USD/JPY Technical Analysis (4H Chart)USD/JPY Technical Analysis (4H Chart)

USD/JPY is currently consolidating around 154.00, after a strong bullish impulsive move that broke structure (BOS) above 153.00. The pair is now reacting to the equal highs (EQH) zone near 154.50, which acts as a liquidity area.

📊 Market Context:

The recent BOS confirms a bullish structure.

Price is now in the premium zone, suggesting limited upside potential before a pullback.

The RSI/Stochastic show overbought conditions, indicating possible short-term exhaustion.

🎯 Key Levels:

Resistance / Liquidity Zone: 154.40–154.60 (EQH area – potential for liquidity grab and rejection)

Support / Re-entry Zone: 152.00–152.50 (Equilibrium + previous demand + EMA confluence)

Structure Confirmation: BOS at 153.00 remains valid for bullish bias.

🧭 Trade Scenarios:

Short-term Sell Setup:

Wait for rejection at 154.40–154.60 (EQH).

Target 153.00 → 152.50.

SL above 154.80 (liquidity sweep protection).

Continuation Buy Setup:

If price retests 152.50–152.00 equilibrium zone and forms bullish SMC confirmation.

Target new high above 154.60.

🧠 Pro Tip:

USD/JPY is heavily influenced by U.S. yields and DXY. If DXY weakens near its resistance zone, expect USD/JPY to correct lower before any continuation

Tradingview

TradeCityPro | Bitcoin Daily Analysis #207👋 Welcome to TradeCity Pro!

After a short break, let's get back to the daily Bitcoin analysis. The market is still in a very large range box.

⏳ 1-Hour Timeframe

Currently, Bitcoin is recovering after the drop to the 106319 level and has moved up to 110803.

✅ Today is Saturday, and as you can see, the market volume has dropped significantly. It seems that the market may range until tomorrow afternoon and won't move much upwards, with the main movement starting next week.

⚡️ The triggers we have for opening positions right now are:

For long: 110803

For short: 108844 and 106319

💥 Overall, Bitcoin is in a very large range box between 106319 and 115808, and as long as the price stays between these two levels, I will open my positions with very low risk.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

ASPN - cup, handle, and maybe the moonAspen Aerogels (ASPN) shows a textbook “cup and handle” pattern on the daily chart. The stock broke above the MA50 and MA200, forming a golden cross - a clear signal of trend reversal. The buy zone sits around 7.4–7.8 , where price has twice found support. Holding above 8.0 keeps the door open toward 11.3, 13.7, and possibly 16.0 - key supply levels from previous distribution.

On the fundamental side , ASPN benefits from strong interest in energy-efficient materials and aerogels used in green construction and EV insulation. With US policy support for clean tech, the company may catch a new growth wave.

Tactically , as long as price stays above 7.8 , the setup remains bullish. Break above 9.0 confirms further upside, while a drop below 7.0 cancels the pattern.

Every cup looks perfect until someone shakes the table - let’s see if this one stays steady.

SILVER 4H - double top before the dropAfter a strong rally, silver retested the 49.0–49.5 area aligning with the key 0.618 Fibonacci level. On the 4H chart, we see a clear double-top pattern with falling volume and oscillator divergence. Price already broke below the short-term trendline and failed to hold above resistance - a classic sign of fading bullish momentum.

Fundamentally, silver faces pressure as the dollar stabilizes and rate-cut expectations fade. Industrial demand from Asia is cooling too, reducing the “safe-haven” appeal.

Tactically, while price stays below 49.5, the path of least resistance is down toward 43.8 and possibly 41.1 - key accumulation zones. A breakout above 50.0 would cancel the bearish setup.

Every silver rally ends the same way - right when everyone starts to believe it’ll never end.

Will Ethereum’s tight range lead to a breakout? | Day 34☃️ Welcome to the cryptos winter , I hope you’ve started your day well.

⏰ We’re analyzing BTC on the 1-Day timeframe .

👀 Ethereum on the daily timeframe. Ethereum is currently inside a box-like structure in a trading range format. The top of this trading range is in the $4,161 area, and the bottom of this trading range is in the $3,801 price area, where by breaking these zones, Ethereum can start a stronger and more impulsive leg of movement.

