Hellena | Oil (4H): SHORT to support area of 61.937 (Fibo lvl).Hello, colleagues!

Well, I think that the previous scenario is still relevant and the “ABC” correction is developing according to the scenario.

At the moment, I see a five-wave structure in the downward wave “C”. I expect a small correction to the area of 67.287, then a continuation of the downward movement to the area between 61.8% and 100% of the levels of Fibonacci extension - the support area of 61.937.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Crude Oil WTI

Market Analysis: WTI Crude Oil Struggles In RedMarket Analysis: WTI Crude Oil Struggles In Red

WTI Crude oil is also down and remains at risk of more losses below $62.00.

Important Takeaways for WTI Crude Oil Price Analysis Today

- WTI Crude oil prices extended losses below the $65.00 support zone.

- A major bearish trend line is formed with resistance at $63.05 on the hourly chart of XTI/USD.

WTI Crude Oil Price Technical Analysis

On the hourly chart of WTI Crude Oil, the price struggled to continue higher above $66.00 against the US Dollar. The price formed a short-term top and started a fresh decline below $65.00.

There was a steady decline below the $64.50 pivot level. The bears even pushed the price below $63.50 and the 50-hour simple moving average. Finally, the price tested the $62.15 zone, and the price is now consolidating losses.

On the upside, immediate resistance is near the 23.6% Fib retracement level of the downward move from the $65.98 swing high to the $62.15 low at $63.05. There is also a major bearish trend line at $63.05 and the 50-hour simple moving average.

The main hurdle is $63.50. A clear move above the $63.50 zone could send the price toward the 61.8% Fib retracement level at $64.50.

The next key resistance is near $66.00. If the price climbs further higher, it could face sellers near $68.00. Any more gains might send the price toward the $70.00 level.

Immediate support is near the $62.15 level. The next major level on the WTI crude oil chart is near $61.20. If there is a downside break, the price might decline toward $60.00. Any more losses may perhaps open the doors for a move toward the $55.00 zone.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

USOIL LONG FROM SUPPORT

USOIL SIGNAL

Trade Direction: short

Entry Level: 62.65

Target Level: 68.77

Stop Loss: 58.58

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Oil at Key Support – Bounce or Breakdown?Crude oil is trading around $66.94, showing a bearish correction after failing to hold above $69.05. The chart shows price respecting an ascending channel but currently testing its lower boundary. The recent drop signals weakening bullish momentum, and a confirmed break below the channel could accelerate selling pressure toward lower levels.

📈 Potential Scenarios

- Bullish Rebound: If price holds above the channel support (~$66.00–$66.50) and breaks back above $69.05, it may target $71.03 and possibly $72.00.

- Bearish Breakdown: A confirmed close below $66.00 can accelerate the downside toward $65.00, with extended targets near $63.50–$62.00.

📊 Key Technical Highlights

- Price rejected from the channel top and is now testing lower support.

- Key resistance zones: $69.05 (immediate), $71.03 (major).

- Key support zones: $66.00 (channel), then $65.00–$63.50 (breakdown targets).

- Momentum indicators show weakening buying pressure, favoring cautious trading.

🔑 Key Levels to Watch

- Resistance: $69.05 → $71.03 → $72.00

- Support: $66.00 → $65.00 → $63.50

🧭 Trend Outlook

- A short-term relief bounce is possible, but failure to reclaim $69.05 keeps sellers in control.

- Breaking below the channel would shift the overall outlook to bearish for August.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

USOIL H4 | Potential bearish dropBased on the H4 chart analysis, we can see the price has rejected off the sell entry which acts as a pullback resistance that lines up with the 23.6% Fibonacci retracement and could drop to the downside.

Sell entry is at 64.13, which is a pullback resistance that lines up with the 23.6% Fibonacci retracement.

Stop loss is at 67.06, which is a pullback resistance that aligns with the 61.8% Fibonacci retracement.

Take profit is at 60.05, which is a multi-swing low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

USOIL rebounds from 6,300.0. Where next?USOIL rebounds from 6,300.0. Where next?

USOIL bounced back from the 6,300.0 mark on Tuesday, building on slight gains from the prior session, after President Donald Trump prolonged a tariff truce with China for an additional 90 days. The decision, made just before new tariffs were due, provided temporary relief from rising trade tensions that might hinder global growth and energy demand. The modest rise towards SMA50 and 6,500.0 level is expected. Market participants will also be waiting for OPEC’s monthly report, along with US EIA and IEA forecasts, for fresh supply–demand signals.

USOIL: Eyes on 64.10 as Geopolitics Take Center Stage!!In today’s session, we’re watching USOIL for a potential short setup around the 64.10 zone. Price action remains in a broader downtrend, with the current move looking like a corrective retracement into a key support turned resistance area.

From a fundamental perspective, all eyes are on the scheduled August 15 meeting between Donald Trump and Vladimir Putin. A ceasefire agreement could fuel bearish momentum, potentially accelerating the sell-off. On the other hand, if talks collapse, renewed geopolitical tension could keep oil prices bid in the short term.

Technically, 64.10 is the battleground a decisive rejection here could offer an attractive risk reward for sellers aligned with the dominant trend.

Oil | Bearish Bias Below 64.70as Markets Await U.S.–Russia TalksOil Little Changed, With Focus on U.S.–Russia Meeting

Oil prices were steady in afternoon trade as markets awaited Friday’s meeting between U.S. President Trump and Russian President Putin, which could potentially pave the way for a Ukraine peace deal.

Oil has fallen over 10% this year, pressured by OPEC+ restoring production faster than planned and by weakening global demand prospects.

Technical Outlook:

The price maintains a bearish bias while trading below 64.70, targeting 63.45 and 61.85, with further downside toward 60.20 if broken.

However, market direction could shift sharply depending on the outcome of Friday’s meeting.

A move above 64.75 would target 65.80, and a breakout beyond this could trigger bullish momentum toward 67.20 and 69.10.

Pivot: 64.70

Support: 63.45, 61.85, 60.20

Resistance: 65.80, 67.20, 69.10

Crude Oil Weekly Outlook: Tariffs, Ceasefire, OPEC & CPI RisksKey Events This Week

• WTI drops to 62.60 ahead of major geopolitical and economic catalysts: Ukraine ceasefire, U.S.–China tariffs, OPEC report, and U.S. CPI

• Global tariff developments continue to shape sentiment and crude demand valuations, especially in relation to OPEC’s evolving supply strategy

WTI’s latest drop is currently holding at the 0.618 Fibonacci retracement of the May–June uptrend, and precisely at the neckline of the inverted head and shoulders pattern around the 62.60 level. The Fibonacci retracement was applied from the $55 low to the $77.80 close, filtering out breakout noise from the Iran–Israel escalation outside the borders of the 3-year down trending channel.

• If 62.60 breaks, downside risks may accelerate toward the mid-zone of the channel, with key levels in sight at 61.40, 59.40, and 55.20, respectively.

• If 62.60 holds, and WTI reclaims ground above 65, we could see a recovery toward the upper edge with next resistance levels at 68.00, 70.00, 71.40, and 72.70.

Written by Razan Hilal, CMT

USOIL H4 | Potential bearish dropUSOIL has reacted off the sell entry which is a pullback resistance and could drop from this level to the take profit.

Sell entry is at 64.13, which is a pullback resistance.

Stop loss is at 67.06, which is a pullback resistance.

Take profit is at 60.05, which is a multi swing low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

CRUDE OIL Strong Downtrend! Sell!

Hello,Traders!

CRUDE OIL is trading in a

Downtrend and the price

Made a bearish breakout

Of the key horizontal level

Of 63.96$ and the breakout

Is confirmed so we will be

Expecting a further bearish

Move down on Monday!

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USOIL: Long Signal with Entry/SL/TP

USOIL

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long USOIL

Entry - 63.34

Sl - 63.02

Tp - 63.91

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Oil Trap Activated – Limit Orders Set for the Big Score💥🛢️Crude Oil Vault Breach Plan – DCA Heist Begins!🧨💰

🚨Asset: CL1!

