GBPCAD: Move Down Ahead 🇬🇧🇨🇦

GBPCAD will likely turn bearish next week,

as the market is closed, retesting a significant

daily resistance cluster.

Expect a down movement at least to 1.855 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Technical Analysis

Is EURUSD Loading for Another Rally? Key Zone at 1.15800!Hey Traders,

In today’s trading session, we are closely monitoring EURUSD for a potential buying opportunity around the 1.15800 zone. EURUSD remains in a well-defined uptrend and is currently undergoing a healthy corrective pullback, approaching a key trendline confluence and the 1.15800 support-turned-resistance area, which may act as a strong demand zone for bullish continuation.

With the broader market environment still favoring USD weakness, the technical structure continues to support a bullish continuation scenario on EURUSD.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

US30 is Nearing an Important Support! Hey Traders, in today's trading session we are monitoring US30 for a buying opportunity around 49,120 zone, Dow Jones is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 49,120 support and resistance area.

Trade safe, Joe.

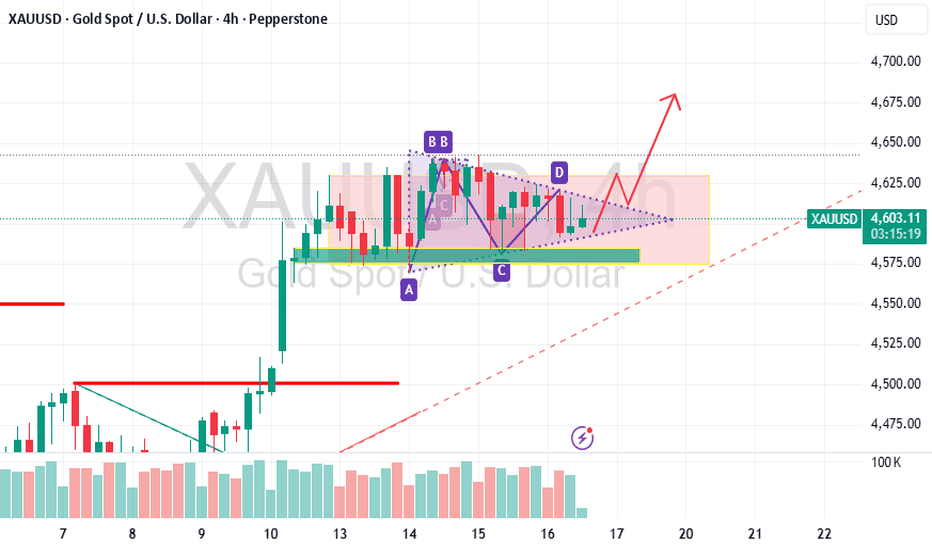

XAUUSD at a Crucial Crossroad: Breakout or Breakdown?Hello Traders 👋

Gold (XAUUSD) is currently trading at a very important decision-making zone on the 1H timeframe. Price is approaching a well-respected descending channel resistance while simultaneously holding above a strong support area formed by the previous day’s gap and trendline support. This clearly shows that both buyers and sellers are active, making this a high-probability and high-impact zone.

On the bullish side, a strong breakout and sustained hold above the resistance and seller zone can confirm a trend shift, opening the path for a healthy upside move toward higher liquidity zones. This long setup is valid only with confirmation, not anticipation.

On the bearish side, if price fails to break the resistance and shows rejection from the seller zone, we can expect sellers to regain control, potentially driving price back toward the lower support and previous gap area. This move can be fast and aggressive, so risk management is key.

This is not a market to chase. Let price show its intention, respect your levels, wait for confirmation, and execute with discipline. Clean structure, clear invalidation, and patience will define the winning trades here.

SOL - Descending Wedge Rejection at $145 | FVG Retest Incoming

What's up traders! 👋

SOLUSD is setting up for a key move. We've got a symmetrical wedge pattern with price respecting the descending resistance perfectly - hitting it and getting rejected. Let me break down what I'm seeing on the 45-minute chart.

The Setup

SOL is trading at $144.85 on the 45-minute timeframe. Price is inside a symmetrical wedge pattern - descending resistance on top (lower highs) and ascending support on bottom (higher lows). The key here: price just hit the descending resistance near $145-$147 and got REJECTED.

This is textbook wedge behavior. Price respects the trendlines until breakout. Right now, it's following the wedge DOWN toward the FVG zone.

