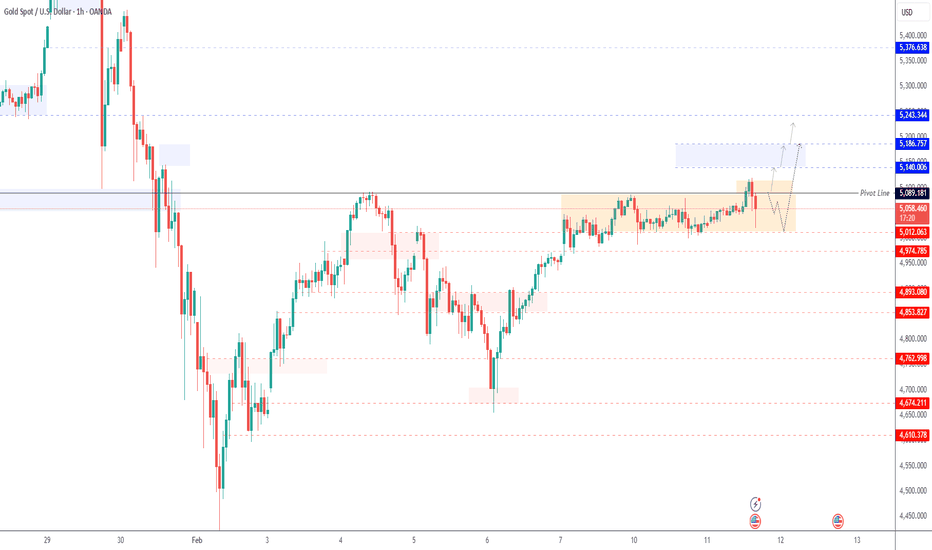

GOLD | Consolidation Ahead of BreakoutGOLD | Consolidation Range Ahead of Breakout

Gold is currently trading in a consolidation range between 5089 and 5012, with traders watching for the next directional breakout.

Technical Outlook

A 15-minute candle close above 5089 would confirm bullish continuation toward 5140, followed by 5186 and potentially 5243.

A move below 5012 would invalidate the bullish scenario and shift momentum bearish toward 4974 and 4893.

Key Levels

• Pivot: 5089

• Support: 5012 – 4975 – 4893

• Resistance: 5140 – 5186 – 5243

Trend Analysis

EURUSD - Will it break the resistance?EURUSD is currently trading within a well-defined 4-hour structure, where both support and resistance are clearly mapped by fair value gaps. After a strong recovery from the lows, price has entered a consolidation phase just below a key resistance zone. The market is now reacting precisely to higher-timeframe imbalances, making the 4-hour FVG levels critical in determining the next directional move. The coming sessions will likely revolve around whether resistance gives way or whether another temporary pullback occurs before continuation.

Bullish 4H Support Bounces

EURUSD has consistently found support within the 4-hour bullish FVG zones below current price. Each time the pair retraced into these imbalances, buyers stepped in decisively, producing strong bounces. This repeated reaction confirms that demand remains active at these levels and that market participants are defending this support structure. As long as price continues to respect the 4-hour bullish FVG and closes above it, the short-term structure remains constructive. These bounces suggest accumulation rather than distribution, reinforcing the idea that the market may be preparing for another leg higher.

Bearish 4H FVG Resistance

The key resistance level currently capping price is the 4-hour bearish FVG above. This zone has limited upside attempts and acts as the main barrier for further continuation. It represents an area where selling pressure previously entered the market, and it is now functioning as supply. If EURUSD manages to break through this bearish 4-hour FVG with strength and conviction, it would signal that buyers have absorbed the remaining supply. Such a breakout would likely open the path for price to revisit the previous highs and potentially extend beyond them.

The Highs

Above the current structure lie the relative highs, which represent a clear liquidity target. These highs contain resting stop orders and buy-side liquidity that the market is naturally drawn toward. Given the consistent support from the bullish 4-hour FVG and the compression beneath resistance, the probability increases that EURUSD will attempt to take out these highs. A sweep of this liquidity would complete the current structure and could trigger momentum continuation if buyers remain in control.

