Volatility

Nifty W2, Day 4 (Jan 8, 2026) Quick ViewSpot View

Critical choke point – calls defending stubbornly (C26.1K volume yesterday).

Technicals

* PR1X spot: 199–200 key zone

* 🐻 199 → 200-202+

* 🐂 199 → swift downside

Bias

Bullish below 199 | Bearish break above 202.

Options Flow

Simple & clear: If calls surrender that key holding line on the 1/2-hour timeframe, puts will likely take control. If not, we could see put premiums crash back to Monday’s (Jan 05) levels, with calls rebounding to Tuesday’s (Jan 06) pricing.

This call/put dynamic extends to other strikes too with delta 0.3 above.

N

NVDA – Consolidation Breakout Toward 200 Core Resistance?🔶 Downside structure

Looking at NVDA on the daily chart, one level clearly stands out on the downside:

170 PUT support , where price has bounced multiple times in the past. This level has been well defended by put positioning, creating a solid structural floor. 🔴

🔶 Consolidation behavior

Over the past weeks, price spent a considerable amount of time sitting on the 50-day moving average , repeatedly testing it from below but failing to break through decisively. That dynamic now appears to be changing. NVDA is starting to push higher, suggesting a potential breakout from this consolidation range. 🟢

🔶 Upside reference level

If this breakout holds, the next key level to watch is 200 Call Resistance . This is currently the largest Call Resistance on the board, and it also aligns with an 8/8 MM level , adding technical confluence to the zone. 🟢

🔶 Options sentiment context

What’s important here is sentiment:

🔵 Call Pricing Skew is currently minimal, meaning the options market is not aggressively positioned for upside yet. This keeps the move cleaner and reduces the risk of an overcrowded bullish trade. In other words, this is not a euphoric call-heavy environment, which often allows price to travel further if momentum builds.

🔶 Scenario

🟢 If NVDA successfully breaks out of this consolidation and holds above the 50-day MA , a move toward the 200 Call Resistance becomes a very realistic upside target.

🔶 Key levels

🔴 PUT Support: 170

🔵 Trigger: Sustained breakout above the 50-day MA

🟢 Upside Target: 200 Call Resistance (8/8 MM)

Not financial advice — just a clean structure driven by price, positioning, and option market context.

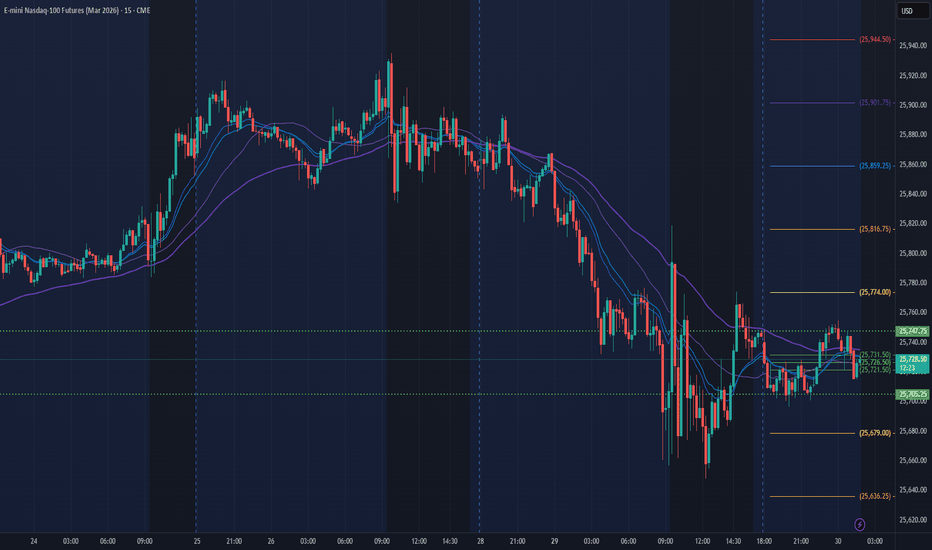

NQ Power Range Report with FIB Ext - 1/7/2026 SessionCME_MINI:NQH2026

- PR High: 25844.75

- PR Low: 25815.50

- NZ Spread: 65.25

Key scheduled economic events:

08:15 | ADP Nonfarm Employment Change

10:00 | ISM Non-Manufacturing PMI

- ISM Non-Manufacturing Prices

- JOLTs Job Openings

Session Open Stats (As of 12:25 AM)

- Session Open ATR: 331.18

- Volume: 21K

- Open Int: 275K

- Trend Grade: Long

- From BA ATH: -2.3% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

Amazon Blow-off Top before the CrashAmazon is setting up for a wonderful rise to the 250 range but will face alot of resistance at the previous high of 258.

If or when it breaks upto 260 and the resistance is met and this is matched with a large amount of selling from Dumb Money, it will be a nasty ride down!

The RSI is starting to diverge downard as the price increase which is creating a bearish signal. When the selling begins, I am looking for a break below 225, which will signal the next support levels at 211.

My Support Levels are at 211, 191 and 171. If 191 breaks it will cause a Bearish downtrend!

MLP.TO — Swing Trade Idea (TSXV / TSX-V)💰 MLP.TO — Swing Trade Idea (TSXV / TSX-V)

🏢 Company Snapshot

• Millennial Potash Corp. is an early-stage potash explorer with assets in Gabon

• Potash equities have been attracting speculative inflows as fertilizer prices stabilize and ag commodities firm

• This is a technical swing, not a long-term fundamental investment

📊 Fundamental Context (Trade-Relevant Only)

• Valuation: Pre-revenue explorer — valuation driven purely by sentiment and optionality

• Balance Sheet: Typical junior profile; dilution risk always present

• Cash Flow: Negative (expected)

• Dividend: N/A

Fundamental Read: Fundamentals neither help nor hurt — trade is driven entirely by trend structure and momentum resets.

