USDCHF Oversold and approaching an 11-year Low.The USDCHF pair has been trading within a Channel Down since its November 2022 High rejection on the 1M MA200 (orange trend-line). This month isn't only approaching the bottom of that pattern but also Support 1, which consists of the January 2015 Low (0.74250).

With the 1M RSI almost oversold and similar to December 2020 (every oversold 1M RSI has historically been a massive long-term buy signal), we don't technically believe that this decline has much more room to extend to, beyond at least the -17.86% of the previous Bearish Leg.

Instead, we treat this as an excellent long-term buy opportunity, with a first Target on the 0.5 Fibonacci retracement level (again similar as the previous Channel Down rebound) at 0.83450. Note that this is more suited to long-term investors and not shorter term traders.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USD

NZDUSD Breakout and Potential Retrace!Hey Traders, in today's trading session we are monitoring NZDUSD for a buying opportunity around 0.58200 zone, NZDUSD was trading in a downtrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 0.58200 support and resistance area.

Trade safe, Joe.

GOLD | Breaks $5,100 as Shutdown & Geopolitical Risks RiseGOLD | Breaks Above $5,100 as Shutdown & Geopolitical Risks Fuel Rally

Gold surged above $5,100 per ounce, extending its historic rally after decisively breaking the $5,000 psychological level. The move comes as markets react to rising U.S. government shutdown fears, persistent geopolitical tensions, and expectations that the Federal Reserve may be approaching the later stage of its restrictive cycle.

With risk sentiment fragile and real yields under pressure, gold continues to attract strong safe-haven demand, keeping volatility elevated despite overextended conditions.

Technical Outlook

After the sharp upside move, price is expected to consolidate within the 5097–5077 zone before the next directional break.

A confirmed 15min or 1H close below 5077 would signal a deeper corrective move toward 5052, with further downside risk toward the 5000 psychological level.

However, price stability above 5052, and especially a hold above 5097, would keep the bullish structure intact and support a continuation toward 5140 and 5168.

Key Levels

• Pivot Zone: 5077 – 5097

• Support: 5052 – 5000

• Resistance: 5140 – 5168

EURUSD is Nearing an Important Support!Hey Traders, in today's trading session we are monitoring EURUSD for a buying opportunity around 1.18200 zone, EURUSD is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 1.18200 support and resistance area.

Trade safe, Joe.

Fundamental Note: DXY(USD) 26 Jan 2026DXY starts the week hovering near the 97 handle and around four-month lows as investors reassess the dollar’s “safe-haven” role amid rising policy/geopolitical uncertainty and increased FX-hedging by foreign holders of US assets. The key event is the Fed’s Jan 28 FOMC meeting, where rates are widely expected to be kept unchanged and the market will trade off Powell’s tone rather than new projections. Beyond the policy statement, the Fed-independence narrative is a real macro risk premium now, with political pressure and legal/probe headlines potentially impacting USD confidence and rate expectations simultaneously. US Treasuries are the second big driver: this week’s heavy auction slate (2Y/5Y/7Y) can swing front-end yields and the curve, which usually feeds directly into DXY momentum. However, if investors demand higher term premium because of Fed credibility/fiscal-policy concerns, long yields can rise without a “clean” USD bid (a classic setup for choppy, headline-driven DXY). Geopolitics remains two-sided: Greenland-linked US–EU tariff threats and Middle East/Iran risk can spark haven demand, but recent bouts have also pushed flows into gold and other havens while the dollar softened.

Bottom line: DXY is set for a volatility week where Fed communication + Treasury yields + geopolitical headlines decide whether the dollar bounces or stays “sold on rallies.”

🟢 Bullish factors:

1. Fed holds rates and sounds less dovish than market pricing → yields/USD rebound.

2. Firm US data (e.g., durable goods) supporting growth/real yields.

3. Risk-off spikes can still generate short-term USD demand via liquidity preference.

🔴 Bearish factors:

1. Any dovish tilt from Powell (or clearer “cuts by mid-2026” guidance) pressures DXY.

2. Fed-independence/policy uncertainty → more FX hedging / “Sell America” diversification flows.

3. FX-intervention talk around USDJPY can weigh on broad USD sentiment.

🎯 Expected targets: Base-case range trading 98.0–100.0 into/through the FOMC; a hawkish-hold + firmer yields scenario can lift DXY toward 99.8–100.6 , while dovish messaging or renewed Fed-independence headlines risk a slide toward 97.5–96.8 .

#AN031: January, 5 Geopolitical Shocks

January 2026 isn't offering a single "black swan" event, but a sequence of progressively unleashed geopolitical shocks: European energy, the Middle East/Iran, Latin America, Ukraine, and renewed US-Europe/Arctic tensions, along with a parallel Asia-Pacific (Taiwan) element that rekindles risk-on/risk-off sentiment. The result, for the FX market, is a month where the risk premium constantly shifts between the dollar, safe-haven currencies, and commodity-related blocs.

1) Europe: Permanent ban on Russian gas (long timeline, immediate impact on expected prices)

On January 26, the EU gave final approval to a regulation to ban Russian gas imports by the end of 2027, including LNG by the end of 2026 and pipelines by September 30, 2027 (with technical possibilities for postponement in specific cases).

Why it matters for FX (now, not in 2027):

FX price in expectations: a trajectory of reduced energy dependence reduces structural tail risk in Europe, but in the short term it can generate a volatility premium (pricing of bottlenecks, contracts, LNG infrastructure, weather/consumption shocks).

If energy returns to being an inflation driver, the chain is: energy → CPI expectations → expected ECB rates → EUR.

Operational implications:

EUR: tends to react more to energy price surprises than to the news itself. The real issue is "how much does it cost to replace" and "with what stability."

NOK/SEK: often become regional proxies when the market recalibrates energy and European growth (focus on oil/gas and global risk).

2) Middle East/Iran: "armada," sanctions, oil, and USD volatility

In just a few days, the Iran → oil → global inflation → USD positioning channel has been rekindled: new US sanctions on entities and vessels linked to Iranian oil transport and military rhetoric/deployment pushed Brent and WTI up about 3% in one session, reactivating the energy risk premium.

Key FX Mechanism:

Oil up → (global) inflation pressure up → expected real rates up → rotation to USD or flight to safe havens (JPY/CHF) if event risk concerns rise.

In parallel, domestic Iran is showing financial stress (equity sell-off and currency under pressure), a sign that the local market is pricing in a higher risk scenario.

Those who tend to move more:

CAD (oil) often benefits if the rally is orderly and growth-friendly.

JPY/CHF (safe havens) if the market interprets escalation as a risk of a sudden shock.

EMFX: suffers if energy translates into higher import bills and tighter financial conditions.

3) Latin America: Venezuela, "hard power" and geopolitical risk on EM flows

The month brought a rare element: a qualitative leap in US posture in the region, with the arrest/capture of Nicolás Maduro and a communication framework that speaks of conflict against narco-networks and pressure on energy assets/routes. The consequences are greater than Venezuela alone: they increase the likelihood that the market will apply a wider risk premium on EM currencies sensitive to geopolitics and sanctions.

FX: What to Really Watch

It's not just "USD vs. VES" (not traditionally tradable): it's the perception of regional instability and "policy unpredictability."

Secondary effect: attention to energy channels and capital flows into USD and liquid instruments when uncertainty rises.

4) Ukraine: harsh winter, infrastructure affected, and European energy risk "returning"

Offensive attacks on infrastructure and power grids (Kharkiv and other areas) are making the Ukraine issue "macro-relevant" again, just as Europe is talking about definitively ending its energy dependence on Moscow.

For Forex:

Any increase in risk on Europe (energy/security) tends to produce:

EUR more fragile during risk aversion peaks, demand for USD/CHF and often JPY, repricing on gas/oil which falls under point (1).

5) US-Europe/Arctic: Greenland, NATO, and the Risk of Transatlantic Friction

Tensions over Greenland and transatlantic relations are becoming a new geopolitical overlay that the market cannot ignore, especially since it impacts defense, Arctic shipping, and European political cohesion.

How it transforms into FX:

The risk of policy shocks (tariffs/retaliation/tense negotiations) increases.

In times of friction, the market tends to favor the most liquid and defensive asset: often the USD, with rapid rotations between risk-on and risk-off.

ETHUSD H1 | Potential Bullish ReversalThe price is falling towards our buy entry level at 2,880.38, which is a pullback support.

Our stop loss is set at 2,781.26, which is a pullback support.

Our take profit is set at 3,045.57, which is sn ovrlap resistance that is slightly below tthe 50% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

BCHUSD H1 | Bullish Bounce Off Pullback SupportThe price is falling towards our buy entry level at 578.39, which is a pullback support that aligns with the 50% Fibonacci retracement.

Our stop loss is set at 561.98, which is a multi-swing low support.

Our take profit is set at 600.45, which is a multi swing high resistance.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

Heading towards 38.2% Fib resistance?USD/JPY is rising towards the pivot, which acts as a pullback resistance that aligns with the 38.2% Fibonacci retracement and could reverse to the 1st support.

Pivot: 155.63

1st Support: 152.96

1st Resistance: 157.19

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish bounce setup?Kiwi (NZD/USD) is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 0.5889

1st Support: 0.5847

1st Resistance: 0.5980

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

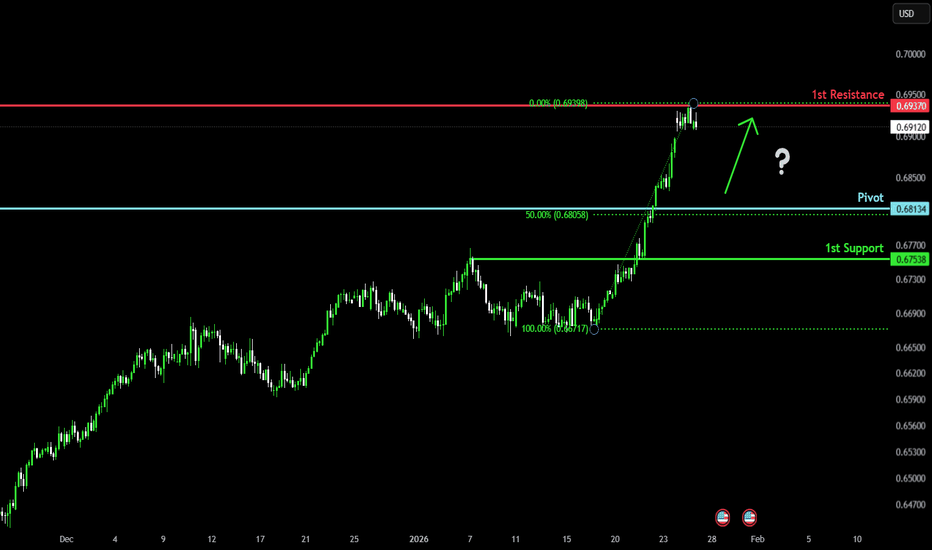

Bullish momentum to extend?Aussie (AUD/USD) could fall towards the pivot, which aligns with the 50% Fibonacci retracement, and could bounce to the 1st resistance.

Pivot: 0.6813

1st Support: 0.6753

1st Resistance: 0.6937

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish bounce off?WTI Oil (XTI/USD) is falling towards the pivot, which has been identified as an overlap support and could bounce to the swing high resistance.

Pivot: 58.72

1st Support: 56.92

1st Resistance: 62.33

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish continuation?Gold (XAU/USD) could fall towards the pivot, then bounce to the 1st resistance.

Pivot: 4,864.86

1st Support: 4,690.83

1st Resistance: 5,111.04

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Potential bearish continuation?USD/CHF is rising towards the resistance level, which is a pullback resistance that aligns with the 38.2% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 0.7851

Why we like it:

There is a pullback resistance level that aligns with the 38.2% Fibonacci retracement.

Stop loss: 0.7918

Why we like it:

There is a pullback resistance that aligns with the 61.8% Fibonacci retracement.

Take profit: 0.7733

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bullish reversal setup?USD/CAD has bounced off the support level, which is a pullback support that lines up with the 100% Fibonacci projection and could potentially rise from this level to our take profit.

Entry: 1.3683

Why we like it:

There is a pullback support that lines up with the 100% Fibonacci projection.

Stop loss: 1.3644

Why we like it:

There is a swing low support level.

Take profit: 1.3798

Why we like it:

There is an overlap resistance that aligns with the 50% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bullish momentum to extend?GBP/USD is falling towards the support level, which is a pullback support that is slightly above the 50% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 1.3547

Why we like it:

There is a pullback support that is slightly above the 50% Fibonacci retracement.

Stop loss: 1.3458

Why we like it:

There is a pullback support lwvwl.

Take profit: 1.3714

Why we like it:

There is a pullback resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bullish continuation?EUR/USD is falling towards the support level, which is a pullback support that is slightly below the 38.2% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 1.1806

Why we like it:

There is a pullback support that is slightly below the 38.2% Fibonacci retracement.

Stop loss: 1.1748

Why we like it:

There is a pullback support that aligns with the 50% Fibonaci retracement.

Take profit: 1.1908

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

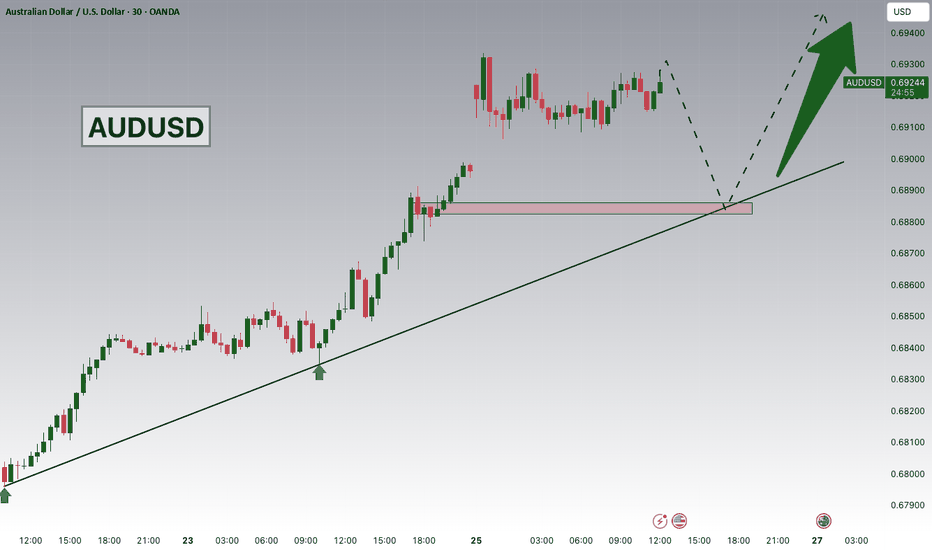

AUDUSD Strong Bullish Momentum!Hey traders, in today's trading session we are monitoring AUDUSD for a buying opportunity around 0.68800 zone, AUDUSD is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 0.68800 support and resistance area.

Trade safe, Joe.

USDJPY Strongest Buy Signal in 4 months on the 1D MA100.The USDJPY pair has hit its 1D MA100 (green trend-line) for the first time in more than 4 months (since September 17 2025), which was the last Higher Low exactly at the bottom of the 9-month Channel Up.

With the 1D RSI oversold, exactly like when the Channel Up started on April 21 2025, we treat this as the strongest long-term buy opportunity towards a potential Resistance (July 03 2024 High) test. As a result, we turn bullish here targeting 162.000.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

EURUSD ahead of biggest test in 8 years! Collapse or Golden era?The EURUSD pair is going for its most important test in 8 years, the 1M MA200 (orange trend-line). This level last tested in February 2018, causing a massive rejection, which kick-started the Bear Cycle of 2018 - 2019. Technically that was the Bearish Leg of the 11-year Bearish Megaphone pattern that the pair has been trading in basically since the last time it closed a 1M candle above the 1M MA200, which was in November 2014.

The previous Bearish Leg of 2021 - 2022 also started close to the 1M MA200 but the price got rejected a little lower. Nonetheless, it did create a Lower Highs trend-line, which is currently sitting marginally above the 1M MA200. As a result, EURUSD is approaching a massive Resistance Zone, while at the same time its 1M RSI is attempting to re-test its 66.50 Resistance, which got rejected in June 2025 and also started 8 years ago with the first Lower High.

As a result, until the price closes a 1M candle above the 1M MA200 (would be the first in more than 11 years), we believe it is more likely to see a rejection starting the new Bearish Leg. However the development that confirmed that during the previous two Bearish Legs was a 1M candle closing below the 1W MA50 (red trend-line). If that takes place, it will be the confirmation signal for a long-term Sell.

