XAUUSD: This Is a Breakout PreparationXAUUSD – 1H |

Structure: Strong impulsive rally followed by bullish consolidation below previous high → classic continuation pattern.

Key Zone: Former resistance ~4,350–4,380 flipped into strong support. Price keeps respecting this base.

Momentum: Higher highs & higher lows intact → buyers still in control. No distribution signal yet.

Next Objective: Clean continuation opens the path toward 4,700 (new ATH projection).

Macro Drivers (Supporting the Move):

Fed rate-cut expectations in 2025 keep real yields pressured.

USD lacks strong upside momentum, reducing headwinds for gold.

Ongoing geopolitical & fiscal uncertainty sustains safe-haven demand.

➡️ Bias: Bullish continuation. Pullbacks into support are buy-the-dip, not reversal signals

Technical Analysis

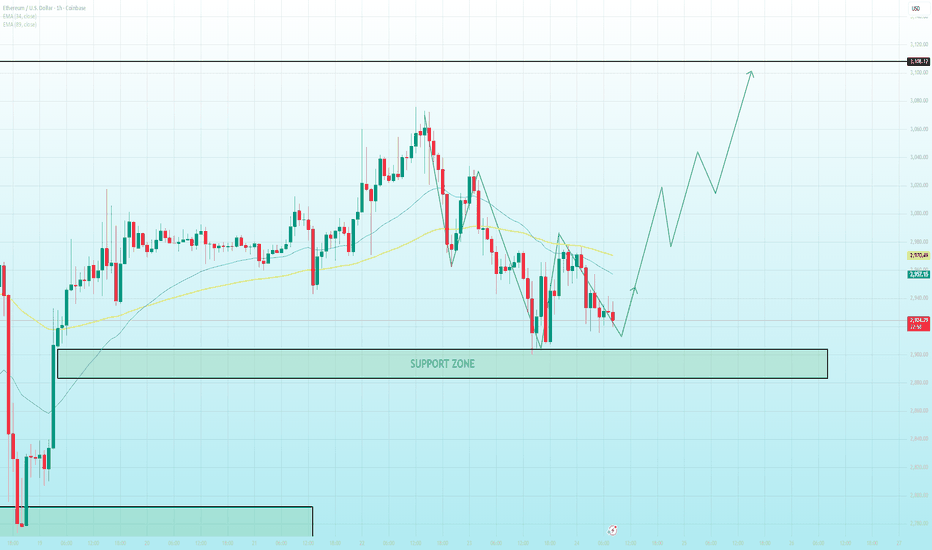

A Christmas Setup: Is the Breakout Gift Coming?ETH/USD – 1H | Key Points:

Market State: Range consolidation after a sharp pullback.

Support Zone: ~2,900–2,920 → buyers defending repeatedly.

Resistance Zone: ~3,030–3,060 → strong supply overhead.

Structure: Higher lows forming from support → recovery attempt.

Bias: Neutral → bullish only if price reclaims 3,000+.

Context (Macro / Holiday):

Low Christmas liquidity → slow, choppy price action.

Real momentum likely comes after a clean breakout.

Plan:

Buy reactions at support.

Confirm longs only on break & hold above resistance.

Quiet Christmas range — volatility is being delayed, not cancelChristmas Liquidity Trap – BTC Is Loading the Next Move

BTC/USD – 1H | Key Takeaways:

Market State: High-liquidity range consolidation.

Support Zone: ~86.7k–86.8k → buyers defending well.

Resistance Zone: ~90.3k–90.5k → major supply cap.

Structure: Higher lows forming inside the range → pressure building.

Bias: Neutral → breakout-dependent.

Holiday / Macro Context:

Christmas = thin liquidity, slow flows.

Smart money accumulates quietly inside ranges.

Real expansion often comes after the holiday lull.

Playbook:

Range trade only until breakout.

Bullish continuation only on clean break & hold above 90.5k.

Thin Liquidity, Gold Can Fly: Are You Buying at the Right Level?Hello traders, let’s continue with today’s XAUUSD outlook.

Personally, I believe the primary trend of XAUUSD remains BULLISH , supported by both fundamental news and technical structure . However, in a thin holiday liquidity environment , the market may choose one of two clear scenarios below before confirming its next directional move.

From a news perspective, gold has just printed a record high during the Asian session , driven by rising safe-haven demand amid escalating U.S.–Venezuela geopolitical tensions . With year-end trading volumes remaining light , defensive capital flows tend to amplify price swings, making gold more prone to sharp breakouts or fast pullbacks than usual.

Scenario (1) – Direct continuation higher:

If price holds firmly above the 4,480 area (support zone 1) and buying pressure remains steady, gold could push directly toward the 4,550 target. This is the trend-following scenario, favored when safe-haven sentiment stays dominant and no strong selling pressure appears at current levels.

Scenario (2) – Deeper pullback, then rally:

If the market needs to “cool off”, price may correct toward the 4,400 area (support zone 2). Should this zone be well defended, the pullback would likely be technical in nature, forming a stronger base for the next bullish leg toward 4,550. This scenario often unfolds when RSI eases and buyers step back in at more favorable prices.

Conclusion:

Regardless of which path the market takes, 4,550 remains the key short-term objective. The most important factor is discipline: buy only with confirmation at support, and avoid FOMO during strong holiday-driven volatility.

Note: This is only a trading idea for reference. I’d be happy to hear your views—feel free to share your perspective or leave a comment below.

Gold Is No Longer a Spike — It’s a TrendXAUUSD is maintaining a clear bullish bias, as the fundamental backdrop continues to strongly favor gold. Rising safe-haven demand, expectations of further Fed easing, and a weaker U.S. dollar are helping gold stay at elevated price levels. Gold’s breakout above 4,500 USD/oz and its ~70% gain in 2025 (the strongest since 1979) confirm that this move is no longer a short-term “spike,” but a structurally supported trend driven by long-term capital flows.

On the H4 chart you shared, the uptrend remains dominant, with price trading inside a rising channel and currently consolidating just below the 4,550 supply zone after a strong impulsive move. The 4,470 area is acting as a key base, making pullbacks into this zone healthy corrections for continuation, rather than signs of reversal.