Conclusion

EURUSD remains technically supported by strong 4-hour bullish FVG reactions while facing clear resistance at the bearish 4-hour FVG overhead. As long as support continues to hold, the bias leans toward an eventual breakout above resistance and a move to take out the highs. The market is approaching a decision point, and a clean break above the bearish FVG would likely confirm the next bullish expansion phase.

-------------------------

Thanks for your support. If you enjoyed this analysis, make sure to follow me so you don't miss the next one. And if you found it helpful, feel free to drop a like 👍 and leave a comment 💬, I’d love to hear your thoughts!

Bullish bounce off pullback support?Swissie (USD/CHF) is falling towards the pivot, which is a pullback support that is slightly below the 61.8% Fibonacci retracement and could bounce to the 1st resistance, which is also a pullback resistance.

Pivot: 0.7684

1st Support: 0.7654

1st Resistance: 0.7654

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party.

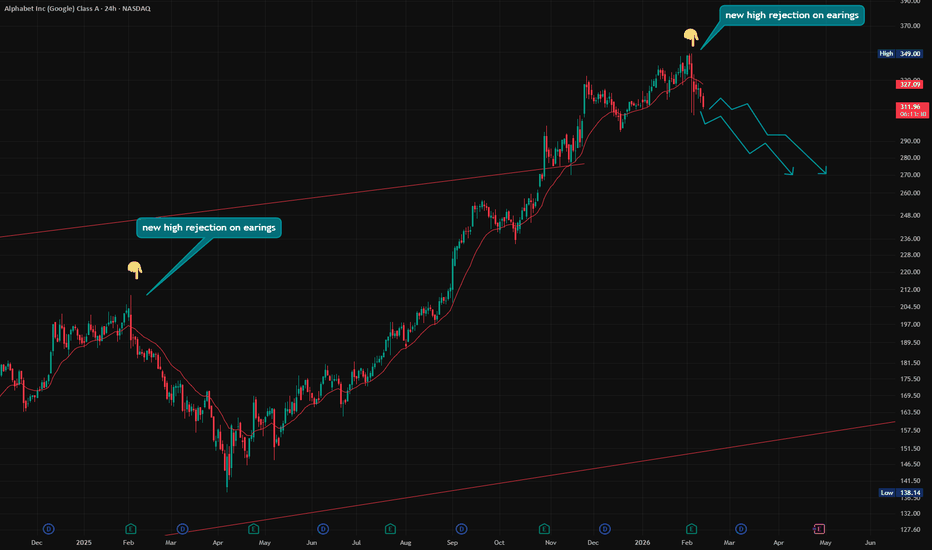

Alphabet ($GOOGL) is likely heading back toward at least $270.Alphabet ( NASDAQ:GOOGL ) is likely heading back toward at least $270.

Four reasons: 👇

- New high rejection on earnings. We saw a similar setup about a year ago — markets often repeat behavior.

- The 2025 trend showed a late-stage acceleration, which historically often precedes a reversal.

- The last few months resemble a developing head-and-shoulders pattern. It’s not perfect, but in trading, close is often close enough.

- If you’re heavily long and want to reduce overnight exposure, a short setup with Google can help balance portfolio risk.

Credit to a sharp member who brought this to my attention before we shorted it this morning.

New Analysis – West Texas Oil (WTI)Those who follow my work know that we have posted multiple oil analyses in a row,

all of them successful, closed with high reward ratios ✅

But let me be very clear:

❌ I’m not part of OPEC

❌ I’m not a politician

❌ I don’t have access to political or economic decisions

No one knows what’s really going on in Powell’s mind,

what Trump plans to do with Iran,

or what the future holds for Venezuela, Cuba, or others.

📌 These are market drivers,

but we have zero access to policymakers’ decision rooms.

We are simply small traders,

trying to extract profits from opportunities — nothing more.

🔎 In this analysis, after making solid profits,

I’m willing to risk a small portion of those gains.

This setup carries higher risk, and that’s fully intentional.

📉 At the moment,

we are sitting at a good area to sell oil.