🪙 Industry & Sector Backdrop

• Short-Term (1–4 weeks): Fertilizer & ag-related names showing selective strength

• Medium-Term (1–6 months): Juniors with clean trends outperforming TSX-V averages

• Macro Influence: Potash tied to food security themes and commodity stabilization

Sector Bias: Neutral → Selectively Bullish (momentum-dependent)

📐 Technical Structure (Primary Driver)

• Trend:

– Price remains above rising 50-SMA

– 200-SMA well below price → primary trend intact

• Momentum:

– RSI(2) has fully reset from overbought into the 20–40 zone

– Prior RSI(2) resets at the 50-SMA led to continuation legs

• Pattern:

– Higher-high / higher-low structure since August

– Current pullback into rising 50-SMA after failed breakout attempt

• Volume:

– Expansion on advances, contraction on pullbacks → constructive

Key Levels

• Support: 3.10 – 3.20 (50-SMA + prior breakout zone)

• Resistance: 3.75 – 3.95 (range highs / supply zone)

🎯 Trade Plan (Execution-Focused)

• Entry: 3.15 – 3.30

– Pullback into 50-SMA with momentum reset

• Stop: 2.95

– Daily close below support + trend violation

• Target: 3.90 – 4.00

– Prior highs / measured continuation move

• Risk-to-Reward: ~2.5R

Alternate Scenario:

If price loses 3.10 on volume, stand aside. Next actionable long only after reclaim of the 50-SMA or a higher low above 3.00.

🧠 Swing Trader’s Bias

Price remains in a confirmed uptrend above the 50-SMA with RSI(2) resetting into a high-probability continuation zone. I’m looking for buyers to defend the 3.15–3.30 area and push price back toward range highs for a 2.5R swing. A daily close below 2.95 invalidates the setup.

NQ Power Range Report with FIB Ext - 1/6/2026 SessionCME_MINI:NQH2026

- PR High: 25598.75

- PR Low: 25560.75

- NZ Spread: 85.0

Key scheduled economic events:

09:45| S&P Global Services PMI

Session Open Stats (As of 12:15 AM)

- Session Open ATR: 336.38

- Volume: 20K

- Open Int: 271K

- Trend Grade: Long

- From BA ATH: -2.9% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

EIF (Exchange Income Corporation:TSX)— Swing Trade Idea💰 EIF — Swing Trade Idea

🏢 Company Snapshot

• Exchange Income Corporation operates aviation, aviation services, and related infrastructure businesses in Canada and internationally.

• Momentum is strong with a recent pullback into the 50-SMA, aligning with a clean institutional uptrend — a tactical entry point for swing traders.

📊 Fundamental Context (Trade-Relevant Only)

• Valuation: Trading near fair value vs Canadian industrial peers.

• Balance Sheet: Stable liquidity, manageable debt, no near-term leverage risk.

• Cash Flow: Consistently positive, supporting operational stability.

• Dividend: Neutral — modest yield, not a primary driver.

Fundamental Read: Fundamentals are stable, supporting continuation of technical uptrend rather than creating headwinds.

🪙 Industry & Sector Backdrop

• Short-Term: Canadian industrials/aviation sector showing rotation into relative strength.

• Medium-Term: Outperforming TSX Composite, supported by stable earnings.

• Macro Influence: Low rates and moderate commodity exposure support operational margins.

Sector Bias: Bullish

📐 Technical Structure (Primary Driver)

• Trend: Price above 50-SMA and rising; weekly SMA also confirms uptrend.

• Momentum: RSI(2) has dipped below 3, indicating oversold reset within uptrend.

• Pattern: Pullback into 50-SMA support after strong prior advance — classic mean-reversion setup.

• Volume: Moderate accumulation during pullback; no major distribution.

Key Levels:

• Support: 81.60 – 81.85 CAD (recent 50-SMA touch)

• Resistance: 86.20 – 86.50 CAD (prior swing high)

🎯 Trade Plan (Execution-Focused)

• Entry: 81.75 – 81.85 CAD (confluence of 50-SMA and RSI2 oversold)

• Stop: 79.50 CAD (decisive 50-SMA breakdown invalidates setup)

• Target: 86.24 CAD (measured move to prior swing high)

• Risk-to-Reward: ~2.5R

Alternate Scenario: If price fails to hold 50-SMA, wait for deeper pullback near 80.50 – 80.70 CAD or a second oversold RSI2 signal for safer entry.

🧠 Swing Trader’s Bias

Price remains in a controlled uptrend above the 50-SMA with RSI(2) resetting into support. Looking for a clean reaction at the entry zone to target prior highs for a 2.5R swing. Failure below 50-SMA invalidates the setup.