The most reasonable scenario over the next 24 hours is for gold to cool off toward 4,470 to absorb liquidity, then rebound to retest 4,550. Only a clear H4 close below 4,470 would slow the bullish momentum; as long as this level holds, I continue to favor buying pullbacks within the broader uptrend.

$SPY & $SPX Scenarios — Friday, Dec 26, 2025🔮 AMEX:SPY & SP:SPX Scenarios — Friday, Dec 26, 2025 🔮

🌍 Market-Moving Headlines

• Post-holiday, low-liquidity session: No scheduled macro data — price action driven by flows, positioning, and thin volume.

• Year-end dynamics: Window dressing, tax positioning, and reduced participation can exaggerate moves without real conviction.

📊 Key Data & Events (ET)

• None scheduled

⚠️ Disclaimer: For informational use only — not financial advice.

📌 #SPY #SPX #markets #trading #holiday #yearend

DOGE - Descending Channel at $0.127

Executive Summary

COINBASE:DOGEUSD is trading at approximately $0.127 on Christmas Day, down 58% YTD and trapped in a descending channel on the 4H timeframe. The performance metrics are brutal: -60.92% over the past year. However, multiple analysts are pointing to a cycle fractal that suggests DOGE may be in the "golden pocket" for accumulation before a major bull run. The key level to watch is $0.138 - a reclaim above this Fibonacci level could signal the start of a significant rally. Meanwhile, futures trading volume has surged 53,000% to $260 million, and spot DOGE ETFs are boosting demand.

BIAS: NEUTRAL - Bullish Potential with Current Bearish Structure

The chart structure is bearish (descending channel), but the cycle fractal and accumulation signals suggest this could be the calm before the storm. Wait for confirmation above $0.138 before turning bullish.

Current Market Context - December 25, 2025

Dogecoin is at a critical juncture:

Current Price: $0.127 (-1.22% in 24h)

Market Cap: $19.39 billion

52-Week Range (Market Cap): $15.59B - $64.11B

Volume: 590.15M (below 30D average of 1.13B)

Open Interest: $1.51 billion (11.8 billion DOGE)

Rank: #9 by market cap

Performance Metrics - MOSTLY RED:

1 Week: +0.83% (Green)

1 Month: -15.91% (Red)

3 Months: -42.45% (Red)

6 Months: -19.67% (Red)

YTD: -58.30% (Red)

1 Year: -60.92% (Red)

The numbers are ugly. DOGE has lost nearly 60% of its value this year. But is this the bottom?

THE BULL CASE - Cycle Fractal Points to Imminent Rally

The Dogecoin Cycle Fractal

Crypto analyst Cryptollica has identified a cycle fractal that shows DOGE may be at the point before it begins its bull run. The fractal has repeated itself at the macro level with four distinct structural points:

Zone 1 & 2: "Boredom phases" where volatility died and smart money accumulated

Zone 2: Was the launchpad for the massive 2021 parabolic run

Zone 4 (CURRENT): Same rounding-bottom formation playing out

Price is stabilizing and forming a heavy base just like before previous explosions

Key Insight: The analyst states this is the "Golden Pocket" for accumulation. If the fractal plays out as it did in 2020 (Zone 2), the current price action is simply the calm before the storm.

RSI at Historical Support

Weekly RSI at 32 level - acts as historical floor

DOGE has formed a macro bottom every time RSI touched this baseline

RSI has reset to this critical support level

Indicates sellers are exhausted

Momentum is primed to flip

The $0.138 Level - Key to Recovery

Analyst Kevin has identified $0.138 as THE critical level:

Must be reclaimed on 3-day to weekly timeframe closes

Would place DOGE back above macro 0.382 Fibonacci retracement

This Fib level divides bearish and bullish market phases

Also aligns with 200-week Simple Moving Average

A move above would signal long-term buyers regaining control

Next major target after reclaim: $0.46 (liquidity/resistance zone)

Futures Volume Surge - 53,000%

Dogecoin futures trading volume surged 53,000% to $260 million

Driven by Dogecoin ETF activity and derivatives

This surge came before recent price stability

Could be catalyst for upcoming trend reversal

Spot DOGE ETFs launched in late 2025, boosting demand

Analyst Price Targets

Cryptollica: DOGE could rally significantly and possibly exceed $1

Kevin: Next major resistance at $0.46 after $0.138 reclaim

Current resistance targets: $0.148 and $0.196

Support expected in $0.11 range

THE BEAR CASE - Descending Channel Still Intact

Current Technical Structure

The 4H chart shows a clear descending channel:

Lower highs and lower lows dominating

Price trapped between declining trendlines

Channel resistance capping rallies

Channel support providing temporary bounces

No confirmed breakout yet

Bearish structure until proven otherwise

Concerning Metrics

YTD: -58.30% - Massive underperformance

1 Year: -60.92% - Lost more than half its value

Market cap down from $64.11B high to $19.39B

Volume below 30-day average (590M vs 1.13B)

Open interest dropped 4.03% in last 24 hours

Lost crucial $0.13 support level

Market Headwinds

Broader crypto market in risk-off mode

Total crypto market fell below $3 trillion to $2.94 trillion

Fed rate expectations pushing out (rates on hold until April)

Holiday trading with thin liquidity

DOGE utility discussions (sidechains, L2) progressing slowly

Technical Structure Analysis

Price Action Overview - 4 Hour Timeframe

The chart shows a descending channel pattern:

Descending Channel Characteristics:

Upper trendline: Connecting lower highs (resistance)

Lower trendline: Connecting lower lows (support)

Channel slope: Bearish (declining)

Price oscillating between boundaries

Current position: Mid-to-lower channel

Recent Price Action:

Dec 19 surge to $0.134 high

Failed to break channel resistance

Pulled back to current $0.127 level

Now trading in tight range ($0.126-$0.135)

Consolidation setting stage for next move

Key Support and Resistance Levels

Resistance Levels:

$0.134-$0.135 - Immediate resistance / recent high

$0.138 - CRITICAL LEVEL (Fibonacci 0.382 + 200-week SMA)

$0.148 - Next resistance target

$0.196 - Secondary resistance

$0.46 - Major liquidity zone (if $0.138 reclaimed)

