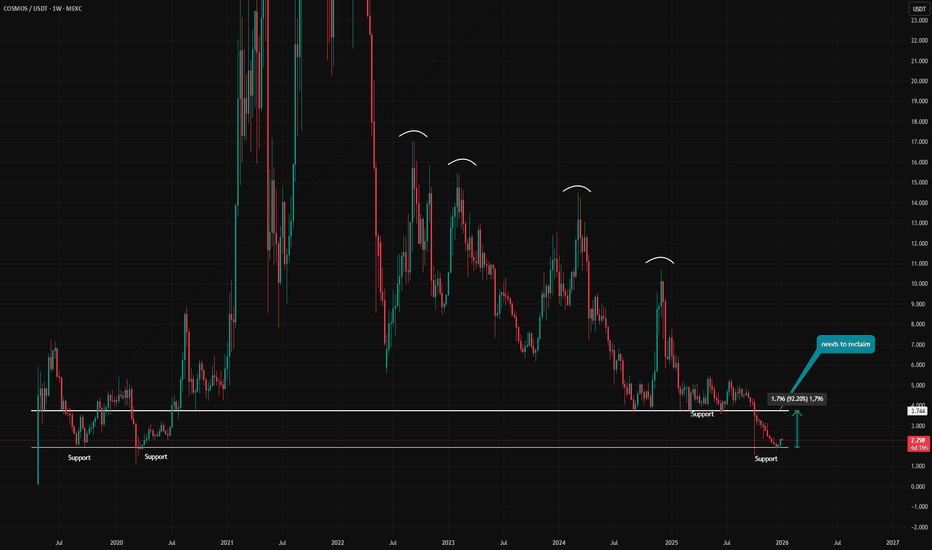

ATOM - +21% Weekly Rally at $1.16B | Tokenomics Redesign

Executive Summary

Cosmos (ATOM) market cap trading at $1.16B after a massive +21.17% weekly rally on the 4H timeframe. Price surged from $880M support to test $1.18B resistance. Major catalysts ahead: tokenomics redesign (Q1 2026), Solana/Ethereum L2 IBC integrations, and THORChain cross-chain swaps live. Strong momentum but approaching resistance.

BIAS: BULLISH - Strong Momentum, Watch Resistance

Current Market Data

Current: $1.16B (+0.33%)

Day's Range: $1.14B - $1.16B

52-Week: $803.29M - $2.8B

Volume: 63.52M (above 30D avg of 53.47M)

Performance:

1W: +21.17% | 1M: +7.14% | 3M: -39.69%

6M: -31.52% | YTD: +23.37% | 1Y: -59.76%

Key Catalysts

Tokenomics Redesign (Q1 2026) - Lower inflation, fee capture from appchains

IBC Integrations - Solana and Ethereum L2s connectivity coming

THORChain Cross-Chain Swaps - Native ATOM swaps live (no bridges)

CometBFT Upgrades - Targeting 10k+ TPS for enterprise

Enterprise Blockchain Fleet Manager - SWIFT, SMBC adoption potential

Stablecoin Surge - Cosmos Labs predicts new issuers in 2026

Technical Structure - 4H

Strong Uptrend:

Clean rally from $880M to $1.16B

Higher highs and higher lows

Now testing upper resistance at $1.18B

Volume above average - confirms momentum

Key Levels (Market Cap):

Resistance:

$1.16B - $1.18B - Current resistance zone

$1.20B - Psychological resistance

$1.40B+ - Extended bullish target

Support:

$1.10B - Immediate support

$1.00B - Psychological support

$880M - Major support (red line at bottom)

SCENARIO ANALYSIS

BULLISH: Breakout Above $1.18B

Trigger: Close above $1.18B with volume

Targets: $1.20B → $1.40B → $1.60B

Catalyst: Tokenomics redesign approval, IBC integrations

BEARISH: Rejection at Resistance

Rejection at $1.18B resistance

Pullback to $1.00B-$1.10B support

Healthy consolidation before next leg

My Assessment

Strong +21% weekly rally with volume confirmation. Approaching resistance at $1.18B. Major catalysts ahead: tokenomics redesign to lower inflation and capture fees, IBC integrations with Solana/ETH L2s, and enterprise adoption push. Bullish structure intact - watch for breakout or pullback to support.