NQ Power Range Report with FIB Ext - 1/5/2026 SessionCME_MINI:NQH2026

- PR High: 25463.25

- PR Low: 25406.50

- NZ Spread: 126.75

Key scheduled economic events:

10:00 | ISM Manufacturing PMI

- ISM Manufacturing Prices

Session Open Stats (As of 12:15 AM)

- Session Open ATR: 339.04

- Volume: 32K

- Open Int: 271K

- Trend Grade: Long

- From BA ATH: -3.4% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

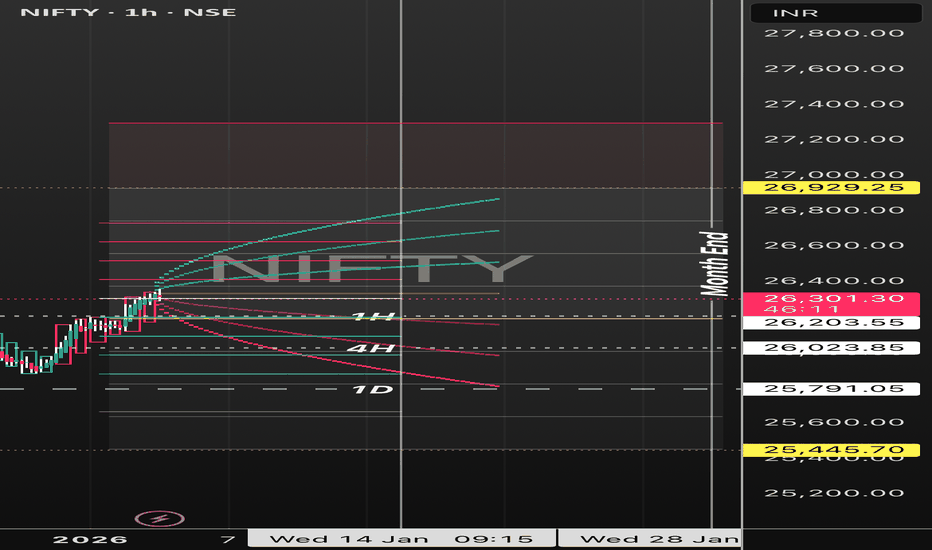

Nifty Update – Week 2, Day 1 (Jan 5, 2026)Spot view

Nifty shows NO overhead resistance in higher timeframes — clear path to new ATH if momentum holds.

Technicals

* Open path towards 26,300–26,500.

* Key Signal: Repeated rejection at PR1XINV 202+ zone (inverse pattern) indicates underlying strength — failed breakdowns signal bullish continuation.

Bias

Bullish if spot sustains above 26,100.

Options Flow

Puts remain quiet. Any call rejection risks rapid put premium expansion and accelerated Nifty downside.

Notes

* Monthly range marked by white lines on chart.

* Week 1 recap: Third view, Put scenario failed; saw call-side rise as hinted (despite initial put lean).

Chart:

🤞🏻 Rooting for put, let's see

Bread Financial Holdings, Inc. (NYSE) — Swing Trade Idea💰 BFH — Swing Trade Idea

Bread Financial Holdings, Inc. (NYSE)

🏢 Company Snapshot

• Consumer finance and payments company (private-label credit cards, BNPL, loyalty solutions)

• Matters now due to sustained relative strength in Financials and a clean trend resumption after a controlled pullback from highs

📊 Fundamental Context (Trade-Relevant Only)

• Valuation: Discount to broader Financials on P/E, reflecting conservative expectations

• Balance Sheet: Deleveraging trend post-spin, liquidity remains adequate

• Cash Flow: Stable to improving with normalization in credit conditions

• Dividend: Present but secondary to price action

Fundamental Read: Fundamentals are not a catalyst but provide downside support while price leads the thesis.

🪙 Industry & Sector Backdrop

• Short-Term (1–4 weeks): Financials showing rotation strength vs SPX

• Medium-Term (1–6 months): Select consumer finance names outperforming on risk normalization

• Macro Influence: Stable rates supportive for credit spreads

Sector Bias: Bullish

📐 Technical Structure (Primary Driver)

• Trend: Strong uptrend; price above rising 50-SMA and well above 200-SMA

• Momentum: RSI(2) recently reset into oversold and is rebounding — classic mean-reversion within trend

• Pattern: High-tight advance followed by orderly pullback into prior breakout zone

• Volume: No heavy distribution; pullback volume lighter than advance

Key Levels

• Support: 73.50 – 74.00 (prior breakout + 50-SMA confluence)

• Resistance: 78.80 – 79.20 (recent highs / measured continuation)

🎯 Trade Plan (Execution-Focused)

• Entry: 73.80 – 74.30 (reaction buy at trend support)

• Stop: 71.50 (loss of structure and 50-SMA invalidates)

• Target: 79.10 (prior high / continuation objective)

• Risk-to-Reward: ~2.6R

Alternate Scenario:

If price loses 74 on closing basis, stand aside and reassess near 70.50–71.00 (next demand + rising structure).

🧠 Swing Trader’s Bias

Price remains in a controlled uptrend with RSI(2) resetting into support. I’m looking for a clean reaction off the 50-SMA to target prior highs for a ≥2R continuation swing. A decisive close below 71.50 invalidates the setup.

NQ Power Range Report with FIB Ext - 1/2/2026 SessionCME_MINI:NQH2026

- PR High: 25504.00

- PR Low: 25448.50

- NZ Spread: 124.0

Key scheduled economic events:

09:45 | S&P Global Manufacturing PMI

Session Open Stats (As of 12:25 AM)

- Session Open ATR: 333.71

- Volume: 26K

- Open Int: 275K

- Trend Grade: Long

- From BA ATH: -2.9% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

Educational Insight | Bajaj Auto (Technical Observation)

Bajaj Auto — where structure aligns with momentum

- Price has resolved above a long weekly cup range, followed by a decisive RSI regime shift above 60 after nearly a year.