As far as Targets are concerned, the Jan 2025 Low is our first candidate, targeting 1.0200 fulfils this condition as well as the 0.618 Channel Fibonacci level, which has priced three bottoms in the past 6 years (green circles). A monthly close below Support 1 (Jan 2025 Low) could grant an extension to the 0.786 Channel Fib at 0.9800, which is where another three Lows were price (blue circles).

In any event, if the 1M RSI turns oversold (below 30.00) it has been the ultimate long-term Buy Signal within 11 years and we will turn into long-term buyers regardless of the actual price of EURUSD at the time.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USD/JPY Rate Check - What's NextUSD/JPY broke down in a big way to finish last week and that weakness has so far held through the weekly open. There's already widespread allegation of intervention but I think that remains a murky topic, and this is something that we often can't confirm for a while although that won't stop many on social media from spreading the rumors.

In my mind this just may be an organic move fueled by a really crowded trade, and the BoJ may have just accomplished what they would want from an intervention without actually having to intervene. The reason that I think this may be the case is the way that the sell-off happened: There was an initial shock of weakness in USD/JPY around the BoJ meeting on Friday, but the big sell-off in the pair hit after the US open, and it was a cascading affair with the selling intensifying into the close.

This seems more likely to be from institutional traders removing hedges on JPY-linked trades, and if we look at the threat of more rate hikes from the BoJ at the meeting just a night earlier it makes sense as to why these market participants would want to remove hedges.

With USD/JPY getting so close to the 160.00 level that was widely believed to be the price that the finance ministry would defend - combined with a Bank of Japan that's gearing markets up for more rate hikes combined with a Fed that seems too shell-shocked to even think rate hikes and are still contemplating more cuts - all capitalized by the idea that President Trump will get to name a new Chair at the FOMC - it made little sense for traders and hedge funds to hold on to those hedges.

And as we often see from a crowded trade, a snowball can quickly turn into an avalanche as the exit door for getting out is only so wide, and nobody wants to be left holding that bag.

if there is an actual intervention, that snowballing effect is often the desired trait of the intervening party and the intervention itself is basically compacting snow to begin the process.

Given the impossibility of knowing whether this was legitimately intervention until or unless actually confirmed by Japanese data or Japanese policymakers - the 'why' matters far less than the 'what' here, and at this point, with USD/JPY well-below that 160.00 handle. We're probably going to find out whether this was more of a market driven dynamic or whether it was engineered to run some stops.

At this point, price is testing support at 153.41 which is the 61.8% retracement from the last carry unwind episode back in 2024. The 154.45-155.00 zone remains a key spot as this is what was defended in December around when the BoJ was prepping markets for rate hikes and if bulls can force a move back above that, then there would appear to be little fear of intervention given the ~500 pips up to the 160.00 handle. In that scenario GBP/JPY or EUR/JPY might be even more attractive but the battleground for the theme is without a doubt the USD/JPY pair. - js

EUR/USD Bulls Pennant Breakout Nears Massive LevelUSD has broken down and the widespread accusation is intervention in USD/JPY. It will take time before we know whether the move was actual intervention or merely unwind from a very crowded trade of JPY-weakness, but regardless of the push point the 'what' is far less debatable here, with USD breaking down to fresh lows.

Despite JPY being only 13.6% of the DXY basket the move has had repercussions elsewhere, similar to what showed in Q3 of 2024, the last time we had a carry unwind scenario in the pair. And in this instance, like last, the Euro is catching a bid against the USD and this time, the pair is well-above the 1.12000 level that had previously helped to set resistance.

Just last week I looked at a bull pennant formation in the pair and that's now given way. We're fast approaching a big test for EUR/USD as the pair approaches the four-year high around the 1.1909 level. This is the spot that held the highs on September 17th, when the Fed announced their first rate cut for last year.

Also key is what's lurking above that price, as the 1.2000 level is one of those major psychological levels that can often take time to leave behind, similar to 1.1500 but now we're looking at the other side of the matter after the 1.1500 level provided significant support back in November.

Bulls are still in control here and there's now quite a bit of short-term support context for bullish continuation scenarios. - js