Strategy:

Long on breakout above $1.18B → Target $1.20B, $1.40B

Or buy pullback to $1.00B-$1.10B support

Stop below $880M major support

Tell me your thoughts below!

GBP/USD – USD Weakness Lifts the PoundEntering the early trading sessions of 2026, GBP/USD is presenting an increasingly constructive picture as downside pressure from the USD begins to fade. After a highly volatile 2025, market attention is shifting toward the possibility that the Federal Reserve may maintain an accommodative stance amid signs of cooling in the U.S. economy. This macro backdrop is creating a favorable environment for counterpart currencies such as the British pound to recover.

From a technical perspective, the bullish structure in GBP/USD is becoming more clearly defined . On the H2 timeframe, price continues to form higher lows, while rebounding decisively from the 1.3530 support zone. This area has shown swift and confident buying interest, signaling that bulls remain committed to defending the current trend.

On the upside, 1.3600 stands out as a key psychological resistance . As long as price holds above the current support base and consolidates in an orderly manner, the probability of a gradual push toward this level remains high. A clean and sustained breakout above 1.3600 would likely open the door for further upside continuation in the sessions ahead.

Overall, GBP/USD is trading within a controlled and well-supported uptrend , backed by both a supportive macro narrative and a constructive technical structure. In this context, short-term pullbacks are more likely to act as continuation setups, reinforcing the broader bullish outlook rather than signaling a reversal.

Buyers Are Back — The Recovery Is Taking ShapeOANDA:XAUUSD has reclaimed the mid-range support after a sharp sell-off and is now building a bullish recovery structure. The bounce from the lower demand zone and the clean gap fill suggest buyers have regained short-term control, shifting momentum back to the upside.

Price is now pressing toward the 4,480–4,500 resistance zone, where reactions are likely. As long as pullbacks remain shallow above support, the structure favors continuation rather than rejection.

Resistance: 4,480 – 4,500, then 4,550

Support: 4,400 – 4,420, then 4,280 – 4,300

➡️ Primary: hold above 4,400 → grind higher → test 4,480–4,500, with potential continuation toward 4,550.

⚠️ Risk: rejection at resistance → pullback toward 4,420 before reassessment.

EUR/USD Breakdown Confirmed – The Bearish Trend Comes Into FocusAs we move into early January 2026 , EUR/USD is sending clear signs of weakness , with both macro fundamentals and technical structure aligning in favor of the sellers. Market sentiment remains cautious at the start of the year, while capital flows are gradually rotating back into the U.S. dollar.

From a fundamental perspective, the USD is being supported by expectations that upcoming U.S. economic data will remain resilient, whereas the ECB has yet to deliver any fresh policy signals strong enough to support the euro. This divergence in expectations continues to place downward pressure on EUR/USD in the short term, especially as markets currently favor safety and stability via the USD.

On the technical side, the bearish structure remains intact . Price has attempted several recoveries, but each rally has been firmly rejected at the descending trendline, confirming that selling pressure continues to dominate market structure. Recent upward moves are purely corrective, lacking the momentum required to signal any meaningful trend reversal.

The 1.1740 level stands out as a key resistance zone. As long as price remains below this level, the higher-probability scenario favors further downside, with EUR/USD likely to resume its decline toward the 1.1650 support area following a brief corrective bounce.

In short, EUR/USD remains a sell-on-rallies market — until the structure clearly proves otherwise.

AVAX - Rising Wedge at $14.12 | ETF Filings Spark +11% Rally

Executive Summary

Avalanche (AVAX) trading at $14.12 within a rising wedge on the 2H timeframe. Price surged +11% this week as institutional ETF filings sparked a rally. Now testing upper resistance with two scenarios: bullish breakout above $14.75 or pullback to $12.00-$12.75 support zone before continuation.

BIAS: NEUTRAL - Watching for Breakout or Pullback

Current Market Data

Current: $14.123 (-0.82%)

Day's Range: $14.033 - $14.516

52-Week: $9.013 - $44.575

Market Cap: $6.08B

24h Volume: $384.76M

Technical Rating: Neutral

Performance:

1W: +11.80% | 1M: +6.89% | 3M: -53.89%

6M: -23.09% | YTD: +14.80% | 1Y: -66.85%

Key Catalyst

Institutional ETF filings sparked +11% rally

AVAX among altcoins with ETF filing momentum

Fortune 100 companies expected to launch blockchains on Avalanche

Strong ecosystem for enterprise adoption

Technical Structure - 2H

Rising Wedge Pattern:

Rising support and resistance trendlines (yellow dashed)

Wedge narrowing toward apex

Can break either direction

Currently testing upper resistance

Key Levels:

Resistance:

$14.50 - $14.75 - Upper resistance / breakout level

$15.00 - Psychological resistance

$16.00+ - Extended bullish target

Support:

$14.00 - Immediate support

$12.75 - Upper support zone

$12.00 - $12.75 - Major support zone (purple)

$11.75 - Deep support (red line)

SCENARIO ANALYSIS

BULLISH: Breakout Above $14.75

Trigger: 2H close above $14.75 with volume

Targets: $15.00 → $16.00 → $18.00

Catalyst: ETF momentum continues

BEARISH: Pullback to Support Zone

Rejection at upper wedge resistance

Pullback to $12.00-$12.75 support zone

Healthy retest before continuation

Buy opportunity at support

My Assessment

Rising wedge at resistance after +11% ETF-driven rally. Two scenarios: breakout above $14.75 or pullback to $12.00-$12.75 support zone. ETF filings provide fundamental catalyst. Watch for confirmation before entry.

Strategy:

Long above $14.75 breakout → Target $15, $16, $18

Or wait for pullback to $12.00-$12.75 support

Long at support with stop below $11.75

Target $14.50+ on bounce

List your thoughts below!

TROW Long 1D Investment Conservative TradeConservative Trade

+ long impulse

+ 1/2 correction

+ SOS level

+ supporting zone

? ultravolume 2Sp+

= perforated T2

+ 1/2 correction

+ volumed 2Sp+

Calculated affordable virtual stop limit

1 to 2 R/R take profit

- outside 1D

+ inside 1M

Monthly CounterTrend

"- short balance

+ expanding ICE

+ support zone

+ biggest volume 2Sp+

+ weak test

+ 1/2 correction"

Yearly Trend

" '+ long impulse

+ T2 level

+ support zone

- deep correction

+ volumed interacting bar"

ENA – Daily UpdateFrom the higher timeframe, ENA is still trading within a broader bearish structure.

The recent bounce is a reaction from support, not a confirmed trend reversal yet.

On the Daily, price is still respecting the descending trendline.

At this moment, there is no valid long trigger.

What I want to see next:

Price needs to print a high and then reclaim the key resistance level, turning it into support.

That R/S flip is required to confirm a potential structure shift.

Until that reclaim happens, this remains a patience trade.

No reclaim, no confirmation = no trade.

Let price do the work first.

Are you waiting for the reclaim or staying sidelined for now?

MrC

BANANA GUN – Daily UpdateFrom the weekly perspective, price is still in a broader bearish structure.

The recent move is only a reaction after a prolonged downtrend — not a confirmed reversal yet.

On the Daily, price has broken the descending trendline, which is a first sign of potential change.

However, at this stage there is still no valid long trigger.

What I want to see next:

Price needs to print a higher high and then come back for a proper resistance → support flip.

Only after that reclaim would the structure shift be confirmed.

Until that happens, this remains a wait-and-see scenario.

No confirmation = no trade.

Patience first.

Let price prove itself before committing risk.

Are you waiting for the reclaim or already anticipating the move?

MrC

BONK – Daily UpdateAfter a long downtrend, price finally broke the descending trendline with a strong impulsive move.

This impulsive candle also created a Daily FVG, showing clear imbalance to the upside.

At the moment, price is extended.

I’m not chasing this pump.

My plan is simple:

I’m waiting for a pullback into the 0.5 Fibonacci level, which aligns perfectly with the Daily FVG.

That zone is my area of interest.

If price retraces into that area, I’ll drop to the lower timeframes and wait for a clean long trigger.

No pullback, no confirmation = no trade.

Don’t chase the pump.

Let the price come to you.

Are you waiting for the retrace or already looking for entries?

MrC

USDCAD Outlook | Downtrend + January FOMC Rate Cut Risk!Hey Traders,

In tomorrow’s trading session, we are closely monitoring USDCAD for a potential selling opportunity around the 1.37800 zone. USDCAD remains in a clear downtrend and is currently in a corrective pullback, approaching a key trendline confluence and the 1.37800 support-turned-resistance area, which could act as a strong rejection zone.