- Daily structure supports the move with higher highs and sustained strength above key levels.

- Trend transitioning from range → expansion.

BTC: The 15-Year Prophecy (Hosoda Time & The Diagonal)There is a ghost in the machine.

For the last few months, amidst the noise of breakouts and new highs, a specific signal has been flashing a warning that defies the rules of a standard Bull Market. It is a "glitch" in the data—a silence where there should be noise.

Most are ignoring it. Some are confused by it. Today, we are going to try solving it.

Below is the full evolution of the Bitcoin setup, from the Daily traps to the Macro truth, revealing why the "Silence" is actually the loudest signal we have ever seen.

Part 1: The Micro Trap (1D Chart)

Zooming into the daily timeframe, the structure of the decline is textbook. We are currently navigating Wave (4), but the context provided by the previous move is critical.

The "Extended" Wave 3: The drop we just witnessed wasn't a standard correction; it was an impulsive sell-off where Wave 3 was extended. when the third wave extends, it confirming strong momentum in the direction of the trend. The bears are in control.

Current Status (Wave 4): We seem to be in the middle of a Wave (4) relief rally, potentially unfolding as an ABC correction.

Sub-waves 'a' and 'b' appear complete, with 'b' potentially establishing a local higher low.

What's Next: We are likely waiting for Wave 'c' to expand upwards to potentially complete the structure.

The Potential Resistance ($99k): If this structure holds, Wave 'c' might push towards the resistance confluence around $99,323. This area could serve as a ceiling for this corrective phase.

The Downside Risk ($79k): Traders should remain cautious. If Wave (4) finds resistance near $99k, the Elliott Wave guidelines suggest a Wave (5) decline could follow. If that scenario plays out, the market might target the major support zone near $79,000.

Part 2: The Time Anomaly (1W Chart)

While the daily chart showed us the immediate price action, the Weekly chart reveals the true scale of the move. As discussed in previous updates, we are navigating a large-scale Irregular Flat Correction, and we are currently at the tail end of Wave (1) of the 5-wave impulse that makes up the larger C-Wave.

So, the entire impulsive structure we just analyzed on the Daily chart? That was just the first leg of this Weekly move.

☁️ The Ichimoku Signal: Testing "Senkou Span B" Price action has now entered the Ichimoku Cloud (Kumo), a critical zone of turbulence.

The Level: you can see candles trading inside the cloud. We have already tested the bottom support, specifically the Leading Span B (Senkou Span B).

The Forecast: Hitting this level signals that Wave (1) is either ending or has already ended. However, the market rarely makes it easy. I am expecting a potential "False Breakout" below the Cloud to trigger panic, followed by a sharp reclamation. That fake-out would likely mark the bottom of Wave (1) and start of Wave (2).

⏳ The Time Anomaly: Why so fast? There is a strange disconnect in the "Time" dimension of this cycle compared to history (see picture).

2021 Cycle: In the previous bull run, the correction for Wave 1 typically took 70 days to cool the RSI down to 37.

Current Cycle: We have smashed down to an RSI of 35.8 in just 42 days.

The Question: Why is the market correcting nearly twice as fast as before? This "Time Compression" indicates the cycle is moving faster and more violently than we are used to.

The "BBWP Mystery" Finally, look at the BBWP (Volatility) in the below picture. This presents a genuine anomaly. Throughout this cycle, we have seen contractions many times, yet the spectrum never reached the extreme 90% expansion levels. Now, at the very end of the cycle, we are seeing another massive BBWP Contractions.

Why is this happening? Is it just noise, or is this contraction actually telling us the truth?

Part 4: The Truth (6-Month Macro Chart)

Why is the market moving so fast? And what is the "BBWP Signal" we mentioned Before? Look at the 6-Month Logarithmic Chart below.

The Big Picture: Elliott Wave Supercycle on 6M Log Scale

On the logarithmic chart, Bitcoin appears to be wrapping up a massive impulse wave that started from its early days:

Wave (I): Peaked around 2013 (~$1,200 high).

Wave (II): Bottomed in 2015 (~$200 low).

Wave (III): Explosive rally to the 2021 all-time high (~$69,000).

Wave (IV): The 2022 bear market low (~$15,500).

Wave (V): Ongoing since late 2022, but here's the twist—it's unfolding as an ending diagonal (wedge pattern with overlapping subwaves: 1-2-3-4-5).

2.Applying Hosoda Time Theory (Ichimoku Time Theory indicate potential future market turning point).

The vertical lines in the chart are not Fibonacci; they are Hosoda Numbers (9, 13, 17, 21...),

9: Marked the 2023 Bull Run start.

13: Exactly Marked the Jan 2025 Top as end of wave 3, which matches the irregular flat analysis on Weekly chart which states that Cycle top was on Jan 2025.

17 (±1): Matches our projection for the next major pivot—the end of wave IV and the start of the final Wave V run on Jul-2026 or Jan-2027.

The "Mystery": The BBWP Anomaly

BBWP is contracting sharply now on weekly chart—at what feels like the end of the cycle, not the start. This flips the script on historical behavior. Why? I tie it back to the higher-degree Elliott count: The ending diagonal's converging nature naturally squeezes volatility, compressing Bollinger Bands as momentum fades. Instead of signaling a fresh bull, this late-cycle contraction could be foreshadowing a reversal—think trend exhaustion rather than accumulation.

