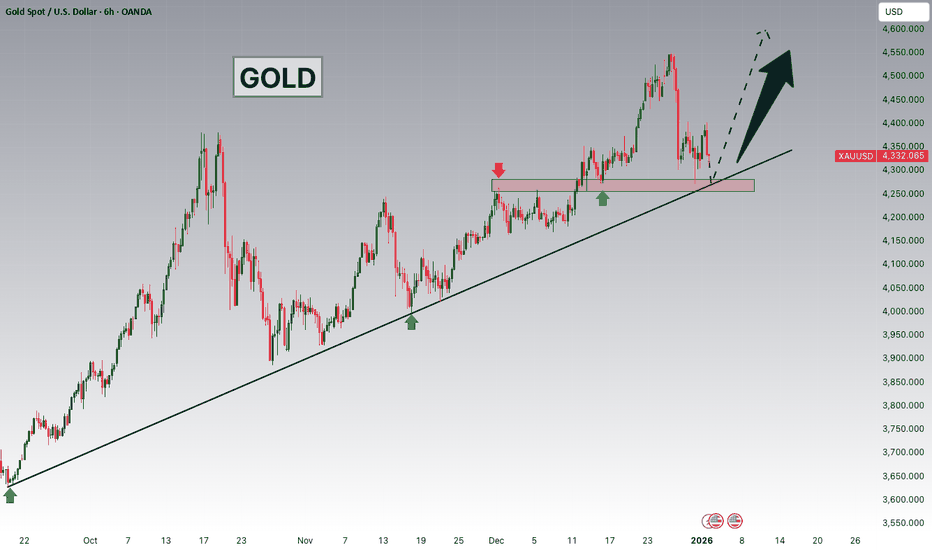

Gold Bullish Outlook | Dollar Weakness & Geopolitical Risks!Hey Traders,

In the coming week, we are closely monitoring XAUUSD (Gold) for a potential buying opportunity around the 4,280 zone. Gold remains in a strong bullish trend and is currently undergoing a healthy corrective pullback, approaching a key trendline confluence and 4,280 support & resistance zone, which could act as a high-probability demand area.

From a macro perspective, the recent weakness in the US Dollar continues to support upside momentum in Gold. Additionally, last night’s escalation of US tensions with Venezuela has increased geopolitical uncertainty, further boosting safe-haven demand for Gold, which strengthens the bullish bias.

As always, wait for confirmation and manage risk accordingly.

Trade safe,

Joe.

Technical Analysis

BTC/USDT: Strong Breakout Above $98K - Is 94K Next? Analysis Summary: Bitcoin is showing significant bullish momentum today. Here is a breakdown of the key timeframes:

Daily Timeframe: A solid Green Candle has been printed, reaching the $90,000 psychological level. What’s important here is the strong volume supporting this move, indicating real buying interest.

4-Hour Timeframe: We have successfully broken the previous resistance at $89,000. Currently, the price is reacting to the $90,438 resistance zone. This minor pullback is healthy after such a breakout.

1-Hour Timeframe (Execution): I am looking for a continuation of the trend. A clean break above $90,354 would be a high-probability signal to open a Long position.

Key Levels: 📍 Resistance: $90,438 / $94,000 📍 Support: $89,000 / $86,800

Conclusion: The overall bias is bullish as long as we stay above the $89k flip zone. Watch for the $90,354 breakout for confirmation.

Risk Warning: Always use a Stop-Loss and manage your risk according to your capital.

GBPUSD is Nearing a Decent Support Area!Hey Traders, in today's trading session we are monitoring GBPUSD for a buying opportunity around 1.33600 zone, GBPUSD is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 1.33600 support and resistance area.

Trade safe, Joe.

USDJPY: High Chance for a Rise 🇺🇸🇯🇵

USDJPY will likely continue growing on Monday,

following a recent breakout of a strong horizontal resistance

on a daily.

