EURUSD final rally before complete collapse?The EURUSD pair is on a very aggressive 2-day rebound just after hitting its 1D MA200 (red trend-line) on Friday for the first time in more than 10 months (since March 05 2025)! This is naturally directly related to the new round of U.S. - E.U. tariffs discussions over Greenland. Typically moves on impulse news fade and technicals come back to center stage to dominate the price action.

So technically, since the September 15 2025 High, this basically ranged price action resembles the peak formation of January - May 2021, which led to a massive 18-month Bear Cycle.

The break below (even though marginal) the 1D MA200 is the first bearish signal and the final confirmation will come when the 1W MA50 (blue trend-line) breaks. So far even the 1W RSI Lower Highs sequences among the two fractals are similar.

As a result, when if the bearish break-out is confirmed (a 1W candle close below the 1D MA200 before the 1W MA50), we expect the pair to enter a new Bear Cycle, which by late 2026 - early 2027 can test the previous Low at 1.0200.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

DJ FXCM Index

GBPUSD H1 Liquidity Sweep and Bullish Continuation Setup📝 Description

FX:GBPUSD on the H1 timeframe is trading inside a short-term bullish structure after a clear sell-side liquidity sweep. The recent impulsive move from the lower FVG suggests active demand and a shift toward higher prices, with price now consolidating above key intraday support.

________________________________________

📈 Signal / Analysis

Primary Bias: Bullish while price holds above the recent H1 higher low

Preferred Setup:

• Entry: 1.3442

• Stop Loss: Below 1.3426

• TP1: 1.3458

• TP2: 1.3475

• TP3: 1.3491 (BSL / higher liquidity)

________________________________________

🎯 ICT & SMC Notes

• Sell-side liquidity taken prior to bullish expansion

• Bullish displacement confirms short-term order-flow shift

• Buy-side liquidity resting above recent highs

________________________________________

🧩 Summary

As long as price remains above the swept sell-side and maintains higher lows, FX:GBPUSD is likely to continue its bullish intraday move toward buy-side liquidity.

________________________________________

🌍 Fundamental Notes / Sentiment

UK CPI y/y came in stronger than expected, reinforcing GBP strength and pushing back expectations for near-term BoE easing. At the same time, USD momentum remains weak. This backdrop favors upside continuation in GBPUSD, with pullbacks likely corrective rather than trend-changing.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

USDCHF - Anticipating the Price to Bounce off Weekly SupportThe image provided displays a technical analysis chart for the USD/CHF (US Dollar/Swiss Franc) currency pair on a weekly timeframe, showing price consolidation within a triangle pattern.

Chart Analysis and Trading Strategy 📊

The chart indicates the following key technical elements and a potential trading bias:

Currency Pair: USD/CHF. 💴

Pattern: The price action is consolidating within a "Triangle" or symmetrical triangle pattern, characterized by converging trendlines (lower highs and higher lows). This generally indicates a period of market indecision before a potential breakout.

Key Levels: 🎯

Weekly Resistance: A resistance zone is marked near the upper boundary of the triangle. A breakout above the resistance area (around 0.8145 according to recent analysis) would confirm a strong upward movement.

Weekly Support: A support area is indicated near the lower boundary of the triangle (around 0.7865). A break below this support would invalidate the bullish scenario and suggest further decline.

Indicated Bias: The annotation "LOOK FOR LONGS" suggests a bullish bias, anticipating that the price will bounce off the lower trendline/support and eventually break out to the upside. Other recent analyses on the pair also suggest a potential for recovery after testing key support levels. ⬆️

USDCHF Short-term bullish + potential break-out.Early this month (January 08, see chart below) we gave a strong buy signal on the USDCHF pair, which shortly after hit our 0.80350 Target:

As it got rejected just below the 1D MA200 (orange trend-line), the price pulled back to the 7-month Support Zone and turned into a buy opportunity again.

Now, we have Target 1 at 0.80100, just below the Inner Lower Highs trend-line. If we close a 1D candle above that as well, re-buy with Target 2 at 0.80650 (Fibonacci 0.786) just below the Lower Highs trend-line.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Could we see a reversal from here?USDX is rising towards the resistance level, which is a pullback resistance that aligns with the 61.8% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 98.72

Why we like it:

There is a pullback resistance level that aligns witht he 61.8% Fibonacci retracement.

