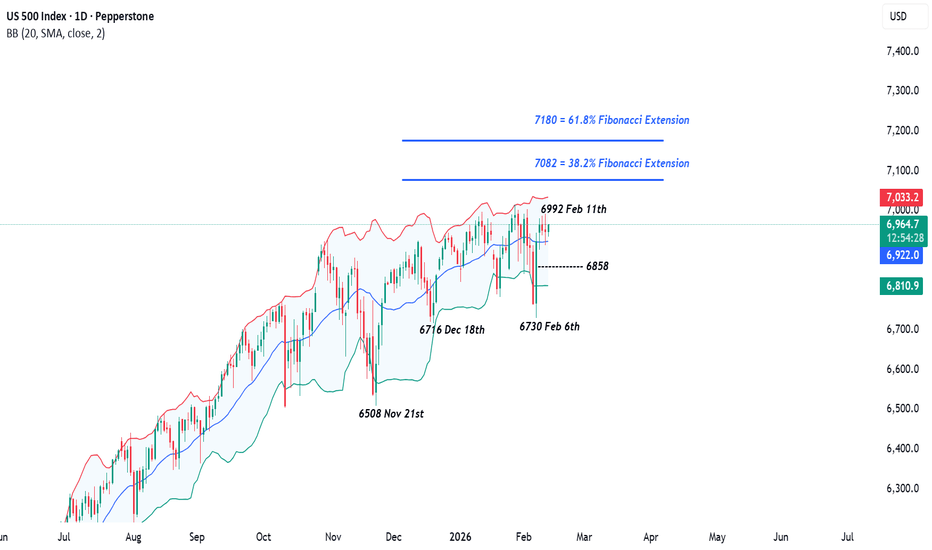

US 500 Index – Struggling for Momentum Against Record HighsIt’s been a choppy week for the US 500 index so far, with prices jumping around in a 1.3% range between lows at 6901, seen at the start of the week, and highs of 6992, briefly seen after the release of a much stronger than expected US Non-farm Payrolls report yesterday afternoon.

While the jobs report provided good news for traders in one sense by adding support to the theory that the US economy remains resilient, which may boost corporate earnings in the near term, it also dented market expectations for a Federal Reserve interest rate cut in the first half of 2026 as well. This repricing, alongside the on-going shift out of software stocks that may be negatively impacted by the progress of AI, combined to help to cap the US 500 ahead of its recent record highs at 7015.

In terms of interest rates, the US central had already signaled at their January meeting that there were reasons to pause and evaluate incoming economic data readings before deciding on their next move, meaning yesterday’s jobs report will probably need to be assessed against Friday’s US CPI release (1330 GMT).

This latest inflation update could now take on even more significance for US 500 traders, who may currently be more sensitive to any reading that shows prices accelerating above expectations, an outcome that may keep the Fed from cutting interest rates for even longer than currently anticipated.

The technical outlook could also be important for the direction of the US 500 index moving into the weekend and the start of next week.

Technical Update: Is the Recovery Stalling Against the 7015 All-Time High?

Since the US 500 index posted its all‑time high at 7015 on January 28th, price action has turned choppy. The index fell more than 4% from that peak before staging a recovery, reaching 6992 on Wednesday following the delayed payrolls data release.

Despite the strength of the recent rebound, the US 500 index has so far been unable to break back above the 7015 all‑time high. Selling pressure has re‑emerged at this area, slowing the advance and signalling a possible loss of positive momentum. Some traders may view this as an early sign that the rally is stalling, raising the risk of fresh downside pressure and even a deeper corrective phase.

There is still no clear evidence of sustained strength or weakness, leaving directional bias uncertain. For now, the focus remains on monitoring key support and resistance levels to determine where the next meaningful move may emerge.

Assessing Potential Support Levels:

If, and it remains speculative at this stage, upside momentum continues to fade and fresh declines emerge, a meaningful support break on a closing basis would be needed to increase downside risks. The focus now turns to 6858, which represents a 50% retracement of the latest recovery and may act as a potential pivot level.

If a more extended decline were to unfold and prices close below the 6858 support level, downside pressure could be possible. The next support zone to monitor could then be 6716/30, which captures the December 18th and February 6th lows. A break beneath this area could raise the risk of further declines toward 6508, the November 21st low.

