Trend Analysis

Amgen May Have Broken OutAmgen spent a quarter consolidating near record highs, and now it may have broken out.

The first pattern on today’s chart is the surge on February 4 after earnings beat estimates. The pharmaceutical giant pulled back to hold a 50 percent retracement of the move, potentially confirming its upward trajectory.

Second, the 50-day simple moving average (SMA) crossed above the 100-day SMA in November and has expanded since, which may confirm its long-term direction has grown more bullish.

Third, the 8-day exponential moving average (EMA) is above the 21-day EMA. MACD is also rising. Those signals could reflect short-term bullishness.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. Learn more here about TradingView’s Broker of the Year!

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

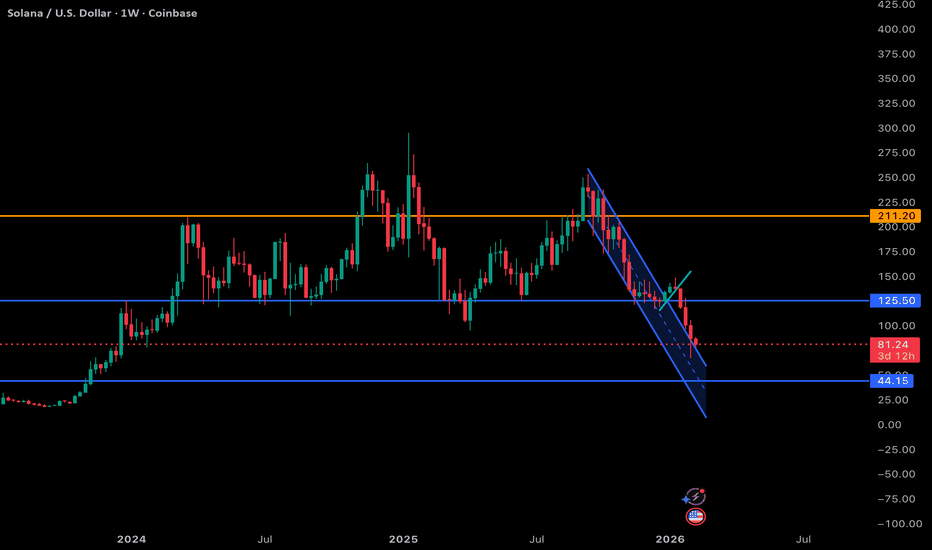

$SOL 1W Update: In the middle of the range here Solana looks like it wants to produce a relief bounce, but zooming out on the weekly, it’s still trading in the middle of a large multi-month range, which limits immediate upside expectations. After the aggressive breakdown through 125.5, momentum has clearly shifted bearish, yet the pace of the selloff is beginning to stretch as price presses into the 80 region, an area that previously acted as a reaction zone. This is typically where short-term exhaustion can develop, especially after a clean channel breakdown like we’ve seen.

That said, structurally SOL is not at macro support yet. The true higher-timeframe demand sits closer to 44, meaning any bounce from here is likely corrective unless price can reclaim 125.5 and build acceptance back inside the prior range. In other words, the market may be due for relief, potentially back toward 95–110, but within the context of a broader corrective phase. Until SOL starts printing higher highs and reclaiming lost range support, rallies are more likely to be sold into rather than the start of a fresh expansion leg.

USOIL BEARS ARE STRONG HERE|SHORT

USOIL SIGNAL

Trade Direction: short

Entry Level: 65.09

Target Level: 64.38

Stop Loss: 65.56

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GOLD BEARS ARE GAINING STRENGTH|SHORT

GOLD SIGNAL

Trade Direction: short

Entry Level: 5,063.85

Target Level: 5,027.96

Stop Loss: 5,091.30

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

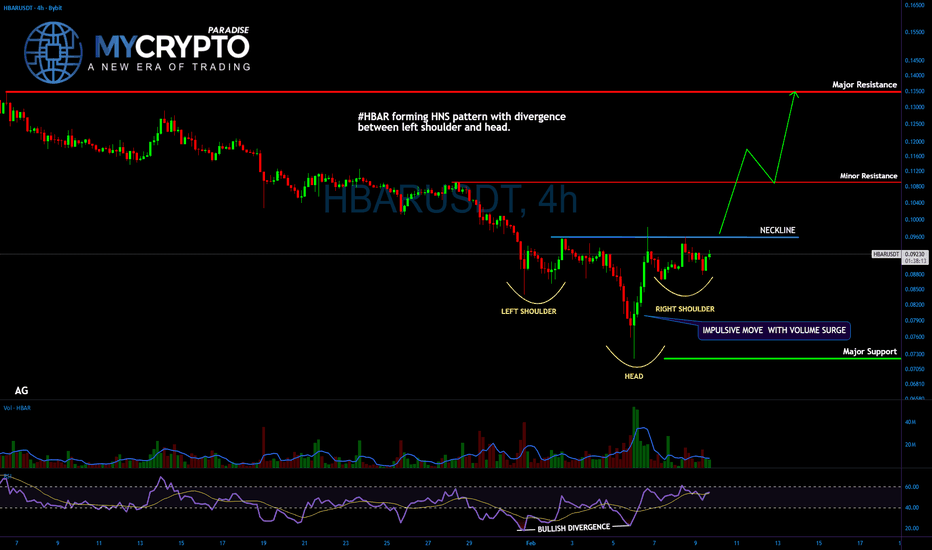

#HBAR—This HNS Structure Rarely Fails After Liquidity Is Taken

Yello Paradisers! -Are you noticing how HBAR is quietly setting a trap after taking liquidity exactly where most traders panicked and sold, and could this be the moment when patience finally pays off?

💎#HBAR forming a clean inverse head and shoulders pattern right at a previous support zone, which is a classic professional accumulation behavior. Before this structure started to develop, price deliberately swept liquidity below support, forcing out weak hands and triggering stop losses from inexperienced traders. This is exactly the type of environment where smart money likes to build positions.

💎After the liquidity sweep, we saw a sharp bullish impulse accompanied by strong volume. This move was crucial because it broke above the previous swing high of the left shoulder, which also aligned perfectly with horizontal resistance acting as the neckline. This is a strong technical confirmation that buyers are stepping in with conviction, not randomly.

💎At the moment, #HBAR is forming the right shoulder. What is important here is not speed but quality. Price is consolidating tightly while volume is clearly declining. This is a healthy sign, as it signals an absence of aggressive sellers. When price holds near the neckline without heavy selling pressure, it usually increases the probability of continuation to the upside rather than a breakdown.

💎The RSI already gave us an early warning signal. A bullish divergence formed between the left shoulder and the head, showing that downside momentum was weakening even while price was still moving lower. This divergence often appears before trend reversals and is another reason why this structure deserves close attention.

💎Another key detail is the neckline behavior itself. This level has already been tested three times, and each test weakens the ability of sellers to defend it. Repeated tests usually favor a breakout rather than rejection, especially when combined with declining volume during consolidation.

💎From a level perspective, major support is located around the 0.072 area. As long as the price holds above this zone, the bullish structure remains valid. On the upside, the major resistance sits near 0.135, with an intermediate resistance around 0.110 that may cause short-term reactions.

That's why Paradisers, we are playing it safe and focusing only on high-probability structures like this one. Strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler. This is the only way you will make it far in your crypto trading journey and get inside the winner circle.

MyCryptoParadise

iFeel the success🌴

GBPUSD | FRGNT DAILY FORECAST |Q1 | W6 | D12 | Y26📅 Q1 | W6 | D12 | Y26

📊 GBPUSD | FRGNT DAILY FORECAST |

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:GBPUSD

PREPARING TO BUY INTO G/UGBP/USD 30M - As you can see price is looking good for potential long positions, I want to see price just pullback now that we have had a fractal break to the upside.

The pullback is price setting a higher low before it goes on to set a new higher high, this is where we would look to buy into this market from. Giving us the ability to get involved with a refined entry.

Once price trades in and clears this area its then just a case of waiting on price to reject this area of interest, once we have that we have means to enter in on this market.

I will be setting my SL just below the zone I get involved from, my TP will be set just below the last high that was created, this guarantees that our TP can be achieved, I will keep you all posted.