$1.00 - Analyst moon target

Support Levels:

$0.126 - Immediate support / range bottom

$0.125 - Key support (must hold for bullish setup)

$0.12 - Psychological support

$0.11 - Major support zone

$0.10 - Deep support / psychological

Range Analysis

Current consolidation range:

Range high: $0.135

Range low: $0.126

Range width: ~$0.009 (7%)

Breakout direction will determine next major move

Above $0.138 = Bullish confirmation

Below $0.12 = Bearish continuation

Moving Average Analysis

Price below major moving averages

200-week SMA at ~$0.138 area - key resistance

MAs sloping downward on shorter timeframes

Need to reclaim MAs for trend reversal

Currently bearish MA structure

RSI Analysis

4H RSI at 42 - showing growing buyer interest

Weekly RSI near 32 - historical support level

RSI breakthrough would boost momentum

Target resistance at $0.134 if RSI breaks higher

Oversold conditions on higher timeframes

Bitcoin Correlation - Key Catalyst

Analyst Kevin notes that DOGE's recovery is tied to Bitcoin:

Bitcoin needs to reclaim $88,000-$91,000 range

This would require BTC to rally 2-6% from current levels

BTC strength would support bullish momentum across crypto

Without BTC confirmation, DOGE may continue consolidating

Watch BTC as leading indicator for DOGE direction

SCENARIO ANALYSIS

BULLISH SCENARIO - Breakout Above $0.138

Trigger Conditions:

3-day or weekly close above $0.138

Bitcoin reclaims $88,000-$91,000

RSI breaks above 50 on weekly

Volume surge on breakout

Descending channel breakout confirmed

Price Targets if Bullish:

Target 1: $0.148 - First resistance

Target 2: $0.196 - Secondary resistance

Target 3: $0.46 - Major liquidity zone

Moon Target: $1.00+ (cycle fractal projection)

Bullish Catalysts:

Cycle fractal pointing to bull run

RSI at historical support (32 level)

"Golden Pocket" accumulation zone

Futures volume surge (53,000%)

Spot DOGE ETFs boosting demand

Smart money accumulation phase

Rounding bottom formation

BEARISH SCENARIO - Breakdown Below $0.12

Trigger Conditions:

4H close below $0.12

Bitcoin weakness below $85,000

Volume spike on breakdown

Descending channel continues

Open interest continues declining

Price Targets if Bearish:

Target 1: $0.11 - Major support zone

Target 2: $0.10 - Psychological support

Target 3: $0.08-$0.09 - Extended downside

Bearish Risks:

Descending channel still intact

YTD: -58.30% - Severe underperformance

Lost $0.13 crucial support

Volume below average

Open interest declining

Broader crypto market weakness

Fed rate expectations pushed out

Utility development slow

NEUTRAL SCENARIO - Continued Range Trading

Most likely short-term outcome:

Price continues in $0.126-$0.135 range

Consolidation before next major move

Wait for Bitcoin direction

Wait for $0.138 reclaim or $0.12 breakdown

Holiday trading keeps volatility low

MY ASSESSMENT - NEUTRAL with Bullish Potential

This is a genuinely mixed setup:

Bearish Factors (Current Reality):

Descending channel intact

YTD: -58.30%, 1Y: -60.92%

Below all major moving averages

Lost $0.13 support

Volume declining

Open interest dropping

Bullish Factors (Future Potential):

Cycle fractal pointing to bull run

RSI at historical support

"Golden Pocket" accumulation zone

Futures volume surge 53,000%

Spot ETFs boosting demand

Analysts targeting $0.46 to $1.00+

Rounding bottom forming

My Stance: NEUTRAL - Wait for Confirmation

The current structure is bearish, but the accumulation signals are compelling. This is NOT the time to short, but also not the time to go heavy long without confirmation.

Strategy:

Wait for $0.138 reclaim for bullish confirmation

Or wait for $0.12 breakdown for bearish confirmation

Small accumulation positions acceptable in $0.125-$0.127 zone

Don't chase - let the market show its hand

Watch Bitcoin for direction

Trade Framework

Scenario 1: Bullish Breakout Trade

Entry Conditions:

3-day or weekly close above $0.138

Volume confirmation

Bitcoin above $88,000

Trade Parameters:

Entry: $0.138-$0.142 on confirmed breakout

Stop Loss: $0.125 below recent support

Target 1: $0.148 (Risk-Reward ~1:0.5)

Target 2: $0.196 (Risk-Reward ~1:4)

Target 3: $0.46 (Extended)

Scenario 2: Accumulation in Range

Entry Conditions:

Price tests $0.125-$0.127 support

Bullish rejection candle

RSI holding above 30

Trade Parameters:

Entry: $0.125-$0.127 at range support

Stop Loss: $0.118 below $0.12 psychological

Target 1: $0.134-$0.135 (range high)

Target 2: $0.138 (key Fibonacci level)

Target 3: $0.148+ (if breakout occurs)

Risk-Reward: ~1:1.5 to first target

Scenario 3: Bearish Breakdown Trade

Entry Conditions:

4H close below $0.12

Volume confirmation

Bitcoin weakness

Trade Parameters:

Entry: $0.118-$0.12 on confirmed breakdown

Stop Loss: $0.128 above recent consolidation

Target 1: $0.11 (Risk-Reward ~1:1)

Target 2: $0.10 (Risk-Reward ~1:2)

Target 3: $0.08-$0.09 (Extended)

Risk Management Guidelines

Position sizing: 1-2% max risk per trade

DOGE is highly volatile - use appropriate size

Wait for confirmation before large positions

Respect the descending channel until broken

Watch Bitcoin correlation closely

Holiday trading = thin liquidity

Scale into positions rather than all-in

Take profits at targets

Invalidation Levels

Bullish thesis invalidated if:

Price closes below $0.11

Descending channel breaks down further

Bitcoin crashes below $80,000

Weekly RSI breaks below 25

Bearish thesis invalidated if:

Price closes above $0.138 on weekly

Descending channel breaks to upside

Bitcoin reclaims $91,000

Volume surge on breakout

Conclusion

COINBASE:DOGEUSD is at a critical inflection point. The current structure is bearish with a descending channel and -58% YTD performance. However, multiple analysts are pointing to a cycle fractal that suggests this could be the "golden pocket" for accumulation before a major bull run.

The Numbers:

Current Price: $0.127

YTD Performance: -58.30%

1-Year Performance: -60.92%

Market Cap: $19.39 billion

Key Level: $0.138 (Fibonacci 0.382 + 200-week SMA)

Key Levels:

$0.138 - CRITICAL (reclaim = bullish confirmation)

$0.134-$0.135 - Immediate resistance

$0.127 - Current price

$0.125-$0.126 - Immediate support

$0.12 - Psychological support (breakdown level)

$0.11 - Major support

The Setup:

Dogecoin is consolidating in a descending channel with the cycle fractal suggesting accumulation. The $0.138 level is THE key - a reclaim would signal the start of a potential rally to $0.46 and beyond. Without that confirmation, the bearish structure remains intact.

Strategy:

NEUTRAL stance - wait for confirmation

Small accumulation acceptable at $0.125-$0.127

Bullish above $0.138 (targets $0.148, $0.196, $0.46)

Bearish below $0.12 (targets $0.11, $0.10)

Watch Bitcoin for direction

As analyst Cryptollica says: "Ignore Dogecoin now, chase it later." The spring is loading - patience is required.

BTC’s OCD means EMA by NYEWe all know the market has a little OCD. Certain levels it just has to touch before it’ll allow the next move.

On the monthly BTC chart, that level looks like the 9 EMA — and it’s lining up as a likely “must-tag” into month’s end.

Here’s the key observation:

• The monthly 9 EMA has been sliding down ~$2k–$3k per month.

• It’s already dropped from just over $100k last month to a little over ~$98k this month.

• Meanwhile, this month’s high / top wick area is ~94,500.

So right now there’s a gap: 9 EMA above, price wick below.

For the 9 EMA to “touch” the top of this month’s candle (~94,500), one of two things has to happen:

1. EMA drops to price (hard), or

2. Price rises to EMA (much easier).

To get the EMA to drop several thousand more this month, BTC would need a major dump (think the kind of move that drags the average down hard — i.e., ugly). That’s possible, but it’s the less probable path compared to a tag from price.

I built a simple little calculator/tool on my chart that estimates what price would need to do for an EMA tag — and based on that, the cleaner path is BTC pushing higher into month-end to meet the 9 EMA, then potentially setting up the next move (including a possible January fade).

We’re already in the final week of the month, and the tape is starting to look like that “EMA magnet” move could be underway.

Bias: Looking for a long into the 9 EMA tag into year-end — with eyes open for a potential January reversal setup after the touch.

Merry Christmas — consider it my gift to the chart watchers 🎁

EURUSD Pullback Toward 1.178 as Dollar Weakness Builds!Hey Traders,

In today’s trading session, we’re monitoring EURUSD for a potential buying opportunity around the 1.17800 zone.

From a technical standpoint, EURUSD remains in a well-defined uptrend and is currently undergoing a healthy correction, pulling back toward trend support and a key support/resistance confluence at 1.17800. This area has previously attracted strong buyer interest and could act as a launch point for trend continuation.

On the macro side, the US Dollar backdrop remains fragile. Recent developments point toward continued USD weakness, with:

A 25bps Fed rate cut already delivered

Balance sheet expansion resuming, historically bearish for the dollar

Markets increasingly sensitive to incoming US labor market data, which could revive expectations for additional easing ahead

As long as the dollar struggles to regain momentum, the EURUSD upside bias remains intact, with this pullback offering a potential higher-low setup within the broader bullish structure.

Watching closely for price reaction at 1.17800 to confirm buyer participation.

Trade safe,

Joe

USDJPY Approaches Key Sell Zone at 156.60!!Hey Traders,

In today’s trading session, we’re closely watching USDJPY for a potential selling opportunity around the 156.600 zone.

From a technical perspective, the pair remains in a clear downtrend. Price is currently in a corrective rebound, retracing toward a key trendline and support/resistance confluence near 156.600—an area that could attract renewed selling pressure if the broader bearish structure holds.

This zone is critical: rejection here would reinforce the downside bias and open the door for trend continuation lower.

Waiting for confirmation and price reaction at the level before engaging.

Trade safe,

Joe

Christmas Calm Before the Breakout – ETH Is Still WaitingKey Points :

Structure: Range / consolidation between support and resistance.

Bias: Neutral → waiting for expansion.

Support Zone: Holding so far, buyers still defending.

Resistance Zone: Major cap; breakout needed to confirm upside.

Liquidity: Thin Christmas liquidity → false moves possible.

Macro Context:

Holiday period = low volume, reduced institutional flow.

No strong macro catalyst → price driven mainly by technical levels.

Trading Note:

Avoid overtrading during Christmas.

Best opportunity comes after the holidays, not during.

Nebius Group N.V. (NBIS) when growth stops being randomI am looking at the weekly chart of NBIS and this is no longer about emotions, it is about structure. Price has formed a stable bullish cycle, broke out from a wide base and is now holding above key moving averages. On the weekly timeframe most indicators have already shifted into buy mode, while the market does not look overheated. RSI remains in a neutral bullish zone, momentum is intact, and pullbacks are being absorbed without aggressive selling pressure.

The 50, 100 and 200 week moving averages are starting to align into a bullish configuration, which often signals a transition into a medium term trend. Volume confirms the move. This is not an empty or purely speculative rally, but one supported by growing participation from longer term capital. Technically, this structure suggests trend continuation with potential for new highs as long as the current range is held.

From a fundamental perspective, Nebius has gone through a major transformation over recent years. Company revenue has increased multiple times compared to prior periods, while the income structure has become more diversified. The core contribution now comes from cloud solutions, infrastructure services and technology driven segments that continue to grow even in a challenging macro environment. EBITDA has returned to a positive trend in recent reporting periods, and operational metrics are improving due to cost optimization and a stronger focus on higher margin business lines.

Yes, the company is still in an investment phase and this is not a classic profit here and now story. However, revenue growth rates, business scaling and expansion of core segments provide a clear long term value setup. This is not hype. It is a bet on a technology platform that is only entering its value realization phase.

