#NIFTY Intraday Support and Resistance Levels - 06/02/2026Nifty is expected to open flat, suggesting a cautious and range-bound start to the session. The recent price structure clearly shows consolidation after the sharp volatility seen earlier, indicating that the market is currently waiting for a decisive trigger. Early trades may remain slow, with price oscillating around the immediate support–resistance zone, and traders should avoid aggressive positions in the first few minutes.

On the upside, the key level to watch is 25750. A sustained move above this level can signal a reversal long setup, confirming strength returning to the index. If Nifty manages to hold above 25750, upside targets are placed at 25850, 25900, and 25950+. This zone marks a previous supply area, so only a clear breakout with follow-through should be considered reliable for bullish trades. Until then, upside moves may face selling pressure near resistance.

On the downside, 25700 remains a critical breakdown level. If Nifty slips below 25700 and shows acceptance, it can open the path for further downside toward 25600, 25550, and 25500. These levels act as demand zones where short covering or fresh buying interest may emerge, so partial profit booking is advised for shorts near these supports rather than expecting a straight move down.

Overall, the market setup favors a wait-and-watch and level-based trading approach. With a flat opening and no major gap, false breakouts are possible on both sides. Traders should focus on confirmation at key levels, keep tight stop-losses, and prefer intraday trades rather than positional bets until Nifty breaks out of this consolidation range decisively.

Technical Analysis

$SPY & $SPX — Market-Moving Headlines Friday Feb 6, 2026🔮 AMEX:SPY & SP:SPX — Market-Moving Headlines Friday Feb 6, 2026

🌍 Market-Moving Themes

☁️ Cloud Confidence Restored

AMZN earnings reverse the AI capex panic as AWS profit growth proves spending is paying off

🚗 Legacy Auto Breakdown

Ford EV losses confirm widening gap between legacy automakers and Tesla as price wars intensify

📱 Ad Tech Surprise

SNAP earnings signal renewed advertiser demand and Gen Z engagement after years of stagnation

📊 Jobs Day Volatility

Non-Farm Payrolls set the tone for rates expectations, risk appetite, and end-of-week positioning

🛡️ Gold as Shock Absorber

Gold remains bid as hedge against both recession fear and inflation surprise from jobs data

📊 Key U.S. Economic Data Friday Feb 6 ET

8:30 AM

U.S. employment report Jan: 55,000

U.S. unemployment rate Jan: 4.4%

U.S. hourly wages Jan: 0.3%

Hourly wages YoY: 3.6%

10:00 AM

Consumer sentiment prelim Feb: 55.0

12:00 PM

Fed Vice Chair Philip Jefferson speaks

3:00 PM

Consumer credit Dec: $8.0B

⚠️ For informational purposes only. Not financial advice.

📌 #SPY #SPX #JobsReport #NFP #AMZN #AI #Cloud #Macro #Markets #Stocks #Options

Wow, BTC! The Dip to the Dip to the Dippity DipHey, Traders. Just a quick follow up on our last BTC analysis and how this once again played like a New York Symphony. This structure we have been following led us all the way from ~110K down to EXACTLY the top of this Weekly Demand Source ~$59,900. If you've been following, see our previous posts on BTC and ETH to see how we have been able to follow this market structure and not fall prey to the mass liquidations and gross losses from those who have been longing BTC.

What Happened: The Market played out like the market does. Many players big and small starting buying the DIP on BTC when it fell to around 103K from All Time Highs, not understanding that there was a MUCH bigger picture playing out. They tried again at around the $80 - 85 area when the Market Makers faked most people out and dragged more buyers in for the kill. Unfortunately, the whole time, the Market was seeking this ~$60K area. If you are able to learn how to read and follow what the market is showing, there is almost ALWAYS a few clear signals that can help you stay out of trouble.

What happens now: Now we are sitting at this major Weekly Demand Zone. There are a LOT of buyers for BTC in this area...worldwide volumes of large buyers who have been waiting for everyone else to get liquidated or to tap out, so they can swoop in and buy what is likely to be the World's most valuable asset.

From here, we need to watch this Weekly Zone and look for bullish confirmation out of it. It doesn't mean that the market will automatically start buying, but it does mean the interest in buying is at substantially high levels. We need to watch the H4 in particular in this area and look for a BOS up out of it. The last H4 Supply zone is sitting up near 75K, so it's not likely that it will push up that strong and break that level. We are more likely to make a bullish response on the H4 and create another potential supply zone that can be more easily broken.