Assessing Potential Resistance Levels:

For now, the 6858 support level remains intact, as it has not been broken on a closing basis. This keeps open the possibility of renewed attempts at price strength. If upside pressure rebuilds, the initial focus might turn to the 6992 February 11th high, followed by the 7015 all-time extreme.

It may well be that only a closing break above this 6992/7015 resistance band could revive discussion of renewed positive momentum and open scope for a push to higher levels. As the chart above highlights, sustained closes above 7015 could shift focus toward 7082, which is the 38.2% Fibonacci extension, and potentially even 7180, the higher 61.8% level.

The material provided here has not been prepared accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

Volatility

DELL GEX - Curling off the lows...🔶 DELL – Holding Above Put Support, Attempting Breakout Above HVL 🔶

On the daily chart, DELL has repeatedly found strong support around the 110 put support level , with multiple successful bounces confirming it as a key downside anchor . 🔴

Currently, price is trading above the High Volatility Level (HVL) , suggesting a more supportive gamma regime compared to reactive downside conditions. 🟢 At the same time, DELL is pushing through the 200 and 50 moving average , which adds technical significance to the current move.

Structurally, price remains inside a broader consolidation but is now attempting an upside breakout from the sideways range. 🟢

🔶 Additional Context 🔶

Price is positioned within a positive GEX zone , which may act as a support area during pullbacks 🟢

Earnings are scheduled for February 26 , introducing a potential catalyst for volatility expansion 🔵

From an options perspective, the next major reference is the 140 call resistance , which stands out as the next significant upside GEX level . 🟢

🔶 Key Structure to Watch 🔶

110 – put support / structural floor 🔴

HVL – regime support, currently reclaimed 🟢

200 - 50 MA – technical breakout area 🔵

140 – next major call resistance 🟢

Best,

Greg

AAPL GEX 280 rejection multiple times🔶 AAPL – Rejection at 280 Call Resistance, Testing Support While Above HVL 🔶

On the daily chart, AAPL has once again been rejected at the 280 call resistance , a level that has now rejected price multiple times, confirming it as a significant call-side ceiling . 🔴

Yesterday’s rejection from 280 triggered downside momentum, and today price is showing a clear follow-through move lower, with AAPL currently down around 3% , signaling emerging relative weakness compared to its previously strong performance within the tech sector. 🔴

Technically, price has now moved to the 50-day moving average , which adds short-term pressure to the structure. Despite this weakness, the broader regime remains supportive for now:

Price is still trading above the High Volatility Level (HVL) 🟢

The GEX profile remains positive , suggesting dealer positioning is not yet in a fully reactive downside regime 🔵

From a structural perspective, the next key area to monitor sits around the 265–266 zone , which represents:

a nearby technical support level 🔵

an area just below the 50 SMA where buyers may attempt to stabilize price 🟢

🔶 Key Structure to Watch 🔶

280 – confirmed call resistance / rejection zone 🔴

HVL – regime pivot, still holding above 🟢

265–266 – near-term support area 🔵

Positive GEX – supportive but weakening context 🔵

If AAPL holds above HVL, downside may remain controlled despite short-term weakness. However, continued rejection at 280 combined with relative underperformance could shift sentiment if support levels fail.

Best,

Greg

BTC — Daily LONG Setup (RSm) | 12 Feb 2026BINANCE:BTCUSDC

Context

- D-horizon shows ~80% mean-reversion probability

- Sign-change / transition level: 68.6k

- Expected timing: ~1–10 days (D-horizon window)

- Higher horizons do not block the upside

Expectation

RSm indicates a high probability of price reverting toward the 68.6k level on the Daily horizon.

This is a mean-reversion setup, not a trend forecast.

Execution Note

I execute Lot1 (see RSm White Paper) to participate in the move while preserving capital flexibility if deviation expands.

Target level may adjust if downside acceleration increases deviation and shifts the sign-change level.

Notes

This is a rules-based RSm setup.

Model state documentation — not financial advice.

I document RSm model states in real time. Follow to track how this setup resolves.

NQ Power Range Report with FIB Ext - 2/12/2026 SessionCME_MINI:NQH2026

- PR High: 25296.50

- PR Low: 25206.00

- NZ Spread: 202.75

Key scheduled economic events:

08:30 | Initial Jobless Claims

10:00 | Existing Home Sales

13:01 | 30-Year Bond Auction

Session Open Stats (As of 12:25 AM)

- Session Open ATR: 475.74

- Volume: 25K

- Open Int: 261K

- Trend Grade: Long

- From BA ATH: -5.0% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26691

- Mid: 25544

- Short: 23372

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

Nasdaq M30Good day everyone

This is what our today’s trade in Nasdaq looks like

Were patiently waiting for price to trigger our entry point then were looking to catch over +points

Meta , Nvidia and apple are not doing the most as they’re the ones driving this price higher and higher !

Once our order is trigger and sniper entry

SL : 50 points from entry

Tp1 : 100points

Then let the rest running for over +300points

+-30 points in prove put SL at entry for safe trading

Cheers 🥂

OP (Optimism) — Mean Reversion Buy Setup Toward 0.24Buy initiated on OP within the defined entry zone 0.18–0.19, targeting a rebound toward 0.24, with a protective stop at 0.15. The setup is based on a high-confidence mean-reversion signal supported by improving order-flow structure and constructive sentiment catalysts.

Technical Structure:

ADX (~48) signals strong directional force, increasing the probability of a decisive rebound once support holds.

Recent pullback occurred on relatively subdued selling volume, while order-flow metrics show absorption near support, indicating limited distribution pressure.

Hourly volume patterns suggest consolidation rather than breakdown, consistent with a mean-reversion entry profile.

Despite the constructive near-term setup, both short- and long-term trend signals remain bearish, classifying the trade as counter-trend and time-limited.

Catalysts / Sentiment:

Sentiment backdrop is moderately positive, supported by governance-approved buyback activity and improving ecosystem narrative, which provides a near-term demand tailwind.

Execution Plan:

Entry: 0.18 – 0.19

Stop-loss: 0.15

Primary Target: 0.24

Secondary Resistance to watch: 0.28

Expected Horizon: Short-term tactical rebound

Risks:

Scheduled token unlock at end-February may introduce supply pressure.

Counter-trend positioning increases sensitivity to broader crypto-market liquidity shocks.

Any shift in order flow from absorption to active distribution invalidates the setup.

Conclusion:

The combination of support-level absorption, strong ADX readings, and constructive sentiment creates a favorable tactical risk/reward mean-reversion opportunity, provided strict adherence to the defined stop at 0.15 and disciplined position sizing appropriate for a counter-trend trade.

NQ Power Range Report with FIB Ext - 2/11/2026 SessionCME_MINI:NQH2026

- PR High: 25287.75

- PR Low: 25252.75

- NZ Spread: 78.5

Key scheduled economic events:

08:30 | Average Hourly Earnings

- Nonfarm Payrolls

- Unemployment Rate

10:30 | Crude Oil Inventories

13:00 | 10-Year Note Auction

AMP increase US Equity Indices Margins to 25% for U.S. Economic News Releases

Session Open Stats (As of 12:25 AM)

- Session Open ATR: 479.62

- Volume: 19K

- Open Int: 261K

- Trend Grade: Long

- From BA ATH: -5.0% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26691

- Mid: 25544

- Short: 23372

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

GBPUSD – Preparing for Political Event Driven Volatility Preparing for Political Event Driven Volatility

So far, increased UK political uncertainty has had a limited downside impact on GBPUSD. In fact, the pair has strengthened over the past couple of sessions as general dollar weakness drifts across the G7 currency space. This has taken it from lows at 1.3509 seen on Friday, back up to 1.3672 at the time of writing (0630 GMT). However, this does not guarantee that further upside is on the cards and FX traders may need to stay alert to real time news flow in case unexpected headlines trigger renewed price volatility.

Currently, Keir Starmer is indicating his determination to remain PM and potential rivals for his position are sitting on the sidelines, biding their time while deciding whether to attempt a leadership challenge. This is a developing situation which could change at any time triggering a period of increased volatility and sudden price moves in either direction, making prudent risk management essential for UK‑related assets. This may include the consideration of reduced position sizes, refreshing awareness of key support and resistance levels, and ensuring that stop‑losses are placed in a timely and appropriate manner.