Tactically, I view NBIS as a growth stock where the market can continue higher without a deep correction as long as the current structure holds. While price remains above key weekly levels and moving averages, the bullish scenario stays valid. This is not a one day idea. It is a trend that is just beginning to form.

Sometimes the market already knows where the money is going, and in those moments it is better to listen to the chart rather than the headlines.

ETH Is Not Weak — This Is Smart Money Reloading Before the PUSHETH / USD – 1H

1. Market Structure (What Price Is Really Doing)

ETH has returned precisely into the previous range support zone (~2,900–2,930).

The sell-off did not break structure impulsively — instead, price formed compression + shallow lower wicks, signaling sell-side liquidity absorption.

The recent down move is corrective, not a trend reversal:

Lower highs are short-lived

No strong bearish expansion

Buyers step in immediately at range low

➡️ This is range re-accumulation, not distribution.

2. Key Levels

Primary Support (High-Probability Demand): 2,900 – 2,930

Range High / Resistance: 3,050 – 3,080

Upside Liquidity Target: 3,100 – 3,150

As long as ETH holds above 2,900, bullish structure remains intact.

3. Price PatH

Expected Flow:

Minor dip or sweep below 2,920 (liquidity grab)

Sharp reaction back into range

Expansion toward range high

Break above 3,080 → 3,100+

This is a classic “sell the fear, buy the base” setup inside a higher-timeframe range.

4. Macro & Crypto-Specific Tailwinds

Macro Alignment

USD momentum is weakening as markets price Fed easing in 2025.

Risk assets remain supported → ETH benefits disproportionately vs BTC during rotations.

Crypto-Specific

ETH continues to gain from:

ETF narrative speculation

Reduced net issuance (post-merge supply dynamics)

Capital rotation from BTC into ETH during consolidation phases

➡️ Macro does not support sustained downside here.

🧠 Final Takeaway

ETH is not breaking down — it is reloading at the most logical level.

Structure: Neutral → Bullish

Location: Optimal (range low)

Liquidity: Below price already taken

Bias: Upside continuation toward 3,100+

Unless ETH accepts below 2,880, this remains a buy-the-dip environment, not a short-the-rally one.

BTC Is Bleeding Liquidity — Breakdown Before the Next Big Move?BTC/USD – 1H QUICK ANALYSIS

Technical

Price is making lower highs after rejection from the resistance zone ~90,300.

Structure shows weak bounces → distribution inside range.

Short-term bias remains bearish-to-sideways while below mid-range.

Likely drift toward range low / liquidity sweep before any reversal.

Key Levels

Resistance: 88,800 – 90,300

Support: 86,800 → 85,200

Macro Context

Profit-taking after strong run-up.

USD stabilizing short-term limits BTC upside.

No major bullish catalyst → market favors range rotation.

Bias

Sell rallies / wait for support reaction.

Bullish only after a clean reclaim above resistance.

“ETH Pullback Is a Reload — Not the TopETH/USD – 1H QUICK ANALYSIS

Technical

Price is forming a higher low after the recent impulsive rally.

Current consolidation sits above short-term demand → bullish continuation structure intact.

Upside path remains open toward the major resistance ~3,160.

Only a clean break below the recent swing low would weaken the setup.

Key Levels

Support: 2,900–2,920

Resistance / Target: 3,050 → 3,160

Macro Drivers

Risk-on sentiment returning into year-end.

USD weakness as markets price Fed rate cuts in 2025.

ETH beta advantage: Ethereum tends to outperform during early risk-on rotations.

Bias

Buy dips, not breakouts.

Trend remains bullish while holding above support.

“ETH Is Testing the Floor Not Breaking ItETH/USD – 1H |

Structure: Pullback is corrective, not a trend break. Price is reacting inside a major demand / support zone.

Support: Strong base around 2,900–2,920 — buyers already defending this area.

Trend Context: Higher-timeframe structure remains bullish; this is a re-accumulation leg.

Scenario: Hold above support → rebound toward 3,020 → 3,080. Breakdown only if support fails decisively.

Bias: Bullish while above support. This zone favors buyers, not panic sellers.

EURUSD: The Uptrend Remains Intact – BUY Still Holds the AdvantaHello everyone, below is my view on today’s EURUSD outlook.

From a fundamental perspective, the overall backdrop continues to support the euro. The U.S. dollar remains under pressure as expectations for U.S. interest rates weaken, despite occasional short-term technical rebounds. The key point is that USD strength is not sufficient to reverse the trend, which overall allows EURUSD to maintain its upward momentum.

Looking at the chart, the bullish structure remains very clean and well-respected. Price is trading above the Ichimoku cloud, with the cloud sloping upward, confirming that the primary trend is bullish. The ascending trendline has been respected throughout and has not been broken. After the recent rally, price is now consolidating above the 1.1770 support zone, which signals a healthy market, not distribution.

As long as EURUSD holds above this key base, the probability remains high for price to continue pushing toward the 1.1840 area, as marked on the chart. Any volatility along the way should be seen as technical corrections, not as a change in the overall bullish structure.

Conclusion: EURUSD is still moving in line with its bullish trend. The strategy remains to BUY with the trend, avoid FOMO at the highs, and wait patiently for confirmation that support holds. As long as the structure stays intact, the advantage remains with the buyers — and that is always the side worth aligning with.

NQ1! - S&P 500 Hits Record High | Santa Rally UnderwayCME_MINI:NQ1! (NASDAQ 100 E-mini Futures) is trading at 25,866.50 on Christmas Eve as the Santa Claus rally officially begins. The S&P 500 just hit a new all-time high, and all major indices are set for their third consecutive yearly gain. With +21.62% YTD performance and the AI trade regaining momentum, the setup favors bulls heading into 2026. However, thin holiday volumes and Fed uncertainty create short-term volatility risk.

BIAS: BULLISH - Santa Rally in Progress

The trend is clearly bullish. All timeframes show strength. The only caution is thin holiday liquidity which can amplify moves in either direction.