📈Bias: BULLISH RAID MODE ON

🎯Target: $74.50

🛡️Stop Loss: $67.50

🔑Entry: ANY LEVEL – Thief stacking limit orders like layers of gold bars 💼⚖️ (DCA Mode Activated)

🕵️♂️Thief Trader is not chasing, we're ambushing 🧠 — scaling in smart with multiple limit traps. The crew never FOMOs, we trap the market 🎯.

💣This is a layered loot plan, not for weak hands. Watch how we load up quietly while market sleeps 😴, then hit hard when the vault cracks open 🔐.

Support this heist by smashing that ❤️LIKE button

💬 Comment your plans below & join the real thief squad

🤝 Together we rob the market — LEGALLY & LOGICALLY

#ThiefTrader #OilHeist #CL1 #BullishTrap #DCA #CrudeOilStrategy #SmartMoneyPlay #MarketRobbery #TeamLoot #NoRetailPanic

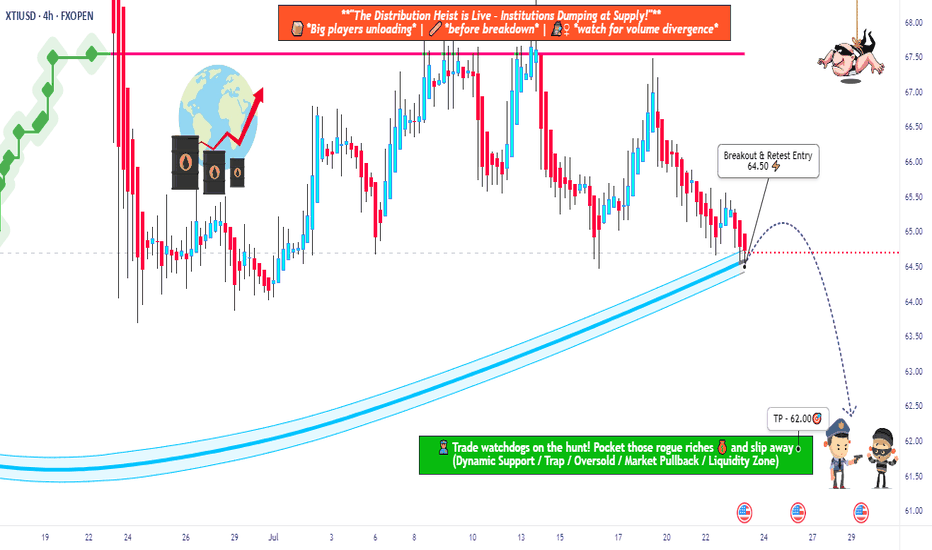

USOIL Robbery Alert! Smart Entry Plan Below Key MA Level🔐💥 “WTI Energy Heist: Thief Trader’s Bearish Master Plan” 💥🔐

The Official Robbery Blueprint for Smart Traders

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

💸 Welcome, Money Makers & Market Robbers! 💸

🚨 Get ready to break into the "US Oil Spot/WTI" market with precision-crafted bearish strategy from the one and only — Thief Trader Style!

📉💣 THE HEIST IS ON: SHORT PLAN LOADED! 💣📉

We’ve analyzed the charts using Thief Technicals + Fundamental Lockpick Tools and spotted a high-risk GREEN zone – a consolidation trap where greedy bulls usually get caught. This is where we strike.

🔑 ENTRY:

"Wait for the Neutral Moving Average to Break — Then Make Your Move!"

🎯 Focus zone: 64.50

☠️ Wait for the breakout – do NOT enter before it happens.

✅ Use sell stop orders above the MA line or place sell limit orders on the pullback after the breakout (target within the 15–30 min candle near swing high/low).

🧠 Thief Tip: Layer in entries using the DCA (layered attack strategy) to catch price on its way down. Set a chart alert so you don’t miss the strike moment.

🛑 STOP LOSS:

"Set it smart or don’t set it at all — you choose the fire you want to play with!"

📍 SL only gets placed AFTER breakout.

🎯 Recommended SL at 66.00 on the 4H swing level.

☠️ DO NOT place any orders or SL before confirmation breakout.

📊 Your SL depends on your risk %, lot size, and number of entries stacked.

🎯 TARGET ZONE: 62.50

💸 Lock profits before the bulls wake up. This level is based on market exhaustion zones and historical bounce areas.

🧠 WHY WE'RE SHORTING THIS?

This isn’t just a chart move — it’s backed by full-scale robbery research:

📰 COT Reports

📈 Macro & Seasonal Trends

🛢️ Crude Oil Inventories

💹 Sentiment & Intermarket Correlation

📉 Supply-Demand Dynamics

📚 Before pulling the trigger, educate yourself with the fundamentals. Dive into COT, Seasonal, and Macro reports. Don’t rob blindly — rob smart.

⚠️ Risk Management Alert:

Major news releases? Step back.

Trailing stops? Lock it in.

Position sizing? Know your risk.

Trade like a professional robber, not a street pickpocket.

💥💖 SUPPORT THE ROBBERY PLAN 💖💥

🧨 Smash that BOOST button to support this trading style and help more traders rob the market clean. Every like, every boost makes this community stronger.

💬 Drop a comment, share your entry levels, or post your winning trades.

This is a trading crew – we rob together, we profit together.

🔔 Stay tuned — more heist plans dropping soon.

Until then... Rob Smart. Trade Hard. Take Profits. 💰💪🎯

USOIL: The Market Is Looking Up! Long!

My dear friends,

Today we will analyse USOIL together☺️

The market is at an inflection zone and price has now reached an area around 63.337 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move up so we can enter on confirmation, and target the next key level of 63.685.Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

WTI Crude Oil Analysis – Is a Major Wave 3 About to Begin?🛢 WTI Crude Oil Analysis – Is a Major Wave 3 About to Begin? 🚀

According to Elliott Wave count, it appears that the corrective Wave 2 has either completed or is in its final stages. The (ABC) corrective structure, combined with reactions to key Fibonacci levels, suggests a potential end to the correction and the start of a powerful Wave 3.

Key Fibonacci Support Levels:

📍 $60.39 – 50% retracement

📍 $58.84 – 78.6% retracement

As long as price holds above these levels, the bullish structure remains intact, with the ultimate target for Wave 3 projected well above the previous all-time highs.

💬 What’s your view? Is crude oil ready for a historic move, or is there still room for more correction?

✅ Save this idea & follow for future updates.

-------------------------------------------------------------------------------------------------------------------

🚀 Who am I?

I'm Mahdi, a prop firm trader with 7+ years of experience in technical analysis, mainly focusing on Smart Money Concepts and Elliott Wave theory.

I specialize in delivering high-quality trading signals, market insights, and educational content tailored for serious traders and investors.

📊 My Tools: SMC, Elliott Wave, Fibonacci, Liquidity Grabs, Order Blocks

💼 Prop Challenge Passed: Yes | Funded Account: In Progress

🔗 Follow for consistent updates and trading insights.

USOIL Sellers In Panic! BUY!

My dear subscribers,

USOIL looks like it will make a good move, and here are the details:

The market is trading on 63.34 pivot level.

Bias - Bullish

My Stop Loss - 63.05

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 63.89

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

USOIL BEST PLACE TO BUY FROM|LONG

USOIL SIGNAL

Trade Direction: long

Entry Level: 63.31

Target Level: 68.69

Stop Loss: 59.72

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

WTI OIL on its first 1D Death Cross since Sep 2024!WTI Oil (USOIL) is on the decline and is about to form a 1D Death Cross for the first time since September 06 2024! That is technically a bearish signal but last time once completed, the market formed a bottom 2 days later.

As a result, we expect a max drop to Support 1 ($60.05) but then more likely a rebound back to the Resistance ($71.40), especially given the fact that the 1D RSI will almost get oversold (>30.00).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Is oil price heading back up? Watching a potential inverse head and shoulders forming on the 30-minute chart for Oil.

🔹 Risk/Reward: 2.7

🔹 Entry: 63.290

🔹 Stop Loss: 63.043

🔹 Take Profit 1 (50%): 63.93

🔹 Take Profit 2 (50%): 64.21

A couple of key factors still need to align before I pull the trigger:

• One will confirm around 14:45 SAST (GMT+2)

• Looking for lower volume on the right shoulder compared to the left

What do you think? Is oil ready to push higher?

Drop your thoughts or how you trade inverse head and shoulders below! 👇