KHC The Kraft Heinz Company Options Ahead of EarningsAnalyzing the options chain and the chart patterns of KHC The Kraft Heinz Company prior to the earnings report this week,

I would consider purchasing the 25usd strike price Calls with

an expiration date of 2026-3-20,

for a premium of approximately $0.67.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Trading-course

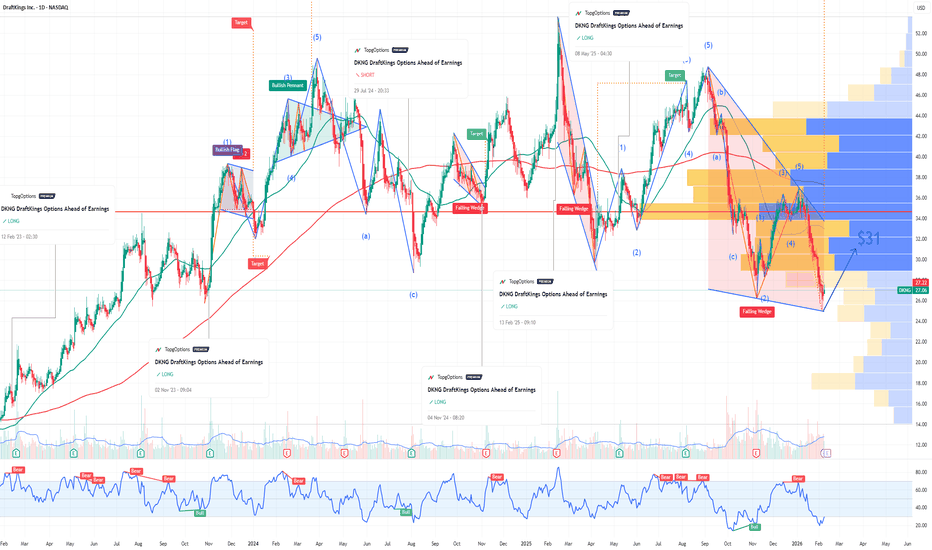

DKNG DraftKings Options Ahead of EarningsIf you haven`t bought DKNG before the rally:

Now analyzing the options chain and the chart patterns of DKNG DraftKings prior to the earnings report this week,

I would consider purchasing the 31usd strike price Calls with

an expiration date of 2026-3-6,

for a premium of approximately $0.80.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

PINS Pinterest Options Ahead of EarningsAfter PINS touched the price target:

Analyzing the options chain and the chart patterns of PINS Pinterest prior to the earnings report this week,

I would consider purchasing the 23usd strike price Calls with

an expiration date of 2026-6-18,

for a premium of approximately $1.77.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

AMAT Applied Materials Options Ahead of EarningsIf you haven`t bought AMAT before the rally:

Now analyzing the options chain and the chart patterns of AMAT Applied Materials prior to the earnings report this week,

I would consider purchasing the 330usd strike price Calls with

an expiration date of 2026-3-20,

for a premium of approximately $25.00.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

QNT Quant Cryptocurrency Buy AreaQNT Quant is not a bad project, but still not a buy for me!

In my opinion, QNT (Quant) crypto appears to address a significant challenge in the blockchain space by focusing on bridging disparate blockchains. The ability to create multi-chain applications or mApps using Quant seems promising, as it enables enhanced usability and communication between different blockchain networks. This is particularly crucial in the cryptocurrency landscape, where interoperability and seamless connectivity among various projects and platforms can greatly benefit the industry as a whole. By facilitating cross-blockchain communication, Quant has the potential to unlock new possibilities for developers and users, fostering innovation and efficiency within the decentralized ecosystem.

I have a large buy area in which I'm willing to average down if it`s the case: $41 - $71.

looking forward to read your opinion about it.