Current Market Context - December 24, 2025

It's Christmas Eve and the markets are in holiday mode:

Current Price: 25,866.50 (+0.21% on the day)

Day's Range: 25,777.50 - 25,868.25

52-Week Range: 16,460.00 - 26,399.00

52-Week High: 26,399.00

Volume: 115.66K

Open Interest: 265.94K

Front Month: NQH2026

Performance Metrics - ALL GREEN:

1 Week: +2.11%

1 Month: +5.77%

3 Months: +4.53%

6 Months: +14.07%

YTD: +21.62%

1 Year: +18.96%

Every timeframe is positive. This is a textbook bull market.

THE BIG STORY - S&P 500 Hits Record High, Santa Rally Begins

Record High on Christmas Eve

The S&P 500 touched an intraday record high of 6,921.42 on December 24, 2025 - surpassing its previous peak from October. This is the 38th record high of the year.

Key drivers:

Investors betting on more Fed rate cuts in 2026

AI trade regaining momentum

Strong Q3 GDP growth (4.3% - fastest in two years)

Resilient labor market data

Third consecutive yearly gain for all major indices

Santa Claus Rally Officially Underway

The Santa Claus rally period began on December 24 and runs through January 5, 2026. Historically, the S&P 500 posts gains during the last five trading days of the year and the first two of January.

Bull market that began October 2022 remains intact

Optimism around AI, rate cuts, and resilient economy supporting sentiment

VIX (fear gauge) hovering near lowest since December 2024

All three main indices set for third straight yearly gain

MACRO DRIVERS - What's Moving Markets

1. Strong Economic Data

Q3 GDP: +4.3% (fastest pace in two years, far exceeded 3% expectations)

Driven by faster consumer spending, stronger exports, higher government outlays

Initial jobless claims fell to 214,000 (better than expected 223,000)

Labor market remains steady despite seasonal volatility

2. Fed Policy Outlook

Mixed signals creating uncertainty

Hot economy could mean fewer rate cuts

Cooling jobs market suggests cuts still possible

Citigroup economists say data doesn't alter Fed outlook significantly

Pantheon expects Q4 growth to slow to 0.5%-1%

Consumer spending may slow as pandemic-era savings exhausted

3. AI Trade Regaining Momentum

Nvidia up 7.5% over past five days

Chinese companies fueling demand for AI chips

Nvidia plans to ship 80,000 H200 chips to China by mid-February

AMD's China-compliant AI chips close to commercial rollout

Alibaba plans to buy 50,000 AMD chips

Micron Technology jumped 4% to record high after strong forecast

4. M&A Activity Surging

Deals on pace to hit $4.55 trillion for 2025 (30% above 2024)

Tech and industrial sectors most active (~$1.4 trillion combined)

Private equity sitting on $2.2 trillion in dry powder

Two-thirds of buyers expect larger deal pipeline in 2026

Netflix's $72 billion offer for Warner Bros. studio/streaming assets

Cybersecurity sector ripe for M&A (Palo Alto, CrowdStrike)

5. Wall Street Institutional Moves

Apple CEO Tim Cook bought $3 million of Nike shares

Sanofi buying Dynavax Technologies for $2.2 billion

JPMorgan exploring crypto trading for institutional clients

Morgan Stanley, Charles Schwab launching crypto trading H1 2026

CAUTION FACTORS - Holiday Trading Risks

Thin Volumes

Tuesday had lowest trading volumes since January 3

Markets closed early on Christmas Eve (1 PM ET)

Markets closed Thursday for Christmas

Many traders away from desks

Thin volumes make it harder to gauge market consensus

Low volumes can bring volatility - small selling can spark outsize moves

Potential Headwinds

Central bank shifts in Japan pushing up Treasury yields

U.S.-Venezuela tensions could drive oil prices higher

Higher oil = inflation risk = fewer Fed rate cuts

Fed Chair succession uncertainty (Trump comments)

Q4 growth expected to slow significantly

Consumer spending may weaken as excess savings exhausted

Technical Structure Analysis

Price Action Overview - 45 Minute Timeframe

The chart shows a textbook bullish structure:

Recent Rally (Dec 16-24):

Strong rally from ~24,600 lows (Dec 16-17) to current ~25,866

Gain of approximately 1,266 points (+5.1%)

Higher highs and higher lows throughout

Momentum accelerated Dec 19-21

Brief consolidation Dec 23-24 before continuation

Price approaching 52-week high of 26,399

Current Structure:

Uptrend intact on all timeframes

Price consolidating near highs (healthy)

No significant pullback or reversal signals

Bullish momentum dominant

Volume supporting the move

Key Support and Resistance Levels

Resistance Levels:

25,868 - Day's high / immediate resistance

26,000 - Psychological round number

26,399 - 52-WEEK HIGH (key target)

26,500 - Next resistance above ATH

27,000 - Extended bullish target

30,000 - Forward curve target (2030)

Support Levels:

25,777 - Day's low / immediate support

25,600-25,650 - Recent consolidation support

25,400-25,500 - Secondary support zone

25,000 - Psychological support

24,600-24,700 - Dec 16-17 swing low (major support)

24,000 - Deep support

Moving Average Analysis

Price trading well above all major moving averages

All MAs sloping upward - bullish alignment

Short-term MAs above long-term MAs (golden cross structure)

MAs providing dynamic support on pullbacks

Trend structure extremely bullish

Forward Curve Analysis

The forward curve shows steady upward trajectory:

Dec 2025: ~25,500

2026: ~26,000-26,500

2027: ~27,000-28,000

2028: ~28,000-29,000

2029-2030: ~29,000-30,000

Market pricing in continued growth over next 5 years

Contango structure (futures above spot) - bullish

Volume and Open Interest

Volume: 115.66K

Open Interest: 265.94K

Healthy participation despite holiday period

Open interest supporting the uptrend

No signs of distribution

SCENARIO ANALYSIS

BULLISH SCENARIO - Breakout to New ATH

Trigger Conditions:

Price breaks above 26,000 with volume

Santa rally momentum continues

AI stocks continue leading

Fed signals more rate cuts coming

Strong January inflows

Price Targets if Bullish:

Target 1: 26,000 - Psychological level

Target 2: 26,399 - 52-week high

Target 3: 26,500-27,000 - New ATH territory

Extended: 28,000+ (Q1 2026)

Bullish Catalysts:

Santa Claus rally (Dec 24 - Jan 5)

S&P 500 at record high

AI trade momentum (Nvidia, AMD, Micron)

Strong Q3 GDP (4.3%)

M&A activity surging

Third consecutive yearly gain

VIX at yearly lows

Institutional buying

BEARISH SCENARIO - Holiday Volatility Pullback

Trigger Conditions:

Thin volume selloff

Profit-taking after strong rally

Fed hawkish surprise

Geopolitical escalation (Venezuela, etc.)