Checking the Pepperstone economic calendar for important scheduled UK and US data releases across the week can also be useful. US Retail Sales for December is due later today at 1330 GMT. This number could shed light on US consumer spending over the Christmas period at a time when consumer confidence has been falling. Any surprise deviation from expectations could impact the dollar (USD) side of the GBPUSD pair.

The same could be said for the delayed US Non-farm Payrolls release, which is now due at 1330 GMT on Wednesday. This update could be more significant for currency markets and while the headline number may remain volatile, FX traders could choose to focus on the unemployment rate, which unexpectedly fell to 4.4% in the previous reading, before deciding where GBPUSD may move next.

Thursday sees a shift back to the UK or GBP side of the equation, when the preliminary Q4 2025 GDP growth update is released. The Bank of England were very close to cutting interest rates last week, and a weaker reading could see traders become more confident that a cut may be due sooner rather than later, while a stronger update could see current rate cut expectations pared back.

Then finally, the latest US CPI is scheduled for release at 1330 GMT on Friday, the outcome of which could ensure that any GBPUSD volatility may continue right up to the weekly close.

Technical Update: Identifying Potential Support and Resistance Levels to Monitor

Potential Support Levels:

Although the rally from the 1.3509 February 6th low has impressed, the chart currently shows little evidence of a sustained trend developing. As a result, traders may focus on potential support at 1.3599, which represents half of the latest up move, as the first interim level to watch.

A closing break below this support at1.3599 could open the door to further downside. Such a move might point toward a deeper decline, first suggesting risks to test the 1.3509 February 6th low, and if that level gives way, extending toward 1.3339, which is the January 19th downside extreme.

Potential Resistance Levels:

While the support at 1.3599 continues to hold on a closing basis the risks may still lean toward further attempts at price strength. However, renewed upside could require a closing break above initial resistance at 1.3733, which is the February 4th high, to confirm fresh momentum.

A closing break above the 1.3733 high could potentially see traders looking for continued attempts toward higher levels. As the chart above highlights, the next resistance could sit at 1.3869, which is the January 27th high, with scope for further gains if that level is also broken above on a closing basis.

The material provided here has not been prepared accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

NQ Power Range Report with FIB Ext - 2/10/2026 SessionCME_MINI:NQH2026

- PR High: 25395.50

- PR Low: 25328.00

- NZ Spread: 151.0

Key scheduled economic events:

08:30 | Retail Sales (Core|MoM)

Session Open Stats (As of 12:45 AM)

- Session Open ATR: 499.95

- Volume: 34K

- Open Int: 259K

- Trend Grade: Long

- From BA ATH: -5.4% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26691

- Mid: 25544

- Short: 23372

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

Volatility Is Not DirectionThis is the first in a five-part series on volatility, structure, and decision-making in the S&P 500.

Each note focuses on a single principle that governs when participation is justified—not on setups, signals, or trade outcomes.

The intent is not to predict direction, but to clarify eligibility: understanding the conditions under which decisions are worth making at all.

________________________________________________

Most traders treat volatility as a reaction to price.

Institutions treat volatility as a condition for participation.

That distinction explains a large percentage of failed trades.

Volatility answers how the market is behaving, not where it is going.

When VIX is compressing, expansion trades tend to fail—even if direction appears obvious.

When VVIX is rising while VIX is flat, instability is increasing beneath the surface—often before price resolves.

This is why directional bias without volatility context is incomplete.

On the chart, note how price movement that looks impulsive often stalls or reverses when volatility regimes are misaligned. The trade didn’t fail because direction was wrong—it failed because conditions were wrong.

Professional decision-making starts with a simple question:

Is the market in a state that supports participation at all?

Only after volatility conditions are understood does direction become meaningful.

________________________________________

Key takeaway:

Direction without volatility context is guessing.

Volatility defines whether opportunity exists in the first place.