🧮RSI oscillator, which has now formed two important oscillation zones for us — one around 54, which overlaps with our long trigger, and the other around 40, which overlaps with our short trigger. The fluctuation limit crossing these zones can give more momentum to Ethereum’s next move on the daily timeframe.

🕯 Ethereum’s volume, after the flash crash the market experienced, has increased sharply, but the tendency has been pushed toward selling pressure, which has caused Ethereum’s corrections to always come with selling pressure.

📈 For Ethereum positioning, the specified zones have high price action validity, where you can set alerts so that if the price reaches these zones, you can open a position. Or, in the multi-timeframe, you can find the identified support and resistance zones and open positions with lower risk around these areas, moving toward anticipating higher or lower levels, so that in each level, you can add some risk to your position.

❤️ Disclaimer : This analysis is purely based on my personal opinion and I only trade if the stated triggers are activated .

Has Bitcoin already priced in its next move ? | Day 56☃️ Welcome to the cryptos winter , I hope you’ve started your day well.

⏰ We’re analyzing BTC on the 1-Day timeframe .

👀 Bitcoin on the daily timeframe. After the flash crash it experienced, Bitcoin is almost building a box with a top at $114,559 and a bottom at $106,431, which by breaking these areas, it can get out of this trading range and give us a position.

The noteworthy point in the recent days is the Monday meeting between Trump and the President of China, which can determine the destiny of the market and give it a good direction.

🧮 The RSI oscillator, two key zones have formed for us in the areas of 54.5 and 36, and by the fluctuation limit crossing these areas, the next move of Bitcoin can begin.

🕯 Bitcoin’s volume on the daily timeframe has increased sharply after recording a new all-time high, and this has been a tendency toward increasing selling pressure. In the image, it is completely clear that you can see exactly what happened to the market after the flash crash it experienced.

📈 To take a position with this structural style that we currently have, you can refer to the multi-timeframe analysis of Bitcoin and extract the long and short position triggers, and if Bitcoin gives you an entry, enter the position around the anticipated top or bottom with low risk so that later you can add more volume to your position at higher or lower levels.

❤️ Disclaimer : This analysis is purely based on my personal opinion and I only trade if the stated triggers are activated .

FLNC 1D – The power comeback!On the daily chart, Fluence Energy (FLNC) shows a clean cup and handle formation followed by a golden cross (MA50 crossing above MA200) - a textbook bullish reversal setup.

Price broke out of the structure and is now pulling back into the buy zone ($14.57–$16.80) - a confluence of Fibonacci support and previous resistance.

✅ Golden cross confirms trend reversal

✅ Rising volume supports the move

✅ MAs below price - bulls are in control

The first target sits near $27.43, while the second projection extends to $40.28 if momentum continues.

Fundamentally, Fluence remains a leader in energy storage and grid technology - a hot spot for global investment as the renewable sector accelerates.

Let’s just say - this chart looks fully charged ⚡️

ARDX – Double Rising Window Hints Bullish ContinuationARDX – CURRENT PRICE : 6.06

The stock has broken above its long-term downtrend line accompanied by strong volume (look at red arrow). This breakout was confirmed by the formation of a Rising Window (1), signaling the end of the previous bearish phase.

Another Rising Window (2) appeared recently, again on high trading volume, reinforcing bullish sentiment and indicating the likelihood of a continuation in the uptrend. Take note also that the RSI has climbed into bullish territory (above 50), suggesting a shift in momentum towards buyers’ control and further room for upside before reaching overbought conditions.

ENTRY PRICE : 5.80 - 6.10

FIRST TARGET : 7.00

SECOND TARGET : 8.00

SUPPORT : 5.11 (bottom of the Rising Window area)

Has Bitcoin entered the distribution phase yet?👋🏻 Hey everyone! Hope you’re doing great! Welcome to SatoshiFrame channel.

✨ Today we’re diving into the 4-Hour Bitcoin analysis. Stay tuned and follow along!

👀 On the 4-hour timeframe, we can see that Bitcoin recently dropped due to the impact of the FOMC news but then rebounded from the key support level at $106,520 and is now facing its multi-timeframe resistances. Looking at the chart more broadly, we notice equal highs and lows around the $115,585 and $106,520 zones. With a breakout of either of these levels, Bitcoin could experience a sharp and significant move.

🧲 Bitcoin’s selling volume has slightly increased, and if the supports break, this selling could turn into pressure — collectively applying downward force on the market price. Then, buyers may re-enter and start buying Bitcoin again. The hypothesis of a possible distribution phase could turn into a valid theory; however, we must be cautious — if Bitcoin decides to move upward after Monday’s session, it could confirm a new all-time high and continue its upward trend.

✍️ The main scenario for Bitcoin lies around the $115,585 price zone. If this level breaks, we could enter a long position and stay with it for a potentially extended upward move. It’s worth noting that an increase in buying volume along this path could serve as a strong confirmation for our long position.

On the other hand, the short position scenario would become valid if the price breaks below the support and selling pressure intensifies, giving us a high-momentum short setup.

❤️ Disclaimer : This analysis is purely based on my personal opinion and I only trade if the stated triggers are activated .

CLOV 1D - Health Is Back in TrendOn the daily chart, Clover Health (CLOV) has broken out of its descending channel and triangle, now pulling back for a retest near 3.27–3.43 - a key buy zone aligned with the MA50. Buyers are clearly regaining control, and the setup looks ready for continuation.

Technically:

– first clean breakout of the downtrend since January 2025;

– volume expansion on bullish candles, suggesting institutional accumulation;

– holding above the former resistance turned support.

Upside targets: $4.71 (local volume peak) and $5.98, offering +70% potential upside if momentum sustains.

From a fundamental perspective, Clover Health is stabilizing its business:

– a leading player in Medicare Advantage, with an expanding senior member base;

– Q3 results show 40% reduction in net loss and +18% YoY revenue growth;

– leveraging AI-driven healthcare analytics to improve efficiency and patient outcomes;

– with high short interest, a confirmed breakout above $4.70 could ignite a short squeeze.

Tactical plan: accumulation near 3.27–3.43, add above 4.70, targets 4.71 → 5.98. Sometimes the healthiest trend is the bullish one.

Did you Know ?!!!Did you really think that profiting from the current bull run (a comprehensive upward market) would be easy? Don't be naive. Do you think they will let you buy, hold, and sell at low levels without any struggle? If it were that simple, everyone would be rich. But the truth is: 90% of you will lose. Why? Because the crypto market is not designed for everyone to win. They will shake you. They will make you doubt everything. They will panic you and sell at the worst possible moment. Do you know what happens next? The best players in this game buy when there is fear, not sell; because your panic gives them cheap assets. This is how the game goes: strong hands feed off weak hands. They exaggerate every dip, every correction, every sale. They make it look like the end of the world so that you abandon everything, and when the market starts up again, you'll sit there saying, "What the heck just happened?" This is not an accident. It's a system. The market rewards patience and punishes weak emotions. The big players already know your thoughts. They know exactly when and how to stir fear to make you give up. Because when you panic, they profit. They don't play the market. They play you. That's why most people never succeed. Because they fall into the same traps over and over again. People don't realize that dips, FUD (fear, uncertainty, doubt), and panic are all part of the plan. But the winners? They digest the noise. They know that fear is temporary, but smart decisions last forever. We've seen this hundreds of times. They pump the market after you sell. They take your assets, hold them, and sell them to you at the top, leaving you with nothing, wondering how it happened. Don't play their game. Play your own.

REMEMBER

TRX's situation+ Target PredictionFinally, the price broke the wedge, and the price experienced a significant drop. I think is the time for TR to rise again to 0.73 after more correction . STRONG SUPPORT 0.26.

Previous analysis

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to

OPEN 1D - Flag Ready for Takeoff?On the daily chart, Opendoor Technologies (OPEN) is forming a clean bullish flag - a consolidation phase following a massive +400% rally since spring 2025. Price action remains tightly contained within the pattern, with strong support from the MA50 and the 6.3–7.4 buy zone, aligning with the 0.618 Fibonacci retracement.

Technically , the setup looks mature: MA50 is trending upward, MA200 sits far below, and volume contraction hints at a breakout ahead. The first target sits at $16.50 (1.618 extension), while the second target lies at $25.60 (2.618 extension) - a potential +200% move from current levels.

Fundamentally, Opendoor is finally emerging from its downturn:

– +37% YoY growth in property transactions;

– operating costs reduced by ~25%;

– positive operating cash flow for the first time in three years;

– partnerships with Zillow and Redfin driving stronger customer acquisition.

With the U.S. housing market showing signs of recovery and potential Fed rate cuts on the horizon, OPEN stands out as a high-upside play in the proptech sector.

Tactical plan: watch for accumulation near 6.3–7.4, add on breakout confirmation. Profit targets: 16.5 → 25.6.

After all, in both trading and real estate - it’s all about timing and location.

Ethereum confirmation of breakout, downside targetEthereum confirmed a breakout below the 4050–4100 zone, completing the double top pattern. The price stays under the 50 and 100 EMA, showing continued bearish pressure. Priority remains on short positions during pullbacks.

Nearest downside targets: 3463 (Target 1) and 3007 (Target 2). A move above 4100 would cancel the bearish scenario.

Amid expectations of the Fed’s rate decision and rising bond yields, risk assets remain under pressure. Inflows to crypto funds are declining, increasing the downside risks for ETH. In the short term, correction may continue until new bullish catalysts appear.

ETHUSD remains in a bearish setup. Downside targets — 3460 and 3000. Long positions should be considered only after a confirmed move above 4100.

ETH/USDT: Price Decline Warning, Caution for Buy Opportunities!The ETH/USDT pair is currently facing clear downward pressure after failing to break through the strong resistance at 4,150.00. The 4-hour chart shows that Ethereum is moving in a short-term downtrend, with prices heading towards the important support level of 3,780.00. The strong rejection from this area indicates that the current market sentiment is leaning towards selling.

The market's cash flow also reflects short-term distribution, and the RSI indicator shows that ETH has previously entered overbought territory, and may continue to correct downward. These factors suggest that Ethereum could continue to face selling pressure, especially if the support levels are not strong enough to hold the price.

Impact of Recent News:

1. Australia's Core Inflation Data Rises Sharply: Australia's core inflation index increased by 1.0% in Q3, exceeding the forecast of 0.8%. This reduces expectations of a near-term rate cut and could affect ETH/USDT if the USD strengthens.

2. Expectations on U.S. Federal Reserve's Monetary Policy: The market expects the Fed to maintain high interest rates, which could strengthen the USD and put downward pressure on ETH/USDT.

Conclusion: Given the current downtrend and pressure from technical indicators, ETH/USDT is likely to continue decreasing over the next 48 hours. However, traders need to be cautious and closely monitor the support level at 3,780.00. If the price shows strong signs of recovery from here, it could present a good opportunity to enter the market.

How to Analyze Your Trading Performance ScientificallyBy Skeptic – Founder of Skeptic Lab

Most traders know how to analyze charts — but few know how to analyze themselves.

A professional trader doesn’t just look at last month’s profit or loss; they examine consistency , volatility , and long-term stability.

Earlier today, as part of my usual routine, I was reviewing my trading performance and reflecting on my recent results. That’s when I decided to share my analysis process with you :) — a framework built from personal study and research that might help others turn raw data into real improvement.

In this tutorial , we’ll walk through a data-driven framework to evaluate your trading performance like a portfolio manager — using metrics such as cumulative return, volatility, Sharpe ratio, and trend analysis.

1. Data Collection: Turning Trades into Monthly Returns

Instead of focusing on single trades, record your monthly returns in percentage terms.

It can look as simple as this:

This structure helps you see the bigger behavioral pattern behind your system — not just isolated results.

“If you can’t describe what you’re doing as a process, you don’t know what you’re doing.” – W. Edwards Deming

2. Cumulative Return: The Power of Compounding

Your total return isn’t the average of each month — it’s compounded over time:

This shows whether your trading system has truly grown across time, not just fluctuated.