Oil price spike

Price Targets if Bearish:

Target 1: 25,600-25,650 - Recent support

Target 2: 25,400-25,500 - Secondary support

Target 3: 25,000 - Psychological support

Extended: 24,600-24,700 (Dec 16-17 lows)

Bearish Risks:

Thin holiday volumes amplifying moves

Profit-taking near 52-week high

Treasury yields rising (Japan central bank)

Oil price risk from Venezuela tensions

Q4 growth expected to slow significantly

Consumer spending may weaken

Fed Chair succession uncertainty

NEUTRAL SCENARIO - Consolidation Near Highs

Most likely short-term outcome:

Price consolidates between 25,600-26,000

Low volume holiday trading

Wait for January for directional clarity

Healthy consolidation before next leg higher

Santa rally provides floor

MY ASSESSMENT - BULLISH

The weight of evidence strongly favors bulls:

Bullish Factors (Dominant):

S&P 500 at record high (38th of the year)

Santa Claus rally officially underway

All performance metrics green (YTD +21.62%)

AI trade regaining momentum

Strong Q3 GDP (4.3%)

M&A activity surging

VIX at yearly lows

Third consecutive yearly gain

Bull market since Oct 2022 intact

Forward curve pricing continued growth

Bearish Factors (Minor):

Thin holiday volumes

Near 52-week high (profit-taking risk)

Treasury yields rising

Q4 growth expected to slow

Fed uncertainty

My Stance: BULLISH - Buy Dips

The trend is your friend. Don't fight the tape. The Santa rally is underway, the S&P 500 is at record highs, and all major indices are set for their third straight yearly gain. The AI trade is back, M&A is surging, and the VIX is at yearly lows.

Strategy:

Buy dips to 25,600-25,700 support

Target 26,000 and 52-week high (26,399)

Tight stops given thin holiday liquidity

Don't chase at current levels - wait for pullback

Respect the trend - it's bullish

Trade Framework

Scenario 1: Breakout Trade Above 26,000

Entry Conditions:

Price breaks above 26,000 with volume

Momentum indicators confirming

S&P 500 holding record highs

Trade Parameters:

Entry: 26,000-26,050 on confirmed breakout

Stop Loss: 25,700 below recent support

Target 1: 26,399 (52-week high)

Target 2: 26,500-27,000 (new ATH territory)

Risk-Reward: ~1:2

Scenario 2: Buy the Dip at Support

Entry Conditions:

Price pulls back to 25,600-25,700 zone

Bullish rejection candle

Volume spike on bounce

Trade Parameters:

Entry: 25,600-25,700 at support

Stop Loss: 25,400 below support zone

Target 1: 25,900-26,000

Target 2: 26,399 (52-week high)

Risk-Reward: ~1:2.5

Scenario 3: Bearish Breakdown Trade

Entry Conditions:

Price breaks below 25,400

Volume confirmation

S&P 500 losing record high

Trade Parameters:

Entry: 25,350-25,400 on confirmed breakdown

Stop Loss: 25,700 above recent support

Target 1: 25,000 (psychological)

Target 2: 24,700 (Dec 16-17 lows)

Risk-Reward: ~1:1.5

Risk Management Guidelines

Position sizing: 1-2% max risk per trade

CRITICAL: Thin holiday volumes = amplified moves

Use tighter stops than normal

Markets closed Thursday (Christmas)

Early close Wednesday (1 PM ET)

Expect erratic price action

Scale out at targets

Don't overtrade during holidays

Wait for January for larger positions

Invalidation Levels

Bullish thesis invalidated if:

Price closes below 25,000

S&P 500 loses record high with volume

VIX spikes above 20

Fed signals no more rate cuts

Major geopolitical escalation

Bearish thesis invalidated if:

Price closes above 26,399 (new ATH)

Santa rally momentum accelerates

AI stocks continue surging

Strong January inflows

Conclusion

CME_MINI:NQ1! (NASDAQ 100 E-mini Futures) is in a strong bullish trend as the Santa Claus rally officially begins. The S&P 500 just hit its 38th record high of the year, and all major indices are set for their third consecutive yearly gain.

The Numbers:

Current Price: 25,866.50

YTD Performance: +21.62%

1-Year Performance: +18.96%

52-Week High: 26,399.00

S&P 500: Record high (6,921.42)

Key Levels:

26,399 - 52-WEEK HIGH (bullish target)

26,000 - Psychological resistance

25,866 - Current price

25,600-25,700 - Support zone

25,000 - Psychological support

24,600-24,700 - Major support (Dec lows)

The Setup:

The Santa rally is underway. The AI trade is back. M&A is surging. The VIX is at yearly lows. The bull market that began in October 2022 remains intact. All signs point higher.

Strategy:

Buy dips to 25,600-25,700

Target 26,000 and 26,399 (52-week high)

Tight stops given thin holiday liquidity

Don't fight the trend - it's bullish

Watch for January momentum

The path of least resistance is higher. Enjoy the Santa rally.

USDJPY – Pullback Into Reversal Zone | Waiting for ConfirmationUSDJPY – Pullback Into Reversal Zone | Waiting for Confirmation

Technical Analysis

USDJPY recently completed a strong bullish impulse, breaking previous structure and printing a new swing high near the top of the chart. This impulsive leg confirms that buyers were firmly in control during that phase.

After reaching the high, price shifted into a healthy corrective move, forming a sequence of lower highs and lower lows, which is typical behavior after an aggressive expansion. This correction does not yet invalidate the bullish structure; instead, it suggests profit-taking and rebalancing.

Key Level – Reversal / Demand Zone

The chart highlights a well-defined Reversal Zone (demand area), marked by:

Origin of the last impulsive bullish move

Strong bullish candles with minimal retracement

Previous imbalance and unfilled orders

Price has now returned into this zone, which is a critical area where buyers are expected to step in again.

