EURNZD Massive Short! SELL!

My dear friends,

EURNZD looks like it will make a good move, and here are the details:

The market is trading on 1.9707 pivot level.

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 1.9616

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Tecnicalanalysis

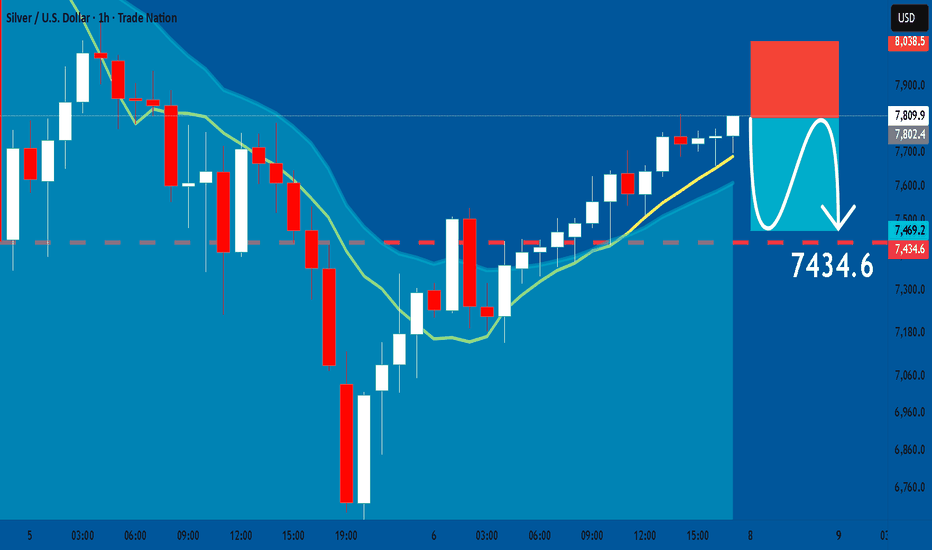

SILVER: Short Signal Explained

SILVER

- Classic bearish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Short SILVER

Entry - 78.099

Sl - 80.385

Tp - 74.346

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

TESLA Massive Long! BUY!

My dear followers,

This is my opinion on the TESLA next move:

The asset is approaching an important pivot point 410.99

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 425.61

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

NATGAS Technical Analysis! BUY!

My dear subscribers,

This is my opinion on the NATGAS next move:

The instrument tests an important psychological level 3.405

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 3.488

My Stop Loss - 3.360

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

US30 My Opinion! SELL!

My dear friends,

Please, find my technical outlook for US30 below:

The instrument tests an important psychological level 50111

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 49609

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURUSD Set To Fall! SELL!

My dear friends,

Please, find my technical outlook for EURUSD below:

The price is coiling around a solid key level - 1.1814

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 1.1802

Safe Stop Loss - 1.1823

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

XAUUSD (H2) – Liam View Rally into supply XAUUSD (H2) – Liam View

Rally into supply | Volatility risk rising

Gold is rebounding from the 4550–4600 demand base, but the broader H2 structure still points to a sell-side environment. The current move higher looks corrective, driven by short covering and liquidity rotation rather than a confirmed trend reversal.

From the chart, price is rotating back toward 4900–5030, a zone where previous distribution and liquidity rest. Unless price can accept above this area, rallies should be treated as sell-side opportunities, not breakout confirmation.

Key technical zones

Major sell zone: 5536 – 5580 (HTF supply)

Near-term reaction zone: 5000 – 5030

Key demand / base: 4550 – 4600

Intraday support: ~4730

Market context

Recent US political headlines and institutional reviews add another layer of headline-driven volatility, increasing the risk of sharp swings and liquidity sweeps. In such conditions, gold often reacts erratically intraday, but higher-timeframe structure tends to reassert itself once the noise fades.

Outlook

As long as price stays below 5030, the bias remains sell-side dominant.

Failure to hold above 4730 would reopen downside risk toward the demand base.

Only a clean H2 acceptance above 5030 → 5100 would neutralise the bearish structure.

Execution note

Avoid chasing momentum in news-driven sessions.

Let price come to levels. Trade the reaction, not the headlines.

— Liam

XAUUSD – Brian | M15 Liquidity Reaction XAUUSD – Brian | M15 Liquidity Reaction & Short-Term Structure

Gold is currently trading within a short-term recovery leg after sweeping downside liquidity earlier in the week. The rebound from the lows shows clear liquidity absorption, but price is now approaching a critical sell-side reaction zone, where sellers previously defended aggressively.

On the M15 structure, price has formed a sequence of higher lows, indicating short-term strength. However, this move is still unfolding inside a broader corrective phase, not a confirmed trend reversal. The upper zone around 5034 – 5067 remains a key SELL liquidity area, aligned with prior distribution and intraday resistance.