Why I'm Leaning Bearish (Short-Term)

Price rejected from descending resistance at $147

Failed to clear $150 resistance - sellers defending

Dropped below $146 and $145 - now below 100-hour SMA

Hourly RSI below 50 - bearish momentum

MACD showing bearish pressure

Long/short ratio at 0.7569 - traders leaning short

$10.5M in liquidations - $7.7M were longs

3M performance: -20.40% | 1Y: -29.60% - macro downtrend

The Wedge Structure

DESCENDING RESISTANCE (Top): Lower highs forming - sellers capping rallies at $145-$147

ASCENDING SUPPORT (Bottom): Higher lows forming - buyers defending around $138-$140

CURRENT ACTION: Price hit descending resistance and rejected

FVG ZONE: $140-$142 is the next target for retest

TREND: Following the wedge DOWN until breakout

The News Context - January 16, 2026

Mixed signals but leaning bearish short-term:

SOL failed to hold above $146 - entered short-term correction

Price below 100-hour simple moving average

Broke below 61.8% Fib retracement of $138-$149 move

$10.5M liquidations - mostly longs ($7.7M)

Long/short ratio 0.7569 - traders positioning short

RSI below 50, MACD bearish

Bullish Catalysts (Watch For Breakout)

Solana ETF inflows $23.57M - highest in 4 weeks

Forward Industries building largest SOL treasury (6.9M SOL)

Alpenglow upgrade coming - transaction finality 100-150ms (from 12.8s)

RWA ecosystem hit $1.15B record valuation

Network processed $1.6T in 2025 trading volume

68M active addresses (up 14%) - most used network

Open Interest jumped from $6.8B to $8.8B

"Clarity Act" could ease SEC requirements for SOL

Key Levels I'm Watching

Resistance:

$145.50 - Day's high / immediate resistance

$146 - First major resistance

$148.29 - MAJOR RESISTANCE (breakout level)

$150 - Psychological round number

$155 - Next target if breakout

$162 - Extended bullish target

$200 - Analyst target (if network growth continues)

Support:

$144.85 - Current price

$141 - Bullish trendline support

$140-$142 - FVG ZONE (key retest target)

$140.23 - MAJOR SUPPORT (76.4% Fib)

$138 - Swing low

$137.72 - CHANNEL BOTTOM

$132 - Next support if breakdown

$124 - Extended bearish target

Two Scenarios

BEARISH CONTINUATION (PRIMARY):

Price continues following the descending wedge. After rejecting from $145-$147 resistance, SOL drops to retest the FVG zone at $140-$142. If FVG fails to hold, continuation to $137.72 channel bottom.

First target: $141 (trendline support)

Second target: $140.23 (major support / 76.4% Fib)

Extended target: $137.72 (channel bottom)

Breakdown target: $132, then $124

Triggers: Continued rejection at descending resistance, break below $140, risk-off sentiment, no major bullish catalyst.

BULLISH BREAKOUT (ALTERNATE):

Big news hits and price breaks above the descending wedge resistance. SOL clears $148.29 with volume and targets higher levels.

First target: $150 (psychological)

Second target: $155 (next resistance)

Extended target: $162, then $173

Moon target: $200 (if network growth accelerates)

Triggers: Break above $148.29 with volume, major ETF news, Alpenglow upgrade hype, institutional buying.

My Take - BEARISH BIAS (Short-Term)

I'm leaning BEARISH here. Here's why:

1. Price respecting descending resistance - SOL hit the wedge top at $147 and got rejected. This is textbook - follow the trend until breakout.

2. Technical indicators bearish - RSI below 50, MACD bearish, below 100-hour SMA. Momentum favors sellers.

3. Liquidation data bearish - $7.7M in long liquidations vs $2.8M shorts. Longs getting squeezed.

4. Long/short ratio bearish - At 0.7569, traders are positioning short. Smart money leaning bearish.

5. Macro structure weak - Down 20.40% in 3 months, down 29.60% in 1 year. Still well below $295 ATH.

BUT - Watch for the Breakout

The bullish catalysts are real:

ETF inflows strongest in 4 weeks

Alpenglow upgrade is massive (100ms finality)

Institutional adoption growing (Forward Industries)

Network fundamentals strong (68M addresses, $1.6T volume)

If big news hits, SOL could spike above $148.29 and invalidate the bearish thesis. But until that happens, I'm following the wedge DOWN.

Trade Plan

Bearish Entry (PRIMARY):

Entry: Rejection at $145-$146 resistance OR break below $141

Stop: Above $148.29 (above major resistance)

Target 1: $141 (trendline)

Target 2: $140.23 (major support)

Target 3: $137.72 (channel bottom)

R:R: ~1:2

Bullish Entry (if breakout):

Entry: Break above $148.29 with volume

Stop: Below $144

Target 1: $150 (psychological)

Target 2: $155

Target 3: $162

R:R: ~1:2.5

The Bottom Line

SOLUSD is respecting the symmetrical wedge perfectly. Price hit descending resistance at $147 and got rejected - now heading toward the FVG zone at $140-$142 for a retest.

Short-term, I'm BEARISH. Follow the wedge until it breaks. The FVG zone at $140-$142 is the next target. If that fails, $137.72 channel bottom is in play.

Long-term, the fundamentals are strong (ETF inflows, Alpenglow upgrade, institutional adoption). But technicals say DOWN until we break above $148.29.

Watch the FVG zone. That's your tell.

What do you think? Continuation down or breakout up? Drop your thoughts below! 👇

PLUG long-term TAPLUG has been pumped and dumped pretty hard, but it's not dead, as a matter of fact it has a positive bullish formation on weekly since the last few months, moreover, monthly frame has finally bottomed out for the first time since 2022 and has regained the support level, it's not yet bullish on monthly but it's a significant improvement. Currently, there's a consolidation on mid-term with rising trend strength which is in the formation process of bullish trend continuation.

Also, when assessing their fundamental priorities or incentives, you may want to consider the demand for their products during the AI boom which can be the further trigger for the growth.

SUPER Trade Setup – Watching the RetestWe’re tracking SUPER closely as it approaches a major technical juncture. The price is pressing up against the daily descending resistance line, along with a key overhead resistance zone. We're not looking to chase the initial breakout. Instead, we want to see a clean break, followed by a constructive retest and hold above former resistance.

🔁 Trade Plan:

The entry trigger comes on a successful retest of the $0.23 level, turning it into support. That’s our confirmation for a long spot position. If the level holds on the pullback, it could open the door for the next leg up.

🎯 Targets & Risk Management:

Take Profit Zones: $0.28–$0.36 and $0.47–$0.55

Stop Loss: Just below $0.2050

GBPAUD: Bullish Move From Support 🇬🇧🇦🇺

There is a high probability that GBPAUD will pullback

from the underlined support.

Goal - 2.0004

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDJPY at Risk? Sell Zone at 158.600 as Intervention Fears Rise!Hey Traders,

In today’s trading session, we are monitoring USDJPY for a potential selling opportunity around the 158.600 zone. USDJPY previously traded in a strong uptrend but has successfully broken below that structure, signaling a potential shift in momentum. Price is now in a corrective pullback, approaching a key retracement level and the 158.600 support-turned-resistance area, which may act as a strong rejection zone.

From a fundamental perspective, recent comments from the Bank of Japan (BoJ) and Japan’s Ministry of Finance (MoF) continue to emphasize heightened intervention risk at elevated price levels. This ongoing threat of currency intervention adds downside pressure to USDJPY and supports the bearish technical bias.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

Bitcoin’s Structure Is Speaking — Are You Listening?Hello Traders,

If you zoom out and look at Bitcoin calmly, one thing becomes very clear, price is not breaking down, it is building structure. The current movement may look slow on the surface, but underneath, the market is still behaving in a controlled and bullish manner.

Big Picture:– Structure Matters More Than Noise

Bitcoin is currently trading inside a Rising Structure / Bullish Range.

This structure is defined by higher lows and a gradually rising price channel, which tells us that buyers are still in control despite short-term pullbacks.

The upper trendline is acting as dynamic resistance, where temporary profit booking appears.

The lower trendline continues to act as strong support, showing consistent demand on dips.

As long as this structure remains intact, the broader bias stays bullish.

High-Probability Accumulation Zone

This 90.2k – 89.5k zone marked on the chart is not random.

This area was previous resistance , which has now flipped into support.

Price is consolidating above this zone , not breaking below it, a strong sign of acceptance.

Sellers are failing to push price lower , indicating absorption of supply.

This is why this region qualifies as a high-probability accumulation zone, not a chasing zone.

Upside Targets – If Structure Holds

If Bitcoin continues to respect the demand zone and the rising structure, these levels come into play naturally:

Target 1 → 91,825

Target 2 → 93,790

Target 3 → 96,027

These are not predictions :— they are logical reaction levels based on structure and range expansion.

Risk Side:– Structure Invalidation

Every bullish structure has a clear line in the sand.

A clean breakdown below 87,600 would invalidate the current bullish structure.

If that happens, the market would need time to rebuild acceptance before any sustainable upside continuation.

Strong trends don’t start from excitement :—they usually start from patience.

Conclusion :- At the moment, Bitcoin is:

Holding above key demand

Respecting its rising structure

Consolidating instead of breaking down

The next major move will depend not on speed, but on how price reacts around this zone.

If this analysis helped you see the chart more clearly, share your view in the comments,

I’m always open to discussing structure with serious traders.

Analysis By @TraderRahulPal | More analysis & educational content on my profile.

XAUUSD – 4H Consolidation Before BreakoutGold is trading in a tight consolidation range after a strong bullish impulse. Price is forming a symmetrical triangle, indicating volatility compression.

Key levels:

Resistance: 4,630 – 4,650

Support: 4,580 – 4,595

Outlook:

Bullish breakout above 4,630 may push price toward 4,680–4,700.

Bearish breakdown below 4,580 can lead to 4,540–4,520.

Plan:

Wait for a clear 4H close outside the range.

ETH Is Holding the Key Support — Break Higher or Deeper PullbackOn the ETHUSD H1 timeframe, price is currently in a post-impulse consolidation phase following a strong bullish expansion. The impulsive leg upward created a clear market imbalance, after which ETH pulled back and is now reacting precisely at the former breakout zone around 3,280–3,290, an area that previously acted as resistance and has now flipped into structural support. This behavior is technically healthy and fully aligned with trend continuation dynamics.

From a market structure perspective, the overall trend remains bullish as long as price continues to defend this key support. The recent rejection from higher levels appears corrective rather than impulsive, suggesting sellers are taking profit while buyers are absorbing supply. The moving average beneath price is rising and converging into the same support area, reinforcing this zone as a high-probability decision point.

Looking ahead, there are two clear scenarios. Primary bullish scenario: if ETH holds above the 3,280 support and forms a higher low, price is likely to rotate higher toward 3,397 → 3,433 → 3,475, continuing the broader uptrend. Alternative scenario: a clean breakdown below 3,280 would signal a loss of short-term structure, opening the door for a deeper retracement toward the 3,180 demand zone, where buyers may step back in. Until that breakdown occurs, the bias remains bullish with pullbacks viewed as corrective, not reversal driven.

XAUUSD – Bearish Pressure Building, Watch Breakdown Zone (H1)Market Context (H1)

Gold is trading inside a descending structure, with price repeatedly rejected from the upper supply zones. The recent recovery attempts remain corrective and lack follow-through, suggesting sellers are still in control in the short term.

From a fundamental angle, markets are cautious ahead of upcoming U.S. data, keeping gold vulnerable to downside moves while risk appetite remains unstable. This environment favors sell-on-rallies until structure shifts.

Structure & Price Action

H1 structure is bearish / corrective, with lower highs intact.

Price continues to respect the descending trendline and supply layers above.

The zone around 4,581 is a key breakdown level — loss of this area could accelerate selling pressure.

Trading Plan – MMF Style

Primary Scenario – SELL Continuation

Preferred SELL zones:

4,607 – 4,618

4,634 area (strong supply cap)

Look for bearish reactions or rejection signals at these zones. Avoid chasing mid-range moves.

Downside Targets

TP1: 4,581

TP2: 4,557

Extension: deeper liquidity if momentum expands

Alternative Scenario

If price fails to break below 4,581 and reclaims 4,618 with strong H1 close, pause SELL bias and wait for structure confirmation.

Invalidation

H1 close above 4,634 → bearish scenario invalid, reassess market structure.

Summary

Bias remains bearish while below supply. The optimal strategy is patience — sell at premium zones or wait for a confirmed breakdown to follow momentum.

AUDJPY: I finally Bought 🇦🇺🇯🇵

This morning, I finally opened a long position on AUDJPY.

I was patiently waiting for a pullback, after the last bullish wave

and BoS.

The price testing a powerful confluence zone based on a rising

trend line and a horizontal support.