Watch for it...wait for it, and if we get it, be ready to buy! As stated in the previous post, aggressive buyers already have longs set at around the ~55K area.

I pray you all are trading safely and staying ahead of the game. If you need help in analyzing and understanding the markets better, let us know and we'll be glad to help. As always, PLEASE leave me your comments, questions, and suggestions, and I'll reply.

Bitcoin Structure Update (Daily)Bitcoin remains in a bearish structural regime on the daily timeframe.

Price continues to trade below the 200 EMA, with the 10, 20, and 50 EMAs all positioned beneath it. Shorter-term EMAs (10 & 20) maintain downward curvature, indicating that downside pressure remains unresolved and trend structure has not yet repaired.

Momentum & Participation

RSI: Downside pressure remains elevated, but momentum is beginning to decelerate following the most recent daily close. RSI is still deeply stretched and remains below key recovery thresholds, signaling early stabilization rather than confirmation.

Rate of Change (ROC): The pace of the decline is slowing, suggesting downside momentum is no longer accelerating. However, ROC remains negative, indicating that pressure has eased but has not yet transitioned into a positive regime.

Summary

Structure remains bearish. Momentum is showing early signs of deceleration, but no confirmed reversal or structural reclaim is present at this time. This remains a structural assessment of current conditions, not a prediction.

BUY XAUUSDGold is approaching a key demand zone around 4672 after an extended short-term sell-off, where price previously reacted and liquidity is likely resting. This area sits near structural support and comes after bearish momentum that looks stretched, making it a logical place for buyers to step in if rejection appears. If price slows into the zone and prints bullish reaction candles or a short-term structure shift on lower timeframes, it would support a corrective rebound toward the higher resistance area marked above, favoring a tactical long setup rather than chasing the breakdown lower.

SELL XAUUSDGold is showing short-term bearish signs after being rejected from a key supply zone and failing to break above a descending trendline. Price is forming lower highs, struggling around the moving averages, and the recent bounce from support looks corrective rather than impulsive, suggesting sellers remain in control. With multiple technical factors aligning—trendline resistance, EMA rejection, and weak bullish momentum—the probability favors a short-term continuation lower unless price can reclaim those resistance levels decisively.

BTC monthly yelling at us for something interesting ?We read daily news about ETF, accumulation by institutes and scarcity in the exchanges, but I recognize something different in the chart based on multiple indicators. Historically, BTC boomed after touching 50 EMA and whenever it is extended it traces back to 50 EMA on monthly chart. As per current data, BTC is extended far from it. Also RSI and MACD indicating that it is losing momentum with -ve divergence. Volume as well descreasing since last leg, though price moved up. So, I expect price to retrace to 50 EMA which coincides with previous high at 60K. Let us see how it unfolds.

AUD/NZD BUYERS WILL DOMINATE THE MARKET|LONG

AUD/NZD SIGNAL

Trade Direction: short

Entry Level: 1.162

Target Level: 1.166

Stop Loss: 1.159

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBP/NZD BEARS ARE STRONG HERE|SHORT

Hello, Friends!

GBP/NZD is making a bullish rebound on the 4H TF and is nearing the resistance line above while we are generally bearish biased on the pair due to our previous 1W candle analysis, thus making a trend-following short a good option for us with the target being the 2.259 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

The Elephant Jungle 2/4/26 part 3If you go back and read the articles from months ago, you’ll notice we kept talking about a PO3 playing out. Well, It wasn’t fast. It wasn’t pretty. But it was patient. That PO3 took over 120 days to fully play out. We reached the objective, pushed through every obstacle along the way, and made it all the way through the expansion phase. This is exactly why context matters in the jungle. Price doesn’t move on our timeline. It moves when the work is finished. And when you zoom out, you can see that the structure we were waiting on didn’t fail, it delivered. Now the question isn’t what happened. The question is what phase comes next.