From a fundamental perspective, growing expectations of a potential interest rate cut at the January FOMC meeting could weaken the US Dollar, adding further downside pressure on USD-based pairs, including USDCAD, and reinforcing the bearish bias.

As always, wait for confirmation and manage risk accordingly.

Trade safe,

Joe.

USOIL Sell Opportunity | Downtrend + Rising Venezuela Supply!Hey Traders,

In tomorrow’s trading session, we are closely monitoring USOIL for a potential selling opportunity around the 57.50 zone. USOIL remains in a well-defined downtrend and is currently in a corrective pullback, approaching a key trendline confluence and the 57.50 support-turned-resistance area, which could act as a strong rejection zone.

From a fundamental perspective, expectations that Trump’s takeover of Venezuela’s oil supply could increase global oil production may lead to higher supply in the market. According to basic supply and demand dynamics, an increase in supply—if not matched by demand—can put downward pressure on oil prices, reinforcing the bearish technical outlook.

As always, wait for confirmation and manage risk carefully.

Trade safe,

Joe.

Gold doesn’t hate you. Gold just loves… your liquidity.If you’ve ever felt like XAUUSD has a personal grudge against you — price spikes the moment you enter, sweeps your SL perfectly, then runs strongly in your predicted direction right after you exit — take a breath. Pause for a second.

The gold market doesn’t move based on emotions.

It moves based on liquidity — the fuel behind every major move .

1. Retail traders trade price. Institutions trade orderflow.

You look at the chart to find a perfect entry.

Institutions look at the chart to find where the most SL and pending orders are stacked.

To them, it’s not a “resistance zone” — it’s a liquidity pool.

When retail SL gets triggered, it turns into market orders.

And those market orders become the free matching engine for big players to enter without excessive slippage.

You think you’re protecting your risk with SL.

The market thinks you’re placing free orders for them to fill their positions.

2. Gold loves clean levels because SL sits at clean levels.

Liquidity sweep zones usually share the same traits:

- Recent highs/lows everyone can see

- Support/resistance that looks clean and easy to draw

- Attractive round numbers like 2,700 – 2,650 – 2,600…

These areas are liquidity magnets, not breakout signals.

3. “Sweep then run” is a process, not an exception.

A major gold move typically has 2 phases:

- Liquidity grab (SL sweep, pending activation)

- Expansion (the real trend begins)

Most traders lose because they confuse phase 1 with phase 2.

Retail sees a spike → fear trend break.

Institutions see a spike → mission accomplished, liquidity collected, positions filled.

4. The market doesn’t need you to be wrong — it only needs you forced out.

Gold doesn’t need to prove your analysis was bad.

It just needs enough volatility to make you:

- Hit SL

- Or close manually out of panic

Either way, the market gets the liquidity you left behind.

5. Trading maturity = not turning yourself into liquidity.

You don’t need to remove SL. You just need to:

- Place SL where the structure is truly invalidated, not where liquidity is obvious

- Enter after liquidity is swept, not before

- Keep margin to reposition during pullbacks

- Understand: being right isn’t enough — you must be right at the right time.

ATOM / USDT – Weekly OutlookATOM is still trading in a long-term downtrend, but price is currently resting on a major historical support zone.

Market Structure

Clear sequence of lower highs, confirming bearish structure

Strong support zone that has been defended multiple times in the past

No confirmed trend shift yet

Key Zones

Support: current range where price is consolidating

Resistance: previous support that must be reclaimed and held

Above resistance, upside momentum can accelerate

Scenario

As long as support holds, a relief bounce is possible

Rejection at resistance would confirm trend continuation

Only a clean reclaim and hold above resistance would signal trend reversal

Do you expect ATOM to bounce from support or continue lower?

MrC

[NL25](AEX) - Bullish Trendline Breakout - LONG SetupThe Netherlands 25 (AEX) has finally broken its long-term descending trendline! We are seeing a clear shift in market structure on the 4H timeframe. Is this the start of a New Year rally?

Breakout: Price has decisively closed above the primary descending trendline.

Support Flip: The previous resistance at 952.00 is now acting as a solid support base.

Momentum: Higher highs and higher lows are forming, confirming a bullish transition.

Long Setup

Entry: 951.94

Stop Loss (SL): 938.14 (Below the accumulation zone)

Take Profit 1 (TP1): 968.45

Take Profit 2 (TP2): 977.25

Risk/Reward Ratio: ~1:1.9

⚠️ Disclaimer: Trading financial instruments involves significant risk of loss and is not suitable for every investor. This post is for educational and informational purposes only and does not constitute financial advice. Past performance is not indicative of future results. Always perform your own due diligence and manage your risk strictly.

EURUSD Is Not Reversing — This Is a Support Reaction Hello everyone,

On the H1 timeframe, the key focus right now is not the recent bearish push, but how EURUSD is reacting at a clearly defined support zone and attempting to rebuild structure. Price has already completed a corrective leg down; what matters now is whether demand can hold and fuel a measured recovery.

OANDA:EURUSD sold off into the 1.1720–1.1730 support area, where downside momentum stalled and price began to stabilize. This zone has acted as a reaction base before, and the current candles show absorption rather than continuation, suggesting sellers are losing follow-through at these levels.

Structurally, the market is transitioning from impulsive downside into a corrective recovery sequence. The first objective is a push toward 1.1747, which marks the nearest intraday resistance. A successful reclaim and hold above this level would set up a retest-and-continue move toward 1.1755, followed by 1.1765. These levels align precisely with prior breakdown points, making them natural upside magnets during a correction.

The projected path on the chart reflects this logic clearly:

- Hold above support (1.1720–1.1730) → initiate rebound.

- Reclaim 1.1747 → short-term confirmation.

- Retest and continuation toward 1.1755 and 1.1765.

Only a clean break and acceptance below 1.1720 would invalidate the recovery scenario and reopen downside risk.

Importantly, there is no evidence of aggressive distribution at the lows. Price action remains orderly, and rebounds are developing step by step, which supports the view of a technical pullback resolution, not a trend reversal.

As long as EURUSD holds above the highlighted support, the path of least resistance is a corrective grind higher toward the marked targets, with patience and level discipline remaining key.

Wishing you all effective and disciplined trading.

Bitcoin Is Still Trapped — H1 Box Accumulation Has Not Resolved Hello everyone,

On the H1 timeframe, the key focus right now is not the recent push higher, but the fact that Bitcoin remains locked inside a clearly defined box accumulation structure. Despite several directional attempts, the market has not achieved acceptance beyond the range boundaries.

Structurally, BTC continues to rotate between the 87,100–87,300 support band and the 90,300–90,400 resistance zone. The latest advance stalled exactly near the upper half of the box around 89,100–89,200, where selling pressure has consistently appeared in previous rotations. This confirms that supply remains active before the range high, preventing a clean breakout.

Price action inside the box remains overlapping and corrective. Higher lows are forming, but they are doing so within the range, not above it. This tells us that buyers are active, yet still operating in absorption mode rather than trend-expansion mode. The market is building pressure, but has not released it.

The projected paths on the chart reflect two realistic outcomes that are fully aligned with current structure:

- A short-term rejection from the upper range, followed by a pullback toward the 88,000–88,200 area, which would represent a normal rotation inside accumulation.

- Alternatively, a continued grind higher, but only a clean break and acceptance above 90,400 would confirm that accumulation has completed and open the door for upside expansion.

As long as price remains inside the box, directional conviction is premature. This is not a trending environment; it is a liquidity-building phase, where false breaks and rotations are part of the process.

Only two things matter from here:

- Acceptance above resistance → bullish expansion.

- Acceptance below support → failed accumulation and deeper correction.

Until one of those conditions is met, Bitcoin is not breaking out. It is waiting.

Wishing you all effective and disciplined trading.

Gold Is Not Done — H1 Structure Favors ContinuationHello everyone,

On the H1 timeframe, the key focus right now is not the short-term hesitation, but the fact that gold has successfully transitioned from a corrective phase into a recovery structure and is now reacting constructively below resistance.

After the sharp sell-off earlier in the session, price found strong demand inside the 4,280–4,300 support zone, where selling pressure was fully absorbed. The impulsive rejection from this area marked a clear structural low, followed by a steady sequence of higher lows. This confirms that the downside move has already completed and that the market is now in a rebuilding phase.

