Bullish bounce off?USD/CAD is reacting off the support level, which is an overlap support that is slightly above the 50% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 1.3796

Why we like it:

There is an overlap support level that is slightly above the 50% Fibonacci retracement.

Stop loss: 1.3744

Why we like it:

There is an overlap support level that is slightly below the 61.8% Fibonacci retracement.

Take profit: 1.3869

Why we like it:

There is a pullback resistance that is slightly above the 50% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

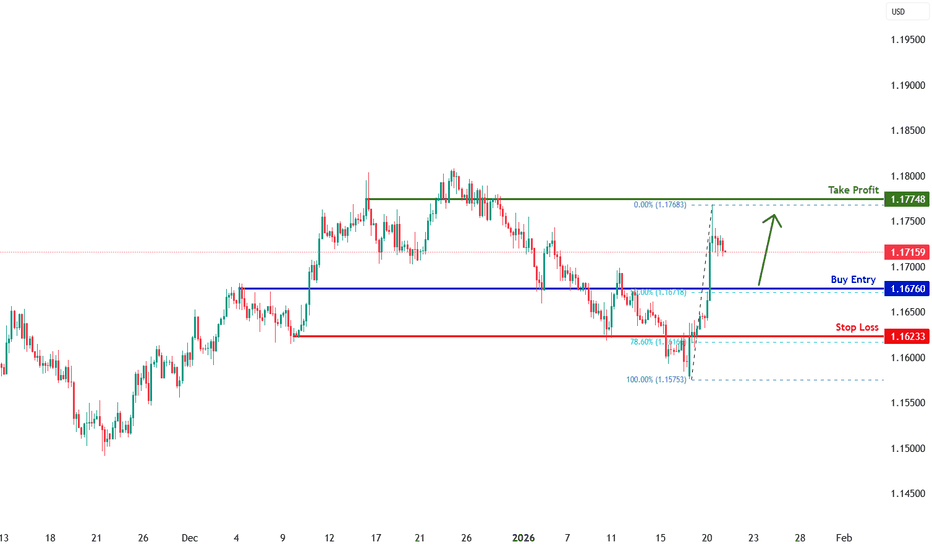

USD

Bullish bounce off key level?EUR/USD is falling towards the support level, which is an overlap support that aligns with the 50% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 1.1678

Why we like it:

There is an overlap support level that aligns with the 50% Fibonacci retracement.

Stop loss: 1.1621

Why we like it:

There is a pullback support level that aligns with the 78.6% Fibonacci retracement.

Take profit: 1.1776

Why we like it:

There is a pullback resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

GOLD | New ATH Above $4,730 as Safe-Haven Demand SurgesGold Breaks Above $4,730 on Weaker Dollar & Safe-Haven Demand

Gold prices surged past the $4,730 level for the first time, supported by a weaker U.S. dollar and renewed safe-haven demand amid rising geopolitical and trade-related concerns.

The U.S. Dollar Index slipped to 98.70 (−0.7%), making gold more attractive for non-USD buyers.

At the same time, a mix of geopolitical uncertainty, concerns over central-bank independence, and elevated U.S. debt levels has unsettled investors, driving capital flows toward gold and silver over currencies and government bonds.

This comes after an already exceptionally strong performance for precious metals, reinforcing gold’s role as a hedge against policy and macro uncertainty.

Technical Outlook (GOLD)

The price pushed higher by approximately $110, exactly as outlined in the previous idea.

Short-Term Structure

While trading below 4733, a retest is likely toward 4718–4710

From this zone, bullish momentum is expected to resume

Bullish Continuation

A rebound from support would target: 4742

A confirmed break above 4742 opens the way toward: 4757 - 4784

Bearish Risk

A bearish scenario becomes valid only if geopolitical tensions ease

Sustained price action and stabilization below 4710 would shift momentum bearish

Key Levels

Pivot Line: 4733

Resistance: 4742 – 4757 – 4784

Support: 4710 – 4695 – 4678

PREVIOUS IDEA:

AUDUSD Ready to Rally? Gold Correlation + 0.66700 Support!Hey Traders,

In today’s trading session, we are closely monitoring AUDUSD for a potential buying opportunity around the 0.66700 zone. AUDUSD remains in a well-established uptrend and is currently undergoing a healthy corrective pullback, approaching a key trendline confluence and the 0.66700 support-turned-resistance area, which may act as a strong demand zone for bullish continuation.