Taiwan Export Data Reinforces Bullish Thesis for Nvidia (NVDA)Taiwan Export Data Reinforces Bullish Thesis for Nvidia (NVDA): UBS Sees Material Upside Ahead

Recent trade data out of Taiwan has injected fresh momentum into the already robust bullish narrative surrounding Nvidia Corporation (NASDAQ: NVDA), offering quantitative evidence that demand for AI infrastructure remains not only resilient but is actively accelerating. On February 10, UBS analyst Timothy Arcuri reaffirmed his Buy rating on Nvidia and maintained a $235 price target, citing January export figures from Taiwan's Ministry of Finance as a powerful leading indicator for the company's upcoming earnings and forward trajectory.

The Taiwan ADP Signal: A Leading Indicator Decoupling or Converging?

The data point commanding Wall Street's attention is Taiwan's export performance in Automatic Data Processing (ADP) equipment, a category that excludes laptops and serves as a credible proxy for server, networking, and AI accelerator shipments. In January, Taiwan's ADP exports reached $22.6 billion, representing an 8% month-over-month increase from December's $20.9 billion. This performance stands in stark contrast to normal seasonal patterns, which historically show a 4% monthly decline in January.

More significantly, the elevated export run rate that first emerged in October—when ADP exports surged to $22.2 billion from September's $14.1 billion—has now stabilized at these higher levels with minimal variance across December and January. This consistency suggests that the step-function increase in AI infrastructure shipments is not a transitory spike but a durable, sustained ramp.

For the full fiscal fourth quarter, Taiwan's ADP exports now stand at $66.2 billion, representing a 25% quarter-over-quarter increase. This materially exceeds UBS's modeled estimate of 18% sequential growth for Nvidia's data center revenue. Arcuri's commentary is noteworthy in its directness:

*"This is well ahead of the ~18% Q/Q growth we model for NVDA data center revenue, so while this data has decoupled with NVDA's results in recent periods, Taiwan ADP exports would appear to support additional upside in the NVDA print."*

The acknowledgment of prior "decoupling" is important. In recent quarters, Taiwan export data and Nvidia's reported revenue have not always moved in perfect lockstep, creating analytical friction for sell-side modelers. However, the sustained magnitude and duration of the current export surge suggest that any historical decoupling may be giving way to renewed correlation—and with it, the potential for positive earnings revisions.

Broader Semiconductor Context: SIA Data and TSMC on Deck

UBS's confidence is not solely reliant on a single data point. The firm previously highlighted December data from the Semiconductor Industry Association (SIA), which also came in above typical seasonal trends, reinforcing the view that semiconductor demand broadly, and AI-specific demand particularly, remains robust.

The next critical catalyst on the horizon is TSMC's January sales report, expected to be released as soon as Friday. As the exclusive manufacturer of Nvidia's flagship AI accelerators, TSMC's revenue trajectory serves as the highest-fidelity real-time proxy for Nvidia's production volumes and, by extension, its near-term revenue recognition. A strong print would further corroborate the Taiwan ADP narrative and likely drive incremental upward revisions to Nvidia's outlook.

Nvidia's Positioning: The AI Compute Backbone

Nvidia's strategic position within the global AI ecosystem requires little introduction. The company's platforms power the data center infrastructure underpinning large language model training and inference, autonomous vehicle development, robotics, and cloud-based AI services. As enterprises transition from experimentation with generative AI to full-scale production deployment, demand for Nvidia's compute fabric has shifted from cyclical to structural.

This secular demand profile is increasingly visible in hard economic data, not merely in company commentary or sell-side enthusiasm. The Taiwan ADP export surge reflects real, physical shipment of goods—servers, switches, accelerators—destined for hyperscale data centers and enterprise AI clusters worldwide.

Technical Perspective: Defining the Support Framework

For investors and traders positioning ahead of Nvidia's next earnings report and the anticipated TSMC sales print, the technical landscape offers a clearly defined risk management level:

Critical Support Zone: $170 – This level represents a major technical and psychological floor. It has served as a foundational support area in prior consolidations and aligns with the post-earnings breakout level from late 2025. A sustained hold above $170 would signal that the stock's long-term uptrend remains structurally intact and that current levels represent a constructive entry or addition point.

A violation of this support, while not the base case given the strengthening fundamental backdrop, would suggest a broader de-risking of the AI trade and warrant defensive positioning. Conversely, a successful defense of $170, accompanied by positive catalysts from TSMC sales data and eventual Nvidia earnings, could provide the launchpad for a move toward the $235 price target articulated by UBS and other bullish analysts.

Conclusion: Data-Driven Conviction in the AI Leader

The convergence of hard economic data—Taiwan ADP exports, SIA semiconductor sales, and forthcoming TSMC revenue—paints a compelling picture of sustained, accelerating demand for AI infrastructure. Nvidia, as the principal enabler of this technological paradigm shift, stands to benefit disproportionately. UBS's reiterated Buy rating and $235 price target are grounded not in speculative narrative but in quantifiable, observable supply chain signals.

For investors, the path forward is unusually transparent. The Taiwan data has provided an early, high-confidence read-through to Nvidia's quarterly performance. The TSMC sales report will serve as the next confirmation point. And the $170 support level offers a disciplined risk management framework. In a market often characterized by ambiguity and narrative-driven volatility, Nvidia presents a rare convergence of fundamental strength, quantifiable catalysts, and technical clarity.

The data suggests the AI cycle is not merely intact—it is accelerating. Nvidia remains the most direct, high-conviction vehicle for capturing that upside.

USDJPY Trade Plan 12/02/2026Dear Traders,

USDJPY appears to have completed a 3 Drive Pattern near the recent highs, followed by a strong bearish rejection. Price is now trading within a short-term descending channel, indicating corrective pressure after the previous bullish leg.

As long as price remains below the 157.70 – 158.00 resistance zone, bearish momentum is likely to dominate in the short term.

🔻 Bearish Scenario

Key downside levels to watch:

152.50

150.50 (major demand zone & 1.27 Fibonacci extension)

A confirmed break below 150.50 could expose 148.00

🔄 Bullish Reaction Scenario

The 150.50 – 151.00 area is a critical decision zone.

If strong buying pressure appears (bullish rejection, divergence, or channel breakout), we may see a corrective move toward:

155.00

157.70

📌 Summary

Below 157.70 → Short-term bearish bias

Reaction at 150.50 → Potential bounce

Breakdown below 150 → Continuation toward 148

Let’s see how price reacts at the demand zone.

Regards,

Alireza!

looking for reaction to retrace - Short analysisLooking from top down, hawkish Auzzie news alongside a weak USD this week has proven a great week for Auzzie, however we have surpassed a key level shown in black, and we have seen a false break out area in green tapped which indicates we can likely see a pullback to retest the black line. I am watching on the 1 hr for a final leg up to complete a bullish w formation and a tap against a counter trend line before seeing a push down. this is a high risk set up as the overall trand is bullish. I have a bullish target not yet hit on the weekly ased on fib extension. however the intraday needs to complete the waves and has met resistance so i trade what i see. Friday tends to also be a volatile day and can wick against any direction. Friday expecting a pullback from the weekly uptrend. If pullback occurs nexxt week i will look for entries for long to my red target.

Note i am simply sharing my ideas and would appreciate any feedback on the analysis.

GBPUSD | FRGNT DAILY FORECAST | Q1 | W6 | D11 | Y26📅 Q1 | W6 | D11 | Y26

📊 GBPUSD | FRGNT DAILY FORECAST |

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:GBPUSD

EURGBP - Bearish Channel Suggest Price Is In A DowntrendPrice was in a rising channel (bullish phase), then broke down and formed a falling channel, repeatedly rejecting the same resistance zone.

That resistance area and the bearish channel now suggest EUR/GBP is in a downtrend, so the chart is signaling to look for short entries near that highlighted resistance zone.

SPX500 | Futures Subdued Ahead of Jobs DataSPX500 | Futures Subdued Ahead of Delayed Jobs Report

U.S. stock futures were subdued as investors awaited key labor market data, delayed by the partial government shutdown, while also monitoring ongoing earnings releases.

Markets continue to price in a potential June rate cut, with attention on Kevin Warsh, President Trump’s Fed Chair nominee, pending Senate approval.

Technical Outlook

The index has shifted bearish after stabilizing below 6988.

As long as price remains below 6988, downside pressure is expected toward 6918, followed by 6900 and 6858.

A recovery above 6988 would be needed to neutralize the bearish bias.

Key Levels

• Pivot: 6964

• Support: 6920 – 6900 – 6858

• Resistance: 6988 – 7020 – 7050

Gold crash: The ath won't be challenged —Bear market correctionJust the first move to signal the top, the all-time high, resulted in a 21.42% drop. This happened in just three days.

XAUUSD (Gold) showed the highest volume ever at the all-time high, with the session closing red. A clear top signal. Here comes the start of major correction, potentially a downtrend.

Gold produced a parabola, which always ends in a crash, and has been overbought for years, since March 2024. These are bearish signals.

Here you can have a closer look—daily timeframe:

First, $4,100. The main support range after $4,100 breaks mid-term, sits between $3,600 - $3,150. This is where Gold is headed long-term.

The all-time high is very likely to remain unchallenged thanks to the parabolic chart structure and the very strong reaction after this level was hit. The peak happened at $5,602 but the close was $4,895. The gap is just too big and this is extremely bearish.

Namaste.

EURUSD | FRGNT DAILY FORECAST | Q1 | W6 | D12 | Y26📅 Q1 | W6 | D12 | Y26

📊 EURUSD | FRGNT DAILY FORECAST |

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:EURUSD

$ETH vs $NVDA: The "World Compute" 0.886 Reality Check📉📉📉

The "World Computer" narrative is meeting the 0.886 Fibonacci reset.

While Ethereum ( CRYPTOCAP:ETH ) struggles to clear its $2k ceiling.

The actual compute leader powering 80% of #AI

( NASDAQ:NVDA ) has crushed it in relative price performance.

Ironic since Ethereum used to be mined on NVDIA GPU's !!!

The Setup: We are tracking a deep 0.886 retracement in the ETH/NVDA ratio, a level traditionally seen as the "capitulation zone" for underperforming assets.

Analysis: The AI explosion "real-world compute" has drained liquidity from speculative crypto layers.

Target: Watching for a structural bottom at the 0.886 reset level to see if the "World Computer" can finally find a bid against the hardware king.

Going forward... once achieved

ETH may only do well to simply retest the Double top neckline.

Moodng Forms a Strong Bottom | Is a Bullish Reversal Coming?Here is an extended, SEO-friendly English version suitable for TradingView and traders:

It appears that Moodng has formed a significant and important bottom, indicating a potential trend reversal or accumulation phase. Recently, the price moved below a long lower shadow (wick), showing strong selling pressure, but it immediately rebounded upward. This reaction suggests that buyers are actively defending this area and that demand is present at lower price levels.

At this stage, the main Change of Character (CH) has not yet been fully formed, and the price has not confirmed stability or consolidation above the key support zone. This means that the market is still in a sensitive phase and may experience further volatility before establishing a clear bullish structure.

However, if the price revisits lower levels, it can provide a good opportunity for traders to enter at more favorable prices. In such scenarios, it is essential to strictly respect the invalidation level, as proper risk management remains a priority. Since the asset is currently trading in a relatively cheap zone and the long lower wick has been filled, the risk-to-reward ratio appears attractive for potential long positions.

For more conservative and risk-averse traders, it is recommended to wait for clear confirmation. This includes strong consolidation above the key level and the formation of a valid CH. Entering after confirmation may reduce risk and increase the probability of success, even if it means missing part of the initial move.

All target levels are clearly marked on the chart and should be followed according to your trading plan. These targets are based on technical structure, key resistance zones, and potential liquidity areas.

It is important to note that a daily candle close below the invalidation level will invalidate this bullish scenario and cancel the current analysis. In that case, traders should reassess market conditions and avoid holding long positions.

As always, traders are advised to combine this analysis with their own strategies, proper risk management, and market context before making any trading decisions.

If you would like us to analyze a coin or altcoin for you, first like this post, then comment the name of your altcoin below.

If the price continues to respect the support zone and confirms bullish momentum, we may see a strong upside move toward higher liquidity levels and major resistance zones.

If you would like us to analyze a coin or altcoin for you, first like this post, then comment the name of your altcoin below.