Stop loss: 99.27

Why we like it:

There is a swing high resistance level.

Take profit: 97.94

Why we like it:

There is a pullback support that is slightly above the 78.6% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

USDOLLAR H4 | Bullish Bounce OffThe price has bounced off our buy entry level at 12.707, which is an overlap support that is slightly above the 78.6% Fibonacci retracement.

Our stop loss is set at 12.686, which is a pullback support.

Our take profit is set at 12.73, whichis a pullback resistance that aligns with the 50% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited (fxcm.com/uk), Stratos Europe Ltd (fxcm.com/eu):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (fxcm.com/en): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited (fxcm.com/au):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com/au

Could we see a reversal from here?US Dollar Index (DXY) is rising towards the pivot and could reverse to the 1st support.

Pivot: 99.17

1st Support: 98.45

1st Resistance: 99.53

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

USDJPY W1 HTF Distribution and Weekly Bearish Pullback Scenario📝 Description

FX:USDJPY on the weekly timeframe is trading inside a mature HTF bullish cycle that shows clear signs of exhaustion. Price is reacting below major weekly supply and within a premium zone, suggesting a transition from expansion into a distribution phase rather than trend continuation.

________________________________________

📈 Signal / Analysis

Primary Bias: Bearish weekly correction from HTF supply

Preferred Setup:

• Entry: 157.81

• Stop Loss: Above 160.73

• TP1: 155.12

• TP2: 152.63

• TP3: 149.68

________________________________________

🎯 ICT & SMC Notes

• Price trading inside HTF premium zone

• Weekly FVG acting as distribution area

• No strong bullish displacement after recent highs

• Sell-side liquidity remains the higher-timeframe draw

________________________________________

🧩 Summary

As long as FX:USDJPY remains capped below the weekly supply and fails to break above the recent high, downside continuation toward lower weekly liquidity levels remains the higher-probability scenario.

________________________________________

🌍 Fundamental Notes / Sentiment

Recent US trade-policy uncertainty has weakened USD confidence, while surging Japanese government bond yields driven by political risk increase JPY attractiveness. This combination narrows yield differentials and caps USDJPY upside. Over the medium to long term, downside pressure is favored, with rallies likely corrective unless USD regains clear policy support.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

EURUSD H4 Bearish CHOCH + BOS, Descending Channel Continuation 📝 Description

EURUSD on H4 has completed a clear CHOCH followed by BOS, confirming a shift into a bearish HTF framework. Price is now respecting a descending channel, with pullbacks failing below prior resistance and acceptance holding under key PD Arrays.

________________________________________

📈 Analysis (Scenario-Based | Non-Signal)

Primary Bias: Bearish within the channel

• Continuation favors a measured sell-off along the channel slope

• Pullbacks into H4 resistance / FVG are corrective, not impulsive

• Downside draw remains toward lower H4 liquidity (LQ/SSL) inside the channel

• Any bounce without acceptance above the channel top is viewed as sell-side opportunity

________________________________________

🎯 ICT & SMC Notes

• Confirmed CHOCH + BOS (H4) validates bearish structure

• H4 FVG overhead acting as dynamic supply

• Liquidity draw favors SSL below recent lows

________________________________________

🧩 Summary

Structure and geometry align for continued downside. As long as EURUSD trades below channel resistance, probability favors gradual bearish expansion toward lower liquidity pools rather than a reversal.

________________________________________

🌍 Fundamental Notes / Sentiment

With USD strength increasing such as ISM and Unemployment Rate, and no clear catalysts for EUR, macro flow supports a bearish continuation. This backdrop reinforces the expectation of downside movement within the drawn channel, barring a sudden shift in USD momentum or euro-specific catalysts.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

Velocity Of Money Rolling Over Again!The Real Interpretation

This chart is telling one story:

Money supply growth has massively outpaced real output for decades.

It lines up perfectly with:

Falling real productivity

Stagnant wages

Declining borrower quality

Rising debt-to-GDP

Asset inflation decoupling from fundamentals

The economy shifting from productive borrowing → consumption and asset speculation

You don't fix this with “policy choices.”

You fix it with real wealth creation, which requires creditworthy borrowers — not printing.