This is not an automatic buy zone — it is a reaction zone.

Current Price Behavior – Decision Area

USDJPY is currently:

Trading inside the reversal zone

Showing reduced momentum

Printing small-bodied candles, signaling indecision

This behavior tells us the market is waiting for participation, either from buyers defending the zone or sellers breaking through it.

As clearly marked on the chart:

➡️ “Need Pattern Here”

What Confirmation to Look For

For bullish continuation, traders should wait for:

Bullish engulfing candle on 2H

Strong rejection wicks from the demand zone

Break and hold above minor structure highs

Increase in bullish volume

Without confirmation, entering early increases risk.

Projected Scenarios

Scenario 1 – Bullish Continuation (Primary Bias)

Price respects the reversal zone

Bullish pattern forms

Market moves back toward recent highs

Potential continuation toward higher resistance levels

Scenario 2 – Deeper Correction (Alternative)

Demand zone fails

Clean 2H close below the zone

Price seeks lower support levels before finding balance

Market Psychology

This setup reflects a classic “strong move → correction → decision” phase:

Late buyers are trapped at the highs

Smart money watches the reaction at demand

Patience separates professionals from emotional traders

The edge here is waiting, not guessing.

Conclusion

USDJPY is currently sitting at a high-probability reaction zone, but confirmation is mandatory. The broader structure remains bullish unless the reversal zone fails. Traders should let price reveal intent before committing capital.

BTCUSD at Trendline Resistance – Breakout or Rejection?BTCUSD (BTCUSDT Perpetual) – 30-Minute Structure Breakdown & Decision Zone

Technical and Fundamental Analysis

Bitcoin is currently trading in a short-term corrective phase after printing a local high near the 90K region. The recent price action shows a clear shift from impulsive bullish movement into controlled bearish structure, characterized by lower highs and lower lows.

The chart highlights a descending trendline, which is acting as dynamic resistance, consistently rejecting price on each retest.

Trendline S/R Interchange (Key Concept)

One of the most important elements on this chart is the Trendline Support–Resistance Interchange:

Previous bullish support has now flipped into resistance.

Each pullback into the descending trendline attracts sellers.

This behavior confirms trend continuation pressure unless structure breaks.

This is a classic sign of market acceptance below resistance.

Mini Reversal Zone – Demand Reaction

Price recently dipped into a Mini Reversal Zone, marked by:

A previous demand imbalance

Strong reaction candles

Short-term liquidity sweep

The bounce from this area is technical, not impulsive — meaning it is likely a pullback, not a trend reversal yet.

Current Price Location – Decision Point

Bitcoin is now trading exactly at a key decision area, where:

Descending trendline resistance

Minor horizontal level

Short-term bullish pullback

all converge.

This zone determines the next directional move.

➡️ Market is neutral here — no blind entries.

Projected Scenarios

Scenario 1 – Structure Hold (Sell Setup – Higher Probability)

Price rejects from the trendline

Bearish candle confirmation appears

Continuation toward lower support zones

Sellers remain in control

Scenario 2 – Structure Break (Buy Setup – Conditional)

Strong 30m candle closes above the trendline

Follow-through volume confirms acceptance

Retest holds as support

Upside continuation toward higher resistance

As marked on the chart:

“If this structure follows → Buy | If rejection → Sell”

Volume & Momentum Insight

No aggressive bullish volume is present yet

Momentum remains corrective

Buyers must prove strength with structure break + hold

Without confirmation, upside moves are vulnerable to rejection.

Trading Mindset & Risk Management

This is a reaction-based trade environment, not a prediction zone.

Let price confirm direction

Avoid emotional entries at trendline

Wait for either rejection confirmation or clean breakout & retest

Professional traders trade confirmation, not hope.

Conclusion

BTC is at a critical technical junction. The trendline defines control. Until price decisively breaks and holds above it, the bearish bias remains intact. Smart traders will wait for the market to choose a side before committing capital.

NASDAQ Breakout and Potential RetraceHey Traders, in today's trading session we are monitoring NAS100 fora buying opportunity around 25,450 zone, NASDAQ was trading in a downtrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 25,450 support and resistance area.

Trade safe, Joe.

A good gold trade doesn’t need to be earlyIn my view, a good gold trade doesn’t need to be early.

Gold never lacks opportunities — but the market seriously lacks patience.

Anyone who trades XAUUSD knows:

It loves to sweep SL before the real trend begins

It prefers to retest zones more than once

It creates more fake breaks than my end-of-year resolutions

So entering early isn’t always wrong — it’s just usually unnecessary.

A beautiful trade is not the fastest trade

A beautiful trade is one where you:

Don’t FOMO

Don’t guess

Don’t enter while price is still shaking out stops

Enter when the chart finally starts telling a clear story, even if that story appears a few candles later

Sometimes waiting for 1–2 confirmation candles gives you:

A more confident entry

A safer SL that’s less likely to be hunted

A lighter mindset

And most importantly: placing a trade without feeling like you're gambling

The real story behind a “worth-it” gold entry

Price touches zone once → no rush.

Touches twice → still chill.

Touches the third time + closes a clean rejection candle + structure intact → this is the moment to enter, not early, but comfortable.

3 simple reminders, nothing too philosophical

Being one step late on the chart is better than being one step late in your account

Price touching a zone is just a greeting — confirmation is the real invitation

A good trade is one that doesn’t make you doubt yourself

Wishing you more comfortable, smooth, and effective entries.

Gold Pauses, Not Reverses — Pullback Before the Next ExpansionXAUUSD – 1H KEY POINTS

Technical

Strong impulsive uptrend intact; current move is a healthy pullback.

Price holding above prior breakout → bullish retest structure.

As long as price stays above the support zone ~4,420–4,430, upside remains favored.

Next upside targets sit around 4,525 → 4,570.

Key Levels

Support: 4,420 – 4,430

Resistance / Target: 4,500 → 4,525 → 4,570

Macro / News Impact

USD softness & falling real yields continue to support gold.

Ongoing geopolitical risk + rate-cut expectations keep demand strong.

No risk-off shock → pullbacks are being bought, not sold.

Bias

Buy pullbacks above support.

Trend invalidated only on a clean break below support.