TTWO Take-Two Interactive Software Options Ahead of EarningsIf you haven`t bought the dip on TTWO:

Now analyzing the options chain and the chart patterns of TTWO Take-Two Interactive Software prior to the earnings report this week,

I would consider purchasing the 160usd strike price Puts with

an expiration date of 2027-1-15,

for a premium of approximately $7.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

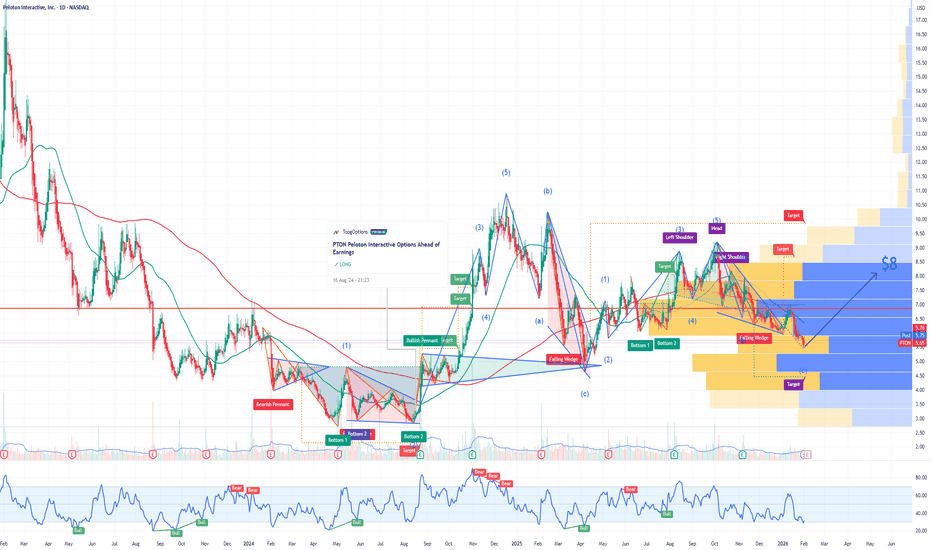

PTON Peloton Interactive Options Ahead of EarningsIf you haven`t bought the dip on PTON:

Now analyzing the options chain and the chart patterns of PTON Peloton Interactive prior to the earnings report this week,

I would consider purchasing the 8.00usd strike price Calls with

an expiration date of 2026-7-17,

for a premium of approximately $0.53.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

PYPL PayPal Holdings Options Ahead of EarningsIf you haven`t bought PYPL before the previous rally:

Now analyzing the options chain and the chart patterns of PYPL PayPal Holdings prior to the earnings report this week,

I would consider purchasing the 100usd strike price Calls with

an expiration date of 2028-1-21,

for a premium of approximately $3.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

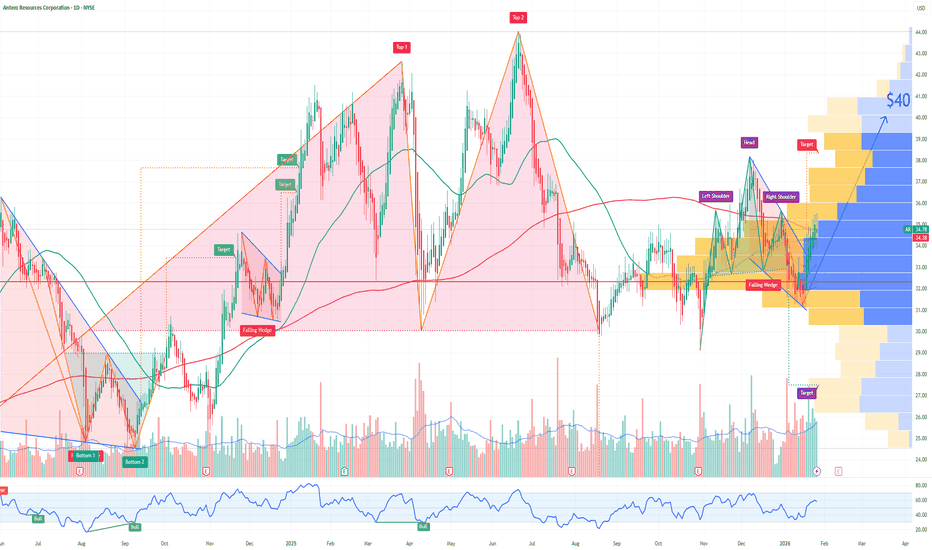

AR Antero Resources Bullish Bets in the Options Market! PT: $40Macro Catalyst: Winter Storm Fern:

The severe storm has disrupted U.S. gas supply, cutting production by 9–15% and boosting demand. For AR, focused on Appalachian gas, this spells direct upside as exports and heating needs spike.

Technicals:

AR held support above $34, with recent highs at $35.51. Volume topped 3.69M shares. A bullish pennant pattern suggests a breakout past $35.50–36 could target $37–38, accelerating to $40 post-earnings. EPS growth hit +472% Q/Q, limiting downside (support at $32–30).

Options Flow: Heavy Bullish Bets:

Sentiment screams bullish: $105M call premiums vs. minimal puts, volumes 6.8x daily average. Key unusual activity on long-dated calls:

Massive blocks on Feb 2026 $37 strikes (35k+ contracts, $2.6M–$8.6M premium)

Mar 2026 $38/$39 strikes with sweeps (40k/3k contracts)

Recent Mar $39 calls at $0.85

IV at 41–48%, high heat score signals aggressive upside plays. Dark pool blocks (e.g., 1.17M shares ~$40M) show smart money accumulating quietly.

Analyst Consensus: Strong Buy with Upside!

15 analysts rate Buy overall (9 Buy, 7 Hold, 2 Strong Buy), average target $44.33 (~29% upside). Wells Fargo at $46, Siebert at $48; optimists see $60. Stable BBB- ratings from Fitch/S&P. Expect ~$500M FCF boost from recent acquisitions like HG Energy.

Outlook: $40 Feasible!

Volatility in gas prices and post-storm corrections are risks, plus options decay without quick moves.

But with insider buying, earnings positioning, and flow momentum, $40 looks realistic post-report – a ~16% gain aligning with key strikes!

MSFT Microsoft Corporation Options Ahead of EarningsIf you missed buying MSFT when they took a 49% stake in OpenAI:

Nor sold the recent double top:

Now analyzing the options chain and the chart patterns of MSFT Microsoft Corporation prior to the earnings report this week,

I would consider purchasing the 475usd strike price Calls with

an expiration date of 2026-2-20,

for a premium of approximately $14.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

STX Seagate Technology Holdings Options Ahead of EarningsAnalyzing the options chain and the chart patterns of STX Seagate Technology Holdings prior to the earnings report this week,

I would consider purchasing the 357.50usd strike price Puts with

an expiration date of 2026-1-30,

for a premium of approximately $17.90.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

NOW ServiceNow Options Ahead of EarningsIf you haven`t bought NOW before the rally:

Now analyzing the options chain and the chart patterns of NOW ServiceNow prior to the earnings report this week,

I would consider purchasing the 155usd strike price Calls with

an expiration date of 2026-3-20,

for a premium of approximately $3.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

2026 Price Target for SPY: $790 – Why the S&P 500 Could Soar 15%If you haven`t bought the dip on SPY last year:

Why my Price Target is $790 for SPY? Key Drivers for 2026!

Earnings Growth Acceleration:

Analysts expect S&P 500 EPS to grow 12–15% in 2026 (Goldman Sachs: 12%; FactSet consensus: ~14.9%). This builds on the AI-driven productivity boom and resilient consumer spending. If AI adoption accelerates (as seen in Meta, Nvidia, and Microsoft earnings), we could see 15–18% EPS growth—pushing multiples higher in a low-rate environment.

Fed Policy Tailwinds:

With inflation cooling (core PCE at ~2.8% in November, in line with expectations) and the economy strong (Q3 2025 GDP revised to +4.4%), the Fed is likely to deliver 1–2 more rate cuts in 2026. Lower rates support valuations and boost corporate borrowing/profits—classic bull-market fuel.

Geopolitical & Policy Clarity:

Trump's recent backtrack on aggressive tariffs (U-turn on 10–25% threats to NATO allies and Greenland deal) has eased fears. Combined with potential fiscal stimulus and deregulation, this creates a pro-growth backdrop. Midterm elections could add volatility, but history shows markets often "pump" post-election.

Valuation Expansion Potential:

The forward P/E is ~22x—elevated but justified by AI productivity gains. If earnings beat expectations and rates fall, multiples could stretch to 24–25x (similar to past tech-led cycles), supporting my higher target.

Comparison to Wall Street ConsensusWall Street targets for the S&P 500 end-2026 range widely:

Conservative: Bank of America ~7,100 (3–4% upside)

Average: ~7,269–7,600 (6–11% upside)

Bullish: Oppenheimer 8,100; Deutsche Bank 8,000; Goldman Sachs ~12% total return

My $790 SPY target sits on the bullish side (~15% upside), assuming stronger-than-expected earnings and policy support. It's not moonshot territory (some outliers see 8,000+), but it requires the rally to broaden beyond Big Tech.