A Possible Explanation: If the macro structure is indeed an Ending Diagonal, then this volatility crunch (BBWP contractions) and the market correcting nearly twice as fast as before makes perfect sense. We would be squeezing into the apex of a 15-year wedge. The market might be running out of "oxygen".

The Verdict: With the 6-Month structure potentially squeezing into a corrective Wave IV, the weight of evidence suggests that the path of least resistance is down. Until the market touches the lower boundary of this diagonal (or invalidates the structure), the only logical macro view is bearish.

Nifty Playbook W1 Day 4 (Jan 1, 2026) – Quick Market UpdateNifty Playbook W1 Day 4 (Jan 1, 2026) – Quick Market Update

Spot Nifty itself shows no major resistance in the immediate higher timeframe — open path toward ATH if momentum sustains.

Technicals

Spot Resistance: Minimal overhead; clear runway above 26,300–26,500.

Key Level: PR1XINV rejecting repeatedly at 202+ zone — classic inverse signal suggesting underlying Nifty strength (failed breakdowns = bullish continuation).

Bias: Bullish continuation likely if spot holds above 26,000. Rejection of call-side HTF resistance could fuel put sharp upside.

Options Flow

One failed breakout or call rejection → potential for rapid put IV explosion and accelerated selling.

Flip mechanism: Puts relatively quiet; any call rejection could see put premiums shoot quickly!

So Stay nimble.

Chapter 7 — HOW-TO: MARAL Supports Traders in Live MarketsChapter 7 — How -TO : MARAL Supports Traders in Live Markets (v1.1.0)

Execution Discipline, Risk Control, and Greed Management (Educational Framework)

MARAL — Execution Workflow (Build v1.1.0 — Optional Modules) is a discretionary decision-support framework built in Pine Script for TradingView.

It standardizes live execution through a repeatable workflow:

Context → Qualification → Management → Action (EDC).

✅ No automation. No trade execution. No signal service. No performance guarantees.

MARAL is designed to reduce the biggest live-market problems: overtrading, greed, impulsive entries, timeframe conflict, and weak post-entry control.

7.1 Why Traders Fail Live (Even With “Correct” Concepts)

Many traders understand structure/liquidity ideas — yet still lose because execution breaks down:

Anticipation entries (entering before permission)

Timeframe conflict under pressure (HTF bias ignored by LTF noise)

Unclear invalidation (“Where exactly am I wrong?”)

Weak post-entry control (holding too long, panic exits, SL shifting)

Greed loops (overtrade after wins, revenge after losses)

MARAL is built to control decisions under stress by converting market information into clear states and actionable gates.

7.2 MARAL’s Live Execution Architecture (Boards + Optional Modules)

A) Context Board (Market Environment)

Answers: “Is this a trade-worthy environment?”

Summarizes direction, HTF bias (1H/4H/D), structure, momentum, volatility (ATR%), trend strength (ADX), scoring, liquidity context, plus optional layers such as session/LTF bias/participation.

B) Qualification Gate (Pre-Entry Permission)

Answers: “Do I have permission NOW?”

Blocks trades unless HTF/structure/momentum/regime/liquidity/alignment requirements are acceptable, then issues:

ENTRY PERMISSION: ENTER / WAIT / SKIP.

C) Management Desk (Post-Entry Control)

Answers: “How do I manage this trade without emotion?”

Monitors trade health, phase, obstacles, exit pressure, score trend, risk state, trade age, SL mode, and action state.

D) EDC — Execution Decision Core (Unified State Summary)

Answers: “What is the correct action right now?”

Compresses the entire workflow into:

SETUP → ENTRY PERMISSION → LIQUIDITY → TRADE STATUS → ACTION STATE.

Optional v1.1.0 Modules (Advanced Live Support)

ECI Panel (Execution Confidence Index)

Session Context (ACTIVE / TRANSITIONAL / DEAD)

LTF Execution Bias (15m & 5m) + LTF Exec quality

Divergence as Risk Modifier (context only; no entry trigger)

Post-Entry Stress (Manual Tracker)

Scalp Execution & Exit Panel (permission-locked)

7.3 How MARAL Controls Greed in Live Markets

Greed is not solved by motivation — it is solved by rules + visibility.

MARAL reduces greed through:

WAIT discipline (no permission = no trade)

Setup scoring + grade (filters “almost-good” entries)

Liquidity context & obstacles (prevents holding into walls)

Exit pressure + score trend (prevents emotional holding)

Post-entry stress tracking (controls behavior after entry)

Scalp permission lock (prevents fast-market overtrading)

The result is not “more trades.”

The result is better decisions and fewer mistakes.

7.4 Key Live-Market Features (How to Use MARAL Correctly)

1) Permission-First Execution (ENTER / WAIT / SKIP)

ENTER = minimum execution quality is met

WAIT = context is not confirmed (do not force entries)

SKIP = environment is unsuitable (chop/regime weakness/conflict)

2) Alignment Score + Grade (Quality Control)

Grades are execution quality labels, not predictions.

Higher grades generally reflect cleaner agreement across direction, momentum, HTF context, structure, and liquidity environment.

3) Liquidity Context + Obstacle Ahead (Risk Awareness)

Highlights sensitive zones (PDH/PDL and swing liquidity).

This helps avoid entering into traps or holding into “walls”.