🔁 If this level breaks,

as always,

I’ll wait for a pullback and look for a long position.

🎯 No bias, no predictions — just following the market.

🌹 Stay safe & stay profitable

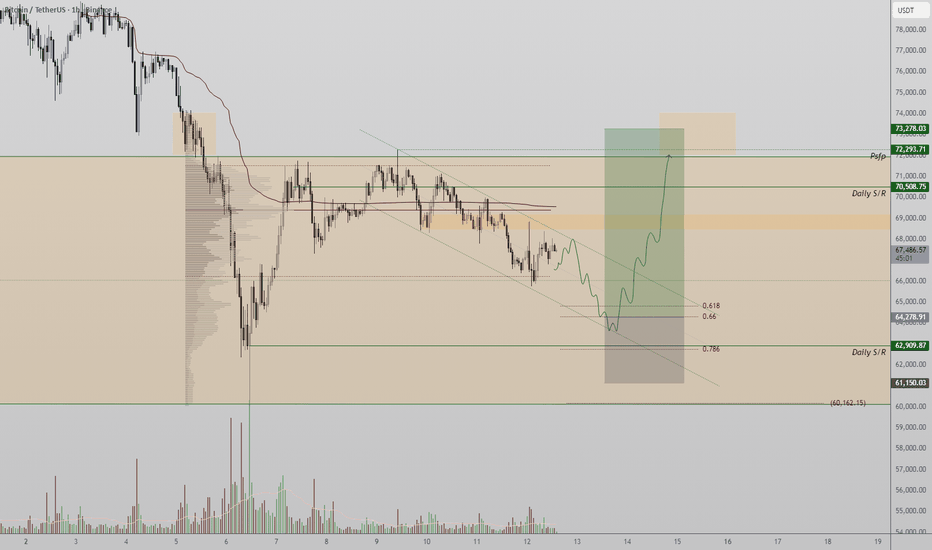

BTC trading at key support zone, bounce potential Bitcoin price action on the intraday timeframe continues to trade within a broader high-timeframe range, bounded by major support near $62,000 and resistance around $72,000. At present, price is rotating near the midpoint of this range, reflecting a state of balance rather than directional conviction. This area often acts as an equilibrium zone where the market consolidates before making a more decisive move.

From a short-term perspective, the local trend remains bearish. Bitcoin has been printing consecutive lower highs and lower lows on the lower timeframes, indicating persistent selling pressure within the range. However, it is important to note that the 0.618 Fibonacci retracement of the recent move has not yet been retested. This level, situated near the $64,000 region, represents a key technical area where price could attempt to stabilize.

A controlled retest of the $64,000 zone would be constructive if accompanied by strong bullish volume and rejection signals. Such a reaction could establish a higher low and open the probability of a rotational move back toward the upper boundary of the range near $72,000.

Until that occurs, price is likely to remain range-bound, with internal rotations dominating intraday price action. Traders should remain patient and monitor volume and structure closely as Bitcoin searches for its next directional catalyst.

2200 | OVERBOUGHT RANGE — Rejection Risk at Static Resistance TADAWUL:2200 — 1D Chart | DSRTL-ML Algorithmic Reading

Matrix State: S3/D1 | Confidence: 55% | Bias: Rejection Risk (Overbought)

Price at SAR 5.28 sits mid-range between Static Support (SAR 4.73–4.77) and Static Resistance (SAR 5.38–5.44). The Dynamic state reads D1 (Overextended Up), meaning price is stretched above dynamic equilibrium without structural confirmation. This creates a classic overbought-in-range condition with mean reversion pressure.

Key Structural Observations

A resistance confluence sits directly overhead: Pivot Dyn ▲ (SAR 5.38) aligns exactly with Static R lower boundary (SAR 5.38). This double-wall makes a clean breakout unlikely without strong volume.

POC at SAR 5.33 is above current price — the volume-accepted fair value has not been reclaimed yet.

5PT Dyn ▲ at SAR 5.07 and Pivot Dyn ▼ at SAR 4.92 define the dynamic floor below.