DVA Surges 21% on Stellar Earnings: Undervalued Dialysis Giant?Title: DVA Surges 21% on Stellar Earnings: Undervalued Dialysis Giant or Short Lived Rally? Deep Dive Inside 🚀💹

Hello TradingView community! 👋📈

Today, let's dive into DVA with a detailed analysis focusing on fundamentals, SWOT, and technicals. This isn't financial advice, just an in depth look based on public data. 🔍📊

Current Snapshot:

Price: 134.73 💰

52 Week High/Low: 178.47 / 101.00 📉📈

Market Cap: 7.85B 🏦

Fundamental Analysis (e.g., Intrinsic Value and Ratios):

Using methods like discounted cash flow (DCF) or comparable analysis, estimate intrinsic value with inputs like EPS (9.51 TTM), book value per share (9.50), and debt to equity (1,111.35%).

For instance, DCF models might project a value range of 250 to 350 based on growth assumptions. Compare to peers for relative valuation. Key ratios: ROE (64.85%), P/E (14.17), and EV/EBITDA (8.02) highlight efficiency and valuation status (undervalued compared to healthcare services sector average P/E around 25 to 30). 📊💡

SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats):

Strengths : Resilient business model with strong market position (>35% US share in dialysis services) and effective cost management. 💪🏆

Weaknesses : High debt levels and dependence on government healthcare programs for reimbursement. ⚠️📉

Opportunities : Expansion into integrated kidney care and emerging international markets like Brazil. 🌍🚀

Threats : Regulatory risks, competition, and vulnerability to cybersecurity threats. 🛡️😠

Technical and Risk Insights:

Incorporate non repainting indicators like 200 day SMA (129.85) for support/resistance. Current RSI (78.80) signals overbought. Risk factors: Volatility (beta 1.01), or factor exposure (e.g., to interest rates). Consider performance attribution how much return comes from sector vs. stock selection. 📉🔍

Historical Context and Examples:

DVA has shown 5.39% annualized returns over 10 years, with examples like 2025 dip (25% loss due to declining patient volumes) leading to recovery. This illustrates how methods like SWOT or DCF can inform decisions in real markets. 📜🔄

What do you think, does this align with your view on DVA for 2026? Share your analyses or charts below! 💭🗣️

#DVA #StockAnalysis #FundamentalAnalysis #InvestingEducation

DOW JONES INDEX (US30): Consolidation Completed?!

Dow Jones Index violated a resistance line of a symmetrical

triangle pattern on a daily time frame.

It indicates a highly probable completion of a bullish accumulation.

The market may continue rising now and reach 50000 level soon.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD 04/02 – SMC H4 ROUTE MAP | 5000 BALANCE STATE BROKEN👉 Fibo 0.5 has been broken → the market is no longer in a balanced upward state. What is happening now is a pullback in a bearish structure, not a reversal. Today, the focus is not on “buying or selling,” but on how the price reacts when it touches the old FVG and supply zones.

MACRO CONTEXT IN BRIEF

The market is still sensitive to Fed expectations and USD data → high intraday volatility.

Geopolitics keeps gold from collapsing directly, but not enough to pull a new trend.

➡️ Result: gold rebounds quickly, but there is no trend commitment yet.

TECHNICAL STRUCTURE H4

Previous H4 uptrend:

✅ has swept the peak

✅ a bearish CHoCH has appeared

Fibo 0.5 (≈ 5000) has been broken → the upward structure is invalidated.

Current price is:

rebounding to H4 FVGs

in the context of a still valid bearish structure

TODAY'S ROUTE MAP – KEY PRICE ZONES

🔴 UPPER ZONE – SELL REACTION ZONE (PRIORITY TO OBSERVE)

👉 5200 – 5250

H4 FVG

Fib 0.618 – 0.705

The “textbook” rebound zone in a bearish structure

➡️ If the price rebounds here but is not accepted, it is a clear signal of a continuation to decrease.

👉 5350 – 5450

High FVG + Fib 0.786

Only if the price breaks and holds above this zone, the H4 bearish bias will be negated.

🟢 LOWER ZONE – BUY REACTION / SUPPORT

👉 5000 – 5020 (has been broken, now a sensitive zone)

Old Fibo 0.5

Price may react, but it is no longer a safe buying zone for swing.

👉 4850 – 4900

FVG + Fib 0.382

Important support zone for the next decrease.

👉 4600 – 4550

Liquidity low

Only activated if bearish continues strongly and decisively.