4) MTF/LTF Diagnostics (Timeframe Discipline)

MTF Status: ALIGNED / MIXED / CONFLICT

LTF Exec (optional): SUPPORTIVE / WEAK / RISKY / AVOID

5) Management Desk (Post-Entry Control)

MARAL continues beyond entries:

Trade Status: VALID / RISKY / WEAK

Exit Pressure: LOW / RISING / HIGH

Action State: HOLD / TIGHT SL / SCALE OUT / EXIT

7.5 Core Filters (Copy-Safe Disclosure)

MARAL uses 6 core market filters + multiple execution intelligence layers (structure, displacement, scoring/grades, MTF/LTF diagnostics, and post-entry management).

7.6 Post-Entry Stress (Manual Tracker) — Deep Live Explanation

Why this module exists

Most traders lose control after entry (panic, greed, SL shifting, refusing to exit, adding emotionally).

Post-Entry Stress converts post-entry behavior into objective states:

✅ RISK STATE: LOW / MED / HIGH

✅ ACTION: HOLD / REDUCE / PROTECT / EXIT

This is not a signal engine. It is a discipline engine.

What you input (manual)

Tracking ON/OFF — enable only when you have a real position

Direction — Long or Short

Entry Price — your actual filled entry (not candle close)

Stop Loss (recommended) — your planned SL (manual or ATR-based)

What it monitors (conceptually)

MAE (ATR) — adverse excursion measured in ATR units (stress magnitude)

MFE (ATR) — favorable excursion measured in ATR units (progress magnitude)

Rejection pressure (wick aggression)

Volatility expansion

Opposing pressure (conditions flipping against your trade)

SL safety context (when SL is provided)

How to read it live

LOW → trade is behaving normally → HOLD

MED → stress building → REDUCE / PROTECT (rule-based)

HIGH → risk is dominant → PROTECT / EXIT

SL compromised → trade is compromised → EXIT

Professional rule:

If the stop is compromised, the trade is compromised.

7.7 MARAL v1.1.0 Feature Index — 56 User-Facing Features (Panels)

A) Context Board — 18 Features (Environment + Alignment)

1.DIRECTION — Bullish / Bearish / Neutral bias derived from the master scoring engine.

2.H1 CONTEXT — HTF1 bias state (ON/OFF; Bull/Bear/Neutral).

3.H4 CONTEXT — HTF2 bias state (ON/OFF; Bull/Bear/Neutral).

4.DAILY CONTEXT — Daily bias state (ON/OFF; Bull/Bear/Neutral).

5.STRUCTURE — Bull Struct / Bear Struct / Neutral Struct (swing structure mapping).

6.MOMENTUM — UF-RSI momentum state: BULL / BEAR / NEUTRAL.

7.VOLATILITY (ATR%) — ATR as % of price for stability/regime awareness.

8.TREND STRENGTH (ADX) — ADX-based trend quality reading.

9.LONG SCORE + Grade — Long alignment score + grade (A++/A+/A/B/No-Trade).

10.SHORT SCORE + Grade — Short alignment score + grade (A++/A+/A/B/No-Trade).

11.ALIGNMENT SCORE — master execution score used for live filtering.

12.LIQUIDITY CONTEXT — HIGH / NEUTRAL / LOW (event/near/eventless context).

13.PARTICIPATION (optional) — STRONG / NEUTRAL / WEAK (participation quality context).

14.MTF STATUS — ALIGNED / MIXED / CONFLICT (timeframe agreement diagnostic).

15.SESSION (optional) — ACTIVE / TRANSITIONAL / DEAD / OFF (session context).

16.15m BIAS (optional) — 15-minute execution bias state (Bull/Bear/Neutral).

17.5m BIAS (optional) — 5-minute execution bias state (Bull/Bear/Neutral).

18.LTF EXEC (optional) — SUPPORTIVE / WEAK / RISKY / AVOID (micro execution quality).

B) Qualification Gate — 8 Features (Permission to Execute)

19.SETUP — LONG / SHORT / WAIT based on qualified candidate conditions.

20.HTF CONTEXT — OK / WARN / BAD (direction compatibility check).

21.STRUCTURE — OK / WARN / BAD (structure confirmation strength).

22.MOMENTUM — OK / WARN / BAD (momentum confirmation + chop avoidance).

23.VOL/REGIME — OK / WARN / BAD (volatility + trend regime suitability).

24.LIQUIDITY — HIGH / NEUTRAL / LOW (execution safety context).

25.ALIGNMENT — score vs threshold (example: 78 / 65).

26.ENTRY PERMISSION — ENTER / WAIT / SKIP (final execution gate).

C) Management Desk — 11 Features (Post-Entry Control)

27.TRADE STATUS — VALID / RISKY / WEAK (idea health state).

28.MARKET PHASE — IMPULSE / PULLBACK / CONTINUATION / RANGE (phase awareness).

29.OBSTACLE AHEAD — YES / NO (PDH/PDL or swing proximity risk).

30.EXIT PRESSURE — HIGH / RISING / LOW (risk escalation logic).

31.MOMENTUM HEALTH — STRONG / WEAKENING / WEAK / NEUTRAL (post-entry momentum state)

32.SCORE TREND — IMPROVING / DETERIORATING / STABLE (quality drift).

33.RISK STATE — OVEREXTENDED / NORMAL (distance vs volatility).

34.TRADE AGE — FRESH / MID / LATE (time-in-trade awareness).

35.SL MODE — BE OK / TIGHT / NORMAL (stop behavior guidance).

36.ACTION STATE — HOLD / TIGHT SL / SCALE OUT / EXIT (rule-based action).

37.ACTIVE WINDOW — ON / OFF (management window after last setup).