Volume Profile shows the heaviest node at SAR 4.87 (59.05% of POC) — well below price, meaning support above it is structurally thin.

Buy delta is marginally positive (+103K), but sell volume (3.16M) nearly matches buy volume (3.27M) — no decisive buyer commitment.

Levels to Watch

Immediate Resistance: SAR 5.33 (POC) → SAR 5.38 (Pivot Dyn ▲ + Static R)

Immediate Support: SAR 5.07 (5PT Dyn ▲) → SAR 4.92 (Pivot Dyn ▼)

Verdict: SHORT-TERM BEARISH (Within Range)

The algorithm reads S3/D1 as an overextended condition inside a broader range. Price is pressing into a heavy resistance cluster (SAR 5.33–5.44) without sufficient volume confirmation. The D1 overextension signal — without price actually breaking any resistance — suggests exhaustion rather than strength. The expectation is a pullback toward SAR 5.07 (5PT Dyn ▲), with SAR 5.33–5.38 acting as a rejection zone. A clean daily close above SAR 5.44 would invalidate this bearish bias.

In summary: Range-bound structure with a bearish short-term lean. Rallies into SAR 5.33–5.38 are more likely to face rejection than breakout.

⚠️ This reading is generated entirely by the DSRTL-ML indicator's algorithmic output. It does not constitute investment advice.

AMD Dip Looks Exhausted — Smart Money Eyeing a BounceAMD QuantSignals V4 Swing 2026-02-11

Signal: BULLISH

Strategy: Mean-Reversion Swing

Horizon: 2–4 Weeks

Conviction: Moderate

Alpha Score: 72

🎯 Trade Parameters

Instrument: $215 CALL

Expiration: March 13, 2026

(Prefer entry on strength — 15-min close above VWAP or break of morning high.)

✅ Target 1: $12.50 (+38%)

✅ Target 2: $15.50 (+70%)

Risk-to-Reward: ~1 : 2.5

🧠 Trade Thesis

AMD is showing deep oversold momentum with RSI near 32, signaling seller exhaustion and increasing the probability of a mean reversion toward the 50-day moving average (~$221).

Supporting factors:

AI models project a move toward $222

Potential geopolitical support from TSMC-linked tariff exemptions

Strong PEG profile suggests valuation support

🔑 Key Levels to Watch

Support: $205 (VWAP)

Major Support: $200 (Thesis invalidation level)

Resistance: $221 (50-MA magnet)

A sustained move above VWAP increases probability of upside continuation.

Risk Factors

Broad semiconductor weakness

Daily close below $200 opens path toward the 200-MA

Risk Grade: MEDIUM

BTCUSD – 2H timeframe...BTCUSD – 2H timeframe.

🔍 Structure

Clear downtrend (descending trendline respected)

Price trading below Ichimoku cloud

Currently moving toward major demand zone 63,500 – 62,000

Equal lows liquidity sitting below 64K

📉 Bearish Scenario (More probable short term)

If price breaks 64,000 cleanly:

🎯 Sell Targets:

TP1: 63,500

TP2: 62,000 (strong demand zone)

Extended: 60,000 psychological level

❌ Invalidation: 2H close above 69,500

📈 Bullish Reversal Scenario

If price taps 62K–63K and shows strong rejection:

🎯 Buy Targets:

TP1: 70,000

TP2: 72,000 (my marked supply zone)

Extended: 78,000 – 80,000 major resistance

📌 My View

Short term → downside liquidity sweep toward 62K looks likely

After that → possible bounce to 70K+

MCB – TECH INVESTMENT SET-UP | W | 11 FEB 2026 | By TCAMCB – TECH INVESTMENT SET-UP | W | 11 FEB 2026 | By The Chart Alchemist

• Buy 1: Rs. 422 (30%) (current price)

• Buy 2: Rs. 390 (30%)

• Buy 3: Rs. 376 (40%)

Target Prices:

• TP1: Rs. 440

• TP2: Rs. 470

• TP3: Rs. 500

• TP4: Rs. 530

SL (W closing): Below Rs. 364 | R:R: 1:4

📢 Disclaimer: All trade setups are shared for informational purpose.