Risks to Watch:

Tariff resurgence or trade wars could cap gains.

Inflation reacceleration might delay Fed cuts.

AI spending disappointment → valuation compression.

Volatility spikes around elections or macro data.

Still, the base case remains bullish: resilient economy, AI tailwinds, and supportive policy. SPY at $790 would mark another strong year in this bull run.

LAES SEALSQ Corp Options Ahead of EarningsAnalyzing the options chain and the chart patterns of LAES SEALSQ Corp prior to the earnings report next week,

I would consider purchasing the 5usd strike price Calls with

an expiration date of 2027-1-15,

for a premium of approximately $0.62.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

INTC Intel Corporation Options Ahead of EarningsIf you haven`t bought the dip on INTC:

Now analyzing the options chain and the chart patterns of INTC Intel Corporation prior to the earnings report this week,

I would consider purchasing the 48usd strike price Calls with

an expiration date of 2026-3-20,

for a premium of approximately $2.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

MU Micron Technology Options Ahead of EarningsIf you haven`t bought MU before the rally:

Now analyzing the options chain and the chart patterns of MU Micron Technology prior to the earnings report next week,

I would consider purchasing the 247.5usd strike price Calls with

an expiration date of 2025-12-19,

for a premium of approximately $8.10.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

FUBO: A Hidden Gem in 2026 – Disney Merger’s Overlooked ValueIf you haven`t bought FUBO before the merger:

As we enter 2026, FuboTV Inc. (FUBO) stands out as a high-conviction bullish pick in the streaming sector, trading at a deeply undervalued ~$2.67 per share with a market cap around $900 million.

Following its transformative merger with Disney's Hulu + Live TV assets, which closed in October 2025, FUBO is primed for significant synergies that could drive explosive growth this year.

With Disney holding a ~70% stake, the combined entity (NewCo) boasts ~6 million subscribers, positioning it as the sixth-largest pay-TV provider in the U.S. and setting the stage for a potential 4x+ upside if execution delivers.

The merger’s rationale is clear: FUBO’s sports-focused platform complements Hulu’s content library and Disney’s ecosystem (Disney+, ESPN+).

Key catalysts in 2026 include full integration by mid-year, which could slash content costs (currently 73% of revenue) through shared deals and boost average revenue per user (ARPU) from ~$76 to $90+ via targeted ads and bundling.

Adding to the bullish case, unusual options activity signals institutional confidence. In early January 2026, aggressive buying of $10 strike calls expiring January 2027 (over 1,500 contracts at ~$0.21) reflects bets on a breakout to $10+ – a ~270% jump from current levels.

This deeply out-of-the-money positioning screams lottery play, but it’s backed by real potential: if synergies materialize, FUBO could attract a full buyout from Disney to consolidate control, offering a premium of $8–12 per share, similar to ongoing media consolidations like Warner Bros. Discovery.

Risks exist – integration delays or subscriber churn could weigh on sentiment – but at this price, the asymmetry favors bulls.

If 2026 brings relaxed antitrust under Trump and a streaming boom, FUBO could triple or more. This is a speculative gem for patient investors eyeing the next big media winner.

JBL Jabil Options Ahead of EarningsIf you haven`t bought JBL before the rally:

Now analyzing the options chain and the chart patterns of JBL Jabil prior to the earnings report this week,

I would consider purchasing the 220usd strike price Puts with

an expiration date of 2025-12-19,

for a premium of approximately $8.45.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

DRI Darden Restaurants Options Ahead of EarningsIf you haven`t bought DRI before the rally:

Now analyzing the options chain and the chart patterns of DRI Darden Restaurants prior to the earnings report this week,

I would consider purchasing the 180usd strike price puts with

an expiration date of 2025-12-19,

for a premium of approximately $3.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Are You a Trader Seeking Clarity and Market Mastery?Are you a trader who wants clarity, accuracy, and real mastery over the markets?

Do you want to understand the deeper principles behind price movement — not just follow indicators?

If yes — Welcome. You’re exactly where you need to be.