From a structural perspective, gold has reclaimed multiple intraday levels and is currently trading above the 4,350–4,360 area, which previously acted as resistance. This level has now flipped into short-term support, indicating acceptance at higher prices. The current pause just below the 4,400–4,405 resistance zone is therefore a reaction point, not a sign of weakness.

The projected paths drawn on the chart reflect realistic scenarios rather than predictions:

- A shallow pullback toward the 4,350–4,370 region to retest demand, followed by continuation higher.

- If momentum persists, acceptance above 4,405 would open the door for a push toward 4,450–4,480, and potentially higher toward the upper resistance cluster.

- Only a clean breakdown back below 4,330 would invalidate the bullish continuation structure and shift the market back into range behavior.

Importantly, price action remains orderly, with no impulsive selling and no expansion to the downside. This tells us that current consolidation is part of a trend continuation process, not distribution. As long as gold holds above the reclaimed support levels, the path of least resistance remains to the upside.

Wishing you all effective and disciplined trading.

Bitcoin at the Edge: Breakout Incoming or Another Trap $89000BTCUSD H1 chart, price is currently testing a key resistance zone around 88,800 – 89,000, an area that has previously triggered multiple rejections. The recent upward move represents a recovery leg within a broader range, rather than a confirmed breakout.

As price reaches this resistance, buying momentum is clearly slowing, with smaller bullish candles and immediate selling pressure appearing at the zone. This behavior suggests that sellers are still active, and the market has not yet accepted higher prices. Without a strong H1 close above this resistance, the current move lacks technical breakout confirmation.

The more probable short-term scenario is a rejection from resistance, followed by a pullback toward nearby support levels. Initial support is located around 88,200 – 88,000, with a deeper support zone near 87,700, where buyers previously stepped in. As long as price remains capped below resistance, the market structure continues to reflect a range-bound / consolidation environment.

In summary, this is not a confirmed breakout. Bitcoin is trading at a decision area where price must either produce a clean, impulsive close above resistance to confirm continuation, or face rejection and rotate back into the range. Until that clarity appears, bias remains neutral, with focus on price reaction rather than directional anticipation.

Ethereum Near Major Resistance: Structure StrengtheningEthereum is currently trading just below a strong resistance zone around 3,050–3,070, where multiple prior rejections have occurred. Price is advancing within a clearly defined ascending price channel, indicating controlled bullish pressure rather than impulsive expansion. The recent sequence of higher lows suggests buyers are active, but the lack of strong follow-through near resistance highlights hesitation.

From a technical structure perspective, ETH is transitioning from a recovery phase into a potential range environment. The upper boundary of the rising channel aligns closely with horizontal resistance near 3,030–3,050, creating a confluence zone where profit-taking is likely. Momentum candles are slowing, and price is beginning to overlap, which typically precedes either consolidation or a corrective pullback rather than an immediate breakout.

If ETH fails to reclaim and hold above 3,050 on a clean H1/H4 close, the higher-probability scenario is a rotation back toward the mid-range, with downside targets around 3,000 → 2,970, and potentially deeper into the 2,950–2,930 support cluster. This would keep Ethereum locked in a sideways range, rather than confirming a trend continuation.

From a macro perspective, the environment remains mixed. While expectations of future rate cuts in 2026 provide medium-term support for risk assets, near-term USD stability and restrictive financial conditions continue to cap aggressive upside moves. Additionally, flows into crypto remain selective, favoring short-term rotations rather than sustained breakouts. Without a clear macro catalyst (such as dovish Fed signaling or a strong risk-on impulse), upside attempts near resistance are vulnerable to rejection.

Summary:

Ethereum is technically constructive but not in breakout conditions yet. As long as price remains below the strong resistance zone, the market should be treated as range-bound, with upside capped and pullbacks toward support remaining a valid and healthy scenario. Patience is required until either structure breaks decisively higher—or the range resolves with confirmation.

GBP/USD at a Decision Point: Breakout Potential or Another RangeGBP/USD is currently trading inside a clearly defined range structure, with price compressing between a well-respected support zone around 1.3450 and a resistance zone near 1.3490–1.3500. Recent price action shows a sharp recovery from the lower boundary, but upside momentum has stalled again as price re-enters the prior resistance area. This behavior suggests the market is not trending, but rotating liquidity within the range.

