EUR/USD Is Not Trending — This Is a Controlled Liquidity RangeMarket Analysis (EUR/USD – H1)

EUR/USD is currently trading inside a well-defined sideways range, with price repeatedly rotating between support around 1.1760–1.1770 and resistance near 1.1804, while the upper extension at 1.1819 remains untouched. The structure is clear: lower highs capped by resistance and consistent demand absorption at support, signaling balance rather than directional conviction.

From a technical perspective , the repeated rejections at 1.1804 confirm the presence of resting sell liquidity, while buyers continue to defend the support zone aggressively, preventing a breakdown. Volume remains relatively stable without expansion, reinforcing that this is range rotation driven by liquidity sweeps, not trend continuation.

Macro-wise, EUR/USD remains sensitive to USD yield stability and expectations around Fed policy normalization. With no fresh catalyst shifting rate differentials, price action reflects indecision and positioning cleanup, not a new macro leg. Until either USD strength accelerates or Euro demand improves via data surprise, this range is likely to persist.

Key takeaway:

As long as price holds above 1.1760, downside remains limited. However, a clean breakout above 1.1804–1.1819 with volume is required to unlock bullish continuation. Until then, EUR/USD remains a mean-reversion environment, favoring patience over prediction.

Traders

Breakout Ahead or Another Trap Inside the $85K–$90K Range?Bitcoin is currently trading inside a well-defined consolidation range between $85,000 and $90,000, and the latest price action confirms that this zone remains highly respected by both buyers and sellers. On the 1H timeframe, price was aggressively pushed into the upper boundary near $89,500–$90,000, but the immediate rejection shows that sell-side liquidity and profit-taking are still concentrated at this resistance zone. This behavior is typical of a mature range market, where impulsive moves toward the extremes are often faded unless strong follow-through volume appears.

From a technical structure perspective, Bitcoin has failed to establish a clean series of higher highs above resistance. Instead, the market continues to print range highs with weak continuation, while the EMA 34 and EMA 89 remain relatively flat, reinforcing the sideways environment. The lack of trend expansion indicates that momentum is being absorbed rather than extended. As long as price remains below the $90,000 supply zone, upside attempts should be treated as range tests, not trend breakouts.

On the downside, the $86,000–$85,500 support zone remains the key level to monitor. This area has repeatedly attracted buyers and represents the lower liquidity pool of the range. The projected move on the chart suggests that, after rejection from resistance, price may rotate lower toward this support zone to rebalance liquidity. A reaction from this area would likely result in another mean-reversion move back toward mid-range or resistance, keeping the market rotational rather than directional.

From a macro standpoint, Bitcoin is currently lacking a strong catalyst to break out decisively. U.S. macro data remains mixed, with Federal Reserve rate-cut expectations still uncertain, keeping risk assets in a cautious state. Liquidity conditions are stable but not expanding aggressively, which aligns with Bitcoin’s current consolidation rather than trend acceleration. Without a clear shift in monetary policy expectations or ETF inflow momentum, the market is more likely to continue respecting this range.

In conclusion, Bitcoin remains neutral and range-bound, not bearish but also not yet bullish. Traders should remain disciplined, focusing on selling near resistance and buying near support until a confirmed breakout occurs. A daily close above $90,000 with strong volume would invalidate the range and open the door toward higher targets. Until then, patience is key, the market is building structure, not direction.

Bitcoin Is Compressing — The Bigger the RangeBTC/USD (4H) — Market Analysis

Market State

Bitcoin remains range-bound between $85,000 and $90,000, showing classic high-liquidity consolidation after a strong prior move. Price is not trending it is building energy.

Key Zones

Resistance Zone: $89,500 – $90,500

→ Repeated rejections confirm strong supply and profit-taking.

Support Zone: $85,500 – $86,500

→ Buyers consistently defend this area.

Mid-Range Magnet: ~$87,500

→ Price frequently rotates back here, signaling balance.

Structure Insight

EMAs are flattening and overlapping → clear sideways regime.

Wicks on both sides show liquidity sweeps, not directional commitment.

This is range trading, not accumulation completion yet.