Expect a rise at least to 157.6 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

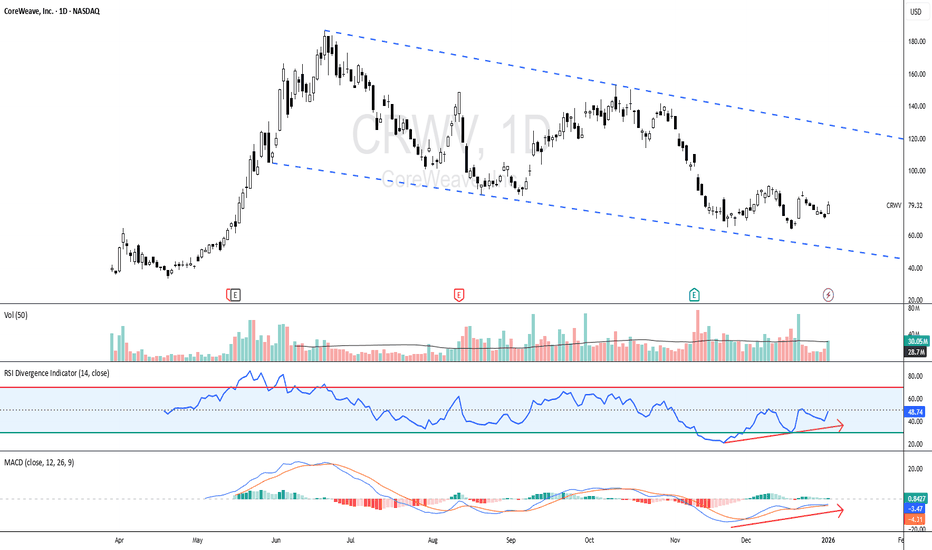

CRWV - Risk is clearly defined, making this a structured setup!CRWV - CURRENT PRICE : 79.32

CRWV is currently trading within a descending channel, indicating a medium-term corrective move after a prior uptrend. Importantly, price is now basing near the lower boundary of the channel, a zone where buyers previously showed interest.

Rather than breaking down aggressively, price action is stabilizing, suggesting selling pressure is starting to fade.

📈 Momentum Is Improving (Key Clue)

While price remains subdued, momentum indicators are telling a different story:

~ RSI (14):

RSI is recovering from lower levels and moving higher while price is still near the channel bottom. This signals improving momentum and early bullish divergence characteristics.

~ MACD:

MACD histogram is contracting, and the lines are starting to curl upward. This typically reflects weakening bearish momentum and the potential for a trend shift.

👉 When momentum improves while price holds support, it often precedes a technical rebound.

📌 This is a technical rebound setup — confirmation comes with continued momentum improvement and price holding support.

ENTRY PRICE : 77.00 - 79.32

FIRST TARGET : 96.00

SECOND TARGET : 110.00

SUPPORT : 63.80 (the low of BULLISH HARAMI pattern - 17 and 18 DECEMBER 2025 candle)

GBP/USD Pulls Back to Demand — Recovery Is ConditionalOn the 1H timeframe, GBP/USD has just completed a sharp bearish impulse, breaking below short-term structure and pushing price down into a well-defined support zone around 1.3420–1.3430. This move followed a clear rejection from the resistance area near 1.3480–1.3500, where prior buying attempts repeatedly failed. The speed and range of the sell-off indicate that sellers briefly regained control after a prolonged period of balance.

From a market structure perspective, the pair has transitioned from a choppy, sideways-to-slightly-bullish environment into a corrective bearish phase. The break below the 34 EMA, followed by price acceptance beneath both the 34 EMA and 89 EMA, signals a loss of short-term bullish momentum. The moving averages are now rolling over, suggesting that upside moves are currently corrective rather than impulsive.

The current support zone is technically significant, as it aligns with prior reaction lows and has previously attracted demand. The initial bounce projected from this area should be interpreted as a technical reaction, not a trend reversal. For any upside recovery to gain credibility, price must reclaim the 1.3480 resistance zone and hold above it with structure and momentum. Without that, rallies remain vulnerable to selling pressure.

