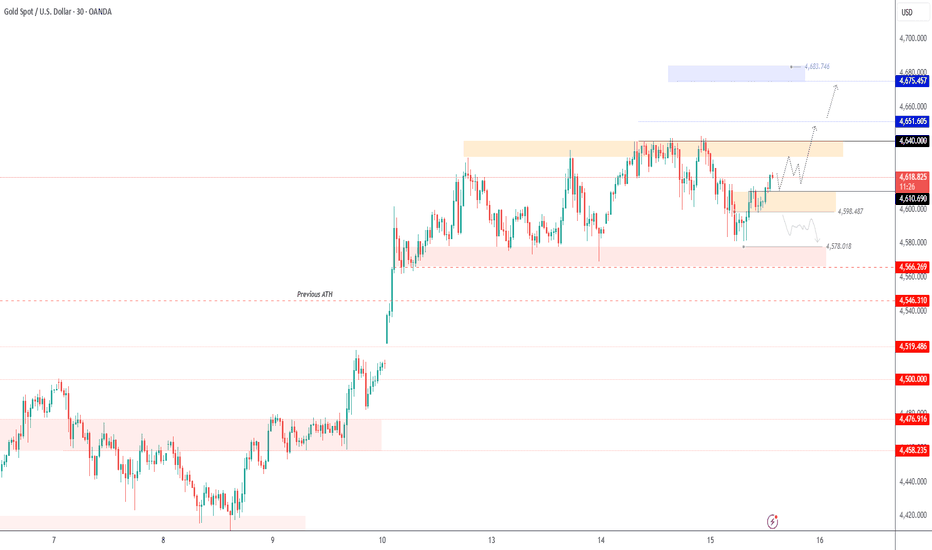

GOLD | Range-Bound Ahead of BreakoutGOLD | Overview

The price is consolidating between 4594 and 4612, awaiting a clear breakout.

Bearish Scenario

A confirmed 1H or 15-minute candle close below 4594 will support bearish continuation toward:

4578 - 4566

Bullish Scenario

Holding above 4612 supports bullish continuation toward: 4621 - 4640

Further upside extension may reach 4651

Key Levels

Pivot Line: 4612

Resistance: 4621 – 4640 – 4651

Support: 4594 – 4578 – 4566

USD

EURUSD Testing its 1D MA200 on the bring of a Bear Cycle.The EURUSD pair is about to test its 1D MA200 (red trend-line) for the first time since March 2025. The sideways price action of the past 6 months, is basically an result of the price hitting in September 2025 the top of the 11-year Channel Down.

On both previous Lower High tops of this pattern, every time the 1D MA200 broke after such High, the new Bearish Leg / Bear Cycle was confirmed. In addition to that, the 1M RSI has already been rejected on the 66.50 Resistance, which is exactly where the previous two Bear Cycles started.

The minimum decline of such a Bearish Leg has been -15.31%, which gives us a 1.0100 Target for the long-term.

It goes without saying that the current 1D MA200 test can be the market's most important development for 2026.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDJPY at Risk? Sell Zone at 158.600 as Intervention Fears Rise!Hey Traders,

In today’s trading session, we are monitoring USDJPY for a potential selling opportunity around the 158.600 zone. USDJPY previously traded in a strong uptrend but has successfully broken below that structure, signaling a potential shift in momentum. Price is now in a corrective pullback, approaching a key retracement level and the 158.600 support-turned-resistance area, which may act as a strong rejection zone.

From a fundamental perspective, recent comments from the Bank of Japan (BoJ) and Japan’s Ministry of Finance (MoF) continue to emphasize heightened intervention risk at elevated price levels. This ongoing threat of currency intervention adds downside pressure to USDJPY and supports the bearish technical bias.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

ETHUSD H4 | Bullish Bounce Off Key SupportBased on the H4 chart analysis, we could see the price fall to our buy entry level at 3,201.69, which is an overlap support that is slightly below the 50% Fibonacci retracement.

Our stop loss is set at 3,069.75, which is an overlap support that aligns with the 50% Fibonacci retracement.

Our take profit is set at 3,370.40, which is a multi swing high resistance.

High Risk Investment Warning

Stratos Markets Limited (

Aussie H4 | Potential bullish bounceBased on the H4 chart analysis, we can see that the price has bounced off our buy entry level at 0.6681, which is a pullback support.

Our stop loss is set at 0.6653, which is a pullback support that aligns with the 61.89% Fibonacci retracement.

Our take profit is set at 0.6752, which is a swing high resistance.

High Risk Investment Warning

Stratos Markets Limited (

USDJPY H4 | Falling Towards 50% Fib SupportBased on the H4 chart analysis, we could see the price fall to our buy entry level at 157.57, which is a pullback suport that aligns with the 50% Fibonacci retracement.

Our stop loss is set at 156.94, which is a pullback support that aligns with the 61.8% Fibonacci retracement.

Our take profit is set at 158.82, which is a pullback resistance.

High Risk Investment Warning

Stratos Markets Limited (

GBPUSD H4 | Bearish Reversal Off Key LevelThe price is rising towards our sell entry level at 1.3425, which is an overlap resistance that aligns with the 50% Fibonacci retracement.

Our stop loss is set at 1.3472, which is a pullback resistance.

Our take profit is set at 1.3350, which is an overlap support that lines up with the 141% Fibonacci extension.

High Risk Investment Warning

Stratos Markets Limited (

EURUSD H4 | Heading Towards Pullback ResistanceThe price is rising towards our sell entry level at 1.1630, which is a pullback resistance that aligns with the 38.2% Fibonacci retracement.

Our stop loss is set at 1.1673, which is a pullback resistance that aligns with the 78.6% Fibonacci retracement.

Our take profit is set at 1.1568, which is a pullback support that is slightly above the 78.6% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited (

Bullish bounce off overlap support?WTI Oil (XTI/USD) is falling towards the pivot, which has been identified as an overlap support and could bounce to the 1st resistance.

Pivot: 58.68

1st Support: 57.47

1st Resistance: 60.77

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

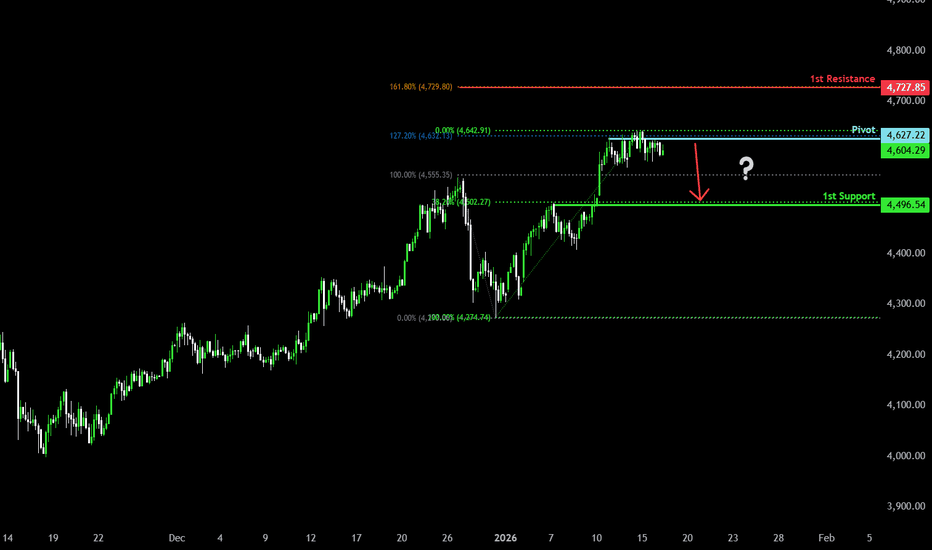

Could we see a reversal from this level?Gold (XAU/USD) is reacting off the pivot and could drop to the 1st support level which is a pullback support that aligns with the 38.2% Fibonacci retracement.

Pivot: 4,627.22

1st Support: 4,496.54

1st Resistance: 4,727.85

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bearish reversal for the Loonie?The price has rejected off the pivot, which is a pullback resistance, and could drop to the 38.2% Fibonacci support.

Pivot: 1.3910

1st Support: 1.3810

1st Resistance: 1.3975

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Falling towards pullback support?USD/JPY is falling towards the pivot and could bounce to the 1st reiststance which is a pullback resistance.

Pivot: 157.60

1st Support: 156.74

1st Resistance: 158.85

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish reversal off key support?Kiwi (NZD/USD) has bounced off the pivot and could rise to the 1st reistance, which is an overlap resistance.

Pivot: 0.5725

1st Support: 0.5692

1st Resistance: 0.5795

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish bounce off?The Aussie (AUD/USD) has bounced off the pivot, which has been identified as an overlap support, and could rise to the 1st resistance, a swing high.

Pivot: 0.6673

1st Support: 0.6646

1st Resistance: 0.6752

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

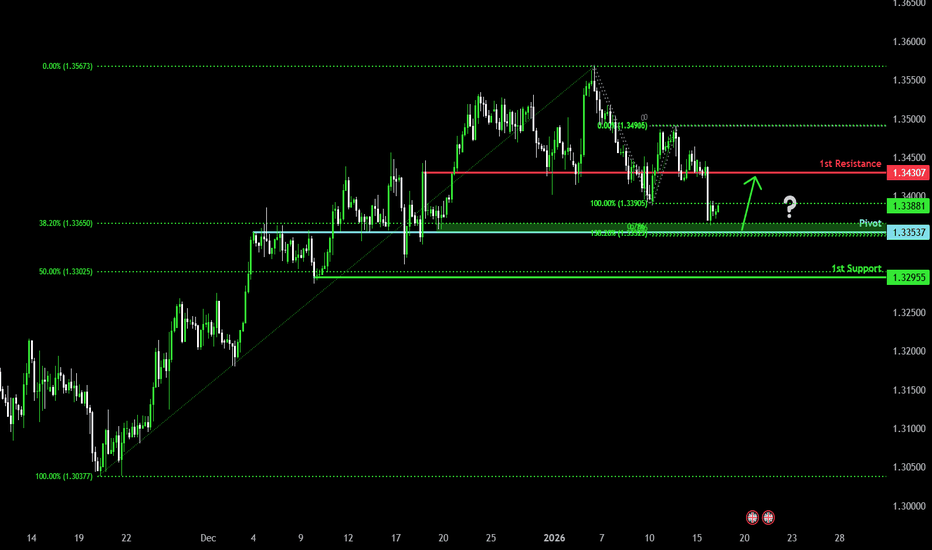

Bullish reversal?Cable (GBP/USD) is falling towards the pivot, which is an overlap support and could bounce to the key resistance.

Pivot: 1.3353

1st Support: 1.3295

1st Resistance: 1.3430

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bearish continuation?Fiber (EUR/USD) is rising towards the pivot, which acts as a pullback resistance and could drop to the 1st support.

Pivot: 1.1632

1st Support: 1.1577

1st Resistance: 1.1678

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

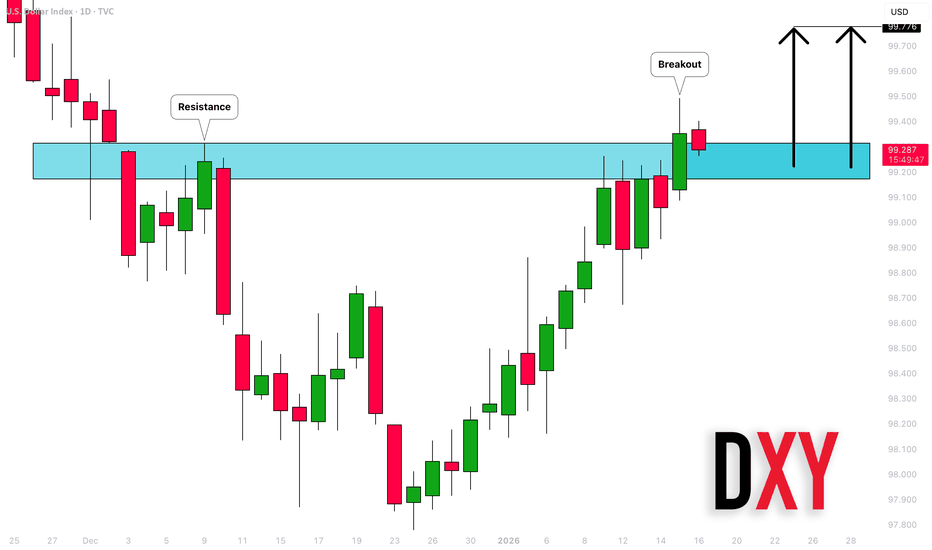

USD Ascending Triangle #2 BreakoutSo far it's been a bullish start to 2026 for the US Dollar and while USD/JPY was doing a lot of that push, more recently, it's been EUR/USD, which dropped to a fresh monthly low earlier today.

There hasn't really even been any strong US data or news, as the CPI print on Tuesday saw Core print below the expectation and the NFP print from last Friday saw a miss in the headline number. But, this is where trends can show their hands, when a market moves in a direction that's not easily explained by the fundamental backdrop.

In the USD, it's the same 100 area in DXY that looms large as this spot held multiple resistance tests last year, including a double top in November that led to a break down in December. But, so far, that breakdown held a higher-low as sellers couldn't quite get down to the prior July/September lows, and this brings scope for bullish potential.

On a shorter-term basis, we have a breakout and fresh highs and this also means prior triangle resistance is now support potential. Whether the USD can continue the rally will probably derive from whether EUR/USD bears defend lower-high resistance, with 1.1616 already in play and 1.1656 just a bit higher.

For DXY, support is now plotted at 99.26 with 98.98 just below that, and then the prior triangle resistance at 98.76. - js

GBPUSD - From Bullish to Bearish, keeping it simpleGBPUSD has shifted gears.

After losing its bullish structure, price is now trading inside a falling red channel, keeping the broader bias bearish.

As GBPUSD retests the upper bound of the falling channel, and that retest lines up perfectly with the orange supply zone. This is a classic area where sellers tend to step back in.

As long as this intersection holds, the plan is simple:

wait for lower timeframe confirmation and look for trend-following short setups, aiming for continuation back toward the lower side of the channel.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

GBPUSD - Right Into Resistance… Again!GBPUSD is now trading at a very important intersection.

Price is pressing right into the upper red trendline, while also sitting inside the green resistance zone. This is not a random area... it’s a level that has already rejected price multiple times in the past.

From a bigger-picture perspective, the structure remains overall bearish, with price still respecting the descending channel. The recent push higher looks more like a corrective move rather than a true trend reversal.

As long as this trendline + resistance intersection holds, my focus stays clear:

I’ll be looking for trend-following shorts, preferably after lower-timeframe confirmation and signs of bearish control.

Only a strong and clean break above this zone would force a reassessment. Until then, sellers still have the edge.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

GOLD | Profit-Taking Within Bullish StructureGold Falls on Profit-Taking as Iran Fears Ease

Gold prices slipped as investors booked profits after the metal posted a record high on Wednesday. Additional pressure came from easing concerns over imminent U.S. military action against Iran, reducing short-term safe-haven demand.

Sentiment was further weighed down by President Trump’s softer tone toward Federal Reserve Chair Jerome Powell. In an interview with Reuters, Trump stated that he has no plans to remove Powell, despite the ongoing Justice Department investigation.

Markets are now focused on U.S. weekly jobless claims for further clues on the Fed’s policy outlook, as expectations for lower interest rates tend to support non-yielding assets such as gold.

Technical Outlook (GOLD)

The broader structure remains bullish, though the market is currently undergoing a corrective phase.

Above 4610: Bullish momentum remains active

Upside targets: 4630 – 4640

A confirmed 15M or 1H close above 4640 would open the way toward:

4651 - 4675

Bearish / Corrective Scenario

A move below 4598 would shift momentum into a bearish correction, targeting:

4578 - 4566

A confirmed break below this zone would expose further downside toward:

4546 - 4519

Key Levels

Pivot Line: 4610

Resistance: 4630 – 4640 – 4675

Support: 4598 – 4578 – 4566

XAUUSD SELL?Today CPI!

Trump is completely unpredictable – and with him, the United States as well. As is well known, he doesn’t have a good relationship with the Fed chairman either. Anything is possible. Trading needs to be approached with extreme caution. Even if you enter the setup I shared, do it wisely. Trump is really crazy. 😕