Probable Scenarios

Primary (Higher Probability):

Continued range rotation between support and resistance.

Bullish Breakout:

A clean 4H close above $90,500 opens upside toward $92,000+.

Bearish Breakdown:

Loss of $85,500 exposes downside toward $83,000–82,000.

Macro Context

Market is waiting for a catalyst (rates, USD move, ETF flows).

Until macro momentum returns, BTC favors patience over aggression.

Bottom Line

Bitcoin is not weak it’s coiling.

The longer price stays trapped, the more violent the eventual breakout.

Until then, discipline beats prediction.

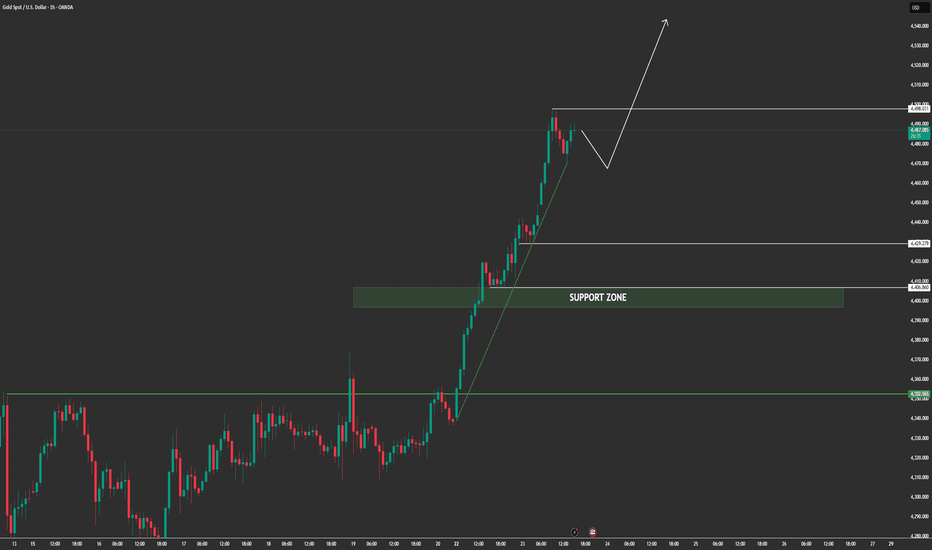

Gold Just Absorbed a Sharp Sell-Off — This Is a PullbackGOLD (XAUUSD) — 1H Market Analysis

Gold remains firmly within a primary bullish structure , despite the recent aggressive bearish candle. The current price action is best interpreted as a technical pullback into dynamic support , not a breakdown. The market is resetting momentum after a strong impulsive leg higher.

1) Market Structure: Bullish Trend Still Intact

The broader structure continues to show:

- Higher highs and higher lows on the intraday trend

- Price still trading above the 89 EMA, which is acting as a medium-term trend support

- The recent sell-off failed to break the last structural higher low

This confirms that buyers remain in control, and the decline is corrective rather than impulsive.

2) Key Technical Levels (Execution Zones)

Support Zone 4,470 – 4,450

Confluence of:

- EMA 89 (~4,476)

- Prior breakout structure

The long lower wick shows strong buy-side absorption at this level.

If this zone holds, the bullish trend remains valid.

Resistance & Upside Targets

- Target 1: 4,505 – 4,520

First reaction zone after the bounce

- Target 2: 4,525 – 4,550

Previous consolidation high

- Target 3: 4,580 – 4,600

Measured move extension + psychological round number

High probability zone for partial profit-taking

3) Momentum & Moving Averages

- EMA 34 has been briefly lost but price is attempting to reclaim it

- EMA 89 remains unbroken → trend bias stays bullish

- Momentum reset is healthy after the prior impulsive rally

In strong trends, price often pulls back to EMA 89 before expanding again.

4) Macro Context: Why Gold Is Still Supported

- Gold strength is not random it is backed by macro tailwinds:

- U.S. Dollar weakness continues to support precious metals

- Expectations of future rate cuts keep real yields under pressure

- Ongoing geopolitical uncertainty sustains safe-haven demand

- Central bank gold accumulation remains structurally supportive

These factors limit downside risk and favor dip-buying behavior rather than trend reversal selling.

5) Scenarios Going Forward

Bullish Continuation (Primary Scenario)

Price holds above 4,450

Reclaims 4,500

Extension toward 4,550 → 4,600

Bearish Invalid Scenario

Clean breakdown and acceptance below 4,450

Would expose 4,420 – 4,400

Only then would the bullish structure be compromised

Final Assessment

This move is a controlled pullback within a strong uptrend, not a bearish signal. As long as price holds above the EMA 89 and structural support, the path of least resistance remains upward.

Smart money buys pullbacks — not tops — and the current zone is exactly where trend continuation setups usually form.

ETH/USD – H1 Technical Analysis DetailETH/USD – H1 Technical Analysis

Ethereum has just delivered a strong impulsive breakout from the consolidation structure around 2,950–2,980, pushing price decisively above the prior balance area and reclaiming the psychological $3,000 level. This move is technically significant because it comes after an extended period of compression, where liquidity was building on both sides of the range.

From a structure perspective, ETH has flipped the former resistance zone around 2,980–3,000 into a new support zone. The impulsive bullish candle was accompanied by a clear volume expansion, confirming that this was not a false breakout but rather active participation from buyers. As long as price holds above this reclaimed support, the bullish structure remains intact.

The next key levels are clearly defined:

Immediate support: 2,980–3,000

Resistance 1: ~3,033

Major resistance: ~3,073

A healthy pullback into the 3,000 zone would be structurally bullish, allowing the market to build a higher low before attempting continuation toward 3,030 → 3,070. A clean break and acceptance above 3,073 would open the door for a broader upside expansion on higher timeframes.

On the macro backdrop, ETH is benefiting from a stable risk-on environment, with crypto sentiment supported by expectations of easier monetary conditions in 2026, declining US real yields, and continued institutional positioning in large-cap digital assets. As long as Bitcoin holds its higher range and the USD remains capped, Ethereum retains upside potential.

Conclusion:

This is no longer a range trade. ETH has shifted into a bullish continuation phase, with pullbacks likely to be corrective rather than trend-reversing. The market now favors buying dips above $3,000, not chasing breakouts blindly, while respecting that failure back below 2,980 would invalidate the bullish scenario.

Gold Just Broke Its Rising ChannelGold (XAUUSD) – H1 Technical & Macro Analysis

Gold has shifted from a bullish continuation structure into a clear distribution and breakdown phase . After trending higher inside a rising channel, price failed to sustain momentum near the upper boundary around 4,520–4,540 , forming lower highs and showing repeated rejection. This behavior signals that buying pressure has been absorbed and smart money has begun distributing positions rather than pushing price higher.

From a technical structure standpoint, the critical signal was the clean break below the rising channel support near 4,480–4,460. This breakdown invalidates the bullish channel and confirms a short-term trend reversal. The subsequent pullback attempts were weak and corrective, indicating that sellers are now in control. As long as price remains below 4,500, the market structure favors downside continuation rather than a bullish recovery.

Key levels to monitor:

Broken support /new resistance: 4,480–4,500

Intermediate support: ~4,420

Major downside target: 4,340–4,300 (previous demand & liquidity zone)

On the macro side, gold is currently pressured by stabilizing US yields and a resilient US dollar , which reduce the attractiveness of non-yielding assets like gold. Additionally, the absence of immediate geopolitical escalation or aggressive dovish signals from the Federal Reserve has cooled safe-haven demand. With markets pricing a more gradual rate-cut path, gold is losing short-term momentum despite its longer-term bullish narrative.

Conclusion:

Gold has transitioned from an uptrend into a bearish corrective phase on the H1 timeframe. Any bounce toward 4,480–4,500 is technically a sell-the-rally opportunity, not a trend reversal, unless price reclaims and holds above the broken channel. Until then, the probability favors continued downside toward 4,420 and potentially 4,300 , where stronger demand may re-emerge.

Ethereum Trapped Between Supply and DemandETH/USD (4H) — Market Analysis

Market Structure

Ethereum is stuck in a broad sideways range after a strong rejection from the upper resistance zone (~3,000–3,050).

The sharp sell-off from the top confirms strong supply pressure at premium prices.

Current price action shows range rotation, not trend continuation.

Key Zones

Strong Resistance: 3,000–3,050

→ Previous rejection zone, heavy sell orders remain.

Mid Resistance: ~2,960–2,980

→ Short-term cap where price repeatedly fails.

Support Zone: 2,880–2,910

→ Buyers defended this area multiple times.

Major Support: 2,760–2,800

→ Last demand before structure turns bearish.

Probable Scenarios

Base Case (Higher Probability):

Price continues sideways consolidation, bouncing between support and resistance to absorb liquidity.

Bullish Scenario:

A clean 4H close above 2,980–3,000 opens upside continuation toward the upper resistance zone again.

Bearish Scenario:

Loss of 2,880 support exposes ETH to a deeper drop toward 2,760–2,800.

Momentum & Trend Context

EMAs are flattening, confirming range conditions.

No impulsive follow-through yet → market is waiting for a catalyst.

Macro Context

Risk assets remain sensitive to USD strength and bond yields.

With no strong bullish macro trigger, ETH is more likely to range than trend aggressively in the near term.

Bottom Line

Ethereum is in balance mode.

Until price clearly accepts above resistance or breaks support, expect choppy, two-sided price action rather than a sustained trend.

This Sideways Move Is the Setup Before ExpansionETHUSD – 4H MARKET ANALYSIS

1. Market Structure

ETH is moving inside a sideways accumulation range after a strong impulsive move.

Price is forming higher lows above the main support, showing absorption rather than distribution.

2. Key Zones

Resistance Zone: ~3,150–3,160

→ Sellers are active, price is being capped.

Primary Support Zone: ~2,880–2,920

→ Strong demand, repeated defenses.

Secondary Support: ~2,770

→ Last line if the range fails.

3. Price Behavior

Repeated range oscillations → liquidity building.

No impulsive rejection from support → buyers still in control.

Compression near support often precedes expansion, not breakdown.

4. Scenarios

Bullish (Preferred):

Hold above 2,900

Break & accept above 3,160

Expansion toward 3,250+

Bearish (Lower Probability):

Clean breakdown below 2,880

Retest 2,770 liquidity zone

5. Conclusion

ETH is not trending yet it is preparing.

As long as price holds above the main support, this range favors upside continuation, not reversal.

Sideways here is accumulation — not weakness.

Most Traders Lose Because They Don’t Know What a Trend Really IsDOW THEORY – THE FOUNDATION OF TREND READING

1. The Market Moves in Trends – Not Randomly

- Price does not move randomly. What looks like chaos is actually structured movement driven by collective behavior.

A trend exists when the market consistently creates:

+ Higher Highs & Higher Lows → Uptrend

+ Lower Highs & Lower Lows → Downtrend

As long as this structure remains intact, the trend remains valid regardless of news, opinions, or emotions.

2. Every Trend Has Three Levels of Movement

- Understanding timeframe hierarchy is critical.

Markets move in three simultaneous layers:

+ Primary Trend – the dominant direction (weeks to months)

+ Secondary Move – corrective phases against the main trend

+ Minor Swings short-term noise

Most traders lose money because they trade against the primary trend, reacting to minor swings and mistaking them for reversals.

3. The Three Phases of a Trend

A trend does not start or end suddenly. It evolves through three psychological phases:

1️⃣ Accumulation Phase

Smart money quietly builds positions

Price moves sideways, volatility is low

Public interest is minimal

2️⃣ Participation Phase

Trend becomes clear

Breakouts occur

Most trend-following profits are made here

3️⃣ Distribution Phase

Late buyers enter emotionally

Volatility increases

Smart money exits

Understanding these phases helps traders avoid buying tops and selling bottoms.

4. Structure Is the Only Valid Trend Confirmation

A trend is not confirmed by indicators alone.

A trend is confirmed when:

+ Price breaks structure in the trend direction

+ Pullbacks respect previous swing levels

+ Momentum continues after corrections

If structure is not broken, there is no reversal only a correction.

This is why predicting tops and bottoms is dangerous.

5. Volume Confirms Direction, Not Timing

Volume does not tell you when to enter — it tells you whether the move is real.

- Rising volume in the direction of the trend = confirmation

- Weak volume during pullbacks = healthy correction

- High volume against structure = warning sign

Price leads. Volume confirms.

6. A Trend Continues Until Proven Otherwise

This is the most ignored rule and the most important.

A trend does NOT end because:

- Price “already went too far”

- Indicators are overbought/oversold

- Social media says “top is in”

A trend ends only when structure breaks and fails to recover.

HOW TO APPLY THIS IN REAL TRADING

Simple, repeatable framework:

- Identify the dominant trend (HH/HL or LH/LL)

- Wait for a correction not a reversal

- Enter only after structure resumes in trend direction

- Place stop-loss where structure becomes invalid

- Hold until the market changes structure

No prediction. No guessing. Just reading what price is already telling you.

FINAL THOUGHT

Most traders don’t lose because they lack indicators.

They lose because they don’t understand trend behavior.

When you stop predicting and start reading structure,

the market becomes clear, calm, and repeatable.

Bitcoin Is Not Weak — It’s Reloading LiquidityBTC/USD – QUICK ANALYSIS (1H)

Structure

Price is rotating inside a high-liquidity range

Recent sell-off did not break structure → liquidity grab

Buyers defended the range low / intraday support

Key Zones

Support: ~87,000 – 86,800

Range Mid: ~88,300

Resistance: ~90,500 – 90,800

Price Behavior

Sharp drop = stop-hunt, not trend reversal

Current bounce shows absorption + acceptance back into range

Outlook

Base case: Range continuation → push back to range high

Bullish trigger: Acceptance above 88.5k

Invalidation: Clean breakdown below 86.8k

Bias

Neutral → Bullish within range

Strategy: Trade the range, not the breakout

“ETH Pullback Is a Reload — Not the TopETH/USD – 1H QUICK ANALYSIS

Technical

Price is forming a higher low after the recent impulsive rally.

Current consolidation sits above short-term demand → bullish continuation structure intact.

Upside path remains open toward the major resistance ~3,160.

Only a clean break below the recent swing low would weaken the setup.

Key Levels

Support: 2,900–2,920

Resistance / Target: 3,050 → 3,160

Macro Drivers

Risk-on sentiment returning into year-end.

USD weakness as markets price Fed rate cuts in 2025.

ETH beta advantage: Ethereum tends to outperform during early risk-on rotations.

Bias

Buy dips, not breakouts.

Trend remains bullish while holding above support.

Gold Isn’t Topping — This Is a PauseGOLD (XAUUSD) – H1

Technical Structure + Macro Context

1. Price Action & Structure

Gold just delivered a strong impulsive breakout, accelerating vertically from the 4,35xx base.

Current price action is consolidating just below the recent high, not rejecting.

This behavior = bullish continuation, not distribution.

Key observation:

➡️ Strong moves don’t reverse at the high — they pause, absorb liquidity, then expand.

2. Key Levels on Chart

Immediate Resistance / Pause Zone: ~4,485 – 4,500

Support Zone (Buyers’ Control): ~4,400 – 4,415

Trend Support: Rising impulse trendline remains intact

As long as price holds above 4,400, the bullish structure remains valid.

3. Market Psychology

Sellers failed to push price back below the support zone.

Pullbacks are shallow and corrective, showing weak selling pressure.

Liquidity is being absorbed above former resistance → acceptance at higher prices.

This is a textbook bullish flag / continuation pause.

4. Macro & Financial Drivers

USD Weakness:

Market expectations are shifting toward slower Fed tightening / future easing bias.

Real yields are stabilizing → USD momentum fades.

Safe-Haven & Inflation Hedge Demand:

Ongoing geopolitical uncertainty keeps risk premium priced into gold.

Central bank gold accumulation remains structurally supportive.

Inflation expectations remain sticky → gold retains long-term demand.

➡️ Macro environment continues to favor gold upside, not aggressive selling.

5. Forward Scenarios

Primary Scenario (High Probability):

Short-term pullback into 4,440–4,460

Continuation toward 4,520 → 4,550 zone

Invalidation:

Clean breakdown and acceptance below 4,400 would pause the bullish cycle.

🧠 Final Takeaway

Gold is not overextended it is repricing higher.

Gold Is Not Overbought — This Is a Controlled ExpansionGOLD (XAUUSD) – SHORT ANALYSIS (1H)

Technical

Strong impulsive uptrend with shallow pullbacks → bullish strength.

Price holds well above EMA34 & EMA89 → trend intact.

Previous resistance (~4,430–4,450) flipped into key support.

Current move = impulse → brief consolidation → continuation.

Key Levels

Support: 4,430 – 4,450

Upside continuation: 4,520 → 4,580+

Macro / News Drivers

USD softness and easing real yields support gold.

Ongoing rate-cut expectations keep dip-buying active.

Persistent geopolitical risk & central bank demand underpin bullish bias.

Bias

Buy the pullbacks, not chase highs.

As long as price holds above the new support, trend continuation remains the base case.

BTC Is Trapped — The Next Move Won’t Be SmallBTCUSD (H4) — Technical & Macro Analysis

1) Market Structure

- Bitcoin is currently trading inside a well-defined range / accumulation zone, capped by a strong Resistance Zone above and supported by a clear Support Zone below.

- Price is still below EMA34 and EMA89, meaning short-term momentum remains neutral-to-weak until these levels are reclaimed.

- Overall structure confirms a sideways market, not a confirmed trend yet.

2) Key Technical Levels

- Key Resistance / Pivot: 88,000 – 89,400

→ Reclaiming this zone is required to shift momentum bullish.

- Mid-range target: 90,000 – 92,000

- Major Resistance (Range High): 94,000 – 95,000

- Local Support: 85,000 – 86,000

- Critical Support (Range Low): 82,000 – 83,000

3) Price Behavior

- Failure to hold above the EMAs shows buyers are still cautious.

- However, repeated defense of the 85k–86k zone suggests accumulation rather than distribution.

- This is classic range behavior: build liquidity → fake moves → real breakout later .

4) Scenarios Ahead

Primary Scenario (Preferred): Sideways Accumulation → Push Higher

- Condition: Price holds above 85k–86k and reclaims 88k–89.4k.

- Target path: 90k–92k → 94k–95k.

Alternative Scenario: Rejection → Retest Support

- If BTC is rejected again at the EMA resistance zone, price may revisit 85k–86k, or deeper toward 82k–83k.

Invalidation: A clean breakdown below 82k–83k would invalidate the range structure and open downside risk.

5) Macro Context

- Fed policy uncertainty keeps risk appetite cautious.

- High bond yields & strong USD continue to pressure risk assets.

- Major US data (CPI, NFP, PCE) often trigger volatility, but price typically compresses before these events.

- Liquidity conditions favor accumulation and consolidation, not impulsive trends.

Summary

BTC remains in a clear consolidation phase. Until a strong breakout occurs, the market should be traded as a range with patience, confirmation, and strict risk management.

What do you think about BTC at this key zone?

EURUSD Is Quiet — But This Structure Signals the Next MoveEURUSD – H1 | Technical + Macro Analysis

Technical Structure

Price has broken the descending trendline and is now stabilizing above the key support zone.

The market is forming higher lows, signaling selling pressure is weakening.

Price is holding near the EMA cluster, suggesting a transition from correction to accumulation.

Upside targets sit at the previous supply zone, where a range breakout could accelerate.

Macro Context (EUR vs USD)

USD momentum is fading as markets price in slower US growth and future rate cuts.

ECB policy remains restrictive relative to growth risks, helping stabilize EUR.

Risk sentiment has improved slightly, reducing defensive USD demand.

Outlook

Primary scenario: Consolidation above support → gradual push toward resistance.

Invalidation: Clean break below the support zone would reopen downside risk.

Bottom Line

EURUSD is no longer trending down it’s building a base.

If macro pressure on USD continues, this structure favors a controlled upside rotation, not a breakdown.

this ETH Structure Usually Breaks Higher — Most Traders Miss ItETH/USD – H1 |

Technical Structure

ETH is holding firmly above the key support zone and both EMA 34 & EMA 89, confirming trend control by buyers.

Recent pullbacks are shallow and corrective, forming higher lows → classic bullish continuation behavior.

Price is compressing below the next resistance around 3,100, indicating energy build-up rather than distribution.

As long as support holds, the structure favors step-by-step expansion, not reversal.

EMA 34 & EMA 89 remain below price, acting as dynamic support.

Macro Context

Risk appetite remains supported as markets price in softer USD conditions and future Fed easing.

ETH benefits from capital rotation into majors, especially when BTC stabilizes.

No major macro headwinds at the moment → momentum stays with trend-following buyers.

Outlook

Primary scenario: Hold above support → consolidation → push toward 3,100+.

Invalidation: Only a clean breakdown below the support zone would delay the bullish continuation.

Bottom Line

ETH is not overextended it’s absorbing liquidity above support.

This structure typically resolves higher, not sideways or lower.

Bitcoin Isn’t BreakingBTCUSD (H1) — Focused Analysis

Market Structure

BTC remains in a clear range-bound market.

Price is rotating between strong support and resistance, not forming a trend.

The prior downtrend has transitioned into accumulation / balance.

Key Zones

Resistance Zone: ~90,500

Support Zone: ~85,200

Current Price: Mid–upper range → liquidity-driven moves dominate.

Liquidity Context

The highlighted area is a high-liquidity price range.

Price is designed to sweep both sides:

Push up to resistance → trap longs

Flush to support → trap shorts

This environment favors range trading, not breakout chasing.

Scenarios

Primary Scenario (High Probability):

Continued sideways oscillation inside the range.

Expect fake breakouts and sharp reversals.

Breakout Scenario (Lower Probability):

Only valid with a strong close above 90,500 + volume expansion.

Until then, upside spikes are likely liquidity grabs.

Summary

Bitcoin is not trending it’s absorbing orders.

Patience is the edge. Wait for confirmation, or trade the range with discipline.

GBPUSD Isn’t Trending — It’s Loading Liquidity for BreaKGBPUSD – H1 Technical Analysis

Market Structure:

GBPUSD is currently trading inside a well-defined moving range, not a trend. Price is rotating cleanly between support and resistance, indicating liquidity-building behavior rather than directional commitment.

Key Zones:

Resistance Zone: ~1.3450–1.3460

Support Zone: ~1.3315–1.3330

Price Action Insight:

Repeated rejections from both extremes confirm a range-bound environment.

Recent higher low inside the range suggests short-term bullish momentum, but still within consolidation.

No strong impulsive breakout candle → market is waiting for confirmation.

Primary Scenario:

Price continues to oscillate inside the range, potentially pushing toward the upper resistance zone to test sell-side liquidity before a decision point.

Alternative Scenario:

A failure near resistance could send price back toward range support for another liquidity sweep.

Conclusion:

GBPUSD is not ready to trend yet. Until a clean breakout with acceptance occurs, the market favors range trading and patience, not aggression.

Bitcoin Isn’t Stuck — It’s Trapping Liquidity BTCUSD – H1 Technical Analysis

Market Structure:

Bitcoin is trading inside a high-liquidity range, holding firmly above the key support zone. The sharp rejection from support followed by strong recovery confirms buyers are still in control.

Key Levels:

Support Zone: ~85,200 — aggressively defended, forming a solid base.

Liquidity Range: 86,800 – 89,500 — price is compressing here to absorb orders.

Resistance Zone: ~90,500 — the next major breakout trigger.

Price Action Insight:

Sideways movement after a strong bounce = accumulation, not weakness.

Higher lows inside the range indicate building bullish pressure.

No heavy selling despite repeated tests → supply is being absorbed.

Primary Scenario:

Continuation toward the 90,500 resistance, followed by a breakout targeting new highs above 91,000 once liquidity is cleared.

Invalidation:

Only a clean breakdown and acceptance below 85,200 would shift the bias bearish.

Conclusion:

Bitcoin is not ranging randomly it is coiling. As long as support holds, the path of least resistance remains upward.

ETH Isn't Chasing— It’s Building Pressure for the Next ExpansionETHEREUM (ETHUSD) – 1H TECHNICAL & MACRO UPDATE

Technical Structure

Price is printing higher highs and higher lows, confirming short-term bullish structure.

The support zone around 2,910–2,920 is holding firmly → buyers are defending pullbacks.

Current price is consolidating above the prior breakout level, a classic continuation setup.

Target 1 (~3,060) acts as the first liquidity objective.

Target 2 (~3,160) aligns with the next major supply zone if momentum persists.

No bearish reversal pattern is present unless price loses the highlighted support zone decisively.

Macro Context

USD strength has stalled, reducing downside pressure on risk assets.

U.S. yields are stabilizing, allowing capital to rotate back into crypto.

Broader market sentiment favors risk-on accumulation, especially for large-cap crypto like ETH.

No negative macro catalyst currently strong enough to invalidate the bullish structure.

Summary

Bias remains bullish while above support.

Expect shallow pullbacks → continuation toward Target 1, then Target 2.

Strategy favors buying pullbacks, not chasing breakouts.

ETH is advancing with structure and macro alignment this is controlled expansion, not excess.

Smart Money Is Executing the Next PhaseGOLD MARKET ANALYSIS (XAUUSD) — DAILY UPDATE

📌 Market Context

Gold continues to follow a Wyckoff schematic, transitioning from Phase B into Phase C/D.

The breakout from the prolonged range confirms active participation from large players, not retail-driven noise.

🔎 Structure & Technicals

Price holds above key moving averages, keeping the primary uptrend intact.

Current advance represents a markup leg, followed by a healthy technical pullback.

Momentum indicators remain elevated → volatility is expected, but no reversal signals are present.

📈 Today’s Scenarios

Primary Scenario:

Mild correction → re-accumulation above new support → continuation toward higher targets.

Alternative Scenario:

Deeper pullback = liquidity test (Spring / Shakeout) before the next leg higher.

Daily Bias:

BUY with structure. Avoid FOMO.

🎯 Strategic Insight

This move is driven by smart money positioning, not emotional buying.

Patience and phase recognition remain the edge.

TODAY’S LIMITED STRATEGY — DEC 22

Intraday Focus: Re-Accumulation

📌 Setup 1 — Timing Sell Zone

Sell Zone: 4418 – 4421

TP: 4415 – 4410

SL: 4425

📌 Setup 2 — Timing Buy Zone

Buy Zone: 4332 – 4335

TP: 4338 – 4343

SL: 4328

⚠️ Strict risk management required. Protect capital first.

Bottom Line:

The trend is bullish.

The edge is patience not speed.

Gold Is Building the Base for a Fresh ATH — Macro Is the FuelXAUUSD – H1 | Technical

Technical Structure

Gold is holding above former resistance, now acting as support — a classic post-breakout consolidation.

Higher lows remain intact, momentum structure is bullish.

Price is compressing just below old ATH, signaling acceptance at high levels, not rejection.

Macro Drivers Supporting a New ATH

US Dollar weakness: Expectations of rate cuts and slowing US growth continue to pressure USD.

Falling real yields: This directly supports gold as a non-yielding asset.

Central bank demand: Ongoing accumulation from global central banks keeps long-term demand strong.

Geopolitical & macro uncertainty: Sustains safe-haven flows into gold.

Scenario Outlook

Primary: Short consolidation → breakout → New ATH expansion.

Pullbacks: Any retracement toward previous breakout levels is likely buy-the-dip, not trend reversal.

Bottom Line

Gold is not chasing highs it is building value above resistance.

With macro conditions aligned, the probability favors a clean breakout into a new all-time high rather than a major correction.

How Smart Money Trap Retailer 22 Dec 2025This video explains how smart money traps retail traders by focusing on how institutional participants think and operate as a coordinated group rather than as individuals. The discussion highlights how liquidity is created around obvious price levels, how collective positioning works, and why retail traders often react emotionally while smart money plans strategically.

The objective of this video is to build awareness about smart money behavior, team-based execution, and liquidity-driven market movement, helping viewers understand market dynamics from a learning perspective rather than a signal-based approach.