The Elephant Jungle 2/10/26 Page 1Since Friday, February 6th, the Bulls finally started barking back and, more importantly, they followed it up with a bite. As of today, price is up 15.18%. That is not noise, that is presence.

The 1W Internal Demand Range is currently holding as support for the Bulls, but the real question is simple. Is it enough?

Can the Bulls pull the Uno reverse card and flip this month’s candle back to bullish? Can they reclaim price back into the Macro Range and change the entire conversation?

That is going to take real momentum from the Bulls. No shortcuts, no hopium. Still, credit where it is due. After getting trampled by the Bears for almost 5 straight months, the Bulls are not dead. They are alive, breathing, and swinging back.

Now here is the part nobody wants to ignore. The Bulls better hope the Bears did not just step out for a coffee break. If the Bears return with full force, they can easily push price down to sweep the 48.9k low. And if we see a monthly candle close below that level, that is the market clearly telling us that 30k is back on the table.

Tecnicalanalysis

XAUUSD – Medium-Term Rebound Structure ✨

Gold is currently trading within a medium-term recovery phase after defending the lower boundary of the rising channel. Recent price action confirms buyers remain active, with the structure printing higher lows while respecting the ascending trendline.

From a technical standpoint, price is consolidating just below the 5,080–5,100 resistance zone, signalling hesitation rather than weakness. This area aligns with prior reaction highs and short-term sell pressure, making it a key decision point for the next directional move.

🔍 Key technical zones

4,870–4,930: Buy zone aligned with Fibonacci retracement and trendline support. A pullback into this region would represent a healthy correction within the rebound structure.

5,080–5,100: Near-term resistance. Acceptance above this level would confirm continuation.

5,300–5,350: Upper sell zone and trendline test. This area acts as a higher-timeframe liquidity target if bullish momentum expands.

📈 Market structure

The overall structure remains constructive. Current consolidation appears to be a liquidity-building phase before the next expansion. As long as the rising channel holds, downside moves are likely corrective rather than trend-reversing.

🌍 Fundamental backdrop

Gold continues to find support from a weaker US dollar and easing US Treasury yields, as markets price in a higher probability of future Fed rate cuts following softer labour market data. In addition, ongoing gold accumulation by central banks, particularly from emerging markets and China, provides a strong long-term demand base. Persistent geopolitical risks also keep safe-haven flows intact, reinforcing gold’s underlying bullish bias despite short-term volatility.

🧠 Lana’s perspective

Bias remains moderately bullish while price respects the buy zone and rising channel. Patience is key—waiting for either a pullback into value or a clean breakout above resistance offers better risk alignment than chasing price.

✨ Trade the structure, respect the levels, and let liquidity guide the move.

XAUUSD (H2) – Liam Market Structure XAUUSD (H2) – Liam Market Structure

Gold reacting at resistance, upside remains corrective

Gold is currently trading below a cluster of strong resistance, where Fibonacci expansion and psychological levels are aligning. The recent push higher is best viewed as a corrective bounce, not a trend continuation.

🔍 Technical breakdown

Price is capped below strong resistance near 5100, where multiple failed attempts signal weak acceptance.

Above current price, two major sell zones stand out:

5432 – Fibonacci + psychological resistance

5780 – Higher-timeframe extension and swing sell zone

The market is holding above the 4932 buy zone, which acts as short-term support and trendline confluence.

As long as price holds above 4932, a further push toward 5100 → 5432 remains possible. However, this move is still a liquidity-driven rotation into supply, not a confirmed bullish reversal.

🎯 Trading logic (structure first)

Upside: corrective rally into 5100 / 5432 → look for sell-side reactions.

Downside risk: loss of 4932 would invalidate the bounce and reopen downside exploration.

Bias: sell rallies until price proves acceptance above resistance.

🧠 Liam’s view

This is a market trading into resistance, not breaking out.

Let price show its hand at supply before committing.

Patience beats prediction.

Trade the structure.

Respect the levels.

— Liam

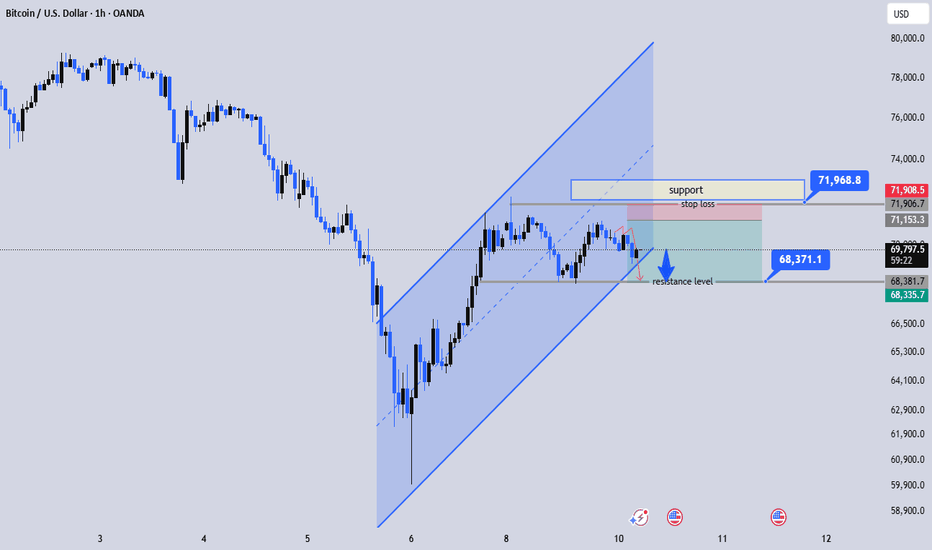

Premium Sell Zone Activated on BTCUSDMarket Structure – BTCUSD (1H)

Price is moving inside a rising channel

Overall short-term structure = bullish correction inside a broader downtrend

We’re currently trading around 69,790

Key reaction zones are clearly marked:

Upper supply / resistance: 71,968 – 71,900 area

Mid support / target zone: 68,371

Channel support below that

🧠 What’s Happening?

Price rallied strongly from the 60K lows and is now compressing near the upper half of the channel.

But here’s the important part:

The 71.9K zone is acting as a major supply area + prior support turned resistance.

That makes it a strong reaction zone.

The chart bias looks like a sell-from-premium idea inside the channel.

📉 Bearish Scenario (Primary Idea)

Entry zone: 71,900 – 71,968

Stop loss: Above 72,200 (clean break above supply)

TP1: 70,000 psychological level

TP2: 68,371 (major support level marked)

Extended TP: Channel support near 66K if momentum builds

This would be a clean liquidity grab above resistance → rejection → move back to mid-channel support.

Risk-reward is solid if entry is near 71.9K.

📈 Bullish Invalidation

If BTC:

Breaks and closes strong above 72.2K

Holds above the supply zone

Then we likely see continuation toward 74K–75K and possibly channel highs.

⚖️ My Technical Take

Right now, this looks more like a corrective rising channel inside a bearish macro structure — which statistically favors:

👉 Sell high in the channel

👉 Target mid or lower channel

Unless buyers show strong breakout volume.

GBPCHF - - Price ObservationWhat I see!

GBPCHF is currently trading above a previously active support area after an extended corrective phase. Price action has slowed and is consolidating, suggesting a pause rather than aggressive continuation in either direction.

Higher price regions remain areas of interest if current structure continues to hold, while a move back below recent lows would shift attention to lower zones.

This chart is shared purely for market observation and educational discussion.

USDCHF: Growth & Bullish Continuation

The analysis of the USDCHF chart clearly shows us that the pair is finally about to go up due to the rising pressure from the buyers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

USDCAD My Opinion! BUY!

My dear subscribers,

This is my opinion on the USDCAD next move:

The instrument tests an important psychological level 1.3568

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.3619

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

NZDCHF Set To Grow! BUY!

My dear friends,

Please, find my technical outlook for NZDCHF below:

The instrument tests an important psychological level 0.4642

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 0.4655

Recommended Stop Loss - 0.4633

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

NZDUSD: Expecting Bearish Movement! Here is Why:

Remember that we can not, and should not impose our will on the market but rather listen to its whims and make profit by following it. And thus shall be done today on the NZDUSD pair which is likely to be pushed down by the bears so we will sell!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GOLD: Short Trade Explained

GOLD

- Classic bearish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Sell GOLD

Entry - 5039.1

Stop - 5052.8

Take - 5016.5

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURUSD A Fall Expected! SELL!

My dear friends,

Please, find my technical outlook for EURUSD below:

The price is coiling around a solid key level - 1.1909

Bias - Bearish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 1.1871

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBPCAD Will Explode! BUY!

My dear subscribers,

My technical analysis for GBPCAD is below:

The price is coiling around a solid key level - 1.8534

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 1.8561

My Stop Loss - 1.8518

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

XAUUSD – Market Outlook | Lana XAUUSD – Market Outlook | Lana ✨

Gold is maintaining a constructive structure as the US Dollar weakens, while market participants remain cautious ahead of delayed key US data. This macro backdrop continues to provide underlying support for precious metals, especially as risk sentiment stays mixed.

From a technical perspective, price is trading inside a rising channel, respecting higher lows and holding above key Fibonacci retracement levels. The recent rebound from the 4,750–4,780 area confirms strong buyer interest, keeping the medium-term bullish structure intact.

🔍 Key zones to watch:

4,980–5,030: Current balance zone where price is consolidating. Acceptance above this area may open the way toward higher liquidity.

5,200–5,220: Near-term resistance aligned with the upper trendline. A reaction here is likely before any continuation.

5,500–5,510: Major higher-timeframe resistance and liquidity target if momentum accelerates.

4,750–4,780: Critical downside support. As long as this zone holds, pullbacks remain corrective rather than bearish.

📈 Market structure insight

The current move appears to be a controlled pullback within an uptrend, suggesting the market is building liquidity rather than reversing. A brief dip toward support could provide healthier structure before the next expansion leg.

🧠 Lana’s view

Bias remains cautiously bullish while price holds above key support. Patience is essential—let the market complete its consolidation and show acceptance at resistance before committing aggressively.

✨ Trade the structure, respect the zones, and let price lead the way.

XAUUSD (H2–H4) – Liam Market ViewXAUUSD (H2–H4) – Liam Market View

Gold at a critical decision zone as macro pressure builds

Gold is currently trading inside a broad corrective range, with price struggling to reclaim key supply after the previous impulsive sell-off. The recent rebound remains technical in nature, driven by short-term liquidity rotation rather than a confirmed trend reversal.

🔍 Technical Structure (from the chart)

Price is capped below the mid-range resistance around 5000–5050, showing weak acceptance.

The 5386 – 5580 zone remains the dominant sell-side supply, aligned with higher-timeframe distribution.

Downside liquidity is clearly defined near 4730 – 4760, acting as the primary demand base.

As long as gold trades below 5386, the structure continues to favour sell-on-rallies rather than breakout continuation.

This keeps the market in a range-to-bearish rotation, where rallies are corrective unless proven otherwise.

🌍 Macro & Cross-Market Context (Today)

Rising expectations of faster BOJ rate hikes are supporting JPY and adding pressure across USD pairs.

At the same time, USD strength remains a headwind for gold, limiting upside expansion.

Ongoing warnings about JPY volatility intervention add uncertainty to FX markets, increasing the probability of liquidity-driven swings across risk assets and commodities.

With global central banks shifting toward tighter policy paths, gold is struggling to sustain upside momentum despite its safe-haven role.

🎯 Scenarios to Watch

Primary bias – Sell the rally

Rejections into 5000 → 5386 favour rotation back toward 4730 liquidity.

Alternative scenario – Range continuation

Price may oscillate between 4730 and 5050 as markets wait for clearer macro catalysts.

Bullish invalidation

Only a clean acceptance above 5386 would shift the bias and reopen upside toward higher supply.

🧠 Liam’s Take

This is a market of levels, not emotions.

Gold is reacting to macro pressure and liquidity mechanics, not trending freely. Until price proves acceptance above supply, patience and level-based execution remain key.

Trade the structure.

Let liquidity show intent.

— Liam

EURUSD 30M Market Structure: Higher Highs & Breakout ConfirmatioClear ascending channel with consistent higher highs and higher lows.

Price respected the lower boundary multiple times (strong bullish structure).

We just got a strong impulsive breakout above recent resistance.

Current price is holding near 1.1853–1.1858 zone.

Momentum is strong. No major bearish rejection yet.

📈 Bullish Scenario (Primary Bias)

As long as price holds above 1.1830 – 1.1826 support zone:

Entry Zone: Around 1.1833 (retest area)

Stop Loss: Below 1.1826

Target Point: 1.1858 – 1.1860

Extended Target: 1.1870+

XAUUSD Bullish Continuation Inside Rising Channel | 5,038 TargetPrice is pushing toward the upper boundary of the channel

Consolidation just below resistance shows accumulation, not rejection

Momentum still favors bulls unless structure breaks

This is a bullish continuation setup, not a reversal setup.

📈 Bullish Plan

✅ Entry Zone

Around current price (4,960–4,970 area) or on minor pullback inside the channel.

🎯 Targets

TP1: 4,972 – 4,975

TP2: 4,984 – 4,993

TP3: 5,018

Extended target: 5,038 (measured channel expansion)

If price breaks and closes strongly above 5,018, we can expect acceleration toward 5,038.

🛑 Stop Loss

Conservative SL: Below 4,944

Safer structural SL: Below 4,932 (support zone)

If price breaks below 4,932 and closes under the channel, bullish structure weakens.

🟡 Key Support Zone

4,932 – 4,945

This is the demand area. If price pulls back into this zone and holds, that’s a stronger buy confirmation.

⚠ What Would Invalidate This?

Strong bearish candle breaking below the ascending channel

30M close below 4,932

Failure at channel high followed by lower low

Overall Bias: Bullish continuation inside ascending channel

This setup looks technically strong — just don’t chase breakouts blindly. Either buy structure or buy pullback.

US30: Market Sentiment & Forecast

The price of US30 will most likely collapse soon enough, due to the supply beginning to exceed demand which we can see by looking at the chart of the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURUSD: Bearish Continuation & Short Trade

EURUSD

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short EURUSD

Entry Point - 1.1814

Stop Loss - 1.1822

Take Profit - 1.1799

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

TESLA: Market of Buyers

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the TESLA pair price action which suggests a high likelihood of a coming move up.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NATGAS: Long Trade Explained

NATGAS

- Classic bullish formation

- Our team expects growth

SUGGESTED TRADE:

Swing Trade

Buy NATGAS

Entry Level - 3.404

Sl - 3.347

Tp - 3.493

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

QQQ The Target Is UP! BUY!

My dear friends,

My technical analysis for QQQ is below:

The market is trading on 609.55 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 620.06

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

SILVER Trading Opportunity! SELL!

My dear followers,

I analysed this chart on SILVER and concluded the following:

The market is trading on 78.099 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 74.855

Safe Stop Loss - 80.157

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

APPLE What Next? SELL!

My dear subscribers,

APPLE looks like it will make a good move, and here are the details:

The market is trading on 278.07 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 269.38

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK