Macro on Netflix - 7 month downtrend + Earnings + NewsI have my eyes on Netflix. A very popular stock globally, very FA strong.

It will be a macro analysis on Netflix with focus on higher timeframes with additions of lower timeframe mentions in an attempt to highlight potential swing trade areas or entry points. I will also discuss indicators, chart patterns, candle stick behavior and more.

I dont normally go into news or FA since its all priced into the charts in my opinion.

But i will say this, big news on Netflix and it hussling to gather cash for the potential Warner Bros acqusition. It shows that they mean business which is good for business and uptrends.

Since most people trade news + FA, it is something to consider. With Earnings today for Q4 and data suggestion positive earnings. This info could be used to predict potential price movement to Upside with an attempt to test or try to get back on the broken Uptrend Support trendline that was propping up its recent Uptrend.

Especially since Netflix has been on a downtrend for past 7 months. We are down roughly 34.00%. Probabilities of an uptrend increase , the longer the decline.

Questions im asking: how long the downtrend will continue? Where is the next Support area?

Is there signs in the lower timeframes of a potential bounce to test the recently broken Uptrend Support trendline.?

Netflix has a strong case for observation and attention at the moment.

Look for more posts and evidence as i continue to monitor Netflix.

Trendlineanalysis

Sector Divergence: Technology vs Industrials1. Nature of the Two Sectors

The Technology sector is primarily growth-oriented, driven by innovation, intellectual property, software scalability, and network effects. Revenue growth, margin expansion, and long-term disruption potential are central to valuation. Many technology companies operate with relatively low marginal costs and high operating leverage once scale is achieved.

The Industrials sector, in contrast, is cyclical and asset-heavy, encompassing manufacturing, infrastructure, engineering, capital goods, logistics, and defense. Performance depends heavily on economic growth, government spending, private capital expenditure (capex), and global trade volumes.

This structural difference lays the foundation for divergence.

2. Macro-Economic Sensitivity

Technology tends to outperform during:

Low interest rate environments

High liquidity conditions

Periods of moderate but stable economic growth

Times when productivity-enhancing investments are favored

Lower rates increase the present value of future cash flows, which disproportionately benefits tech stocks due to their long-duration earnings profile.

Industrials outperform during:

Economic expansions or recoveries

Rising capex cycles

Infrastructure booms

Manufacturing upcycles

Industrial earnings are more sensitive to GDP growth, PMI data, and order books. When economies accelerate, industrial revenues and operating leverage rise sharply.

3. Interest Rates and Inflation Impact

Interest rates are a key driver of divergence.

Technology suffers when interest rates rise sharply, as higher discount rates compress valuations. Even strong earnings growth may not offset multiple contraction.

Industrials often perform better in moderate inflation and rising-rate environments, especially when pricing power and order visibility improve.

High inflation with aggressive tightening:

Negative for tech (valuation compression)

Mixed for industrials (input cost pressure vs demand strength)

Controlled inflation with fiscal spending:

Strongly positive for industrials

Neutral to mildly positive for tech

4. Earnings Cycles and Visibility

Technology earnings:

More scalable and margin-rich

Often recurring (subscriptions, SaaS, licensing)

Sensitive to enterprise spending cycles

Vulnerable to sudden demand slowdowns (IT budget cuts)

Industrial earnings:

Order-book driven

Higher revenue visibility over medium term

Sensitive to raw material costs, labor, and logistics

Strong operating leverage during upcycles

This difference means tech can re-rate quickly on expectations, while industrials move more steadily with economic data.

5. Valuation Dynamics

Technology stocks typically trade at:

Higher P/E and EV/EBITDA multiples

Premiums based on growth and innovation

Valuation sensitive to guidance and long-term TAM (Total Addressable Market)

Industrials usually trade at:

Lower multiples

Closer alignment with earnings cycles

Valuation support from tangible assets and cash flows

Divergence often appears when:

Tech valuations expand faster than earnings

Industrials lag despite improving fundamentals

or vice versa during late-cycle slowdowns.

6. Market Cycle Positioning

Early Cycle

Tech outperforms as liquidity returns

Industrials lag until capex recovers

Mid Cycle

Industrials gain leadership

Tech continues performing but with selective stock picking

Late Cycle

Industrials peak as cost pressures rise

Tech leadership becomes narrow and volatile

Recession / Risk-Off

Both decline, but defensiveness within tech (large-cap, cash-rich firms) may outperform cyclical industrials

Understanding the cycle helps explain why divergence can persist for quarters, not just weeks.

7. Policy and Government Spending Influence

Industrials benefit disproportionately from:

Infrastructure spending

Defense budgets

Energy transition projects

Manufacturing incentives

Technology benefits from:

Digitalization policies

AI, cloud, semiconductor incentives

Education and skill development initiatives

When fiscal policy dominates monetary policy, industrials tend to outperform. When liquidity and innovation dominate, technology leads.

8. Global Trade and Supply Chains

Industrials are more exposed to:

Global trade volumes

Supply chain disruptions

Commodity price fluctuations

Geopolitical risks

Technology, while global, is increasingly:

Asset-light

Service-oriented

Less exposed to shipping and logistics disruptions

This difference can cause divergence during geopolitical or supply-chain stress periods.

9. Investor Behavior and Sentiment

Technology attracts:

Momentum investors

Growth funds

Retail participation

Venture and innovation capital

Industrials attract:

Value investors

Income-oriented funds

Long-term institutional capital

During risk-on phases, tech sentiment can turn euphoric quickly. Industrials, however, tend to see more measured inflows based on fundamentals.

10. Trading and Investment Implications

For Traders

Sector rotation strategies can exploit divergence

Relative strength (Tech / Industrials ratio) is a key indicator

Divergence often precedes index-level trend changes

For Long-Term Investors

Balance growth (tech) with cyclicality (industrials)

Adjust weights based on macro signals (rates, PMI, policy)

Avoid over-concentration during extreme divergence

For Risk Management

Tech-heavy portfolios are more duration-sensitive

Industrial-heavy portfolios are more growth-sensitive

11. India-Specific Context (Optional Insight)

In markets like India:

Technology (IT services) is linked to global demand and currency trends

Industrials are closely tied to domestic growth, infrastructure, and government spending

Periods of strong domestic capex often see industrials outperform IT, even when global tech struggles.

Conclusion

Sector divergence between Technology and Industrials is not random—it reflects deeper forces such as interest rates, economic cycles, policy direction, earnings visibility, and investor psychology. Technology thrives on liquidity, innovation, and long-term growth expectations, while Industrials benefit from economic expansion, capex cycles, and fiscal stimulus.

Successful investors and traders monitor this divergence closely, using it as a leading indicator for market regime shifts. Rather than choosing one sector permanently, the key lies in dynamic allocation, recognizing when leadership is changing, and positioning accordingly.

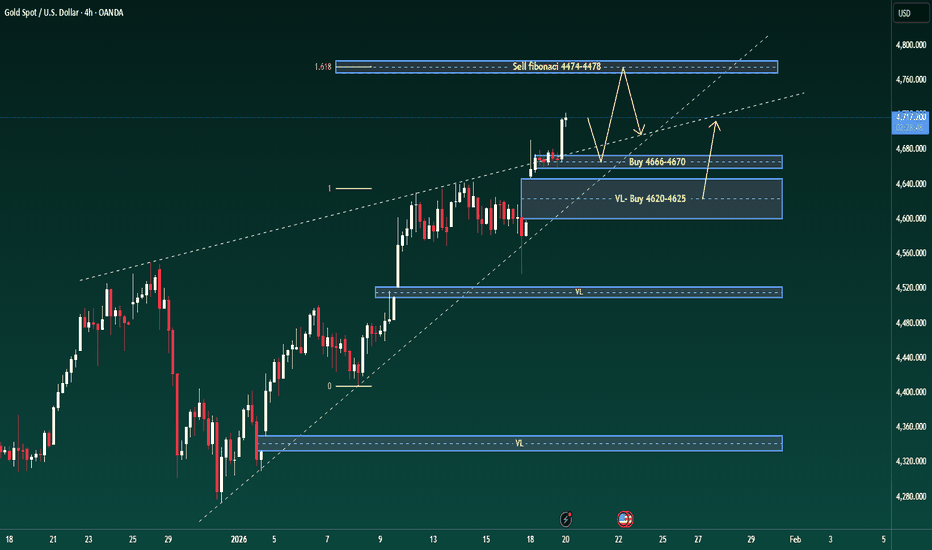

XAUUSD (H4) — Bond Selloff, Yields Jump Pullback Opportunity or Rejection at the Top?

Gold is still holding a bullish structure on the H4 chart, but the rebound in global yields can easily trigger sharp swings around key resistance. Today’s approach is simple: trade the zones, not the noise.

I. Executive Summary

Primary trend: H4 uptrend remains intact.

Trading bias: Prefer BUY on pullbacks into demand; consider SELL only with clear rejection at Fibonacci resistance.

Key zones:

Sell: 4774–4778

Buy: 4666–4670

Value Buy: 4620–4625

Rule: Enter only after zone touch + confirmation (rejection / micro-structure shift).

II. Macro & Fundamentals (optimized & concise)

Global bond selloff: Bond selling is spreading globally; Japan’s 40-year JGB yield hitting 4% signals broad, persistent yield pressure.

US yields rebounding: Higher US yields (10Y–30Y) raise the opportunity cost of holding gold → short-term bearish pressure for XAUUSD.

Risk premium still alive: Geopolitical tension and tariff headlines keep markets sensitive, supporting defensive flows and limiting deep downside.

Fundamental takeaway: Rising yields can drive a pullback, but the broader risk backdrop favors a correction within an uptrend, not a full reversal (unless structure breaks).

III. Technical Structure (from your chart)

1) H4 overview

Price is extended after a strong impulse and is now consolidating, while structure still prints Higher Highs / Higher Lows.

The ascending trendline remains supportive → the higher-probability play is buying dips into demand rather than chasing price.

2) Key zones

Fibonacci Sell zone: 4774 – 4778 (major supply / resistance — profit-taking and rejection risk)

Buy zone: 4666 – 4670 (shallow pullback within trend)

VL / Value Buy: 4620 – 4625 (deeper pullback — higher-quality dip if yields spike again)

Lower support zones remain a contingency for a deeper flush.

IV. Trading Plan (Brian style — 2 scenarios)

⭐️ PRIORITY SCENARIO — BUY (trend continuation)

Idea: As long as the H4 uptrend holds, look to buy pullbacks into demand with confirmation.

Option A — Buy pullback: 4666 – 4670

SL: below 4620 (more conservative: below 4616–4610 depending on volatility/spread)

TP: 4716 – 4740 – 4774 – 4800

Option B — Value Buy (if a deeper sweep happens): 4620 – 4625

SL: below the nearest H4 swing low / below 460x (risk preference dependent)

TP: 4666 – 4716 – 4774 – 4800

Confirmation cues (optional):

Strong rejection wick at the buy zone, or

H1 micro-structure break back to the upside, or

Liquidity sweep then close back above the zone.

⭐️ ALTERNATIVE SCENARIO — SELL (rejection at Fibonacci resistance)

Idea: With yields rising, gold may react sharply at the top — treat this as a reaction trade, not a macro trend reversal call.

Sell zone: 4774 – 4778 (SELL only if price rejects clearly)

SL: above 4788 – 4800

TP: 4740 – 4716 – 4670

Important: If H4 closes and holds above 4778 (acceptance), the bias shifts to buying pullbacks instead of forcing shorts.

Structural Compression Phase🔎 Overview

This idea focuses on identifying potential bullish expansion after a multi-day price consolidation inside the EMA 100 High–Low Band.

The structure highlights range compression, swing-based trendline pressure, and rising volume during consolidation, which together can signal a market preparing for directional movement rather than random noise.

────────────────────────────

📘 Core Components

EMA 100 High–Low Band

• The EMA 100 High–Low Band represents fair value and balance.

• Price consolidating inside this band suggests indecision and energy buildup, not trend weakness.

Pivot High–Low Swings

• Pivot Highs and Pivot Lows are used to map internal market structure.

• Two swing-based trendlines are drawn:

• One connecting lower highs

• One connecting higher lows

This creates a structure squeeze within value.

────────────────────────────

🛠 Market Structure Concept

Consolidation & Compression

• Price has remained inside the EMA High–Low Band for multiple sessions.

• Swing highs are compressing downward while swing lows are compressing upward.

• This reflects decreasing volatility and controlled price action, often seen before expansion.

────────────────────────────

📐 Trendline Structure

• Upper trendline connects progressively lower swing highs.

• Lower trendline connects progressively higher swing lows.

• Both trendlines converge, indicating structural pressure.

This is not direction — it is preparation.

────────────────────────────

📊 Volume Behavior

• Volume is above average while price remains in consolidation.

• Rising participation without range expansion suggests absorption, not exhaustion.

• This behavior often precedes directional acceptance, not immediate rejection.

────────────────────────────

📈 Bullish Expansion Context (Structure-Based)

• A clean acceptance above the upper swing trendline

• Followed by price sustaining above recent structure highs

• While remaining supported outside the EMA High–Low Band

This sequence would indicate resolution of compression rather than a false breakout.

────────────────────────────

🧭 Validation, Devalidation & Projection Framework

Validation Line (Strength Confirmation)

• A candle close above the validation line confirms structural acceptance.

• This signals that the compression phase has resolved with strength, not noise.

Devalidation Line (Structure Failure)

• A candle close below the devalidation line invalidates the setup.

• This indicates failure of compression logic and negates the structural thesis.

Target Line (Maximum Structural Projection)

• Once validated, the target line represents the maximum expected structural expansion based on current compression range.

• This is a projection reference, not a prediction.

Devalidation as Protection

• After validation, the Devalidation level acts as a structure protection zone.

• A sustained close below this level signals loss of acceptance and invalidates continuation logic.

────────────────────────────

📝 Summary

• EMA 100 High–Low Band defines balance and value.

• Price consolidates inside the band for multiple sessions.

• Swing-based trendlines show structural compression.

• Volume expands during consolidation, indicating participation.

• Validation and devalidation lines define acceptance and failure zones.

• Target and revalidation levels provide structured projection and protection.

• The idea focuses on structure resolution, not prediction.

• Direction is assessed only after acceptance, not anticipation.

────────────────────────────

⚠️ Disclaimer

📘 For educational purposes only.

🙅 Not SEBI registered.

❌ Not a buy/sell recommendation.

🧠 Purely a learning resource.

📊 Not Financial Advice.

$BNB Bull Run Rapidly & Price Hit $1,515 Q2 in 2026On January 15, 2026, BNB Chain executed its 34th quarterly BNB token burn, permanently removing 1,371,803.77 BNB, valued at approximately $1.277 billion, from circulation.

The event highlights BNB's deflationary model enhancing scarcity, potentially impacting market dynamics and long-term asset valuation amid BNB Chain's ongoing ecosystem growth initiatives.

BNB Chain conducted its 34th quarterly token burn on January 15, 2026, permanently removing 1,371,803.77 BNB. This action aligns with the network's goal of reaching a 100 million BNB supply cap using a deflationary model. The 34th BNB Burn highlights the impact on the ecosystem.

Fermi Hardfork Live on Mainnet

Meanwhile, the Fermi hard fork upgrade is now live on BNB Smart Chain. Developers activated the upgrade on mainnet on Jan. 14, 2026, at 02:30 UTC, supported by the v1.6.4 client release.

Following the Fermi mainnet activation, block time dropped from 0.75 seconds to 0.45 seconds, improving transaction speed and dApp responsiveness.

Fermi also adds more parameter updates, improvements, and bug fixes to the BNB network.

Additionally, Fermi introduces updated voting rules for fast finality through BEP-590 to support frequent block production.

Essentially, Fermi makes the network faster without compromising reliability. It follows other major updates, including Lorentz, Pascal, and Maxwell.

BNB Price Outlook, What to Expect

BNB, the native digital asset of the BNB Chain, is currently showing improvement in its price. Over the past 24 hours, BNB price increased by 0.9% to $938.2, with a market cap of $127.9 billion.

Considering its latest move, BNB now moves closer to hitting the $1,000 mark. BNB closed higher after breaking above the $920 key resistance.

If the move continues, analysts have predicted that the BNB price may head toward the next resistance zone between $1050 and $1080.

The potential launch of a BNB ETF is one key factor that could fuel the move towards $1,000. Just a few hours after Grayscale announced the filing of its incoming spot BNB ETF, the BNB price posted 2% gains.

#Write2Earn #BinanceSquareFamily #Binance #BNB #SUBROOFFICIAL

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions. Digital asset prices are subject to high market risk and price volatility. The value of your investment may go down or up, and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance is not available for any losses you may incur. Past performance is not a reliable predictor of future performance. You should only invest in products you are familiar with and where you understand the risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment.

Chumtrades XAUUSD H2 | Is the Liquidity Sweep Over?On Friday, the market reacted strongly after Trump’s comments regarding Kevin Hassett, when Trump expressed his preference for Hassett to remain in his current role rather than taking a new position.

👉 As a result, gold printed a long wick liquidity sweep back into the prior ATH zone, around 4530–453X, before closing back above 456X.

This brings us to the key question:

Was this sweep enough for the BUY side, or is the market still looking to test lower levels?

Political developments will be a key driver for gold direction in the coming week.

📰 Key Political Factors to Monitor

1. Trump – Greenland

The US has imposed 10% tariffs, with the possibility of increasing them to 25% on countries that do not support the annexation of Greenland

No fixed deadline, tariffs remain until Greenland becomes part of the US

→ This is a supportive factor for gold, especially amid rising geopolitical uncertainty

→ This news may directly impact the market open

→ If price reacts strongly, avoid SELLs near resistance

2. Iran – Protests

Monitor the risk of Trump returning to direct intervention

→ A potential headline-driven volatility trigger

🟢 Key Support Zones to Watch

4530 – 4535

4515 – 4510

4480 – 4482

4462

4410 – 4407

🔴 Key Resistance Zones to Monitor

4618 – 4628

4648 – 4650

4655 – 4660

4698 – 4699

⚠️ Trading Notes

Price levels are zones for observation, not instant entry points

SELL setups around 462X must be evaluated based on news reaction

If momentum accelerates on headlines → stay flat and avoid trading against strength

💬 Question for the New Week

Is the market finishing its liquidity collection on the BUY side,

or was Friday’s sweep the final test before the next leg higher?

📌 Follow www.tradingview.com for proactive market analysis, structured trade planning, and risk management insights.

ETH-The final drop before the cows come home (SHORT TERM SHORT)hello all 👋🙋♂️🙋♀️ Thank you so much for coming today

Let's get right to it💡. Today we are looking at a 4 hour view of ETHEREUM. I have noticed several things about ETH price action and what it could indicate.

⬆️ above on chart 📈📉 you can see I have labeled

major trend line (support line)

We have made contact with this long standing trend line and have seen some bullish pressure after doing so.

🤸🤸♂️

HOWEVER

There has been a Head and shoulders bearish pattern formed on the 4 hour view in which we did go down from but bounced back up to make a bearish flag 🐻🧸

🌊🏄♂️🏄♀️

MORE RECENTLY

We have formed a bearish harmonic pattern, which leads me to believe we will try to continue our head and shoulders pattern (with a drop in price) ⏬🔻But will catch support at our major trend line ~(3800)

🐼This is a Short term short Idea. The cryptocurrency market is extremely volatile.💣

This is not financial advice

🐶

Always have a stop loss ✋🛑💲 set🆗

Any thoughts 💭💡, questions 🙋♀️🙋♂️❓, good 👍, bad👎, happy 😄 or sad 😥, in the comments always welcome.😄

Jazerbay ☯️

Gold Before CPI: Top or Trap?1. STRATEGIC CONTEXT

Primary trend: GOLD remains in an uptrend; the higher-timeframe structure is still intact.

Macro backdrop:

CPI tonight may cause short-term volatility.

However, geopolitics is currently a stronger driver than CPI.

Key geopolitical risks:

Greenland tensions → escalating global strategic rivalry.

Protests in Iran, power and internet cuts → rising Middle East risks.

👉 Strategic implication:

Gold continues to be supported as a safe-haven asset → pullbacks are for buying, not for chasing shorts.

📊 2. CURRENT MARKET STRUCTURE

Price is:

Holding the ascending trendline

Consolidating in a box, compressing ahead of CPI

Market condition:

High probability of false breakouts

Top-catching traps are very likely before the news

📍 3. KEY PRICE LEVELS

🔴 RESISTANCE

4,680 – 4,700

→ Previous high / ATH zone

→ Reactive sells only if clear rejection appears

4,655 – 4,660

→ Intermediate resistance, easily swept pre-CPI

🟣 CONSOLIDATION BOX

4,595 – 4,630

→ Sideways range ahead of CPI

→ No FOMO inside the box

🟢 SUPPORT

4,545 – 4,550 → Major confluence support

4,480 → Medium-term support, trendline retest

4,420 → Deep support, last bullish structure zone

📝 4. IMPORTANT NOTES

Higher CPI:

May trigger a technical pullback

❌ Does NOT automatically mean a top

Lower / in-line CPI:

Gold may consolidate above highs and break ATH

Selling before CPI:

→ Reactive scalps only, no holding

Buying:

→ Only when price reaches key zones with clear reaction

🎯 5. STRATEGIC MINDSET

❌ Don’t force top-catching while geopolitics supports gold

✅ Focus on risk management – wait for zones – wait for confirmation

🧠 Before CPI: survival > profit

Role of International Trade1. Promotes Economic Growth

One of the most significant roles of international trade is its contribution to economic growth. By opening access to larger global markets, countries can sell more than they could within their domestic boundaries. This increased demand encourages higher production, leading to better utilization of resources and economies of scale. Export-oriented industries often grow faster, contributing positively to a nation’s Gross Domestic Product (GDP). For developing countries, international trade provides opportunities to accelerate growth by integrating with global value chains.

2. Efficient Allocation of Resources

International trade is based on the principle of comparative advantage, which states that countries should specialize in producing goods and services they can produce most efficiently and at lower opportunity cost. For example, a country rich in natural resources may focus on mining or agriculture, while a technologically advanced country may specialize in manufacturing or services. This specialization leads to efficient allocation of global resources, minimizing waste and maximizing productivity worldwide.

3. Enhances Consumer Choice and Living Standards

Trade allows consumers access to a wide variety of goods and services that may not be available domestically. Products such as electronics, automobiles, medicines, clothing, and food items can be sourced from different parts of the world at competitive prices. Increased competition among producers also leads to better quality and innovation. As a result, consumers enjoy lower prices, improved quality, and greater choices, which significantly enhances living standards.

4. Encourages Industrial Development

International trade supports industrialization, especially in developing and emerging economies. Exposure to global markets encourages industries to improve efficiency, adopt new technologies, and meet international quality standards. Export-led growth strategies have helped many countries transform from agrarian economies into industrial powerhouses. Trade also attracts foreign direct investment (FDI), which brings capital, managerial expertise, and advanced technology.

5. Generates Employment Opportunities

Trade expansion leads to job creation in export-oriented industries such as manufacturing, agriculture, logistics, shipping, finance, and information technology. As companies expand production to meet global demand, they require more labor. Although trade can sometimes lead to job displacement in less competitive sectors, overall it creates better employment opportunities and encourages skill development. Governments can support workforce transition through training and education programs.

6. Facilitates Technology Transfer and Innovation

International trade plays a crucial role in spreading technology and innovation across borders. Imports of advanced machinery, equipment, and software help domestic industries modernize production processes. Multinational companies often share best practices, research methods, and technical knowledge with local firms. This exchange accelerates innovation, increases productivity, and strengthens a country’s technological capabilities.

7. Strengthens International Relations

Trade fosters cooperation and interdependence among nations. Countries engaged in trade are more likely to maintain peaceful relations, as economic ties create mutual benefits. Trade agreements and economic partnerships promote dialogue, trust, and collaboration on broader global issues such as climate change, security, and sustainable development. Thus, international trade also plays a diplomatic role by strengthening global stability.

8. Supports Economic Diversification

For many countries, especially those dependent on a single commodity or sector, international trade encourages diversification. By exploring new export markets and products, economies reduce dependence on limited resources and minimize vulnerability to price fluctuations. Diversification improves economic resilience and helps countries better withstand global economic shocks.

9. Increases Government Revenue

Trade generates significant revenue for governments through customs duties, tariffs, and taxes on imports and exports. These revenues can be used to fund public services such as infrastructure, healthcare, education, and social welfare programs. While many countries are reducing tariffs under free trade agreements, trade-related economic growth still expands the tax base.

10. Promotes Global Economic Integration

International trade is a foundation of globalization. It connects countries into a single economic system where goods, services, and capital flow more freely. This integration helps align production standards, financial systems, and business practices. While globalization presents challenges such as inequality and environmental concerns, its benefits—driven largely by trade—have lifted millions out of poverty worldwide.

11. Challenges and Responsible Trade

Despite its advantages, international trade also presents challenges. Trade imbalances, protectionism, unfair trade practices, environmental degradation, and social inequality are important concerns. Therefore, the role of international trade must be supported by fair trade policies, strong regulations, environmental protection, and inclusive growth strategies. Sustainable and ethical trade ensures that the benefits are widely shared.

Conclusion

The role of international trade in the modern world is multifaceted and indispensable. It drives economic growth, promotes efficiency, enhances consumer welfare, supports industrial and technological advancement, and strengthens global cooperation. While challenges exist, well-managed international trade remains a powerful engine for development and prosperity. In an increasingly interconnected global economy, countries that actively and responsibly engage in international trade are better positioned to achieve long-term economic stability and improved quality of life for their citizens.

XAUUSD H1– Bullish Bias, Waiting for Channel BreakoutXAUUSD H1 – Bullish Bias, Waiting for Channel Breakout

Gold continues to trade inside an ascending channel on H1, and the overall structure still favours upside continuation. At this stage, the priority is not chasing price, but waiting for either a clean channel breakout or a controlled retest of demand before the next impulsive move.

TECHNICAL STRUCTURE

Price is consolidating inside a rising channel after a strong impulsive rally.

Higher lows are still being respected, showing that buyers remain in control.

The current range looks like re-accumulation, preparing for the next expansion leg.

KEY LEVELS TO WATCH

Buy-on-retest zone:

4612 – 4615

This is the most important level in the short term. A successful retest and hold here keeps the bullish structure intact and opens the door for continuation.

Upper resistance / reaction zone:

4688 – 4690

This area may cause short-term reactions or consolidation, but a strong break and acceptance above it would confirm bullish momentum.

Upside target:

4745

This is the next major objective once price breaks out of the channel and absorbs sell-side liquidity above.

Sell-side liquidity below:

The lower boundary of the channel acts as liquidity support. As long as price holds above it, pullbacks are considered corrective.

PRIORITY SCENARIO – BULLISH CONTINUATION

Price retests 4612–4615, holds above the zone, and forms bullish confirmation.

A breakout above 4688–4690 confirms strength.

Momentum accelerates toward 4745 as buy-side liquidity is triggered.

ALTERNATIVE SCENARIO – RANGE EXTENSION

If price fails to break immediately, further consolidation inside the channel is possible.

In this case, patience is key until a clear breakout or a clean retest of demand appears.

SUMMARY VIEW

Bias remains bullish

Focus on buying pullbacks, not chasing highs

A confirmed break of the channel is the signal for the next expansion

4612–4615 defines whether buyers stay in control

The market will show direction once liquidity is taken — wait for confirmation.

MINISO Group Holding (MNSO) - Accumulation Phase After DowntrendMINISO is currently displaying a clear accumulation structure following a prolonged corrective phase. After the prior impulse move higher, price entered a controlled downtrend and has now stabilized back around the long-term mean, where TrendGo Accumulate has been consistently active .

This is an important shift in behavior: instead of acceleration to the downside, price is now moving sideways with reduced volatility , suggesting absorption of supply rather than distribution.

TrendGo System Read

• Accumulate: Multiple accumulation signals have appeared during the base-building phase, historically aligning with areas where downside pressure fades and positioning begins.

• Structure: Price is holding around the long-term reference line, forming a flat, compressed range rather than lower lows.

• Context: Institutional volume remains low, which often characterizes early-stage accumulation rather than late-cycle breakouts.

What matters next

This is not a breakout environment yet - it is a preparatory phase .

For a constructive continuation, we want to see:

• Sustained holding above the accumulation zone

• Gradual expansion in range and participation

• Follow-through rather than single-candle reactions

If price fails to hold the base, the accumulation thesis weakens and the structure resets.

TrendGo perspective

This is how trends are born quietly - compression first, expansion later.

No prediction, no urgency. Context before decisions.

The question is not “ will it go up tomorrow? ”

The real question is whether this base is being respected over time.

Political instability Can gold rebound to the previous ATH?Political instability: Venezuela’s President Maduro arrested – Can gold rebound to the previous ATH?

1️⃣ Market Context

The overall structure remains bullish.

Price is undergoing a short-term correction after a strong volatile move.

The 4300 area is acting as a key support zone.

RSI shows buy–sell convergence; bulls are gradually absorbing bears, keeping downside pressure well controlled.

2️⃣ News & Fundamental Factors

Geopolitical tension: Venezuela attacked by the U.S., President arrested and transferred to the U.S.

Expectation of a gap and bullish move in gold in the upcoming session.

Current news flow continues to support a positive outlook for gold.

3️⃣ Main Scenario

Priority scenario: Price holds above 4300 and resumes the bullish structure.

Key intraday levels to watch:

Support: 4300–431X, 4270–4275

Resistance: 4370–4375, 4402–4404

Focus on shallow pullbacks in line with the main trend.

4️⃣ Trading Strategy (Intraday / Weekly)

Trend-following remains the core approach, while being prepared for minor pullbacks to avoid missing moves.

Closely monitor price reactions at:

4300: Nearest support, currently holding well.

437X: Potential intraday reaction zone.

Always wait for price action confirmation, avoid entries in the middle of the range.

5️⃣ Extensions & Notes

If 4300 breaks decisively:

Deeper correction toward 427X, 425X

Further extension to 417X, a zone worth watching for swing opportunities.

Volatility remains high → risk management is the top priority.

✨ Wishing everyone a profitable new week, green accounts as far as the eye can see

BTCUSD – 1H Chart Analysis📊 BTCUSD – 1H Chart Analysis

Bitcoin remains in a bullish structure after the recent breakout and continuation. Price is currently consolidating above the previous resistance zone, which is now acting as near-term support.

Price Action:

The strong impulsive move created a new higher high, followed by a controlled pullback.

Recent candles show buyers defending dips, indicating acceptance above prior resistance.

No strong bearish rejection is visible yet, suggesting consolidation rather than reversal.

EMA Structure:

EMA 9 & EMA 21 are flattening and starting to curl up, showing short-term stabilization.

EMA 50 (~92,830) remains well below price, confirming the broader bullish trend.

Price holding above EMA 21 keeps the bullish bias intact.

🔎 Key Levels

Resistance: ~94,400–94,600

Support (S1): ~93,500

Support (S2): ~92,800 (EMA 50 zone)

📈 Market Scenarios

Bullish continuation: Holding above S1 with acceptance may allow another push toward higher levels.

Pullback scenario: Loss of S1 could lead to a deeper retrace toward S2, still within bullish structure.

🧠 Short TradingView Minds Version

BTCUSD 1H: Price consolidating above prior resistance after breakout. EMA structure supports bullish bias while holding above ~93.5k. Continuation favored unless key support breaks.

Educational view only.

ETHUSD – 30M Chart Analysis📊 ETHUSD – 30M Chart Analysis

Ethereum is currently trading in a range structure after the recent impulsive bullish move. Price is consolidating between a defined resistance zone near 3,255–3,260 and a support area around 3,215–3,220.

🔑 Key Levels

Resistance: ~3,255 – 3,260

Support (S1): ~3,215 – 3,220

Lower Support: ~3,140 – 3,150

📈 Price Action Reasoning

Price faced selling pressure at resistance, shown by multiple rejections and upper wicks.

Pullbacks are being absorbed near support, indicating buyers are defending this area.

EMA 9 & EMA 21 are acting as short-term dynamic support, keeping price stable.

EMA 50 (~3,212) aligns with horizontal support, strengthening the demand zone.

🔎 Market Outlook

Holding above 3,215 keeps the structure constructive and favors continuation attempts.

A clean break below support may lead to a deeper pullback toward the lower support zone.

Acceptance above resistance could allow continuation toward higher levels.

🧠 Short TradingView Minds Version

ETHUSD 30M: Price consolidating between 3,220 support and 3,260 resistance after impulsive move. EMAs align with support, showing buyers active. Range remains intact until a clear break.

Educational view only.

XAUUSD H1 –Liquidity Reaction After Geopolitical SpikeXAUUSD H1 – Liquidity Reaction After Geopolitical Spike

Gold surged strongly at the start of the week as escalating geopolitical tensions boosted safe-haven demand, while expectations of further Fed rate cuts continued to support the broader bullish narrative. From a technical perspective, price is now reacting around key liquidity and Fibonacci zones rather than trending impulsively.

TECHNICAL OVERVIEW

On H1, gold experienced a sharp sell-off followed by a recovery, forming a V-shaped reaction that suggests aggressive liquidity clearing.

Price is currently trading below prior breakdown zones, indicating that supply remains active at higher levels.

The market structure favours sell-on-rallies in the short term, while deeper pullbacks may attract fresh buyers.

KEY LEVELS & MARKET BEHAVIOUR

Upper sell zones (supply & Fibonacci confluence):

4497 – 4500 (FVG sell zone, premium area)

4431 – 4435 (Fibonacci + former support turned resistance)

These zones represent areas where sellers previously stepped in aggressively, making them important reaction levels if price rebounds.

Lower buy-side liquidity:

4345 – 4350 (Value Low / buy-side liquidity zone)

This area aligns with trendline support and prior accumulation, making it a key level to monitor for a bullish reaction if price rotates lower.

EXPECTED PRICE FLOW

Short term: price may continue to consolidate and rotate between resistance and liquidity below, with choppy price action likely.

A rejection from the upper resistance zones could lead to another leg lower toward buy-side liquidity.

If buy-side liquidity is absorbed and defended, the market may attempt another recovery move.

FUNDAMENTAL CONTEXT

Gold’s strength is underpinned by two major factors:

Rising geopolitical risk, which increases demand for safe-haven assets.

Dovish expectations from the Federal Reserve, as markets continue to price in additional rate cuts, reducing the opportunity cost of holding non-yielding assets like gold.

These fundamentals support gold on higher timeframes, even as short-term technical corrections play out.

BIG PICTURE VIEW

Medium-term bias remains constructive due to macro and geopolitical support.

Short-term price action is driven by liquidity and reaction zones rather than trend continuation.

Patience is key—allow price to interact with major levels before committing to the next directional move.

Let the market show its hand at liquidity.

XAUUSD (H2) – BUY priority today Gold holds above 4,400 on safe-haven flows | Trade liquidity, don’t chase

Quick summary

Gold started the week with strong momentum and pushed above 4,400 during the Asian session as global markets rotated into safe-haven assets. Geopolitical risk is the key driver after reports of US ground strikes in Venezuela and the detention of President Nicolás Maduro and his wife.

With that backdrop, my plan today is simple: prioritise BUY setups at liquidity zones, and avoid FOMO while price is elevated.

1) Macro context: Why gold is supported

When geopolitical risk escalates, capital typically flows into gold.

Headline-driven sessions often bring:

✅ fast pumps, ✅ liquidity sweeps, ✅ larger wicks/spreads.

➡️ The safest execution is waiting for pullbacks into predefined buy zones, not chasing highs.

2) Technical view (based on your chart)

On H2, gold has bounced sharply and your chart highlights clear execution areas:

Key levels for today

✅ Buy zone: 4340 – 4345 (trend/structure pullback zone)

✅ Strong Liquidity: lower support band (marked on chart)

✅ Sell zone: 4436 – 4440 (near-term supply / reaction area)

✅ Sell swing / target: 4515 – 4520 (higher objective / profit-taking zone)

3) Trading plan (Liam style: trade the level)

Scenario A (priority): BUY the pullback into 4340–4345

✅ Buy: 4340 – 4345

SL (guide): below the zone (adjust to spread / lower TF structure)

TP1: 4400 – 4410

TP2: 4436 – 4440

TP3: 4515 – 4520 (if momentum continues with headlines)

Logic: 4340–4345 offers a cleaner R:R than chasing above 4,400.

Scenario B: If price holds above 4,400 and only dips lightly

Look for a buy only on clear holding signals near the closest support/strong liquidity (M15–H1).

Still not recommending FOMO entries in headline volatility.

Scenario C: SELL reaction (scalp) at supply

✅ If price tags 4436–4440 and shows weakness:

Sell scalp: 4436 – 4440

SL: above the zone

TP: back toward 4400–4380

Logic: This is a near-term supply area — good for quick profit-taking, not a long-term reversal call.

4) Notes (avoid getting swept)

Asian session can spike hard on headlines → wait for pullback confirmations.

Reduce size if spreads widen.

Only execute when price hits the level and prints a clear reaction (rejection / engulf / MSS).

What’s your plan today: buying the 4340–4345 pullback, or waiting for price to push into 4515–4520 before reassessing?

EUR/CAD: Bullish Continuation After ConsolidationThe EURCAD pair had been accumulating within a horizontal range on the 4-hour timeframe for over a week.

Today, its resistance was breached with a strong bullish movement.

The price may experience further growth. The nearest resistance level is at 1.6174.

$BRENT technicals in convegence between Fibonacci and TrendlineBLACKBULL:BRENT has been on a downtrend since last Summer...

Now the descending trend line is about to hit the bottom of the Fibonacci Retracement Levels.

This forms a triangle that we know can break either upward or downward - place your entry points and Stop-Loss points accordingly.

While I don't provide Fundamentals analysis, the latest turns of events with USA and Venezuela make me lean towards a break on the downside for more supply of Crude Oil available to the US.

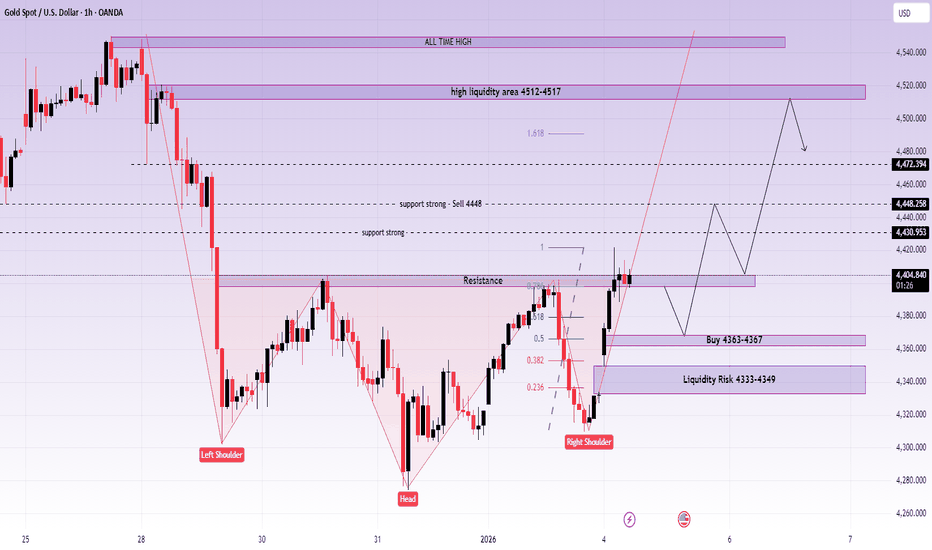

XAUUSD (H1) – Inverse Head & Shoulders in play Lana focuses on pullback buys above key liquidity 💛

Quick overview

Timeframe: H1

Pattern: Inverse Head & Shoulders confirmed on the chart

Bias: Bullish continuation while price holds above neckline

Strategy: Buy pullbacks into liquidity zones, avoid chasing highs

Technical view – Inverse Head & Shoulders

On H1, gold has completed a clean Inverse Head & Shoulders structure:

Left shoulder: Formed after the first sharp sell-off

Head: Deeper liquidity sweep, followed by strong rejection

Right shoulder: Higher low, showing weakening selling pressure

Neckline: Around the 4030–4040 resistance zone (now being tested)

The recent breakout and strong follow-through suggest buyers have regained control. As long as price holds above the neckline, the structure favors continuation to the upside.

Key levels Lana is watching

Primary buy zone – Pullback entry

Buy: 4363 – 4367

This area aligns with prior structure support and sits inside a healthy pullback zone. If price revisits and shows acceptance, it offers a good risk-to-reward buy.

Liquidity risk zone – Deeper pullback

Liquidity risk: 4333 – 4349

If volatility increases and price sweeps deeper liquidity, this zone becomes the secondary area to watch for bullish absorption.

Upside targets & resistance

High liquidity area: 4512 – 4517

ATH zone: Above the previous all-time high

These zones are expected to attract profit-taking or short-term reactions, so Lana avoids chasing price near these levels.

Fundamental context (market drivers)

Geopolitics: Rising tension after comments about potential military intervention in Colombia adds background support for gold as a safe haven.

Goldman Sachs: Views Venezuela-related developments as having limited impact on oil, keeping broader commodity sentiment stable.

ISM Manufacturing PMI (US): Any sign of slowing manufacturing can pressure USD and indirectly support gold.

Overall, fundamentals remain supportive for gold, reinforcing the bullish technical structure.

Trading plan (Lana’s approach)

Prefer buying pullbacks into 4363–4367 while structure holds.

Be patient if price dips into 4333–4349 and wait for confirmation before entering.

If price falls back below the neckline and fails to reclaim it, Lana steps aside and reassesses.

This is Lana’s personal market view and not financial advice. Please manage your own risk before trading. 💛