In terms of price behavior, the projected path highlights a potential range rotation: a rebound from support, followed by consolidation and a test of resistance. This is consistent with markets that are digesting a recent impulse rather than immediately continuing in one direction. Failure to hold above support would expose the pair to deeper downside continuation, while acceptance above resistance would be required to shift bias back toward expansion.

From a macro context, GBP/USD remains sensitive to relative expectations around Bank of England versus Federal Reserve policy, as well as ongoing USD liquidity dynamics. With no immediate catalyst forcing repricing, the market is more likely to respect technical levels in the short term rather than trend aggressively.

In summary, GBP/USD is currently stabilizing at support after a bearish impulse. The setup favors caution: upside scenarios require confirmation through acceptance above resistance, while downside risk remains present if support fails. Until one of these boundaries is decisively broken, the pair should be treated as range-to-corrective, not directional.

SOLUSDT 4hr – Trade idea Price is currently trading inside a range after a strong impulsive move down.

We are seeing multiple fair value gaps below and above, indicating unfinished business on both sides.

Context

Overall structure remains bearish

Price is consolidating near local support

Liquidity has been swept to the downside

Bullish idea

If price holds this support and reclaims the local fair value gap, a move towards the higher timeframe imbalance becomes likely.

Bearish idea

Failure to hold this area could lead to a continuation into the lower fair value gap, completing the downside move.

Are you expecting a range expansion up or further downside first?

MrC

LINKUSDT: long setup from daily resistance at 13.355Regarding BINANCE:LINKUSDT.P the level of 13.355 (formed on Dec 5) has been identified. Look at how precisely the price hit it today.

However, the asset has already covered nearly twice its average daily range compared to the last two weeks. Due to this, the probability of a breakout drops slightly — the asset might simply lack the energy to break through.

Nevertheless, the clear confirmation of this level means it is definitely worth watching. If a clean entry point forms, specifically with low volatility right in front of the level, that will be a signal for a Long.

The scenario I expect:

Volatility contraction on approach

Momentum stall at the level

Prolonged consolidation │ Довга консолідація

Closing near the level

Closing near the bar's extreme

The chart displays negative factors:

Yesterday's bar closed far from the level

Was this analysis helpful? Leave your thoughts in the comments and follow to see more.

EURUSD is Nearing an Important Support!Hey Traders, in tomorrow's trading session we are monitoring EURUSD for a buying opportunity around 1.17000 zone, EURUSD is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 1.17000 support and resistance area.

Trade safe, Joe.

MES - Descending Wedge at 6,900 | Support Zones Below For Bounce

Executive Summary

Micro E-mini S&P 500 futures (MES1!) trading at 6,900.50 within a descending wedge on the 4H timeframe. After the S&P 500's third consecutive year of gains (+16.56% 1Y), price is consolidating below the 52-week high of 6,995. Multiple support zones below offer potential bounce opportunities. Descending wedge typically bullish reversal pattern.

BIAS: NEUTRAL - Watching Support Zones for Direction

Current Market Data

Current: 6,900.50 (+0.12%)

Day's Range: 6,866.50 - 6,939.75

52-Week: 4,832.50 - 6,995.00

Open Interest: 130.39K

Front Month: MESH2026

Performance:

1W: -1.15% | 1M: +0.51% | 3M: +2.02%

6M: +9.41% | YTD: -0.01% | 1Y: +16.56%

Key Market Context

S&P 500 just completed 3rd consecutive year of gains

50% odds of 4th straight year based on history

Valuation indicators at extreme levels (98th percentile)

Breadth oscillators on sell signals

Equity put-call ratios rising (bearish)

VIX still complacent - bullish for stocks

Fed rate cuts expected in 2026

AAII bears at lowest since Oct 2024

Technical Structure - 4H

Descending Wedge Pattern:

Falling resistance trendline (yellow dashed)

Falling support trendline (yellow dashed)

Wedge narrowing - compression before breakout

Typically bullish reversal (70% break up)

Key Levels:

Resistance:

6,940 - Day's high / immediate resistance

6,970 - Upper resistance (red line)

6,995 - 52-WEEK HIGH

7,000+ - Psychological / breakout target

Support Zones (Purple):

6,860 - 6,880 - Upper support zone

6,800 - 6,820 - Middle support zone

6,720 - 6,760 - Lower support zone

6,675 - Major support (red line at bottom)

SCENARIO ANALYSIS

BULLISH: Wedge Breakout

Trigger: Break above 6,970 with volume

Targets: 6,995 (52-week high) → 7,000+ → 7,100

BEARISH: Test Support Zones

Price tests 6,860-6,880 first support

If fails, drops to 6,800-6,820

Deeper support at 6,720-6,760

Major support at 6,675 (must hold)

My Assessment

Descending wedge at 6,900 with multiple support zones below. Market breadth weakening but VIX complacent. Expect test of support zones before potential breakout. Watch 6,860-6,880 for bounce. Break below 6,675 invalidates bullish thesis.

Strategy:

Watch for bounce at 6,860-6,880 support

Long on wedge breakout above 6,970

Target 6,995 (52-week high), then 7,000+

Stop below 6,675 major support

List your thoughts below!

xauusd1st of all very very happy new year to all of you and specially to those who been profitable on 2025, and big congrets to those who loss and still dont give up, because if you give up you will never be their where you want to be, trading takes a time and patient.

i look at gold and consider if its a breakout or not.// so waiting for aconfirmation and some risk on pullback. my 1st trade will be on monday. i have draw a some line which may help to understand easy in my opinion. let me know what you think about a gold is still bullish or it will fall a bit more before go more higher.

TSLA Cracking Again!TSLA has been this high since November 2021, and it absolutely hates it.

Many people have been caught off guard by TSLA, when it gets this high, hoping and praying it will break out, only to see it collapse!

Rising wedge that has already cracked, 3 weak highs with no follow-through, only to get further and further away from the upper trendline.

Pikers love TSLA markets don't. It’s become a stock story with no story left bc it leads in nothing anymore. It reminds me of GME. All hype, no substance.

As I have said before, look at the chart for the last 4 years to know what it will do next. Nothing! Just drawdown after drawdown anytime it gets this high.

No one should be involved in TSLA.Never invest in Toxic people. They will always burn you in the end. 100% Guaranteed!

I maintain my WARNING! in TSLA

If you enjoy the work:

👉 Drop a solid comment

Let’s push it to 6,000 and keep building a community grounded in raw truth, not hype.

BTC - Ascending Triangle | Liquidity Sweep Before Breakout?

Executive Summary

Bitcoin is trading at $90,529 on the first trading day of 2026, testing the upper resistance of an ascending triangle on the 4H timeframe. Price has rallied +2% today as dip buyers stepped in aggressively. The structure suggests a short-term pullback to sweep liquidity below $88K before breaking the ascending pattern and bursting higher.

BIAS: BULLISH - Short-Term Dip, Then Breakout

Current Market Data

Current: $90,529 (+1.98%)

Day's Range: $88,309 - $90,927

October Peak: $126,000

Key Support: $86,000-$88,000

Fear & Greed Index: 36 (Fear → improving)

What's Driving the Rally

"January Effect" - Tax-loss selling ended, capital redeploying

Whale accumulation visible on-chain

Open interest up 2% to $130B - leveraged bulls entering

$217.82M in shorts liquidated in 24 hours

Meme coins rallying (PEPE +32%) - risk-on returning

Fed rate cuts expected by March

Key News Context

Bitcoin's four-year cycle officially broken - first red post-halving year

ETF effect pulled liquidity forward into 2024

BlackRock deposited 1,134 BTC ($101.4M) to Binance - bearish signal

But whales reducing exchange deposits - bullish signal

Zero Bitcoin obituaries in 2025 - first time since Satoshi era

Technical Structure - 4H

Ascending Triangle Pattern:

Rising support trendline (yellow dashed) - higher lows

Horizontal resistance at $90,000-$90,500 (pink zone)

Price compressing toward apex

Typically bullish breakout pattern (70%+)

Key Levels:

Resistance:

$90,000 - $90,500 - Horizontal resistance (pink zone)

$93,000 - $93,200 - Upper target zone

$100,000 - Psychological level

Support:

$88,000 - CME gap zone ($87,800-$88,000)

$86,000 - $86,500 - Major support zone (pink)

$84,000 - $84,500 - Deep support / liquidity pool

Liquidity Analysis

Heavy liquidation clusters below $88,000

More intense bands near $86,000 and $84,500

CME gap at $87,800-$88,000 - likely to be filled

Thin resistance between $91,000-$94,000 if breakout occurs

SCENARIO ANALYSIS

PRIMARY: Liquidity Sweep Then Breakout

Short-term dip to $86,000-$88,000 to sweep liquidity

Fill CME gap at $87,800-$88,000

Bounce off ascending trendline support

Break above $90,500 resistance

Target $93,000-$94,000, then $100,000

BULLISH: Direct Breakout

Trigger: 4H close above $90,500 with volume

Targets: $93,000 → $94,000 → $100,000

BEARISH: Triangle Breakdown

Trigger: Break below $86,000 and ascending trendline

Targets: $84,500 → $83,000 → $80,000

My Assessment

Ascending triangle at resistance with liquidity pools below. Expect short-term dip to sweep $86K-$88K liquidity, fill CME gap, then break ascending pattern and burst higher. Risk-on sentiment returning, whale accumulation, and January Effect support bullish thesis.

Strategy:

Wait for dip to $86,000-$88,000 zone

Long on bounce with stop below $84,500

Target $93,000-$94,000, then $100,000

Or long on confirmed breakout above $90,500

Drop your comments below on what you think is the NEXT MOVE!

Ethereum Near Major Resistance: Structure StrengtheningEthereum is currently trading just below a strong resistance zone around 3,050–3,070, where multiple prior rejections have occurred. Price is advancing within a clearly defined ascending price channel, indicating controlled bullish pressure rather than impulsive expansion. The recent sequence of higher lows suggests buyers are active, but the lack of strong follow-through near resistance highlights hesitation.

From a technical structure perspective, ETH is transitioning from a recovery phase into a potential range environment. The upper boundary of the rising channel aligns closely with horizontal resistance near 3,030–3,050, creating a confluence zone where profit-taking is likely. Momentum candles are slowing, and price is beginning to overlap, which typically precedes either consolidation or a corrective pullback rather than an immediate breakout.

If ETH fails to reclaim and hold above 3,050 on a clean H1/H4 close, the higher-probability scenario is a rotation back toward the mid-range, with downside targets around 3,000 → 2,970, and potentially deeper into the 2,950–2,930 support cluster. This would keep Ethereum locked in a sideways range, rather than confirming a trend continuation.

From a macro perspective, the environment remains mixed. While expectations of future rate cuts in 2026 provide medium-term support for risk assets, near-term USD stability and restrictive financial conditions continue to cap aggressive upside moves. Additionally, flows into crypto remain selective, favoring short-term rotations rather than sustained breakouts. Without a clear macro catalyst (such as dovish Fed signaling or a strong risk-on impulse), upside attempts near resistance are vulnerable to rejection.

Summary:

Ethereum is technically constructive but not in breakout conditions yet. As long as price remains below the strong resistance zone, the market should be treated as range-bound, with upside capped and pullbacks toward support remaining a valid and healthy scenario. Patience is required until either structure breaks decisively higher—or the range resolves with confirmation.

Gold at a Tipping PointHello Traders,

Gold is currently trading within a short-term recovery structure after forming a clear swing low and establishing a rising support trendline. Price has respected this ascending support well, producing higher lows and signaling that buyers are gradually regaining control following the prior impulsive sell-off.

At the moment, price is pressing into a clearly defined resistance zone. This area previously acted as supply and now represents a critical decision point for the market. The recent bullish push into this zone suggests growing momentum, but continuation is not confirmed until acceptance above resistance is seen.

If price breaks above this resistance and holds, the structure opens the door for upside continuation toward the next higher liquidity levels. In this scenario, the preferred execution is not chasing the initial breakout, but waiting for a pullback that successfully retests the broken resistance as support. This confirms acceptance and provides a cleaner risk-to-reward framework.

Alternatively, failure to hold above the resistance could result in a corrective rotation. A rejection here would likely send price back toward the rising support trendline. As long as this support remains intact, such a move would still be considered a healthy pullback within an emerging bullish structure rather than a reversal.

The bullish outlook is invalidated if price decisively breaks below the ascending support and accepts beneath the recent swing low. That would signal a structural failure and shift the market back into a bearish or neutral regime.

At this stage, Gold is at a decision zone rather than an execution zone. Patience is required. Let price confirm whether it accepts above resistance or rotates back toward support before committing to directional bias.

Share your perspective below.

Bitcoin Is Not Escaping Yet — This Is H2 Accumulation Hello everyone,

On the H2 timeframe, the key focus right now is not an immediate breakout, but the fact that Bitcoin remains locked inside a broad accumulation range, where price continues to rotate between clearly defined support and resistance.

Structurally, BTC has spent an extended period compressing inside the 86,200–90,500 range. Multiple upside attempts toward the upper resistance zone have been rejected, while every pullback into the lower support zone has been absorbed. This repeated rotation confirms balance, not trend, and signals that liquidity is still being built.

From a technical perspective, price is currently holding above the EMA34–EMA89 cluster, which has acted as dynamic support during the recent recovery. The latest dip was defended cleanly and followed by a push higher, forming a support-and-retest structure around the 88,200–88,400 area. This behavior shows that buyers are active, but not yet aggressive enough to force acceptance above resistance.

Importantly, there is no structural breakout at this stage. Highs remain capped below the range top, and price action continues to print overlapping swings, typical of accumulation rather than continuation. The projected path on the chart reflects this well: a shallow pullback to retest support, followed by another attempt higher toward resistance.

Resistance zone: ~90,400–90,600 — range high and breakout trigger.

Mid-range support / retest: ~88,200–88,400 — current decision area.

Major support: ~86,200–86,500 — accumulation floor.

Invalidation: Acceptance back below the EMA cluster would weaken the constructive setup.

Only a clean breakout and sustained acceptance above the resistance zone would confirm that accumulation has completed and open the door for upside expansion. Until then, Bitcoin is not trending — it is absorbing liquidity and preparing, where patience and level discipline remain critical.

Wishing you all effective and disciplined trading.

EURUSD Under Structural StressHello Traders,

On the H1 timeframe, EURUSD is currently trading in a corrective-to-bearish structure after failing to hold above the previously marked resistance zone. Price was repeatedly rejected from this supply area, confirming it as an active distribution zone rather than a continuation base.

Following the rejection, price expanded lower and is now rotating toward the lower range, approaching a clearly defined support zone. The recent downside impulse shows increasing bearish pressure, suggesting that sellers remain in control in the short term.

This support zone now represents a critical decision area. If price stabilizes and holds above this level, a corrective rebound toward the prior intraday targets becomes possible. Such a move would be classified as a pullback within a broader range, not an immediate trend reversal.

However, failure to hold this support — especially with acceptance below the zone — would signal further structural weakness. In that scenario, downside continuation becomes the dominant path, invalidating any short-term bullish recovery expectations.

From a structural perspective, EURUSD is currently not offering a clean entry. Price is transitioning between resistance rejection and support testing. The next directional move will be defined by whether the market defends this support or breaks through it with conviction.