A positive total means your system is resilient; a negative one signals structural issues.

3. Key Statistical Metrics

Once your data is ready, calculate the following metrics — the backbone of every professional performance review:

4. Coefficient of Variation (CV) – Stability Indicator

A CV below 1 implies your returns are stable and predictable.

Above 1.5 suggests your system’s risk-to-reward profile is unstable — and may need adjustment.

5. Sharpe-like Ratio – Measuring Efficiency

Assuming a zero risk-free rate, the Sharpe ratio measures how much return you generate per unit of volatility:

Sharpe > 0.5 → healthy performance

Sharpe > 1 → professional-level consistency

Sharpe < 0.3 → the system needs review

“It’s not about being right, it’s about being consistent.” – Mark Douglas

6. Trend Analysis – Detecting Growth or Decay

Run a simple linear regression between time (month number) and return.

Positive slope: system improving

Negative slope: decline in edge or discipline

Positive slope with high variance: profitable but unstable behavior

Combining this with the Sharpe ratio gives a complete health check of your strategy.

📝Summary Table

Data without action is noise.

Use these insights to correct weaknesses and scale strengths:

Identified Issue: High volatility

→ Practical Fix: Reduce position size in range-bound markets

Identified Issue: Consecutive drawdowns

→ Practical Fix: Add trailing stops or break-even adjustments

Identified Issue: Low average return

→ Practical Fix: Reassess position sizing or strategy fit

Identified Issue: Overconfidence after wins

→ Practical Fix: Apply daily or weekly risk caps

🧩 Final Thoughts

Analyzing your performance is not just about profits — it’s about understanding your patterns .

By measuring Sharpe, CV, and trend, you can answer three crucial questions:

Is my growth consistent or random?

Is my risk proportional to my return?

Can I replicate this performance?

If the answer is yes, you’re not just improving your system —

you’re evolving as a trader :)

🩵If you found this tutorial helpful, give it a boost and share it with your fellow traders. Let’s grow together, not alone!

Happy trading, and see you in the next tutorial ! 💪🔥

LULU 1D - stretching into a comebackOn the daily chart of Lululemon Athletica (LULU), a clean AB=CD pattern is forming, signaling a potential end to the correction and the beginning of a new upward wave. The price has tested the strong buy zone between 164–167, aligned with a major daily support level and rising volume - a classic setup indicating that buyers are regaining control.

Technically , the structure is highly symmetrical, RSI shows a bullish divergence, and the 50-day moving average is starting to turn upward - all suggesting a possible trend reversal. The first upside target for this pattern is $230, followed by a second target at $340, which corresponds to the 1.272 and 1.618 Fibonacci extensions.

From a fundamental standpoint, Lululemon remains a powerhouse in the premium activewear market, maintaining strong brand loyalty even amid competition from Nike and Alo. The company continues to expand its men’s line and footwear segment, which now accounts for over 25% of total revenue. International growth remains robust, with new stores opening in South Korea, the UAE, and Germany. Lululemon’s shift toward higher-margin online sales and more efficient logistics continues to strengthen its profitability.

In the latest quarterly report (September 2025), revenue grew by 9% year-over-year, and EPS came in above Wall Street expectations. High customer retention - over 90% repeat purchase rate - and stable gross margins create a solid foundation for a mid-term recovery in the stock.

Tactical plan: watch for entries within the 164–167 buy zone, consider partial profit-taking near $230, and target $340 if momentum extends. Just like in yoga, patience and balance lead to the best results.

ANET - Rebounds from EMA 50ANET - CURRENT PRICE : 148.00 - 149.00

Technical Rationale:

1. Rebound from Key Moving Average Support

The stock price has rebounded strongly from the 50-day EMA, which has acted as a dynamic support level throughout the uptrend. This rebound indicates renewed buying interest at a technically significant area.

2. Bullish Momentum Confirmation

ANET has crossed above the 20-day SMA, suggesting a short-term shift back to bullish momentum after a healthy pullback. This crossover reflects improving short-term trend strength.