With a high probability, it will rise now and reach 106.65 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

$SPY & $SPX — Market-Moving Headlines Friday Jan 16, 2026🔮 AMEX:SPY & SP:SPX — Market-Moving Headlines Friday Jan 16, 2026

🌍 Market-Moving Themes

🧠 AI Hardware Euphoria

TSMC earnings smash expectations as AI chip demand described as tight and insatiable

🔧 Semiconductor Capex Wave

TSMC guides higher spending, reinforcing strength across chip manufacturing supply chains

🛢️ Oil War Premium Evaporates

Crude drops sharply after geopolitical tensions ease, erasing recent risk pricing

💻 Hardware vs Software Split

AI capital continues rotating toward chips and infrastructure while software lags

🏦 Bank Rotation Shift

Investment banks rebound on dealmaking strength as consumer banks remain under pressure

📊 Key U.S. Economic Data Friday Jan 16 ET

9:15 AM

- Industrial Production Dec: 0.1%

- Capacity Utilization Dec: 76.0%

10:00 AM

- Home Builder Confidence Index Jan: 40

⚠️ Disclaimer: For informational purposes only. Not financial advice.

📌 #SPY #SPX #Macro #Earnings #AI #Semiconductors #Oil #Fed #Markets #Trading #Stocks #Options

YM1! - Symmetrical Wedge Compression Inside 2HR FVG | Breakout?

What's up traders! 👋

YM1! E-mini Dow Jones Futures is setting up for a big move. We've got a symmetrical wedge compressing right inside a 2HR FVG zone - this is textbook pre-breakout structure. Let me break down what I'm seeing.

The Setup

YM1! is trading at 49,639 on the 45-minute timeframe. Price is consolidating inside a symmetrical wedge pattern - descending resistance on top (lower highs) and ascending support on bottom (higher lows). The apex of this wedge is converging right inside the 2HR FVG zone around 48,700-48,850.

This is compression before expansion. The question is: which way does it break?

Why I'm Leaning Bullish

Higher timeframes (2HR, 4HR, Daily) all bullish structure

Dow closed +292 points (+0.60%) today at 49,442

TSMC blockbuster earnings - AI capex up 37% to $52-56B

Goldman Sachs +4%, Morgan Stanley +6% on earnings beats

Jobless claims 198K (beat expectations of 215K)

Forward curve pricing 50,800+ by December 2026

Up 15.95% over the past year - strong momentum

Just 0.5% from 52-week high (49,901)

The Wedge Structure

DESCENDING RESISTANCE (Top): Lower highs forming - sellers capping rallies

ASCENDING SUPPORT (Bottom): Higher lows forming - buyers defending dips

CONVERGENCE POINT: Price squeezing into tighter range inside FVG

2HR FVG ZONE: 48,700-48,850 acting as equilibrium zone

BREAKOUT PENDING: Wedge apex approaching - move coming soon

The News Context - January 15, 2026

Today's session was BULLISH:

Dow +292.81 points (+0.60%) to 49,442.44

TSMC surged 4.4% on record Q4 profits + massive AI capex plans

Goldman Sachs +4% - 12% profit increase, deal-making fees +25%

Morgan Stanley +6% - 18% profit jump, IB revenue +47%

Jobless claims 198K vs 215K expected - labor market strong

Airlines +2.6%, Semiconductors +1.8%

Oil down 4.68% - Trump eased Iran tensions

10Y Treasury yield +2bp to 4.16%

Macro Drivers

TSMC 2026 capex $52-56B (37% increase) - AI boom has legs

Fed's Schmid: Independent Fed serves public best

Japan #1 holder of US securities at $1.2T

China holdings down to $682.6B (selling continues)

European stocks at record highs

KOSPI 10-day winning streak - global risk-on

Key Levels I'm Watching

Resistance:

49,792 - Day's high / immediate resistance

49,901 - 52-WEEK HIGH (critical breakout level)

50,000 - PSYCHOLOGICAL ROUND NUMBER

50,200 - Wedge breakout target 1

50,800 - Forward curve target (Dec 2026)

Support:

49,639 - Current price

49,253 - Day's low

48,700-48,850 - 2HR FVG ZONE (key support)

48,200 - Major horizontal support

48,000 - Lower wedge support / psychological

47,600 - Channel bottom (if breakdown)

Two Scenarios

BULLISH BREAKOUT (PRIMARY):

The symmetrical wedge breaks to the upside. Price holds the 2HR FVG zone, bounces off ascending support, and breaks above descending resistance. Targets:

First target: 49,901 (52-week high retest)

Second target: 50,000 (psychological)

Extended target: 50,200-50,400 (new ATH territory)

Triggers: Break above 49,800 with volume, TSMC momentum continues, bank earnings strength, risk-on sentiment.

