USDCHF H4 | Could We See A ReversalThe price is reacting off our sell entry level at 0.7992, which is an overlap resistance that lines up with the 61.8% Fibonacci retracement and the 78.6% Fibonacci projection.

Our stop loss is set at 0.8025, which is a pullback resistance that is slightly below the 78.6% Fibonacci retracement.

Our take profit is set at 0.7942, which is a pullback support that aligns with the 38.2% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited (

USD

GBPUSD H4 | Bullish Reversal SetupThe price is reacting off our buy entry at 1.3420, which is an overlap support.

Our stop loss is set at 1.3371, which is a pullback support that aligns with the 127.2% Fibonacci extension.

Our take profit is set at 1.3485, which is a pullback resistance that lines up with the 50% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited (

EURUSD H4 | Falling Towards Key SupportThe price is falling towards our buy entry level at 1.1612, which is an overlap support that aligns with 61.8% Fibonacci retracement and slightly below the 78.6% Fibonacci projection.

Our stop loss is set at 1.1612, which acts as an overlap support that aligns with 61.8% Fibonacci retracement and slightly below the 78.6% Fibonacci projection.

Our take profit is set at 1.1674, which is a pullback resistance.

High Risk Investment Warning

Stratos Markets Limited (

DXY 1Y Chart - Concerns AheadToday you can review the technical analysis idea on a 1Y linear scale chart for US Dollar Index (DXY).

The RSI being below the trend line seems concerning for the DXY however let's see how the global economy works out this year.

If you enjoy my ideas, feel free to like it and drop in a comment. I love reading your comments below.

Disclosure: This is just my opinion and not any type of financial advice. I enjoy charting and discussing technical analysis. Don't trade based on my advice. Do your own research! #millionaireeconomics #DXY

GOLD H4 | Bullish Bounce OffThe price has bounced off our buy entry level at 4,403.41, which is a pullback support that is slightly above the 50% Fibonacci retracement.

Our stop loss is set at 4,316.54, whic is a pullback support.

Our take profit is set at 4,534.93, which is a swing high resistance.

High Risk Investment Warning

Stratos Markets Limited (

Bullish bounce off?AUD/USD has bounced off the support level, which is a pullback support that aligns with the 78.6% Fibonacci retracement, and could bounce from this level to our take profit.

Entry: 0.6685

Why we like it:

There is a pullback support that aligns with the 78.6% Fibonacci retracement.

Stop loss: 0.6665

Why we like it:

There is a multi-swing low support.

Take profit: 0.6712

Why we like it:

There is a pullback resistance that aligns with the 38.2% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

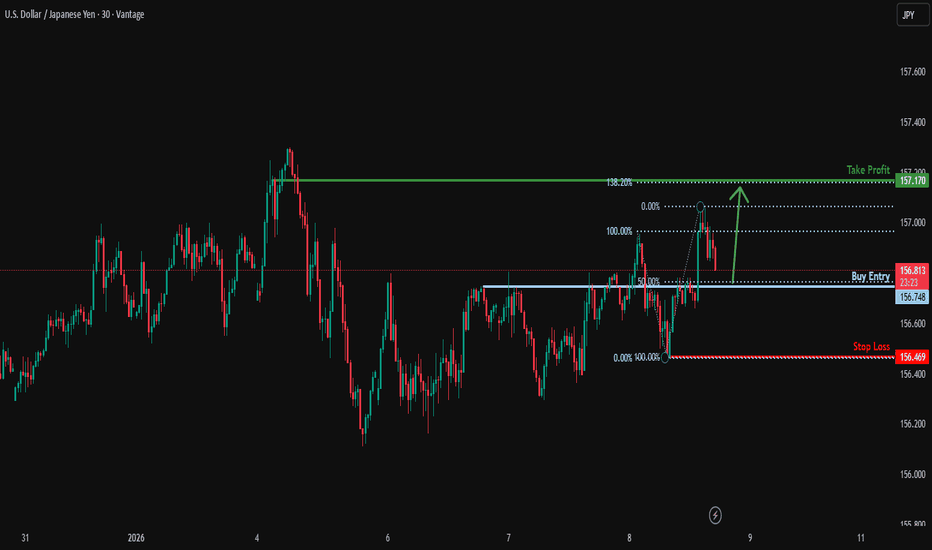

Could we see a bounce from here?USD/JPY is falling towards the support level, which is a pullback support that aligns with the 50% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 156.74

Why we like it:

There is a pullback support level which is a pullback support that aligns with the 50% Fibonacci retracement.

Stop loss: 156.46

Why we like it:

There is a pullback support level.

Take profit: 157.17

Why we like it:

There is a pullback resistance that aligns with the 138.2% Fibonacci extension.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bearish reversal off 50% Fib resistance?USD/CAD is rising towards the resistance level, which is a pullback resistance that aligns with the 50% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 1.3896

Why we like it:

There is a pullback resistance level that aligns with the 50% Fibonacci retracement.

Stop loss: 1.3977

Why we like it:

There is a pullback resistance level.

Take profit: 1.3799

Why we like it:

There is a pullback support that aligns with the 38.2% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Potential bearish drop?GBP/USD is rising towards the resistance level, which is a pullback resistance and could reverse from this level to our take profit.

Entry: 1.3484

Why we like it:

There is a pullback resistance.

Stop loss: 1.3567

Why we like it:

There is a swing high resistance level.

Take profit: 1.3355

Why we like it:

There is an overlap support level that aligns with the 38.2% Fibonacci retracement

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

USD/CAD Comes Back to LifeComing into 2025 it seemed like USD bulls had full control of the FX market, but the Dollar set a high less than two weeks into the New Year and then weakness remained for pretty much the rest of the year. Of course, much of that weakness was confined the first-half of 2025, but another bearish run in December made it really easy to come into 2026 as a USD bear and so far in the New Year we've seen bullish price action in the DXY.

This puts a lot of focus into U.S. data with tomorrow's Non-farm Payrolls report and then inflation reports to be released thereafter, and what we're seeing now could simply be a degree of squaring up ahead of some big risk events, but in the USD/CAD pair, a strong sell-off has since led to a sizable rally with the pair continuing to show gains.

Notably, it was the oversold reading on the daily chart in late 2025 trade that led into the move and the question now is whether there's the making of a trend in here. Price is already testing a spot of resistance just inside of the 1.3900 handle and the 1.4000 level is a massive spot, if it does come into play. So chasing from here can be challenging, but, there's now bullish structure that can be worked with down to an upward-sloping trendline that's developed in the early stages of the rally.

I'm tracking supports at 1.3836, 1.3800 and then the zone from 1.3743-1.3750 as an 's3' of sorts. If sellers can elicit a closed body break below 's3' it's going to look like the rally is done for but, until that scenario, there's bullish potential for a re-test of the 1.4000 handle.

If 1.4000 trades before any of those supports come into play, then current resistance becomes the new 's1' area of support and that spans from 1.3889-1.3905. - js