3. Rising Support Line Intact

The long-term rising support trendline remains intact, confirming that the broader uptrend structure is well-maintained. Each corrective phase has so far been supported near this line, reinforcing the bullish bias.

4. Momentum Indicator (RSI)

The RSI is recovering from the mid-zone (~53), showing that bullish momentum is building again without being overbought. This supports the potential for further upside continuation.

ENTRY PRICE : 148.00 - 149.00

FIRST TARGET : 162.00

SECOND TARGET : 173.00

SUPPORT : 136.00

SOFI — Bullish Breakout with Strong VolumeSOFI has broken out to a new all-time high with strong volume, signaling strong buying pressure and renewed bullish momentum.

The stock remains in a clear uptrend, trading above the 50-day EMA. Recently, SOFI rebounded perfectly at the EMA 50, confirming it as a strong dynamic support zone. The bullish pennant pattern breakout further strengthens the case for a trend continuation.

The uptrend line is still intact, and as long as the price holds above the EMA 50, the bullish outlook remains valid.

Entry Price : 31.00 - 32.00

Stop Loss: Below EMA 50 (~26.80–26.90)

Targets: 35.00 and 38.00

INTC Target Hit, Now Showing Another Bullish Setup!INTC - CURRENT PRICE : 41.53

My earlier INTC buy call has reached its projected targets. The previous analysis is shared below for reference.

Technical Highlights

1) New 52-week High – Price has broken into a fresh yearly high, confirming strong bullish momentum.

2) Pennant Breakout – The breakout from a bullish pennant pattern suggests continuation of the prior uptrend, with a potential target of $49 based on the pattern projection.

3) Golden Cross Intact – The 50-day EMA remains above the 200-day EMA, maintaining the long-term bullish bias.

4) RSI in Bullish Territory – RSI remains above 70, indicating strong momentum and persistent buying strength.

ENTRY PRICE : 40.00 - 42.00

FIRST TARGET : 45.00

SECOND TARGET : 49.00

SUPPORT : 36.43 (the low of 23 OCTOBER 2025 candle)

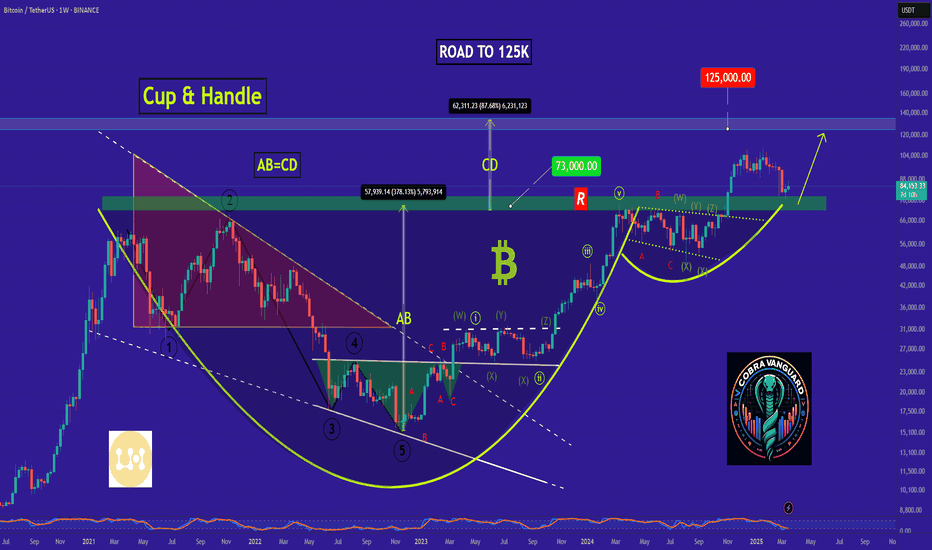

DOGE's situation+next targets and expected movementsNo matter how bad Dogecoin looks on lower timeframes, the higher timeframes tell a different story—one of strength and potential. As you can see, the weekly chart has formed a large Cup and Handle pattern. If this pattern breaks out, the price could easily surge above $1. So be patient and stay alert, because you don’t want to miss the next bull run.

Unfortunately, the harsh truth is that 99% of you *will* miss it.