From a fundamental perspective, recent news around the US commitment to partial UN payments helped stabilise risk sentiment, but did not create strong directional conviction. This supports the view of range-based trading rather than impulsive continuation.

Key zones to watch:

Sell zone: 5034 – 5067 (liquidity & resistance)

Intraday reaction zone: current consolidation area

Demand support: previous liquidity sweep lows below

➡️ Scenario:

Price may attempt a final push into upper liquidity before facing rejection. Failure to hold above intraday support would open the door for a pullback back into demand.

In this phase, reaction at liquidity zones matters more than prediction. Patience and structure confirmation remain key.

Follow the TradingView channel to stay updated on real-time market structure and liquidity behaviour.

XAUUSD – H1 Outlook: Liquidity Build XAUUSD – H1 Outlook: Liquidity Build While Risk Premium Supports Gold | Lana ✨

Gold is holding firm after a clean rebound from the sell-side liquidity sweep, and the current price action suggests the market is now building structure rather than trending aggressively.

📌 Technical picture (SMC/flow-based)

Price has transitioned from the sell-side sweep into a steady climb, now respecting the upper trendline.

The 4,940–4,970 region is acting as a short-term balance / re-accumulation zone where price is pausing and collecting liquidity.

Above current range, buyside liquidity is visible near the recent highs, with a key magnet around 5,015.

A healthy pullback into 4,920–4,940 would still keep the bullish intraday structure intact and often provides a better re-entry opportunity than chasing highs.

🎯 Scenarios to watch

Bullish continuation: Hold above 4,940–4,970 → reclaim highs → seek liquidity toward 5,015, then extension higher if price accepts.

Corrective dip first: A brief sweep below the range toward 4,920–4,940 → bounce back into the trendline → continuation to highs.

🌍 Macro backdrop (short & relevant)

ETF inflows into oil are rising sharply as US–Iran tensions increase, which typically lifts the geopolitical risk premium. When risk sentiment tightens, gold often benefits as a defensive hedge — supporting the idea that pullbacks may remain corrective, not reversal-driven.

✨ Stay patient, trade the levels, and let liquidity guide the next expansion.

Follow Lana for more intraday updates and share your view in the comments.

EURUSD Break & Retest Setup – Bulls Target 1.1800Strong bullish move from the session low.

Clear higher highs + higher lows forming.

Price now consolidating just under minor resistance near 1.1800–1.1801.

Momentum is steady, not impulsive — looks like controlled accumulation before a push.

🟢 Bullish Scenario

As long as price holds above the 1.1786–1.1790 support zone, structure remains bullish.

That zone aligns with:

Previous breakout area

Intraday demand

Higher-low protection

🎯 Target area: 1.1800 – 1.1801

If buyers break and hold above that, extension toward 1.1810+ becomes realistic.

The triangle/pullback you marked suggests continuation if resistance flips to support.

🔴 Bearish Risk

If price closes below 1.1786, we get:

Structure break

Possible move back toward 1.1775–1.1770

That would invalidate the immediate continuation idea.

📌 Key Insight

This is a break-and-retest style setup.

Best entry logic = buy pullback, not breakout chase into resistance.

💡 Bias

Short-term: Bullish above 1.1786

Invalidation: Clean break below support

Target: 1.1800+

GBPCAD: Bullish Continuation is Highly Probable! Here is Why:

Our strategy, polished by years of trial and error has helped us identify what seems to be a great trading opportunity and we are here to share it with you as the time is ripe for us to buy GBPCAD.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

AUDUSD: Short Trade with Entry/SL/TP

AUDUSD

- Classic bearish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Sell AUDUSD

Entry - 0.6985

Stop - 0.7002

Take - 0.6958

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

CHFJPY Will Collapse! SELL!

My dear subscribers,

My technical analysis for CHFJPY is below:

The price is coiling around a solid key level - 201.99

Bias - Bearish CHFJPY

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 201.09

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

NZDCAD: Bullish Forecast & Outlook

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the NZDCAD pair price action which suggests a high likelihood of a coming move down.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

CADCHF: Bearish Continuation & Short Signal

CADCHF

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short CADCHF

Entry Point - 0.5685

Stop Loss - 0.5689

Take Profit - 0.5677

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPCHF Expected Growth! BUY!

My dear followers,

I analysed this chart on GBPCHF and concluded the following:

The market is trading on 1.0565 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 1.0602

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GOLD Buyers In Panic! SELL!

My dear subscribers,

GOLD looks like it will make a good move, and here are the details:

The market is trading on 4862.6 pivot level.

Bias - Bearish

My Stop Loss - 4893.5

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 4806.5

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

XAUUSD – H4 Technical & Macro OutlookXAUUSD – H4 Technical & Macro Outlook: Liquidity Compression Ahead of Fed Expectations | Lana ✨

Gold is currently trading in a tight compression structure, while macro conditions are beginning to tilt in favour of precious metals. Weak US labour data and a growing probability of Fed rate cuts are putting pressure on the US Dollar, creating an important backdrop for the next move in gold.

At the same time, price action on XAUUSD suggests the market is approaching a key liquidity-driven decision point.

📈 Technical Structure & Price Behaviour

After failing to sustain above the upper supply zone near 5,200–5,300, gold entered a corrective decline and is now trading inside a descending wedge, bounded by falling resistance and rising support.

Price is currently holding around 4,800–4,830, a short-term balance area.

Repeated rejections from descending resistance indicate supply remains active.

At the same time, sell-side liquidity is clearly resting below the structure, near 4,570–4,550.

This behaviour suggests the market is not trending yet, but preparing for a liquidity expansion.

🔍 Key Levels to Monitor

Near-Term Resistance: ~5,070 – 5,130

A key reaction zone aligned with Fibonacci retracement and prior structure.

Compression Pivot: ~4,800 – 4,830

Holding above this area keeps price in consolidation mode.

Sell-Side Liquidity: ~4,570 – 4,550

A likely downside target if the structure breaks lower.

Major Supply (Higher TF): ~5,500

Still the upper boundary for any medium-term bullish continuation.

🎯 Likely Scenarios

Scenario 1 – Liquidity Sweep Lower (Base Case):

If price fails to hold the rising support, gold may dip toward 4,570–4,550 to clear sell-side liquidity. Such a move would likely be corrective, not a trend reversal, especially given the macro backdrop.

Scenario 2 – Bullish Break from Compression:

If price accepts above 5,070–5,130, the descending structure would be invalidated, opening the door for a recovery toward higher resistance zones.

🌍 Macro Context: USD Weakness & Fed Expectations

Recent US labour data has reinforced concerns about economic momentum:

JOLTS job openings fell sharply below expectations.

ADP employment growth slowed significantly.

CME FedWatch now shows a rising probability of a March rate cut, up from earlier in the week.

As a result, the US Dollar Index (DXY) has struggled to extend its weekly gains, trading slightly lower while remaining near recent highs. This environment is typically supportive for gold, especially during corrective phases.

Upcoming NFP data will be a key catalyst and may act as the trigger for the next liquidity expansion.

🧠 Lana’s View

Gold is currently in a waiting phase, balancing between technical compression and shifting macro expectations. The focus should remain on how price reacts at the edges of the structure, rather than predicting direction too early.

Patience is essential here. The next move is likely to be fast and liquidity-driven once the market commits.

✨ Respect the structure, follow the levels, and let the market reveal the next expansion.

#WLFI –Smart Money Is Distributing.. Are You Holding the Bag?

Yello Paradisers! Are you ready for what might be the final phase of a textbook Wyckoff distribution on #WLFI? This setup is unfolding with near-perfect precision — and the window for positioning before a potential breakdown is closing fast.

💎#WLFI is currently displaying a textbook Wyckoff distribution pattern that began with clear signs of buyer exhaustion. A steep parabolic rally marked the Buying Climax (BC), where price action turned aggressive and unsustainable. This was quickly followed by a classic Upthrust After Distribution (UTAD), where price briefly pushed above previous highs — only to reverse sharply, trapping breakout buyers and signaling a major shift in market intent. What followed was even more telling: a clear structural shift from higher highs to a lower low, a classic Sign of Weakness (SOW) indicating the distribution phase was well underway.

💎Most recently, we saw a weak bounce, known in the Wyckoff model as the Last Point of Supply (LPSY). Price attempted to retest the upper supply zone but was quickly rejected to the downside — a strong signal that bears are taking control and the final distribution push may be complete. The UTAD zone now acts as a major resistance level, and as long as price remains below that zone, the path of least resistance remains downward.

💎In terms of key levels, minor support sits around $0.1475. However, a break below that level could accelerate the move down toward the stronger support area at $0.1275 — a level that could trigger emotional selling if breached.

But it never is and never will be a free ride. Make sure you play it smart, Paradisers. Discipline, patience, robust strategies, and trading tactics are the only ways you can make it long-term in this market.

MyCryptoParadise

iFeel the success🌴

GBPUSD: Market Sentiment & Price Action

It is essential that we apply multitimeframe technical analysis and there is no better example of why that is the case than the current GBPUSD chart which, if analyzed properly, clearly points in the upward direction.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPAUD: Long Trading Opportunity

GBPAUD

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long GBPAUD

Entry - 1.9425

Sl - 1.9396

Tp - 1.9483

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPJPY On The Rise! BUY!

My dear followers,

This is my opinion on the GBPJPY next move:

The asset is approaching an important pivot point 212.63

Bias - Bullish

Safe Stop Loss - 212.10

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 213.56

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK