AUDUSD Ready to Push Higher? | 0.66700 Support+Gold Correlation!Hey Traders,

In the coming week, we are closely monitoring AUDUSD for a potential buying opportunity around the 0.66700 zone. AUDUSD remains in a well-established uptrend and is currently undergoing a healthy corrective pullback, approaching a key trendline confluence and the 0.66700 support-turned-resistance area, which may act as a strong demand zone for bullish continuation.

From a fundamental perspective, the Australian Dollar often benefits from its positive correlation with Gold. With Gold maintaining a strong bullish tone, this correlation could provide additional upside support for AUDUSD, reinforcing the bullish technical outlook.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

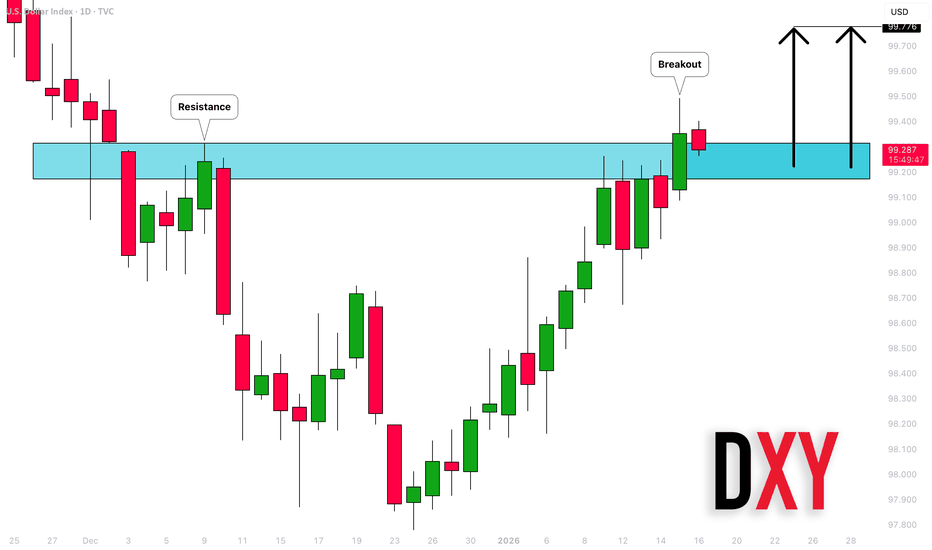

USD

Is EURUSD Loading for Another Rally? Key Zone at 1.15800!Hey Traders,

In today’s trading session, we are closely monitoring EURUSD for a potential buying opportunity around the 1.15800 zone. EURUSD remains in a well-defined uptrend and is currently undergoing a healthy corrective pullback, approaching a key trendline confluence and the 1.15800 support-turned-resistance area, which may act as a strong demand zone for bullish continuation.

With the broader market environment still favoring USD weakness, the technical structure continues to support a bullish continuation scenario on EURUSD.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

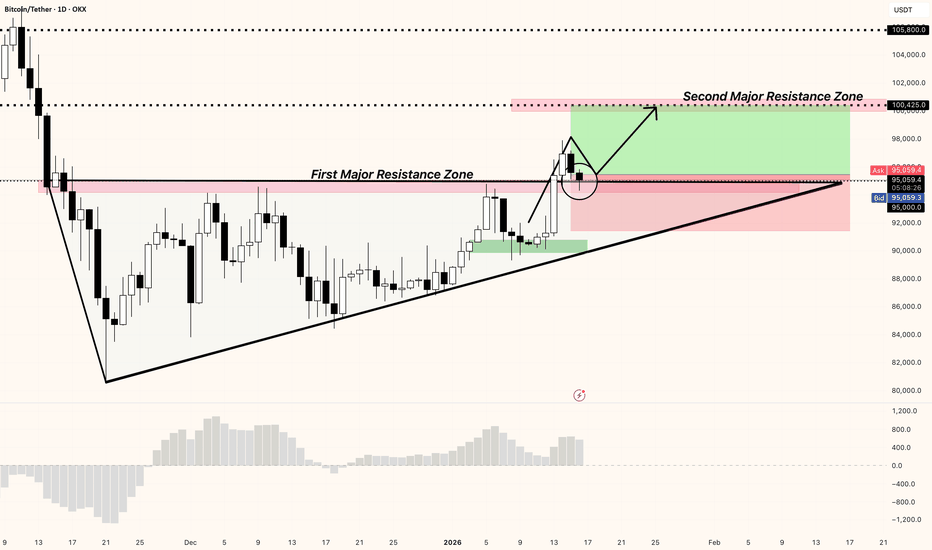

USDCAD - DOLLAR STRENGTH TO COTINUEst]

We can see the pair has been in a strong upside trend since the start of January

Price has found support at 1.38640 which also is in confluence with the 100MA on the daily time frame, we can see support has held and buyers have potentially resumed in the market to continue this trades uptrend

TP 1: 1.4000

TP 2: 1.40939

EUR/USD: inside a triangleHi!

EUR/USD is trading within a well-defined descending triangle, a structure that typically reflects corrective price action rather than a strong trending environment. Price remains compressed between declining resistance and rising support, signaling a market in balance and approaching a decision point.

Within this broader structure, the market has formed a Head and Shoulders pattern (left shoulder, head, right shoulder), which has already played out to the downside. However, the bearish follow-through has been limited, suggesting weak downside momentum rather than aggressive distribution.

Currently, price is reacting around a key demand / reaction zone, where buyers have previously defended the market. From this area, two scenarios are technically valid:

A minor bullish correction toward the upper boundary of the wedge, driven by short-term mean reversion.

A continuation lower toward wedge support if price fails to build acceptance above the current zone.

As long as EUR/USD remains inside the triangle, the market should be treated as range-bound with directional uncertainty. A confirmed breakout from either boundary will be required to establish the next sustained directional move.

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

GOLD | Range-Bound Ahead of BreakoutGOLD | Overview

The price is consolidating between 4594 and 4612, awaiting a clear breakout.

Bearish Scenario

A confirmed 1H or 15-minute candle close below 4594 will support bearish continuation toward:

4578 - 4566

Bullish Scenario

Holding above 4612 supports bullish continuation toward: 4621 - 4640

Further upside extension may reach 4651

Key Levels

Pivot Line: 4612

Resistance: 4621 – 4640 – 4651

Support: 4594 – 4578 – 4566

EURUSD Testing its 1D MA200 on the bring of a Bear Cycle.The EURUSD pair is about to test its 1D MA200 (red trend-line) for the first time since March 2025. The sideways price action of the past 6 months, is basically an result of the price hitting in September 2025 the top of the 11-year Channel Down.

On both previous Lower High tops of this pattern, every time the 1D MA200 broke after such High, the new Bearish Leg / Bear Cycle was confirmed. In addition to that, the 1M RSI has already been rejected on the 66.50 Resistance, which is exactly where the previous two Bear Cycles started.

The minimum decline of such a Bearish Leg has been -15.31%, which gives us a 1.0100 Target for the long-term.

It goes without saying that the current 1D MA200 test can be the market's most important development for 2026.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDJPY at Risk? Sell Zone at 158.600 as Intervention Fears Rise!Hey Traders,

In today’s trading session, we are monitoring USDJPY for a potential selling opportunity around the 158.600 zone. USDJPY previously traded in a strong uptrend but has successfully broken below that structure, signaling a potential shift in momentum. Price is now in a corrective pullback, approaching a key retracement level and the 158.600 support-turned-resistance area, which may act as a strong rejection zone.

From a fundamental perspective, recent comments from the Bank of Japan (BoJ) and Japan’s Ministry of Finance (MoF) continue to emphasize heightened intervention risk at elevated price levels. This ongoing threat of currency intervention adds downside pressure to USDJPY and supports the bearish technical bias.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

ETHUSD H4 | Bullish Bounce Off Key SupportBased on the H4 chart analysis, we could see the price fall to our buy entry level at 3,201.69, which is an overlap support that is slightly below the 50% Fibonacci retracement.

Our stop loss is set at 3,069.75, which is an overlap support that aligns with the 50% Fibonacci retracement.

Our take profit is set at 3,370.40, which is a multi swing high resistance.

High Risk Investment Warning

Stratos Markets Limited (

Aussie H4 | Potential bullish bounceBased on the H4 chart analysis, we can see that the price has bounced off our buy entry level at 0.6681, which is a pullback support.

Our stop loss is set at 0.6653, which is a pullback support that aligns with the 61.89% Fibonacci retracement.

Our take profit is set at 0.6752, which is a swing high resistance.

High Risk Investment Warning

Stratos Markets Limited (

USDJPY H4 | Falling Towards 50% Fib SupportBased on the H4 chart analysis, we could see the price fall to our buy entry level at 157.57, which is a pullback suport that aligns with the 50% Fibonacci retracement.

Our stop loss is set at 156.94, which is a pullback support that aligns with the 61.8% Fibonacci retracement.

Our take profit is set at 158.82, which is a pullback resistance.

High Risk Investment Warning

Stratos Markets Limited (

GBPUSD H4 | Bearish Reversal Off Key LevelThe price is rising towards our sell entry level at 1.3425, which is an overlap resistance that aligns with the 50% Fibonacci retracement.

Our stop loss is set at 1.3472, which is a pullback resistance.

Our take profit is set at 1.3350, which is an overlap support that lines up with the 141% Fibonacci extension.

High Risk Investment Warning

Stratos Markets Limited (

EURUSD H4 | Heading Towards Pullback ResistanceThe price is rising towards our sell entry level at 1.1630, which is a pullback resistance that aligns with the 38.2% Fibonacci retracement.

Our stop loss is set at 1.1673, which is a pullback resistance that aligns with the 78.6% Fibonacci retracement.

Our take profit is set at 1.1568, which is a pullback support that is slightly above the 78.6% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited (

Bullish bounce off overlap support?WTI Oil (XTI/USD) is falling towards the pivot, which has been identified as an overlap support and could bounce to the 1st resistance.

Pivot: 58.68

1st Support: 57.47

1st Resistance: 60.77

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

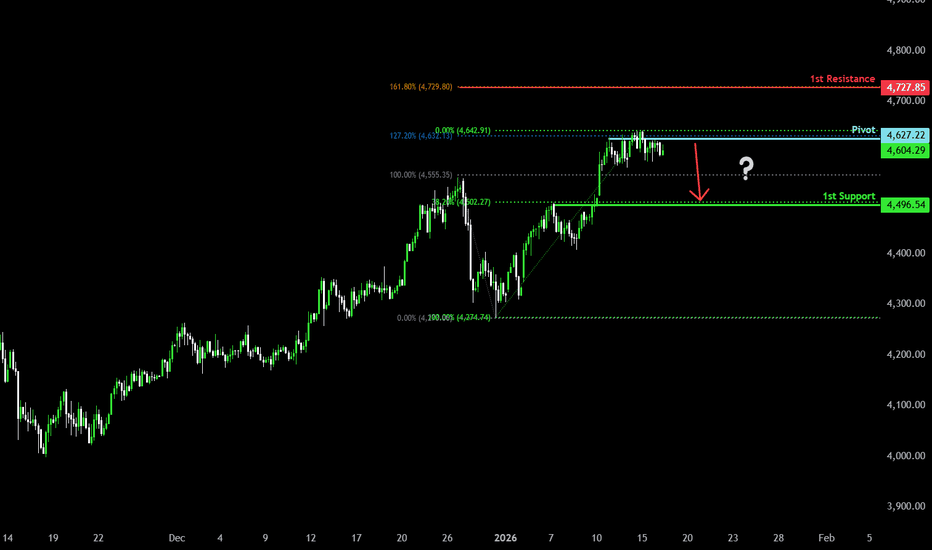

Could we see a reversal from this level?Gold (XAU/USD) is reacting off the pivot and could drop to the 1st support level which is a pullback support that aligns with the 38.2% Fibonacci retracement.

Pivot: 4,627.22

1st Support: 4,496.54

1st Resistance: 4,727.85

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bearish reversal for the Loonie?The price has rejected off the pivot, which is a pullback resistance, and could drop to the 38.2% Fibonacci support.

Pivot: 1.3910

1st Support: 1.3810

1st Resistance: 1.3975

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Falling towards pullback support?USD/JPY is falling towards the pivot and could bounce to the 1st reiststance which is a pullback resistance.

Pivot: 157.60

1st Support: 156.74

1st Resistance: 158.85

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish reversal off key support?Kiwi (NZD/USD) has bounced off the pivot and could rise to the 1st reistance, which is an overlap resistance.

Pivot: 0.5725

1st Support: 0.5692

1st Resistance: 0.5795

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish bounce off?The Aussie (AUD/USD) has bounced off the pivot, which has been identified as an overlap support, and could rise to the 1st resistance, a swing high.

Pivot: 0.6673

1st Support: 0.6646

1st Resistance: 0.6752

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

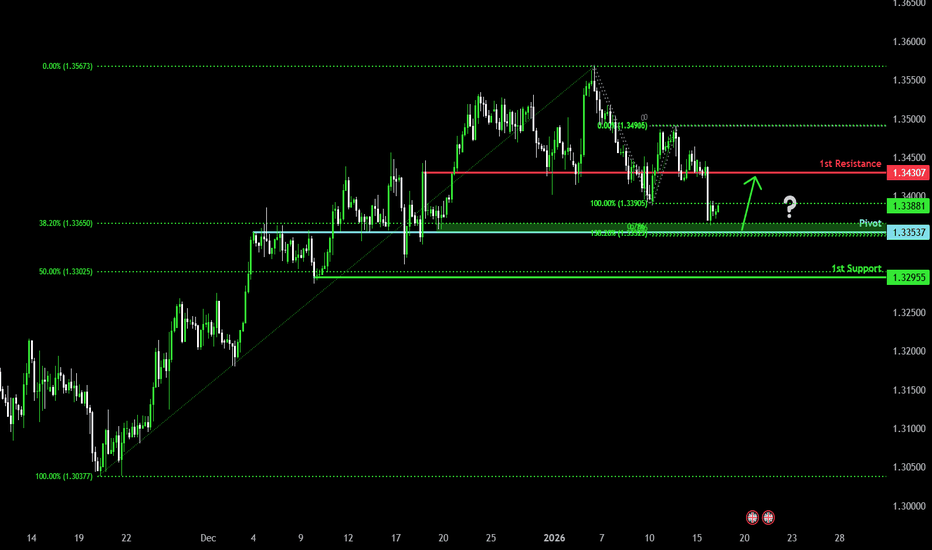

Bullish reversal?Cable (GBP/USD) is falling towards the pivot, which is an overlap support and could bounce to the key resistance.

Pivot: 1.3353

1st Support: 1.3295

1st Resistance: 1.3430

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bearish continuation?Fiber (EUR/USD) is rising towards the pivot, which acts as a pullback resistance and could drop to the 1st support.

Pivot: 1.1632

1st Support: 1.1577

1st Resistance: 1.1678

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party