BTC — Long-Term Outlook (1–2 Quarters) | RSmBINANCE:BTCUSDT NASDAQ:QQQ NASDAQ:SOXX

Context (Higher Horizons)

-Quarter (Q): −85% → reference level ~90,000

-Month (M): −100% → reference level ~75,000

These are deep negative extremes on higher horizons.

In RSm terms, this historically implies a high probability of upward mean reversion toward the associated horizon levels over the next 1–2 quarters.

Base expectation :

BTC has a strong statistical bias upward, with higher-horizon reference levels acting as mean-reversion targets, not short-term price forecasts.

The Risk: Equity-Led Volatility

BTC has recently shown clear follow-through behavior with U.S. tech indices.

Current equity risks:

SOXX: potential drop of ~15% (probability ~80%)

QQQ: potential drop of ~8% (probability ~84%)

If these moves materialize, they can temporarily pull BTC lower, even though BTC’s own higher-horizon probabilities favor upside.

What This Actually Means

This is not a clean “up only” setup.

Before the long-term BTC move resolves upward toward higher-horizon levels:

-price may drop further,

-or move sideways in volatile ranges,

-or show sharp down–up moves that shake out early or overleveraged longs.

This behavior does not invalidate the Q/M upside signal —

it reflects cross-market pressure and typical pre-move volatility.

How to Read This Setup

-BTC (M) → upward bias toward ~75k

-BTC (Q) → broader upside toward ~90k

-QQQ / SOXX → near-term downside risk

-Net result → long-term upside remains likely, path will be noisy

Key Takeaway

-BTC is statistically positioned for a higher move over the next 1–2 quarters,

with ~75k (M) and ~90k (Q) acting as mean-reversion reference levels.

-Expect volatility and shakeouts first, especially if equities weaken.

-RSm treats trends as risk, not confirmation.

-Higher-horizon probabilities dominate — patience matters.

Gold – Correction Over?Precious metals markets have been volatile to say the least in the last 2 weeks, but could the downside correction for Gold be over?

At this point last Monday Gold prices were in the throws of a meltdown which had seen prices reverse from a record high of 5598 registered on January the 29th to a low of 4403. Since then, while price action has been extremely choppy, prices have moved higher again, briefly touching a peak at 5047 this morning before slipping back lower to trade +1% at 5010 at the time of writing (0730 GMT).

There are currently a lot of drivers impacting Gold. Data released over the weekend showed that the Chinese central bank (PBOC) bought for the 15th month in a row, and Bloomberg reported only this morning that Chinese regulators have advised financial institutions to rein in their holdings of US treasuries, which could add to Gold’s appeal as a safe haven asset.

Not only that, Sunday’s landslide election win for Japanese PM Sanae Takaichi on a mandate of tax cuts and higher spending have renewed concerns about the sustainability of government finances in the developed economies, something that could add to demand for precious metals, and Gold in particular, as debasement assets. For this reason, the announcement of new fiscal measures from the Japanese government may be heavily scrutinised and could impact the direction of Gold.

Looking forward, tensions between US and Iran seem to have eased in the short term, after talks recent talks between the two nations ended with a more positive tone, although the US maintains a heavy military presence in the region. Traders may be keen to see how this story progresses across this new week, with President Trump meeting the Israeli President on Wednesday and further talks between US-Iranian delegations also a possibility.

US economic data could also be important with the delayed US Non-farm Payrolls release now due at 1330 GMT on Wednesday and the next CPI reading due on Friday (1330 GMT). Both these releases have the potential to change market expectations for Federal Reserve interest rate moves in the first half of 2026 and could add to Gold price volatility heading into Friday’s close.

Gold Technical Update: Is the Correction Over?

Gold’s more than 21% liquidation from the 5598 January 29th all-time high caught many investors off guard due to both its speed and extent. However, the decline did reach a potential long‑term support zone at 4425, which aligns with the 50% Fibonacci retracement of the entire June 30th 2025 to January 29th 2026 rally.

As the chart above shows, it was this long‑term 4425 retracement support that successfully held the decline, a level from which prices have since recovered. This could reinforce 4425 as a key longer term support level going forward.

With some uncertainty still dominating sentiment in Gold, it could be useful to identify potential key support and resistance levels that may be in focus for the week ahead to help gauge where the next directional risks may lie.