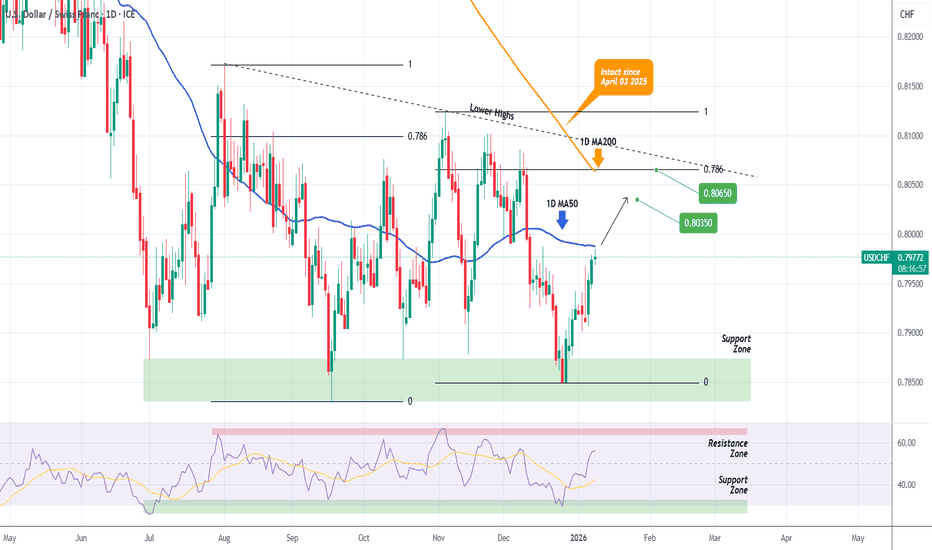

USDCHF Moment of truth on the 1D MA200 is coming.The USDCHF pair is on a strong rise since its December 26 2025 Low, which is technically the Bullish Leg of the long-term Descending Triangle. Today it is testing the 1D MA50 (blue trend-line) and if broken, will be the perfect buy continuation signal.

If it breaks, buy and target a potential 1D MA200 (orange trend-line) test at 0.80350. This will be the market's most important test for 2026 as the 1D MA200 has been untouched since April 03 2025.

If it breaks, the long-term trend most likely shifts to bullish, but even on the short-term we can again engage into a quick buy, targeting the top (Lower Highs trend-line) of the Descending Triangle at 0.80650, which is also the 0.786 Fibonacci retracement level (where the previous Lower High was priced).

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Gold Outlook: Consolidation Near Highs as Profit-Taking EmergesGold Futures Slip on Profit-Taking | Focus Shifts to U.S. Data

Gold prices edged lower as investors book profits and turn their attention to key U.S. economic data due this week.

At current levels, prices are becoming more sensitive to liquidity shifts and profit-taking, leaving room for sharp but temporary pullbacks, even as the medium-term bullish trend remains supported.

TECHNICAL VIEW (GOLD)

Price is expected to consolidate between 4436 and 4458 until a breakout occurs

Bearish Scenario

A 1H candle close below 4436 would extend weakness toward 4420 and 4407

A break below this zone may open the path toward 4378 and 4360

Bullish Scenario

Stability above 4458 supports a move toward 4475

A 1H candle close above 4475 would confirm bullish continuation toward 4500 and 4520

Key Levels

Pivot Line: 4458

Resistance: 4475 – 4500 – 4520

Support: 4420 – 4407 – 4378 – 4360

EURUSD Breakout and Potential RetraceHey Traders, in today's trading session we are monitoring EURUSD for a buying opportunity around 1.16600 zone, EURUSD was trading in a downtrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 1.16600 support and resistance area.

Trade safe, Joe.

H4 US Dollar Index (DXY) – Technical AnalysisThe US Dollar Index (DXY) is trading near 98.70 on the 4H chart, and it’s looking like it’s going to continue its recovery within that rising channel from the low at 97.75. Price has managed to take back the 50% Fib level at 98.24 and is now testing the resistance at 98.74 – which just so happens to be where a prior support level used to be.

The 200-EMA at 99.00 is a big deal as far as upside goes, while the supports sit at 98.12 and 97.9. RSI is sitting at 58, which is a pretty good sign. The trade idea is to pick up a few dollars on the dip near 98.30 and aim for 99.20, but set a stop loss below 97.95.

Fundamental Note: EURUSD 07 Jan 2026EURUSD is trading around the 1.17 area as markets position for the first Non-Farm Payrolls release of 2026 on Friday, 9 Jan (Employment Situation for Dec 2025). This print matters more than usual because it’s the year’s first “reality check” on whether the late-2025 slowdown in hiring is turning into a softer trend (supporting more Fed cuts) or stabilizing (supporting USD via higher yields). Right now, consensus expectations lean toward a modest jobs gain in the mid-50k to ~60k range, with unemployment seen near 4.5% and wage growth watched closely for a rebound risk. In the short term, a weaker NFP and/or softer earnings would likely push US yields and the USD lower, giving EURUSD room to squeeze back toward recent highs; a hot wages surprise or upside payroll miss could quickly flip the move into a USD rebound. On the Euro side, easing inflation keeps the ECB comfortable in its “hold” stance, which reduces near-term EUR policy volatility versus the US data-driven repricing this week.

Bottom line: the market is mostly looking for a “soft-but-not-breaking” NFP that validates expectations for further Fed easing in 2026—any big deviation should produce an outsized EURUSD reaction.

🟢 Bullish factors:

1. NFP downside surprise or softer wages → lower US yields/USD.

2. Market still broadly positioned for additional Fed cuts in 2026.

3. ECB “on hold” narrative reduces euro-side policy shock risk near-term.

🔴 Bearish factors:

1. Strong NFP and/or hot wage growth → higher US yields, USD bid.

2. Risk-off flows (or renewed geopolitical stress) typically favor USD liquidity.

3. Euro inflation cooling can revive future ECB cut discussions if growth fades.

🎯 Expected targets: Volatile range into/through NFP. Base case (soft NFP): upside toward 1.1750–1.1820. Hawkish surprise (strong jobs/wages): pullback toward 1.1600–1.1550, with 1.1500 as the next downside area if the USD rally extends.

My view on GBPUSDMy view on GBPUSD 👇

I like the higher-timeframe structure, but right now price is reacting inside demand after a pullback, so I’m more cautious here.

What I’m watching:

We’ve had a CHoCH into demand, so this area could act as a base

I’d expect some consolidation or a small sweep before any strong move

If price holds above 1.3420–1.3400 and shows bullish confirmation, I’m open to longs toward 1.3550–1.3600

If demand fails, then we could see a deeper pullback before continuation

Overall: bullish bias, but I’d prefer confirmation from demand, not chasing the move.

BTCUSD H4 | Bullish Bounce Off 61.8% Fib SupportThe price is falling towards our buy entry level at 89,685.29, which aligns with the 61.8% Fibonacci retracement.

Our stop loss is set at 86,649.35, which is a pullback support.

Our take profit is set at 93,898.42, which is a multi swing high resistance.

High Risk Investment Warning

Stratos Markets Limited (

Bearish drop off?Aussie (AUD/USD) is reacting off the pivot and could drop to the overlap support that aligns with the 61.8% Fibonacci retracement.

Pivot: 0.6718

1st Support: 0.6666

1st Resistance: 0.6752

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Potential bullish rise?Loonie (USD/CAD) has bounced off the pivot and could rise to the overlap resistance.

Pivot: 1.3810

1st Support: 1.3748

1st Resistance: 1.3975

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bearish reevrsal off Fib confluenceSwissie (USD/CHF) is rising towards the pivot, which is an overlap resistance and could reverse to the 1st support, which is a pullback support.

Pivot: 0.7992

1st Support: 0.7934

1st Resistance: 0.8025

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish bounce off overlap support?Cable (GBP/USD) is falling towards the pivot, which has been identified as an overlap support and oculd bounce to the 1st resistance.

Pivot: 1.3422

1st Support: 1.3347

1st Resistance: 1.3530

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

AUDUSD (Short Bias)The sell is still forming and yesterday price decided to do 1 more spike up above the consolidation box. The new data printed makes me think there wont be a retest of the consolidation, based on the type of schematic it printed this might be the type that just leaves a supply for future incentivized shorts.

ETHUSD H4 | Falling Towards 50% Fib SupportThe price is falling towards our buy entry level at 3,053.65, which is a pullback support that aligns with the 50% Fibonacci retracement.

Our stop loss is set at 2,914.81, which is a pullback support that is slightly above the 78.6% Fibonacci retracement.

Our take profit is set at 3,252.70, which is a pullback resistance.

High Risk Investment Warning

Stratos Markets Limited (