Trend Analysis

TradeCityPro | Bitcoin Daily Analysis #260Welcome to TradeCity Pro!

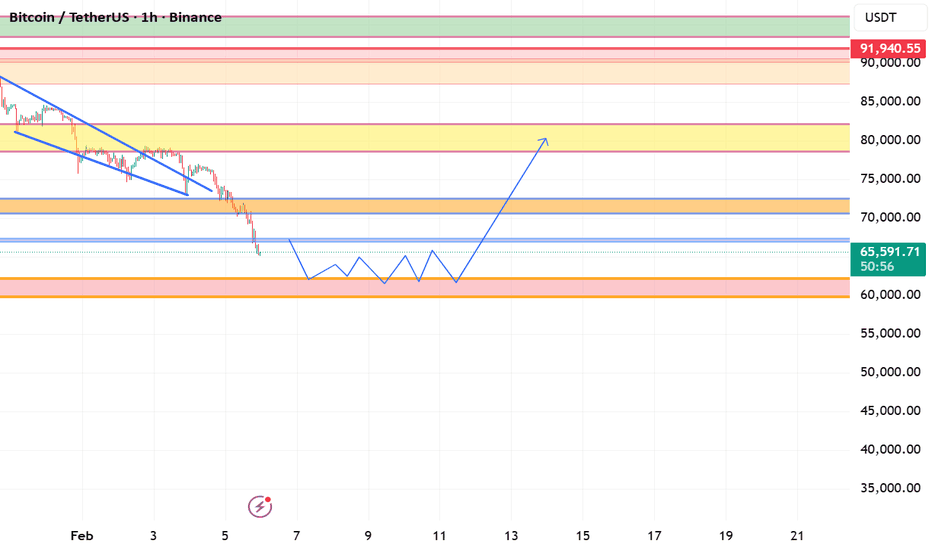

Let’s move on to Bitcoin analysis. The market is in a very sharp downtrend, and we can take advantage of this move to look for short opportunities.

1-Hour Timeframe

As you can see on the 1-hour chart, Bitcoin’s trend is clearly bearish, and yesterday, with the break of 72,996, the next bearish leg officially started.

The RSI oscillator is hovering near the oversold zone and has already found support around the 30 level multiple times. A move of RSI into oversold territory is a strong momentum trigger for short positions.

If you already have an open position, an RSI move into oversold could push your trade into strong profit. However, if you haven’t taken profits yet, I strongly recommend doing so—this bearish wave has already extended quite a lot, and the market could enter a corrective phase at any time.

At the moment, we don’t have a new trigger for opening additional short positions. We need to wait for the market to build more structure before the next short trigger forms.

For long positions, it’s still far too early to consider them. The market is currently bearish, and conditions are not suitable for longs.

If this bearish leg continues, the next support level to watch is 67,735, where Bitcoin could potentially show a reaction.

META under regulatory pressure in EuropeMETA under regulatory pressure in Europe: the social media debate reopens risks for the sector

By Ion Jauregui – Analyst at ActivTrades

The technology sector has once again moved to the center of the European political debate following strong criticism from Telegram founder Pavel Durov of the Spanish government’s plan to limit access to social media for minors under 16 and to toughen the criminal liability of executives for content considered harmful or hate speech. A position that was also joined by Elon Musk, owner of X, increasing tensions between regulators and major digital platforms.

Although media attention has focused on Telegram, the implications of the debate directly affect giants such as Meta Platforms, Alphabet, Snap, and TikTok, whose shares reacted with market declines amid rising regulatory uncertainty. In Meta’s case, the stock fell by more than 3% during the session, reflecting market sensitivity to any measure that could affect its business model based on algorithms, segmentation, and advertising monetization.

From a fundamental perspective, Meta faces a double risk in Europe. On the one hand, the possible restriction of access for minors could impact active user metrics and future user acquisition. On the other, the criminalization of the use of algorithms considered amplifiers of harmful content introduces a significant legal risk, which could force structural changes in the way content is distributed, directly affecting engagement and, by extension, advertising revenues.

This context aligns with a broader trend in Europe, where countries such as France, the United Kingdom, Greece, and more recently Australia have hardened their stance toward social media. For Meta, which has already had to adapt to the framework of the Digital Services Act (DSA) and the Digital Markets Act (DMA), the European regulatory environment continues to be a medium-term pressure factor.

Technical analysis of Meta Platforms (META)

From a technical standpoint, Meta shows signs of fatigue after the strong bullish rally of 2024 and 2025. On the daily chart, the price has lost momentum after setting recent highs, generating a correction that coincides with increased regulatory noise. After the highs of this year reached at the end of January, trading above 739, the stock experienced a sharp correction following the liquidation of positions after positive company results. Current regulatory news does not support its performance in Spain or the broader European trend, but we can observe that the long-term move has caused the price to fluctuate between the ceiling at 747.90 dollars and the floor at 579.04 dollars, with its midpoint—the point of control—around 666.15 dollars.

The current move is testing the 50-day moving average, creating a zone of indecision after a double moving average crossover that appears to be correcting the stock upward. The RSI has exited a very high overbought zone and is pointing toward consolidation, while the MACD is showing a contraction in bullish momentum, although without a clear signal of a long-term trend change. This could be revealing a sideways movement in the stock ahead of the quarterly earnings report. A loss of the current support level could open the door to deeper corrections if the 100-session moving average fails to hold. The resistance at recent highs has established itself as a rejection zone with high volume, now acting as a particularly important ceiling.

Regulatory tensions could affect results

Meta presents a long-term sideways structure with underlying bullish phases, but the European regulatory context acts as a catalyst for short- and medium-term corrections. As long as the price respects key support levels, the bias remains constructive; however, a more aggressive regulatory escalation could prolong the consolidation phase and increase the stock’s volatility.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance and forecasting are not a synonym of a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Political risk is unpredictable. Central bank actions can vary. Platform tools do not guarantee success.

TRXUSD 6-month Channel Down in total control targeting 0.2600.Tron (TRXUSD) has been trading within a 6-month Channel Down since its August 14 2025 High and is right now already halfway through its 3rd Bearish Leg.

Having lost both its 1D MA200 (orange trend-line) and 1D MA200 (orange trend-line), which should serve as the long-term Resistance from now on, we expect it to test the 1W MA100 (red trend-line) on the long-term.

On the short-term based on the previous Bearish Legs, we expect it to complete at least a -19.37% total decline form the Lower High, targeting 0.26000.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

DAX breakout zone retest support at 24400The DAX remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 24400 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 24400 would confirm ongoing upside momentum, with potential targets at:

25033 – initial resistance

25180 – psychological and structural level

25340 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 24400 would weaken the bullish outlook and suggest deeper downside risk toward:

24200 – minor support

23990 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the DAX holds above 24400. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

EURAUD: Bearish Move After Trap?! 🇪🇺🇦🇺

EURAUD may drop after a presumably false violation of an

intraday horizontal resistance.

Today's intraday price action looks bearish after a London session opening.

Goal - 1.6870

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

RSI Continuation Analysis in Bull and Bear Market Regimes (BTC) This study set out to answer two practical questions about how Bitcoin behaves after extreme RSI readings, depending on whether the broader market is trending upward or downward:

1. In bear markets, does an RSI reading below 30 typically lead to continued price weakness?

2. In bull markets, does an RSI reading above 70 typically lead to continued price strength?

To investigate this, daily Bitcoin price data was examined over a multi‑year period, and each day was categorized by both its market regime and its RSI condition. Forward returns were then measured to determine whether prices tended to continue in the same direction after these extreme momentum signals.

1. Data and Time Period

The analysis used daily Bitcoin‑USD closing prices covering:

September 17, 2014 through February 6, 2026

This provided a long, diverse dataset containing multiple bull markets, bear markets, and transitional periods.

2. Indicator Construction

Two key pieces of information were calculated for every trading day:

Relative Strength Index (RSI‑14)

A momentum indicator ranging from 0 to 100.

• RSI < 30 is traditionally labeled “oversold.”

• RSI > 70 is traditionally labeled “overbought.”

200‑Day Moving Average (MA200)

Used to determine whether the broader market trend was upward or downward.

The slope of the MA200 over a 20‑day window was used to confirm whether the long‑term trend was rising or falling.

3. Market Classification

Each day in the dataset was assigned to one of two regimes:

Bull Regime

• Price above the 200‑day moving average

• MA200 trending upward

• Conditions sustained for several consecutive days to avoid noise

Bear Regime

• Price below the 200‑day moving average

• MA200 trending downward

• Conditions also required to persist for multiple days

This ensured that each day was placed into a stable, meaningful trend environment rather than reacting to short‑term fluctuations

4. Forward Return Measurement

For every day in the dataset, the 5‑day forward return was calculated.

This measures how much price changed over the next five trading days, expressed as a percentage.

This allowed the study to answer:

“After an extreme RSI reading, what typically happens next?”

5. Grouping by RSI Thresholds and Regime

Each day was placed into one of four groups:

• Bear regime + RSI < 30

• Bear regime + RSI > 70

• Bull regime + RSI < 30

• Bull regime + RSI > 70

For each group, the following were computed:

• Mean 5‑day forward return

• Hit rate (percentage of days with positive forward returns)

• Sample size (N)

These statistics were then compared to understand how RSI behaves differently depending on the market environment.

6. Results

BEAR MARKETS

RSI < 30: MEAN 5 DAY RETURN WAS -0.706%, HIT RATE WAS 57.86%, N = 140

RSI > 70: MEAN 5 DAY RETURN WAS +1.519%, HIT RATE WAS 57.92%, N = 183

BULL MARKETS

RSI < 30: MEAN 5 DAY RETURN WAS +1.968%, HIT RATE WAS 61.80%, N = 233

RSI > 70: MEAN 5 DAY RETURN WAS +3.278%, HIT RATE WAS 63.44%, N = 640

A second summary using median-based measures produced similar directional conclusions:

In BEAR MARKETS, RSI < 30 showed slightly negative continuation on average

In BULL MARKETS, RSI > 70 showed strong positive continuation

7. Interpretation in Plain Language

The findings show that RSI behaves very differently depending on the broader trend.

In bear markets, an RSI reading below 30 does not signal a reliable rebound; instead, prices tend to continue drifting lower over the next several days. In bull markets, an RSI reading above 70 does not signal an imminent reversal; rather, prices tend to continue rising, showing that strong momentum often persists. In short, “oversold” does not reliably help you buy dips in downtrends, and “overbought” does not reliably warn of reversals in uptrends, momentum tends to continue, not reverse.

BTC at a Significant Zone: Key Level to WatchBitcoin (BTC) is currently trading around a significant technical zone. If the price holds and shows clear acceptance above this area, it could indicate strength and increase the probability of an upward move. This zone will be critical in determining whether bullish momentum can continue.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Trading cryptocurrencies involves substantial risk, and losses can exceed expectations. Always trade responsibly. *

MPCO rebounded from the 200 MA &broke out of the triangle patterMPCO rebounded from the 200 MA 📐🔄 and broke out of the triangle pattern with strong volume 📈🔊.

The main resistance to watch is 1.72 🧱.

A break and close above this level would open the way toward the first target at 1.9 🎯, followed by the second target at 2 🚀.

⚠️ Note: RSI is showing a bearish divergence 📉, so some consolidation or a retest remains possible before continuation.

⚠️ Disclaimer: This is general information only and not financial advice. For personal guidance, please talk to a licensed professional.

Hope Our Analysis will Save you from Buying Gold @Wrong Levels!Gold (XAU/USD) Short-Sell Analysis (4H Timeframe)

After reaching an all-time high of $5,600, Gold broke its immediate trendline and experienced a bearish spike down to a low of $4,400. It has now pulled back to around the $5,000 level and is resuming its downward movement. We expect this bearish trend to continue toward the target levels before any potential accumulation or trend reversal.

Pullback Level:

Around $5,100

EURUSD 15M – Smart Money Trap Below Support | Buyers Take ControPrice is inside a clear ascending channel → overall bullish structure intact.

Recent move was a pullback to channel support, not a trend break.

The reaction from the lower boundary shows buyers defending aggressively.

🧠 Key Observation (Circle Area)

You’ve marked a liquidity sweep / stop-hunt below support.

After sweeping lows, price printed a strong bullish impulsive candle → classic smart money entry signal.

This confirms fake breakdown → bullish continuation.

📍 Important Levels

Support zone: 1.1780 – 1.1785 (strong demand + channel support)

Entry area: ~1.1788

Invalidation: Below 1.1780 (clean break & close)

Target: 1.1800 🎯 (near-term)

Extended target: 1.1825 – 1.1830 (upper channel)

📈 Trade Bias

Bias: Bullish continuation

Setup: Buy on pullbacks / bullish candle confirmation

RR: Clean and favorable (structure-based)

⚠️ What to Watch

If price accepts below channel support, bullish idea weakens.

A 15M close above 1.1800 opens the door for the next leg up.

🧾 Summary

Liquidity grab + channel support + bullish displacement

➜ High-probability continuation setup

US30 DAILY MARKET STRUCTURE AND DIRECTIONAL BIAS .US30 is the common trading symbol for the Dow Jones Industrial Average (DJIA), a price-weighted index tracking 30 major U.S. blue-chip companies. It serves as a key gauge of U.S. economic health and investor sentiment, with higher share prices of components wielding greater influence.

Fed Rate Impact

Fed rate cuts lower borrowing costs, boosting corporate profits and stock valuations, which typically lifts US30—evident in 2025 pauses after prior hikes. Rate hikes raise costs and slow growth, pressuring the index downward, as during the 1980s inflation fight when funds rate hit 20%.

Dollar Strength Effects

A strong USD (rising DXY) often weighs on US30 by hurting multinational exporters' overseas earnings and signaling risk-off sentiment that shifts capital to cash. Conversely, a weakening dollar supports the index as it enhances competitiveness and encourages equity inflows.

Weights shift with share prices, but recent sources highlight these leaders based on the index's methodology:

Rank Company (Ticker) Approx. Weight Notes

1 UnitedHealth (UNH) ~8-10% High share price drives top spot

2 Goldman Sachs (GS) ~7-11% Financial heavyweight

3 Caterpillar (CAT) ~6-9% Industrials leader

4 Microsoft (MSFT) ~5-6% Tech influence via price

5 Home Depot (HD) ~5% Retail giant

US30 market structure ,am looking at one more swing to take all the buy gains on correction of over 1000pips profit on selloff correction.

#us30

No NFP TomorrowHi, I’m Maicol, an Italian trader.

I study Gold since 2019.

I need your support.

Leave a like and follow me.

It’s a small thing for you, but important for my work.

Please read the description to understand the trading plan.

Don’t focus only on the chart. Thanks.

Live today at 14:00 CET (Rome time).

🌞 GOOD MORNING EVERYONE 🌞

Gold can’t close the daily above the main shift.

At this point, the chance of a move back to lower zones is high.

So I’ll look to target those areas.

We have three TF — D, H4, H1 — all with a bearish setup.

It makes sense to follow that for now.

See you live later today.

🔍 Reminder 🔍

I avoid trading during the Asian and London sessions.

I focus on the 14:30 news and the New York open at 15:30.

🔔 Turn on notifications so you don’t miss anything.

📬 If you have any questions, message me. I’ll reply.

🔍 NEXT APPOINTMENTS 🔍

As usual, we’ll be live at 14:00 to follow the market in real time.

In the meantime, have a good day.

-GOOD TRADING

-MANAGE RISK

-BE PATIENT

Around $4850: A Battleground for Bulls and BearsAround $4850: A Battleground for Bulls and Bears

As shown in the chart, gold prices are currently at a critical juncture where technical and fundamental factors converge. The interplay of bullish and bearish factors has led to narrowing price fluctuations and consolidation in the short term.

Two questions:

1. Should large funds push up gold prices? This would release funds trapped at higher prices.

2. Should large funds continue selling? A large number of bargain hunters are driving up the cost of further selling.

Currently, savvy investors are in a very conflicted position.

Summary:

1. The $4800 to $4900 range has become a key consolidation area, where bulls and bears are fiercely battling for control.

2. As long as gold prices remain above $4700, intraday trading should continue to focus on buying on dips and establishing long positions at lower prices.

3. This week, we continued our buy-low strategy, generating 1-2 profit signals daily, resulting in profits exceeding 100 points and over $10,000 per order. We will continue this strategy.

I will share the signals in real-time on the channel.

Key News and Policy Summary

1. Dovish Expectations Provide Support: The market is betting on two more rate cuts by the Federal Reserve in 2026. Weak ADP employment data reinforced this expectation.

2. The US dollar index hit a two-week high, putting downward pressure on dollar-denominated gold.

3. Iran and the United States agreed to hold talks, easing market concerns about a larger-scale military conflict and weakening gold's safe-haven appeal.

4. Events such as the US Navy shooting down an Iranian drone will temporarily boost safe-haven demand.

5. Key Focus (February 6): US January Non-Farm Payrolls Data.

The data results will directly impact expectations of a Fed rate cut and the dollar's performance, making it the most important catalyst for today's market movements. Gold prices are currently at a critical juncture.

Key support area: The area around $4800 is the core of the current market.

Meanwhile, the $4880-$4900 range is also considered a previous consolidation platform and a cost zone for bulls, forming strong support.

Therefore, gold's reaction in this area is crucial.

Upside resistance and momentum: Gold prices have recently retreated after failing to break through the $5100 level. Major resistance levels are located at $4993 (50% Fibonacci retracement) and $5134 (61.8% Fibonacci retracement).

Technical indicators suggest that gold prices need a new catalyst to break through, but gold remains in a long-term uptrend.

In summary, $4800-$4900 is the lifeline for today's battle between bulls and bears.

Before the release of the non-farm payroll data, it is recommended to remain cautious and observe the market, or test the market with a very small position, prioritizing risk control and waiting for data guidance before making further decisions.

Whenever SP500 pullback, watch the old high as new support... Whenever stocks pull back, the key thing I would watch is whether the old high can hold as new support. This is one of the most consistent features of a healthy bull market, and the SPX chart illustrates this perfectly over multiple cycles. Each major advance eventually runs into a correction, often sharp and emotional, but as long as the prior breakout level holds, the broader trend remains intact.

Looking back, we can see several deep pullbacks that initially looked like trend reversals. In reality, they were corrective phases within a rising channel. Once price retested former resistance and buyers stepped back in, the market resumed higher, often with strong impulsive follow-through.

Well, the reason why I bring this chart on is because I see Dollar making some important recovery and if this strenght will resume, stocks can see a pullback, as more investors seems to be selling more and more assets and moving into cash. First was cryptos, then metals, and now just wondering if stocks are next. But 10-12% can be enough; we may not see 20% drop like before. Because always when market goes higehr and higher, pullbacks in % are smaller.

And one more thing, Trump will 100% try to defend any kind of a strong sell-off...

Be carefull, wait on better levels, then chasing new entries here.

GH

BUY XAUUSDGold is approaching a key demand zone around 4672 after an extended short-term sell-off, where price previously reacted and liquidity is likely resting. This area sits near structural support and comes after bearish momentum that looks stretched, making it a logical place for buyers to step in if rejection appears. If price slows into the zone and prints bullish reaction candles or a short-term structure shift on lower timeframes, it would support a corrective rebound toward the higher resistance area marked above, favoring a tactical long setup rather than chasing the breakdown lower.

#SEI/USDT - Final Support Before a Major Reversal or Breakdow#SEI

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 0.0800. The price has bounced from this level several times and is expected to bounce again.

The RSI is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 0.0820

Target 1: 0.0829

Target 2: 0.0844

Target 3: 0.0860

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

Time & Price Analysis — NIFTY IntradayTime & Price Analysis — NIFTY Intraday (Educational)

Intraday markets don’t respond to price alone.

They respond when price reaches the right zone at the right time.

Today’s structure is guided by a Time & Price Map, where demand is expected to respond on dips within a defined time window.

🧠 Intraday Framework:

CMP: 25,735

Strategy: Buy on Dips

Risk Definition: Below 25,680

Stop Loss: Below 25,680

⏳ Time Condition:

This setup remains valid on or before 14:35.

If price respects structure within this window, continuation remains favored.

🎯 Projected Price Zones:

Target 1: 25,780

Target 2: 25,870

Educational Insight for Viewers:

Price without time is incomplete.

When time and price align, moves become decisive rather than noisy.

Key Takeaway:

Intraday trading is not prediction —

it is planning price behavior within time.

⚠️ Educational view only. Risk management is essential.

GBPUSD Next MoveGBPUSD is respecting a clean bullish market structure after the impulsive breakout above the mid-range resistance cluster and is now pulling back into a confluence demand zone aligned with previous structure, Fibonacci retracement, and liquidity sweep behavior, which signals a classic breakout and retest continuation pattern rather than reversal. Price holding above this support band shows buyers defending higher lows, keeping bullish momentum intact and positioning the pair for continuation toward the upper resistance region if the zone holds. Fundamentally, pound strength is being supported by relatively sticky UK inflation expectations and a Bank of England stance that remains cautious about aggressive rate cuts, while the US dollar side is facing pressure from softer growth signals and shifting Federal Reserve rate path expectations, reducing yield advantage and favoring risk-on currency flows. This combination of bullish price action structure, demand zone reaction, higher timeframe trend continuation, and shifting monetary policy expectations creates a strong probability environment for upside expansion, making pullbacks into support technically attractive within a trend-following strategy focused on momentum, liquidity, and smart money positioning.

EUR/USD Forecast – Long-Term Bullish Bias (ICT Framework)Pair: EUR/USD

Bias: Bullish (Long-Term)

Date: Feb 5, 2026

Higher Time Frame Context (HTF)

On the higher time frames, EUR/USD remains in a bullish market structure, with price trading above major historical lows and respecting higher-time-frame discount levels. The recent downside move appears corrective rather than impulsive, suggesting re-accumulation before continuation higher.

Key HTF Observations

Bullish structure intact on Daily / Weekly

Recent sell-off aligns with a premium → discount rebalancing

Price approaching Daily discount (0.6–0.7)

Unmitigated bullish inefficiencies below current price

Short-Term Expectation (Drawdown Phase)

In the short term, price may:

Sweep sell-side liquidity below recent lows

Mitigate remaining Daily FVG

Complete drawdown into discount before expansion

This drawdown is viewed as buy-side positioning, not trend reversal.

Long-Term Trade Thesis

Accumulation Zone: 1.1760 – 1.1790 (HTF discount)

Invalidation: Sustained Daily close below key structure low

Bullish Targets:

1.1900 (range equilibrium)

1.1980 (prior high)

1.2050+ (buy-side liquidity)

Expectation

Once sell-side liquidity is fully taken and price re-enters bullish delivery, expect:

Strong displacement to the upside

Reclaim of mid-range value

Continuation toward buy-side liquidity

📈 Bias remains bullish unless HTF structure is violated.

Disclaimer

This analysis is for educational purposes only. Always manage risk and confirm entries on lower time frames.

NSE – NIFTY 750 | Infosys Limited | 05 Feb 2026Monthly structure view of Infosys as part of the NIFTY 750 Structure Census.

Long-term rising structural support remains intact despite multiple corrective phases.

Current behaviour reflects higher-range consolidation within a sustained structural framework.

This is a structural update, not a directional call.

#NIFTY750 #Infosys #MarketStructure #EquityStructure #LongTerm #EWAVESJOURNAL

Is NVIDIA showing signs of a potential momentum shift?Is NVIDIA starting to shift momentum after a strong uptrend since October 2022?

There’s a possibility of a retest toward $88 if price fails to break out above the $180 range.

Volume continues to decline, suggesting weakening participation. Only time will tell.