Potential Support Levels:

While 4425 remains the key long‑term support, Friday’s strong rebound from the 4655 low suggests this may act as initial support in the week ahead. A close back below 4655 could warn of renewed weakness and a potential retest of the 4425 retracement level.

While not a guarantee of continued weakness, a close below 4425 could then increase the risk of further downside, opening scope toward the next support at 4150, which is the 61.8% retracement. A break below the 4150 level on a closing basis could extend losses toward 3887, which is the October 28th extreme.

Potential Resistance Levels:

While the 4655 and 4425 supports continue to hold any future price declines, further attempts to push higher remain a possibility. Any such strength could shift attention to the first potential resistance at 5092, which is the February 4th high. How this level is defended on a closing basis could be key.

If Gold prices were to close above 5092 in the coming week, further upside attempts could be possible. Such a break could shift focus back toward the 5598 all‑time high from January 29th, although that level may still act as strong resistance.

The material provided here has not been prepared accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

NQ Power Range Report with FIB Ext - 2/9/2026 SessionCME_MINI:NQH2026

- PR High: 25294.50

- PR Low: 25153.75

- NZ Spread: 314.75

No key scheduled economic events

0.10% weekend gap up (open)

Session Open Stats (As of 12:15 AM)

- Session Open ATR: 488.50

- Volume: 76K

- Open Int: 275K

- Trend Grade: Long

- From BA ATH: -5.4% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26691

- Mid: 25544

- Short: 23372

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

BTC - Long setup (RSm) | 29 January 2026Symbol : BINANCE:BTCUSDT

Horizons : Daily (D) & Weekly (W)

Context :

Following the recent drop, both the Daily (D) and Weekly (W) horizons are in extreme states.

The RSm model indicates an elevated probability (~80% for both horizons) of upside mean reversion.

Expectation (model-based)

D-horizon:

-Mean reversion toward 86470

-Expected time: ~1.25 days on average, up to ~12 days

W-horizon:

-Mean reversion toward 91101

-Expected time: ~1 day on average, up to ~50 days

Execution note:

This post reflects how I trade and interpret the RSm model.

Risk management and execution are trader-specific.

Not investment advice

BTC — Short-term Forecast | RSm | 6 Feb 2026BINANCE:BTCUSDT

Context

BTC remains in a downside regime that started on 14 Jan 2026.

Lower horizons still indicate unresolved downside pressure.

Short-term (1–2 days)

From the RSm perspective, BTC has room for a local downside continuation before the current move is structurally complete.

Near-term risk: continuation toward the lower range

This phase is treated as risk, not opportunity

Weekly view (1-2 weeks)

On the higher horizon, BTC approaches a high-probability mean-reversion zone.

Weekly mean-reversion scenario becomes relevant after short-term pressure is absorbed

Upside is considered only as a reaction, not a trend call

Execution logic

Lower horizons resolve first.

Higher-horizon reversion is evaluated only after completion of the short-term phase.

Note

This post documents a multi-horizon RSm state.

It is not a trade recommendation.

BTCUSDT — No Trade Short Setup (RSm) | 6 Feb 2020BINANCE:BTCUSDT

Context

BTC is trading near 70.3k after a strong upward impulse

Intraday price action shows deceleration and consolidation, which could resemble a short-term top in isolation

RSm signal

D-horizon mean reversion probability: 94%

Local expectation suggests a potential pullback toward ~68.5k

Typical timing for D mean reversion: 1–3 days

Why the short is NOT allowed

Because Monthly (M) and Quarterly (Q) horizons are both in high-probability regimes, above 80% probability of the up move.

According to RSm rules:

- High-probability M/Q horizons override D-horizon signals

- Counter-directional trades against M/Q are forbidden, regardless of D probability

- This converts the D signal from an actionable trade into contextual risk only

Conclusion

- Short bias is statistically visible but structurally blocked

- RSm state: WAIT

- Downside is possible, but not tradable under the current higher-horizon alignment

This post documents a rules-based RSm state. Not a trade recommendation.

Gold Futures: A Sharp Drop in Open Interest After Extreme MovesGold futures have seen very violent price action recently. After an exceptional 2025 — with prices nearly doubling — gold is now trading roughly 10% below its all-time high.