HOW WE READ & TRADE TODAY

With the current structure:

Scalp: follow price reactions at FVG & fib (especially during the European – American session).

Swing: only follow the acceptance of the H4 structure, not emotional bottom fishing.

Remember:

👉 The strongest rebounds often appear in a bearish market. But only the structure decides who goes far, who gets eliminated.

LucasGrayTrading will continue to update as the price reacts at decisive zones. Follow to not miss quality intraday reactions.

— LucasGrayTrading

Gold Daily Trend Shows Strong Momentum With Volatility RisingDespite the recent selloff, Gold continues to trade within a well-established bullish trend on the daily timeframe, highlighted by a strong series of higher highs and higher lows. Price remains decisively above both the 50-day and 200-day SMAs, with the 50-day SMA trending sharply higher and acting as dynamic support throughout the advance. The wide separation between price and the long-term 200-day SMA underscores the strength of the broader uptrend.

Recent price action reflects a sharp impulsive rally followed by increased volatility and a brief corrective pullback. Former resistance levels in the mid-range of the structure have transitioned into support, suggesting that the market is consolidating gains rather than reversing trend. Despite the pullback from recent highs, price continues to hold above key structural levels, keeping the bullish framework intact.

Momentum indicators align with this view. RSI pushed into overbought territory during the rally and has since cooled back toward the mid-50s, indicating a reset in momentum without a loss of trend strength. MACD remains firmly positive, with the histogram elevated, reflecting sustained bullish momentum even as short-term momentum moderates.

Overall, gold is displaying strong trend continuation characteristics with signs of digestion after an extended rally. As long as price remains supported above rising moving averages and prior breakout zones, the technical picture continues to favor a bullish bias within a volatile but constructive market environment.

-MW

USDMXN Daily Trend Remains Under Bearish PressureUSD/MXN continues to trade within a clearly defined bearish structure on the daily timeframe, characterized by a sequence of lower highs and lower lows. Price remains firmly below both the 50-day and 200-day simple moving averages, with the 50-day SMA acting as dynamic resistance and reinforcing the prevailing downtrend. The long-term 200-day SMA is also sloping lower, highlighting sustained downside pressure rather than a short-term correction.

From a structure standpoint, recent price action shows a sharp impulsive move lower followed by a modest rebound. This bounce has so far lacked follow-through and appears corrective, with price still holding beneath prior support zones that have now transitioned into resistance. The inability to reclaim these levels keeps the broader bearish bias intact.

Momentum indicators support this view. RSI recently dipped toward oversold territory and is now attempting to recover, but remains below the neutral 50 level, suggesting that bearish momentum has eased slightly without signaling a trend reversal. MACD remains in negative territory, with the signal and histogram reflecting ongoing downside momentum, even as selling pressure shows signs of slowing.

Overall, USDMXN is displaying a bearish trend with short-term stabilization after an extended decline. Unless price can meaningfully recover above key moving averages and former support levels, the technical picture continues to favor a cautious, downside-leaning bias within the broader trend.

-MW

USD/JPY Daily Structure Holding Within Rising ChannelUSDJPY continues to trade within a well-defined ascending channel on the daily timeframe, highlighting a broader bullish market structure that has been in place for several months. Price action remains above the 200-day SMA, which is gradually turning higher and reinforcing the longer-term trend bias. The recent pullback appears corrective rather than impulsive, with price stabilizing near the midline of the channel.

From a moving average perspective, the 50-day SMA is acting as a dynamic reference point. After a sharp downside spike, price has rebounded back toward this average, suggesting dip-buying behavior within the prevailing uptrend. As long as daily closes remain above the lower boundary of the channel and the 200-day SMA, the broader structure remains intact.

Momentum indicators show mixed but stabilizing signals. RSI has recovered from near the lower end of its recent range and is moving back toward the neutral 50 level, indicating easing downside momentum rather than strong bearish pressure. MACD remains slightly negative but appears to be flattening, which can be consistent with consolidation within an established trend rather than trend reversal.

Overall, USDJPY is displaying signs of short-term consolidation within a larger bullish channel. The technical picture suggests the market is digesting recent volatility while respecting key trend-defining levels, keeping the medium-term bias constructive unless the channel structure is decisively broken.

-MW

GPSUSDT.P: long setup from daily resistance at 0.008500SETUP SUMMARY

BINANCE:GPSUSDT.P is holding well below the level, considering yesterday’s strong rally. Usually, a correction is expected, but we see the asset sticking nearly to the level and consolidating clearly and calmly, without sharp moves — this is a sign of a confident buyer.

About 2 hours ago, there was a false breakout, and this is now the key factor to watch: whether a correction follows it. If not, it is a strong long signal. If a correction occurs, it means sellers are blocking the upside, and we will need to wait for a new approach and re-evaluate the overall picture. Therefore, the shallower the correction and the faster the re-test of the level, the better.

PRO-THESIS FACTORS:

volatility contraction on approach

impulse absorption at the level

close retest

price compression (Squeeze) (4h)

lack of rejection after false break

at-level close ADVERSE FACTORS:

overhead congestion

lack of accumulation Leave your thoughts on the setup in the comments. Follow this profile to monitor all upcoming ideas

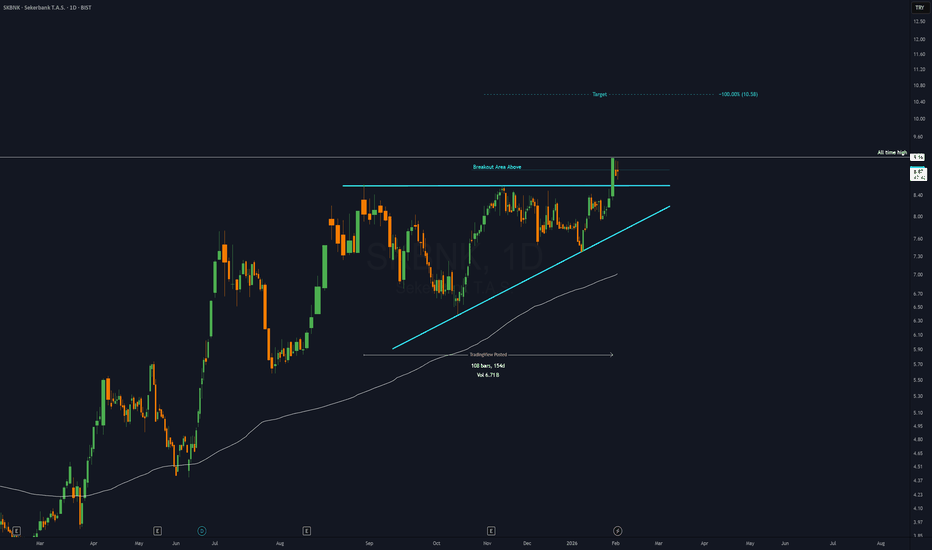

SKBNK - 5 months ASCENDING TRIANGLE══════════════════════════════

Since 2014, my markets approach is to spot

trading opportunities based solely on the

development of

CLASSICAL CHART PATTERNS

🤝Let’s learn and grow together 🤝

══════════════════════════════

Hello Traders ✌

After a careful consideration I came to the conclusion that:

- it is crucial to be quick in alerting you with all the opportunities I spot and often I don't post a good pattern because I don't have the opportunity to write down a proper didactical comment;

- since my parameters to identify a Classical Pattern and its scenario are very well defined, many of my comments were and would be redundant;

- the information that I think is important is very simple and can easily be understood just by looking at charts;

For these reasons and hoping to give you a better help, I decided to write comments only when something very specific or interesting shows up, otherwise all the information is shown on the chart.

Thank you all for your support

🔎🔎🔎 ALWAYS REMEMBER

"A pattern IS NOT a Pattern until the breakout is completed. Before that moment it is just a bunch of colorful candlesticks on a chart of your watchlist"

═════════════════════════════

⚠ DISCLAIMER ⚠

The content is The Art Of Charting's personal opinion and it is posted purely for educational purpose and therefore it must not be taken as a direct or indirect investing recommendations or advices. Any action taken upon these information is at your own risk.