BEARISH BREAKDOWN:

The wedge breaks down. Price loses the 2HR FVG zone, breaks below ascending support, and targets lower levels:

First target: 48,200 (horizontal support)

Second target: 48,000 (psychological)

Extended target: 47,600 (channel bottom)

Triggers: Break below 48,700 with volume, Fed hawkish surprise, geopolitical escalation, risk-off rotation.

My Take - BULLISH BIAS

I'm leaning BULLISH here. Here's why:

1. Higher timeframe structure is bullish - 2HR, 4HR, and Daily all showing higher highs and higher lows. The large bearish candle on higher TFs is just a pullback within the uptrend.

2. Wedge inside FVG = accumulation - When price consolidates inside an FVG with a symmetrical wedge, it's typically smart money accumulating before the next leg.

3. News flow is bullish - TSMC's massive AI capex, bank earnings beats, strong labor data. The fundamentals support higher prices.

4. Forward curve is bullish - Market pricing 50,800+ by December 2026. The path of least resistance is higher.

5. Just 0.5% from ATH - We're consolidating near all-time highs. This is typically bullish - accumulation before breakout.

The risk is the descending wedge top - sellers are capping rallies. But the ascending wedge bottom shows buyers are defending. When these converge, the breakout typically follows the prevailing trend - which is UP.

Trade Plan

Bullish Entry:

Entry: Break above 49,800 with volume OR bounce from FVG zone (48,700-48,850)

Stop: Below 48,500 (below FVG zone)

Target 1: 49,901 (52-week high)

Target 2: 50,000 (psychological)

Target 3: 50,200+ (new ATH)

R:R: ~1:2.5

Bearish Entry (if breakdown):

Entry: Break below 48,700 with volume

Stop: Above 49,000

Target 1: 48,200

Target 2: 48,000

Target 3: 47,600

R:R: ~1:2

The Bottom Line

YM1! is compressing inside a symmetrical wedge right at the 2HR FVG zone. This is textbook pre-breakout structure. The higher timeframes are bullish, the news flow is bullish, and we're just 0.5% from all-time highs.

I'm watching for the breakout above 49,800 to confirm the bullish thesis. If we lose the FVG zone at 48,700, I'll reassess.

The wedge is tightening. The move is coming. I think it's UP.

What do you think? Breakout or breakdown? Drop your thoughts below! 👇

marketreview Greetings, traders.

I’d like to comment on the current crypto market situation to clarify why there has been little analysis published in the group recently.

In my opinion, the market is currently in a state of indecision — it lacks a clear directional bias. Consequently, there are no clean charts or structures that would hint at the future trend.

For now, we are simply moving sideways with occasional price spikes up and down. However, this volatility is chaotic, and trading it is, in my view, a lottery.

I have seen this before, and the only correct decision is to wait for better conditions. This market phase is not eternal; the longer it lasts, the closer its end.

I scan the market daily looking for a high-probability setup. But if I don't find anything — I won't publish anything. Better to stay flat than to force a bad trade.

The Traders House

WTI Crude Oil Faces Rejection at 200-Day SMA After Sharp RallyThe daily chart for WTI crude oil shows a strong rebound from December lows, but the rally stalled near the 200-day SMA (6,222), which acted as a key resistance level. Price briefly tested this zone before pulling back sharply, closing near 5,917. This rejection suggests that the longer-term bearish trend remains intact for now.

Technical Observations:

Moving Averages: The 50-day SMA (5,855) is still below the 200-day SMA, maintaining a bearish alignment. Price is currently above the 50-day SMA but failed to sustain above the 200-day SMA, signaling potential exhaustion of the recent bullish momentum.

MACD: The MACD histogram is positive, and the signal lines are trending higher, indicating improving short-term momentum. However, the recent price rejection could lead to a slowdown in bullish momentum if confirmed by a bearish crossover.

RSI: At 52.82, RSI is neutral but slightly bullish. The indicator recently approached 60 before pulling back, reflecting the loss of upward strength.

Key Levels: Resistance remains at 6,222 (200-day SMA), while support is seen near 5,500, which has held multiple times during previous declines.

Summary: WTI crude oil is at a critical juncture. The inability to break above the 200-day SMA suggests that sellers are still defending the longer-term trend. A sustained move above this level would be a significant technical shift, while failure to do so could lead to a retest of the mid-range or even the 5,500 support zone.