D) EDC — Execution Decision Core — 5 Features (Unified Action)

38.EDC: SETUP — LONG / SHORT / WAIT.

39.EDC: ENTRY PERMISSION — ENTER / WAIT / SKIP.

40.EDC: LIQUIDITY — HIGH / NEUTRAL / LOW.

41.EDC: TRADE STATUS — VALID / RISKY / WEAK / —.

42.EDC: ACTION STATE — HOLD / TIGHT SL / SCALE OUT / EXIT / —.

E) ECI Panel (Optional) — 3 Features (Execution Confidence)

43.ECI SCORE + Grade — confidence context derived from alignment score (graded).

44.RISK MOD (optional) — POSITIVE / NEGATIVE / NEUTRAL (divergence-based modifier).

45.CAP NOTES — automatic constraints summary (why quality is capped).

F) Post-Entry Stress Panel (Optional Manual Tracker) — 6 Features

46.TRACKING — ON / OFF (manual tracker state).

47.DIRECTION — Long / Short (tracked position side).

48.MAE (ATR) — adverse excursion measured in ATR units (stress magnitude).

49.MFE (ATR) — favorable excursion measured in ATR units (progress magnitude).

50.RISK STATE — LOW / MED / HIGH (stress classification).

51.ACTION — HOLD / REDUCE / PROTECT / EXIT (stress-driven behavior).

G) Scalp Exec Panel (Optional; Permission-Locked) — 5 Features

52.SCALP ENTRY — PERMITTED / BLOCKED (strict permission lock).

53.ENTRY QUALITY — A / B / C (execution quality classification).

54.MGMT — HOLD / PROTECT / PARTIAL / EXIT (fast management instruction).

55.SL CONTEXT — VALID / AT-RISK / COMPROMISED / — (stop safety context).

56.PARTICIPATION — STRONG / NEUTRAL / WEAK / OFF (context-only quality).

7.8 Visual & On-Chart Execution Tools (Built-In)

Risk Planning (optional): Auto SL + TP1 + TP2 + TP3 (ATR-based)

PDH/PDL reference lines

Swing liquidity points (pivot highs/lows)

Optional state markers (LONG/SHORT)

Candle coloring by bias

7.9 Professional Clarity (What MARAL Is / Is Not)

MARAL supports traders by:

enforcing permission-based execution (ENTER / WAIT / SKIP)

reducing overtrading through gating + scoring

standardizing post-entry management via Trade Status + Action State

showing risk early (exit pressure, obstacles, deterioration)

enabling disciplined scalping via permission locks (optional)

MARAL does not:

predict the future

guarantee outcomes

execute trades

replace learning, discipline, or risk management

full maral panel togather for USD/GOLD

Permission first. Risk always. Discipline forever.

This script and the content in this chapter are provided strictly for educational and informational purposes.

Note : Discretionary decision-support only: MARAL is a chart-analysis workflow designed to help traders structure their decision process (context → qualification → management).

Not financial advice: Nothing here is investment advice, trading advice, or a recommendation to buy/sell any asset.No automation / no execution: The script does not place trades, execute orders, or provide any guaranteed “signal service.”No guarantees: Trading involves significant risk. Past performance does not predict future results. Any examples shown are for learning only.User responsibility: You are solely responsible for your own decisions, risk management, position sizing, and compliance with your local regulations and broker rules.

Use at your own risk. Trade responsibly.

#TradingView #PineScript #TradingEducation #Execution #TradingPsychology #RiskManagement #Discipline #NoTradeZone #Overtrading #GreedControl #TradeManagement #MarketStructure #Liquidity #SmartMoney #ICT #MTFAnalysis #PriceAction #ATR #ADX #RSI #Scalping #IntradayTrading #Forex #Crypto #Stocks

Positive GEX Profile Points Toward 700 Gap FillMETA – Holding Above HVL, 50 DMA Reclaim in Progress, Upside Call Resistance at 700

META is currently trading below the 200-day moving average , but recent price action suggests a potential structural improvement rather than continued weakness.

From an options perspective, the broader structure remains Positive GEX , indicating that dealer positioning is still supportive on pullbacks. At the same time, IV remains low , which typically favors range expansion and directional follow-through once key technical levels are reclaimed.

On the daily chart, price is now starting to reclaim the 50-day moving average , a level that previously acted as dynamic resistance. Importantly, META is also holding above the High Volatility Level (HVL) , which keeps the short-term regime constructive rather than defensive.

Volatility conditions remain favorable:

Call Pricing Skew is elevated (~31.6%), showing persistent call demand

IV remains controlled, allowing price to move without immediate volatility compression pressure

Looking forward, the most important upside call resistance is the 700 level, which represents:

Highest core call resistance on the Feb 20 (Optimal Monthly) expiration

A major gap fill from the prior breakdown

A clear technical resistance zone visible on the daily chart

This confluence makes 700 a logical upside target if price can hold above HVL and fully reclaim the 50 DMA.

Key structure to watch:

200 DMA – higher timeframe resistance overhead

50 DMA – short-term trend reclaim in progress

HVL – holding above keeps structure constructive

700 – primary upside target (gap fill + core call resistance)

As long as price holds above HVL with supportive GEX structure, rotational upside toward 700 remains the higher-probability path .