While price alone looks dramatic, the more important signal right now comes from Open Interest.

Open Interest is collapsing — and that matters

As shown in the chart, open interest has dropped sharply, reaching some of the lowest levels seen in the last few years. This decline happened during a period of elevated volatility and fast price moves.

A falling open interest tells us that:

Existing positions are being closed, not replaced

Leverage is being reduced

The move is driven more by liquidation than by new directional conviction

This is a key distinction. When price moves lower with rising open interest, it usually signals growing bearish positioning. Here, we see the opposite: participation is shrinking, not expanding.

What this usually implies

Historically, strong price moves combined with falling open interest tend to mark:

The end of an impulsive phase

A transition into consolidation or re-pricing

Reduced trend-following edge in the short term

In other words, the market is clearing positions and searching for a new equilibrium, rather than committing to a new directional trend.

Bottom line

The recent move in gold looks less like a structural trend reversal and more like a deleveraging event.

Until open interest stabilizes and volatility cools, gold futures are more likely in a transition regime than in a clean trending environment.

This analysis is for educational purposes only. It does not constitute investment or trading advice.

Market Regime Analyzer — Understanding Consolidation Regimes

Markets don’t always trend. Much of the time, price oscillates within a range where mean reversion dominates and breakout strategies underperform.

This example illustrates how the Market Regime Analyzer identifies a Consolidation Regime and how price behavior aligns with that classification.

What the chart is showing:

Price rotates within a defined range without sustained directional expansion

Breakouts repeatedly fail or fade back into the range

Volatility remains contained and directional follow-through is limited

This behavior matches the indicator’s Consolidation Regime classification.

Indicator interpretation:

The oscillator fluctuates around a mean-reversion reference level

Oscillations around this level define the regime’s behavior

Volume pressure remains muted, reinforcing range-bound conditions

Transition probabilities strongly favor continued consolidation

Important:

The Market Regime Analyzer is not a trade signal. It is designed for regime awareness and strategy selection.

How this should influence decision-making? When a consolidation regime is active:

Trend-following strategies lose edge

Mean-reversion and range-based approaches perform better

Risk should be reduced on breakout attempts

Patience becomes a position

Understanding when not to force trades is a competitive advantage.

Indicator used:

Market Regime Analyzer

This indicator is designed to help traders align execution with market conditions, not predict direction.

BTC | 3 days forecast | 5 Feb 2026BINANCE:BTCUSDT

Context

D-horizon is in a downside extreme and has started stabilizing

→ implies a high probability of upward mean reversion

W-horizon remains positive and supportive

→ no higher-horizon block for upside

Current price action fits a corrective move within a broader W-context, not a trend break

Expectation

Direction: LONG

Target: 72,000

Type: Mean reversion on D within a supportive W structure

Timing: Expected within several days

Notes

This is a rules-based RSm setup

The post documents a model state, not a trade recommendation

Trends are treated as risk; reversions as opportunity

NIFTY50 2H|LVRB Box Formation — Breakout ImminentLVRB Box Forming at 25,700–26,000

On the NIFTY50 2-hour chart, LVRB has detected a volatility contraction zone and formed a Box.

After a sharp rally from around 24,800 to 26,300 on February 3, price has been trapped in a narrow 25,700–26,000 range for over two days. Candle bodies have become extremely small, indicating that buying and selling pressure are at equilibrium.

LVRB automatically detects these periods where volatility disappears. This state is like a compressed spring — eventually, price will break out in one direction, and when it does, a significant move in that direction is likely to follow.

Lakshmi - Low Volatility Range Breakout

Layering this daily timeframe bearish bias with the LVRB Box forming on the 2-hour chart, the probability favors a downside breakout — a SHORT signal firing.

Strategy for Now

Price is still inside the Box. No signal has fired yet. The correct approach is not to front-run the breakout, but to wait for LVRB to confirm the direction.

If the Box breaks to the downside and a SHORT signal fires, it would align with the daily-timeframe distribution thesis, making it a high-conviction entry.

If it breaks to the upside, that would contradict the bearish daily scenario and require careful judgment.

LAKSHMI