Forward-Looking View

Unless:

Productivity rises

Real output accelerates

Borrowers gain real income strength

Capital flows into productive sectors instead of financial games…this ratio won’t materially rise.

That means:

Every new dollar is buying less GDP

Long-term growth potential is fading

More money chasing fewer productive opportunities

More fragility in the credit system

It’s a classic late-cycle fiat symptom.

Here are questions to ask:

If “money creation” creates growth, why is GDP-per-dollar collapsing?

Why did 40 years of money expansion not produce proportional GDP?

If borrowers create loans, where are the new productive borrowers?

Why did QE cause asset inflation but no sustainable GDP boost?

If the system is “fine,” why does each new dollar buy less real output?

Perma Bulls, MMTers, Politicians etc.. can’t answer those without admitting the private-sector engine is weakening.

The less productive output per $ while the markets keep rising & rising will only produce less and less profit per share over time. No matter how much lipstick they put on that pig. Eventually, the economy & markets will CRASH! They always correct themselves in the end.

Perma Bulls have no exit strategy and will go down with the boat!

MMTers will want Gov to borrow and spend EVEN MORE! despite the empirical self-evident fact that print and play doesn't work!

Politicians will borrow and spend even more, claiming they will "STIMULATE THE ECONOMY"

I got all that from just one chart? NO! The entire spectrum of data.

Here is one

THANK YOU for getting me to 5,000 followers! 🙏🔥

Let’s keep climbing.

If you enjoy the work:

👉 Drop a solid comment

Let’s push it to 6,000 and keep building a community grounded in truth, not hype.

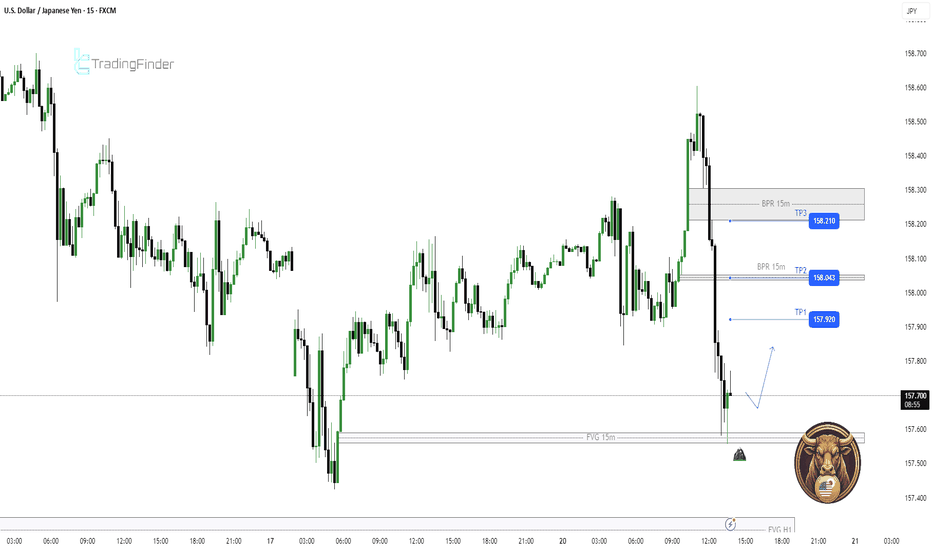

USDJPY M15 Bullish Liquidity Reversal Setup📝 Description

After a sharp sell-off and sell-side liquidity sweep, FX:USDJPY price has entered a reactive phase. Early signs of a short-term bullish reversal are visible on the M15 timeframe.

________________________________________

📈 Signal / Analysis

Primary Bias: Bullish while price holds above the M15 liquidity low

Preferred Setup:

• Entry: 157.700

• Stop Loss: Below 157.561

• TP1: 157.920

• TP2: 158.043

• TP3: 158.210 (BPR / higher liquidity)

________________________________________

🎯 ICT & SMC Notes

• Sell-side liquidity fully swept on M15

• Strong displacement candle from demand

• Price reclaimed internal range low

________________________________________

📌 Summary

As long as price remains above the recent demand zone, the dominant scenario is a bullish continuation toward overhead BPR and liquidity pools. A break below the recent low weakens this setup.

________________________________________

📰 Fundamental Notes / Sentiment

Following recent trade-related rhetoric and policy uncertainty, USD momentum has weakened, increasing volatility risk. While a buy scenario remains valid on structure, current headlines argue for stricter risk management, as sudden shifts in sentiment can trigger sharp pullbacks before continuation.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

Bullish bounce off key support?US Dollar Index (DXY) is falling towards the pivot which has been identified as an overlap support, and could bounce to the 1st resistance.

Pivot: 98.70

1st Support: 98.45

1st Resistance: 99.15

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

GBPUSD H1 Liquidity Grab and Bearish Pullback Setup📝 Description

FX:GBPUSD price has rallied into a higher-timeframe liquidity zone after a strong impulsive leg, tapping premium levels and reacting near prior highs. Current structure suggests the move is corrective rather than the start of a new bullish leg.

________________________________________

📈 Signal / Analysis

Primary Bias: Bearish while price remains below the H1 liquidity high

Preferred Setup:

• Entry: 1.3442

• Stop Loss: Above 1.3454

• TP1: 1.3420

• TP2: 1.3406

• TP3: 1.3386 (HTF draw / lower liquidity)

________________________________________

🎯 ICT & SMC Notes

• Buy-side liquidity taken near H1 highs

• Bearish displacement respected on lower timeframes

• Downside liquidity remains the primary draw

________________________________________

🧩 Summary

As long as price holds below the recent liquidity high, the structure favors a bearish pullback targeting lower H1 liquidity pools before any potential stabilization.

________________________________________

🌍 Fundamental Notes / Sentiment

With USD maintaining relative strength and no fresh GBP catalyst, short-term sentiment supports corrective downside rather than bullish continuation.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

DXY H1 | Bullish Bounce SetupThe price could fall to our buy entry level at 98.35, a pullback support.

Our stop loss is set at 98.07, whic is a pullback support.

Our take profit is set at 98.65, an overlap resistance that aligns with the 61.8% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

EUR/USD, USD/JPY Technical SetupsThe US dollar had a rough start to the week with Trump's tariffs rearing their ugly head once again. This could pave the way for a follow-though bounce on EUR/USD, though I remain a tad suspicious of the daily hammer on USD/JPY - even if it could bounce over the near term.

MS

USDJPY M15 HTF Liquidity Sweep and Bullish Setup📝 Description

USDJPY after a sharp sell-off has swept sell-side liquidity and is now reacting positively from a discount FVG zone. Price action shows stabilization and early signs of bullish absorption rather than continuation of impulsive downside.

________________________________________

📈 Signal / Analysis

Primary Bias: Bullish recovery toward intraday PD arrays

Preferred Setup:

• Entry: 157.887

• Stop Loss: Below 157.810

• TP1: 158.032

• TP2: 158.171

• TP3: 158.321 (BPR / HTF reaction zone)

________________________________________

🎯 ICT & SMC Notes

• Clear sell-side liquidity sweep below recent lows

• Downside move shows exhaustion, not continuation

• Upside targets aligned with BPR and prior imbalance

________________________________________

🧩 Summary

As long as price holds above the swept liquidity low and respects the M15 FVG, a bullish retracement toward higher PD arrays remains the higher-probability scenario.

________________________________________

🌍 Fundamental Notes / Sentiment

With no immediate risk-off catalyst and USD stability, short-term flows favor a corrective bullish move in USDJPY.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

GBPUSD H1 HTF Downtrend Continuation and BPR Rejection Setup📝 Description

GBPUSD is trading within a clear HTF bearish structure, with price respecting a descending trendline and failing to reclaim prior range highs. The current pullback appears corrective, occurring into a premium BPR zone rather than a structural reversal area.

________________________________________

📈 Signal / Analysis

Primary Bias: Bearish continuation below HTF descending resistance

Preferred Setup:

• Entry: 1.34083

• Stop Loss: Above 1.34212

• TP1: 1.33886

• TP2: 1.33673

• TP3: 1.3340 (HTF FVG / liquidity draw)

________________________________________

🎯 ICT & SMC Notes

• Price reacting to H1 BPR in a premium zone

• Structure remains bearish with lower highs intact

• Pullback classified as mitigation, not reversal

________________________________________

🧩 Summary

As long as price stays below the descending trendline and fails to break above the H1 BPR, bearish continuation toward lower HTF liquidity levels remains the higher-probability scenario.

________________________________________

🌍 Fundamental Notes / Sentiment

With ongoing USD resilience and lack of strong GBP catalysts, market conditions continue to favor downside pressure on GBPUSD in the short term.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

USDCAD testing its 1W MA50. Can it sustain the uptrend?The USDCAD pair has been trading within a Channel Up since the May 13 2025 High and right now got on Friday its first test on its true technical long-term Support, the 1W MA50 (blue trend-line).

This is rally that made this test is part of the pattern's Bullish Leg that started on the December 26 2025 Low. The 1D CCI turned overbought (red circle) and got rejected back into the neutral zone, in a similar way as the August 01 2025 did, which was also the start of the previous Bullish Leg.

This is evidence of strong symmetry within this pattern and if it continues, it won't be surprising to see this Bullish Leg make a +4.43% rise in total and peak on the 1.236 Fibonacci extension, as the previous one. As a result, we may see a short-term pull-back now that the 1W MA50 has rejected further uptrend, but on the long-term our Target is 1.42450.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

NZDUSD Long Setup – Break of Structure + Buy ZoneNZDUSD Long Setup – Break of Structure + Buy Zone

The NZDUSD Daily Chart is showing a clean bullish setup, with price breaking structure and pulling back into a well-defined Buy Zone. After a decisive Break of Structure (BOS), the pair is now consolidating above the Order Trend Line (OTL), suggesting bullish intent.

With price currently around 0.57779, the setup offers a tight risk profile and multiple upside targets, making it attractive for swing traders and intraday momentum players.

🟢 Trade Setup Details

- Buy Zone: ~0.57229 to 0.57779

- Stop Loss: 0.57229

- Take Profit Targets:

- 🎯 TP1: 0.58044

- 🎯 TP2: 0.58167

- 🎯 TP3: 0.58392

- 🎯 TP4: 0.58578

The setup offers a Risk/Reward Ratio of 2.02, with a projected gain of 1.067% toward TP3.

🔍 Technical Highlights

- BOS confirms bullish momentum shift.

- Price is respecting the Buy Zone, forming a base above the OTL.

- Volume shows signs of accumulation, supporting the bullish thesis.

- The yellow arrow projection suggests a clean path toward TP levels.

📈 Bullish Scenario

If NZDUSD holds above the Buy Zone and breaks through 0.58044, we could see a steady climb toward TP3 and TP4. Watch for:

- Bullish daily close above 0.5800

- Volume spike confirming breakout

- Momentum indicators turning positive

⚠️ Risk Management

- SL below 0.57229 protects against invalidation of the bullish structure.

- Consider scaling out at TP1 and TP2 to secure gains.

- Avoid chasing if price moves too far—wait for pullbacks or retests of breakout levels.

💡 Summary: NZDUSD is showing a textbook bullish continuation setup, with price stabilizing in the Buy Zone and gearing up for a breakout. With layered TP targets and a tight SL, this setup offers precision and potential.

📊 Whether you're trading the bounce or positioning for a move toward 0.585+, this chart deserves your attention.

USDOLLAR H4 | Bullish Bounce?The price is falling towards our buy entry whcih is a pullback support that aligns with the 38.2% Fibonacci retracement.

Our stop loss is set at 12.71, which is a pullback support that aligns with the 38.2% Fibonacci retracement.

Our take profit is set at 12.77, which is an overlap resistance.

High Risk Investment Warning

Stratos Markets Limited (

Bullish bounce?US Dollar Index (DXY) is falling towards the pivot, which acts as a pullback support and could bounce to the 1st resistance, which is a multi-swing high resistance.

Pivot: 98.74

1st Support: 97.64

1st Resistance: 100.25

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

US Dollar: Bullish! Look For Buys Opportunities!Welcome back to the Weekly Forex Forecast for the week of Jan 19-24th.

In this video, we will analyze the following FX market: USD Dollar

The USD is showing some strength, with a strong bullish close to the W candle. I am looking for continuation of that momentum going into next week.

Mindful that there may be a short term pullback before the next push higher. Be patient for the market to confirm directional bias before looking for entries.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.