At this stage, patience is required. Let price confirm its reaction at the support zone before committing to directional bias.

Share your view below.

Bitcoin at the Edge: Breakout Incoming or Another Trap $89000BTCUSD H1 chart, price is currently testing a key resistance zone around 88,800 – 89,000, an area that has previously triggered multiple rejections. The recent upward move represents a recovery leg within a broader range, rather than a confirmed breakout.

As price reaches this resistance, buying momentum is clearly slowing, with smaller bullish candles and immediate selling pressure appearing at the zone. This behavior suggests that sellers are still active, and the market has not yet accepted higher prices. Without a strong H1 close above this resistance, the current move lacks technical breakout confirmation.

The more probable short-term scenario is a rejection from resistance, followed by a pullback toward nearby support levels. Initial support is located around 88,200 – 88,000, with a deeper support zone near 87,700, where buyers previously stepped in. As long as price remains capped below resistance, the market structure continues to reflect a range-bound / consolidation environment.

In summary, this is not a confirmed breakout. Bitcoin is trading at a decision area where price must either produce a clean, impulsive close above resistance to confirm continuation, or face rejection and rotate back into the range. Until that clarity appears, bias remains neutral, with focus on price reaction rather than directional anticipation.

Gold Turns at Key Support — Break or Fake Into Resistance?Gold on the H1 timeframe has completed a clean rebound from the major support zone, confirming that buyers are actively defending this area. The sharp rejection from the lows suggests the recent sell-off was corrective rather than the start of a sustained bearish trend.

Price is now recovering above the short-term structure and pushing back toward the key resistance zone around 4,425–4,450. This area is critical, as it previously acted as a strong supply region and aligns with prior breakdown levels. The current move should be treated as a reaction leg, not a confirmed continuation yet.

Two clear scenarios are in play.

Scenario 1: Price holds above the recent pullback level, consolidates, and breaks cleanly through resistance. This would open the path toward higher levels and a potential retest of the upper range and ATH zone.

Scenario 2: Price stalls or rejects at resistance, forming a lower high, which would signal ongoing range behavior and a possible rotation back toward mid-range or support.

In summary, Gold has turned bullish from support , but confirmation depends on acceptance above resistance. Until a clean breakout occurs, the market remains reactive and range-controlled, with resistance being the key decision point.

EURUSD Is Not Reversing — This Is a Pullback Into H1 SupportHello everyone,

On the H1 timeframe, the key focus right now is not the recent bearish candles, but how EURUSD is reacting after rejecting from a descending resistance and pulling back into a well-defined support zone.

Structurally, the market remains capped by a descending resistance trendline, with price consistently forming lower highs beneath it. The most recent push higher stalled precisely at the EMA cluster and the resistance zone, where sellers stepped in aggressively. This rejection confirms that upside attempts are still being sold and that bullish momentum has not yet regained control.

Following that rejection, EURUSD is now rotating lower toward the 1.1720–1.1730 support zone, which has already acted as a strong reaction base in previous sessions. This area is technically important: it marks prior demand and has previously absorbed selling pressure before producing sharp rebounds. The current move lower appears orderly and corrective, rather than an impulsive breakdown.

From a price action perspective, there is no confirmed trend reversal at this stage. The decline into support fits well with a pullback within a broader corrective structure, not a fresh bearish expansion. As long as price holds above the support zone, downside follow-through remains limited.

The projected path on the chart reflects this logic:

A test or sweep of the 1.1720 support zone to check demand

A technical rebound back toward the mid-range

Potential continuation higher toward the descending resistance if buyers regain strength

Only a clean breakdown and acceptance below the support zone would invalidate this pullback scenario and open the door for deeper downside. Conversely, a reclaim above the EMA cluster and descending trendline would be the first signal that bearish pressure is fading and that a larger recovery toward resistance is possible.

Until confirmation appears, EURUSD is not trending aggressively in either direction. It is rebalancing after rejection, and patience around key levels remains critical.