I’m Niraj M Suratwala, a dedicated practitioner and mentor of W.D. Gann Theory.

For years, I’ve focused on studying, decoding, and practically applying:

✔ The Law of Vibration

✔ Time–Price Cycles

✔ Market Geometry

✔ Predictive price structures used by W.D. Gann

My mission is simple:

To help traders understand the market scientifically, logically, and precisely — exactly as Gann intended.

📚 What You’ll Get in My Upcoming TradingView Ideas

In this series, I will be sharing:

🔸 Simple and clear breakdowns of Gann concepts

🔸 Real chart examples

🔸 Practical implementation techniques

🔸 Time, price, angles & vibrations analysis

🔸 Actionable insights you can immediately start applying

This is not about shortcuts or magic indicators —

This is about understanding the natural laws that govern market movement.

🚀 Let’s Begin This Journey

This introduction is just the beginning.

If you truly want to strengthen your trading with Gann’s timeless principles —

don’t miss the upcoming ideas.

Markets follow natural laws.

Let’s decode them together.

BBAI BigBear ai Holdings Options Ahead of EarningsIf you haven`t bought BBAI before the massive rally:

Now analyzing the options chain and the chart patterns of BBAI BigBear ai Holdings prior to the earnings report this week,

I would consider purchasing the 3usd strike price Calls with

an expiration date of 2025-12-19,

for a premium of approximately $1.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

QURE uniQure Options Ahead of EarningsAnalyzing the options chain and the chart patterns of QURE uniQure prior to the earnings report this week,

I would consider purchasing the 15usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $2.32.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Bullish Thesis for INTC Intel Stock in 2025If you haven`t bought INTC before the previous earnings:

Now Intel INTC is positioned for a potential turnaround and upside by the end of 2025, driven by strategic leadership changes, foundry business expansion, AI innovation, and favorable geopolitical dynamics. Here’s why INTC could head higher this year:

1. Leadership Transformation and Strategic Vision

The appointment of Lip-Bu Tan as CEO in March 2025 has injected new optimism into Intel’s prospects. Tan is a respected semiconductor industry veteran, and his arrival was met with a 10% jump in INTC’s share price, reflecting renewed investor confidence in the company’s direction.

2. Foundry Business Expansion and Government Support

Intel’s pivot toward a foundry-centric model is gaining momentum. The company is leveraging its U.S.-based manufacturing footprint to attract domestic and international clients, especially as geopolitical tensions and trade restrictions make U.S. chip production more attractive.

There is speculation about strategic partnerships, such as TSMC potentially acquiring a stake in Intel’s foundry operations, which could accelerate technology transfers and client wins.

The U.S. government is likely to continue supporting domestic semiconductor manufacturing through incentives and tariffs, directly benefiting Intel’s foundry ambitions.

3. AI and Next-Gen Product Launches

Intel is aggressively targeting the AI and data center markets. The upcoming Jaguar Shores and Panther Lake CPUs, built on the advanced 18A process node, are set for release in the second half of 2025. These chips will be available not only for Intel’s own products but also for external clients like Amazon and Microsoft, expanding the addressable market.

Intel’s renewed focus on AI accelerators and competitive cost structures could help it regain share in high-growth segments.

4. Financial Resilience and Market Position

Despite recent setbacks, Intel remains a dominant player in the PC CPU market and continues to generate substantial revenue, outpacing some key competitors in the latest quarter.

Analysts have revised their short-term price targets upward, with some projecting INTC could reach as high as $62—a potential upside of over 170% from current levels.

Forecasts for 2025 suggest an average price target in the $40–$45 range, with bullish scenarios pointing even higher if execution on foundry and AI strategies meets expectations.

5. Technical and Sentiment Factors

While technical analysis currently signals caution, the $18.50–$20 zone has provided strong support, and any positive news on foundry contracts or AI wins could catalyze a breakout from current consolidation patterns.

Market sentiment has shifted more positively following the CEO change and strategic announcements, suggesting the potential for a sustained rebound if Intel delivers on its promises.

In conclusion:

Intel’s combination of visionary leadership, foundry expansion, AI innovation, and favorable geopolitical trends sets the stage for a potential stock price recovery by the end of 2025. With analyst targets and investor sentiment turning more bullish, INTC presents a compelling case for upside as it executes its turnaround strategy

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.