NQ Power Range Report with FIB Ext - 12/30/2025 SessionCME_MINI:NQH2026

- PR High: 25747.75

- PR Low: 25705.25

- NZ Spread: 95.0

Key scheduled economic events:

14:00 | FOMC Meeting Minutes

Session Open Stats (As of 12:45 AM)

- Session Open ATR: 343.23

- Volume: 16K

- Open Int: 275K

- Trend Grade: Long

- From BA ATH: -2.4% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

Nifty Playbook W1-Day 2 (Dec 30, 2025) – Quick Market UpdateMarket in a chokehold around 25,900–26,000. Yesterday closed ~25,942 (-0.38%).

Technicals

• Resistance: 3H close at overhead supply (26,100–26,200).

• Support: Strong at 25,700–25,800 (1D/4H confluence).

• Bias: Range-bound, mildly bullish above 25,800. Dips likely to test support then bounce; breakdown below 25,800 signals caution.

Options Flow

Puts have solid ITM/ATM support; calls show weak backing and heavy resistance. Flip mechanism: put support break could trigger call upside.

FII/DII- FIIs net selling heavily; DII inflows 3–4x stronger, providing cushion.

Feels bubble-like with stretched valuations + thin volumes. Stay selective, manage risk tightly. Bulls need close above 26,200 & PR1X Below 199.7 ; watch 25,800 downside closely.

Amazon.com May Be CoilingAmazon.com has done little since the summer, but some traders may think it’s poised to move in the New Year.

The first pattern on today’s chart is the price area between roughly $233 and $234. This matches the closing price on July 31 before a bearish earnings gap. It’s also near a weekly low on November 14 and a weekly close on November 28. AMZN ended last week slightly below that zone, which may create potential for a breakout.

Second, the e-commerce giant has pushed through a falling trendline that started in early November.

Third, the 50- and 100-day simple moving averages are near each other. Bollinger Bandwidth has also compressed. Could that period of sideways movement lay the groundwork for a new trend?

Next, MACD is rising and the 8-day exponential moving average (EMA) crossed above the 21-day EMA. That may reflect emerging short-term bullishness.

Finally, AMZN is an active underlier in the options market. (Its average daily volume of 556,000 contracts ranks fifth in the S&P 500, according to TradeStation data.) That could help traders take positions with calls and puts.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com . Visit www.TradeStation.com for full details on the costs and fees associated with options.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com .

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

AUXX.TO — Swing Trade Idea💰 AUXX.TO — Swing Trade Idea

🏢 Company Snapshot

Gold X2 Mining Inc. is a TSXV-listed junior gold explorer with exposure to precious metals.

Why now: gold strength + junior miners showing relative momentum; AUXX is emerging from a multi-month base into a higher-high structure.

📊 Fundamental Context (Trade-Relevant Only)

Valuation: Typical junior explorer — priced on optionality, not earnings; leveraged to gold moves.

Balance Sheet: Low operating leverage; financing risk typical but manageable near-term.

Cash Flow: Pre-revenue; price action is the signal.

Dividend: None.

Fundamental Read: This is a technically driven momentum trade with gold acting as the macro tailwind.

🪙 Industry & Sector Backdrop

Short-Term (1–4 weeks): Gold miners showing improving momentum as gold holds elevated levels.

Medium-Term (1–6 months): Select juniors outperforming TSX on beta expansion.

Macro Influence: Gold bid on rate expectations and risk hedging.

Sector Bias: Bullish

📐 Technical Structure (Primary Driver)

Trend: Price firmly above rising 50-SMA; long-term trend constructive.

Momentum: RSI(2) reset into support zone, consistent with continuation pullbacks.

Pattern: Bullish pullback within an established uptrend; prior breakout above 0.60 holding.

Volume: Expansion on impulse leg; lighter volume on consolidation = constructive.

Key Levels

Support: 0.58 – 0.60

Resistance: 0.70 – 0.74

🎯 Trade Plan (Execution-Focused)

Entry: 0.60 – 0.62 (pullback into prior breakout + 50-SMA confluence)

Stop: 0.56 (loss of structure and trend invalidation)

Target: 0.74 (measured move into prior supply / range extension)

Risk-to-Reward: ~2.5R

Alternate Scenario: If price loses 0.58 on a closing basis, stand aside and reassess near the rising 50-SMA or prior base.

🧠 Swing Trader’s Bias

Price remains in a controlled uptrend above the 50-SMA with momentum resetting, not breaking. Looking for continuation from the 0.60–0.62 demand zone toward 0.74 for a clean 2.5R swing. A daily close below 0.56 invalidates the setup.

NQ Power Range Report with FIB Ext - 12/29/2025 SessionCME_MINI:NQH2026

- PR High: 25879.00

- PR Low: 25843.00

- NZ Spread: 80.5

No key scheduled economic events

Session Open Stats (As of 12:55 AM)

- Session Open ATR: 353.46

- Volume: 21K

- Open Int: 270K

- Trend Grade: Long

- From BA ATH: -2.2% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

Nifty Playbook W1 (as of Dec 29, 2025)Nifty playbook Week 1 (as of Dec 29, 2025):

• Dotted projectile lines → My exhaustion zones (VAR-based) — where momentum typically fades and reversals kick in.

• Range lines → My standard expected up/down volatility range.

• Key S/R lines (some marked by specific candle timeframe closes) → Strong support/resistance levels for added conviction.

Playbook summary: Now just watch the chart dance. Wait for price to interact with exhaustion zones + range boundaries + key S/R. When confirmation hits, execute the flip mechanism exactly as outlined in my 23 Dec idea (reversal trade on exhaustion failure or breakout).

Stay patient — the market will show its hand.