KO - 17 months ASCENDING TRIANGLE══════════════════════════════

Since 2014, my markets approach is to spot

trading opportunities based solely on the

development of

CLASSICAL CHART PATTERNS

🤝Let’s learn and grow together 🤝

══════════════════════════════

Hello Traders ✌

After a careful consideration I came to the conclusion that:

- it is crucial to be quick in alerting you with all the opportunities I spot and often I don't post a good pattern because I don't have the opportunity to write down a proper didactical comment;

- since my parameters to identify a Classical Pattern and its scenario are very well defined, many of my comments were and would be redundant;

- the information that I think is important is very simple and can easily be understood just by looking at charts;

For these reasons and hoping to give you a better help, I decided to write comments only when something very specific or interesting shows up, otherwise all the information is shown on the chart.

Thank you all for your support

🔎🔎🔎 ALWAYS REMEMBER

"A pattern IS NOT a Pattern until the breakout is completed. Before that moment it is just a bunch of colorful candlesticks on a chart of your watchlist"

═════════════════════════════

⚠ DISCLAIMER ⚠

The content is The Art Of Charting's personal opinion and it is posted purely for educational purpose and therefore it must not be taken as a direct or indirect investing recommendations or advices. Any action taken upon these information is at your own risk.

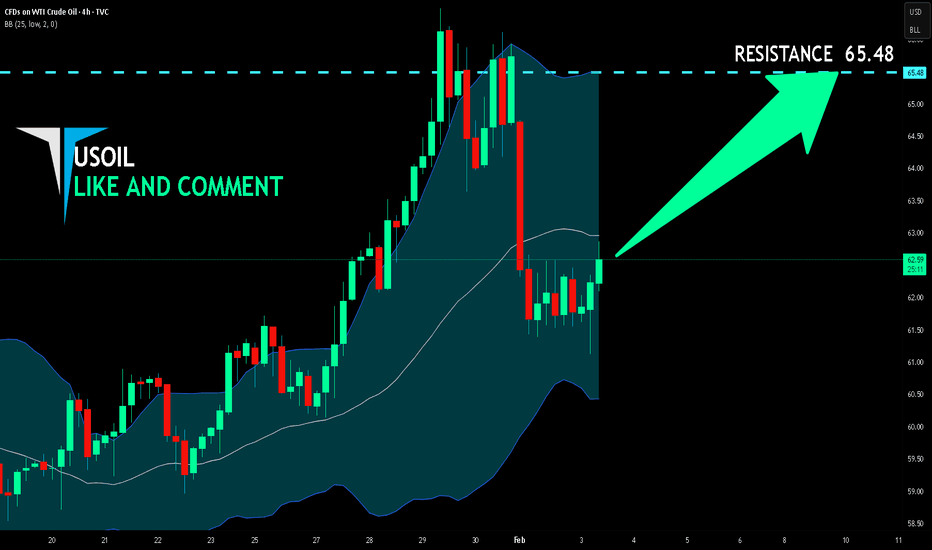

USOIL BULLS ARE GAINING STRENGTH|LONG

Hello, Friends!

Bullish trend on USOIL, defined by the green colour of the last week candle combined with the fact the pair is oversold based on the BB lower band proximity, makes me expect a bullish rebound from the support line below and a retest of the local target above at 65.48.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

CSX - 4 months ASCENDING TRIANGLE══════════════════════════════

Since 2014, my markets approach is to spot

trading opportunities based solely on the

development of

CLASSICAL CHART PATTERNS

🤝Let’s learn and grow together 🤝

══════════════════════════════

Hello Traders ✌

After a careful consideration I came to the conclusion that:

- it is crucial to be quick in alerting you with all the opportunities I spot and often I don't post a good pattern because I don't have the opportunity to write down a proper didactical comment;

- since my parameters to identify a Classical Pattern and its scenario are very well defined, many of my comments were and would be redundant;

- the information that I think is important is very simple and can easily be understood just by looking at charts;

For these reasons and hoping to give you a better help, I decided to write comments only when something very specific or interesting shows up, otherwise all the information is shown on the chart.

Thank you all for your support

🔎🔎🔎 ALWAYS REMEMBER

"A pattern IS NOT a Pattern until the breakout is completed. Before that moment it is just a bunch of colorful candlesticks on a chart of your watchlist"

═════════════════════════════

⚠ DISCLAIMER ⚠

The content is The Art Of Charting's personal opinion and it is posted purely for educational purpose and therefore it must not be taken as a direct or indirect investing recommendations or advices. Any action taken upon these information is at your own risk.