Bullish reversal for the Swissie?The price is reacting off the support level, which is a pullback support and could rise from this level to our take profit.

Entry: 0.7928

Why we like it:

There is a pullback support level.

Stop loss: 0.7892

Why we like it:

There is a pullback support level

Take profit: 0.7992

Why we like it:

There is an overlap resistance level that is slightly below the 50% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

USD

Bearish drop off?EUR/USD has rejected off the resistance level, which is a pullback resistance and could drop from this level to our take profit.

Entry: 1.1755

Why we like it:

There is a pullback resistance level.

Stop loss: 1.1803

Why we like it:

There is a swing high resistance level.

Take profit: 1.1676

Why we like it:

There is a pullback support level that aligns with the 38.2% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

GOLD | CPI Volatility Incoming — Watching 4314 & 4291GOLD (XAUUSD) | Short Technical Overview

Gold is currently trading around the 4314 pivot line, showing a consolidation pattern after failing to break the 4347 resistance zone.

The chart indicates two possible paths: a short bullish correction back toward 4340–4347, or a continuation of the bearish move toward the 4291 support if the pivot breaks.

Today’s U.S. CPI is expected to be released above 3.00%, which typically strengthens the USD and pressures Gold downward.

If CPI comes in higher, Gold may drop toward 4291, and a break below it could open the way toward deeper support levels.

Key Levels:

Pivot: 4314

Resistance: 4334 → 4347

Support: 4303 → 4291 → 4267

Zcash ZEC Update: Breakdown confirmed, hold your horses ZEC Update: Price has now decisively broken down from the rising channel, and the attempted reclaim back into the structure failed, confirming this move as corrective rather than trend continuation. Former channel support in the 390-400 region is continuing to act as resistance, and the inability to hold above it reinforces that sellers remain in control. Structurally, this shifts the bias back to the downside, with price likely to remain under pressure into year end.

From a broader perspective, this lines up with the wider crypto market showing signs of distribution and risk-off behavior following the recent expansion phase. As liquidity tightens and momentum cools across majors, higher beta and narrative-driven assets like ZEC tend to retrace deeper and test higher timeframe levels. In that context, continuation back toward the ~300 HTF support zone makes the most sense from both a technical and macro standpoint.

The ~300 level is especially important here. This would be a second test of what has recently flipped from resistance to support, making it a true validation level. A strong reaction would suggest acceptance of this zone as a higher low within a larger cycle, while a weak or impulsive break would open the door to further downside and a longer basing process. I’m cautious here, as second tests often determine whether a level holds structurally or fails outright.

Assuming the market continues to flush and reset into early next year, I’d expect conditions to improve closer to February once excess leverage and weak hands are cleared out. Until then, the focus remains on respecting structure, managing risk, and letting price confirm before getting aggressive. For now, this looks like consolidation and downside continuation within a broader market reset rather than the start of a new uptrend.

USDJPY H4 | Bullish RiseMomentum: Bearish

The price has bounced off the buy entry, which acts as a multi-swing low support, adding significant strength to this level.

Buy entry: 154.79

Multi swing low support

Stop loss: 154.07

Pullback support

Take profit: 156.37

Pullback resistance

High Risk Investment Warning

Stratos Markets Limited (tradu.com ), Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

USDCHF H4 | Bullish Reversal SetupMomentum: Bearish

The price could make a short-term pullback to the buy entry, which acts as a pullback support.

Buy entry: 0.7961

Pullback support

Stop loss: 0.7922

Pullback support

Take profit: 0.8011

Overlap resistance that aligns with the 50% Fibonacci retracement

High Risk Investment Warning

Stratos Markets Limited (tradu.com ), Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

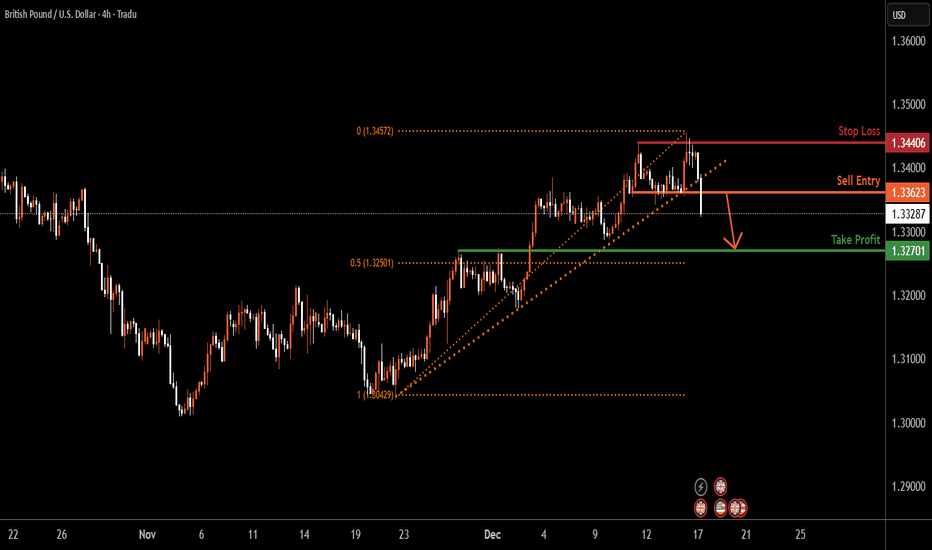

GBPUSD H4 | Bearish BreakoutMomentum: Bullish

The price is reacting off the sell entry, which acts as a pullback resistance with clear selling pressure.

Sell entry: 1.3362

Pullback resistance

Stop loss: 1.3440

Multi swing high resistance

Take profit: 1.3270

Pullback support

Slightly above the 50% Fibonacci retracement

High Risk Investment Warning

Stratos Markets Limited (tradu.com ), Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

EURUSD H4 | Potential Bearish DropMomentum: Bullish

The price is reacting off the sell entry which acts as a pullback resistance.

Sell entry: 1.1726

Pullback resistance

Stop loss: 1.18023

Swing high resistance

Take profit: 1.1651

Overlap support

61.8% Fibonacci retracement

High Risk Investment Warning

Stratos Markets Limited (tradu.com ), Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

XAGUSD M30 | Bearish Reversal Off 50% Fib ResistanceMomentum: Bullish

Price is reacting off the sell entry, which aligns with the 50% Fibonacci retracement, adding significant confluence and strength to this level.

Sell entry: 62.66

Pullback resistance

50% Fibonacci retracement

Stop loss: 63.80

Pullback resistance

78.6% Fibonacci retracement

Take profit: 60.73

Pullback suport

High Risk Investment Warning

Stratos Markets Limited (tradu.com ), Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

USDCAD H4 | Bullish Reversal Off Multi Swing LowMomentum: Bearish

The price is falling towards the buy entry which has been identified as a multi-swing low support.

Buy entry: 1.3766

Multi swing low support

Stop loss: 1.3688

Pullback support

Take profit: 1.3822

Pullback resistance

High Risk Investment Warning

Stratos Markets Limited (tradu.com), Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

NZDUSD H4 | Bearish drop offMomentum: Bullish

The price has reacted off the sell entry, which acts as a pullback support.

Sell entry: 0.5796

Pullback support

Stop loss: 0.5841

Swing high resistance

Take profit: 0.5728

Pullback support

38.2% Fibonacci retracement

High Risk Investment Warning

Stratos Markets Limited (tradu.com), Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

AUDUSD H4 | Bullish Bounce OffMomentum: Bullish

The price is falling towards the buy entry, which is slightly below the 23.6% Fibonacci retracement and also trading above the Ichimoku cloud.

Buy entry: 0.6612

Pullback suport

Slightly below the 23.6% Fibonacci retracement

Stop loss: 0.6573

Pullback support

Take profit: 0.6686

Multi swing high resistance

High Risk Investment Warning

Stratos Markets Limited (tradu.com), Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

GBPUSD | Bearish Structure Below 1.3372 Ahead of CPIGBPUSD | Technical Overview

The price has stabilized below the pivot level at 1.3372, which maintains a bearish outlook for the pair.

As long as GBPUSD trades under this level, the market is expected to move toward 1.3295, and a break below this zone may extend the decline toward 1.3232.

A 4H candle close above 1.3410 is required to reverse the current structure and activate a bullish momentum toward 1.3445.

Today’s U.S. CPI release will significantly impact market direction and volatility.

Pivot Line: 1.3372

Support: 1.3295, 1.3232

Resistance: 1.3410, 1.3445

Timeframe: 4H

Bias: Bearish while below 1.3372

EUR/USD - Central Bank Week in Control (18.12.2025)📝 Description🔹 Market Context (Fundamental) FX:EURUSD

This week is central-bank heavy, keeping EUR/USD sensitive to volatility and USD strength:

BoE (Thursday): High impact – rate cut expected → risk-off tone

ECB (Thursday): Low impact – policy hold expected

BoJ (Friday): High impact – rate hike expectations, supporting JPY and pressuring USD pairs via risk repricing

Overall, policy divergence + risk uncertainty keeps EUR/USD capped near resistance.

🔹 Technical Setup

Price is trading below a key resistance zone and struggling to hold above short-term EMA / cloud levels. Repeated rejections from the highlighted zone indicate seller dominance.

As long as price stays below resistance, pullbacks are likely to extend lower.

📌 Trade Plan 🔴 Bearish below resistance

Sell-on-rejection from the resistance zone

Momentum confirmation preferred on lower timeframes

🔴 1st Support: 1.1685

🔴 2nd Support: 1.1660

#EURUSD #ForexTrading #FundamentalAnalysis #CentralBankWeek #PriceAction #SupportResistance #FXMarket #TradingView #Kabhi_TA_Trading

⚠️ Disclaimer

This analysis is for educational purposes only.

Not financial advice. Always manage risk and use a stop-loss.

❤️ Support the Analysis 👍 Like if this breakdown helps 💬 Comment your EUR/USD bias

🔁 Share with fellow traders

Heading towards pullback resistance?WTI Oil (XTI/USD) is rising towards the pivot, which acts as a pullback resistance and could reverse to the 1st support.

Pivot: 57.45

1st Support: 55.20

1st Resistance: 58.51

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish reversal setup?Swissie (USD/CHF) is falling towards the pivot, which is a pullback support and could bounce to the 1st resistance, which has been identified as an overlap resistance.

Pivot: 0.7931

1st Support: 0.7891

1st Resistance: 0.7993

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Could we see a drop from here?Kiwi (NZD/USD) has rejected off the pivot and could drop to the 1st support.

Pivot: 0.5790

1st Support: 0.5715

1st Resistance: 0.5830

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

BTCUSD H4 | Bearish ContinuationMomentum: Bearish

Price has rejected from the sell entry, which is acting as pullback resistance. It is also trading below the Ichimoku cloud, adding significant confluence and strength to this level.

Sell entry: 89,761.64

Pullback resistance

Stop loss: 94,934.32

Pullback resistance

Take profit: 82,105.45

Swing low support

High Risk Investment Warning

Stratos Markets Limited (tradu.com ), Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Potential bearish drop?Aussie (AUD/USD) has reacted off the pivot and could drop to the pullback support, which is slightly above the 61.8% Fibonacci retracement.

Pivot: 0.6619

1st Support: 0.6540

1st Resistance: 0.6672

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bearish drop off 61.8% Fibonacci resistance?Cable (GBP/USD) has rejected off the pivot, which acts as a pullback resistance and could drop to the 1st support, which is also a pullback support.

Pivot: 1.3396

1st Support: 1.3316

1st Resistance: 1.3437

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bearish reversal off pullback resistance?Fiber (EUR/USD) has rejected off the pivot, which aligns with the 61.8% Fibonacci retracement and could drop to the 1st support.

Pivot: 1.1757

1st Support: 1.1703

1st Resistance: 1.1799

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party