Do your own research before taking any position - No claim, No blame

#AVAX is Ready for an Explosive Move. Will it Recover From Here?Yello, Paradisers! Is #AVAX preparing for a powerful bullish continuation, or are we about to see a painful shakeout? Let’s view the #Avalanche trading setup:

💎#AVAXUSDT is currently forming a clear bullish flag pattern on the 4H timeframe after a strong impulsive move to the upside. Price has been consolidating inside this downward-sloping channel, respecting both resistance and support perfectly, a classic continuation structure if confirmed.

💎 The key level holding this entire setup together is the demand zone between $7.91 and $8.23. As long as the price remains above this area, the bullish structure stays valid. Momentum is starting to shift. We are seeing signs of a potential bullish MACD crossover, which would indicate that bearish momentum is fading. If this crossover confirms while price breaks above the flag resistance, it would significantly increase the probability of a continuation move.

💎If #AVAXUSD manages to push the price above the immediate moderate resistance at $9.39 and flip it into support, we expect continuation toward the strong resistance near $10.34, where major supply and profit-taking could occur.

💎However, if #AVAXUSDT loses the $7.91 demand zone, this bullish setup becomes invalid. A breakdown below that level would confirm weakness in structure and could trigger a move toward the $7.50 region, sweeping liquidity before any potential recovery.

Trade smart, Paradisers. This setup will reward only the disciplined.

MyCryptoParadise

iFeel the success🌴

XAUUSD – 15M Structure-Based Buy Setup📈 Setup Highlights:

Demand zone: 5045–5055

Price forming higher lows short-term momentum bullish

Key resistance: 5090–5100

💡 Entry Strategy:

Aggressive: Buy near demand zone (5045–5055)

Confirmation: Wait for clean break above 5100 with strong bullish candle → safest entry

🎯 Targets:

1️⃣ 5100

2️⃣ 5120–5130 (aligned with 1H structure)

⚠️ Stop Loss:

Below demand zone (~5040)

💬 Note:

Structure and zones favor but but always follow risk management

Aggressive vs confirmation entries explained above

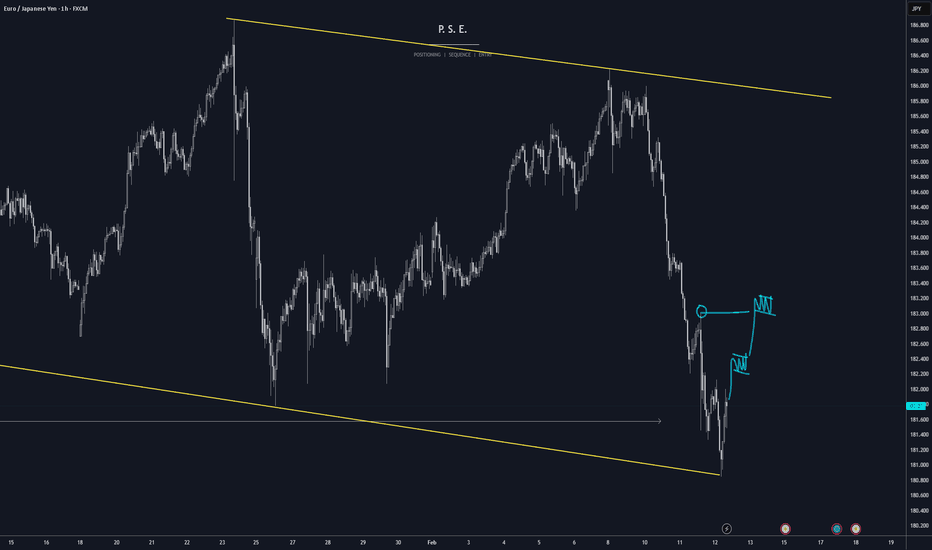

EURGBP SHORT Date: February 11, 2026

Asset: EUR/GBP (Euro / British Pound)

Bias: Bearish (Short)

Executive Summary

The EUR/GBP currency pair is exhibiting a high-probability shorting opportunity based on a multi-timeframe alignment of market structure, Fibonacci retracement, and momentum indicators. Current price action as of February 2026 confirms that sellers remain in control, with the pair trading below key pivot levels and responding to technical resistance zones.