Wishing you all effective and disciplined trading.

Gold Is Not Done Yet — H1 Structure Is Rebuilding for a BreakoutHello everyone,

Intraday trading: Increase

📌 SET UP 1. Timming Sell Zone

XAUUSD SELL ZONE: 4463 - 4466

💰 Take Profit(TP): 4460 - 4455

❎ Stoploss(SL): 4470

Note capital management to ensure account safety

📌 SET UP 2. Timming Buy Zone

XAUUSD BUY ZONE: 4263 - 4266

💰 Take Profit(TP): 4269 - 4274

❎ Stoploss(SL): 4259

Note capital management to ensure account safety

On the H1 timeframe, the key focus right now is not the prior sell-off, but how gold is rebuilding structure after completing a full corrective cycle and reclaiming key dynamic levels. The chart clearly shows a transition from impulsive downside into controlled recovery and re-accumulation.

After the breakdown from the rising channel, gold completed a five-wave bearish impulse into the 4,265–4,280 support zone, where selling pressure was finally absorbed. This marked a structural low, followed by a clean shift in behavior: price stopped expanding lower and began forming higher lows, signaling the end of the markdown phase.

From there, gold entered a corrective bullish sequence, respecting the short-term ascending support trendline. Price has now reclaimed EMA34 and is pressing into the EMA89, which currently aligns with the 4,380–4,400 resistance zone. This confluence makes the current area a decision zone, not a random pause.

Structurally, this move fits a classic ABC recovery:

(A) rebound from the lows

(B) higher-low pullback, holding above support

(C) current push into resistance and EMA confluence

Importantly, this advance has been orderly, not vertical. Pullbacks are shallow, momentum is controlled, and price is holding above prior reaction highs — all characteristics of strength rebuilding, not distribution.

Key levels to watch:

Immediate resistance: 4,380–4,400 (EMA89 + prior support turned resistance)

Bullish confirmation: Acceptance above 4,405–4,420 would open the door for a continuation move toward 4,515–4,520, as projected on the chart

Key support: 4,350–4,365 (trendline + EMA34 area)

Invalidation: A clean breakdown below 4,330 would weaken the bullish recovery structure

Until proven otherwise, gold is not in a bearish continuation phase. It is transitioning from correction into potential expansion, with the next directional clue coming from how price behaves at the current resistance cluster.

Wishing you all effective and disciplined trading.

EURUSD Is Not Reversing — This Is a Support Reaction Hello everyone,

On the H1 timeframe, the key focus right now is not the recent bearish push, but how EURUSD is reacting at a clearly defined support zone and attempting to rebuild structure. Price has already completed a corrective leg down; what matters now is whether demand can hold and fuel a measured recovery.

OANDA:EURUSD sold off into the 1.1720–1.1730 support area, where downside momentum stalled and price began to stabilize. This zone has acted as a reaction base before, and the current candles show absorption rather than continuation, suggesting sellers are losing follow-through at these levels.

Structurally, the market is transitioning from impulsive downside into a corrective recovery sequence. The first objective is a push toward 1.1747, which marks the nearest intraday resistance. A successful reclaim and hold above this level would set up a retest-and-continue move toward 1.1755, followed by 1.1765. These levels align precisely with prior breakdown points, making them natural upside magnets during a correction.

The projected path on the chart reflects this logic clearly:

- Hold above support (1.1720–1.1730) → initiate rebound.

- Reclaim 1.1747 → short-term confirmation.

- Retest and continuation toward 1.1755 and 1.1765.

Only a clean break and acceptance below 1.1720 would invalidate the recovery scenario and reopen downside risk.

Importantly, there is no evidence of aggressive distribution at the lows. Price action remains orderly, and rebounds are developing step by step, which supports the view of a technical pullback resolution, not a trend reversal.

As long as EURUSD holds above the highlighted support, the path of least resistance is a corrective grind higher toward the marked targets, with patience and level discipline remaining key.

Wishing you all effective and disciplined trading.