From a technical perspective, the rejection from the resistance zone is technically clean. Price failed to hold above the short-term equilibrium and slipped back below the mid-range, indicating that buyers lack conviction at higher levels. The moving averages are flattening and overlapping, reinforcing the idea of balance rather than trend. Until a decisive break occurs, upside moves should be treated as corrective, not impulsive.

The bullish scenario only becomes valid if GBP/USD can break and hold above the 1.3490–1.3500 resistance zone, followed by acceptance above that level. In that case, upside expansion could open toward 1.3510 → 1.3525, where higher-timeframe supply is located. Without that confirmation, any push higher remains vulnerable to rejection.

On the bearish / range-continuation scenario, failure to reclaim resistance keeps price rotating back toward the 1.3450 support zone. A clean breakdown below this support would expose deeper downside toward 1.3430 and below, extending the range rather than reversing the broader structure.

From a macro standpoint, GBP remains sensitive to the USD side of the equation. Persistent USD resilience—supported by relatively restrictive financial conditions and cautious Fed messaging—continues to cap upside in GBP/USD. At the same time, the Bank of England’s stance remains restrictive but growth concerns limit aggressive GBP inflows. This macro backdrop favors choppy, range-bound price action, not clean directional trends.

Summary:

GBP/USD is in a neutral-to-range environment. The market is waiting for confirmation. A sustained break above resistance is required to unlock upside continuation; otherwise, the higher-probability outcome remains range rotation back toward support. Patience and confirmation are key at this level.

Gold Turns at Key Support — Break or Fake Into Resistance?Gold on the H1 timeframe has completed a clean rebound from the major support zone, confirming that buyers are actively defending this area. The sharp rejection from the lows suggests the recent sell-off was corrective rather than the start of a sustained bearish trend.

Price is now recovering above the short-term structure and pushing back toward the key resistance zone around 4,425–4,450. This area is critical, as it previously acted as a strong supply region and aligns with prior breakdown levels. The current move should be treated as a reaction leg, not a confirmed continuation yet.

Two clear scenarios are in play.

Scenario 1: Price holds above the recent pullback level, consolidates, and breaks cleanly through resistance. This would open the path toward higher levels and a potential retest of the upper range and ATH zone.

Scenario 2: Price stalls or rejects at resistance, forming a lower high, which would signal ongoing range behavior and a possible rotation back toward mid-range or support.

In summary, Gold has turned bullish from support , but confirmation depends on acceptance above resistance. Until a clean breakout occurs, the market remains reactive and range-controlled, with resistance being the key decision point.

Bitcoin Is Not Escaping Yet — This Is H2 Accumulation Hello everyone,

On the H2 timeframe, the key focus right now is not an immediate breakout, but the fact that Bitcoin remains locked inside a broad accumulation range, where price continues to rotate between clearly defined support and resistance.

Structurally, BTC has spent an extended period compressing inside the 86,200–90,500 range. Multiple upside attempts toward the upper resistance zone have been rejected, while every pullback into the lower support zone has been absorbed. This repeated rotation confirms balance, not trend, and signals that liquidity is still being built.

From a technical perspective, price is currently holding above the EMA34–EMA89 cluster, which has acted as dynamic support during the recent recovery. The latest dip was defended cleanly and followed by a push higher, forming a support-and-retest structure around the 88,200–88,400 area. This behavior shows that buyers are active, but not yet aggressive enough to force acceptance above resistance.

Importantly, there is no structural breakout at this stage. Highs remain capped below the range top, and price action continues to print overlapping swings, typical of accumulation rather than continuation. The projected path on the chart reflects this well: a shallow pullback to retest support, followed by another attempt higher toward resistance.

Resistance zone: ~90,400–90,600 — range high and breakout trigger.

Mid-range support / retest: ~88,200–88,400 — current decision area.

Major support: ~86,200–86,500 — accumulation floor.

Invalidation: Acceptance back below the EMA cluster would weaken the constructive setup.

Only a clean breakout and sustained acceptance above the resistance zone would confirm that accumulation has completed and open the door for upside expansion. Until then, Bitcoin is not trending — it is absorbing liquidity and preparing, where patience and level discipline remain critical.

Wishing you all effective and disciplined trading.