From a fundamental perspective, the Australian Dollar often benefits from its positive correlation with Gold. With Gold maintaining a constructive bullish tone, this relationship could provide additional upside support for AUDUSD, reinforcing the bullish technical outlook.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

USDCHF H4 | Bullish ReversalBased on the H4 chart analysis, we can see that the price has bounced off our buy entry level at 0.7895, which is a pullback support that aligns with the 78.6% Fibonacci retracement.

Our stop loss is set at 0.7863, which is a swing low support.

Our take profit is set at 0.7963, which is an overlap resistance that aligns with the 50% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

Cable H4 | Bearish Drop OffBased on the H4 chart analysis, we can see that the price has rejected off our sell entry level at 1.3485, which is a pullback resistance that aligns with the 61.8% Fibonacci retracement.

Our stop loss is set at 1.3548, which is a swing high resistance.

Our take profit is set at 1.3371, which is a pullback support.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

USD/IDR Surge: Rupiah Crumbles on Fiscal PanicThe Indonesian Rupiah is in freefall. USD/IDR has breached critical resistance levels as fiscal anxiety grips Jakarta. A failed bond auction and foreign capital exodus have created a perfect storm for the currency. Traders must now navigate a landscape defined by populist spending risks and global contagion.

Macroeconomics and Economics

The latest debt auction exposes deep systemic cracks. Indonesia sold 36 trillion rupiah ($2.1 billion) of debt, yet demand evaporated. The bid-to-target ratio collapsed to 2.51, the weakest since March. Investors are rejecting Indonesian paper. They demand higher premiums to hold assets denominated in a depreciating currency. This waning appetite forces yields higher, further straining the government's balance sheet. The market is effectively pricing in a deterioration of Indonesia's sovereign credit profile.

Geopolitics and Geostrategy

Jakarta is suffering from global collateral damage. A selloff in Japanese notes, triggered by Prime Minister Sanae Takaichi’s aggressive tax plans, sparked a worldwide debt rout. This contagion hit Southeast Asia hard. Indonesia, often viewed as a high-beta proxy for emerging market risk, took the brunt of the hit. Geostrategically, foreign capital is fleeing back to the safety of the US Dollar. The USD/IDR pair is rising not just on Rupiah weakness, but on a strategic flight to safety.

Management and Leadership

Investor confidence in Indonesia's economic stewardship is eroding. Markets are reacting negatively to reports of "populist spending." Traders fear these fiscal expansions will blow out the budget deficit. Furthermore, concerns regarding the independence of the central bank add a risk premium to the currency. Effective leadership demands fiscal discipline, yet the current trajectory suggests the opposite. Without credible austerity signaling, the central bank lacks the credibility to defend the Rupiah effectively.

Business Models and Industry Trends

The business model of "carry trade" is dead for the Rupiah. Foreign investors submitted bids for only 3.9 trillion rupiah, a fraction of last year's 15.6 trillion average. Handy Yunianto of PT Mandiri Sekuritas notes that yield spreads are no longer attractive. The risk-reward ratio has flipped. Global asset managers are liquidating positions in Indonesian fixed income to cover losses elsewhere or to chase higher risk-free rates in the US.

Technology and High-Tech

Modern capital flight occurs at the speed of light. High-frequency algorithmic trading exacerbates these selloffs. Unlike in 1998, digital financial infrastructure allows foreign investors to exit positions instantly. This technological efficiency accelerates volatility in USD/IDR. There are no buffers. When sentiment turns, the digital exit doors are wide open, and capital flows out unchecked.

Conclusion

The USD/IDR pair is unmoored. Fiscal deterioration, combined with a loss of foreign confidence, paints a bearish picture for the Rupiah. Unless the government restores fiscal credibility or global yields stabilize, the path of least resistance for USD/IDR is higher.

EURUSD H4 | Fallling Towards 50% Fib SupportThe price is falling towards our buy entry level at 1.1676, which is an overlap support that aligns with the 50% Fibonacci retracement.

Our stop loss is set at 1.1623, which is a pullback support that line sup with the 78.6% Fibonacci retracement.

Our take profit is set at 1.1774, which is a pullback resistance.

High Risk Investment Warning

Stratos Markets Limited (fxcm.com/uk), Stratos Europe Ltd (fxcm.com/eu):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (fxcm.com/en): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited (fxcm.com/au):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com/au

Potential bullish reversal?Ethereum (ETH/USD) is reacting off the pivot and could reverse to the 1st reistance, which is a pullback resistance that aligns with the 38.2% Fibonacci retracement.

Pivot: 2,913.87

1st Support: 2,814.66

1st Resistance: 3,101.46

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

NZDUSD to continue in the upward move?NZDUSD - 24h expiry

There is no clear indication that the upward move is coming to an end.

Although we remain bullish overall, a correction is possible with plenty of room to move lower without impacting the trend higher.

Risk/Reward would be poor to call a buy from current levels.

A move through 0.5850 will confirm the bullish momentum.

The measured move target is 0.5900.

We look to Buy at 0.5820 (stop at 0.5785)

Our profit targets will be 0.5895 and 0.5900

Resistance: 0.5850 / 0.5875 / 0.5900

Support: 0.5820 / 0.5800 / 0.5785

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

EURUSD | Elliott Wave Running Triangle Near Completion – 1.19 On the H4 chart, price appears to be tracing out a classic Elliott Wave running triangle (A–B–C–D–E).

Key characteristics stand out:

Converging trendlines with contracting volatility

Wave E holding above prior structural support

The lower boundary acting as a clear invalidation level (~1.1575)

Running triangles typically resolve in the direction of the larger trend, often with sharp follow-through once compression ends.

Scenarios:

- If the E-wave low holds and price reclaims momentum:

Resolution higher becomes the dominant path, opening room for a move toward the 1.19 zone, aligned with prior supply and the upper range extension.

- If the invalidation level breaks:

The triangle structure is negated, shifting focus back to broader range continuation and deeper consolidation.

Catalysts:

ECB communication and rate path expectations

U.S. data tied to inflation and growth momentum

Broader USD sentiment across risk assets

Takeaway:

EURUSD is compressing into a late-stage triangle — 1.1575 is the line between structure holding and failure, while upside resolution keeps 1.19 as the key zone to watch.

EURUSD final rally before complete collapse?The EURUSD pair is on a very aggressive 2-day rebound just after hitting its 1D MA200 (red trend-line) on Friday for the first time in more than 10 months (since March 05 2025)! This is naturally directly related to the new round of U.S. - E.U. tariffs discussions over Greenland. Typically moves on impulse news fade and technicals come back to center stage to dominate the price action.

So technically, since the September 15 2025 High, this basically ranged price action resembles the peak formation of January - May 2021, which led to a massive 18-month Bear Cycle.

The break below (even though marginal) the 1D MA200 is the first bearish signal and the final confirmation will come when the 1W MA50 (blue trend-line) breaks. So far even the 1W RSI Lower Highs sequences among the two fractals are similar.

As a result, when if the bearish break-out is confirmed (a 1W candle close below the 1D MA200 before the 1W MA50), we expect the pair to enter a new Bear Cycle, which by late 2026 - early 2027 can test the previous Low at 1.0200.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Global scenario for the EURUSD.Global scenario for the EURUSD. AMEX:USD ASX:EUR #EURUSD

Entry: $1.16600

Stop Loss: $1.19222

Take Profit 1: $0.85100

Take Profit 2: $0.73645

Of course, I could write out a long detailed evidentiary base, but on the 3-month charts of EURUSD and the dollar index everything is already perfectly clear anyway, and the probability of these scenarios actually playing out is quite high.

--------------------------------------------------------

TVC:DXY Global scenario for the US dollar index.

On the 3-month timeframe, it looks like a reversal to continue the upward trend after a correction down to $96.21.

• It seems we can expect growth in the dollar index roughly through 2032, with the main targets being $119.00, $126.00, and $142.00.

• The world is getting unsettled, and metals like gold, silver, platinum, and aluminum are rising with accelerating momentum.

Many investors and countries are scooping up physical metals because they know what could happen in the future, plus there's active construction of bunkers and more than 100 underground cities in the US.

Also, let's not forget that Warren Buffett's Berkshire Hathaway has accumulated historically massive cash reserves, reaching record levels, such as around $381 billion in late 2025.

It's hard to picture what the future holds, but I'm going off the chart here, and this idea gets invalidated if the dollar index drops below $96.00.

Entry: $99.00

Stop Loss: $96.00

Target 1: $119.00

Target 2: $126.00

Target 3: $142.00

TradingView (DXY):

Snapshot:

EURUSD LONGS - BUYER BACK IN CONTROL?After the recent downtrend on the current pair it seems price has halted at support and buyers have resumed.

We can see the 1.16198 area is significant level where price attempted to break lower and failed with buyers entering.

On the daily time frame price is also now trading above the 100 day MA. On the 4 hour we can see a break and restest of the counter trendline signalling a potential big upside move

Expecting EURUSD to make a leg higher if the above holds - TP1 at 1.173 and TP2 at - 1.18150

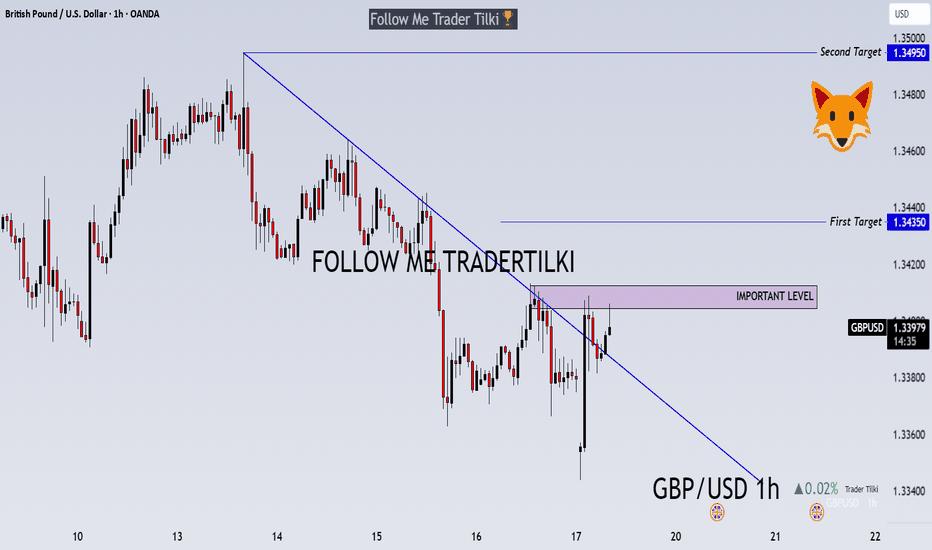

GBPUSD: Breakout and Potential Retrace! Hey Traders, in today's trading session we are monitoring GBPUSD for a buying opportunity around 1.34500 zone, GBPUSD was trading in a downtrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 1.34500 support and resistance zone.

Trade safe, Joe.

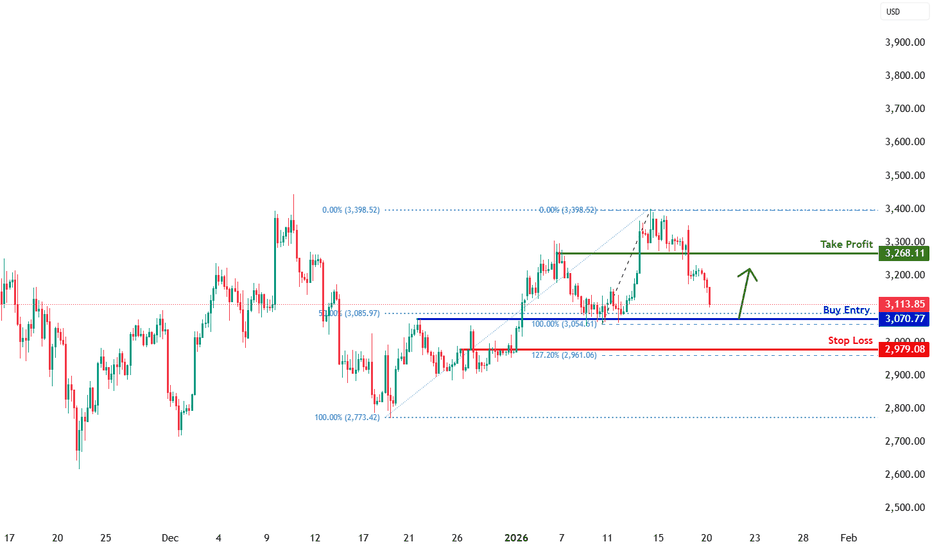

ETHUSD H4 | Falling Towards Overlap SupportThe price is falling towards our buy entry level at 3,070.77, which is an overlap support that aligns with the 50% Fibonacci retracement.

Our stop loss is set at 2,979.08, which is a pullback support that aligns with the 127.2% Fibonacci extension.

Our take profit is set at 3,268.11, which is a pullback resistance.

High Risk Investment Warning

Stratos Markets Limited (fxcm.com/uk), Stratos Europe Ltd (fxcm.com/eu):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (fxcm.com/en): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited (fxcm.com/au):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com/au

GBPUSD – 1-Hour Timeframe Tradertilki AnalysisMy friends, greetings,

I have prepared a GBPUSD analysis for you.

My friends, if GBPUSD closes a candle above the levels of 1.34125-1.34045 on the 1-hour timeframe, I will open a buy position.

My targets:

1st Target: 1.34350

2nd Target: 1.34950

My friends, I share these analyses thanks to each like I receive from you. Your likes increase my motivation and encourage me to support you in this way.🙏

Thank you to all my friends who support me with their likes.❤️

BCHUSD H4 | Bearish Drop OffThe price has rejected our sell entry level at 592.22, which is a pullback resistance.

Our stop loss is set at 618.93, which is an overlap resistance.

Our take profit is set at 552.16, which is an overlap support.

High Risk Investment Warning

Stratos Markets Limited (fxcm.com/au), Stratos Europe Ltd (fxcm.com/au):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (fxcm.com/en): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited (fxcm.com/au):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com/au

Bullish bounce off key support?WTI Oil (XTI/USD) has bounced off the pivot, which is an overlap support, and could potentially rise to the 1st resistance.

Pivot: 58.68

1st Support: 60.77

1st Resistance: 60.77

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Falling towards 38.2% Fib support?Loonie (USD/CAD) is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 1.3810

1st Support: 1.3749

1st Resistance: 1.3912

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bearish reversal off pullback resistance?USD/JPY has rejected off the pivot and could fall to the 61.8% Fibonacci support.

Pivot: 158.28

1st Support: 157.16

1st Resistance: 158.89

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Falling towards 61.8% Fib support?Swissie (USD/CHF) is falling towards the pivot, which aligns with the 61.8% Fibonacci retracement, and could bounce to the 1st reistance, which acts as a pullback resistance.

Pivot: 0.7934

1st Support: 0.7898

1st Resistance: 0.7994

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish rise?Cable (GBP/USD) has bounced off the pivot and could rise to the 61.8% Fibonacci retracement.

Pivot: 1.3398

1st Support: 1.3344

1st Resistance: 1.3489

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party