Technical Analysis Breakdown

1. Market Structure: H4 Bearish Continuation

The H4 (4-Hour) timeframe serves as the primary trend indicator for this setup. The market has recently completed a Break of Structure (BOS) to the downside, invalidating previous minor support levels and confirming a sequence of lower highs and lower lows.

• Significance: A BOS in a downtrend indicates that the "path of least resistance" remains downward. This structural shift suggests that any upward movement is merely a corrective phase (retracement) rather than a trend reversal.

2. Fibonacci Retracement: Premium Reversal Zone

The recent corrective rally has pulled back into the 75%–84% Fibonacci retracement level. In institutional trading, this is often referred to as a "Deep Premium" zone.

• Analysis: Price reached this level and encountered significant selling pressure, forming what appears to be a "rejection wick" or a slowing of bullish momentum. This zone aligns with previous H4 supply areas, providing the confluence needed to justify a short entry.

• Key Level: Traders are closely watching the 0.8720 – 0.8730 resistance cluster for sustained rejection.

3. Execution Signal: H1 13/21 EMA Crossover

To refine the entry, the H1 (1-Hour) timeframe provides the tactical trigger. We are monitoring the 13-period Exponential Moving Average (EMA) crossing below the 21-period EMA.

• The Signal: This "Death Cross" on the intraday chart confirms that short-term momentum has shifted back in favor of the primary H4 downtrend.

• Current Status: The crossover acts as a final filter, ensuring we are not "catching a falling knife" but rather entering as the momentum confirms the reversal from the Fibonacci premium zone.

Live Trade on Micron Technology (MU)The price is currently at the bottom of its channel and meets all the conditions of one of our trading systems for a buy setup.

Follow proper risk and money management.

This is just my personal view, so please trade based on your own strategy and trading system.

Follow me on TradingView for more analyses and live stock trades.

NASDAQ:MU

Solana looking desperate....SOL is testing a major high-timeframe demand zone and sitting at a key inflection area.

Bullish case

If price reclaims this level and holds it as support, we could see a relief bounce back into prior supply and volume resistance.

Bearish case

If it fails to reclaim and builds structure below, momentum favors continuation lower toward deeper macro support.

Daily momentum is pressing into oversold territory. That increases the chance of a bounce, but confirmation is still needed.

This is decision time.

Reclaim the level and structure can repair.

Lose it and downside pressure likely continues.

ICP: waiting for a flush? key levels and targets for the days ahICP. Waiting for one more flush before the real move? Recent headlines about regulators eyeing alt projects plus a boring Bitcoin range keep sucking liquidity out of mid caps, and ICP has been quietly bleeding back to the 2.3 zone. According to market chatter, funds keep rotating into majors, leaving charts like this one oversupplied on every bounce.

On the 4H chart price sits under a fat resistance cluster around 2.4–2.6, right below the main volume node, while RSI hangs near 40 and can’t get above 50. Trend is still a clean staircase down, so I’m leaning to the downside over the next sessions, expecting a retest of the green support near 2.1 and maybe the 2.0 psychological level. I might be wrong, but for now every pump looks more like exit liquidity than accumulation. ⚠️

My base plan: watch for a rejection in the 2.4–2.5 area to hunt shorts toward 2.15 then 2.0, with invalidation if we get a strong 4H close above 2.6. If bulls suddenly reclaim 2.6 on volume and RSI pushes back over 50, that flips the script and opens the way to 2.8–3.0 where the next big supply zone waits. I’m staying flat until price tags one of these levels instead of chasing in the middle.

US 100 on bearish swing in my opinion fundamentally and technically US 100 struggling to take the highs again and manipulation in ranges giving an indication towards selling.

Last liq swept was good and below may important areas of liq to clear let see if more indications from the the technicals appear i ll add 1 or 2 percent more onto this...

Risking no more than 1 or 2 percent.

took partials while you are in profit.

never leave the money on the table.