-MW

USD/CHF Consolidates Within a Broad Range, Testing Key Moving AvThe daily chart for USD/CHF highlights a prolonged consolidation phase, with price oscillating inside a well-defined range between approximately 0.7830 and 0.8115. This range has persisted for several months, indicating indecision and lack of a clear directional trend.

Technical Observations:

Range-Bound Structure: Price remains confined within the shaded horizontal zone, suggesting strong support near 0.7830 and resistance around 0.8115. A breakout beyond these levels would be needed to establish a directional bias.

Moving Averages: The 50-day SMA (0.7976) is currently flat, reflecting the sideways nature of the market. The 200-day SMA (0.8062) is trending downward, reinforcing the longer-term bearish tone. Price is now approaching the 200-day SMA, which could act as dynamic resistance.

MACD: The MACD histogram has turned slightly positive, and the signal lines are close to crossing above zero, hinting at improving bullish momentum in the short term.

RSI: At 60.20, RSI is leaning bullish but still below overbought territory, suggesting room for further upside before hitting extreme levels.

Key Levels to Watch:

Resistance: 0.8115 (range top) and 0.8062 (200-day SMA)

Support: 0.7830 (range bottom)

Overall, USD/CHF remains neutral within its range, but the recent push toward the 200-day SMA could determine whether buyers have enough strength to challenge the upper boundary. A decisive breakout would be significant for trend development.

-MW

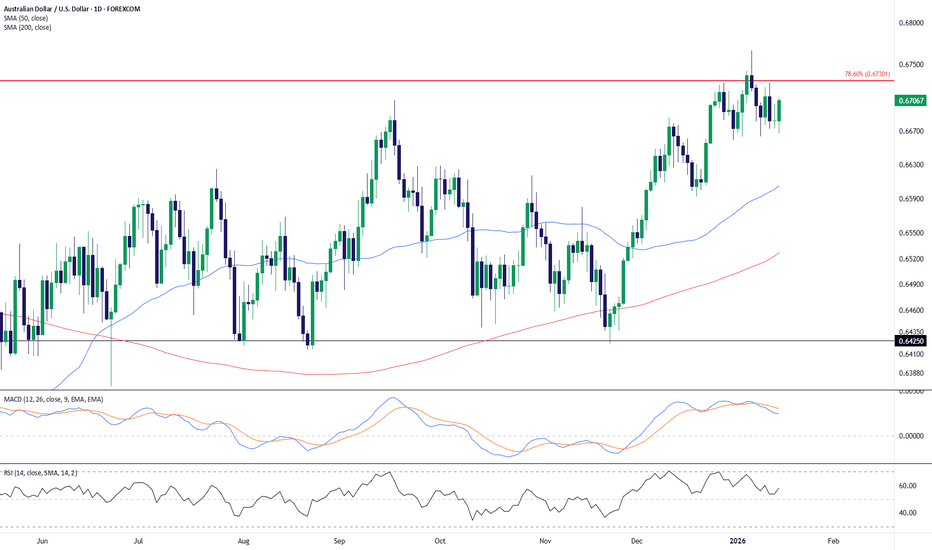

AUD/USD Testing Key Resistance After Strong RallyThe daily chart for AUD/USD shows price consolidating near the 0.6700 level after a strong bullish move from December lows. The pair recently tested the 78.6% Fibonacci retracement level around 0.6730, which is acting as a significant resistance zone. Price action has pulled back slightly but remains above both the 50-day SMA (0.6605) and the 200-day SMA (0.6526), signaling a medium-term bullish structure.

Technical Observations:

Moving Averages: The 50-day SMA is trending above the 200-day SMA, confirming a bullish crossover that occurred earlier. This supports the broader upward momentum.

MACD: The MACD histogram is positive, but the signal lines are flattening, suggesting that bullish momentum may be losing steam.

RSI: Currently at 57.98, RSI is in neutral territory but leaning toward bullish, indicating room for further upside before overbought conditions.

Price Structure: The recent highs near 0.6730 represent a critical resistance level. A sustained break above this zone could open the door for further gains, while failure to clear it may lead to consolidation or a pullback toward the 50-day SMA.

Overall, AUD/USD remains in an uptrend, but the current resistance zone is pivotal. Traders should watch for confirmation of a breakout or signs of reversal as momentum indicators cool off.

-MW.